Professional Documents

Culture Documents

Market Lens 201127

Uploaded by

Om ShrikantOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Lens 201127

Uploaded by

Om ShrikantCopyright:

Available Formats

Monday, February 07, 2011

Nothing collected on account of CGT

Dawn: As the govt. struggles to come up with legislation for new taxes, it has failed to collect a single rupee on account of capital gains tax (CGT) in

8MFY11.

Issuing LoC: IMF to wait for mission report

Business Recorder: The IMF will wait for its mission report on economic situation for deciding the crucial matter of issuing LoC for Pakistan.

Urea sales drop by 21% due to price hike in Jan

Business Recorder: Fertilizer sales have dropped by 21% in Jan 2011 (YoY) due to a PKR350/50kg-bag hike in the price of urea and profiteering in the

Country.

OGDC convertible bonds: Body formed to examine PC proposal

Business Recorder: The PC has reportedly informed the CCoP that ten top international investment banks have provided a favorable view on the pricing of

convertible bonds in OGDC.

External debt liabilities rise to US$58.4bn

Business Recorder: Pakistan’s external debt and liabilities have increased to US$58.4bn during 1QFY11 while the IMF’s debt has aggregated to US$8.1bn.

Foreign debt servicing stood at US$2.169bn in 1QFY11

Business Recorder: Pakistan’s external debt servicing stood at US$2.169bn during 1QFY11 with repayments at US$1.436bn and interest payments at

US$233m.

PKR27bn Thar Coal water carrier scheme approved

Business Recorder: Considering that the most critical infrastructure project is the supply of fresh water to Thar Coal Fields, the CDWP has approved a scheme

for Thar Coal Water Carrier at a cost of PKR27bn.

Govt. warned against injecting funds into PSM

Dawn: The Senate Standing Committee on Industries and Production has said the Pakistan Steel Mills is like a bottomless pit and whatever goes into it will

never come out!

Pakistan should take revenue-raising measures: IMF

Business Recorder: The IMF has said that Pakistan will have to take revenue-raising measures after the recent floods to enhance resources for needed

infrastructure investment.

Diesel, furnace oil sales down in Jul-Jan

Business Recorder: Oil sales declined by 4% to 11.3mn tons during 7MFY11 as compared to 11.8mn tons during the corresponding period.

Chinese firm to convert 2 KESC units to coal

Dawn: The KESC and the Global Mining Company Ltd. of China have signed a MoU for fuel replacement initiative through conversion of two of the six

generating units of Bin Qasim Power unit to coal.

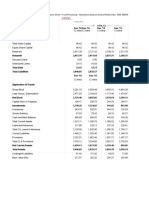

Market Summary Top Eight Sector Wise Volume (mn)

