Professional Documents

Culture Documents

085 - 106 Chapter 8 Capital Budgeting

Uploaded by

Zayna ZenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

085 - 106 Chapter 8 Capital Budgeting

Uploaded by

Zayna ZenCopyright:

Available Formats

Chapter: 8

Capital Budgeting

MEANING OF CAPITAL BUDEGETING

• Capital budgeting is a process of planning capital expenditure which is to be made to maximize the

long-term profitability of the organization.

• It refers to planning for capital assets.

• The capital budgeting decision means a decision as the whether or not money should be invested in

long-term projects such as installing a machinery or creating additional capacities to manufacture a

part which at present may be purchased from outside.

The process of convertible future sums into their present equivalents is known as “discounting”, which is

used to determine the present value of future cashflows

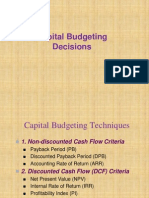

INVESTMENT APPRAISAL TECHNIQUES

Traditional Techniques

a) Payback Period Method

b) Accounting Rate of Return Method

Discounted Cashflow Techniques

a) Net Present Value Method

b) Internal Rate of Return Method

c) Profitability Index Method

d) Discounted Payback Period Method

e) Terminal Value Method

PAYBACK PERIOD METHOD

Payback period represents the time period required for complete recovery of the initial investment in the

project. It is the period within which the total cash inflows from the project equals the cost of investment in

the project. The lower the payback period, the better it is, since initial investment is recouped faster.

Illustration: 1

Suppose a project with an initial investment of Rs. 100 crores, yields a profit of Rs. 20 crores, after writing off

depreciation of Rs. 5 crores per annum. The Payback period of the project is:

CFAT per annum = PAT + Depreciation = Rs. 20 + Rs. 5 crores = Rs. 25 crores.

Payback period = Initial Investment / CFAT per annum = 100 / 25 = 4 years.

Steps used in computation of Simple Payback Period

Step: 1 Determine the Initial Investment (Cash Outflow) of the Project.

Step: 2 Determine the CFAT (Cash Inflow) from the project for various years.

Step: 3 Compute Payback Period

Case 1 In case of uniform CFAT per annum

Payback Period = Initial Investment / CFAT per annum

Case 2 In case of differential CFAT for various years

a) Compute cumulative CFAT at the end of every year.

b) Determine the year in which cumulative CFAT exceeds initial investment.

c) Payback Period = Time at which the cumulative CFAT = Initial Investment.

|KIMS_The Platform to Perform| 85 FM_Capital Budgeting_JM

(which is calculated on time proportion basis. Refer Illustration: 2)

Step: 4 Accept the project, if Payback Period is less than maximum or benchmark period; else

reject the project.

Illustration: 2

The initial outlay for a project is Rs. 25 crore. The project analyst expects the following annual cash flows

which will be generated uniformly over the year:

Year: 0 1 2 3 4 5 6 7

Cash flow (Rs. Crore): (25) 7 6 6 5 4 4 8

You are required to compute the pay back period for the above project. If the cut-off period decided by the

management is 5 years, should the project be accepted?

Year Cash flows (Rs. Cr) Cumulative flows

1 7 7

2 6 13

3 6 19

4 5 24

5 4 28

6 4 32

7 8 40

Evident from the table above, Rs. 25 crores in total would be collected in the 5th year.

Payback Period is

(25 - 24)

4 years + x 12 months = 4years 3months

(28 - 24)

Since, the payback period is less than the cut-off period decided by the management, the project should be

accepted.

Illustration: 3

A project costs Rs. 20,00,000 and yields annually a profit of Rs. 3,00,000 after depreciation @ 12.5%

(straight line method) but before tax @ 50%. Compute the payback period.

[Answer: 5 years]

Illustration: 4

Initial investment is Project X and Project Y is Rs. 1,00,000 each. Following is the cash inflow from the two

projects over a period of five years. Which project should be selected. Use payback period method.

Year Project X Project Y

1 20,000 25,000

2 20,000 25,000

3 30,000 50,000

4 30,000 20,000

5 50,000 10,000

[Answer: Project X – 4 years, Project Y – 3 years]

DISCOUNTED PAYBACK PERIOD METHOD

|KIMS_The Platform to Perform| 86 FM_Capital Budgeting_JM

When the payback period is computed after discounting the cash flows by a pre-determined rate (cut-off

rate), it is called as the “Discounted Payback Period”.

Steps in computation of Discounted PP

Step 1 Determine the total cash outflow of the project. (Initial Investment)

Step 2 Determine the cash inflow after taxes (CFAT) for each year.

Step 3 Determine the PV factor for each year and compute discounted CFAT (DCFAT) for each year.

DCFAT = CFAT for each year x PVIF

Step 4 Determine the cumulative DCFAT at the end of every year.

Step 5 Determine the year in which cumulative DCFAT exceeds the initial investment (Step 1).

Step 6 Compute Discounted Payback Period as the time at which cumulative CFAT = Initial Investment.

This is calculated on “time proportion basis”.

Step 7 Accept if DPP is less than maximum or benchmark period; else reject the project.

Illustration: 5

The initial outlay for a project is Rs. 25 crore. The project analyst expects the following annual cash flows

which will be generated uniformly over the year:

Year: 0 1 2 3 4 5 6 7

Cash flow (Rs. Crore): (25) 7 6 6 5 4 4 8

You are required to compute the discounted pay back period for the above project, assuming cost of capital

to be 12%.

Year Cashflows Discounting Discounted Cashflows Cumulative Discounted

(Rs. Crores) Factor @12% (Rs. Crores) Cashflows (Rs. Crores)

0 (25) 1.000 (25.000) (25.000)

1 7 0.893 6.251 (18.749)

2 6 0.797 4.782 (13.967)

3 6 0.712 4.272 (9.695)

4 5 0.636 3.180 (6.515)

5 4 0.567 2.268 (4.247)

6 4 0.507 2.028 (2.219)

7 8 0.452 3.616 1.397

Discounted payback period = 6 + 2.219 ÷ 3.616 = 6.61 years

PACKBACK RECIPROCAL

It is the reciprocal of payback period. It is expressed in percentage and computed as:

Average Annual Cash Inflows (CFAT p.a.)

Payback Reciprocal =

Initial Investment

The Payback Reciprocal is considered to be an approximation of the Internal Rate of Return (IRR), if:

a) The life of the project is at least twice the payback period;

b) The project generates equal amount of the annual cash inflows; and

c) The project doesn’t require additional outflow during project life.

Illustration: 6

A project with initial investment of Rs. 50,00,000 and life of 10 years, generates CFAT of Rs. 10,00,000 per

annum.

Payback Period = 50,00,000 ÷ 10,00,000 = 5 years

Payback Reciprocal = (1 ÷ 5) x 100 = 20%

ACCOUNTING OR AVERAGE RATE OF RETURN METHOD

Accounting or Average Rate of Return (ARR) means the average annual yield on the project. In this

method, Profit after Taxes (PAT) is used for evaluation, instead of CFAT.

|KIMS_The Platform to Perform| 87 FM_Capital Budgeting_JM

Steps in computation of ARR

Step 1 Determine the average investment of the project.

* Average Investment = (Initial Investment + Salvage Value) ÷ 2

Step 2 Determine the Profits after Tax (PAT) for each year.

PAT = CFAT – Depreciation

Step 3 Determine the total PAT for N years, where N = Project Life.

Step 4 Compute Average PAT per annum = Total PAT for all years ÷ N years.

Step 5 ARR = Average PAT per annum ÷ Average Investment = Step 4 ÷ Step 1.

[* NOTE:

We assume that depreciation is on Straight Line Basis, where Book Value declines at constant rate from

purchase price to zero.

Again,

Average Investment = Net Working Capital + Salvage Value + ½ (Initial Investment – Salvage Value)

If Net Working Capital = 0, the above equation reduces to: ½ (Initial Investment + Salvage Value)]

Illustration: 7

A machine is available for purchase at a cost of Rs. 80,000.

We expect it to have life of five years and to have a scrap value of Rs. 10,000 at the end of the five year

period. We have estimated that it will generate additional profits over its life as follows:

Year 1 2 3 4 5

Amount (Rs.) 20,000 40,000 30,000 15,000 5,000

These estimates are of profits before depreciation. You are required to calculate the accounting rate of

return of the project.

Total profit before depreciation over five years of machine life = Rs. 1,10,000

Average profit per annum = Rs. 1,10,000 / 5 years = Rs. 22,000

Total depreciation over five years = Rs. 80,000 – Rs. 10,000= Rs. 70,000

Average depreciation per annum = Rs. 70,000 / 5 years = Rs. 14,000

Avg. annual profit after depreciation = Rs. 22,000 – Rs. 14,000= Rs. 8,000

Original investment required = Rs. 80,000

Salvage Value = Rs. 10,000

Average Investment = Rs. 90,000 / 2 = Rs. 45,000

Accounting rate of return = (Rs. 8,000 / Rs. 45,000) = 17.78%

Illustration: 8

Compute the accounting rate of return for the project given:

Year Book value of Fixed Profit after

Investment (Rs.) tax (Rs.)

