Professional Documents

Culture Documents

A Report On Market Research On Mobile Value Added Services in India

Uploaded by

Mandeep Singh PundirOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Report On Market Research On Mobile Value Added Services in India

Uploaded by

Mandeep Singh PundirCopyright:

Available Formats

A Report

On

Market Research on

Mobile Value Added

Services in India

Submitted by

Submitted To

Group No. – 9 Prof. Ankush Sharma

Prashant Chauhan

Gaurav Agrawal

Mandeep Singh

Pankaj Khatri

A report on MVAS in INDIA Page 1

Richa Sharma

Saurabh Bose

CONTENTS

Sr. No. Particulars Page No.

I. Background 3

II. Objective 6

III. Methodology 6

IV. Limitations 7

V. Industry Analysis 8

VI. Detailed Research Findings 12 -21

VII. Bibliography ---

A report on MVAS in INDIA Page 2

I. Background

Over the last five years as competition in mobile communication industry is

increasing and the companies are trying to increase their market share in urban and

rural areas both. This competition leads them to lower down their call rates and the

result of this, is decrease in ARPU (Average Revenue per User).

As the ARPU is declining companies are trying to increase their revenue by

offering more value added services to the existing customers. As per TRAI:

“Value Added Services are enhanced services which add value to the basic

teleservices and bearer services for which separate license are issued”

Today most of the consumers want more from their wireless communication

phones apart from mobility and stay connected. So mobile operator felt need for

capitalizing on MVAS market.

Various type of MVAS are provided by the operators like P2P SMS (Peer to Peer

SMS), A2P or P2A SMS (Application to Person or Person to Application SMS),

Games, CRBT/RT (Caller Ring Back Tone or Ring Tone), GPRS etc.

The research was primarily performed to explore the relationships between gender,

age, behavioral trends and mobile phone usage patterns of teenagers and young

people, in the age group 18-30 years.

This paper, by MACRO, is an attempt to replicate the study in the Indian context in

order to arrive at the current trends, especially in metros like Mumbai where

mobile telephony seems to have made an immense impact.

Defining VAS

Value Added Service (VAS) in telecommunication industry refers to non-core

services, the core or basic services being standard voice calls and fax transmission

including bearer services. The value added services are characterized as under:-

• Not a form of core or basic service but adds value in total service offering.

A report on MVAS in INDIA Page 3

• Stands alone in terms of profitability and also stimulates incremental

demand for core or basic services.

• Can sometimes be provided as stand alone.

• Do not cannibalize core or basic service.

• Can be add-on to core or basic service and as such can be sold at premium

price.

• May provide operational synergy with core or basic services.

A value added service may demonstrate one or more of these characteristics and

not necessarily all of them.

In some cases, the value added service becomes so closely integrated with the

basic offering that neither the

user nor the provider acknowledge or realize the difference. A classic example is

of P2P SMS. Some of the

operators do not consider P2P SMS as part of their VAS revenue.

Different MVAS categories

• Entertainment VAS - The key differentiating factor of Entertainment VAS

is the mass appeal it generates. These provide entertainment for leisure time

usage. These not only generate heavy volume (owing to its mass appeal) but

also heavy usage. An example of these kinds of services is Jokes, Bollywood

Ringtones, CRBT (Caller Ring Back Tone) and games.

• Info VAS- These services are characterized by the useful information it

provides to the end user. The user interest comes in from the personal

component and relevance of the content. E.g. of Info VAS is information

on movie tickets, news, banking account etc. They also include user request

for information on other product categories like real-estate, education, stock

updates, etc.

• mCommerce VAS (Transactional services)- These are the services which

involve some transaction using the mobile phone. An example of this kind

of service is buying movie tickets using mobile phone or transfer of money

from one bank account to the other. These can broadly be classified

into 2 types - Mobile banking and Mobile payments.

A report on MVAS in INDIA Page 4

Perceived Value - Perceived value of a MVAS depends on perceived rather than

the actual utility to the end user. When the immediate benefit may not be clear to

the subscriber, the value that a subscriber derives from it largely depends on the

marketing efforts and persona related to the service. The value is gauged more

from the intangible benefits derived from the service like emotional benefits.

A good example of a MVAS with high perceived value is CRBT (Caller Ring

Back Tone).

Practical Value - Practical value is completely based on tangible benefits derived

from the service. The benefits considered could be based on convenience, time or

money. E.g. Service availed to get the cheapest air fares available, money transfer

using mobile These above three categories of MVAS provide a unique

combination of perceived and practical values for every user and this may change

over time as the market & users evolve.

Entertainment VAS has a very high perceived value but scores low on practical

value.

