Professional Documents

Culture Documents

Askari Asset Allocation Fund3778

Uploaded by

ashfaqmemon2001Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Askari Asset Allocation Fund3778

Uploaded by

ashfaqmemon2001Copyright:

Available Formats

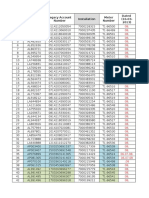

NAV 97.

6270

ASKARI ASSET ALLOCATION FUND Fund Manager Report

November 2007

General Information Investment Objective

Minimum Investment Rs 5,000

Sales Load 2.5% front-end, 0.0% back-end The fund seeks to maximize long-term total return (stocks

Management Fee 3.0% plus income) while incurring lesser risk than a fund

Risk Medium

comprising entirely of stocks. Asset universe of the fund

Manag’nt Company Rating AM3 by JCR-VIS and PACRA

includes stocks, term finance certificates, Government

Fund Size and Growth bonds, treasury bills, certificates of investment, continuous

30 Nov 07 31 Oct 07 funding system, and spread transactions (Redi-Future),

Fund Size Rs 737 mn Rs 722 mn etc. The fund seeks to provide its investors with returns

NAV* 97.6270 99.0956 that are 5% higher than the benchmark (KSE-100 index).

* Dividend of Rs. 1.99 paid as of June 30, 2007

Fund Performance

The Fund was launched (Pre-IPO) on June 2, 2007 with

Rolling Return 1-Month 3-Month Since Inc. FY08 the IPO taking place from Sep 10-13, 2007.

AAAF -1.48% 4.15% -0.38% -2.55%

KSE 100 -2.24% 12.75% 8.23% 1.64% Economic Outlook

Portfolio Details After revising its world growth forecast downward at 4.8%

P/E (FY08) 12.88 in October, the International Monetary Fund is again

Beta 0.90 looking to revise the number further downward in the wake

R2 81.0%

of higher oil prices and mortgage loans crisis in the United

Max Drawdown (DD) 9.2%

Number of days in DD 127 States. However, the State Bank of Pakistan is confident

Standard Deviation* 3.9% that Pakistan will largely remain insulated from the

* On monthly basis international economic slowdown and will achieve 7.0%

Economic Data target growth for FY08.

Nov/06 Mar/07 Jun/07 Sep/07 Nov/07

KSE100 Index 10,618.8 11,271.6 13,772.5 13,351.8 13,998.5 During the month, foreign portfolio investment worth

6M KIBOR 10.57% 10.39% 10.02% 9.97% 9.97% $219.86 million flowed out of Pakistan after the imposition

CPI Inflation 8.10% 7.67% 7.77% 7.07% -

of emergency in the country, which resulted in fairly volatile

price swings during the month. As a result of reported

Asset Allocation lower credit off-take and mixed 3rd quarter results, most of

E&P

the banks lost against the KSE 100 Index. Crude oil prices

Other

19% remained at record highs during the month and brought

Inv B anks 6% good gains in the oil shares. The cement sector remained

2%

Tech& Comm

3%

depressed on the expectation that rising energy input costs

Cement would reduce profits further. Fertilizer prices kept rising

4%

OM C

during the month solidifying the profits of the sector. Rising

5%

Cash

19%

steel prices, a stronger yen, and tighter credit from banks

for car loans made the auto sector less promising than in

previous years. Power, technology and communication

sectors gave a lackluster performance. Some major

Fertilizer insurers announced plans to realize capital gains on their

11%

portfolios before capital gains tax exemption expires at the

end of the calendar year. This gave boost to their shares.

Fixed Income

Banks Rising lint prices due to lower cotton production and

16%

15% apprehension of lower demand due to economic slowdown

in the textile importing countries cast a shadow over the

textile sector. The chemical sector performed somewhat

better.

Fund Performance

At the start of the month, the fund had a high exposure to the market and the fund NAV dipped significantly after

imposition of emergency in the country. The stock market closed at the month end with a small loss. The Fund was,

however, able to outperform the KSE 100 Index by 0.76% percent. Oil exploration and production and fertilizer stocks

performed well. At the end of the month the Fund was invested 65% in equities and 35% in fixed income and cash.

General elections are to be held within a month and the outcome of the election will determine the future trend of the

market. Before the elections, the market is likely to remain somewhat cautious.