1 90,000 20,000

2 80,000 22,000

3 70,000 24,000

4 60,000 26,000

5 50,000 28,000

Average Profit after Tax Rs. 24,000

ARR = = = 34.29%

Average book value of Investment Rs. 70,0 00

NET PRESENT VALUE METHOD (NPV) OR DISCOUNTED CASH FLOW TECHNIQUE (DCF)

The Net Present Value of an investment proposal is defined as the sum of the present value of all future

cash inflows less the sum of the present value of all cash outflows associated with the proposal.

|KIMS_The Platform to Perform| 88 FM_Capital Budgeting_JM

Thus NPV = Discounted Cash Inflows – Discounted Cash Outflows

In simple terms:

FV1 FV2 FV3 FV4 FVn

NPV = + + + +...... + - CO0

( 1 + K) ( 1 + K) ( 1 + K) ( 1 + K) ( 1 + K)

1 2 3 4 n

n

FVi

NPV = ∑ − CO0

( 1 + K)

i

i=1

Where, K = Cut-off rate or discounting rate

FV = Future cash inflows arising at different points of time, I, 2, 3, …., n

CO0 = Initial cash outflow, which pertains to time 0, hence not discounted

Procedure for computation of NPV

Step 1 Determine the total cash outflow of the project

and the time periods in which they occur.

Step 2 Compute the total discounted cash outflow = Outflow X PVIF

Step 3 Determine the total cash inflows of the project and the time periods in which they arise.

Step 4 Compute the total discounted cash inflows = Inflow X PVIF

Step 5 Compute NPV = Discounted Cash Inflows – Discounted Cash Outflows (Step 4 – Step 2)

Step 6 Accept Project if NPV is positive, else reject.

Decision making or Acceptance Rule

If Decision

NPV > 0 Accept the Project. Surplus over and above the cut-off rate is obtained.

NPV = 0 Project generates cash flows at a rate just equal to the cost of capital. Hence, it may be

accepted or rejected. This constitutes an Indifference Point.

NPV < 0 Reject the Project. The Project does not provide returns even equivalent to the cut-off rate.

Cash Outflows

Generally cash outflows consist of (a) Initial Investment which occurs at time t = 0 and (b) Special payment

and outflows, e.g. working capital outflow which arises in the year of commercial production, tax paid on

capital gain made by sale of old asset, if any; and installation charges at time t = 0 or extra outflows during

the life of the project.

Cash Inflows

Cash Inflows = CFAT = PAT + Depreciation. OR

Cash Inflows = PBD (1 – tax rate) + Tax Shield on Depreciation.

Also, specific cash inflows like salvage value of new assets and recovery of working capital at the end of the

project, tax savings on loss due to sale of old asset, should be carefully considered. The general assumption

is that all cash inflows occur at the end of each year.

Discounting Cash Inflows and Outflows

Each item of cash inflow and outflow is discounted to ascertain its present value. For this purpose, the

discounting rate is generally taken as the Cost of Capital since the project must earn at least what is paid out

on the funds blocked in the project. The present value tables (PVIF tables) are used to calculate the present

value of various cash flows. In case of uniform inflows per annum, annuity tables (PVIFA tables) may be

used.

Use of Discounting Rate

Instead of using PVIF tables, the relevant discount factor can be computed as:

|KIMS_The Platform to Perform| 89 FM_Capital Budgeting_JM

1

DF =

(1 + k)

n

, where, k =cost of capital

n =year in which inflow or outflow takes place

DF =Discounting Factor

For example;

PV factor at 10% after one year = 1 ÷ (1.10)1 = 0.9091

PV factor at 10% at the end of 2 years = 1 ÷ (1.10)2 = 0.8264 and so on.

NOTE:

The NPV method will give valid results only if money can be immediately reinvested at a rate of return equal

to the firm’s cost of capital.

Illustration: 9

A company is considering which of two mutually exclusive projects it should undertake. The Finance Director

thinks that the project with higher NPV should be chosen whereas the Managing Director thinks that the one

with the higher IRR should be undertaken especially as both projects have the same initial outlay and length

of life.

The company anticipates a cost of capital of 10% and the net after tax cash flows of the project are as

follows:

Year 0 1 2 3 4 5

Project X (200,000) 35,000 80,000 90,000 75,000 20,000

Project Y (200,000) 218,000 10,000 10,000 4,000 3,000

Calculate the NPV of each project taking 10% as discounting rate.

Year PVIF 10% Project X Project Y

CFAT DCFAT CFAT DCFAT

0 1.00 (200,000) (200,000) (200,000) (200,000)

1 0.91 35,000 31,850 218,000 198,380

2 0.83 80,000 66,400 10,000 8,300

3 0.75 90,000 67,500 10,000 7,500

4 0.68 75,000 51,000 4,000 2,720

5 0.62 20,000 12,400 3,000 1,860

29,150 18,760

As per NPV criterion Project X should be selected which gives better NPV than Project Y.

INTERNAL RATE OF RETURN METHOD (IRR)

Internal Rate of Return (IRR) is the rate at which the sum total of Discounted Cash Inflows equals the

Discounted Cash Outflows. The Internal Rate of Return of a project is the discount rate which makes Net

Present Value of the project equal to zero.

IRR refers to that discount rate K, such that;

FV1 FV2 FV3 FV4 FVn

NPV = + + + +...... + - CO0 = 0

( 1 + K) ( 1 + K) ( 1 + K) ( 1 + K) ( 1 + K)

At IRR, NPV = 0

1 2 3 4 n

and Profitability

n

FVi

NPV = ∑ − CO0 = 0 Index = 1

i=1 ( 1 + K )

i

The discount

rate, i.e., cost of

capital is assumed to be known in the determination of Net Present Value, while in the internal rate of return

calculation, the NPV is set equal to zero and the discount rate which satisfies the condition is determined.

|KIMS_The Platform to Perform| 90 FM_Capital Budgeting_JM

Interpretation

IRR can be interpreted in two ways:

a) IRR represents the rate of return on the unrecovered investment balance in the project.

b) IRR is the rate of return earned on the initial investment made by the project.

Of these, the first view seems to be more realistic, since it may not always be possible for an enterprise to

reinvest immediate cash flows at a rate equal to IRR.

Decision Making or Acceptance Rule

If Decision

IRR > K0 Accept the Project. Surplus over and above the cut-off rate is obtained.

IRR = K0 Project generates cash flows at a rate just equal to the cost of capital. Hence, it may be

accepted or rejected. This constitutes an Indifference Point.

IRR < K0 Reject the Project. The Project does not provide returns even equivalent to the cut-off rate.

Procedure for computation of IRR

Step 1 Determine the total cash outflow of the project and time periods in which they occur.

Step 2 Determine the total cash inflows of the project and the time periods in which they arise.

Step 3 Compute the NPV at an arbitrary discount rate, say 10%.

Step 4 Choose another discount rate and compute NPV. The second discount rate is chosen in such a way

that one of the NPV’s is negative and the other is positive. Suppose, NPV is positive at 10%,

choose a higher discount rate so as to get a negative NPV. In case NPV is negative at 10%,

choose a lower rate.

Step 5 Compute the change in NPV over the two selected discount rates.

Step 6 On proportionate basis, compute the discount rate at which NPV is zero.

Illustration: 10

Taking data from Illustration: 9 calculate the IRR for each project.

Year PVIF Project X Project Y

10% 20% CFAT DCFAT DCFAT CFAT DCFAT DCFAT

10% 20% 10% 20%

0 1.00 1.00 (200,000) (200,000) (200,000) (200,000) (200,000) (200,000)

1 0.91 0.83 35,000 31,850 29,050 218,000 198,380 180,940

2 0.83 0.69 80,000 66,400 55,200 10,000 8,300 6,900

3 0.75 0.58 90,000 67,500 52.200 10,000 7,500 5,800

4 0.68 0.48 75,000 51,000 36,000 4,000 2,720 1,920

5 0.62 0.41 20,000 12,400 8,200 3,000 1,860 1,230

29,150 (19,350) 18,760 (3,210)

Since NPV is positive for both the projects at 10% discounting rate, we arbitrary choose a higher discounting

rate for negative NPV, let say 20%. By interpolation method or on proportionate basis, IRR calculated is:

IRR of Project X:

k − 10 0 − 29,150

= = 0.601 ∴ k = 10 + 6.01 = 16.01%

20 − 10 −19, 350 − 29,150

IRR of Project Y:

k − 10 0 − 18, 760

= = 0.854 ∴ k = 10 + 8.54 = 18.54%

20 − 10 −3, 210 − 18, 760

CONFLICT BETWEEN CHOICE OF

IRR AND NPV METHODS

Causes of Conflict

Generally, the higher the NPV, higher will be the IRR. However, NPV and IRR may give conflicting result in

the evaluation of different projects.

|KIMS_The Platform to Perform| 91 FM_Capital Budgeting_JM

a) Initial Investment Disparity – i.e., different project sizes.

b) Project Life Disparity – i.e., difference in project lives.

c) Outflows Pattern – i.e., when cash outflows arise at different points of time during the project life,

rather than as initial investment (t = 0) only.

d) Cash Flow Disparity – i.e., when there is huge difference between initial CFAT and later years’

CFAT. A project with heavy initial CFAT then compared to later years will have higher IRR and vice-

versa.