A report on MVAS in INDIA Page 5

I. Objective

The Objective of our research project is to estimate the perceived and the

practical value of various MVAS among the youth (age group 18 years to 30

years) who are in college and doing their graduation or post graduation.

Our Target Group is young generation of Mumbai and nearby area, who are in the

age group of 18 to 25 years and pursuing or completed their graduation or post

graduation. This type of target group mostly prefers entertainment value added

services like jokes, games, CRBT/RT etc. and also information value added

services like internet, online news services etc.

Today mobile is known as the fourth screen after cinema, T.V and P.C so it is very

important to know the future and path of growth of this industry as India is the

second largest mobile market after China in the world.

II. Research Methodology

The main objective of our research project is to find out the perceived and practical

value of MVAS for users. We will follow the primary research methodology to

attain our objective. In primary research methodology the most common and

authentic method for research is Survey.

The entire primary research study was done in Mumbai and a Quantitative protocol

was used. In order to provide a current snapshot of the youth market, this protocol

involved data collection through a detailed opinion-questionnaire administered

across suburbs, be it Central, Western or Harbor, with a requisite sample allocation

to garner current comparative opinions on VAS.

The technique used for data collection was One-On-One Interviews. Individual

responses thus obtained were then compiled, processed and analyzed to arrive at

the opinions on various issues. The Instrument for data collection, in the form of a

‘Structured Questionnaire’, was designed to elicit information on demographic and

psychographic aspects of the respondents. The demographic aspects included age,

gender, education, occupation and income. The psychographic variables included

attitude towards usage of Mobile Value added Services and awareness about it.

A report on MVAS in INDIA Page 6

The questionnaire had a mix of open-ended and closed-ended questions in it. The

open-ended questions, which gave an added ‘qualitative feel’ to the instrument,

provided the logic or rationale for the behavioral patterns and thus helped generate

insights.

The sample of survey respondents comprised of teenagers and youths in the age

groups 18-30 years across all SEC households. In all 130 respondents, chosen on a

random convenience-sampling basis, were interviewed. Out of these, 10 interviews

were dropped from the analysis on counts of incomplete data entry at the

respondent end. Therefore, the analysis presented is for the remaining 120

interviews i.e. n=120.

Today, along with the product, marketers have been using media to target specific

age or sex groups (e.g. cartoons for children, sport programs for men, etc.). So the

importance of identifying target groups in terms of age or sex is self-evident. For

analysis purposes, the three most important variables considered are age, gender.

In addition to the primary research, secondary data was collated from articles

published in dailies, magazines and industry reports through visits to libraries and

also from the worldwide web.

III. Limitations

➢ The study seeks to provide a helicopter view of the field reality and hence

inferences drawn do not provide conclusive evidence to any social

characteristics in particular albeit they aid us in spotting an underlying trend.

➢ The findings are based entirely upon the research conducted in Mumbai and

hence may not be applicable directly to other metropolitan areas on counts

of socio-cultural diversity and contextual factors.

➢ With a larger sample size spread across other metropolitan cities in India one

might arrive at results with higher confidence levels and also at trends for

urban India in particular.

➢ Such a survey needs to be undertaken periodically to gauge the exact

consumer perceptions that they keep changing with time.

➢ Due to constraints of time, certain topics have not been touched upon at all

during the course of the study while some of them like the actual purchase

A report on MVAS in INDIA Page 7

pattern have been explored in a ‘limited’ manner. An in-depth analysis may

be further taken up in each of the sub-topics covered.

I. Industry Analysis

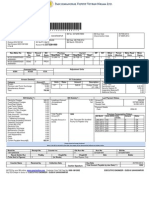

The Current Mobile VAS industry is estimated at Rs. 5780 crore by end June 2008

and is estimated to grow steadily at 70% over the next two years to touch Rs. 9760

crores by end June 2009 and Rs.16520 crores by end June 2010.The current

MVAS market contribution of each of the above services is given below-

VAS Revenue contribution- by Services- Jun 2008

The current MVAS market (as of June 2008) is Rs 5780 crores. P2P SMS

contributes Rs 2140 crores to the MVAS market and this goes only to the operators

(the balance Rs 3640 crores is divided between the different stakeholders including

the operators.). Rs 2312 crores come from CRBT/RT while the balance Rs 1329

crores is divided amongst the other services.

A report on MVAS in INDIA Page 8

MVAS currently contributes around 9 % to the operator’s revenue. It is expected to

increase to 10.4 % in the next 1 year and 12% by June 2010.

