Professional Documents

Culture Documents

Will The 25% Public Float Work?: Debate

Uploaded by

mail_NileshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Will The 25% Public Float Work?: Debate

Uploaded by

mail_NileshCopyright:

Available Formats

WILL THE 25% PUBLIC FLOAT WORK?

he public listing of inate our markets, may not be

T a company is per-

haps its most sig-

nificant rite of pas-

sage. It symbolises

the willingness of its owners to

allow others to participate in

their journey of entrepreneur- The divestment will be in the larger public interest but it will be practical only if there is an

the best way for incremen-

tal capital given that any glob-

al turmoil would impact our

equity markets significantly

as in 2008.

The need of the hour is

to innovate to attract investors

ship, at a price. By accepting to equity markets through M3

public money, a company binds

itself to a governance code. One

enabling environment for the capital market to gain depth and function efficiently allocations. We do not have to

follow foreign regulation as

cannot make the argument that our issues are different.

divesting just a smaller share-

holding allows one to somehow DEBATE Mutual funds need a dif-

ferent outlook. A higher cap-

operate within a more lax code ital requirement for mutual

of governance or to treat mi- interest rates low. As a result, tranches of divestment will nat- ublic listings have be invested in equities. Mu- funds would help give the

nority shareholders different-

ly. Unfortunately, even with

good intentions, minority pub-

lic shareholders currently have

virtually no say in the man-

agement of a large number of

companies, as promoters who

many people, especially pen-

sioners, are now having to es-

chew fixed-income investments

and look elsewhere for returns.

While investors need to be will-

ing to accept market risks, they

need to be partly insulated from

urally take place at prices that

reflect the performance of the

first tranche. This is excellent

from a governance perspective

as it will induce discipline in the

company’s operations. If a share

is originally over-priced, the

P been a good av-

enue to raise cap-

ital, given the val-

ue discovery and

liquidity that they bring, sub-

ject to certain enabling con-

ditions. This would require

tual funds have an assets un-

der management (AUM) of

approximately Rs 74,000

crore, of which exposure to

equities would be around

Rs 40,000 crore, assuming that

60 per cent of premium is in-

requisite confidence to in-

vestors to attract funds. We

should also consider bank de-

posits where funds are swiped

into mutual funds daily or for

fixed tenures. Such deposits

should only use banks as

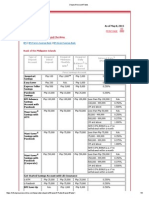

hold between 75 per cent and unnecessary risks caused by public will have an opportu- listed companies to have di- vested in equities. Accord- agencies and hence not be

90 per cent of the shares can illiquid and shallow capital mar- nity in the near term to invest versified shareholdings ingly, of the total savings of part of banks capital mar-

effectively operate the compa- kets as is the case with many at a fair price. through a higher public float Rs 38,00,000 crore, only ket exposures (more like de-

ny as they choose. It is in this stocks today. The new rule pro- In the light of all these ben- as it would enhance trans- Rs 1,55,000 crore hits the eq- fault swaps where banks

light that the recent guidelines vides greater price discovery efits, the proposal would have parency and accountability, uity markets. Most of the maintain capital to protect in-

of the finance ministry which and will dampen market volatil- to be hugely impractical. This enable value discovery and money available with public vestors).

require companies to achieve ity, thereby providing incentive is far from the case. Practi- provide good exit options to (or M3) is invested in cor- Life insurance should be

a 25 per cent free float over a for more retail participants GOVIND cality can be questioned if the investors. However, one needs ABIZER porate government debt. allowed to mature as an in-

three-year timeframe should to enter the market. This can SANKARANARAYANAN market does not have enough to understand the kind of fis- DIWANJI The total market captial- dustry in order to get the

be viewed. There is now a only be beneficial to compa- CFO, depth to pick up the newly cre- cal infrastructure needed to Executive Director, isation of the National Stock much-needed long-term funds

greater likelihood that the ma- nies and investors. TATA Capital Ltd ated shares. This is a circular make this happen. Corporate Finance, KPMG India Exchange is approximately into the market. This, how-

jority promoters will operate One can argue that the gov- argument because one can on- The government’s move to The move will work Rs 62,00,000 crore. Let’s as- ever, needs to be regularised

within certain bounds of ac- ernment has been reasonable

The move facilitates ly create depth in the market raise public shareholding sume the Indian public float through a pension rider.

