Professional Documents

Culture Documents

Chasity D English

Uploaded by

bpspillkillOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chasity D English

Uploaded by

bpspillkillCopyright:

Available Formats

PDF Export Feature Not Enabled..

Order Option #6 (Create PDF W2's and 1099's)

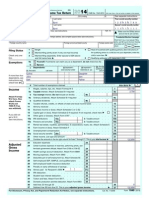

a Employee’s social security number

22222

416-25-4867 OMB No. 1545-0008

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

20-0087714

PDF Export Feature Not Enabled....Please Order Option 15625.00 557.75

#6 (Create PDF W2's and 1099's)

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Skeet's Driftwood

PDF Export FeatureLLC

Not Enabled....Please Order Option 15625.00 968.75

#6 (Create PDF W2's and 1099's)

5 Medicare wages and tips 6 Medicare tax withheld

47940 Highway 59 North

PDF Export Feature Not Enabled....Please Order Option 15625.00 226.56

#6 (Create PDF W2's and 1099's)

7 Social security tips 8 Allocated tips

Bay Minette, AL 36507

d Control number 9 Advance EIC payment 10 Dependent care benefits

004867

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a

C

o

CHASITY

PDF Export D

Feature ENGLISH

Not Enabled....Please Order Option #6 (Create PDF W2'sThird-party

and 1099's) d

e

13 Statutory Retirement

employee plan sick pay 12b

C

o

d

e

46030 CROSBY ROAD LOT 21 14 Other 12c

C

o

d

e

12d

BAY MINETTE, AL 36507 C

o

d

e

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

AL

PDF Export 418879 15625.00

Feature Not Enabled....Please 88.25#6 (Create PDF W2's and 1099's)

Order Option

Wage and Tax

2010

Department of the Treasury—Internal Revenue Service

Form W-2 Statement

Copy 1—For State, City, or Local Tax Department

PDF Export Feature Not Enabled..Order Option #6 (Create PDF W2's and 1099's)

a Employee’s social security number Safe, accurate, Visit the IRS website at

416-25-4867 OMB No. 1545-0008 FAST! Use www.irs.gov/efile

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

20-0087714

PDF Export Feature Not Enabled....Please Order Option 15625.00 557.75

#6 (Create PDF W2's and 1099's)

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Skeet's Driftwood

PDF Export FeatureLLC

Not Enabled....Please Order Option 15625.00 968.75

#6 (Create PDF W2's and 1099's)

6 Medicare tax withheld

47940 Highway 59 North

5 Medicare wages and tips

PDF Export Feature Not Enabled....Please Order Option 15625.00 226.56

#6 (Create PDF W2's and 1099's)

7 Social security tips 8 Allocated tips

Bay Minette, AL 36507

d Control number 9 Advance EIC payment 10 Dependent care benefits

004867

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12

C

CHASITY D ENGLISH

o

d

PDF Export Feature Not Enabled....Please Order Option #6 (Create

13 Statutory

PDF W2'sThird-party

Retirement

and 1099's) e

employee plan sick pay 12b

C

o

d

46030 CROSBY ROAD LOT 21

e

14 Other 12c

C

o

d

e

12d

BAY MINETTE, AL 36507 C

o

d

e

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

AL

PDF Export 418879 15625.00

Feature Not Enabled....Please 88.25#6 (Create PDF W2's and 1099's)

Order Option

Wage and Tax

2010

Department of the Treasury—Internal Revenue Service

Form W-2 Statement

Copy B—To Be Filed With Employee’s FEDERAL Tax Return.

This information is being furnished to the Internal Revenue Service.

PDF Export Feature Not Enabled..Order Option #6 (Create PDF W2's and 1099's)

Notice to Employee

Refund. Even if you do not have to file a tax return, you Corrections. If your name, SSN, or address is incorrect,

should file to get a refund if box 2 shows federal

PDF Export Feature Not Enabled....Please Order Optionincome correct Copies

#6 (CreateB, C, and

PDF2 and W2's askandyour1099's)

employer to

tax withheld or if you can take the earned income credit. correct your employment record. Be sure to ask the

PDFincome

Earned Exportcredit

Feature

(EIC).Not

You Enabled....Please

must file a tax returnOrder

if employer

Option #6to(Create

file Form PDF

W-2c,W2'sCorrected

and Wage

1099's)and Tax

any amount is shown in box 9. Statement, with the Social Security Administration (SSA)

to correct any name, SSN, or money amount error

You mayExport

be ableFeature

to take theNotEIC

Enabled....Please

for 2010 if (a) you doOrder Option

reported#6 to (Create

the SSA on PDFForm W2's

W-2.and 1099's)

If your name and SSN

not have a qualifying child and you earned less than are correct but are not the same as shown on your social

$13,460 ($18,470 if married filing jointly), (b) you have one security card, you should ask for a new card that displays

qualifying child and you earned less than $35,535 your correct name at any SSA office or by calling

($40,545 if married filing jointly), (c) you have two 1-800-772-1213. You also may visit the SSA at

qualifying children and you earned less than $40,363 www.socialsecurity.gov.

