Professional Documents

Culture Documents

Forecast Model Pick Melco Crown Entertainment (MPEL,$MPEL) Up 20% in 19 Days

Uploaded by

ValuEngine.comCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Forecast Model Pick Melco Crown Entertainment (MPEL,$MPEL) Up 20% in 19 Days

Uploaded by

ValuEngine.comCopyright:

Available Formats

ATTENTION Investors and Finance Professionals:

If you are reading this you should sign up for ValuEngine's award-winning stock valuation and forecast

service at the low price of $19.95/month!

NO OBLIGATION, 14 Day FREE TRIAL!

CLICK HERE

January 5, 2010

VALUATION WATCH: Our models find that overvaluation is approaching

levels typically seen when a market correction is imminent. Overvalued

stocks now make up almost 63% of our universe and 30% of the universe is

calculated to be overvalued by 20% or more. 15 of 16 Sectors are now

calculated to be overvalued.

This Bet Paid Off

Forecast Model Pick Melco Crown Entertainment (MPEL,$MPEL) Up 20% in

19 Days

Today we provide info on yet a recent success story from our Forecast

Model. When we completed our last re-balance of the ValuEngine Forecast Model

Market Neutral Strategy Portfolio Newsletter, subscribers received two picks from the

Consumer Discretionary Sector.

The first pick, Hyatt Hotels (H) is up more than 5%. The second pick, Melco

Crown Entertainment (MPEL) is an owner and developer of casino gaming and

entertainment resort facilities focused on the market found in Macau. Since being

selected as one of our top two stocks in the sector 19 days ago, Melco Crown

Entertainment is up more than 21%.

Currently, ValuEngine maintains its BUY recommendation for Melco Crown

Entertainment. Based on the information we have gathered and our resulting

research, we feel that Melco Crown Entertainment has the probability to

OUTPERFORM average market performance for the next year. The company exhibits

ATTRACTIVE momentum, company size and expected EPS growth.

Based on available data as of Jan. 05, 2011, we believe that MPEL should be

trading at $6.16. This makes MPEL 7.65% overvalued. Fair Value indicates what we

believe the stock should be trading at today if the stock market were perfectly

efficient and everything traded at its true worth. For MPEL, we base this on actual

earnings per share (EPS) for the previous four quarters of -$0.15, forecasted EPS for the

next four quarters of -$0.05, and correlations to the 30- year Treasury bond yield of

4.40%.

You can always screen for top-forecast stocks using our VE software package

or our website.