ceptable corporate behaviour. by providing three years to pro- greater price discovery by having a substantial float (rightly excluding American only if the right fiscal today is over 20 per cent and Setting up of a sovereign

One is not suggesting that with moters to reduce the percent- available for people to acquire. Depository Receipts) to 25 per infrastructure is in Rs 2,00,000 crore to Rs fund to partly fund overseas

74 per cent, promoters will be- age of their shareholding. It is

and will dampen While it may appear that the cent for new issues and a grad- 3,00,000 crore is required just and domestic businesses is

come lily-white overnight, but, not easy to support the claim market volatility, market may not be able to ab- ual target of 25 per cent for list- place. Unless to fund existing listed com- important. Sovereign bonds

undoubtedly, a 25 per cent pub- that by forcing promoters to di-

providing incentives for sorb all Rs 1,60,000 crore of of- ed companies should be seen certain enabling panies at current capitalisa- to fund private sector equities

lic stake will be materially more lutes their stakes, one is some- ferings, what will really hap- from this perspective. But some tion. In that case, we would would also be a good long-

influential than a 10 per cent how depriving them of fair val- more retail participants pen is that investors will divert introspection is necessary. conditions are present, need our capital market allo- term source of capital. It needs

public stake. This regulatory ue. At some point over this pe-

to enter the market their investments from the least Indians basically invest the rule is impractical cations to grow five times to to be run independently on

change, therefore, serves the riod, the markets will presum- attractive ones to better ones. most of their savings in bank be able to meet the exit norms commercial terms. This would

cause of good governance. ably provide a reasonable val- The men will be separated from deposits. But, given the cap- along with incremental equi- provide the necessary capital

In addition to the custom- uation. What is perhaps true increased price discovery caused the boys, and that cannot be ital market exposure norms Life insurance companies have ty raising. By no means can for infrastructure as well as

ary commercial arguments for is that wealth created by means by a greater free float will mean bad for the markets per se. of banks and life insurance a cumulative premium income we achieve that. An increase overseas growth for Indian

increasing depth in the equi- of an artificial scarcity in a stock that those seeking to make quick No doubt, like any regula- companies, the amount that of Rs 2,22,000 crore. LIC, the in banks’ capital markets ex- companies.

ty market, there is an over- will disappear. This will per- profits based on manipulation tory change, this will also re- flows into the stock market is largest insurer and the col- posure may not help much but Therefore, the 25 per cent

riding moral consideration that haps reduce the super-normal or scarcity will have to work quire various qualifications and very low. For example, the cu- lector of the maximum re- could prove risky for the bank- public float move is not prac-

needs to be kept in mind for profits of the past, but it seems harder to get the same. This perhaps some fine-tuning. How- mulative deposit base (sav- newal premiums (incremen- ing system. tical unless these measures

a more liquid equity market. illogical to believe that in a sav- cannot be a significant disad- ever, for a country that is deeply ings and term) of banks is tal investments), invests only Mutual funds are strug- are introduced. A series of

India is moving to a phase ings-rich country, investors will vantage when the converse is starved of capital and is at the around Rs 35,00,000 crore Rs 55,000 crore of this in list- gling to garner AUM because regulatory initiatives is also

where there is a general desire turn away opportunities to make the creation of liquidity and bet- cusp of growth, any measure while the capital market ex- ed equities. Other insurance of lack of incentives at the necessary.

to enable consumption and in- a 12-15 per cent equity return ter price discovery. Increasing that improves liquidity, price posure of all banks is a frac- firms invest Rs 39,000 crore broker level and it may take

vestment as opposed to saving, over a three-four year period, the free float in three stages will discovery, depth in the mar- tion of this: approximately although the Insurance Reg- some time before this situa- The author is also the head

something that is now reflect- when fixed income instruments reinforce the need to perform ket and governance can only be Rs 21,000 crore in equities and ulatory and Development Au- tion improves. Foreign insti- of financial services,

ed in a general desire to keep earn less than 8 per cent. The well. The second and third seen as highly desirable. Rs 42,000 crore in debentures. thority allows 60 per cent to tutional investors, which dom- KPMG India

You might also like

- The Commercial Real Estate Tsunami: A Survival Guide for Lenders, Owners, Buyers, and BrokersFrom EverandThe Commercial Real Estate Tsunami: A Survival Guide for Lenders, Owners, Buyers, and BrokersNo ratings yet

