Professional Documents

Culture Documents

Venture Capital Regulations - India

Uploaded by

Faizan KhanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Venture Capital Regulations - India

Uploaded by

Faizan KhanCopyright:

Available Formats

Venture Capital Regulations – India

Nidhi Bothra

Vinod Kothari & Company

When Christopher Columbus set out to travel westwards from Europe to reach India, his risky venture did

not find support with the King of Portugal and he was denied the funds to support his venture. It was

Queen Isabella of Spain who funded his venture, the risks were great but the rewards were greater. The

concept of ‘venture capital’ evolves from here. In modern context it can be said that such ventures which

are unconventional and untried and have a high risk high return potential, which are sure not to be

financed by the conventional mode of funding are sure to find venture capitalists contributing to the

venture.

A venture capital fund (VCF) provides funds to new and promising companies that are typically

knowledge based; assume a high risk element but promise sustainable growth and higher rewards.

Venture capital fund not just makes an equity participation in a company but also assists in the

management and functioning of the company by rendering its expertise to the business; hence are not

passive investors. These companies are unable to attract finances through the conventional mode of

financing as they do not have sufficient track record to attract capital investment and do not have

tangible assets to act as collateral against a loan and have a high gestation periods to be able to raise

funds from traditional sources of financing

History of venture capital in India:

The venture capital industry in India evolved in the late 1980s with the Government of India legalized

venture capital operations in 1988 and has been skimming attention ever since. Technology Development

and Information Company of India Ltd. (TDICI), an equal joint venture of ICICI and UTI, was the first

organization to begin its venture capital operations in India. TDICI was the investment manager and the

funds were registered as UTI’s Venture Capital Unit Scheme (VECAUS).

Thereafter in 1996 the regulatory environment of the industry was defined by the SEBI (Venture Capital

Fund) Regulations, 1996 followed by the SEBI (Foreign Venture Capital Investor) Regulations, 2000 on

the recommendation of Chandrasekhar committee fostering growth in the industry.

How does it work?

• Venture Capital can be formed in:

o Trust

o Company

o Body Corporate

• Investors in venture capital funds are:

o Financial institutions

o Banks

o Pension Funds

o Corporations

o High Networth individuals; etc

• Venture capitalists raises money from these investors and invests in start-up companies

• Venture capitalists act in the advisory capacity in the company and render their professional expertise

to the venture, apart from capital investment

• Typically funds are pooled in for a period of around 10 years and investing it in venture capital

undertakings for a period of 3 to 5 years with an expectation of high returns.

SEBI (Venture Capital Funds) Regulations, 1996

• Definition of VCF – Section 2(m) of the Regulation, defines VCF as:

“venture capital fund” means a fund established in the form of a trust or a company

including a body corporate and registered under these regulation which—

(i) has a dedicated pool of capital;

(ii) raised in a manner specified in the regulations; and

(iii) invests in accordance with the regulations;

• Definition of Venture Capital Undertaking – Section 2(n) of the Regulations define VCU as:

“venture capital undertaking” means a domestic company—

i. whose shares are not listed on a recognized stock exchange in India;

ii. which is engaged in the business for providing services, production or

manufacture of article or things or does not include such activities or sectors

which are specified in the negative list by the Board with the approval of the

Central Government by notification in the Official Gazette in this behalf.

• Application for grant of certificate to be made to the Board in Form A along with non-

refundable application fees. The Board may grant the certificate of incorporation in Form B

Obligations of Venture Capital fund:

• Venture Capital fund shall not carry out any other activity than that of venture capital fund

• Venture capital shall disclose investment strategy at the time of making investments

• VCF shall disclose the duration of the life cycle of the fund

• VCF shall not get its units listed on any recognized stock exchange till the expiry of three years

from the date of issuance of units by VCF

• VCF cannot invite offers from the public for subscribing for its units and shall only receive

monies by the way of private placement of the units

• VCF shall enter into the placement memorandum and subscription agreement which contains

terms and conditions subject to which monies is proposed to be raised from the investors. A copy

of the placement memorandum and subscription agreement will be placed with the Board along

with the actual money collected

• VCF shall maintain its books of accounts, records and documents for a period of 8 years

Minimum Investment in Venture Capital:

• Venture Capital Fund may raise money from Indian, foreign, non-resident Indian, by way of

issue of units

• Investments below Rs.5 lakhs from any investor shall not be accepted other than employees,

principal officer, directors of venture capital fund or employees of fund manager or asset

management company

• Venture capital fund shall invest minimum of Rs.5 crores in each of the schemes launched or

fund set up

Investment Restrictions:

Note: As per SEBI (Venture Capital Fund) (Amendment) Regulations, 2010, a VCF can also make

investments in the securities listed on the SME exchange

Winding up: Intimation of the winding up of a scheme should be given to the Board

Scheme of VCF can be wound up in the following circumstances:

• In case of trust

o Period of scheme mentioned in the placement memorandum is over

o In the opinion of the trustees and in the interest of the investors scheme should be wound

up

o 75% of the investors in the scheme pass a resolution that the scheme should be wound up

• In case of company: wound up in accordance with the provisions of the Companies Act, 1956

• In case of a body corporate: wound up as per the statute under which it is incorporated

