Professional Documents

Culture Documents

Balaji Published Results 28-102010

Uploaded by

Saurabh YadavOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balaji Published Results 28-102010

Uploaded by

Saurabh YadavCopyright:

Available Formats

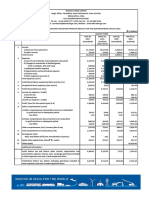

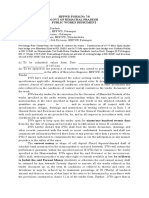

Balaji Telefilms Limited

UN-AUDITED FINANCIAL RESULTS FOR THE QUARTER / HALF YEAR ENDED SEPTEMBER 30, 2010

(Rupees in Lacs)

3 months ended Half-Year ended Year ended

Sr. September 30 September 30 March 31

Particulars

No. 2010 2009 2010 2009 2010

(Un-Audited) (Un-Audited) (Un-Audited) (Un-Audited) (Audited)

1 a) Net Sales / Income from Operations 3,808.31 4,061.50 6,878.18 8,033.08 15,282.41

b) Other Operating Income 7.75 6.82 23.12 13.48 1,119.40

Total 3,816.06 4,068.32 6,901.30 8,046.56 16,401.81

2 Expenditure

a) (Increase) in stock in trade (42.79) (102.85) (24.77) (60.02) (55.13)

b) Cost of Production / Acquisition and Telecast Fees 2,962.64 3,110.30 5,245.41 5,511.37 10,661.80

c) Staff Cost 541.25 372.07 928.60 793.55 1,637.90

d) Depreciation 364.57 275.02 667.06 524.73 1,033.43

e) Other Expenditure 869.69 878.47 1,532.93 1,660.58 3,096.30

Total 4,695.36 4,533.01 8,349.23 8,430.21 16,374.30

3 (Loss) / Profit from Operation Before Other Income and Interest (1-2) (879.30) (464.69) (1,447.93) (383.65) 27.51

4 Other Income 158.23 529.86 981.95 1,512.01 2,197.76

5 (Loss) / Profit before Interest (3+4) (721.07) 65.17 (465.98) 1,128.36 2,225.27

6 Interest - - - - -

7 (Loss) / Profit from Ordinary Activities Before Tax (721.07) 65.17 (465.98) 1,128.36 2,225.27

8 Tax Expenses (80.90) (37.12) (118.90) 116.52 693.09

9 Net (Loss) / Profit After Tax (640.17) 102.29 (347.08) 1,011.84 1,532.18

10 (Short) Provision for Tax in respect of earlier years - - - (13.09) (13.09)

11 Net (Loss) / Profit for the Period / Year (640.17) 102.29 (347.08) 998.75 1,519.09

12 Paid-up Equity Share Capital (Face Value Rs. 2/- each) 1,304.21 1,304.21 1,304.21 1,304.21 1,304.21

13 Reserves excluding Revaluation Reserves 38,873.90

14 Earnings Per Share (EPS) Basic and Diluted (0.98) 0.16 (0.53) 1.53 2.33

15 Public Shareholding:

- Number of Shares 38972693 38997693 38972693 38997693 38972693

- Percentage of Shareholding (%) 59.76 59.80 59.76 59.80 59.76

16 Promoters and promoter group Shareholding

a) Pledged / Encumbered

- Number of Shares - - - - -

- Percentage of Shareholding (as a % of the total

share holding of promoter and promoter group) - - - - -

- Percentage of Shareholding (as a % of the total

share capital of the company) - - - - -

b) Non-encumbered

- Number of Shares 26237750 26212750 26237750 26212750 26237750

- Percentage of Shareholding (as a % of the total

share holding of promoter and promoter group) 100.00 100.00 100.00 100.00 100.00

- Percentage of Shareholding (as a % of the total

share capital of the company) 40.24 40.20 40.24 40.20 40.24

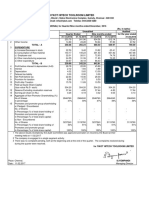

SEGMENT WISE REVENUE, RESULTS AND CAPITAL EMPLOYED

3 months ended Half - Year Ended Year ended

Sr. September 30 September 30 March 31

Particulars

No. 2010 2009 2010 2009 2010

(Un-Audited) (Un-Audited) (Un-Audited) (Un-Audited) (Audited)

