Professional Documents

Culture Documents

Due Diligence Report

Uploaded by

Hitesh JainOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Due Diligence Report

Uploaded by

Hitesh JainCopyright:

Available Formats

A K Kocchar & Associates

Chartered Accountants

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 2 of 16

Chartered Accountants

INDEX

Sr. No. Contents Page No.

I Objective 3

II Executive Summary 4

II Company Background 5

III Income Statement Analysis 6

IV Balance Sheet Analysis 8

V Tax Matters 10

VI Other Matters 12

VII Caveats 13

Appendix A – Engagement Letter 15

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 3 of 16

Chartered Accountants

I-OBJECTIVE

Our objective of preparing this Due Diligence Report is to elucidate the findings of

our comprehensive inspection / audit of lawfulness and commercial attractiveness

of Thyrocare Laboratories Limited (“TLL”) for the last eight years (i.e. Starting

from 01/04/2002 to 31/03/2010 so as to evaluate all advantages and

disadvantages of the said transaction and revelation of all possible risk i.e. financial

/ tax / any other risk connected to purchase of the company.

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 4 of 16

Chartered Accountants

II – E X E C U T I V E S U M M A R Y

TLL is a Public Limited Company listed on Bombay Stock Exchange (“BSE”) and

incorporated in the State of Maharashtra. TLL is in healthcare industry and

expertising in the diagnostics division of healthcare industry.

TLL does not have any business transaction for the last eight years, the main

source of income for TLL during the last eight years have been only by way of

interest income / Income from investments in shares and securities and there had

been no kind of trading activities carried on by TLL during the period under due

diligence.

Share Holding Pattern of Thyrocare Laboratories Limited for the last two years is as

given below.

Type of Shareholder As on As on

31/03/2010 31/03/2009

Promoter & Promoter’s Group 72.02 % 72.02 %

Public – non Institutional 27.98 % 27.98 %

Total 100 % 100 %

It has also been noted that the shares of the company are very thinly traded on

the stock exchange.

The Key Management Personnel of TLL are:

• Mr. A Sundararaju (Chairman & Non-Executive Director).

• Mr. G S Hegde (Non-Executive Director).

• Mrs. V Sumathi (Non-Executive Director).

• Mr. Rao Rajgopal J K (Non-Executive Director).

Bankers of TLL are Axis bank.

Auditors of TLL are S D khanolkar & Co.

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 5 of 16

Chartered Accountants

III – C O M P A N Y B A C K G R O U N D

Thyrocare Laboratories Limited (TLL) was formerly known as Ganapati Udyog

Limited (“GUL”) which was initially incorporated in State of West Bengal on 09

March 1983.

GUL was listed at Calcutta Stock Exchange (CSE), Uttar Pradesh Stock Exchange

(UPSE) and Bombay Stock Exchange (BSE), main objects GUL was trading in fabric

and electrodes.

Post Take over the name of GUL was changed to TLL on 20 th May 2003 also the

state of incorporation was changed from West Bengal to Maharashtra and the

main objects of the company were altered accordingly.

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 6 of 16

Chartered Accountants

IV – I N C O M E S T A T E M E N T A N A L Y S I S

We have set out the below audited income statement for the period under review.

Particulars Year Ended Year Ended Year Ended Year Ended

31/03/2006 31/03/2007 31/03/2008 31/03/2009

Operating Income Nil Nil Nil Nil

Add : Income From Other Sources 10,48,059/- 12,03,312/- 9,86,149/- 3,93,020/-

Less : Total Expenses 3,76,228/- 1,15,755/- 82,598/- 1,55,049/-

Profit Before Taxes 6,71,831/- 10,87,557/- 9,03,551/- 2,37,971/-

Less : Prior Period Items and

Extraordinary Items (10,200)/- Nil Nil 76,787/-

Less : Taxes Including Deferred

Tax 2,38,530/- 52,840/- 2,33,444/- 73,533/-

Profit After Taxes 4,43,501/- 10,34,717/- 6,70,107/- 87,651/-

From the above Income statement it may be noted that the company does not

have any Income from its operating Business, the only source of income for the

company is Interest Income and Income from Investments.