- Living on the Fault Line, Revised Edition: Managing for Shareholder Value in Any EconomyFrom EverandLiving on the Fault Line, Revised Edition: Managing for Shareholder Value in Any EconomyRating: 3.5 out of 5 stars3.5/5 (3)

- Hedge Fund ValuationDocument4 pagesHedge Fund ValuationFarnaz ChavoushiNo ratings yet

- Searching For Space: Real EstateDocument4 pagesSearching For Space: Real Estatesujit274No ratings yet

- Finance MorganstanleyDocument1 pageFinance Morganstanleyapi-567017796No ratings yet

- Capital Markets, Consumption and Investment: Module 2: Principles of Capital Market TheoryDocument7 pagesCapital Markets, Consumption and Investment: Module 2: Principles of Capital Market TheoryAZ OriakhilNo ratings yet

- Portakabin Emerging MarketDocument2 pagesPortakabin Emerging MarketWint Wah Hlaing100% (1)

- II Globallistedinfrastructure UsDocument16 pagesII Globallistedinfrastructure UsHUGAL75No ratings yet

- Cement Majors Commit Big Money To Capex, Signalling Infra RevivalDocument12 pagesCement Majors Commit Big Money To Capex, Signalling Infra RevivalHarshvardhan SurekaNo ratings yet

- The Times Za OuiDocument1 pageThe Times Za OuiLoretta WiseNo ratings yet

- Comprehensive Cross-Border Liquidity Management SolutionsDocument12 pagesComprehensive Cross-Border Liquidity Management Solutionsswetha sweetyNo ratings yet

- Green Building ManifestoDocument1 pageGreen Building Manifestoapi-25930623No ratings yet

- Looking Ahead: Future Market and Business ModelsDocument5 pagesLooking Ahead: Future Market and Business ModelsKarl AbiKaramNo ratings yet

- Forms of Capital by Bourdieu (1986)Document7 pagesForms of Capital by Bourdieu (1986)Kalimah Priforce100% (1)

- The Untold Story of The Premium Collapse of Gulf Finance HouseDocument2 pagesThe Untold Story of The Premium Collapse of Gulf Finance HouseNadia Al NeaimiNo ratings yet

- Hidden ValueDocument3 pagesHidden ValueWilrose GorumbaNo ratings yet

- Managing China's Global Risks: P Plastic Fixits Won't WorkDocument1 pageManaging China's Global Risks: P Plastic Fixits Won't WorkkiranNo ratings yet

- PM OverviewDocument15 pagesPM OverviewRajeev TripathiNo ratings yet

- Risks and Mitigation Measures in Build-Operate-Transfer ProjectsDocument7 pagesRisks and Mitigation Measures in Build-Operate-Transfer ProjectsAnis FarzanaNo ratings yet

- Offshore Project Financing - Issues Relating To Wind Farm Developments in The UKDocument3 pagesOffshore Project Financing - Issues Relating To Wind Farm Developments in The UKapi-19808113No ratings yet

- Recasting FSDocument1 pageRecasting FSCapung SolehNo ratings yet

- Deloitte - MetaverseDocument14 pagesDeloitte - MetaverseTayná CarneiroNo ratings yet

- Pema News 2004 enDocument8 pagesPema News 2004 enkorky1No ratings yet

- Financial Market ReviewerDocument7 pagesFinancial Market ReviewerPrincess SagunNo ratings yet

- Pipe PDFDocument2 pagesPipe PDFEliasNo ratings yet

- BGuyPetersJonPi 2013 45AccountabilityInAnA TheSAGEHandbookOfPublDocument19 pagesBGuyPetersJonPi 2013 45AccountabilityInAnA TheSAGEHandbookOfPublAmy NgNo ratings yet

- WSJ - 1 19 22Document30 pagesWSJ - 1 19 22GeoNo ratings yet

- AFM Unit 2 (Problems Only)Document17 pagesAFM Unit 2 (Problems Only)Goutham GnNo ratings yet

- Capital Markets: The Rise of Non-Bank Infrastructure Project FinanceDocument3 pagesCapital Markets: The Rise of Non-Bank Infrastructure Project FinanceUma Maheswar KNo ratings yet

- Mint Delhi 11-07-2022Document16 pagesMint Delhi 11-07-2022Syed Kamran AbbasNo ratings yet

- Enterprise Communications: Growth Opportunities For Telecoms OperatorsDocument20 pagesEnterprise Communications: Growth Opportunities For Telecoms OperatorsTarek Tarek El-safraniNo ratings yet

