Professional Documents

Culture Documents

Re Insurance Legal Jobs What They Are

Uploaded by

employmentjobsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Re Insurance Legal Jobs What They Are

Uploaded by

employmentjobsCopyright:

Available Formats

EM P LO YMEN T CRO SSI N G | LAWCRO SSIN G

The most jobs— anywhere

Feature

Reinsurance Legal Jobs — What They Are

You may not have heard of reinsurance. It’s a way that insurance companies share the risk of big losses with other

insurance companies — effectively, it’s insurance bought by an insurance company from another insurance company.

It spreads the risk across many companies, protecting them from large or unforeseen losses. This works in the same

way as ordinary insurance, but on a much larger scale. Reinsurance attorneys work to make sure that contracts benefit

their clients, and, if necessary, take legal action against a reinsurer or other body if a contract is violated. They’re

much like other legal jobs that attorneys may take, but reinsurance jobs are much more specialized.

What Reinsurance Does for burns out of 500 will be covered by the premiums paid by

Customers the other 499 homes. However, catastrophic disasters, such

as hurricanes or wildfires, might destroy all the homes in

The benefit of reinsurance to the one area. In that case, the premium paid by unaffected

end consumer is that it allows policyholders wouldn’t be adequate to cover all the

the entire insurance industry destroyed homes.

to work more efficiently. The

work that reinsurance attorneys A policy advised by a reinsurance attorney would protect

perform allows insurance against this situation. Other areas will not have suffered

company to insure companies and from a catastrophe, allowing multiple insurers to spread the

individuals for larger amounts, to risk of potential catastrophes. This allows more policies to

be protected against very large be paid by the insurer.

losses, to stabilize operations from one year to the next,

and to protect business against cyclical business trends. Different Types of Reinsurance

Reinsurance attorneys also provide underwriting expertise

for new markets or new lines of insurance that a company As part of reinsurance legal jobs, you’ll encounter two

wouldn’t otherwise be able to access. different types of reinsurance. These are Excess of Loss

Reinsurance and Proportional Basis Reinsurance. An Excess

Reinsurance Attorney Jobs of Loss contract means that the ceding insurer keeps all

losses up to a particular level, and the reinsuring company

The majority of attorney jobs of this type are found in covers any losses beyond that level. The contract usually

specialist insurance companies, such as hurricane or states a ceiling for loss coverage. In Proportional Basis

earthquake reinsurers. Most of these companies operate Reinsurance legal jobs, all losses and premiums between the

globally. The company buying reinsurance is called the reinsurer and ceding insurer are prorated on a prearranged

ceding insurer. The company selling reinsurance is known basis. This type is frequently used in property reinsurance.

as the reinsurer. Most of the usual reinsurance transactions

with which a reinsurance attorney deals involve sharing risk Types of Reinsurance Contracts

between numerous reinsurers. Since reinsurance deals with

indemnification contracts, reinsurance can only be paid after Two types of reinsurance contracts might be encountered

the ceding insurer has already paid losses under its own by attorneys in this field. Treaty reinsurance comes in

reinsurance or insurance contracts. The insurer’s customers the form of a broad contract that covers a block of the

must be paid before the reinsurance can take effect. ceding company’s total book of business, such as an entire

property class. This type of reinsurance automatically

How Reinsurance Works covers all risks in the specific business class covered, unless

specifically excluded in the contract. While the reinsurer

Reinsurance works much like ordinary insurance, but on or their reinsurance attorney isn’t required to review every

a larger scale. With ordinary insurance, one house which individual risk associated with this treaty, it is important to

PAGE www.lawcrossing.com continued on back

EM P LO YMEN T CRO SSI N G | LAWCRO SSIN G

The most jobs— anywhere

Feature

be aware of the ceding insurer’s overall underwriting policies Reinsurance Contracts in Law Jobs

and business policies.

Like all other contracts in legal jobs, reinsurance contracts

Facultative reinsurance is written for a specific risk of the must be created to clearly express both parties’ intent. The

ceding insurer, and generally covers catastrophic risks. This rules of contract interpretation and general contract law

type of reinsurance covers individual underlying policies, apply to reinsurance contracts. Accordingly, reinsurance

and is written on a policy-specific basis. Parties negotiate lawyers must have a good knowledge of general contract

the terms and conditions for each individual contract law in addition to those of their legal specialty.

separately. The ceding insurer provides the reinsurer with

an individual risk policy, which the reinsurer may reject or Average Reinsurance Attorney Salary Expectations

accept.