It has also been noticed that though the company does not have any income from

operating business every year there is some amount of money spent towards

advertising expenses.

During Assessment Years 2006-2007, 2007-2008, and 2008-2009 TLL had traded

in shares and securities apart from receiving Interest on loan, hence the reasons

for incomparable revenues in March 2009.

We further set out unaudited income statements for the year ended 31/03/2010:

Particulars Year Ended

31/03/2010

Operating Income Nil

Income From Other Sources 3,00,000/-

Less : Total Expenses 1,41,271/-

Profit Before Taxes 1,58,729/-

For the year ended 31/03/2010 the company has received compensation of Rs.

3,00,000/- towards advance against property of Rs. 50,00,000/- which was

outstanding in the books of the company as on 31/03/2003. The advance of Rs.

50,00,000/- against property was repaid back during 2004-2005 for which the

company received compensation during 2009-2010. We have been provided with

the documentation as regards compensation received. However, we documentation

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 7 of 16

Chartered Accountants

for advance given of Rs. 50,00,000/- towards purchase of property has been

requested for from the Management which is yet to be received.

Note: The audited figures given above are taken from the audited financials of the

company.

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 8 of 16

Chartered Accountants

IV – B A L A N C E S H E E T A N A L Y S I S

We have set out the below audited balance sheet for the period under review.

Particulars As On As On As On As On

31/03/2006 31/03/2007 31/03/2008 31/03/2009

Application of Funds

Cash & Bank Balances 46,64,515/- 20,48,761/- 31,65,426/- 48,02,428/-

Advance recoverable in cash or kind 2,44,879/- 40,25,000/- 41,83,800/- 26,70,334/-

Income Tax 81,117/- 3,50,059/- 4,60,402/- 2,38,805/-

Misc. Expenses 1,00,800/- 67,200/- 33,600/- Nil

Deferred tax Asset 41,770/- 41,770/- 6,550/- 6,550/-

Source of Funds

Share Capital 24,50,000/- 24,50,000/- 24,50,000/- 24,50,000/-

Retained Earnings 31,91,276/- 42,25,994/- 48,96,103/- 49,83,754/-

Sundry creditors 2,33,275/- 9,927/- 14,081/- 9,773/-

Provision For Taxes 2,38,530/- 2,91,370/- 4,89,594/- 2,71,757/-

Advance receivable in cash and kind refers to amount given as loans & advances to

certain parties on which interest was charged by TLL.

There are no investments seen in the Balance sheet as the investments made by

the company were disposed of before 31st March of every year to be precise the

company had made only short term investments.

Cash & Bank Balance as on 31/03/2009 also includes Fixed Deposit of Rs.

42,16,306/-, in all other years the company had never deposited any amount in

fixed deposit.

We further set out unaudited Balance Sheet as on 31/03/2010:

Particulars As On 31/03/2010

Application of Funds

Cash & Bank Balances 35,95,386-

Advance recoverable in cash or kind 40,25,000/-

Income Tax 2,38,805/-

Deferred tax Asset 6,550/-

Source of Funds

Share Capital 24,50,000/-

Retained Earnings 51,42,484/-

Sundry creditors 1,500/-

Provision For Taxes 2,71,757/-

The above balance sheet as on 31/03/2010 is unaudited as produced before us, we

are not able to comment on the true and fair nature of the same.

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 9 of 16

Chartered Accountants

We further like to bring to notice that the company had not received any interest

on loans and advances during March 2010 unlike interest received in the previous

financial years.

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 10 of 16

Chartered Accountants

V–TAX MATTERS

Background & Organizational Tax history

TLL came into existence on 20/05/2003 under tax records (Please note before that

it was known as GUL).

TLL has filed its Income Tax returns till 31/03/2009, sales tax returns till

31/03/2010.

Income Tax

We set out various Income Tax details of TLL.