Superiority of NPV

In case of conflicting decisions based on NPV and IRR, the NPV method must prevail. Decisions are based

on NPV sue to the superiority of NPV, as given from the following points:

a) NPV represents the surplus from the project whereas IRR represents the point of no surplus-no

deficit.

b) NPV consider cost of capital as constant. Under IRR, the discount rate is determined by reverse

working, by setting NPV = 0.

c) NPV aids decision-making by itself, i.e., projects with positive NPV are accepted. IRR by itself does

not aid decision-making. For example, a project with IRR = 18% will be accepted if K 0 < 18%.

However, the project will be rejected if K0 = 21% (say > 18%).

d) NPV method considers the timing differences in cash flows at the appropriate discount rate. IRR is

greatly affected by the volatility or variance in cash flow patterns.

e) IRR presumes that intermediate cash inflows will be reinvested at the rate (IRR); whereas in the

case of NPV method, intermediate cash inflows are presumed to be reinvested at the cut-off rate.

The later presumption, viz., reinvestment at the cut-off rate, is more realistic than reinvestment at

IRR.

Illustration: 11

Taking data from Illustration 9 and 10, state with reasons which project would you recommend?

NPV – IRR conflict

Particulars Project X Project Y

NPV at 10% Rs. 29,150 Rs. 18,760

Rank based on NPV I II

Internal Rate of Return 16.01% 18.54%

Rank based on IRR II I

In case of NPV – IRR conflict, NPV should be preferred for decision making since it gives the net benefit in

absolute terms. Hence Project X will be preferred.

NOTE:

Inconsistency in ranking between NPV and IRR arises because:

a) Cash flow patterns of projects are different, Project Y has heavy initial cash inflows and hence has

higher IRR.

Illustration: 12

The cash flows of Project C and D with other details are given below:

Year 0 1 2 3 NPV at 10% IRR

Project C (10,000) 2,000 4,000 12,000 4,139 26.5%

Project D (10,000) 10,000 3,000 3,000 3,823 37.6%

Year PVIF at

10% 14% 15% 30% 40%

1 0.9090 0.8772 0.8696 0.7692 0.7143

2 0.8264 0.7695 0.7561 0.5917 0.5102

3 0.7513 0.6750 0.6575 0.4552 0.3644

|KIMS_The Platform to Perform| 92 FM_Capital Budgeting_JM

a) Compare and rank the projects at different discounting rates based on NPV.

b) Why there is conflict in rankings?

c) Which project do you recommend?

Comparison and Ranking of Projects at different discounting rates based on NPV

Discounting Rate 0% 10% 14% 15% 30% 40%

NPV of Project C 8,000 4,139 2,932 2,653 (633) (2,157)

NPV of Project D 6,000 3,823 3,106 2,937 833 (233)

Preference C C D D D NA

The conflict in project ranking between NPV and IRR is due to the variability of cash flows. Project C has

lower initial cash flows and heavy later inflows. However, Project D has heavy initial inflows and lower

inflows in the later period. This will distort the analysis under IRR. NPV is a realistic technique which takes

into account, the variability of cash flows. Hence, NPV should be preferred over IRR in case of conflict.

We are informed that the company’s cost of capital of 10%, NPV is higher for Project C. Hence, it should be

preferred over Project D.

PROFITABILITY INDEX METHOD

When different investment proposals each involving different initial investments and cash inflows are to be

compared, the technique of Profitability Index (PI) is used.

Profitability Index (PI) or Desirability Factor or Benefit Cost Ratio (BCR) is:

Total Discounted Cash Inflows

Total Discounted Cash Outflows

PI represents the amount obtained at the end of the project life, for every rupee invested in the project at the

initial stage. The higher the PI, the better it is, since the greater is the return for every rupee of investment in

the project.

Decision Making or Acceptance Rule

If Decision

PI > 1 Accept the Project. Surplus over and above the cut-off rate is obtained.

PI = 1 Project generates cash flows at a rate just equal to the cost of capital. Hence, it may be

accepted or rejected. This constitutes an Indifference Point.

PI < 1 Reject the Project. The Project does not provide returns even equivalent to the cut-off rate.

CONFLICT BETWEEN THE CHOICE OF PI AND NPV METHODS

Acceptance – Rejection Decision

• Both NPV and PI techniques recognize the time value of money.

• The discount rate used in NPV and PI methods are the same.

• Both NPV and PI use the same factors, i.e., Discounted Cash Inflows (A) and Discounted Cash

Outflows (B), in the computation. NPV = A – B whereas PI = A ÷ B.

• When NPV > 0, PI will always be greater than 1. Also when NPV < 0, PI will be less than 1.

• Hence, for a given project, NPV and PI method give the same Accept or Reject Decision.

Ranking Criteria

However, if one project is to be selected out of two mutually exclusive projects, the NPV and PI method may

give conflicting ranking criteria.

Example:

Project P Q

Discounted Cash Inflows Rs. 10,00,000 Rs. 5,00,000

|KIMS_The Platform to Perform| 93 FM_Capital Budgeting_JM

Less: Discounted Cash Outflows Rs. 5,00,000 Rs. 2,00,000

Net Present Value Rs. 5,00,000 Rs. 3,00,000

Profitability Index 2.00 2.50

Project P has a better ranking based on NPV while project Q will be preferred if PI were to be used for

decision-making. Thus, there is a conflict in ranking, between NPV and PI methods. This is because NPV

gives the ranking in terms of absolute value of rupees, whereas PI gives ranking for every rupee of

investment, i.e., in terms of ratio.

Decision-making

Generally the NPV method should be preferred since NPV indicates the economic contribution or surplus of

the project in absolute terms. However, in capital rationing situations, for deciding between mutually

exclusive projects, PI is a better evaluation technique.

PROJECT LIFE DISPARITY SITUATIONS – DIFFERENTIAL PROJECT LIVES

In case of evaluation based on NPV method, comparison of two projects is possible only if initial investment

and project lives are the same. If project lives are different, e.g., Machine A operates for 6 years whereas

Machine B operates for 8 years, the decisions can be obtained by any of the following methods:

Equivalent Annual Flows Method

Here, the cash flows are converted into an equivalent annual annuity called EAB, i.e., Equivalent Annual

Benefit (in case of net inflow) or EAC, i.e., Equivalent Annual Cost (in case of net outflow).

Step 1 Compute the Initial Investment of each alternative.

Step 2 Determine the project lives of each alternatives.

Step 3 Determine the annuity factor relating to the project life of each alternative.

Step 4 Compute Equivalent Annual Investment.

(EAI) = Initial Investment ÷ Relevant Annuity Factor

Step 5 Compute CFAT per annum or Cash Outflows per annum, for each alternative.

Step 6 Compute EAB = CFAT per annum – EAI

Compute EAC = Cash outflows per annum + EAI

Step 7 Select project with maximum EAB or minimum EAC, as the case may be.

Illustration: 13

The cash flows of two mutually exclusive projects are as under:

Year 0 1 2 3 4 5 6

Project P (40,000) 13,000 8,000 14,000 12,000 11,000 15,000

Project J (20,000) 7,000 13,000 12,000 - - -

a) Estimate the net present value of the projects P and J using 15% as the hurdle rate.

b) Estimate the internal rate of return of the projects P and J.

c) Why is there conflict in the project by using NPV and IRR criteria?

d) Which criterion will you use in such a situation? Estimate the value at that criterion. Make a project

choice.