($45,373 if married filing jointly), or (d) you have three or

PDF more

Export Feature

qualifying Not Enabled....Please

children and you earned less than Order Option #6 (Create

Credit PDF W2's

for excess taxes.andIf you1099's)

had more than one

$43,352 ($48,362 if married filing jointly). You and any employer in 2010 and more than $6,621.60 in social

qualifying children must have valid social security security and/or Tier I railroad retirement (RRTA) taxes

numbers (SSNs). You cannot take the EIC if your were withheld, you may be able to claim a credit for the

investment income is more than $3,100. Any EIC that is excess against your federal income tax. If you had more

more than your tax liability is refunded to you, but only than one railroad employer and more than $3,088.80 in

if you file a tax return. If you have at least one qualifying Tier II RRTA tax was withheld, you also may be able to

child, you may get as much as $1,830 of the EIC in claim a credit. See your Form 1040 or Form 1040A

advance by completing Form W-5, Earned Income Credit instructions and Pub. 505, Tax Withholding and

Advance Payment Certificate, and giving it to your Estimated Tax.

PDF employer.

Export Feature Not Enabled....Please Order Option #6 (Create

(Also PDF W2's

see Instructions and 1099's)

for Employee on the back of Copy C.)

Clergy and religious workers. If you are not subject to

social security and Medicare taxes, see Pub. 517, Social

Security and Other Information for Members of the Clergy

and Religious Workers.

PDF Export Feature Not Enabled..Order Option #6 (Create PDF W2's and 1099's)

a Employee’s social security number This information is being furnished to the Internal Revenue Service. If you

are required to file a tax return, a negligence penalty or other sanction

416-25-4867 OMB No. 1545-0008

may be imposed on you if this income is taxable and you fail to report it.

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

20-0087714

PDF Export Feature Not Enabled....Please Order Option 15625.00 557.75

#6 (Create PDF W2's and 1099's)

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Skeet's Driftwood

PDF Export FeatureLLC

Not Enabled....Please Order Option 15625.00 968.75

#6 (Create PDF W2's and 1099's)

6 Medicare tax withheld

47940 Highway 59 North

5 Medicare wages and tips

PDF Export Feature Not Enabled....Please Order Option 15625.00 226.56

#6 (Create PDF W2's and 1099's)

7 Social security tips 8 Allocated tips

Bay Minette, AL 36507

d Control number 9 Advance EIC payment 10 Dependent care benefits

004867

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12

C

CHASITY D ENGLISH

o

d

PDF Export Feature Not Enabled....Please Order Option #6 (Create

13 Statutory

PDF W2'sThird-party

Retirement

and 1099's) e

employee plan sick pay 12b

C

o

d

46030 CROSBY ROAD LOT 21

e

14 Other 12c

C

o

d

e

12d

BAY MINETTE, AL 36507 C

o

d

e

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

AL

PDF Export 418879 Not Enabled....Please

Feature 15625.00 88.25#6 (Create PDF W2's and 1099's)

Order Option

2010

Department of the Treasury—Internal Revenue Service

Wage and Tax

Form W-2 Statement Safe, accurate

FAST! Use

Copy C—For EMPLOYEE’S RECORDS (See Notice to

Employee on the back of Copy B.)

PDF Export Feature Not Enabled..Order Option #6 (Create PDF W2's and 1099's)

Instructions for Employee (Also see Notice to 15-year rule explained in Pub. 571). Deferrals under code G are

limited to $16,500. Deferrals under code H are limited to $7,000.

Employee, on the back of Copy B.)