SEBI (Foreign Venture Capital Investor) Regulations, 2000

• Registration: Application to be made to the Board in Form A with the application fee. The

applicant should be granted the necessary permission by RBI to make investments in India. The

certificate of registration is granted in Form B by the Board

• Investment criteria:

o Investor shall disclose his investment strategy

o Can invest all his funds in one venture capital

• Obligations:

o Maintain books of account and records for a period of 8 years

o The foreign investor shall appoint a custodian for custody of the securities

Custodian shall monitor the investment

Furnish periodic reports to the Board

Furnish information as required/ called for by the Board

o enter into an agreement with a designated bank for operating the foreign currency

account

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Group9 Morrissey ForgingsDocument6 pagesGroup9 Morrissey ForgingsVarun GargNo ratings yet

- TRM G3 Tut3 BidvDocument28 pagesTRM G3 Tut3 Bidvtrung luuchiNo ratings yet

- FIN202 - Chap 3 - Selected ExercisesDocument2 pagesFIN202 - Chap 3 - Selected ExercisesThanh ThảoNo ratings yet

- CHAPTER 11 Dividend PolicyDocument56 pagesCHAPTER 11 Dividend PolicyMatessa AnneNo ratings yet

- I3investor - A Free and Independent Stock Investors PortalDocument3 pagesI3investor - A Free and Independent Stock Investors PortalleekiangyenNo ratings yet

- Lecture Session 8 - Currency Futures Forwards Payoff ProfilesDocument8 pagesLecture Session 8 - Currency Futures Forwards Payoff Profilesapi-19974928No ratings yet

- Fund Raising & Overview of IPO: Sharing NTPC ExperienceDocument38 pagesFund Raising & Overview of IPO: Sharing NTPC ExperienceSamNo ratings yet

- Course Books Financial ManagementDocument3 pagesCourse Books Financial ManagementAndré Luís Chrispin GonçalvesNo ratings yet

- BAEEP3 - Teaching Timetable2023-11!09!201158Document2 pagesBAEEP3 - Teaching Timetable2023-11!09!201158theresiamosha69No ratings yet

- Financial Management FM Final PaperDocument13 pagesFinancial Management FM Final PaperSaqib AliNo ratings yet

- Sas - Day #17 - p2 Exam-1Document11 pagesSas - Day #17 - p2 Exam-1grace sagpangNo ratings yet

- Lecture 4Document6 pagesLecture 4Eric CauilanNo ratings yet

- 401k Cost Comparison WorksheetsDocument3 pages401k Cost Comparison Worksheetserichaaz0% (1)

- Corporate Finance (FIN722) Syllabus For Mid Term Exams: Recommended BooksDocument3 pagesCorporate Finance (FIN722) Syllabus For Mid Term Exams: Recommended BooksShrgeel HussainNo ratings yet

- Fabm 1Document2 pagesFabm 1hours cityNo ratings yet

- Astra Microwave Products LTD PDFDocument4 pagesAstra Microwave Products LTD PDFAwakash DixitNo ratings yet

- Options Open Interest Analysis SimplifiedDocument17 pagesOptions Open Interest Analysis SimplifiedNaveenNo ratings yet

- Accounting DictionaryDocument5 pagesAccounting DictionaryShazad HassanNo ratings yet

- Havells India 3QF14 Result Review 30-01-14Document8 pagesHavells India 3QF14 Result Review 30-01-14GaneshNo ratings yet

- AssignmentDocument12 pagesAssignmentpavnijainNo ratings yet

- 360 Gann Price ExcelDocument2 pages360 Gann Price Excelputih12163% (24)

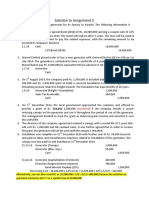

- Assignment 2 SolutionDocument4 pagesAssignment 2 SolutionSobhia Kamal100% (1)

- Equity RiskDocument86 pagesEquity Risksyed shaibazNo ratings yet

- The Insider Trading Anomaly Endures 50 Years After It Was First Identified by Lorie and NiederhofferDocument3 pagesThe Insider Trading Anomaly Endures 50 Years After It Was First Identified by Lorie and Niederhoffertidomam303No ratings yet

- Financial ProjectionDocument25 pagesFinancial ProjectionHimangi GuptaNo ratings yet

- Solved You Are Driving On A Trip and Have Two ChoicesDocument1 pageSolved You Are Driving On A Trip and Have Two ChoicesM Bilal SaleemNo ratings yet

- Chapter 1 Introduction To M&ADocument29 pagesChapter 1 Introduction To M&AK60 Phạm Thị Phương AnhNo ratings yet

- Handouts ConsolidationSubsequent To Date of AcquisitionDocument5 pagesHandouts ConsolidationSubsequent To Date of AcquisitionCPANo ratings yet

- Class#: 09 MBA (1.5) Morning Group Subject: Financial Risk Management Submitted To: DR NisarDocument9 pagesClass#: 09 MBA (1.5) Morning Group Subject: Financial Risk Management Submitted To: DR NisarSana NayabNo ratings yet

- Volpips Accademy ™...Document12 pagesVolpips Accademy ™...Sanal V VNo ratings yet