Future of the Industry

In the age of convergence, the prominent growth driver of MVAS would be the

consumers’ desire of getting more from their mobile phone. While among the

youth entertainment related services would be popular, the other consumers would

also look for utility based services like location information, mobile commerce (M-

Commerce) for mobile transactions and Local content rich services. Mobile VAS

industry in India is undergoing a lot of structural changes and is poised to grow and

contribute greater revenues to the telecom industry in years to come.

Mobile VAS industry in India is undergoing a lot of structural changes. Mobile

VAS industry is poised to grow and contribute greater revenues to the telecom

industry.

• Consolidation of MVAS content provider’s market: Currently, the

MVAS market is fragmented and consists of a large number of small content

providers. Consolidation of MVAS market will happen, leading to mergence

A report on MVAS in INDIA Page 9

of few strong content providers. This would enable content providers to

command greater share of revenue in the MVAS ecosystem.

• Rational revenue structure: With the growth of MVAS market in India,

more rationality will emerge in the revenue structure. The revenue structure

would be dependent on the value added by the respective stakeholder in

delivering the product to the end user. This would enable the growth of

MVAS market in India.

• Rural MVAS market: MVAS market in India is largely dominated by

urban population, with rural constituting around 15% of the total market.

Rural MVAS market would witness marginal growth and would grow to

around 20% in the next couple of years. The growth drivers would be

availability of vernacular content, entertainment services and voice based

services.

• Growth of M-commerce market: M-commerce has tremendous growth

opportunity in India. High penetration of mobile phones would give a boost

to this industry. The stakeholders need to work in tandem to ensure that

issues like low awareness, security constraints, user friendliness and pricing

of the services are aligned towards the consumers. The services that would

provide boost to the m-commerce market in India are mobile marketing,

mobile banking and mobile payment. A major step has been taken by RBI in

issuing the mBanking guidelines.

• Differential pricing of content: The telecom operators have already taken a

step in this direction. Further, in an attempt to cater to the expanding mobile

subscribers in India, the telecom operators will price the content in a manner

suitable to the target respondent.

• Deployment of NGN network: Introduction of Next Generation Network

would enhance the quality of services in the MVAS market in India. The

users would be able to access more feature rich services. NGN uses soft

switch technology, which is based on Packet Switching/IP phone and

enables introduction of new MVAS speedily at reasonable cost. Soft switch

in NGN provides basic and supplementary services called core services

while the MVAS are outside the soft switch as application services

configured through value added application servers. Generally the

application servers are interfaced with soft switch with open and flexible

application programming interfaces. This helps in brining down new MVAS

A report on MVAS in INDIA Page 10

launch time and cost. Hence with usage of NGN network in India, we can

expect greater proliferation of feature rich MVAS.

• Number portability: Government of India is planning to launch number

portability in the metros by March 2009 and in all the remaining circles by

September 2009. This would enable users to change service providers while

retaining the mobile number.

A report on MVAS in INDIA Page 11

DETAILED RESEARCH

FINDINGS

A report on MVAS in INDIA Page 12

Mobile Phones: A communication boom

Today, a cell phone isn't just a rich man's fashion accessory in India. It's transforming the way

millions of people do business in a country where even landlines were a luxury barely a decade

ago. Across the country people with low incomes are now adopting cellular phones as tools for

enhancing their business.

Focus on Youth Market

Companies have practically created a youth market by launching in items like cool ring tones,

games, screensavers and e-mail alerts. As a result, more and more people in the under 30-age

group are using wireless applications for organizing their lives better. On the other hand, older

people haven't spent much time or money on mobile content. The primary reason behind this

could be that most of the content on the ‘wireless web’ has been youth and entertainment-

oriented. Then there are other reasons like - the buttons on the handset are small and reading the

tiny screens can be a strain on the eyes.

Primary research findings:

1. In the research the prime finding is on the basis of mobile expanses most of the respondents

were college going and 36% of the total 120 respondents spend Rs. 300 to Rs. 500 on

monthly basis. (See Fig. 1). Of this billed amount almost 54% respondents (See Fig. 2) spend

90 % of their billed amount on basic service provided by the service provider i.e. Calls and

SMS.

Fig.1

Fig. 2

64% of the total respondents are very well aware about the M-VAS and were

enthusiastic about VAS uses. (See Fig. 3)

Fig. 3

A report on MVAS in INDIA Page 13

Approximate 55% of the total youth use WAP service provider (See Fig. 4) by their

service provider and they are keen about the news and astro features of the MVAS.

Fig. 4

38% of the total respondents have never used M-VAS (see Fig. 5) and by spreading

awareness about MVAS and its benefits companies can improve their ARPU.