To Sign Up for a Two Week FREE TRIAL, Please Click the Logo Below

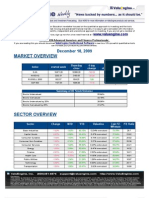

MARKET OVERVIEW

Summary of VE Stock Universe

Stocks Undervalued 37.07%

Stocks Overvalued 62.93%

Stocks Undervalued by 20% 16.85%

Stocks Overvalued by 20% 30.14%

SECTOR OVERVIEW

Sector Change MTD YTD Valuation Last 12- P/E

MReturn Ratio

Aerospace -0.36% -0.32% -0.32% 9.33% overvalued 31.14% 19.95

Auto-Tires-Trucks -0.27% -0.17% -0.17% 15.67% overvalued 47.56% 26.33

Basic Materials -1.74% -1.62% -1.62% 32.03% overvalued 63.36% 37.73

Business Services -0.61% -0.50% -0.50% 7.22% overvalued 17.89% 29.89

Computer and Technology -0.52% -0.37% -0.37% 9.40% overvalued 31.72% 44.19

Construction -1.55% -1.47% -1.47% 7.16% overvalued 10.29% 38.15

Consumer Discretionary -0.98% -0.90% -0.90% 6.24% overvalued 23.38% 31.45

Consumer Staples -0.71% -0.63% -0.63% 11.17% overvalued 16.33% 27.8

Finance -0.98% -0.91% -0.91% 8.71% overvalued 17.98% 25.2

Industrial Products -0.84% -0.76% -0.76% 16.92% overvalued 28.74% 26.47

Medical -0.58% -0.49% -0.49% 2.63% undervalued 17.35% 37.72

Multi-Sector Conglomerates -0.75% -0.71% -0.71% 16.45% overvalued 31.28% 30.1

Oils-Energy -0.97% -0.91% -0.91% 26.81% overvalued 33.45% 41.74

Retail-Wholesale -1.53% -1.42% -1.42% 10.14% overvalued 59.31% 22.14

Transportation -0.67% -0.61% -0.61% 13.89% overvalued 27.09% 42.85

Utilities -0.42% -0.40% -0.40% 8.23% overvalued 12.07% 25.52

You might also like

- ValuEngine Market Valuation Figures Inch Into The Danger Zone (Again... )Document4 pagesValuEngine Market Valuation Figures Inch Into The Danger Zone (Again... )ValuEngine.comNo ratings yet

- Peet's Coffee and Tea (Peet, $peet) Breaks Out, Provides Big Gain For VE Market Neutral PortfolioDocument3 pagesPeet's Coffee and Tea (Peet, $peet) Breaks Out, Provides Big Gain For VE Market Neutral PortfolioValuEngine.comNo ratings yet

- Food Additive Manufacturer Senomyx (SNMX,$SNMX) Leads ValuEngine - Com Forecast ScreenDocument2 pagesFood Additive Manufacturer Senomyx (SNMX,$SNMX) Leads ValuEngine - Com Forecast ScreenValuEngine.comNo ratings yet

- Too LiveDocument2 pagesToo LiveValuEngine.comNo ratings yet

- Fly The American SkiesDocument2 pagesFly The American SkiesValuEngine.comNo ratings yet

- Goldman Sachs (GS,$GS) Beats Expectations But Profits Down Due To Dividend, ValuEngine Models Remain Neutral On The Finance GiantDocument2 pagesGoldman Sachs (GS,$GS) Beats Expectations But Profits Down Due To Dividend, ValuEngine Models Remain Neutral On The Finance GiantValuEngine.comNo ratings yet

- April 26, 2010: Valuengine Models Predict Strong Returns For Citigroup SharesDocument2 pagesApril 26, 2010: Valuengine Models Predict Strong Returns For Citigroup SharesValuEngine.comNo ratings yet

- VE Daily 100427Document2 pagesVE Daily 100427ValuEngine.comNo ratings yet

- Kelly Services Gets A BuyDocument2 pagesKelly Services Gets A BuyValuEngine.comNo ratings yet

- CrossroadsDocument2 pagesCrossroadsValuEngine.comNo ratings yet

- InhospitableDocument2 pagesInhospitableValuEngine.comNo ratings yet

- Vonage Back From The DeadDocument2 pagesVonage Back From The DeadValuEngine.comNo ratings yet

- Still Flying High On The Friendly SkiesDocument3 pagesStill Flying High On The Friendly SkiesValuEngine.comNo ratings yet

- Positive News From Airlines Leads To Gains For ValuEngine Forecast 22 Newsletter Picks AMR and LCCDocument2 pagesPositive News From Airlines Leads To Gains For ValuEngine Forecast 22 Newsletter Picks AMR and LCCValuEngine.comNo ratings yet

- VE Weekly 101119Document8 pagesVE Weekly 101119ValuEngine.comNo ratings yet

- ValuEngine Weekly November 5, 2010Document10 pagesValuEngine Weekly November 5, 2010ValuEngine.comNo ratings yet

- Black GoldDocument2 pagesBlack GoldValuEngine.comNo ratings yet

- VE Bulletin Pick Scores BigDocument2 pagesVE Bulletin Pick Scores BigValuEngine.comNo ratings yet

- VE Daily 100406Document2 pagesVE Daily 100406ValuEngine.comNo ratings yet

- SnapshotDocument2 pagesSnapshotValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter March 30, 2010Document15 pagesValuEngine Weekly Newsletter March 30, 2010ValuEngine.comNo ratings yet

- Exxon-Mobil (XOM,$XOM) Reports Major Gulf Discovery, ValuEngine - Com Rates Energy Giant A BuyDocument2 pagesExxon-Mobil (XOM,$XOM) Reports Major Gulf Discovery, ValuEngine - Com Rates Energy Giant A BuyValuEngine.comNo ratings yet