Particulars 31/03/2006 31/03/2007 31/03/2008 31/03/2009

Applicability of Tax Audit No No No No

Whether MAT Applicable No Yes Yes No

Amount of MAT Payable Nil 1,22,025/- 93,066/- Nil

Total MAT Credit Available 2,178/- 1,24,203/- 2,17,269/- 2,05,529/-

Refund Due 27,894/- Nil Nil 47,624/-

Date of Filing Tax returns 16/11/2006 27/10/2007 25/09/2008 24/09/2009

Due Date of Filing Tax returns 30/11/2006 15/11/2007 30/09/2008 30/09/2009

Whether Refund Orde/143(1) No No Yes No

Received

Was there any scrutiny No No No No

assessment

Carry Forward of Business 1,82,438/- 1,82,438/- 65,036/- Nil

Loss

We would like to bring to notice that the earliest last scrutiny assessment by

income tax department on TLL was for the Assessment Year 2002-2003. The case

had gone till ITAT stages ultimately after which the case was disposed of in TLL’s

favour.

TLL has not yet filed its income tax returns for 31st march 2010 i.e. A Y 2010–

2011, any tax liability for A Y 2010-2011 shall be the burden of TLL’s old

management.

It is also recommended that TLL recovers all its refund dues from Income Tax

department before take over transaction is executed.

In A Y 2010-2011 TLL had received compensations of Rs. 3,00,000/- which the

management is treating as Business Income inspite of the same not being in line

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 11 of 16

Chartered Accountants

with the main object clause of TLL’s MOA as TLL is neither a investment company

nor a real estate company the same can be treated Income From Other Sources

by Income tax Department creating a point of litigation in future which may lead to

a reasonable amount of tax liability.

Sales Tax

TLL has filed all its sales tax returns on time till date, we would like to bring to light

that TLL had never actually done any operating business and hence there has

actually no sales tax liability on TLL.

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 12 of 16

Chartered Accountants

VI – O T H E R M A T T E R S

Software Package

The company is currently using Tally.ERP9 for maintenance of its books of

accounts.

IT Policy

We understand that the Company does not have formal/ documented IT policy in

place. Management states that, no IT related fraud or theft had taken place during

the period under review.

Human Resource Manuals & Policies

The Company does not have an documented HR manual and policies in place.

Internal Audit

The Company does not have an internal audit system in place.

Committee

The Company does not have audit committee, remuneration committee and

investor committee. Operational decisions are concentrated only in the hands of

promoters.

Authorization Matrix

All documents are authorized by one of the promoters.

Contingent Liabilities

Management states that, there are no contingent liabilities outstanding as at March

31, 2010.

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 13 of 16

Chartered Accountants

VI – C A V E A T S

Source of Information

The information contained in this Report has been obtained primarily from

reviewed financial statements of the Company for year ended March 31, 2003 to

March 31, 2009, and unaudited books of accounts for the year ended March 31,

2010.

The books of account and other records of the Company as made available to us

during our field visit.

Discussions with the relevant personnel of the Company and third party

discussions.

For purposes of our due diligence fieldwork, we visited the office of S D Khanolkar

& Co. Chartered Accountants, 210, jolly Bhawan No. 2, 51 New marine Lines, Opp

Nirmala Niketan, Churchgate, Mumbai – 400 020.

Our report is based on the discussion and information received from Mr Sadashiv

Khanolkar – Chartered Accountant (Auditor of Company).

Scope of Work

Our review of the affairs of the Company and its books and accounts does not

constitute an audit in accordance with Auditing Standards and no verification work

has been carried out by us. We have relied on explanations and source information

provided by the Management of the Company. Consequently, we do not express an

opinion on the figures included in this Report.

The scope of our work has been limited both in terms of the areas of the business

and operations which we have reviewed and the extent to which we have reviewed

them. There may be matters, other than those noted in this Report, which might

be relevant in the context of the transaction and which a wider scope might

uncover.