Fig. 5

63% of total respondents do not use mobile for checking their emails and internet

uses (See Fig. 6). As we know that now a day youth is very much tech savvy and

they are using internet frequently so companies can improve their GPRS connection

speed and also introduce offers and contests to tap this huge pool of youth

consumer.

Fig. 6

3G and its impact in Indian MVAS market

Defining 3G

A report on MVAS in INDIA Page 14

3G networks are wide area cellular telephone networks which have evolved to

incorporate high-speed internet access and video telephony. 3G technologies

enable network operators to offer users a wider range of more advanced services

while achieving greater network capacity through improved spectral efficiency.

Services include wide-area wireless voice telephony and broadband wireless data,

all in a mobile environment.

Impact of 3G

Though 3G has created lot of buzz, it is unlikely to have an immediate impact.

Currently, there are not many services which are data speed dependent. But a

definite impact would be considerably higher speed of Internet access and

availability of content for Mobile TV, UGA, etc. A significant spectrum for 3G might

go into providing better voice services. Therefore, 3G will not only be used to

provide data services but also better quality voice.

Pros and cons of 3G

Strength weakness

3G spectrum offers 4-5 times the voice

capacity of 2G spectrum and thus 3G is a The high 3G spectrum and license cost may

cost-effective tool to deliver voice affect cost of service to the subscribers

In urban India, 3G facilitates faster

data/voice connectivity enabling video on 3G handsets are too expensive for a rural

demand subscriber

In rural India, 3G can enable telemedicine, In Europe, 3G growth has not justified the

virtual marketplace and e-learning cost of investment for operators

Due to high cost of handsets and

technology , 3G would be restricted to the

Operators can ensure better quality of upper class and is not expected to reach to

service and reduction of network congestion the masses.

Upgrading from 2.5G and CDMA to 3G is not

a tough challenge compared to investing in Technologies such as Wi-Max, 4G can give

WiMax 3G a run for its money

3G technology has wider deployments and To enter the rural market, 3G first has to

is more matured compared to WiMAX and incorporate local content in its service

4G. delivery.

Analyzing strengths and weaknesses of 3G

A report on MVAS in INDIA Page 15

Barriers to the growth of MVAS in India

Mobile Value Added Services is a growing market and has a huge potential in

Indian telecom market. Presently, it contributes a small percentage to the overall

telecom revenue. There are various roadblocks that restrain the growth of MVAS

market in India. Given the current scenario, it is imperative for the stakeholders

to work together to address each roadblock and enable the market to grow.

The issues facing the MVAS market have been classified into two broad

categories:

Demand Perspective

• Limited awareness of services: The consumers are not fully aware of the

services offered in the MVAS market. The promotional SMS sent on the

mobile phones are the primary source of making end consumer aware of

value added services. This method of promoting MVAS has now reached the

saturation stage. The stakeholders need to ensure that the consumers are

educated about the value of the services in the MVAS market. This would

ensure more acceptability and usage of services among the users.

• High cost of content: Currently, the value added services are priced at a

higher side. This is hampering growth of MVAS market. The consumers

look for value in a service if they are paying for it. Presently, the consumers

perceive that MVAS is priced higher than the actual value it is delivering to

the consumers. The Indian MVAS market consists primarily of prepaid

users, who have relatively lower budget for MVAS in their overall mobile

expenditure. The stakeholders need to package the services in a manner

that ensures correct mix of money and value to the consumer.

• Exit barriers for MVAS consumers are high: The service providers don’t

make the consumers well aware of the process of unsubscribing from any

service. The consumers may restrain from using the services in case the exit

barriers are too high. The service providers need to ensure that there is a

correct mechanism for making the users aware of

Supply Perspective

• Transparency in Revenue sharing arrangements: Revenue sharing

arrangement in India is one of the biggest hindrances for the growth of

MVAS market. The stakeholders are in conflict with each other about the

revenue sharing system in India. Presently, telecom operators take majority

of the revenue and the other entities get a lower share in the overall revenue.

A report on MVAS in INDIA Page 16

This is hampering the growth of content development in India, and in turn

the overall MVAS market.

There is a need for designing a fair revenue structure so that all the

stakeholders in the ecosystem get their share of the revenue. This can be

achieved by aligning the revenue structure in accordance with the services.

• Transparency in billing system: Mobile VAS market faces issues of

transparency in billing and payment system. This leads to conflict among the

stakeholders about the revenue share. There is a need for a central authority

to monitor the IT system and bring transparency to the whole billing system.