Calculation of NPV at 15% hurdle rate

Project P Project J

Year PVIF 15%

CFAT DCFAT CFAT DCFAT

0 1.0000 (40,000) (40,000) (20,000) (20,000)

1 0.8696 13,000 11,305 7,000 6,087

2 0.7561 8,000 6,049 13,000 9,829

3 0.6575 14,000 9,205 12,000 7,890

4 0.5718 12,000 6,862

5 0.4972 11,000 5,469

|KIMS_The Platform to Perform| 94 FM_Capital Budgeting_JM

6 0.4323 15,000 6,485

5,375 3,806

Computation of IRR

Since both the projects yield a positive NPV at 15%, a higher discount rate is used to determine a negative

NPV. IRR hence calculated by interpolation method is 20.15% for Project P and 25.30% for Project J.

(Students are advised to calculate the IRR)

NPV – IRR conflict

Particulars Project P Project J

NPV at 15% Rs. 5,375 Rs. 3,806

Rank based on NPV I II

Internal Rate of Return 20.15% 25.30%

Rank based on IRR II I

Project Life 6 years 3 years

Initial Investment Rs. 40,000 Rs. 20,000

The difference or conflict in ranking between NPV and IRR is attributed to:

a) Disparity in Initial Investment

b) Difference in Project Lives

c) Non uniform cash inflows of the project

Resolving the conflict and Project choice

In case of conflict between NPV and IRR, the NPV criterion is generally preferred. Hence Project P, whose

NPV is Rs. 5,375, will be preferred in the above case. However, in this case, Project P and J have

differential lives and hence, Equivalent Annual Flows Method will be better criteria for project

ranking.

Equivalent Annual Flows from the Project = NPV ÷ PVIFA at 15% for the relevant project life

For Project P: EAF = 5,375 ÷ 3.7845 = Rs. 1,420

For Project J: EAF = 3,806 ÷ 2.2832 = Rs. 1,668

Hence, Project J should be preferred in the above situation, based on Equivalent Annual Flow

criteria.

Terminal Value Method / Modified Net Present Value Method

Under this method it is assumed that each cash flow is reinvested in another project at a predetermined rate

of interest. It is also assumed that each cash inflow is reinvested elsewhere immediately until the termination

of the project. If the present value of the sum total of the compounded reinvested cash flows is greater than

the present value of the outflows the proposed project is accepted otherwise not.

Step 1 Find Terminal Value

Terminal Value = Future value of the immediate cash flows invested at different rates.

n

∑ CF ( 1 + r )

n −1

TV = t

t=1

Where, TV = Terminal Value

CFt = Cash Inflow in year t

r = Re-investment rate

n = Life of the project

Step 2 Find Modified NPV

TV

Modified NPV = − I0

( 1+k )

n

|KIMS_The Platform to Perform| 95 FM_Capital Budgeting_JM

Where, k = Cost of Capital

I0 = Initial Investment

Illustration: 14

Original outlay Rs. 8,000

Life of the project 3 years

Cash inflows Rs, 4,000 p.a. for 3 years

Cost of Capital 10%

Expected interest rates at which the cash inflows will be re-invested:

Year end 1 2 3

% 8 8 8

First of all, it is necessary to find out total compounded sum which will be discounted back to the present

value.

Rate of Total

Cash Inflow Years of Compounding

Year Interest Compounding

(Rs.) Investment Factor

(%) Sum (Rs.)

1 4,000 8 2 1.166 4,664

2 4,000 8 1 1.080 4,320

3 4,000 8 0 1.000 4,000

12,984

Now, we have to find out the present value of Rs. 12,984 by applying the discount rate (cost of capital) of

10%. (PVIF at 10% for 3 years = 0.7513)

Modified NPV = Total Compounding Sum x PVIF – I0

= (Rs. 12,984 x 0.7513) – Rs. 8,000

= Rs. 9,755 – Rs. 8000

= Rs. 1,755

Since Modified NPV is positive, the project would be accepted under the terminal value criterion.

CAPITAL RATIONING – Advance Level

Generally, a firm fixes up the maximum amount that can be invested in capital projects during a given period

of time. The firm then tries to select a combination of investment proposals, which will be within the specific

limits providing maximum profitability, and put them n descending order according to their rate of return.

Such a situation is then considered to be capital rationing.

Situations of Capital Rationing

Situation I

|KIMS_The Platform to Perform| 96 FM_Capital Budgeting_JM

Projects are Divisible

Step 1 Calculate the profitability index of each project

Step 2 Rank the projects on the basis of the profitability index calculated in Step: 1.

Step 3 Choose the optimal combination of the projects.

Illustration: 15

Project Required Initial NPV at the appropriate

Investment (Rs.) cost of capital (Rs.)

A 1,00,000 20,000

B 3,00,000 35,000

C 50,000 16,000

D 2,00,000 25,000

E 1,00,000 30,000

Total funds available is Rs. 3,00,000. Determine the optimal combination of projects assuming that the

projects are divisible.

NPV at the

Required Initial Profitability

Project appropriate cost Rank

Outlay (Rs.) Index

of capital (Rs.)

A 1,00,000 20,000 0.2 3

B 3,00,000 35,000 0.117 5

C 50,000 16,000 0.32 1

D 2,00,000 25,000 0.125 4

E 1,00,000 30,000 0.3 2

Rank of Investment Project Initial Investment (Rs.) Cumulative

1 C 50,000 50,000

2 E 1,00,000 1,50,000

3 A 1,00,000 2,50,000

4 D (50,000÷200,000) 1/4th 50,000 3,00,000

Thus, the optimal combination of projects is C, E, A and 1/4th of D.

Situation II

Projects are Indivisible

Step 1 Construct a table showing the feasible combinations of the project (whose aggregate of initial outlay

does not exceed the fund available for investment).

Step 2 Choose the combination whose aggregate NPV is maximum and consider it as the optimal project

mix.

Illustration: 16

Using the same data as used in previous illustration, determine the optimal project mix on the basis of the

assumption that the projects are indivisible.

Feasible Combinations Aggregate of NPVs (Rs.)

A, C 36,000

A, D 45,000

A, E 50,000

C, D 41,000

|KIMS_The Platform to Perform| 97 FM_Capital Budgeting_JM

C, E 46,000

D, E 55,000

A, C, E 66,000

By a careful inspection of the feasible combinations constructed in the above table, we can conclude that the

optimal project mix is A, C, E because the aggregate of their NPV’s is maximum.

LEASE DECISIONS – Advance Level

Leasing is the general contract between the owner and user of the asset over a specific period of time. The

asset is purchased initially by the lessor and leased to the user which pays a specified rent at periodic

intervals.

From the lessee’s point of view, leasing has the attraction of eliminating immediate cash outflow, and the

lease rentals are also tax deductible expenses.

Buying has the advantages of depreciation allowance and interest on borrowed capital being tax deductible.

Evaluation of the two alternatives is to be made in order to take decision.

Illustration: 17

K Limited has decided to go in for a new model of a Car. The cost of the vehicle is Rs. 40,00,000. The

company has two alternatives:

a) Taking the Car on Finance Lease; or

b) Borrowing and Purchasing the Car.

J Limited is willing to provide the car on financial lease to K Limited for 5 years at an annual rental of Rs.

8,75,000, payable at the end of the year.

The vehicle is expected to have a useful life of 5 years, and it will fetch a net salvage value of Rs. 10,00,000

at the end of year five. The depreciation rate for tax purposes is 40% on written down value basis. The

applicable tax rate for the company is 35%. The applicable before tax borrowing rate for the company is

13.8462%.

What is the advantage of leasing for K Limited?

Rate of discount 1 2 3 4 5

0.138462 0.8784 0.7715 0.6777 0.5953 0.5229

0.09 0.9174 0.8417 0.7722 0.7084 0.6499

Analysis of Lease Option

Company’s cost of borrowing before tax = 13.8462%

Cost of Capital (after tax) = 13.8462 x 0.65 = 9% approx

Annual Lease Rental = Rs. 8,75,000

Less: Tax saved @ 35% = Rs. 3,06,250

Cash outflow net of taxes = Rs. 5,68,750

PV of cash outflows = Cash outflow p.a. x PVIFA

= Rs. 5,68,750 x 3.8896

= Rs. 22,12,210

|KIMS_The Platform to Perform| 98 FM_Capital Budgeting_JM

Analysis of Loan Option

Computation of Depreciation per year (in Rs. Lakhs)

Year 1 2 3 4 5

Opening Balance 40.00 24.00 14.40 8.64 5.18

Less: Dep. @40% 16.00 9.60 5.76 3.46 2.07

Closing Balance 24.00 14.40 8.64 5.18 3.11

Computation of loan amounts repaid (presumed to be repaid in 5 years equally) (in Rs. Lakhs)

Annual repayment of loan = 40.00 ÷ 5 = 8.00

Year 1 2 3 4 5

Opening Balance 40.00 32.00 24.00 16.00 8.00

Less: Repayments 8.00 8.00 8.00 8.00 8.00

Closing Balance 32.00 24.00 16.00 8.00 0.00

Total Cash Outflows of Loan Option (Rs. Lakhs)