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 14 of 16

Chartered Accountants

Limitation of Liability

Our maximum liability relating to services rendered under this assignment

(regardless of form of action, whether in contract, negligence or otherwise) shall

be limited to the fees paid to us for the portion of our services or work products

giving rise to the liability. In no event shall we be liable for consequential,

special, incidental or punitive loss, damage or expense (including without

limitation, lost profits, opportunity costs, etc.) even if we have been advised of

their possible existence. This provision shall apply even after termination of our

assignment.

The Company also agrees to hold harmless A K Kocchar & Associates and its

employees against all actions, claims, proceedings, losses, damages, costs and

expenses, whatsoever and howsoever caused, incurred, sustained or arising

from, or in connection with, the provision of services. This provision shall apply

even after the termination of the engagement for any reason.

Confidential

A K Kocchar & Associates shall hold in strict confidence all information provided

to us by the management, directors, employees and advisors of Thyrocare

Laboratories Limited shall not divulge the same to anyone, unless required by

law, without the express or written consent of the Company. This provision shall

apply even after completion of our assignment.

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 15 of 16

Chartered Accountants

APPENDIX A–ENGAGEMENT LETTER

Our work and summary of procedures to be performed in connection with the

limited scope accounting and financial due diligence review on Thyrocare

Laboratories Limited (‘TLL’) is set out below. We will cover the matters set out

below, but our report will not necessarily cover all of those matters because in the

interests of clearer reporting, we will not report on matters that we do not believe

to be significant. Financial information will be reviewed for the latest period for

which audited accounts are available (‘period’). The scope of work for the

accounting and financial due diligence review of the Company for the period would

be limited to:

General

• Review significant accounting policies, specifically covering revenue recognition,

depreciation, write-downs, research and development expenditure, provisions

and any other notable policies, currently applied by the target to understand

whether these policies are in accordance with relevant GAAP .

• Review internal audit reports, audit committee reports, statutory auditors’

management letters and significant issues or weaknesses identified for the

period under review.

• Review on the appropriateness of TLL’s insurance arrangements.

• Review on the nature of the target’s pension arrangements.

• Review on major operational agreements / arrangements with third parties.

• Review on intra-group transactions and agreements / arrangements.

• Review and comment on the financial statements of the TLL for the 8 years

ended March 31, 2010.

• Review of the operational management structure.

• Review of employment contracts.

Other assets and liabilities

• Review of fixed assets.

• Review of ownership documents for fixed assets and financial commitments

attached to the assets.

• Understand TLL’s general terms of business with major customers.

• Understand the credit policies and credit control measures adopted.

Due Diligence Report of Thyrocare Laboratories Ltd.

A K Kocchar & Associates Page 16 of 16

Chartered Accountants

• Review ageing and composition of accounts receivable as at March 31, 2010.

• Review adequacy of reserve for doubtful debts considering historical ageing

trends and known exposures.

• Review significant loans and advances and other current assets as at March 31,

2010.

• Review current liabilities/provisions including employee related liabilities as at

March 31, 2010.

• Review the provisioning policy of the target

• Review of contracts remaining to be executed on capital account and not

provided for as at March 31, 2010, advances made there against and any

claims for damages, penalty, interest.

We acknowledge that this Due Diligence Report has been made by us so as to

evaluate all advantages and disadvantages of the said transaction and revelation of

all possible risk i.e. financial / tax / any other risk connected to purchase of the

company and the same may not be relied upon by any other person for any other

purpose nor it be quoted in any public document.

For A K Kocchar & Associates

Chartered Accountants

Arun Kocchar

Partner

Membership No. 108245

Mumbai, 27th August, 2010

Due Diligence Report of Thyrocare Laboratories Ltd.