- FMA Topic 1,2Document2 pagesFMA Topic 1,2YuNo ratings yet

- What The New Budget Should Offer To Common People: Editorial 8Document1 pageWhat The New Budget Should Offer To Common People: Editorial 8HossainNo ratings yet

- Ude Desh Ka Aam Naagrik: Significance Key FeaturesDocument1 pageUde Desh Ka Aam Naagrik: Significance Key FeaturesRajat KalyaniaNo ratings yet

- IBM Banking: Grid Technology Helps ZKB Perform Efficient Financial Modeling CalculationsDocument4 pagesIBM Banking: Grid Technology Helps ZKB Perform Efficient Financial Modeling CalculationsIBMBankingNo ratings yet

- Prices, Fast and Slow: Project Sashakt: Several Steps BackwardDocument1 pagePrices, Fast and Slow: Project Sashakt: Several Steps BackwardkiranNo ratings yet

- PDF Spring 2010Document4 pagesPDF Spring 2010bgourl10431No ratings yet

- Reading 23 - Long-Lived AssetsDocument7 pagesReading 23 - Long-Lived AssetsLuis Henrique N. SpínolaNo ratings yet

- Cost of CapitalDocument19 pagesCost of CapitalADITYA KUMARNo ratings yet

- Home Ground - SMHDocument1 pageHome Ground - SMHJane LyonsNo ratings yet

- Anewerain Capital Markets: Cloud Computing Changes The GameDocument24 pagesAnewerain Capital Markets: Cloud Computing Changes The Gamenavin poojaryNo ratings yet

- Leo 3Document44 pagesLeo 3cadeau01No ratings yet

- Summary of Capital Market Instruments in IndonesiaDocument6 pagesSummary of Capital Market Instruments in IndonesiaAyesha MaroofNo ratings yet

- ISJ010Document84 pagesISJ0102imediaNo ratings yet

- ISLA Daily Day 2Document28 pagesISLA Daily Day 2Securities Lending TimesNo ratings yet

- July 16 PDFDocument4 pagesJuly 16 PDFShimu ShahrearNo ratings yet

- EY Capital and Infrastructure Solution BrochureDocument7 pagesEY Capital and Infrastructure Solution BrochureAkshith CpNo ratings yet

- Nombre: Karla Angelica Rangel Lastiri Grupo: Licenciatura en Politicas Y Proyectos SocialesDocument3 pagesNombre: Karla Angelica Rangel Lastiri Grupo: Licenciatura en Politicas Y Proyectos SocialesKarla LastiriNo ratings yet

- IiedDocument2 pagesIiedNaveed AhmedNo ratings yet

- Characteristics Not For Growing One Doubtful Home The: Be Will AsDocument1 pageCharacteristics Not For Growing One Doubtful Home The: Be Will AsSheie WiseNo ratings yet

- Charles, Klein - 1999 - Local vs. Global Issues in Electronic CommerceDocument6 pagesCharles, Klein - 1999 - Local vs. Global Issues in Electronic CommerceSENG CHEE LIMNo ratings yet

- PPTXDocument9 pagesPPTXRahulNo ratings yet

- Forms of Business AssociationsDocument4 pagesForms of Business Associationsnamratha minupuri100% (1)

- A Case of 2nd Model Development ProcessDocument21 pagesA Case of 2nd Model Development ProcessirsyadwachmadNo ratings yet

- Moneyweek 250222userupload - inDocument44 pagesMoneyweek 250222userupload - inAditya SharmaNo ratings yet

- Cost of CapitalDocument10 pagesCost of CapitalAyush MishraNo ratings yet

- Chapter 12 Industry and ServicesDocument2 pagesChapter 12 Industry and ServicesSarah JungNo ratings yet

- Detonaters: By: Aishwarya Jain Devvrat Chavda Shalini Harsh ThakkarDocument6 pagesDetonaters: By: Aishwarya Jain Devvrat Chavda Shalini Harsh ThakkarshaliniNo ratings yet

- D-Reit Whitepaper v1Document23 pagesD-Reit Whitepaper v1Srikanth ReddyNo ratings yet

- Premium Paid Acknowledgement PDFDocument1 pagePremium Paid Acknowledgement PDFPragna NachikethaNo ratings yet