Fund Manager Saeed Aziz Khan Listing Islamabad Stock Exchange

Fund Type Open-end asset allocation fund Trustee Central Depository Company

Launch Date 10 September, 2007 (IPO) Auditors Ford Rhodes Sidat Hyder & Co.

You might also like

- JP Morgan Valuation Training MaterialsDocument49 pagesJP Morgan Valuation Training MaterialsAdam Wueger92% (26)

- General Power of Attorney Final (NEW)Document4 pagesGeneral Power of Attorney Final (NEW)udNo ratings yet

- Final Review Questions SolutionsDocument5 pagesFinal Review Questions SolutionsNuray Aliyeva100% (1)

- 4 Hour MACD Forex StrategyDocument20 pages4 Hour MACD Forex Strategymr.ajeetsingh100% (1)

- Mark-To-Actual Revision of Lower Provision, But Headwind Trend RemainsDocument11 pagesMark-To-Actual Revision of Lower Provision, But Headwind Trend RemainsbodaiNo ratings yet

- An Introduction To Modern Portfolio Theory: Markowitz, CAP-M, APT and Black-LittermanDocument31 pagesAn Introduction To Modern Portfolio Theory: Markowitz, CAP-M, APT and Black-Littermangkk82No ratings yet

- Sap Projects Roadmap For 2014-2015Document33 pagesSap Projects Roadmap For 2014-2015ashfaqmemon2001No ratings yet

- Management of TANESCODocument3 pagesManagement of TANESCOVincsNo ratings yet

- Online Trading and Clearing Settlements at Arihant Capital Market LTD Mba ProjectDocument88 pagesOnline Trading and Clearing Settlements at Arihant Capital Market LTD Mba Projectprakash_rish120No ratings yet

- Entrepreneurial Finance 5Th Edition Full ChapterDocument41 pagesEntrepreneurial Finance 5Th Edition Full Chapterjennifer.wilson918100% (25)

- Hpam Ultima Ekuitas 1: Month MonthDocument2 pagesHpam Ultima Ekuitas 1: Month MonthSaid Al MusayyabNo ratings yet

- Aviva Pension Deposit S6Document2 pagesAviva Pension Deposit S6Ramesh behlNo ratings yet

- Inbound 1447676777343781147Document2 pagesInbound 1447676777343781147ML ChingNo ratings yet

- NIOF-Dec 2020Document1 pageNIOF-Dec 2020chqaiserNo ratings yet

- I Income Fund Apr 23Document3 pagesI Income Fund Apr 23mid_cycloneNo ratings yet

- Can Fin Homes Ltd-4QFY23 Result UpdateDocument5 pagesCan Fin Homes Ltd-4QFY23 Result UpdateUjwal KumarNo ratings yet

- MMF March 21Document1 pageMMF March 21Ng'ang'a KariukiNo ratings yet

- NBP Government Securities Liquid Fund (NGSLF)Document1 pageNBP Government Securities Liquid Fund (NGSLF)Sohail AhmedNo ratings yet

- I Balanced Fund Apr 23Document3 pagesI Balanced Fund Apr 23mid_cycloneNo ratings yet

- BFSI Q2FY22 - Earnings Preview - 08102021 Final (1) (1) - 08-10-2021 - 09Document13 pagesBFSI Q2FY22 - Earnings Preview - 08102021 Final (1) (1) - 08-10-2021 - 09slohariNo ratings yet

- Q2 2022 FactsheetsDocument6 pagesQ2 2022 FactsheetsTolu RomioNo ratings yet

- Bfsi by AxisDocument14 pagesBfsi by AxisJANARTHAN SANKARANNo ratings yet

- Yes Bank: IndiaDocument9 pagesYes Bank: IndiabdacNo ratings yet

- Absa Money Market Fund Fact SheetDocument2 pagesAbsa Money Market Fund Fact Sheetmarko joosteNo ratings yet

- Money Market Fund Fact Sheet - Q1 2018Document1 pageMoney Market Fund Fact Sheet - Q1 2018nathaniel07No ratings yet

- PickoftheWeek 13082022Document3 pagesPickoftheWeek 13082022Photo SharingNo ratings yet

- AngelBrokingResearch STFC Result Update 3QFY2020Document6 pagesAngelBrokingResearch STFC Result Update 3QFY2020avinashkeswaniNo ratings yet