1 Segment Revenue

a) Commissioned Programs 3,246.00 3,386.83 5,850.30 6,704.40 12,838.16

b) Sponsored Programs 562.31 674.67 1,027.88 1,328.68 2,444.25

Total 3,808.31 4,061.50 6,878.18 8,033.08 15,282.41

Less: Inter Segment Revenue - - - - -

Net Sales / Income from Operations 3,808.31 4,061.50 6,878.18 8,033.08 15,282.41

2 Segment Results

Profit Before Tax and Interest from each Segment

a) Commissioned Programs 625.02 852.24 992.31 1,914.94 4,676.94

b) Sponsored Programs 87.49 23.87 204.65 240.22 458.44

Total 712.51 876.11 1,196.96 2,155.16 5,135.38

Less: (i) Interest - - - - -

(ii) Other Unallocable Expenditure 1,591.81 1,354.28 2,644.89 2,552.29 5,107.86

(iii) Unallocable Income (158.23) (543.34) (981.95) (1,525.49) (2,197.76)

(Loss) / Profit before tax (721.07) 65.17 (465.98) 1,128.36 2,225.27

3 Capital Employed

(Segment Assets - Segment Liabilities)

a) Commissioned Programs 9,898.51 9,182.74 9,898.51 9,182.74 11,120.65

b) Sponsored Programs 700.89 750.86 700.89 750.86 743.50

c) Unallocable 29,231.64 29,952.58 29,231.64 29,952.58 28,405.14

Total 39,831.04 39,886.18 39,831.04 39,886.18 40,269.28

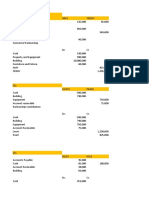

Statement of Assets and Liabilities

(Rupees in Lacs)

As at September 30, 2010 As at September 30, 2009

Particulars (Un-Audited) (Un-Audited)

Shareholders’ Funds:

1,304.21 1,304.21

a) Capital

b) Reserves and Surplus 38,526.83 38,581.97

Total 39,831.04 39,886.18

Fixed Assets (net block) 8,648.03 8,892.22

Investments 21,903.11 23,483.29

Deferred Tax Asset (net) 55.07 482.03

Current Assets, Loans and Advances

170.18 150.30

a) Inventories

4,878.58 4,318.00

b) Sundry Debtors

310.40 661.45

c) Cash and Bank balances

d) Loans and Advances 7,026.34 4,913.82

Less: Current Liabilities and Provisions

3,091.38 2,950.85

a) Liabilities

b) Provisions 69.29 64.08

Total 39,831.04 39,886.18

Notes:

1 The above results were taken on record by the Board of Directors at their meeting held on October 28, 2010.

2 There were no Investors Complaints pending at the beginning of the quarter. The Company has received 13 complaints from the investors during the quarter ended September

30, 2010 and all the complaints were resolved during the quarter. There were no complaints lying unresolved at the end of the quarter.

3 The Company, in the previous year, had invested amounts aggregating to Rs. 4,795.30 lacs in three adjacent plots of land approximately admeasuring 38,870 sq.mtrs. in

aggregate, situated within the limits of Mira Bhayander Municipal Corporation.

In the previous year, the Company was made a party in the dispute with respect to two of the above plots of land approximately admeasuring 24,980 sq.mtrs., between the

original owner of the said plots of land and another party, who claimed to have purchased the aforesaid plots of land at an earlier date. The application for interim relief made by

the said party was dismissed by the Thane Civil Court and the Hon’ble Mumbai High Court. Subsequently, in the previous quarter, a special leave petition filed before the

Hon’ble Supreme Court by the said party against these dismissals was also withdrawn by the party unconditionally.