- Dividend Decision AT Icici: Master of Business AdministrationDocument71 pagesDividend Decision AT Icici: Master of Business AdministrationSaas4989 Saas4989No ratings yet

- AXIS BANK Project Word FileDocument28 pagesAXIS BANK Project Word Fileअक्षय गोयलNo ratings yet

- GWHT PDFDocument22 pagesGWHT PDFAndinetNo ratings yet

- 4s-Logistics 2011-11 12Document8 pages4s-Logistics 2011-11 12rickreddiNo ratings yet

- How The Common Global Implementation and ISO 20022 Standards Can Help You Interface With Bank NetworksDocument18 pagesHow The Common Global Implementation and ISO 20022 Standards Can Help You Interface With Bank Networksaxime100% (1)

- Fined IncomeDocument15 pagesFined IncomeAvid HikerNo ratings yet

- Assured Savings Plan 1Document12 pagesAssured Savings Plan 1DnGNo ratings yet

- BPI Deposit Account RatesDocument5 pagesBPI Deposit Account Ratesparekoy1014No ratings yet

- What Is Global Banking?Document2 pagesWhat Is Global Banking?Pinky GocoyoNo ratings yet

- Guidelines On Operational Risk Management..Document115 pagesGuidelines On Operational Risk Management..bfc7500100% (3)

- Statement May 2018Document5 pagesStatement May 2018tpsroxNo ratings yet

- Qatar Quarterly Equity HandbookDocument60 pagesQatar Quarterly Equity Handbook123bingoNo ratings yet

- Fee Decleration FormDocument2 pagesFee Decleration FormMohit MohanNo ratings yet

- Tata Steel Epa Chennai Posh Hyundai Scrap Auction (Postponed From 8th July 11 To 11th July 11) (7!11!2011)Document5 pagesTata Steel Epa Chennai Posh Hyundai Scrap Auction (Postponed From 8th July 11 To 11th July 11) (7!11!2011)Sangeeta PalNo ratings yet

- A Study On Determinants of Loan Repaymen PDFDocument14 pagesA Study On Determinants of Loan Repaymen PDFgetachewNo ratings yet

- Board of Director Fiduciary DutiesDocument3 pagesBoard of Director Fiduciary DutiesShan WsNo ratings yet

- Firm Infrastructure Risk Management Human Resources Technologic Al Developme NTDocument3 pagesFirm Infrastructure Risk Management Human Resources Technologic Al Developme NTPrincessNo ratings yet

- Conversion Active LandlinesDocument8 pagesConversion Active LandlinesRitsheNo ratings yet

- Finacle Menu and TablesDocument71 pagesFinacle Menu and Tablescheluri_rubiyanaNo ratings yet

- Bcom ProjectDocument76 pagesBcom ProjectVictor Muto100% (1)

- Retirement Fees Lawsuit Filed Against Duke UniversityDocument98 pagesRetirement Fees Lawsuit Filed Against Duke UniversitythedukechronicleNo ratings yet

- English - RESOLUTION - CASH FUND USAGE NEWS EVENTDocument4 pagesEnglish - RESOLUTION - CASH FUND USAGE NEWS EVENTUN Swissindo100% (3)

- Personal Accident Insurance - POLMBKBA82EFIJBDocument3 pagesPersonal Accident Insurance - POLMBKBA82EFIJBGiridharan VenkateshNo ratings yet

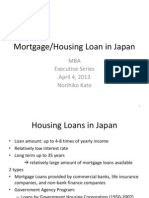

- Mortgage Loans in JapanDocument16 pagesMortgage Loans in JapanBayarmagnay BaasansurenNo ratings yet

- Certified Valuation Analyst-CVADocument4 pagesCertified Valuation Analyst-CVAamyhashemNo ratings yet

- Business, Finance & Economy: Winners - John Semakula & John Masaba, New VisionDocument7 pagesBusiness, Finance & Economy: Winners - John Semakula & John Masaba, New VisionAfrican Centre for Media ExcellenceNo ratings yet

- Batch 17 1st Preboard (P1) No AnswerDocument6 pagesBatch 17 1st Preboard (P1) No AnswerAngelica manaoisNo ratings yet

- Leases Revised 5 30 20Document144 pagesLeases Revised 5 30 20Jeasmine Andrea Diane PayumoNo ratings yet

- Financial Analysis Spreadsheet From The Kaplan GroupDocument4 pagesFinancial Analysis Spreadsheet From The Kaplan GroupPrince AdyNo ratings yet