- Stock UpDocument2 pagesStock UpValuEngine.comNo ratings yet

- ValuEngine Weekly NewsletterDocument14 pagesValuEngine Weekly NewsletterValuEngine.comNo ratings yet

- Free Weekly Newsletter June 18, 2010Document12 pagesFree Weekly Newsletter June 18, 2010ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter July 9, 2010Document13 pagesValuEngine Weekly Newsletter July 9, 2010ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter August 13, 2010Document9 pagesValuEngine Weekly Newsletter August 13, 2010ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter April 15, 2011Document11 pagesValuEngine Weekly Newsletter April 15, 2011ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter May 13, 2011Document10 pagesValuEngine Weekly Newsletter May 13, 2011ValuEngine.comNo ratings yet

- VE Weekly 100326Document9 pagesVE Weekly 100326ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter March 11, 2011Document10 pagesValuEngine Weekly Newsletter March 11, 2011ValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument9 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- February 19, 2010: Bonus For ReadersDocument7 pagesFebruary 19, 2010: Bonus For ReadersValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter July 30, 2010Document16 pagesValuEngine Weekly Newsletter July 30, 2010ValuEngine.comNo ratings yet

- Pier Number One!Document3 pagesPier Number One!ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter February 18, 2011Document10 pagesValuEngine Weekly Newsletter February 18, 2011ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter February 12, 2010Document12 pagesValuEngine Weekly Newsletter February 12, 2010ValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument12 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- Bonus For Readers: February 26, 2010Document10 pagesBonus For Readers: February 26, 2010ValuEngine.comNo ratings yet

- Ciena Thompson Hold+Document6 pagesCiena Thompson Hold+sinnlosNo ratings yet

- ValuEngine Weekly Newsletter July 23, 2010Document15 pagesValuEngine Weekly Newsletter July 23, 2010ValuEngine.comNo ratings yet

- ValuEngine Weekly NewsletterDocument12 pagesValuEngine Weekly NewsletterValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument10 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- June 3, 2011: Market OverviewDocument10 pagesJune 3, 2011: Market OverviewValuEngine.comNo ratings yet

- Kodak (EK,$EK) On The Brink of Bankruptcy and ValuEngine Rates It A SellDocument3 pagesKodak (EK,$EK) On The Brink of Bankruptcy and ValuEngine Rates It A SellValuEngine.comNo ratings yet

- ValuEngine Weekly December 10, 2010Document9 pagesValuEngine Weekly December 10, 2010ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter August 27 2010Document11 pagesValuEngine Weekly Newsletter August 27 2010ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter February 25, 2011Document11 pagesValuEngine Weekly Newsletter February 25, 2011ValuEngine.comNo ratings yet

- January 29, 2010: Market OverviewDocument9 pagesJanuary 29, 2010: Market OverviewValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- VE Weekly 101126Document6 pagesVE Weekly 101126ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter April 22, 2011Document11 pagesValuEngine Weekly Newsletter April 22, 2011ValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor EducationDocument11 pagesThe ValuEngine Weekly Is An Investor EducationValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter September 10, 2010Document11 pagesValuEngine Weekly Newsletter September 10, 2010ValuEngine.comNo ratings yet

- Market Overview: September 4, 2009Document11 pagesMarket Overview: September 4, 2009ValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter January 28, 2011Document8 pagesValuEngine Weekly Newsletter January 28, 2011ValuEngine.comNo ratings yet

- Owens Corning (OC,$OC) Leads ValuEngine Forecast 16 MNS Newsletter Long Side With 26% ReturnDocument3 pagesOwens Corning (OC,$OC) Leads ValuEngine Forecast 16 MNS Newsletter Long Side With 26% ReturnValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter July 2, 2010Document10 pagesValuEngine Weekly Newsletter July 2, 2010ValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- Pollution Monitoring World Summary: Market Values & Financials by CountryFrom EverandPollution Monitoring World Summary: Market Values & Financials by CountryNo ratings yet

- Javascript Applications Nodejs React MongodbDocument452 pagesJavascript Applications Nodejs React MongodbFrancisco Miguel Estrada PastorNo ratings yet

