Professional Documents

Culture Documents

Law Awareness - Faraid or Muslim Inheritance Law

Uploaded by

schumarnaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Law Awareness - Faraid or Muslim Inheritance Law

Uploaded by

schumarnaCopyright:

Available Formats

Law Awareness - Faraid or Muslim Inheritance Law

FARAID OR MUSLIM INHERITANCE LAW

Back to Law Awareness Main Page

Faraid or Muslim inheritance law

Faraid stipulates how the estate of a Muslim is to be dealt with and distributed after his or her death.

For convenience, all references to the male gender include the female gender. The rules described here

reflect the rules practised under the Shafie school of thought; some differences or variations may be

adopted under the Hanafi, Maliki and Hanbali schools.

Priority of payments

Before the estate of the deceased can be distributed to his heirs, all debts owing by the deceased and

all prior claims against him must first be paid.

In order of priority, payments from the estate are as follows:

a. Satisfaction of religious obligations, such as

i. satisfaction of all zakat payments that are unpaid;

ii. performance of the Haj through an acceptable proxy;

iii. making donations of the specified amount to redeem fast days unobserved;

b. Payment of funeral expenses.

c. Redemption of mortgaged property.

d. Payment of all other debts owing by the deceased.

e. Payment of legacies under a valid will.

f. Distribution of net estate among Specified Heirs (described below).

Specified heirs

Heirs entitled to share in the net estate of the deceased in accordance with Faraid are specified in the

Quran. These Specified Heirs include the following:

a. Spouse (surviving wife or husband)

b. Children (adopted children are excluded, and children conceived out of wedlock can only inherit

from their mother, even if their birth is legitimised)

c. Parents

d. Paternal grandparents and paternal great grandfathers

e. Maternal grandmother

f. Descendants from the male line, i.e. children and grandchildren of sons (a daughter’s son,

although a grandson, is not a Specified Heir)

file:///F|/Inheritance2/Law Awareness - Faraid or Muslim Inheritance Law.htm (1 of 4)2007/01/03 03:51:52 PM

Law Awareness - Faraid or Muslim Inheritance Law

g. Siblings including half siblings who share a common father ("consanguine sibling") or a common

mother ("uterine sibling")

h. Nephews (limited to sons of full brothers and consanguine brother)

i. Paternal uncles

j. Male cousins (limited to sons of full paternal uncle and consanguine uncle)

These heirs are entitled to certain prescribed shares which are intended to effect an equitable

distribution of the estate. For instance, males are given 2 shares of the estate to every share given to

his female counterpart because they are expected to assume financial responsibility for the women. In

addition, female heirs are allocated a specified portion of the estate (e.g. half or one sixth) which means

they will always be entitled to a portion of the estate, regardless how small, while male heirs are often

residuary heirs who are only entitled to what is left of the estate after the claims of female heirs have

been met. It may happen that a residuary heir is left with nothing or a very tiny portion after claimants

with specific shares have been paid off.

Specified Heirs forfeit their claim under the following circumstances:

a. he caused the death of the deceased, whether deliberately or unintentionally; or

b. he is not a Muslim (the deceased may be a Muslim convert, or the heir may have renounced

Islam).

Making of Wills

A Muslim can only make a will in favour of his non-Specified Heirs, such as his adopted children, certain

maternal relatives such as maternal aunt or maternal grandfather, or third parties such as close friend

or protege. A will can only be made in respect of not more than one third of the net estate of the

testator. This is to protect those persons with a legitimate claim to the estate, such as spouse and

children. If the will purports to bequeath more than one third of the net estate, the bequests may be

reduced proportionally such that the aggregate will not exceed one third. Alternatively, if the Specified

Heirs voluntarily agree to reduce their own entitlements accordingly, it is possible that the aggregate

amount paid on the bequests could exceed the one third limit.

Estate administration

The first step is for a beneficiary to apply to the Syariah Court for a Certificate of Inheritance ("Sijil

Warisan") to be issued. The Certificate will identify the surviving Specified Heirs, state their relationship

to the deceased, and specify his precise share to the estate (e.g. one eighth portion).

An application is then made to the High Court (if the estate exceeds $3 million), otherwise to the

Subordinate Courts for Letters of Administration to be granted to enable the Court-appointed

Administrator to deal with the estate.