- Chapter 5Document10 pagesChapter 5Ali KazmiNo ratings yet

- NBP Government Securities Savings Fund (NGSSF)Document1 pageNBP Government Securities Savings Fund (NGSSF)Ali RazaNo ratings yet

- AU Small Finance Bank - 1QFY19 - HDFC Sec-201808090630580075937Document11 pagesAU Small Finance Bank - 1QFY19 - HDFC Sec-201808090630580075937Ajay Raj KhandelwalNo ratings yet

- Bifm Pula Money Market Fund Factsheet Q4 2021Document1 pageBifm Pula Money Market Fund Factsheet Q4 2021Unaswi Pearl ShavaNo ratings yet

- HDFC Bank 20072020 IciciDocument15 pagesHDFC Bank 20072020 IciciVipul Braj BhartiaNo ratings yet

- Banks: Banking Sector Update: September 2021Document8 pagesBanks: Banking Sector Update: September 2021dkdehackerNo ratings yet

- Diwali Muhurat Fundamental 2021Document22 pagesDiwali Muhurat Fundamental 2021Swasthyasudha AyurvedNo ratings yet

- Economic Brief Sept 2017Document20 pagesEconomic Brief Sept 2017Áron KerékgyártóNo ratings yet

- MMF Q1 21Document1 pageMMF Q1 21tim walNo ratings yet

- NAFA Islamic Opportunity Fund January 2008Document1 pageNAFA Islamic Opportunity Fund January 2008Ali RazaNo ratings yet

- 2011 Jan 26 - SIAS - FirstREITDocument5 pages2011 Jan 26 - SIAS - FirstREITKyithNo ratings yet

- Press Release Arman Q3FY21Document5 pagesPress Release Arman Q3FY21Forall PainNo ratings yet

- AU Small Bank Motilal OswalDocument10 pagesAU Small Bank Motilal Oswalsaurabhjain05No ratings yet

- Jarir GIB 2022.10Document15 pagesJarir GIB 2022.10robynxjNo ratings yet

- Hpam Ultima Ekuitas 1Document2 pagesHpam Ultima Ekuitas 1Esge KuNo ratings yet

- Al Ameen Funds-Fund Manager Report-Jan-2024Document21 pagesAl Ameen Funds-Fund Manager Report-Jan-2024aniqa.asgharNo ratings yet

- ENMPOOCT19 KuwaitDocument2 pagesENMPOOCT19 KuwaitfdsfdsaNo ratings yet

- Maybank - 1QFY10-20091113-Making A Whole Lot of CentsDocument9 pagesMaybank - 1QFY10-20091113-Making A Whole Lot of CentsseanreportsNo ratings yet

- AngelTopPicks Sep 2022Document12 pagesAngelTopPicks Sep 2022Guru S SankarNo ratings yet

- Eurobond Fund Factsheet April 2023 (Demo)Document1 pageEurobond Fund Factsheet April 2023 (Demo)jeremiah.oNo ratings yet

- Sbin 20220807 Mosl Ru PG012Document12 pagesSbin 20220807 Mosl Ru PG012Rojalin SwainNo ratings yet

- Vol. No. 7 Issue No. 9: March 2010Document32 pagesVol. No. 7 Issue No. 9: March 2010Dr. Sanjeev KumarNo ratings yet

- Weekly Investment Outlook - Aug 09 2010Document6 pagesWeekly Investment Outlook - Aug 09 2010Shikhar BhatiaNo ratings yet

- Dollar Income and Growth Dividend-Paying: Fund DetailsDocument2 pagesDollar Income and Growth Dividend-Paying: Fund DetailsenzlibraryNo ratings yet

- Lic Housing Finance - : Proxy To Play The Real Estate RecoveryDocument4 pagesLic Housing Finance - : Proxy To Play The Real Estate Recoverysaipavan999No ratings yet

- Edelweiss SP - ARC - Jul'19 PMS PDFDocument12 pagesEdelweiss SP - ARC - Jul'19 PMS PDFPanache ZNo ratings yet

- Axis Bank LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument7 pagesAxis Bank LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- NMMF May 2022Document1 pageNMMF May 2022chqaiserNo ratings yet

- Bank of Baroda - KRC - 15 10 09Document2 pagesBank of Baroda - KRC - 15 10 09sudhirbansalNo ratings yet