However, if you were at least age 50 in 2010, your employer

Box 1. Enter this amount on the wages line of your tax return. may have#6

allowed an additional deferral of up to $5,500 ($2,500

PDF Export Feature Not Enabled....Please Order Option (Create PDF W2's and 1099's)

Box 2. Enter this amount on the federal income tax withheld line for section 401(k)(11) and 408(p) SIMPLE plans). This additional

of your tax return. deferral amount is not subject to the overall limit on elective

PDF Export Feature Not Enabled....Please Order Option deferrals.#6

For(Create

code G, thePDFlimit W2's anddeferrals

on elective 1099's) may be

Box 8. This amount is not included in boxes 1, 3, 5, or 7. For

information on how to report tips on your tax return, see your higher for the last 3 years before you reach retirement age.

FormPDF

1040Export Feature Not Enabled....Please Order Option

instructions. #6 (Create

Contact your PDF W2's

plan administrator andinformation.

for more 1099's) Amounts

in excess of the overall elective deferral limit must be included in

Box 9. Enter this amount on the advance earned income credit income. See the “Wages, Salaries, Tips, etc.” line instructions

payments line of your Form 1040 or Form 1040A. for Form 1040.

Box 10. This amount is the total dependent care benefits that Note. If a year follows code D through H, S, Y, AA, or BB, you

your employer paid to you or incurred on your behalf (including made a make-up pension contribution for a prior year(s) when

amounts from a section 125 (cafeteria) plan). Any amount over you were in military service. To figure whether you made excess

$5,000 is also included in box 1. Complete Form 2441, Child deferrals, consider

PDF and

Export Feature

Dependent Care Not Enabled....Please

Expenses, Order

to compute any taxable and Option #6 (Create PDFtheseW2's amounts for the year shown, not the

and 1099's)

current year. If no year is shown, the contributions are for the

nontaxable amounts. current year.

Box 11. This amount is (a) reported in box 1 if it is a distribution A—Uncollected social security or RRTA tax on tips. Include this

made to you from a nonqualified deferred compensation or tax on Form 1040. See “Total Tax” in the Form 1040 instructions.

nongovernmental section 457(b) plan or (b) included in box 3

and/or 5 if it is a prior year deferral under a nonqualified or B—Uncollected Medicare tax on tips. Include this tax on Form

section 457(b) plan that became taxable for social security and 1040. See “Total Tax” in the Form 1040 instructions.

Medicare taxes this year because there is no longer a C—Taxable cost of group-term life insurance over $50,000

substantial risk of forfeiture of your right to the deferred amount. (included in boxes 1, 3 (up to social security wage base), and 5)

Box 12. The following list explains the codes shown in box 12. D—Elective deferrals to a section 401(k) cash or deferred

PDF You

Export Feature

may need Not Enabled....Please

this information to complete your taxOrder

return. Option #6 (Create PDF

arrangement. W2's deferrals

Also includes and 1099's)under a SIMPLE retirement

Elective deferrals (codes D, E, F, and S) and designated Roth account that is part of a section 401(k) arrangement.

contributions (codes AA and BB) under all plans are generally E—Elective deferrals under a section 403(b) salary reduction

limited to a total of $16,500 ($11,500 if you only have SIMPLE agreement

plans; $19,500 for section 403(b) plans if you qualify for the

(continued on back of Copy 2)

PDF Export Feature Not Enabled..Order Option #6 (Create PDF W2's and 1099's)

a Employee’s social security number

416-25-4867 OMB No. 1545-0008

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

20-0087714

PDF Export Feature Not Enabled....Please Order Option 15625.00 557.75

#6 (Create PDF W2's and 1099's)

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Skeet's Driftwood

PDF Export FeatureLLC

Not Enabled....Please Order Option 15625.00 968.75

#6 (Create PDF W2's and 1099's)

5 Medicare wages and tips 6 Medicare tax withheld

47940 Highway 59 North

PDF Export Feature Not Enabled....Please Order Option 15625.00 226.56

#6 (Create PDF W2's and 1099's)

7 Social security tips 8 Allocated tips

Bay Minette, AL 36507

d Control number 9 Advance EIC payment 10 Dependent care benefits

004867

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a

C

o

PDF CHASITY

Export D

Feature Not ENGLISH

Enabled....Please Order Option #6 (Create PDF W2'sThird-party

and 1099's)

d

e

13 Statutory Retirement

employee sick pay 12b

plan C

o

d

e

46030 CROSBY ROAD LOT 21 14 Other 12c

C

o

d

e

12d

BAY MINETTE, AL 36507 C

o

d

e

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

AL

PDF Export 418879 15625.00

Feature Not Enabled....Please 88.25#6 (Create PDF W2's and 1099's)

Order Option

Wage and Tax

2010

Department of the Treasury—Internal Revenue Service

Form W-2 Statement

Copy 2—To Be Filed With Employee’s State, City, or Local

Income Tax Return.