However, during the previous quarter, the Company has received another notice from Thane City Civil Court regarding a suit filed by the said party with respect to the third plot of

land approximately admeasuring 13,890 sq.mtrs., on similar grounds as were for the other two plots of land.

The Company is pursuing all legal remedies available in both the aforesaid matters.

4 In the quarter ended June 2009, the Company had received a show cause-cum-demand notice from the office of the Commissioner of Service Tax, Mumbai for an amount of

Rs.6,348.40 lacs excluding interest and penalty (amounts for which are not quantifiable) pertaining to the service tax for the financial years 2006-07 and 2007-08 on exports

made to one of the customers of the Company. The Adjudicating Authority has dropped the proceedings and the show-cause-cum demand notice vide its order dated

September 7, 2010.

Subequent to the quarter end, the Company has received another show-cause-cum demand notice from the authorities for an amount of Rs.2,897.74 lacs excluding interest and

penalty (amounts for which are not quantifiable), pertaining to service tax for the financial years 2008-09 and 2009-10 on similar grounds as above. The Company has also

received another show-cause-cum demand notice for an amount of Rs.403.12 Lacs for service tax for the financial years 2006-07 to 2009-10 regarding certain other

procedural matters.

The Company is in the process of responding to the said notices and is hopeful of success in the matter.

5 Corresponding figures of the previous period / year have been regrouped / restated, wherever necessary.

Place : Mumbai By Order of the Board

Date : October 28, 2010 For Balaji Telefilms Limited

Jeetendra Kapoor

Chairman

You might also like

- Dealer Management System v2.3.Xlsx - GetacoderDocument19 pagesDealer Management System v2.3.Xlsx - Getacoderapsantos_spNo ratings yet

- Law of Agency CasesDocument10 pagesLaw of Agency CasesAndrew Lawrie75% (4)

- July 2012Document134 pagesJuly 2012kohinoor_roy5447No ratings yet

- Questões Inglês para CesgranrioDocument36 pagesQuestões Inglês para Cesgranriosamuel souzaNo ratings yet

- Hedge Funds-Case StudyDocument20 pagesHedge Funds-Case StudyRohan BurmanNo ratings yet

- Consolidated Q4Document6 pagesConsolidated Q4Qazi MudasirNo ratings yet

- q209 - Airtel Published FinancialsDocument7 pagesq209 - Airtel Published Financialsmixedbag100% (2)

- Spandana Sporthy Balance SheetDocument1 pageSpandana Sporthy Balance SheetMs VasNo ratings yet

- Jamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanaDocument4 pagesJamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanapoloNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Cipla - Unaudited Fin Result For The Quarter Ended 30th June 2010Document4 pagesCipla - Unaudited Fin Result For The Quarter Ended 30th June 2010thelostbardNo ratings yet

- Q3FY22Document7 pagesQ3FY22Pratik PatilNo ratings yet

- Tata Steel LTD: Audited Financial Results For The Year Ended On 31st March 2010Document6 pagesTata Steel LTD: Audited Financial Results For The Year Ended On 31st March 2010fifa05No ratings yet

- Q4 20 - DhunseriDocument8 pagesQ4 20 - Dhunserica.anup.kNo ratings yet

- Financial Results 31 Mar 2010 HSBC Invest DirectDocument2 pagesFinancial Results 31 Mar 2010 HSBC Invest Directbhavnesh_muthaNo ratings yet

- Web Standalone Sep23Document7 pagesWeb Standalone Sep23coolstiffler08No ratings yet

- Quarter1 2010Document2 pagesQuarter1 2010DhruvRathoreNo ratings yet

- Investor Download DataDocument9 pagesInvestor Download Dataindradanush2608No ratings yet

- Q1FY22Document8 pagesQ1FY22Anjalidevi TNo ratings yet

- Icici 2009Document4 pagesIcici 2009Anudeep ReddyNo ratings yet

- IEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021Document13 pagesIEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021seena_smile89No ratings yet