Year 1 2 3 4 5

Principal Repayment 8.00 8.00 8.00 8.00 8.00

Interest @9% on Opening Balance 3.60 2.88 2.16 1.44 0.72

Less: Tax saved on depreciation @ 35% (5.60) (3.36) (2.02) (1.21) (0.72)

Less: Salvage Value (10.00 – 3.11)x0.65 + 3.11 - - - - (7.59)

Outflows 6.00 7.52 8.14 8.23 0.41

PVIF 9% 0.9714 0.8417 0.7722 0.7084 0.6499

Discounted Cash outflows 5.50 6.33 6.29 5.83 0.27

Total Discounted Cash Outflows = Rs. 24,22,000

Thus, net advantage of lease option = Rs. 24,22,000 – Rs. 22,12,210

= Rs. 2,09,790

Exercise

1. A company is considering an investment proposal to install new milling controls at a cost of Rs.

50,000. The facility has a life expectancy of 5 years and no salvage value. The tax rate is 35%. Assume

the firm uses straight line depreciation and the same is allowed for tax purposes. The estimated cash

flows before depreciation and tax (CFBT) from the investment proposal are as follows:

Year : 1 2 3 4 5

CFBT (Rs.) : 10,000 10,692 12,769 13,462 20,385

Compute the following:

a) Pay back period

|KIMS_The Platform to Perform| 99 FM_Capital Budgeting_JM

b) Average rate of return

c) Internal rate of return

d) Net present value at 10% discount rate

e) Profitability index at 10% discount rate

[Answer: 4.328 years, 9%, 6.6%, (Rs. 4,648), 0.907]

2. A company is contemplating to purchase a machine. Two machines A and B are available, each

costing Rs. 5,00,000. In comparing the profitability of the machines, a discounting rate of 10% is to be

used and machines to be written off in five years by straight line method of depreciation with nil residual

value. Cash inflows after tax are expected as follows:

Year Machine A Machine B

1 1,50,000 50,000

2 2,00,000 1,50,000

3 2,50,000 2,00,000

4 1,50,000 3,00,000

5 1,00,000 2,00,000

Indicate which machine would be profitable using the following methods of ranking investment

proposals:

a) Pay Back Method

b) Net Present Value Method

c) Profitability Index Method

d) Average Rate of Return Method

[Answer: a) 2 years 7.2 months, 3 years 4 month, b) Rs. 1.5401 lakhs, Rs. 1.4876 lakhs, c) 1.308,

1.298, d) 28%, 32%]

3. Oasis Plastics Limited is a manufacturer of high quality plastic products. Bania, President, is

considering computerizing the company’s ordering, inventory and billing procedures. He estimates that

the annual savings from computerization include a reduction of 4 clerical employees with annual salaries

of Rs. 50000 each, Rs. 30,000 from reduced production delays caused by raw materials inventory

problems, Rs. 25,000 from lost sales due to inventory stock outs and Rs. 18,000 associated with timely

billing procedures.

The purchase price of the system is Rs. 2,50,000 and installation costs are Rs. 50,000. These outlays

will be capitalized (depreciated) on a straight line basis to a zero books salvage value which is also its

market value at the end of five years. Operation of the new system requires two computer specialists

with annual salaries of Rs. 80,000 per person. Also annual maintenance and operation (cash) expenses

of Rs. 22,000 are estimated to be required. The company’s tax rate is 40% and its required rate of return

(cost of capital) for the project is 12%.

You are required to:

a) Evaluate the project using NPV method.

b) Evaluate the project using PI method.

c) Evaluate the Project’s Payback Period.

[Answer: NPV = (Rs. 16,663), PI = 0.944, PBP = 3.817 years]

4. A company has to make a choice between two projects namely A and B. The initial capital outlay of

two projects are Rs. 1,35,000 and Rs. 2,40,000 respectively for A and B. There will be no scrap value at

the end of the life of both the projects. The opportunity cost of capital is 16%. The annual incomes are as

under:

Year Project A Project B Discounting Factor @16%

1 - 60,000 0.862

2 30,000 84,000 0.743

3 1,32,000 96,000 0.641

4 84,000 1,02,000 0.552

5 84,000 90,000 0.476

|KIMS_The Platform to Perform| 100 FM_Capital Budgeting_JM

You are required to calculate for each project:

a) Discounted Payback Period

b) Profitability Index

c) Net Present Value

[Answer: a) 3.606 years, 4.187 years; b) 1.4315, 1.1451; c) Rs. 58,254, Rs. 34,812]

5. M/s. M & Co. wants to replace its old machine with a new automatic machine. Two models Bye-Bye

and K&K are available at the same cost of Rs. 5,00,000 each. Salvage value of the old machine is Rs.

1,00,000. The utilities of the existing machine can be used if the company purchases Bye-Bye.

Additional cost of utilities to be purchased in that case are Rs. 1,00,000. If the company purchases K&K

then all the existing utilities will have to be replaced with new utilities costing Rs. 2,00,000. The salvage

value of the old utilities will be Rs. 20,000. The cash flows after taxation are expected to be:

Year Cash Inflows of PV factor

@ 15%

Bye-Bye (Rs.) K&K (Rs.)

1 1,00,000 2,00,000 0.87

2 1,50,000 2,10,000 0.76

3 1,80,000 1,80,000 0.66

4 2,00,000 1,70,000 0.57

5 1,70,000 40,000 0.50

Salvage value at the end of year 5 50,000 60,000

The targeted return on capital is 15%. You are required to:

a) Compute, for the two machines separately, net present value, discounted pay back period and

desirability factor, and

b) Advise which of the machines is to be selected.

[Answer: NPV = Rs. 44,000, Rs. 20,000; DPBP = 4.6 years, 4.6 years; DF = 1.088, 1.034]

6. A particular project has a four year life with yearly projected net profit of Rs. 10,000 after charging

yearly depreciation of Rs. 8,000 in order to write-off the capital cost of Rs. 32,000. Out of the capital cost

Rs. 20,000 is payable immediately (Year 0) and balance in the next year (which will be the Year 1 for

evaluation). Stock amounting to Rs. 6,000 (to be invested in Year 0) will be required throughout the

project and for Debtors a further sum of Rs. 8,000 will have to be invested in Year 1. The working capital

will be recouped in Year 5. It is expected that the machinery will fetch a residual value of Rs. 2,000 at

the end of 4th year. Income Tax is payable @ 40% and the depreciation equals the taxation writing down

allowances of 25% per annum. Income Tax is paid after 9 months after the end of the year when profit is

made. The residual value of Rs. 2,000 will also bear tax @ 40%. Although the project is for 4 years, for

computation of tax and realization of working capital, the computation will be required up to 5 years.

Taking discount factor of 10%, calculate NPV of the project and give your comments regarding its

acceptability.

[Answer: NPV = Rs. 10,910; Accept the proposal]

7. K Limited has the following expectations from its project:

Rs. In Lakhs

Year 0 1 2 3 4 5

Total (2,910.24) 1,439.49 1,355.16 1,272.67 1,248.59 2,673.20

To finance its project the company borrowed Rs. 1,000 lakhs @ 12%. The balance was invested through

equity. The cost of equity is 14%. The marginal tax rate applicable to the company is 35%. The company

expects to reinvest the intermediate cash flows @6% in government securities.

You are required to compute the company’s modified NPV and suggest whether the project should be

accepted.

[Answer: Modified NPV = Rs. 2,145.22 lakhs, the company should accept this project]

|KIMS_The Platform to Perform| 101 FM_Capital Budgeting_JM

8. Om Limited has Rs. 10,00,000 allocated for capital budgeting purpose. The following proposals and

associated profitability indices have been determined:

Project 1 2 3 4 5 6

Project Costs (Rs. Lakh) 3.00 1.50 3.50 4.50 2.00 4.00

Profitability Index 1.22 0.95 1.20 1.18 1.20 1.05

Which of the above investments should be undertaken? Assume that projects are indivisible and there is

no alternative use of money allocated for capital budgeting.

[Answer: Mix of projects 3, 4 and 5]

9. Beta Limited is considering 5 capital projects for the years 1, 2, 3 and 4. The company is financed

entirely by equity and its cost of capital is 12%. The expected cash flows of the projects are as follows:

Project Year 1 Year 2 Year 3 Year 4

A (70) 35 35 20

B (40) (30) 45 55

C (50) (60) 70 80

D - (90) 55 65

E (60) 20 40 50

All projects are divisible. None of the projects can be delayed or undertaken more than once. Calculate

which project the company should undertake if the capital available for investment is limited to Rs.

110000 in year 1 and with no limitation in subsequent years?