PDF Export Feature Not Enabled..Order Option #6 (Create PDF W2's and 1099's)

Instructions for Employee (continued from back of T—Adoption benefits (not included in box 1). Complete Form

8839, Qualified Adoption Expenses, to compute any taxable and

Copy C) nontaxable amounts.

F—Elective deferralsFeature

PDF Export under a section 408(k)(6) salary reduction

Not Enabled....Please V—Income

Order Option #6from exercise

(Create of nonstatutory

PDF W2's andstock option(s)

1099's)

SEP (included in boxes 1, 3 (up to social security wage base), and 5).

G—Elective deferrals and employer See Pub. 525 and instructions for Schedule D (Form 1040) for

PDF Export Feature Not contributions (including Order Option

Enabled....Please reporting#6 (Create PDF W2's and 1099's)

requirements.

nonelective deferrals) to a section 457(b) deferred compensation

plan W—Employer contributions (including amounts the employee

PDF Export Feature Not Enabled....Please Order Option elected to#6 (Create

contribute PDF

using W2's125

a section and 1099's)

(cafeteria) plan) to your

H—Elective deferrals to a section 501(c)(18)(D) tax-exempt health savings account. Report on Form 8889, Health Savings

organization plan. See “Adjusted Gross Income” in the Form Accounts (HSAs).

1040 instructions for how to deduct.

Y—Deferrals under a section 409A nonqualified deferred

J—Nontaxable sick pay (information only, not included in boxes compensation plan

1, 3, or 5)

Z—Income under section 409A on a nonqualified deferred

K—20% excise tax on excess golden parachute payments. See compensation plan. This amount is also included in box 1. It is

PDF “Total

ExportTax”Feature

in the FormNot Enabled....Please

1040 instructions. Order Option #6 (Create

subject PDF W2's

to an additional 20%and 1099's)

tax plus interest. See “Total Tax” in

L—Substantiated employee business expense reimbursements the Form 1040 instructions.

(nontaxable)

AA—Designated Roth contributions under a section 401(k) plan

M—Uncollected social security or RRTA tax on taxable cost of

group-term life insurance over $50,000 (former employees only). BB—Designated Roth contributions under a section 403(b) plan

See “Total Tax” in the Form 1040 instructions. CC (For employer use only)—HIRE exempt wages and tips

N—Uncollected Medicare tax on taxable cost of group-term life Box 13. If the “Retirement plan” box is checked, special limits

insurance over $50,000 (former employees only). See “Total Tax” may apply to the amount of traditional IRA contributions that

in the Form 1040 instructions. you may deduct.

Note. Keep Copy C of Form W-2 for at least 3 years after the

PDF P—Excludable

Export Feature

employee

moving expense reimbursements paid directly to

Not

(not included Enabled....Please

in boxes 1, 3, or 5) Order Option #6 due(Create PDF

date for filing W2's

your and

income tax1099's)

return. However, to help

Q—Nontaxable combat pay. See the instructions for Form 1040 protect your social security benefits, keep Copy C until you

or Form 1040A for details on reporting this amount. begin receiving social security benefits, just in case there is a

question about your work record and/or earnings in a particular

R—Employer contributions to your Archer MSA. Report on Form year. Compare the Social Security wages and the Medicare

8853, Archer MSAs and Long-Term Care Insurance Contracts. wages to the information shown on your annual (for workers

S—Employee salary reduction contributions under a section over 25) Social Security Statement.

408(p) SIMPLE (not included in box 1)

You might also like

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerhossain ronyNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerHot HeartsNo ratings yet

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- w-2 2019 Form - LOUISA - BOKACHEVADocument1 pagew-2 2019 Form - LOUISA - BOKACHEVAKeller Brown JnrNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument1 pageWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atHenry KilmekNo ratings yet

- Monday Debra PYW216S EEDocument2 pagesMonday Debra PYW216S EEDeb LewisNo ratings yet

- 2010 1040a Federal Tax FormDocument2 pages2010 1040a Federal Tax FormesvrasNo ratings yet

- Tax Sentry Organizer 2016 PDFDocument9 pagesTax Sentry Organizer 2016 PDFAnonymous 3KHnP6s20YNo ratings yet

- Please Sign PPP Origination Application - PDF BDocument12 pagesPlease Sign PPP Origination Application - PDF BpayneNo ratings yet