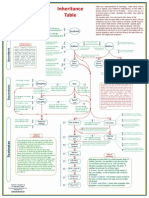

Computation of shares of specified heirs

The rules prescribing the entitlement of Specified Heirs to a share of the net estate of the deceased are

file:///F|/Inheritance2/Law Awareness - Faraid or Muslim Inheritance Law.htm (2 of 4)2007/01/03 03:51:52 PM

Law Awareness - Faraid or Muslim Inheritance Law

fairly simple, although the computation of their respective shares can be fairly complex depending on

the configuration of Specified Heirs surviving the deceased. The table below sets out the general rules

of distribution among certain Specified Heirs and is intended to provide guidance only for simple cases.

You can also visit MUIS’s faraid website at http://www.faraid.gov.sg/.

Heir Share

Husband

If there is no child or grandchild surviving the deceased 1/2

If there is a surviving child or grandchild of deceased 1/4

Wife

If there is no child or grandchild surviving the deceased 1/4

If there is a surviving child or grandchild of deceased 1/8

Son

If there is no daughter Residuary

If there is a daughter (he shares with his sister, but is entitled to 2 shares for every share

given to her) Residuary

Daughter

If sole daughter 1/2

If 2 or more daughters (the daughters_ portion is shared equally among them) 2/3

If there is a son, (she shares with her brother, but is entitled to 1 share for every 2 shares

given to him) Residuary

Father

If there is a child or grandchild surviving the deceased 1/6

If there is no child or grandchild surviving the deceased Residuary

Mother 1/6

Paternal Grandmother (her portion is shared with maternal grandmother) 1/6

If Mother or Father survives Nil

Paternal Grandfather

If no father, child or grandchild survives Residuary

file:///F|/Inheritance2/Law Awareness - Faraid or Muslim Inheritance Law.htm (3 of 4)2007/01/03 03:51:52 PM

Law Awareness - Faraid or Muslim Inheritance Law

If son or grandson survives 1/6

If father survives Nil

Maternal Grandmother (her portion is shared with paternal grandmother) 1/6

If Mother survives Nil

Brothers

If father, son or grandson survives Nil

If no father, son or grandchild survives Residuary

Sister

If father, son or grandson survives Nil

If sole sister 1/2

If 2 or more sisters (they share equally) 2/3

If Brother survives (they share 2:1 with Brother) Residuary

Copyright © The Law Society of Singapore

file:///F|/Inheritance2/Law Awareness - Faraid or Muslim Inheritance Law.htm (4 of 4)2007/01/03 03:51:52 PM

You might also like

- LUL S1062 - Temporary Works - Issue A4Document29 pagesLUL S1062 - Temporary Works - Issue A4HNo ratings yet

- Freemason's MonitorDocument143 pagesFreemason's Monitorpopecahbet100% (1)

- TABLE OF LEGITIME (Wills and Succession)Document2 pagesTABLE OF LEGITIME (Wills and Succession)Princess ZoletaNo ratings yet

- Adha AsabatDocument7 pagesAdha AsabatAdhaHishamNo ratings yet

- Kinds, Appointment and Removal of GuardianshipDocument21 pagesKinds, Appointment and Removal of GuardianshipEmanuel BuansingNo ratings yet

- Inheritance and Sucession To Property - DoDocument10 pagesInheritance and Sucession To Property - DoInshaff MSajeer100% (1)

- Inheritance According To Islamic Sharia LawDocument7 pagesInheritance According To Islamic Sharia Lawmsohailahmed1No ratings yet

- Table of Islamic InheritanceDocument1 pageTable of Islamic InheritanceMohammad Humayon Awan67% (6)

- CNT A HandbookDocument276 pagesCNT A Handbookv_singh28No ratings yet

- English 6: Making A On An InformedDocument30 pagesEnglish 6: Making A On An InformedEDNALYN TANNo ratings yet

- Legal Succession NotesDocument60 pagesLegal Succession NotesshambiruarNo ratings yet

- Ocus Complaint RERADocument113 pagesOcus Complaint RERAMilind Modi100% (1)

- FLEXI READING Implementing GuidelinesDocument94 pagesFLEXI READING Implementing GuidelinesMay L BulanNo ratings yet

- InheritanceDocument31 pagesInheritanceAusama MemonNo ratings yet

- Details of Inheritance in Islamic LawDocument7 pagesDetails of Inheritance in Islamic LawCooking, Painting and FunNo ratings yet

- Table of Sharers Sunni LawDocument2 pagesTable of Sharers Sunni Lawshubham kalita100% (9)

- Inheritance Under Muslim Law PDFDocument40 pagesInheritance Under Muslim Law PDFMannam JeevanthikaNo ratings yet

- Inheritance in Islam by DR YusufDocument12 pagesInheritance in Islam by DR YusufAbdussalamYusuf100% (1)