• Limited availability of local content: Growth of MVAS market in India is

hampered by lack of localization of the content. Lack of local content

restrains the growth of MVAS market in regional areas, which has a great

potential. This requires investment from the content providers. The

stakeholders are unsure about the return on investment, therefore, are

concentrating only on mass market services. The stakeholders need to

produce more local content and work in tandem to ensure that the consumers

are made aware of the value of these services.

Need for MVAS

Given the declining ARPU and increasing competition among operators it’s

imperative to focus on alternate revenue streams.That’s where there is a felt need

for capitalizing on the Value Added Services Market.

The reasons for the increasing importance of MVAS can be classified as:

➢ Decrease in ARPU despite increase in MOU: Though the subscriber base is

growing at a rapid pace and has positively impacted industry revenues, operator

margins also have shrunk owing to competition and lower “Average Revenue

per User” (ARPU) as the major growth is coming from bottom of the pyramid.

As ARPU declines and voice gets commoditized, the challenge is to develop

alternative revenue streams and retain customers by creating a basis for

differentiation in high-churn markets.

A report on MVAS in INDIA Page 17

➢ Need for differentiation: There is a greater need among the telecom operators

to differentiate themselves from each other.

• Number of Licensees: With increasing number of licensees (98 UASL,

and 37 cellular licenses) in the telecom space the average numbers of

operators in many circles have increased to 5-6 operators offering more

choices to the consumer. Thus the competition among the operators has

increased tremendously. Therefore it is very important for them to

differentiate themselves from the others. Now that voice has got

commoditized these operators are using MVAS for their differentiation

and marketing these services heavily for creating awareness among the

consumers.

• Decreasing Call Rates: In order to attract consumers with relatively

low purchasing powers primarily from Semi Urban and Rural India the

operators have drastically reduced the call rates making it affordable to

even the lower segment of society. The tariff in India is one of the

lowest at Rs.1 per minute as compared to the tariff in developed nations

like USA and UK where the call rates are Rs.13 and Rs7-8 respectively.

• 3G bidders who are non operators: The arrival of new technologies

will give rise to greater competition as many non operators are also

bidding for the 3G licenses. Department of Telecom has planned to

A report on MVAS in INDIA Page 18

allow five 3G operators in each circle depending on the availability of

spectrum.

• Saturation in Metro and Urban Market: The metro/urban areas offer

high level of penetration and have significant mobile subscribers. In

such a highly saturated market with the entry of MVNO’s the

competition will get fierce. Therefore capitalizing on value added

services will give operators opportunity to increase ARPU by providing

premium services.

➢ Increasing need and demand from consumers: In addition to the above

supply side reasons the ‘pull effect’ from consumers asking for more than just

basic telephony is also a key driver for MVAS services. Today most of the

consumers are seeking more from their communication device apart from just

mobility and desire to stay connected.

Bibliography

1. Information Note to the Press (Press Release No. 69/2009)

A report on MVAS in INDIA Page 19

TELECOM REGULATORY AUTHORITY OF INDIA

1. MOBILE VALUE ADDED SERVICES IN INDIA

A Report by IAMAI & eTechnology Group@IMRB

2. Cell users in India will jump to 70 million by 2007: Gartner”, Economic

Times article, May 14, 2009

3. India's mobile phone market surges” Wednesday, 07-Apr-2004, Story from

United Press International

4. www.trai.gov.in/WriteReadData/trai/upload/.../108/recom13feb09.pdf accessed on 8th

april 2010.

A report on MVAS in INDIA Page 20

You might also like

- Emerging M-Commerce Opportunities: A Study of Growth in Banking, Retail and TravelDocument107 pagesEmerging M-Commerce Opportunities: A Study of Growth in Banking, Retail and TravelHimani PatelNo ratings yet

- VAS Price, Waterhouse and CoopersDocument48 pagesVAS Price, Waterhouse and CoopersJoel JCNo ratings yet

- Accenture Research New Business Models Profitable Rural Expansion IndiaDocument20 pagesAccenture Research New Business Models Profitable Rural Expansion IndiaNajaf ShanNo ratings yet

- Paper 14Document5 pagesPaper 14VDC CommerceNo ratings yet

- Synopsis FOR Capstone Project: JalandharDocument41 pagesSynopsis FOR Capstone Project: JalandharVishal SinghNo ratings yet

- Impact of Sales Promotion StrategiesDocument5 pagesImpact of Sales Promotion StrategiesLincy Anandaraj0% (1)

- Analysis of Perception of The Customers Towards Digitization of Banking SectorDocument11 pagesAnalysis of Perception of The Customers Towards Digitization of Banking SectorHARSH MALPANINo ratings yet

- May 2014 1400577564 b091d 84 PDFDocument4 pagesMay 2014 1400577564 b091d 84 PDFAkash SaikiaNo ratings yet