- Green Knight Economic Development Corporation IRS Form 990 For FY2015, Showing $20K in Community Grants On $1.8m of RevenueDocument27 pagesGreen Knight Economic Development Corporation IRS Form 990 For FY2015, Showing $20K in Community Grants On $1.8m of RevenueDickNo ratings yet

- FTF1299519215531Document3 pagesFTF1299519215531Leslie Washington100% (1)

- Ach Origination Authorization Form: Transfer InformationDocument1 pageAch Origination Authorization Form: Transfer InformationRebekka ZmoraNo ratings yet

- Vba-26-1880-Are VA Certificate of Eligability ApplicationDocument2 pagesVba-26-1880-Are VA Certificate of Eligability ApplicationJohnnie L. MockNo ratings yet

- Square 2022 W-2Document2 pagesSquare 2022 W-2Zane CardinalNo ratings yet

- Esteban Alexander Ramirez Mongui: Palisades ParkDocument3 pagesEsteban Alexander Ramirez Mongui: Palisades ParkJose Antonio Valero AtuestaNo ratings yet

- Federal 2016 :DDocument15 pagesFederal 2016 :DAnguila Angel Anguila AngelNo ratings yet

- FTF1301242185129Document3 pagesFTF1301242185129Donna SchatzNo ratings yet

- Selection-26 - 55 PDFDocument1 pageSelection-26 - 55 PDFAnonymous fu1jUQNo ratings yet

- Income Tax Return - MHSO - 2022-23Document5 pagesIncome Tax Return - MHSO - 2022-23Mahbub SiddiqueNo ratings yet

- PWR - Carrier PacketDocument3 pagesPWR - Carrier Packetmeda590No ratings yet

- Form W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordsDocument1 pageForm W-2 Wage and Tax Statement 2020 Copy C, For Employee's Recordsbassomassi sanogoNo ratings yet

- Master Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramDocument15 pagesMaster Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan Programdog dogNo ratings yet

- TaxForms PDFDocument2 pagesTaxForms PDFLMN214100% (1)

- W2 PreviewDocument1 pageW2 Previewmrs merle westonNo ratings yet

- SC Tax ReturnDocument12 pagesSC Tax ReturnCeleste KatzNo ratings yet

- Javier A Valdez 2107 BAMBOO ST. Mesquite TX 75150Document2 pagesJavier A Valdez 2107 BAMBOO ST. Mesquite TX 75150javiercreatesNo ratings yet

- Tax Return - Mr. X - AY 2022-23Document12 pagesTax Return - Mr. X - AY 2022-23Rasel AshrafulNo ratings yet

- Cres Fy2016 990Document38 pagesCres Fy2016 990Lachlan MarkayNo ratings yet

- TaxDocument9 pagesTaxKuan ChenNo ratings yet

- NCJC 561348186 - 200712 - 990Document28 pagesNCJC 561348186 - 200712 - 990A.P. DillonNo ratings yet

- ProblemC ch05Document5 pagesProblemC ch05Adan FakihNo ratings yet

- Citi Card Disputes FormDocument1 pageCiti Card Disputes FormAlex MingNo ratings yet

- Health Insurance Forms 1Document1 pageHealth Insurance Forms 1api-453439542No ratings yet

- January 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Document8 pagesJanuary 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Zechariah Kennedy100% (1)

- StatementDocument2 pagesStatementLuis HarrisonNo ratings yet

- Taxes Amy PDFDocument7 pagesTaxes Amy PDFJsjs JsjsjjshshNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- w22009 167305638-1Document1 pagew22009 167305638-1Jamie-Rose Michie0% (1)

- AZ Argan Ventures LTDDocument20 pagesAZ Argan Ventures LTDBarangaySanLuisNo ratings yet

- CC Charge ReceiptDocument1 pageCC Charge Receiptahmed8056No ratings yet

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNo ratings yet

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDocument7 pages2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNo ratings yet

- Security Bank Online PDFDocument1 pageSecurity Bank Online PDFJesebelle Cuya ToraldeNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return7cf42b5d98No ratings yet

- 2016 Individual (Brading, Anthony H. & Amy N.) GovernmentDocument49 pages2016 Individual (Brading, Anthony H. & Amy N.) GovernmentAnonymous 9coWUONo ratings yet

- New JErsey Resident Return NJ-1040Document68 pagesNew JErsey Resident Return NJ-1040Stephen HallickNo ratings yet