- Distribution of Properties of Parsi Person As Per Succession Laws PDFDocument3 pagesDistribution of Properties of Parsi Person As Per Succession Laws PDFpoojabhavsarNo ratings yet

- Muhammedan Law - Reports CompilationDocument55 pagesMuhammedan Law - Reports CompilationAshwanth M.SNo ratings yet

- Sharia LawDocument34 pagesSharia LawEmad The EnthusiastNo ratings yet

- Sunni Inheritance LawDocument5 pagesSunni Inheritance LawSyed Shariq BukhariNo ratings yet

- ReadyReckoner IntroductionDocument3 pagesReadyReckoner IntroductionAhmadZeeshanNo ratings yet

- Types of HeirsDocument6 pagesTypes of HeirsYousuf ZafarNo ratings yet

- INHERITANCEDocument8 pagesINHERITANCEankunda dassyNo ratings yet

- Law of InheritanceDocument20 pagesLaw of InheritancekingNo ratings yet

- Week 12 13122022 015614pmDocument12 pagesWeek 12 13122022 015614pmJehanzaib AminNo ratings yet

- Law of InheritanceDocument12 pagesLaw of InheritanceRameez AhmedNo ratings yet

- Sunni Law of Inheritance: An IntroductionDocument19 pagesSunni Law of Inheritance: An IntroductionZeesahnNo ratings yet

- Muslim Law of InheritanceDocument4 pagesMuslim Law of Inheritanceanon_59359966No ratings yet

- Family Law II May 2018Document12 pagesFamily Law II May 2018AvishiktaNo ratings yet

- Class of Heirs in Sunny LawDocument43 pagesClass of Heirs in Sunny LawHARIBABU0% (1)

- Understanding The Law of Inheritance of The Quran PDFDocument11 pagesUnderstanding The Law of Inheritance of The Quran PDFSalekin KhanNo ratings yet

- Muslim Law - InheritanceDocument8 pagesMuslim Law - InheritanceSonali Sengupta100% (1)

- Types of Heirs: A Āb Al-Farā'i (4 Males & 8 Females)Document4 pagesTypes of Heirs: A Āb Al-Farā'i (4 Males & 8 Females)Yousuf ZafarNo ratings yet

- Law of InheritanceDocument10 pagesLaw of InheritanceJayvikrant RAJPOOTNo ratings yet

- Comparitive Study of Inheritance LawDocument32 pagesComparitive Study of Inheritance LawFahad ZafarNo ratings yet

- Isla Jur Final Exam-1Document4 pagesIsla Jur Final Exam-1Denver GuzmanNo ratings yet

- Table of Sharers Sunni LawDocument3 pagesTable of Sharers Sunni LawRajesh Bazad83% (6)

- Shia Law of InheritanceDocument12 pagesShia Law of InheritanceYashviNo ratings yet

- Succession Under Muslim Law Part IiDocument17 pagesSuccession Under Muslim Law Part IiShangavi SNo ratings yet

- MessageDocument3 pagesMessageQ S L ZNo ratings yet

- Succession NoteDocument6 pagesSuccession NoteRIMA NAIMNo ratings yet

- Sunni Law of InheritanceDocument13 pagesSunni Law of Inheritancemushq8No ratings yet

- InheritanceDocument12 pagesInheritanceIkra MalikNo ratings yet

- Joint Family NotesDocument5 pagesJoint Family NotesSidharth PremkumarNo ratings yet

- Family Law Ii (1020202118)Document18 pagesFamily Law Ii (1020202118)savvyba2031No ratings yet

- Muslim - Law - Sucession of WifeDocument1 pageMuslim - Law - Sucession of WifeParamvir SinghNo ratings yet

- Islamic JurisprudenceDocument34 pagesIslamic JurisprudenceSyed Haris ShahNo ratings yet

- LegitimesDocument1 pageLegitimesAlyk CalionNo ratings yet

- Name: Syed Haris Shah Class Number: 146 Semester: 6th Paper: Islamic Jurisprudence Submitted To: Kiran NisarDocument26 pagesName: Syed Haris Shah Class Number: 146 Semester: 6th Paper: Islamic Jurisprudence Submitted To: Kiran NisarSyed Haris ShahNo ratings yet

- Inheritance in JudaismDocument1 pageInheritance in JudaismRabbi Benyomin HoffmanNo ratings yet

- Intestacy & TestacyDocument3 pagesIntestacy & TestacyMastura Asri0% (1)

- On Inheritance of Property by A WomanDocument21 pagesOn Inheritance of Property by A WomanShobhna Sharda50% (2)

- Intestate Succession Under Muslim LawDocument8 pagesIntestate Succession Under Muslim LawTashuYadav50% (2)