The average salary that can be expected for reinsurance

Reinsurer Insurance attorneys is $73,000. Like all jobs, the amount you’ll be

paid will vary depending on where you live, what the local

A reinsurance attorney may also cost of living is, and the prestige of the firm for which you

encounter retrocession — insurance work. Your experience and education will have an impact on

for reinsurance. Reinsurers pay as well.

buying this kind of reinsurance

are called retrocessionaries. The Conclusion

reinsurers selling retrocession are

called retrocedants. Retrocession Reinsurance attorneys are a specialized branch of the legal

is another way to spread the field. Because of that, they require specific knowledge

reinsurance risk. One thing that in addition to the typical requirements for becoming an

you’ll encounter as a reinsurance attorney is the common attorney. People seeking this type of position should have

tendency to buy reinsurance protection from other reinsurers. experience in dealing with the insurance and reinsurance

If a reinsurer is providing proportional basis reinsurance, it may field. Like many specialized positions, this field isn’t

need to protect itself from catastrophes. Reinsurers providing growing rapidly, but maintains a steady pace, since the

policies on an excess of loss basis might need to protect their demand for reinsurance attorneys is unlikely to abate.

companies against accumulated losses.

EmploymentCrossing is the largest c ollection of active jobs in the world.

We c ontinuously m onitor the hiring nee ds of m o re than 250,000 em ploye r s , including virtually e ve r y cor por a tion and orga nization in the

United State s. We do not c h a rg e e m ploye r s to p ost the ir jobs and we aggressively contact and inve s tiga te th o u sa n d s of e m ploye r s e a c h

day to le a rn of new pos itions . No one w orks ha rde r than Em ploym e ntCr os s ing.

Let Em ployme ntCrossing go to work for you.

PAGE www.lawcrossing.com

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Bin Visa FreeDocument20 pagesBin Visa FreeMichael VirginisNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Debit Account Transactions Date Description Type Amount Available Norman Carl Richard JRDocument3 pagesDebit Account Transactions Date Description Type Amount Available Norman Carl Richard JRfreeman p. donNo ratings yet

- Auditing-Non Profit Entities and HospitalsDocument12 pagesAuditing-Non Profit Entities and HospitalsVirgie MartinezNo ratings yet

- Expected Growth and Demand For Attorney JobsDocument2 pagesExpected Growth and Demand For Attorney JobsemploymentjobsNo ratings yet

- More Regulation of General Counsels ExpectedDocument1 pageMore Regulation of General Counsels ExpectedemploymentjobsNo ratings yet

- The Legal Job Market in New York CityDocument2 pagesThe Legal Job Market in New York CityemploymentjobsNo ratings yet

- The State of The New York Attorney Job MarketDocument2 pagesThe State of The New York Attorney Job MarketemploymentjobsNo ratings yet

- Job Opportunities in Criminal LawDocument2 pagesJob Opportunities in Criminal LawemploymentjobsNo ratings yet

- Lawyers and WarDocument2 pagesLawyers and WaremploymentjobsNo ratings yet

- Heads Rolling More On What Not To Do During A TrialDocument1 pageHeads Rolling More On What Not To Do During A TrialemploymentjobsNo ratings yet

- Managing DirectorDocument2 pagesManaging DirectoremploymentjobsNo ratings yet

- Heller Ehrman DissolvesDocument1 pageHeller Ehrman DissolvesemploymentjobsNo ratings yet

- First Lawsuits Filed Over MetroLink DisasterDocument1 pageFirst Lawsuits Filed Over MetroLink DisasteremploymentjobsNo ratings yet

- Chief Technical Officer JobsDocument2 pagesChief Technical Officer JobsemploymentjobsNo ratings yet

- Partner Resources Partner ResourcesDocument2 pagesPartner Resources Partner ResourcesemploymentjobsNo ratings yet

- McCain Halts Campaign To Address Financial CrisisDocument1 pageMcCain Halts Campaign To Address Financial CrisisemploymentjobsNo ratings yet

- Attorneys Fleeing Financial FirmsDocument1 pageAttorneys Fleeing Financial FirmsemploymentjobsNo ratings yet

- Court Says McCain Is A US CitizenDocument1 pageCourt Says McCain Is A US CitizenemploymentjobsNo ratings yet

- Partner Resources - Recent ArticlesDocument2 pagesPartner Resources - Recent ArticlesemploymentjobsNo ratings yet

- Partner Resources - Recent ArticlesDocument2 pagesPartner Resources - Recent ArticlesemploymentjobsNo ratings yet

- Partner Resources - Partner ResourcesDocument3 pagesPartner Resources - Partner ResourcesemploymentjobsNo ratings yet

- Partner Resources - Partner ResourcesDocument2 pagesPartner Resources - Partner ResourcesemploymentjobsNo ratings yet

- Partner Resources - Recent ArticlesDocument4 pagesPartner Resources - Recent ArticlesemploymentjobsNo ratings yet

- More Wall Street Meltdown NewsDocument1 pageMore Wall Street Meltdown NewsemploymentjobsNo ratings yet

- Partner Resources Partner ResourcesDocument2 pagesPartner Resources Partner ResourcesemploymentjobsNo ratings yet

- The Legal Job Market in TennesseeDocument2 pagesThe Legal Job Market in TennesseeemploymentjobsNo ratings yet