[Answer: Either D or Combination of E, B and C]

10. In a capital rationing situation (investment limit Rs. 25 lakhs), suggest the most desirable and

feasible combination on the basis of the following data (indicate justification):

Project Initial Outlay NPV

A 15,00,000 6,00,000

B 10,00,000 4,50,000

C 7,50,000 3,60,000

D 6,00,000 3,00,000

Projects B and C are mutually exclusive.

[Answer: Project A and B]

11. Five projects M, N, O, P, and Q are available to a company for consideration. The investment

required for each project and cash flows it yields are tabulated below. Projects N and Q are mutually

exclusive. Taking the cost of capital @ 10%, which combination of projects should be taken up for a total

capital outlay not exceeding Rs 3 lakhs on the basis of NPV and Benefit- Cost Ratio?

Project Investment Cash flow p.a. No. of years PV @ 10%

M 50,000 18,000 10 6.145

N 1,00,000 50,000 4 3.170

O 1,20,000 30,000 8 5.335

P 1,50,000 40,000 16 7.824

Q 2,00,000 30,000 25 9.077

[Answer: Projects M, N & P combines to give maximum NPV of Rs. 2,82,070 and maximum BCR

of 1.940]

12. A company is evaluating three projects 1, 2 and 3. Investments required and expected present

values of cash inflows from each of the projects are as below:

Year Investments (Rs.) PV of Inflows (Rs.)

1 2,00,000 2,90,000

2 1,15,000 1,85,000

3 2,70,000 4,00,000

a) If projects 1 and 2 are jointly undertaken, there will be no economies; the investments required and

present values will simply be the sum of the parts.

|KIMS_The Platform to Perform| 102 FM_Capital Budgeting_JM

b) With projects 1 and 3, economies are possible in investment because one of the machines costing

Rs. 30,000 can be used for both of the projects.

c) If projects 2 and 3 are undertaken, there are economies to be achieved in marketing and production

but not in investment. The expected present value of costs saved is Rs. 35,000.

d) If all three projects are undertaken simultaneously, the economies noted will still hold. However, an

extension of plant capacity will be necessary at additional investment of Rs. 1,25,000.

Which projects should be chosen?

[Answer: Combination of 2 and 3]

13. S Limited a highly profitable company is engaged in the manufacture of power intensive products.

As part of its diversification plans, the company proposes to put up a Windmill to generate electricity.

The details of the scheme are as follows:

a) Cost of windmill – Rs. 300 lakhs

b) Cost of land – Rs. 15 lakhs

c) Subsidy from state Government to be received at the end of first year of installation – Rs. 15

lakhs.

d) Cost of electricity will be Rs. 2.25 per unit in year 1. This will increase by Re. 0.25 per unit

every year till year 7. After that it will increase by Re. 0.50 per unit.

e) Maintenance costs will be Rs. 4 lakhs in year 1 and the same will increase by Rs. 2 lakhs

every year.

f) Estimated life is 10 years.

g) Cost of capital is 15%.

h) Residual value of the windmill will be nil. However, land value will go up to Rs. 60 lakhs at

the end of 10 years.

i) Depreciation will be 100% of the cost of the Windmill in year 1 and the same will be allowed

for tax purposes.

j) As windmills are expected to work based on wind velocity, the efficiency is expected to be

an average 30%. Gross electricity generated at this level will be 25 lakhs units per annum. 4% of

this electricity generated will be committed free to the State Electricity Board as per the agreement.

k) Tax rate is 50%

From the above information you are required to calculate the net present value. (Ignore tax on capital

profits.)

Year 1 2 3 4 5 6 7 8 9 10

At 15% 0.87 0.76 0.66 0.57 0.50 0.43 0.38 0.33 0.28 0.25

[Answer: Rs. 8.26 lakhs]

14. K Limited is considering a new project for manufacture of pocket video games involving a capital

expenditure of Rs. 600 lakh and working capital of Rs. 150 lakh. The capacity of the plant is for an

annual production of 12 lakh units and capacity utilization during the 6 year working life of the project is

expected to be as indicated below:

Year : 1 2 3 4–6

Capacity Utilization (%) : 33.33 66.67 90 100

The average price per unit of the product is expected to be Rs. 200 netting a contribution of 40%. The

annual fixed costs, excluding depreciation, are estimated to be Rs. 480 lakh per annum from the third

year onwards; for the first and second year, it would be Rs. 240 lakh and Rs. 360 lakh respectively. The

average rate of depreciation for tax purposes is 33.33 % on the capital assets. The rate of income tax

may be taken as 35%. Cost of capital is 15%.

At the end of the third year, an additional investment of Rs. 100 lakh would be required for working

capital.

Terminal value for the fixed assets may be taken at 10% and for the current assets at 100%. For the

purpose of your calculations, the recent amendments to the tax laws with regard to balancing charge

may be neglected.

[Answer: NPV = Rs. 273 lakh]

|KIMS_The Platform to Perform| 103 FM_Capital Budgeting_JM

15. Run Away Limited is considering the manufacture of a new product. They have prepared the

following estimate of profit in the first year of manufacture:

(Rs.)

Sales, 9,000 units @ Rs. 32 2,88,000

Cost of goods sold:

Labour 40,000 hours @ Rs. 3.50 per hour 1,40,000

Materials and other variable costs 65,000

Depreciation 45,000

2,50,000

Less: Closing stock 25,000 2,25,000

Net Profit 63,000

The product is expected to have a life of four years. Annual sales volume is expected to be constant

over the period at 9,000 units. Production which was estimated at 10,000 units in the first year would be

only 9,000 units each in year two and three and 8,000 units in year four. Debtors at the end of each year

would be 20% of sales during the year, creditors would be 10% of materials and other variable costs. If

sales differed from the forecast level, stocks would be adjusted in proportion.

Depreciation relates to machinery which would be purchased especially for the manufacture of the new

product and is calculated on the straight line basis assuming that the machinery would last for four years

and have no terminal scrap value. Fixed costs are included in labour cost.

There is high level of confidence concerning the accuracy of all the above estimates except the annual

sales volume. Cost of capital is 20% per annum. You may assume that debtors are realized and

creditors are paid in the following year. No changes in the prices of inputs and outputs are expected over

the next four years.

You are required to show whether the manufacture of the new product is worthwhile. Ignore taxes.

[Answer: NPV = Rs. 58,398]

16. A plastic manufacturing company is considering replacing an older machine which was fully

depreciated for tax purposes with a new machine costing Rs. 40,000. The new machine will be

depreciated over its eight-year life. It is estimated that the new machine will reduce labour costs by Rs.

8,000 per year. The management believes that there will be no change in other expenses and revenues

of the firm due to the machine. The company requires an after-tax return on investment of 10%. Its rate

of tax is 35%. The company’s income statement for the current year is given for other information.

Income statement for the current year:

(Rs.)

Sales 5,00,000

Costs:

Materials 1,50,000

Labour 2,00,000

Factory and administrative 40,000

Depreciation 40,000 4,30,000

Net income before taxes 70,000

Less: Taxes (0.35) (24,500)

Earnings after taxes 45,500

Should the company buy the new machine? You may assume the company follows straight line method

of depreciation and the same is allowed for tax purposes.

[Answer: Differential NPV = (Rs. 2,922)]

17. A company is currently considering modernization of a machine originally costing Rs. 50,000

(current book value zero). However, it is in good working condition and can be sold for Rs. 25,000. Two

choices are available. One is to rehabilitate the existing machine at a total cost of Rs. 1,80,000; and the

other is to replace the existing machine with a new machine costing Rs. 2,10,000 and requiring Rs.

30,000 to install. The rehabilitated machine as well as the new machine would have a six year life and

no salvage value. The projected after-tax profits under the various alternatives are:

(Rs.)

Years Expected after-tax profits

|KIMS_The Platform to Perform| 104 FM_Capital Budgeting_JM

Existing machine Rehabilitated machine New machine

1 2,00,000 2,20,000 2,40,000

2 2,50,000 2,90,000 3,10,000

3 3,10,000 3,50,000 3,50,000

4 3,60,000 4,00,000 4,10,000

5 4,10,000 4,50,000 4,30,000

6 5,00,000 5,40,000 5,10,000

The firm is taxed at 35%. The company uses straight line depreciation method and the same is allowed

for tax purposes. Ignore block assets concept. The cost of capital is 12%.

Advise the company whether it should rehabilitate the existing machine or should replace it with the new

machine. Also, state the situation in which the company would like to continue with the existing machine.

[Answer: Incremental NPV for Rehab machine = Rs. 89,980; new machine = Rs. 1,00,960]

18. A company is considering the proposal of taking up a new project which requires an investment of

Rs. 400 lakhs on machinery and other assets. The project is expected to yield the following earnings

before depreciation and taxes over the next five years: Rs. In lakhs: 160, 160, 180, 180 and 150

respectively.