- Unaudited Financial Results For The Quarter Ended 30th September-2017Document2 pagesUnaudited Financial Results For The Quarter Ended 30th September-2017RajNo ratings yet

- Publication 30-06-09Document2 pagesPublication 30-06-09SuhasNo ratings yet

- Q1 20 - DhunseriDocument4 pagesQ1 20 - Dhunserica.anup.kNo ratings yet

- Q4 Results of Bal 2022-23Document11 pagesQ4 Results of Bal 2022-23dewerNo ratings yet

- ITC Financial Result Q1 FY2024 SfsDocument3 pagesITC Financial Result Q1 FY2024 SfsAlricNo ratings yet

- Latest Financials - DR Agarwals May 2022Document11 pagesLatest Financials - DR Agarwals May 2022Mr SmartNo ratings yet

- ResultsDocument5 pagesResultssanjayvichare2020No ratings yet

- Q2 20 & 6 Months DhunseriDocument7 pagesQ2 20 & 6 Months Dhunserica.anup.kNo ratings yet

- Bajaj Auto Limited: Page 1 of 7Document7 pagesBajaj Auto Limited: Page 1 of 7DPH ResearchNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document6 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Kumar RajputNo ratings yet

- GHCL Limited (CIN: L24100GJ1983PLC006513)Document10 pagesGHCL Limited (CIN: L24100GJ1983PLC006513)soumyasibaniNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- 634085163601250000financial Highlights0310-Correcte-1Document2 pages634085163601250000financial Highlights0310-Correcte-1arunnair1985No ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document3 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Upendra GuptaNo ratings yet

- Falcon QTR Sep 09Document1 pageFalcon QTR Sep 09shettypavanNo ratings yet

- Time Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210Document13 pagesTime Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210WeR1 Consultants Pte LtdNo ratings yet

- Profit Loss AccountDocument8 pagesProfit Loss AccountAbhishek JenaNo ratings yet

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARNo ratings yet

- Financial Profile: Unaudited Financial Results For The Quarter Ended 30Th June, 2010Document16 pagesFinancial Profile: Unaudited Financial Results For The Quarter Ended 30Th June, 2010Arun SharmaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Ramco Annual Report 2014Document2 pagesRamco Annual Report 2014nithinNo ratings yet

- Standalone Result Sep, 17Document4 pagesStandalone Result Sep, 17Varun SidanaNo ratings yet

- Directors ReportDocument14 pagesDirectors ReportGaurav JainNo ratings yet

- Results Trident16446Document6 pagesResults Trident16446mohitNo ratings yet

- Q2 Results Bal 2021 22Document11 pagesQ2 Results Bal 2021 22Suraj PatilNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Q1-Results Bal 2019-20Document5 pagesQ1-Results Bal 2019-20Krish PatelNo ratings yet

- Q3 Results Bal - 2022-23Document5 pagesQ3 Results Bal - 2022-23dewerNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- QR September 2009 VILDocument3 pagesQR September 2009 VILsamarth6665No ratings yet

- Q2FY19 Standalone ResultDocument4 pagesQ2FY19 Standalone ResultDivyansh SinghNo ratings yet

- Quarter1 2008Document2 pagesQuarter1 2008Raghavendra DevadigaNo ratings yet

- Resubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Document1 pageResubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Shyam SunderNo ratings yet

- Directors Report 2014 PDFDocument14 pagesDirectors Report 2014 PDFgalacticwormNo ratings yet

- Resubmission of Standalone Financial Results For December 31, 2014 (Company Update)Document1 pageResubmission of Standalone Financial Results For December 31, 2014 (Company Update)Shyam SunderNo ratings yet

- Annual Financial Results 2020Document9 pagesAnnual Financial Results 2020Yathish Us ThodaskarNo ratings yet

- Standalone Result Mar23Document9 pagesStandalone Result Mar23Amit KumarNo ratings yet

- ECSH 3Q 2009 Announcement 111109Document16 pagesECSH 3Q 2009 Announcement 111109WeR1 Consultants Pte LtdNo ratings yet