You might also like

- Due Diligence Report SampleDocument30 pagesDue Diligence Report Samplestsui83% (6)

- Due Diligence in M& ADocument41 pagesDue Diligence in M& AJasmeet Singh AroraNo ratings yet

- Sample Due Diligence Report PDFDocument47 pagesSample Due Diligence Report PDFIbukun Sorinola70% (20)

- Due Diligence Report TemplateDocument18 pagesDue Diligence Report Templatequynhanhle85100% (7)

- Due Diligence ReportDocument26 pagesDue Diligence ReportLindsay LinNo ratings yet

- Master Acquisition Due Diligence ChecklistDocument19 pagesMaster Acquisition Due Diligence ChecklistLoretta Wise100% (1)

- Financial Due-Dilligence-sample by CrisilDocument37 pagesFinancial Due-Dilligence-sample by CrisilDrNitin Pathak100% (1)

- KPMG Due Dil ReportDocument44 pagesKPMG Due Dil Reportquynhanhle85100% (1)

- Legal-Due-Diligence-Guidelines May 2020Document68 pagesLegal-Due-Diligence-Guidelines May 2020Jha Arunima100% (1)

- Due Diligence ProjectDocument33 pagesDue Diligence ProjectUtkarsh ChoudharyNo ratings yet

- Buyer's Side Due Diligence ChecklistDocument4 pagesBuyer's Side Due Diligence ChecklistPERSHINGYOAKLEYNo ratings yet

- Finance Due DiligenceDocument23 pagesFinance Due Diligencerichaagarwal193100% (2)

- LEGAL DUE DILIGENCE - Comprehensive CHK ListDocument28 pagesLEGAL DUE DILIGENCE - Comprehensive CHK Listarskassociates0% (1)

- Financial Due DiligenceDocument15 pagesFinancial Due Diligenceprateekkapoor24100% (1)

- Legal Due DiligenceDocument22 pagesLegal Due Diligencejsdior100% (1)

- Example Financial Due Diligence Report RedactedDocument26 pagesExample Financial Due Diligence Report RedactedDumas Tchibozo75% (4)

- Due Dilligence Report-Full ReportDocument2 pagesDue Dilligence Report-Full ReportOladipupo Mayowa Paul100% (1)

- Due Diligence BookDocument50 pagesDue Diligence Bookgritad100% (2)

- Baker & McKenzie - Acquisitions - Due DiligenceDocument13 pagesBaker & McKenzie - Acquisitions - Due Diligencequynhanhle8550% (2)

- Financial Due DiligenceDocument10 pagesFinancial Due Diligenceapi-3822396100% (6)

- Financial Due Diligence ReportDocument4 pagesFinancial Due Diligence Reportqing9201100% (1)

- Financial Due DiligenceDocument6 pagesFinancial Due DiligencePatrick CheungNo ratings yet

- Legal Due DiligenceDocument4 pagesLegal Due Diligencezeeshanshahbaz50% (2)

- Due Diligence ChecklistDocument12 pagesDue Diligence ChecklistNigel A.L. Brooks100% (1)

- Due DiligenceDocument35 pagesDue DiligenceSonali SinghNo ratings yet

- Financial Due Diligence A Complete Guide - 2020 EditionFrom EverandFinancial Due Diligence A Complete Guide - 2020 EditionRating: 5 out of 5 stars5/5 (1)

- Due Diligence For Private Mergers and AcquisitionsDocument14 pagesDue Diligence For Private Mergers and AcquisitionsMeo U Luc Lac100% (2)

- Legal Due DiligenceDocument25 pagesLegal Due DiligenceAlly AbdullahNo ratings yet

- Legal Due Diligence Summary ReportDocument16 pagesLegal Due Diligence Summary Reportquynhanhle85100% (1)

- 2 Year Mms (Finance) Prof:-: Noor Ghare Jitendra Tatkare Vinay Lad Danish Tayyab Dabir Rizwan KhanDocument11 pages2 Year Mms (Finance) Prof:-: Noor Ghare Jitendra Tatkare Vinay Lad Danish Tayyab Dabir Rizwan KhanHeena AhujaNo ratings yet

- Due Diligence Data Room ChecklistDocument10 pagesDue Diligence Data Room ChecklistanishsinglaNo ratings yet