- Shriram City Union Finance 27042018 1Document14 pagesShriram City Union Finance 27042018 1saran21No ratings yet

- MS13 08 08Document2 pagesMS13 08 08anon-828883No ratings yet

- 2022 Preqin Global Sample Pages: Private EquityDocument9 pages2022 Preqin Global Sample Pages: Private EquityIsabelle ZhuNo ratings yet

- City Union Bank Ltdâ Q2FY23 Result Update - 07112022 - 07-11-2022 - 14Document8 pagesCity Union Bank Ltdâ Q2FY23 Result Update - 07112022 - 07-11-2022 - 14mindvalley lakhaniNo ratings yet

- Weekly Wrap: Recovery Hopes Bolster PCOMP Above 6,600Document2 pagesWeekly Wrap: Recovery Hopes Bolster PCOMP Above 6,600Romel Alvendia ValenciaNo ratings yet

- Public Investment Bank: Alliance Bank Malaysia Berhad OutperformDocument7 pagesPublic Investment Bank: Alliance Bank Malaysia Berhad OutperformZhi_Ming_Cheah_8136No ratings yet

- AU Small Finance Bank - IC - HDFC Sec-201710030810174398816Document30 pagesAU Small Finance Bank - IC - HDFC Sec-201710030810174398816Anonymous y3hYf50mTNo ratings yet

- Alliance Bank OutlookDocument9 pagesAlliance Bank OutlookBrian StanleyNo ratings yet

- Financial Sector Performance and System Stability: 8.1 OverviewDocument52 pagesFinancial Sector Performance and System Stability: 8.1 OverviewdevNo ratings yet

- HSIE Results Daily - 03 May 22-202205030828515687851Document5 pagesHSIE Results Daily - 03 May 22-202205030828515687851prateeksri10No ratings yet

- What Does The Fund Invest In?: Sun Life Grepa Growth PLUS FundDocument1 pageWhat Does The Fund Invest In?: Sun Life Grepa Growth PLUS FundBee ThreeallNo ratings yet

- AU SFB - Centrum - 190324 - EBRDocument11 pagesAU SFB - Centrum - 190324 - EBRDivy JainNo ratings yet

- Weekly Activity Report of ITGDocument6 pagesWeekly Activity Report of ITGashfaqmemon2001No ratings yet

- Advance Payment-Aurangi IIDocument9 pagesAdvance Payment-Aurangi IIashfaqmemon2001No ratings yet

- School ListDocument1 pageSchool Listashfaqmemon2001No ratings yet

- ITABDocument221 pagesITABashfaqmemon2001No ratings yet

- Ordinary Authorization Matrix: Designations /positions - Function Name S. NODocument28 pagesOrdinary Authorization Matrix: Designations /positions - Function Name S. NOashfaqmemon2001No ratings yet

- t47!01!01 2012 Revised Temporary PricesDocument4 pagest47!01!01 2012 Revised Temporary Pricesashfaqmemon2001No ratings yet

- Objective Setting Form - 2013: Employee DetailsDocument4 pagesObjective Setting Form - 2013: Employee Detailsashfaqmemon2001No ratings yet

- Ameer Ahmed Khan: ObjectivityDocument1 pageAmeer Ahmed Khan: Objectivityashfaqmemon2001No ratings yet

- Template of Presentation DMDocument6 pagesTemplate of Presentation DMashfaqmemon2001No ratings yet

- T51 01-08-2012 GST Steel Melters RevisedDocument2 pagesT51 01-08-2012 GST Steel Melters Revisedashfaqmemon2001No ratings yet

- Profile Values Are in Load Shedding Status (10!04!2013)Document3 pagesProfile Values Are in Load Shedding Status (10!04!2013)ashfaqmemon2001No ratings yet

- QM Matix For Service ObjectsDocument122 pagesQM Matix For Service Objectsashfaqmemon2001No ratings yet

- Resume For Cutomer Service ManagerDocument1 pageResume For Cutomer Service Managerashfaqmemon2001No ratings yet

- Sap QM Vendor Rating User ManualDocument11 pagesSap QM Vendor Rating User Manualashfaqmemon2001No ratings yet

- Career Objective: Asra NaveedDocument2 pagesCareer Objective: Asra Naveedashfaqmemon2001No ratings yet

- Fd7ef98 1504HTML000012Document1 pageFd7ef98 1504HTML000012ashfaqmemon2001No ratings yet