- Succession Under Muslim LawDocument4 pagesSuccession Under Muslim LawRupeshPandyaNo ratings yet

- Inheritance by Dr. Zakir NaikDocument3 pagesInheritance by Dr. Zakir NaikFahim Akthar Ullal100% (1)

- Week 13 - Law605 InheritanceDocument16 pagesWeek 13 - Law605 Inheritance2021488406No ratings yet

- 4 Intestate-Succession-2-1Document13 pages4 Intestate-Succession-2-1amit HCSNo ratings yet

- Distribution of Estate and Legitime - BalladaDocument1 pageDistribution of Estate and Legitime - BalladaMa Katrina IlaganNo ratings yet

- Rules of InheritanceDocument5 pagesRules of InheritanceHafiz Asif RazaNo ratings yet

- Inheritance Laws in an Islamic Society: Islamic Cultures Are Distinct in EverywayFrom EverandInheritance Laws in an Islamic Society: Islamic Cultures Are Distinct in EverywayNo ratings yet

- Molina V Pacific PlansDocument31 pagesMolina V Pacific Planscmv mendozaNo ratings yet

- MKT4220 JAN2021 Individual Assessment 30%Document3 pagesMKT4220 JAN2021 Individual Assessment 30%suvendran MorganasundramNo ratings yet

- Critical Analysis of The Concept of Plea Bargaining in IndiaDocument8 pagesCritical Analysis of The Concept of Plea Bargaining in IndiaSRUTHI KANNAN 2257024No ratings yet

- Macroeconomics Canadian 5th Edition Blanchard Solutions ManualDocument24 pagesMacroeconomics Canadian 5th Edition Blanchard Solutions ManualHollyCamposjfynd100% (35)

- Skate Helena 02-06.01.2024Document1 pageSkate Helena 02-06.01.2024erkinongulNo ratings yet

- Key Area IIIDocument26 pagesKey Area IIIRobert M. MaluyaNo ratings yet

- Texas City, TX: Amanda EnglerDocument27 pagesTexas City, TX: Amanda EnglerPrajay ShahNo ratings yet

- In Organic We TrustDocument5 pagesIn Organic We Trustapi-511313050No ratings yet

- Business Case For Donum Industrial CorpDocument7 pagesBusiness Case For Donum Industrial CorpDianne MadridNo ratings yet

- Andres Felipe Mendez Vargas: The Elves and The ShoemakerDocument1 pageAndres Felipe Mendez Vargas: The Elves and The ShoemakerAndres MendezNo ratings yet

- Chernobyl Disaster: The Worst Man-Made Disaster in Human HistoryDocument13 pagesChernobyl Disaster: The Worst Man-Made Disaster in Human HistoryGowri ShankarNo ratings yet

- Cbleenpu 19Document10 pagesCbleenpu 19Malathy VijayNo ratings yet

- Asian Marketing Management: Biti's Marketing Strategy in VietnamDocument33 pagesAsian Marketing Management: Biti's Marketing Strategy in VietnamPhương TrangNo ratings yet

- Session 1 Introduction To Operations Management 3.0Document48 pagesSession 1 Introduction To Operations Management 3.0Aryan DwivediNo ratings yet

- Acc Topic 8Document2 pagesAcc Topic 8BM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- As-1 Disclosure of Accounting PoliciesDocument7 pagesAs-1 Disclosure of Accounting PoliciesPrakash_Tandon_583No ratings yet

- EPLC Annual Operational Analysis TemplateDocument8 pagesEPLC Annual Operational Analysis TemplateHussain ElarabiNo ratings yet

- A List of The Public NTP ServersDocument11 pagesA List of The Public NTP ServersavinashjirapureNo ratings yet

- 2022 Post Report - FinalDocument11 pages2022 Post Report - FinalAise TrigoNo ratings yet

- TKAM ch1-5 Discussion QuestionsDocument14 pagesTKAM ch1-5 Discussion QuestionsJacqueline KennedyNo ratings yet

- Problem Set 1Document2 pagesProblem Set 1edhuguetNo ratings yet

- Was Poll Tax The Most Important Reason For Margaret Thatchers Downfall?Document5 pagesWas Poll Tax The Most Important Reason For Margaret Thatchers Downfall?wendyfoxNo ratings yet

- WhittardsDocument7 pagesWhittardsAaron ShermanNo ratings yet

- Contemporary Philippine Arts From The Regions 2 Semester, S.Y. 2017-2018Document2 pagesContemporary Philippine Arts From The Regions 2 Semester, S.Y. 2017-2018Jerlyn Mae Sales QuiliopeNo ratings yet