- 9 14 10 Due Diligence ProcessDocument33 pages9 14 10 Due Diligence ProcessKiran Laxman ShingoteNo ratings yet

- Legal Due DiligenceDocument9 pagesLegal Due Diligencekavanya suroliaNo ratings yet

- 50 - Due Diligence Checklist - 1Document6 pages50 - Due Diligence Checklist - 1Nikita ShahNo ratings yet

- Template LegalDueDilligence (English)Document27 pagesTemplate LegalDueDilligence (English)Hubertus Setiawan100% (1)

- Due Diligence ReportDocument139 pagesDue Diligence Reportkamara100% (1)

- Due DilligenceDocument26 pagesDue Dilligencedonny_khosla100% (1)

- Legal Due DiligenceDocument36 pagesLegal Due DiligencevakilarunNo ratings yet

- S7. Due DiligenceDocument40 pagesS7. Due DiligenceJinal VasaNo ratings yet

- Comprehensive M&a Due Diligence Checklist For BuyersDocument30 pagesComprehensive M&a Due Diligence Checklist For BuyersSimon Tseung100% (2)

- M&a PPTDocument41 pagesM&a PPTdragonborn1712No ratings yet

- Lecture 3 - Due DiligenceDocument29 pagesLecture 3 - Due DiligenceaparnaskiniNo ratings yet

- Due DiligenceDocument13 pagesDue DiligenceAjayktrNo ratings yet

- Financial Due Diligence Art NirmanDocument41 pagesFinancial Due Diligence Art NirmanPravesh Pangeni0% (1)

- Due Diligence in Concept With Financial Due DiligenceDocument58 pagesDue Diligence in Concept With Financial Due DiligenceZoya SayyedNo ratings yet

- How To Do Due Diligence ReportDocument39 pagesHow To Do Due Diligence Reportianlayno50% (2)

- 20 Key Due Diligence Activities in A Merger and Acquisition TransactionDocument15 pages20 Key Due Diligence Activities in A Merger and Acquisition Transactionquynhanhle85100% (1)

- Due Diligence Tools & TechniquesDocument5 pagesDue Diligence Tools & TechniquesKeith ParkerNo ratings yet

- Due DiligenceDocument5 pagesDue DiligenceKeith Parker100% (3)

- SLA - Due DiligenceDocument2 pagesSLA - Due DiligenceSamhitha KumbhajadalaNo ratings yet

- Different Types of Due DiligenceDocument6 pagesDifferent Types of Due DiligenceMamta VishwakarmaNo ratings yet

- Due Diligence & Valuation Report FormatDocument8 pagesDue Diligence & Valuation Report FormatitechiezNo ratings yet

- 2017 Due Diligence PDFDocument40 pages2017 Due Diligence PDFbdsrl100% (2)

- Acquisition Due Diligence ChecklistDocument9 pagesAcquisition Due Diligence ChecklistProject ProjectNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Delta Corp East Africa Limited (In Liquidation)Document22 pagesDelta Corp East Africa Limited (In Liquidation)LamineNo ratings yet

- Finance For Non FinanceDocument56 pagesFinance For Non Financeamitiiit31100% (3)

- LXL Gr12Accounting 08 Revision Interpretation-of-Financial-Statements 27mar2014 PDFDocument5 pagesLXL Gr12Accounting 08 Revision Interpretation-of-Financial-Statements 27mar2014 PDFNezer Byl P. VergaraNo ratings yet

- SJD Assessment 6Document3 pagesSJD Assessment 6akivamohamed9No ratings yet

- Industry Perspectives On Best Practices 1689569356Document29 pagesIndustry Perspectives On Best Practices 1689569356Ramiro Humberto Nova JaimesNo ratings yet

- Chapter 2 - Requirements of Companies Act 2016Document95 pagesChapter 2 - Requirements of Companies Act 2016ysmeenhannaniNo ratings yet

- (Camp, 2002) Venture Capital Due Diligence PDFDocument267 pages(Camp, 2002) Venture Capital Due Diligence PDFlalall100% (1)