- Quality CertificatesDocument2 pagesQuality Certificatesashfaqmemon2001No ratings yet

- 0508 SAP Audit Management A Simple and Elegant ToolDocument36 pages0508 SAP Audit Management A Simple and Elegant Toolashfaqmemon2001No ratings yet

- Case No. D91/02Document16 pagesCase No. D91/02ashfaqmemon2001No ratings yet

- Developing Marketing Strategies and Plans: Chapter QuestionsDocument4 pagesDeveloping Marketing Strategies and Plans: Chapter Questionsashfaqmemon2001No ratings yet

- New-Product Development and Life-Cycle StrategiesDocument22 pagesNew-Product Development and Life-Cycle Strategiesashfaqmemon2001No ratings yet

- Reporting and Analyzing Long-Term Assets: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinDocument71 pagesReporting and Analyzing Long-Term Assets: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinYvonne Teo Yee VoonNo ratings yet

- CPINDocument114 pagesCPINHelenaNo ratings yet

- 72-270 Chapter 1 - IntroDocument20 pages72-270 Chapter 1 - IntroMike RuffoloNo ratings yet

- PTSP - Icmd 2009 (B01)Document4 pagesPTSP - Icmd 2009 (B01)IshidaUryuuNo ratings yet

- Globtec Investment Group Announces $170 Million Investment in Public Infrastructure and Real Estate Projects in The Visegrád StatesDocument3 pagesGlobtec Investment Group Announces $170 Million Investment in Public Infrastructure and Real Estate Projects in The Visegrád StatesPR.comNo ratings yet

- CH 06Document54 pagesCH 06Gisilowati Dian PurnamaNo ratings yet

- An Evaluation of Flat Carbon Steel Production of National Steel Corporation (NSC) From Its Privatization in 1995 To Its Liquidation in 1999 and Its Implications To The Country's Steel IndustryDocument293 pagesAn Evaluation of Flat Carbon Steel Production of National Steel Corporation (NSC) From Its Privatization in 1995 To Its Liquidation in 1999 and Its Implications To The Country's Steel IndustryArturo B. del AyreNo ratings yet

- Negotiable Instruments Law Bar QuestionsDocument3 pagesNegotiable Instruments Law Bar QuestionsLudica OjaNo ratings yet

- Readme 1 SDocument8 pagesReadme 1 SmohdkhidirNo ratings yet

- Educational Material - ICAI Valuation Standard 103 - Valuation Approaches and MethodsDocument172 pagesEducational Material - ICAI Valuation Standard 103 - Valuation Approaches and MethodsJishnuNichinNo ratings yet

- Acceptable and Unacceptable AssetDocument3 pagesAcceptable and Unacceptable AssetDenicelle BucoyNo ratings yet

- Sharia Family: The Nasdaq 100 (NDX)Document2 pagesSharia Family: The Nasdaq 100 (NDX)Amir Syazwan Bin MohamadNo ratings yet

- HicDocument7 pagesHicBhavin SagarNo ratings yet

- Singapore Financial SystemDocument69 pagesSingapore Financial SystemlemxramosNo ratings yet

- Equity Valuation: Capital and Money Markets AssignmentDocument5 pagesEquity Valuation: Capital and Money Markets AssignmentSudip BainNo ratings yet

- Primary Market 1Document21 pagesPrimary Market 1Dakshata GadiyaNo ratings yet

- What Is Mutual FundDocument6 pagesWhat Is Mutual Fund2K19/EE/116 ISH MISHRANo ratings yet

- 2 Wheeler Automobile IndustryDocument9 pages2 Wheeler Automobile IndustryShankeyNo ratings yet

- Fas 157 PDFDocument2 pagesFas 157 PDFPatrickNo ratings yet

- TYIT InternshipDocument1 pageTYIT Internshipsubhamgupta7495No ratings yet

- iLLUSTRATION OF LUMP SUM LIQUIDATION FOR ENCODINGDocument14 pagesiLLUSTRATION OF LUMP SUM LIQUIDATION FOR ENCODINGMaria Kathreena Andrea AdevaNo ratings yet

- Todd Martin BSC Math Assuris Aug 29, 2016Document4 pagesTodd Martin BSC Math Assuris Aug 29, 2016Todd MartinNo ratings yet