- Partner Resources - Recent ArticlesDocument2 pagesPartner Resources - Recent ArticlesemploymentjobsNo ratings yet

- Partner Resources Partner ResourcesDocument2 pagesPartner Resources Partner ResourcesemploymentjobsNo ratings yet

- Partner Resources Partner ResourcesDocument1 pagePartner Resources Partner ResourcesemploymentjobsNo ratings yet

- Partner Resources Partner ResourcesDocument2 pagesPartner Resources Partner ResourcesemploymentjobsNo ratings yet

- Partner Resources Partner ResourcesDocument2 pagesPartner Resources Partner ResourcesemploymentjobsNo ratings yet

- Partner Resources Partner ResourcesDocument1 pagePartner Resources Partner ResourcesemploymentjobsNo ratings yet

- Partner Resources Partner ResourcesDocument1 pagePartner Resources Partner ResourcesemploymentjobsNo ratings yet

- Sagem d30t AnglaisDocument64 pagesSagem d30t AnglaisZENASNI BOUCIFNo ratings yet

- Aakanksha Gurukul Noida Bank StatementDocument1 pageAakanksha Gurukul Noida Bank StatementAneeta DeviNo ratings yet

- Vertex42 Money Manager 2.1: INSTRUCTIONS - For Excel 2010 or LaterDocument28 pagesVertex42 Money Manager 2.1: INSTRUCTIONS - For Excel 2010 or LaterDistika Adhi PratamaNo ratings yet

- Electronic Ticket Receipt, June 22 For Carlosandres QuintanadeavilaDocument3 pagesElectronic Ticket Receipt, June 22 For Carlosandres QuintanadeavilaCal QuintanaNo ratings yet

- Restaurant Management System - (RMS) FeaturesDocument4 pagesRestaurant Management System - (RMS) FeaturesTejendra PachhaiNo ratings yet

- OpenStack 101 Modular Deck 1Document20 pagesOpenStack 101 Modular Deck 1zero oneNo ratings yet

- Tax Invoice - Spkg1604022862 - C - Hombespkg (29-Apr-16)Document2 pagesTax Invoice - Spkg1604022862 - C - Hombespkg (29-Apr-16)WANSNo ratings yet

- Mutual FundDocument9 pagesMutual Fund05550No ratings yet

- HDFC Apr To As On DateDocument10 pagesHDFC Apr To As On DatePDRK BABIUNo ratings yet

- Obamacare Ushers in New Era For The Healthcare IndustryDocument20 pagesObamacare Ushers in New Era For The Healthcare Industryvedran1980No ratings yet

- Introducing Integrated Access and BackhaulDocument12 pagesIntroducing Integrated Access and Backhaulandr1wdNo ratings yet

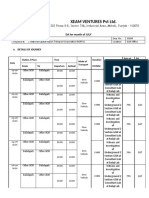

- Xeam Ventures PVT LTD.: E-202 Phase 8-B, Sector 74A, Industrial Area, Mohali, Punjab - 160055Document5 pagesXeam Ventures PVT LTD.: E-202 Phase 8-B, Sector 74A, Industrial Area, Mohali, Punjab - 160055Chandan MondalNo ratings yet

- Recount Text: Meeting My IdolDocument1 pageRecount Text: Meeting My IdolDevina NuraisyahNo ratings yet

- Area Marching Contest Flyer 10Document1 pageArea Marching Contest Flyer 10thepantherbandNo ratings yet

- DocsDocument2 pagesDocsMohsin ShaikhNo ratings yet

- PG Merit List 2014-15Document9 pagesPG Merit List 2014-15GSL Medical CollegeNo ratings yet

- Courier ProfileDocument19 pagesCourier Profilesohel royNo ratings yet

- UBX Cloud - Private Cloud SlickDocument2 pagesUBX Cloud - Private Cloud SlickmohamedalihashNo ratings yet

- Happy Rewards Redemption Form BSN 2017 PDFDocument1 pageHappy Rewards Redemption Form BSN 2017 PDFTc FaridahNo ratings yet

- Admin GuideDocument27 pagesAdmin GuidevinayakbunNo ratings yet

- Pranith V Question BankDocument5 pagesPranith V Question BankpranithNo ratings yet

- Chapter 34Document7 pagesChapter 34loise0% (1)

- Entrepreneurship: Simple BookkeepingDocument9 pagesEntrepreneurship: Simple BookkeepingKaye Ann AbinalNo ratings yet

- Cabatan SC109Document5 pagesCabatan SC109xylynn myka cabanatanNo ratings yet

- D09 RunboardsDocument869 pagesD09 RunboardsmtagossipNo ratings yet

- A Y0pcxschDocument2 pagesA Y0pcxschTaj AhmedNo ratings yet

- دور صناديق الاستثمار الإسلامية في تحسين أداء البنوك الإسلاميةDocument13 pagesدور صناديق الاستثمار الإسلامية في تحسين أداء البنوك الإسلاميةalssaheltechNo ratings yet