- Notes On Limitation ActDocument30 pagesNotes On Limitation ActAhat Sharma100% (4)

- ComplianceForge Hierarchical Cybersecurity Governance Framework PDFDocument1 pageComplianceForge Hierarchical Cybersecurity Governance Framework PDFHakim GuerfaliNo ratings yet

- Due Diligence Report For Land Acquisition and ResettlementDocument16 pagesDue Diligence Report For Land Acquisition and ResettlementJp BorromeoNo ratings yet

- Case 3:09 CV 02053 JPDocument9 pagesCase 3:09 CV 02053 JPvpjNo ratings yet

- Using Machine Learning For Anti-Corruption RiskDocument100 pagesUsing Machine Learning For Anti-Corruption RiskOlah AlohaNo ratings yet

- Field Warehouse Receipt FinancingDocument18 pagesField Warehouse Receipt FinancingYashveer ChoudharyNo ratings yet

- FJMOMI en Brochure 1Document32 pagesFJMOMI en Brochure 1manoranjan838241No ratings yet

- MCQDocument5 pagesMCQnoor guribNo ratings yet

- M&A - Subtask 2 (Extended Instructions)Document2 pagesM&A - Subtask 2 (Extended Instructions)Aviral Arun100% (1)

- Rba Practical GuideDocument20 pagesRba Practical Guidejohnoo7100% (1)

- Guide To Storage HandlingDocument26 pagesGuide To Storage Handlingvona pawaka ningrumNo ratings yet

- Checklist For Due Diligence in Intellectual Property TransactionsDocument10 pagesChecklist For Due Diligence in Intellectual Property TransactionsdealbertNo ratings yet

- Performance Standards Filled Bedding Textiles 2015 17Document10 pagesPerformance Standards Filled Bedding Textiles 2015 17Tahir NizamNo ratings yet

- Due Care Vs Due DiligenceDocument4 pagesDue Care Vs Due DiligencealokNo ratings yet

- Caesars Entertainment LawsuitDocument35 pagesCaesars Entertainment LawsuitGreg SaulmonNo ratings yet

- HrduediligenceDocument28 pagesHrduediligencesunilkumarchaudhary100% (1)

- Template Intent of LetterDocument3 pagesTemplate Intent of LetterBlackBlueNo ratings yet

- Acef Best Practices Due DiligenceDocument15 pagesAcef Best Practices Due DiligenceEthan BatraskiNo ratings yet

- Rule 53 New Trial Ybiernas v. Gabaldon G.R. No. 178925 6 June 2011 FactsDocument2 pagesRule 53 New Trial Ybiernas v. Gabaldon G.R. No. 178925 6 June 2011 FactsAce AnchetaNo ratings yet

- The AMA of Due DiligencyDocument85 pagesThe AMA of Due DiligencySanjay Rathi100% (2)

- Guide For Managing Health Safety Australian Policing OperationalDocument40 pagesGuide For Managing Health Safety Australian Policing OperationalFpaulo36No ratings yet

- Role of Human Resources in Merger & Acquisition - LinkedInDocument6 pagesRole of Human Resources in Merger & Acquisition - LinkedInSanjeev SharmaNo ratings yet

- AHLA-OSAC Hotel Assessment Form2017Document21 pagesAHLA-OSAC Hotel Assessment Form2017Hervian LanangNo ratings yet

- Strategic Services: Developing Winning SolutionsDocument2 pagesStrategic Services: Developing Winning Solutionsstavros7No ratings yet

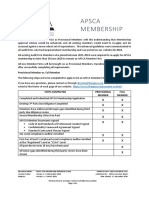

- APSCA Firm Membership Definitions D 028Document1 pageAPSCA Firm Membership Definitions D 028VANo ratings yet

- International Mergers and Acquisitions, International Joint Ventures, and AlliancesDocument33 pagesInternational Mergers and Acquisitions, International Joint Ventures, and AlliancesSteve HanNo ratings yet