The cost of raising the additional capital is 12% and the assets have to be depreciated at 20% on WDV

basis. The salvage value at the end of 5 yrs period may be taken as zero. Income tax applicable is 50%.

Calculate the NPV and IRR of the project.

19. A Limited is considering investing in a project. The expected investment in the project is Rs.

2,00,000. Life of the project is 5 years with no salvage value. The expected net cash inflows after

depreciation but before taxes are in Rs. 85,000; 100,000; 80,000; 80,000 and 40,000 respectively.

Depreciation is 20% on original cost. Applicable tax rate is 30%.

Calculate payback period, ARR, NPV and IRR of the project.

20. A company wants to invest in a machinery costing Rs. 50,000 at the beginning of year 1. It is

estimated that net cash inflows from operation is Rs. 18,000 per annum for 3 years, if the company opts

to service a part of the machinery at the end of year 1 at Rs. 10,000 and the salvage value at the end of

year 3 will be Rs. 12,500. However, if the company decides not to service the part, it will have to be

replaced at the end of year 2 at Rs. 15,400. But in this case, the machinery will work for the 4 th year with

Rs. 18,000 as cash inflow. It will have to be scrapped at the end of year 4 at Rs. 9,000. Opportunity cost

of capital is 10%. Ignore taxation. Will you recommend the purchase of this machine based on NPV? If

the supplier gives you Rs. 5,000 discount, what would be your decision? [1, 0.9091, 0.8264, 0.7513,

0.6830, 0.6209, 0.5644]

21. Following are the date on a capital project being evaluated by X limited.

Annual cost saving Rs. 40,000

Useful life of the project 4 years

IRR 15%

Profitability Index 1.064

Net Present Value ??

Cost of Capital ??

Cost of Project ??

Payback Period ??

Salvage Value 0

Find the missing values.

22. Company X is forced to choose between two machines A and B. The two machines are designed

differently, but have identical capacity and do exactly the same job. Machine A costs Rs. 1,50,000 and

will last for 3 years. It costs Rs. 40,000 per year to run. Machine B is an “economy” model costing Rs.

1,00,000, but will last only for 2 years, and costs Rs. 60,000 per year to run. These are real cash inflows.

Ignore tax. Opportunity cost of capital is 10%. Which machine should company X buy?

23. Company X is operating an elderly machine that is expected to produce a net cash inflow of Rs.

40,000 in the coming year and Rs. 40,000 next year. Current salvage value is Rs. 80,000 and next

year’s value is Rs. 70,000. The machine can be replaced now with a new machine, which costs Rs.

|KIMS_The Platform to Perform| 105 FM_Capital Budgeting_JM

150,000, but is more efficient and will provide a cash inflow of Rs. 80,000 a year for 3 years. Company

wants to know whether it should replace the equipment now or wait a year with the clear understanding

that the new machine is the best of the available alternatives and that it in turn be replaced at the optimal

point. Ignore tax. Take cost of capital 10%. Advise with reasons.

24. PQ limited has decided to purchase a car worth Rs. 40,00,000, have two alternatives:

a) Taking the car on financial lease; or

b) Borrowing and purchasing the car.

LM limited is willing to provide the car on lease for 5 years at an annual rental of Rs. 8.75 lakhs, payable

at the end of the year. The vehicle is expected to have useful life of 5 years, with salvage value of Rs.

10,00,000. Depreciation @ 40% on WDV method. Applicable tax rate is 35%. Applicable before tax

borrowing rate is 13.8462%. Find net advantage of leasing.

25. A company is thinking of replacing its existing machine by a new machine which would cost Rs. 60

lakhs. The company’s current production is 80,000 units and is expected to increase to 100,000 units, if

the new machine is bought. The selling price remain unchanged at Rs. 200 per unit. The following is the

cost of producing one unit of product using both existing and new machine:

Existing machine New machine Difference

Materials 75.00 63.75 (11.25)

Wages and Salaries 51.25 37.50 (13.75)

Supervision 20.00 25.00 5.00

Repairs 11.25 7.50 (3.75)

Power and Fuel 15.50 14.25 (1.25)

Depreciation 0.25 5.00 4.75

Allocated corporate OHS 10.00 12.50 2.50

The existing machine has an accounting book value of Rs. 100,000, and it has been fully depreciated for

tax purposes. It is estimated that machine will be useful for 5 years. The supplier of the new machine

has offered to accept the old machine for Rs. 2,50,000. However, the market price of old machine today

is Rs. 1,50,000 and it is expected to be Rs. 35,000 after 5 years. The new machine has a life of 5 years

and a salvage value of Rs. 2,50,000 at the end of its economic life. Assume corporate income tax rate at

40% and depreciation is charged on straight line basis for income tax purposes. Further assume that

book profit is treated as ordinary income for tax purposes. The opportunity cost of capital is 15%.

Required:

a) Estimate NPV of the replacement decision.

b) Estimate the IRR of the replacement decision.

c) Should company go ahead with the replacement decision? Suggest.

|KIMS_The Platform to Perform| 106 FM_Capital Budgeting_JM

You might also like

- Assignment On Strategic AllianceDocument3 pagesAssignment On Strategic Alliancesurbhi thakkarNo ratings yet

- Unit 5: Project Control: Essential ReadingDocument27 pagesUnit 5: Project Control: Essential Readingtechnicalvijay100% (1)

- Criteria for Offshore Companies Adopting Agile MethodsDocument4 pagesCriteria for Offshore Companies Adopting Agile MethodsMREGANK SONINo ratings yet

- MARKETING PLAN SampleDocument15 pagesMARKETING PLAN SampleThành Đạt Cao NguyễnNo ratings yet

- Global Supply Chain Assignment 1Document3 pagesGlobal Supply Chain Assignment 1Neha204No ratings yet

- Balanced ScorecardDocument10 pagesBalanced Scorecardvstan9100% (1)

- Chapter-6 - Business Policy and StrategyDocument23 pagesChapter-6 - Business Policy and Strategybyomkesh bakshiNo ratings yet

- Credit Assignment 1Document5 pagesCredit Assignment 1Marock Rajwinder0% (1)

- RoxyDocument21 pagesRoxyMahbub JamilNo ratings yet

- Best Sellers Apparels PVT LTDDocument11 pagesBest Sellers Apparels PVT LTDgashwinjainNo ratings yet

- Blood functions and testingDocument4 pagesBlood functions and testingred8blue8No ratings yet

- HRMS Portal (Synopsis)Document9 pagesHRMS Portal (Synopsis)sanjaykumarguptaaNo ratings yet

- Individual Presentation: International Market Expansion of AstrazenecaDocument12 pagesIndividual Presentation: International Market Expansion of AstrazenecaSami Ur Rehman0% (1)

- Marketing Plan AssignmentDocument1 pageMarketing Plan AssignmentMd.shahnewas RokyNo ratings yet

- Borealis Groupb1Document15 pagesBorealis Groupb1AyushNo ratings yet

- Bss050-6 Strategic Management: Individual Written ReportDocument19 pagesBss050-6 Strategic Management: Individual Written Reporttim kimNo ratings yet

- Managing Project Teams Assignment 2 SupportDocument4 pagesManaging Project Teams Assignment 2 SupportSanam SlrNo ratings yet

- Strategic Plan EvaluationDocument5 pagesStrategic Plan EvaluationCEDRIC JONESNo ratings yet

- Lecture 4 Globalization of OperationsDocument28 pagesLecture 4 Globalization of OperationsmalakNo ratings yet

- GSK Strategic Report 2015Document75 pagesGSK Strategic Report 2015nolovNo ratings yet

- Subject: Engineering Business Environment Subject Code: ENGT 5219 Assignment B: Disruptive Low Carbon InnovationDocument23 pagesSubject: Engineering Business Environment Subject Code: ENGT 5219 Assignment B: Disruptive Low Carbon InnovationKishor JhaNo ratings yet

- Chapter 17Document8 pagesChapter 17belma12125No ratings yet

- Literature Review ProformaDocument13 pagesLiterature Review ProformaShashank Varma100% (1)

- Consolidated financial statements of Zena GroupDocument27 pagesConsolidated financial statements of Zena Groupbcnxv100% (1)

- Dell CaseDocument2 pagesDell CaseboneykatariaNo ratings yet

- SE21 Chapter 7 Export Entry ModesDocument26 pagesSE21 Chapter 7 Export Entry ModesShermarn W.100% (2)

- 1321691530financial AccountingDocument21 pages1321691530financial AccountingMuhammadOwaisKhan0% (1)

- Balance ScorecardDocument21 pagesBalance Scorecardfixs2002100% (1)

- Strategy Implementation at UnileverDocument12 pagesStrategy Implementation at UnileverSYED MANSOOR ALI SHAHNo ratings yet