- A R S C P T M-C: Esearch To Tudy The Onsumer Erception Owards OmmerceDocument43 pagesA R S C P T M-C: Esearch To Tudy The Onsumer Erception Owards OmmerceSaransh AggarwalNo ratings yet

- Introduction to Mobile Value Added Services (MVAS) in IndiaDocument7 pagesIntroduction to Mobile Value Added Services (MVAS) in Indiareema3444No ratings yet

- A Study On People Attitude Towards Roaming RechargesDocument11 pagesA Study On People Attitude Towards Roaming RechargesNilabjo Kanti PaulNo ratings yet

- SMS Advertising in IndiaDocument60 pagesSMS Advertising in IndiaManpreet KaurNo ratings yet

- Research Satellite SubmissionDocument33 pagesResearch Satellite SubmissionNamit MishraNo ratings yet

- Mobile Commerce Trends in SingaporeDocument4 pagesMobile Commerce Trends in SingaporeHarshitaSinghNo ratings yet

- 25884014Document10 pages25884014patelali769No ratings yet

- Factors Influencing Mobile Subscribers to Switch Operators in AhmedabadDocument5 pagesFactors Influencing Mobile Subscribers to Switch Operators in AhmedabadAnantNo ratings yet

- A study on consumer awareness and satisfaction towards IRCTCDocument8 pagesA study on consumer awareness and satisfaction towards IRCTCSarit SinghNo ratings yet

- Customer retention strategies in the telecom sectorDocument11 pagesCustomer retention strategies in the telecom sectorArbaz KhanNo ratings yet

- V2i6 1212Document6 pagesV2i6 1212Maria Saleem0% (1)

- Role of Value Added Services in Shaping Indian Telecom IndustryDocument12 pagesRole of Value Added Services in Shaping Indian Telecom IndustryVikram NallamNo ratings yet

- Consumer Preference On Mobile Connections and Buyer Behaviour Towards Relience Mobile in Chennai CityDocument15 pagesConsumer Preference On Mobile Connections and Buyer Behaviour Towards Relience Mobile in Chennai CityShyamsunder SinghNo ratings yet

- Mobile Commerce Literature ReviewDocument6 pagesMobile Commerce Literature Reviewaflstfcap100% (1)

- Ijaiem 2014 03 31 135Document8 pagesIjaiem 2014 03 31 135International Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Bussiness ResearchDocument16 pagesBussiness ResearchVu Ng Phuong AnhNo ratings yet

- Broadband V AnuradhaDocument9 pagesBroadband V AnuradhaManoj kumarNo ratings yet

- The Demand For Mobile Value-Added Services: Study of Smart MessagingDocument22 pagesThe Demand For Mobile Value-Added Services: Study of Smart MessagingcrejocNo ratings yet

- Mobile Phone Usage Among Mumbai Teenagers and YouthDocument8 pagesMobile Phone Usage Among Mumbai Teenagers and YouthSnehal DhuriNo ratings yet

- Marketing Strategies Followed by MultiplexDocument77 pagesMarketing Strategies Followed by MultiplexDanny0% (2)

- Nisha Rupinder M ServicesinIndia A Study On Mobile Banking and ApplicationsDocument9 pagesNisha Rupinder M ServicesinIndia A Study On Mobile Banking and Applicationskalpesh bhNo ratings yet

- MKT 470 MidDocument23 pagesMKT 470 MidAfia Nazmul 1813081630No ratings yet

- 10 Vol-1 Issue-6 ARCHNA SHARMA Mobile Banking As Technology Transfer Journal PaperDocument11 pages10 Vol-1 Issue-6 ARCHNA SHARMA Mobile Banking As Technology Transfer Journal Papermanojmis2010No ratings yet

- A Study On Customer Satisfaction Level of Inflated Rates of Networks With Special Reference To Coimbatore CityDocument40 pagesA Study On Customer Satisfaction Level of Inflated Rates of Networks With Special Reference To Coimbatore Citytamilselvi loganathanNo ratings yet

- 74110Document7 pages74110Anonymous ViVHeR0FNo ratings yet

- Customer SatisfactionDocument26 pagesCustomer SatisfactionSharmistha Mazumder NeelNo ratings yet

- A Request For Proposal For Mobile Services & Applications Consumer - India, Indonesia, and ThailandDocument20 pagesA Request For Proposal For Mobile Services & Applications Consumer - India, Indonesia, and ThailandWasim RajaNo ratings yet

- Service Quality and Its Role in Upselling Cross SellingDocument8 pagesService Quality and Its Role in Upselling Cross SellingHillaryNo ratings yet