- Heavy LiftDocument4 pagesHeavy Liftmaersk01No ratings yet

- Lactobacillus Acidophilus - Wikipedia, The Free EncyclopediaDocument5 pagesLactobacillus Acidophilus - Wikipedia, The Free Encyclopediahlkjhlkjhlhkj100% (1)

- MORIGINADocument7 pagesMORIGINAatishNo ratings yet

- Data Sheet WD Blue PC Hard DrivesDocument2 pagesData Sheet WD Blue PC Hard DrivesRodrigo TorresNo ratings yet

- PVAI VPO - Membership FormDocument8 pagesPVAI VPO - Membership FormRajeevSangamNo ratings yet

- The Rise of Populism and The Crisis of Globalization: Brexit, Trump and BeyondDocument11 pagesThe Rise of Populism and The Crisis of Globalization: Brexit, Trump and Beyondalpha fiveNo ratings yet

- Basic DfwmacDocument6 pagesBasic DfwmacDinesh Kumar PNo ratings yet

- SM Land Vs BCDADocument68 pagesSM Land Vs BCDAelobeniaNo ratings yet

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEDocument1 pageMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULESuhail V VNo ratings yet

- D - MMDA vs. Concerned Residents of Manila BayDocument13 pagesD - MMDA vs. Concerned Residents of Manila BayMia VinuyaNo ratings yet

- Microwave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDocument28 pagesMicrowave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDominico Delven YapinskiNo ratings yet

- Sustainable Urban Mobility Final ReportDocument141 pagesSustainable Urban Mobility Final ReportMaria ClapaNo ratings yet

- TSR KuDocument16 pagesTSR KuAngsaNo ratings yet

- PFI High Flow Series Single Cartridge Filter Housing For CleaningDocument2 pagesPFI High Flow Series Single Cartridge Filter Housing For Cleaningbennypartono407No ratings yet

- The Internal Environment: Resources, Capabilities, Competencies, and Competitive AdvantageDocument5 pagesThe Internal Environment: Resources, Capabilities, Competencies, and Competitive AdvantageHenny ZahranyNo ratings yet

- SCDT0315 PDFDocument80 pagesSCDT0315 PDFGCMediaNo ratings yet

- Configuring Master Data Governance For Customer - SAP DocumentationDocument17 pagesConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoNo ratings yet

- ATPDraw 5 User Manual UpdatesDocument51 pagesATPDraw 5 User Manual UpdatesdoniluzNo ratings yet

- Basic of An Electrical Control PanelDocument16 pagesBasic of An Electrical Control PanelJim Erol Bancoro100% (2)

- Final ExamSOMFinal 2016 FinalDocument11 pagesFinal ExamSOMFinal 2016 Finalkhalil alhatabNo ratings yet

- Year 9 - Justrice System Civil LawDocument12 pagesYear 9 - Justrice System Civil Lawapi-301001591No ratings yet

- Oracle Exadata Database Machine X4-2: Features and FactsDocument17 pagesOracle Exadata Database Machine X4-2: Features and FactsGanesh JNo ratings yet

- Audit Certificate: (On Chartered Accountant Firm's Letter Head)Document3 pagesAudit Certificate: (On Chartered Accountant Firm's Letter Head)manjeet mishraNo ratings yet

- TLE - IA - Carpentry Grades 7-10 CG 04.06.2014Document14 pagesTLE - IA - Carpentry Grades 7-10 CG 04.06.2014RickyJeciel100% (2)

- TAS5431-Q1EVM User's GuideDocument23 pagesTAS5431-Q1EVM User's GuideAlissonNo ratings yet

- IPO Ordinance 2005Document13 pagesIPO Ordinance 2005Altaf SheikhNo ratings yet

- Dissertation On Indian Constitutional LawDocument6 pagesDissertation On Indian Constitutional LawCustomPaperWritingAnnArbor100% (1)

- QA/QC Checklist - Installation of MDB Panel BoardsDocument6 pagesQA/QC Checklist - Installation of MDB Panel Boardsehtesham100% (1)

- Arduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash GuptaDocument3 pagesArduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash Guptaabhishek kumarNo ratings yet