- HPK3PZDocument7 pagesHPK3PZDiane LeeNo ratings yet

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- Prommisary Note USFDocument8 pagesPrommisary Note USFdjduttonNo ratings yet

- Agosto 11Document1 pageAgosto 11dakpi479No ratings yet

- Langford Market Corp Form W-2Document4 pagesLangford Market Corp Form W-2sohcuteNo ratings yet

- A082000109a0298508172c001c: Contact InformationDocument1 pageA082000109a0298508172c001c: Contact InformationYudo KunaNo ratings yet

- File by Mail Instructions For Your 2009 Federal Tax ReturnDocument11 pagesFile by Mail Instructions For Your 2009 Federal Tax ReturnjakeNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- The Green Book, Written by Muammar GaddafiDocument154 pagesThe Green Book, Written by Muammar GaddafiPape VVhoNo ratings yet

- 70 Kevin Lin PDFDocument8 pages70 Kevin Lin PDFKenneth LinNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09fortha loveof100% (5)

- Alarming U.S. Tax Rules ArticleDocument9 pagesAlarming U.S. Tax Rules Articlee1chin0No ratings yet

- Guide: Tax ReturnDocument84 pagesGuide: Tax ReturnLars Renteria SilvaNo ratings yet

- Form 2106Document2 pagesForm 2106Weiming LinNo ratings yet

- Statement For 2022-1Document2 pagesStatement For 2022-1Hengki Yono100% (1)

- Instructions 2022Document52 pagesInstructions 2022Shonga CatsNo ratings yet

- IRS 1040a Instruction BookDocument92 pagesIRS 1040a Instruction Bookgalaxian100% (1)

- US Internal Revenue Service: I8615Document4 pagesUS Internal Revenue Service: I8615IRSNo ratings yet

- IL-1040 InstructionsDocument16 pagesIL-1040 InstructionsRushmoreNo ratings yet

- Declaration of Revocation of ElectionDocument10 pagesDeclaration of Revocation of ElectionAkil Bey95% (39)

- Victoria Freitas - 1040-FormDocument2 pagesVictoria Freitas - 1040-Formapi-537101018No ratings yet

- 20-0453 RPT LAFD 05-15-2020Document41 pages20-0453 RPT LAFD 05-15-2020deeperNo ratings yet

- IRS Form 4868Document4 pagesIRS Form 4868Anil AletiNo ratings yet

- White County Lilly Endowment Scholarship ApplicationDocument11 pagesWhite County Lilly Endowment Scholarship ApplicationVoodooPandasNo ratings yet

- PFD Misc - 1099 2019 016 9938 PDFDocument2 pagesPFD Misc - 1099 2019 016 9938 PDFTatianaNo ratings yet

- Form 8960 InstructionsDocument20 pagesForm 8960 InstructionsforbesadminNo ratings yet

- Principles of Taxation For Business and Investment Planning 2018 Edition 21st Edition - Sally JonesDocument673 pagesPrinciples of Taxation For Business and Investment Planning 2018 Edition 21st Edition - Sally JonesKarthik Ganesan86% (7)

- Tax Papers - 4:17:23 - 2023Document14 pagesTax Papers - 4:17:23 - 2023Jeriah Pecson100% (1)

- Wassim Zhani Federal Taxation For Individuals (Chapter 7)Document36 pagesWassim Zhani Federal Taxation For Individuals (Chapter 7)wassim zhaniNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusjakelong82100% (1)

- Chapter 10 MERGEDDocument10 pagesChapter 10 MERGEDola69% (13)

- 2009 Tax Table 1040 1040NR For H1B, F1, J1, OPTDocument13 pages2009 Tax Table 1040 1040NR For H1B, F1, J1, OPTusvisataxesNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialMia JacksonNo ratings yet

- B Amazon Tax Guide 2 11 20Document10 pagesB Amazon Tax Guide 2 11 20amerikandesignsNo ratings yet

- Idiot Legal ArgumentsDocument159 pagesIdiot Legal ArgumentsEheyehAsherEheyehNo ratings yet

- Form - 1065 - Schedule - k1 PDFDocument2 pagesForm - 1065 - Schedule - k1 PDFHazem El SayedNo ratings yet

- Anil Gupta 2021 w2Document2 pagesAnil Gupta 2021 w2Kawljeet Singh KohliNo ratings yet

- How To File A 1096 and 1099 and 1099oid To Pay Utility BillsDocument10 pagesHow To File A 1096 and 1099 and 1099oid To Pay Utility BillsTitle IV-D Man with a plan99% (87)