- A STUDY ON CONSUMER BEHAVIOUR TOWARDS RELIANCE JIODocument94 pagesA STUDY ON CONSUMER BEHAVIOUR TOWARDS RELIANCE JIOKhan YasinNo ratings yet

- 'Analysis of Consumer Satisfaction From E - Banking ServicesDocument12 pages'Analysis of Consumer Satisfaction From E - Banking ServicesDEEPAKNo ratings yet

- Literature Review On Mobile Number Portability in IndiaDocument7 pagesLiterature Review On Mobile Number Portability in IndiaafmzfgmwuzncdjNo ratings yet

- Technology in BankingDocument1 pageTechnology in BankingkaanthikeerthiNo ratings yet

- Telecom Services: Emerging Trends, Opportunities and Risk Dr.M.Prasanna KumarDocument8 pagesTelecom Services: Emerging Trends, Opportunities and Risk Dr.M.Prasanna KumarNirav KeshariyaNo ratings yet

- Ravi ProjDocument27 pagesRavi ProjAryan singh The blue gamerNo ratings yet

- MVNO Model in IndiaDocument8 pagesMVNO Model in IndiaBimadraj Sharan SinhaNo ratings yet

- Study of Students Preference Different Mobile Service Providers.Document45 pagesStudy of Students Preference Different Mobile Service Providers.shah faisal90% (30)

- Master Thesis FinalDocument125 pagesMaster Thesis FinalShailesh K SinghNo ratings yet

- Differential Effects of Customers'Document24 pagesDifferential Effects of Customers'Wassie GetahunNo ratings yet

- Global MKTDocument28 pagesGlobal MKTArun KumarNo ratings yet

- M R B - Presentation TranscriptDocument3 pagesM R B - Presentation TranscriptAnurag PateriaNo ratings yet

- Lime 8 Case Study DesicrewDocument5 pagesLime 8 Case Study DesicrewPooja shettyNo ratings yet

- Ratika OutlookDocument58 pagesRatika OutlookRatika NagpalNo ratings yet

- Group 7Document3 pagesGroup 7Arika AgarwalNo ratings yet

- Mobile Payment L Six IssuesDocument17 pagesMobile Payment L Six IssuesiAditya100% (4)

- Measuring The PerformanceDocument11 pagesMeasuring The PerformanceDrRam Singh KambojNo ratings yet

- Proposal Group 4Document3 pagesProposal Group 4Aswathi UnniNo ratings yet

- AStudyonFactorsInfluencing 37001 PDFDocument6 pagesAStudyonFactorsInfluencing 37001 PDFSuryakumar KNo ratings yet

- Surya OkDocument9 pagesSurya OkSurya Narayan PandeyNo ratings yet

- Nirma Institute of ManagementDocument34 pagesNirma Institute of ManagementKaran ZalaNo ratings yet

- Exploring Relationship Marketing Tactics & Customer Loyalty: Issues in TheDocument7 pagesExploring Relationship Marketing Tactics & Customer Loyalty: Issues in Themacontreras11No ratings yet

- Effectiveness of Ing Strategies of Airtel ....Document82 pagesEffectiveness of Ing Strategies of Airtel ....Manish Singh100% (1)

- BEHAVIOURAL INFLUENCE OF SELF-SERVICE TECHNOLOGY IN MANAGING INTERFACE IN THE AVIATION INDUSTRYFrom EverandBEHAVIOURAL INFLUENCE OF SELF-SERVICE TECHNOLOGY IN MANAGING INTERFACE IN THE AVIATION INDUSTRYNo ratings yet

- SBDZ 1 Ho 0Document1 pageSBDZ 1 Ho 0Mandeep Singh PundirNo ratings yet

- 3373281000Document1 page3373281000Mandeep Singh PundirNo ratings yet

- Course File First Year Lab Manual Physics IDocument41 pagesCourse File First Year Lab Manual Physics IMandeep Singh PundirNo ratings yet

- Business CommunicationDocument4 pagesBusiness CommunicationMandeep Singh PundirNo ratings yet

- Inclusive Green GrowthDocument192 pagesInclusive Green GrowthSanity FairNo ratings yet

- 15436S.P SA 1 Maths 9th - 2Document4 pages15436S.P SA 1 Maths 9th - 2Mandeep Singh PundirNo ratings yet

- SOM Paper FinalDocument3 pagesSOM Paper FinalMandeep Singh PundirNo ratings yet

- DVGDocument53 pagesDVGbalajigandhirajanNo ratings yet

- Syllabus - IInd Year MeDocument41 pagesSyllabus - IInd Year MeMandeep Singh PundirNo ratings yet