- Touc NG Lives Over: YearsDocument15 pagesTouc NG Lives Over: YearsRavi AgarwalNo ratings yet

- 2016 Annual ReportDocument7 pages2016 Annual ReportHeadshot's GameNo ratings yet

- Aditya Birla Capital Limited Statement of Consolidated Unaudited Results For The Quarter Ended 30Th June 2019Document6 pagesAditya Birla Capital Limited Statement of Consolidated Unaudited Results For The Quarter Ended 30Th June 2019Bhavesh PatelNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document2 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Janki SingDocument72 pagesJanki SingJankiNo ratings yet

- Marks Obtained in Sent-Up Examination February 2018Document24 pagesMarks Obtained in Sent-Up Examination February 2018Pankaj GuptaNo ratings yet

- What Factors Influence Financial Inclusion Among Entrepreneurs in Nigeria?Document9 pagesWhat Factors Influence Financial Inclusion Among Entrepreneurs in Nigeria?International Journal of Innovative Science and Research TechnologyNo ratings yet

- Loan Foreclosure LetterDocument3 pagesLoan Foreclosure LetterBabu BNo ratings yet

- Verana Exhibit and SchedsDocument45 pagesVerana Exhibit and SchedsPrincess Dianne MaitelNo ratings yet

- Yaba, Brixzel's AssignmentDocument4 pagesYaba, Brixzel's AssignmentYaba Brixzel F.No ratings yet

- Acs102 Fundamentals of Actuarial Science IDocument6 pagesAcs102 Fundamentals of Actuarial Science IKimondo King100% (1)

- Deemed Export BenefitDocument37 pagesDeemed Export BenefitSamNo ratings yet

- Acknowledgement To ContentsDocument4 pagesAcknowledgement To Contentsvandv printsNo ratings yet

- 80G CertificateTax ExemptionDocument56 pages80G CertificateTax ExemptionskunwerNo ratings yet

- RSWM 3QFY24 PresentationDocument32 pagesRSWM 3QFY24 PresentationAnand SrinivasanNo ratings yet

- Paramaunt ViacomDocument10 pagesParamaunt ViacomNatalia GastenNo ratings yet

- Chapter 4Document7 pagesChapter 4Eumar FabruadaNo ratings yet

- Module 4Document3 pagesModule 4Robin Mar AcobNo ratings yet

- EFim 05 Ed 3Document23 pagesEFim 05 Ed 3bia070386100% (1)

- Describe The Concept of InsuranceDocument12 pagesDescribe The Concept of InsuranceIndu GuptaNo ratings yet

- Final Assignment - IUB - MBA - Managerial EconomicsDocument12 pagesFinal Assignment - IUB - MBA - Managerial EconomicsMohammed Iqbal HossainNo ratings yet

- Standard Chartered Bank PakistanDocument19 pagesStandard Chartered Bank PakistanMuhammad Mubasher Rafique100% (1)

- Spes Form 5 - Placement Report Cum Gsis - Dec2016Document1 pageSpes Form 5 - Placement Report Cum Gsis - Dec2016Joel AndalesNo ratings yet

- Transpo ReviewerDocument22 pagesTranspo ReviewerPéddiéGréiéNo ratings yet

- GKDocument79 pagesGKramNo ratings yet

- Internship Report ON Foreign Exchange & Remittance Activities of Al-Arafah Islami Bank Limited''Document64 pagesInternship Report ON Foreign Exchange & Remittance Activities of Al-Arafah Islami Bank Limited''Mounota MandalNo ratings yet

- HPPWD FORM No 7Document2 pagesHPPWD FORM No 7Ankur SheelNo ratings yet

- Project Profile-ReadymixConcrete PlantDocument5 pagesProject Profile-ReadymixConcrete PlantAshish MajumderNo ratings yet

- The Impact of Auditor Quality, Financial Stability, and Financial Target For Fraudulent Financial Statement.Document6 pagesThe Impact of Auditor Quality, Financial Stability, and Financial Target For Fraudulent Financial Statement.Surya UnnesNo ratings yet