- MSM MBA DMT Individual Assignment September 2021Document49 pagesMSM MBA DMT Individual Assignment September 2021online storeNo ratings yet

- Designing and Managing Global Marketing StrategiesDocument23 pagesDesigning and Managing Global Marketing StrategiesShreekānth DāngiNo ratings yet

- Space MatrixDocument14 pagesSpace MatrixsofiyyahzahraNo ratings yet

- MGT703 Strategic Management Tutorial 1 IntroductionDocument7 pagesMGT703 Strategic Management Tutorial 1 IntroductionKrishneel Anand PrasadNo ratings yet

- UBG163 Assessment Question Feb 2021Document9 pagesUBG163 Assessment Question Feb 2021bup hrlcNo ratings yet

- Operations Management XYZ Co. For Alkyd Resin Student # Module #Document40 pagesOperations Management XYZ Co. For Alkyd Resin Student # Module #mokbelNo ratings yet

- Gantt Chart Project WholeDocument2 pagesGantt Chart Project Wholeehm_magbujosNo ratings yet

- Investment DecisionDocument26 pagesInvestment DecisionToyin Gabriel AyelemiNo ratings yet

- M.M Case. (McCain Food)Document5 pagesM.M Case. (McCain Food)Roksana LipiNo ratings yet

- Tax Assignment V FinalDocument9 pagesTax Assignment V FinalMuneeb JuttNo ratings yet

- Porter Five Forces MorisonDocument3 pagesPorter Five Forces MorisonAsad SyedNo ratings yet

- Strategic Choices for Mature, Declining MarketsDocument2 pagesStrategic Choices for Mature, Declining MarketsMarielle Salan100% (3)

- Costco Example 1Document12 pagesCostco Example 1Fernando Gonzalez Rodriguez Jr.100% (1)

- Compensatin GSLC Pay PerfomanceeeDocument4 pagesCompensatin GSLC Pay Perfomanceeesherly tanNo ratings yet

- Quizlet Chap 10Document15 pagesQuizlet Chap 10Kryscel ManansalaNo ratings yet

- Assignment Briefing Document Case Studies in PM 2021 T2Document5 pagesAssignment Briefing Document Case Studies in PM 2021 T2Shradha ahluwaliaNo ratings yet

- Ansoff MatrixDocument3 pagesAnsoff MatrixRahul PandeyNo ratings yet

- Starbucks: Introduced ByDocument8 pagesStarbucks: Introduced BydiaNo ratings yet

- PrivateEquityFinalReport PDFDocument140 pagesPrivateEquityFinalReport PDFSachin GuptaNo ratings yet

- Strategic Management AccountingDocument27 pagesStrategic Management AccountingCvetozar MilanovNo ratings yet

- Market Analysis of Everyuth Derma Care RangeDocument58 pagesMarket Analysis of Everyuth Derma Care RangeronypatelNo ratings yet

- Chapter 9. Strategy MonitoringDocument38 pagesChapter 9. Strategy MonitoringAiralyn RosNo ratings yet

- Symphony Theatre Balance Sheet and Income Statement 2001Document8 pagesSymphony Theatre Balance Sheet and Income Statement 2001Sanyam RahejaNo ratings yet

- Property, Plant and Equipment: By:-Yohannes Negatu (Acca, Dipifr)Document37 pagesProperty, Plant and Equipment: By:-Yohannes Negatu (Acca, Dipifr)Eshetie Mekonene AmareNo ratings yet

- A Case Study On Acquisition "Tatasteel and Natsteel"Document15 pagesA Case Study On Acquisition "Tatasteel and Natsteel"ashwinchaudhary100% (1)

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting Decisionsarunadhana2004No ratings yet

- 5, 6 & 7 Capital BudgetingDocument42 pages5, 6 & 7 Capital BudgetingNaman AgarwalNo ratings yet

- FM 11 8 Gbs For Week 10 To 17 1 PDFDocument11 pagesFM 11 8 Gbs For Week 10 To 17 1 PDFvlad vladNo ratings yet

- Capital Budgeting RK 2019Document53 pagesCapital Budgeting RK 2019Ishaan TandonNo ratings yet

- Chapter 9Document44 pagesChapter 9Phạm Thùy DươngNo ratings yet

- Guide to Capital Budgeting Decisions and Investment Project EvaluationDocument38 pagesGuide to Capital Budgeting Decisions and Investment Project EvaluationHimanshu JainNo ratings yet

- It Modernize Data Architecture Phase 1 Develop A DA VisionDocument25 pagesIt Modernize Data Architecture Phase 1 Develop A DA VisionMARIA SELES TELES SOUSANo ratings yet

- School uniforms promote disciplineDocument3 pagesSchool uniforms promote disciplineArista DewiNo ratings yet

- Applications of Positive PsychologyDocument7 pagesApplications of Positive PsychologySarah SmithNo ratings yet

- Metropolitan Trial CourtDocument8 pagesMetropolitan Trial CourtRica VergaraNo ratings yet

- ISLAMIC PERSPECTIVE ON SUICIDE AND SELF-HARMDocument2 pagesISLAMIC PERSPECTIVE ON SUICIDE AND SELF-HARMLIEBERKHUNNo ratings yet

- Calculate business interruption costs of GSU transformer failuresDocument4 pagesCalculate business interruption costs of GSU transformer failuressevero97No ratings yet

- West Tower Condominium Corporation vs. First Philippine Industrial CorporationDocument70 pagesWest Tower Condominium Corporation vs. First Philippine Industrial CorporationJessamine RañaNo ratings yet

- The One-Eyed Trickster and His NamesDocument43 pagesThe One-Eyed Trickster and His NamesTracy Leigh HenryNo ratings yet

- Complaint Against Hazel Paragua Final DraftDocument26 pagesComplaint Against Hazel Paragua Final DraftChin ConsueloNo ratings yet

- BS English Semester 07 MCQs on The God of Small ThingsDocument3 pagesBS English Semester 07 MCQs on The God of Small Thingsfaisal jahangeer67% (3)

- Caretaker AgreementDocument2 pagesCaretaker AgreementWenceslao MagallanesNo ratings yet

- Scholars Challenge Jared Diamond's Views on Why Societies CollapseDocument4 pagesScholars Challenge Jared Diamond's Views on Why Societies CollapseBüşra Özlem YağanNo ratings yet

- Key Research Issues in Supply Chain & Logistics Management: 2030Document24 pagesKey Research Issues in Supply Chain & Logistics Management: 2030Amit Oza0% (1)

- E-PrepTalk Sep 2009Document73 pagesE-PrepTalk Sep 2009Nitin DodejaNo ratings yet

- Republic vs Democracy: Key Differences ExplainedDocument5 pagesRepublic vs Democracy: Key Differences ExplainedRicca ResulaNo ratings yet

- Guidelines COPROCEM LowDocument136 pagesGuidelines COPROCEM LowDekeukelaere Anne100% (1)

- CHUYÊN ĐỀ 14 liên từDocument15 pagesCHUYÊN ĐỀ 14 liên từHạnhhNo ratings yet

- SECURITIZATION AUDIT - A Waste of Foreclosure Victim MoneyDocument9 pagesSECURITIZATION AUDIT - A Waste of Foreclosure Victim MoneyBob Hurt50% (2)

- RPH PKPP English Module Work Year 1Document5 pagesRPH PKPP English Module Work Year 1Thirumaran ArunasalamNo ratings yet

- Marketing Activities - Session 4Document19 pagesMarketing Activities - Session 4ArthurNo ratings yet

- Occupational Injustice Across SpeciesDocument11 pagesOccupational Injustice Across SpeciesDouglas DíazNo ratings yet

- 2000 Years of Church History in 40 MinutesDocument86 pages2000 Years of Church History in 40 MinutesVenito100% (2)

- Types of Business Ownership ExplainedDocument27 pagesTypes of Business Ownership Explainedmaria cacaoNo ratings yet

- The Languages of Global Hip Hop - (Glossary of Hip-Hop Terms)Document6 pagesThe Languages of Global Hip Hop - (Glossary of Hip-Hop Terms)Abraham Calvachi Djsolid Maschine-vinylNo ratings yet

- 1 ChroniclesDocument166 pages1 ChroniclesAlex IordanNo ratings yet

- Brand IdentityDocument37 pagesBrand IdentityAnuranjanSinha80% (5)

- Samia Mceachin - ResumeDocument1 pageSamia Mceachin - Resumeapi-356034642No ratings yet

- SOC Interview QuestionsDocument35 pagesSOC Interview QuestionsAkhil KumarNo ratings yet

- Project Report For DairyDocument20 pagesProject Report For DairyKaushik KansaraNo ratings yet

- Ec 2019Document8 pagesEc 2019malleswarrauNo ratings yet