- Domlabmanualnew 110517072428 Phpapp02Document44 pagesDomlabmanualnew 110517072428 Phpapp02Mandeep Singh PundirNo ratings yet

- Academic Calendar 2013Document4 pagesAcademic Calendar 2013Mandeep Singh PundirNo ratings yet

- OCPP 2.0 Specification - RC1 0.97 PDFDocument198 pagesOCPP 2.0 Specification - RC1 0.97 PDFhirocks126No ratings yet

- Mentor Server Admin v9.1 User GuideDocument395 pagesMentor Server Admin v9.1 User GuideBa Bui VanNo ratings yet

- Hysweep ManualDocument148 pagesHysweep ManualbalachandracNo ratings yet

- Technical Seminar Report On Smart Note TakerDocument28 pagesTechnical Seminar Report On Smart Note TakerRahul Garg77% (13)

- IQ4EDocument16 pagesIQ4EAli AlghanimNo ratings yet

- HW 093059Document32 pagesHW 093059tahiranjum77No ratings yet

- Nptel: Mobile Computing - Web CourseDocument2 pagesNptel: Mobile Computing - Web CourseDavid RahulNo ratings yet

- Disaster Recovery Plan Check ListDocument5 pagesDisaster Recovery Plan Check ListRulingEmpror100% (5)

- PostgreSQL Administration Essentials Sample ChapterDocument25 pagesPostgreSQL Administration Essentials Sample ChapterPackt PublishingNo ratings yet

- ES680 ManualDocument150 pagesES680 ManualDiego Armando Vanegas Rodriguez100% (2)

- Zte CdmaDocument23 pagesZte CdmaOmer JarralNo ratings yet

- OCCAMS: Optimized Command and Control Aerial Management SystemDocument29 pagesOCCAMS: Optimized Command and Control Aerial Management Systemnebp.educationNo ratings yet

- Edge ComputingDocument23 pagesEdge ComputingBasavakumarNo ratings yet

- FortiGate II 10 DiagnosticsDocument33 pagesFortiGate II 10 DiagnosticsTran Tran Duong TinhNo ratings yet

- Sophos Partner Certification Path Deskaid Na 2019Document1 pageSophos Partner Certification Path Deskaid Na 2019AsadasanNo ratings yet

- b0700gq CDocument348 pagesb0700gq CYT100% (2)

- What Is System Software and Application Software? Explain With ExampleDocument19 pagesWhat Is System Software and Application Software? Explain With ExampleYUVRAJ SINGHNo ratings yet

- Ict1 July2014 ColorDocument289 pagesIct1 July2014 ColorLawrence ManaliliNo ratings yet

- Dovado UMR Mobile Broadband Router - Manual PDFDocument42 pagesDovado UMR Mobile Broadband Router - Manual PDFMagnus PerssonNo ratings yet

- Batch 2017 6th Semester CSEDocument36 pagesBatch 2017 6th Semester CSEAzeem KhanNo ratings yet

- # Lecture III - Advanced Computer Networking - Sci-Tech With EstifDocument25 pages# Lecture III - Advanced Computer Networking - Sci-Tech With EstifESTIFANOSNo ratings yet

- Lecture 5 - Routing Information ProtocolDocument10 pagesLecture 5 - Routing Information ProtocolDervpolo VansNo ratings yet

- Wa0002.Document3 pagesWa0002.Project WorkNo ratings yet

- Aoi Bni006a 50-31-040 User GuideDocument26 pagesAoi Bni006a 50-31-040 User Guide04031270100% (1)

- Xweb Evo V 5 3 0 Opr enDocument112 pagesXweb Evo V 5 3 0 Opr enHoàngViệtAnhNo ratings yet

- Point of Care TestingDocument80 pagesPoint of Care TestingInternational Medical Publisher100% (1)

- Branch VPN Solution With Openbsd: Eurobsdcon, Paris, September 24, 2017 Remi LochererDocument31 pagesBranch VPN Solution With Openbsd: Eurobsdcon, Paris, September 24, 2017 Remi Lochererdan_partelly4103No ratings yet

- Infinera BR DTN X FamilyDocument5 pagesInfinera BR DTN X Familym3y54m100% (1)

- Manage multi-vendor networks with SGRwin NMSDocument2 pagesManage multi-vendor networks with SGRwin NMSfonpereiraNo ratings yet

- S I M 7 6 0 0 Series - HSIC - LAN - Application - Note - V1.00Document8 pagesS I M 7 6 0 0 Series - HSIC - LAN - Application - Note - V1.00timNo ratings yet