KSE 30 KSE 100 KSE ALL Sectors Turnover

Current Index 12,095.36 12,415.35 8,603.93 Chemicals 57.60

Previous Index 12,041.16 12,359.06 8,565.16 Personal Goods 17.69

Net Change Points 54.20 56.29 38.77 Banks 15.53

Net Change Percentage 0.45% 0.46% 0.45% Equity Investment Instruments 6.69

Turnover (mn) 70.29 102.52 131.72 Oil and Gas 6.04

Traded Value (bn) 4.17 4.71 5.12 Electricity 5.80

Mkt Cap.(PKR bn) 606.19 3,088.15 3,355.63 Financial Services 5.33

Mkt Cap.(US$ bn) 7.09 36.12 39.25 Gas Water and Multiutilities 4.35

12,146 12,467 8,646

12,109 12,430 8,618

12,072 12,393 8,590

12,035 12,356 8,562

11,998 12,319 8,534

9:07

9:56

10:42

11:26

14:25

15:09

15:56

16:51

9:07

9:56

10:42

11:26

14:25

15:09

15:56

16:51

9:07

9:56

10:42

11:26

14:25

15:09

15:56

16:51

KSE 30 KSE 100 KSE All

Top Five Companies by Index Points Top Five Volume Leaders

Symbol Open Close Index Point Volume Symbol Open Close Change Volume

PPL 212.75 215.18 11.67 1,300,524 LOTPTA 15.98 16.38 0.40 35,364,095

HUBC 38.51 39.52 4.70 1,364,296 BOP 8.13 8.36 0.23 8,591,791

SSGC 23.90 24.91 3.41 4,145,198 NCL 24.57 25.79 1.22 8,133,284

ENGRO 218.62 221.05 3.20 3,380,875 ANL 11.27 11.28 0.01 6,359,077

COLG 935.01 960.00 3.17 6 JSCL 11.52 11.59 0.07 4,319,270

Top Five Price Gainers Top Five Price Losers

Symbol Open Close Change Volume Symbol Open Close Change Volume

RMPL 2,349.42 2,420.30 70.88 67 UPFL 1,160.01 1,105.09 (54.92) 1

ULEVER 4,350.05 4,385.65 35.60 120 SFL 113.90 108.21 (5.69) 1

COLG 935.01 960.00 24.99 6 ILTM 110.05 104.55 (5.50) 1

BATA 629.00 642.11 13.11 488 SITC 118.00 112.56 (5.44) 3,222

LAKST 265.07 277.75 12.68 1 TRIPF 137.91 132.77 (5.14) 105,877

REPO RATES (AVG. YIELD %) KIBOR RATES (%) OIL PRICES (US$/BARREL)

TENOR AVERAGE TENOR BID OFFER London Brent 99.80

Overnight 11.85 1 Month 12.71 13.21 US Crude 89.03

3-Months 13.16 3 Months 13.36 13.61

6-Months 13.46 6 Months 13.51 13.76 GDR (US$)

1-Year 13.56 12 Months 13.77 14.27 MCBS @ 2 Ord. Sh 2.60

OGDC @ 10 Ord. Sh 18.08

UBLA @ 4 Ord. Sh 2.39

PIB YIELD (%) EXCHANGE RATES (PKR) LKCA @ 4 Ord. Sh 3.10

TENOR YIELD RANGE CURRENCY BID OFFER

2.6-3.0 Years 14.15 14.20 US Dollar 85.70 85.90 OTHERS

4.6-5.0 Years 14.20 14.23 Euro 116.15 116.65 SCRA (US$mn)* 2.22

9.6-10.0 Years 14.26 14.30 UK Pound 137.50 138.00 Bank Al Jazira (SR) 18.60

15 Years 14.55 14.60 Japan Yen 1.04 1.14 *Feb 03’11

20 Years 14.70 14.75 UAE Dirham 23.25 23.35 ECONOMIC EVENTS

30 Years 14.75 14.85 Saudi Riyal 22.85 22.95 DATE EVENTS

T-BILL YIELD (%) LIBOR USD (%)

TENOR YIELD RANGE 1 Month 0.26

16-30 Days 12.65 12.75 3 Months 0.31

61.90 Days 13.18 13.28 6 Months 0.46

121-180 Days 13.52 13.58 12 Months 0.79

271-365 Days 13.70 13.75

COMPANY PERIOD DPS % BONUS % RIGHT % EPS DATE COMPANY

Gharibwal Cement Ltd. 30-Jun-10 - - - (4.43) 07-Feb-11 Habib ADM Ltd.

Pakistan International Container

07-Feb-11

Terminal Ltd.

07-Feb-11 Zeal Pak Cement Factory Ltd.

07-Feb-11 Tandlianwala Sugar Mills Ltd.

09-Feb-11 Cherat Papersack Ltd.

09-Feb-11 Pakistan State Oil Co. Ltd.

09-Feb-11 NetSol Technologies Ltd.

09-Feb-11 Shifa International Hospital Ltd.

10-Feb-11 IGI Investment Bank

10-Feb-11 MCB Bank Ltd.

10-Feb-11 Sigma Leasing Corporation

Contact us

Head Office

GF-01, Techno City, Hasrat Mohani Road,

Karachi

Ph: +(92-21)-32270808-13

Fax: +(92-21)-32270519

www.ahcml.com

AHCM Research is also available on Reuters Knowledge

Sales Contact No.92-21-32270801-7

Fax.No.92-21-32270524

E-mail: sales@ahcml.com

Research Contact No. 92-21-32270808-11

Fax No. 92-21-32270520

E-mail: research@ahcml.com

Disclaimer

All rights reserved. The information presented in this report is compiled from sources that we believed to be reliable in the preparation of this report. However,

we do not accept any responsibility for its accuracy & completeness. This report is not intended to be an offer or solicitation to buy or sell any security. AL

Habib Capital Markets (Pvt.) Ltd. and its employees may or may not have a position in or with respect to the securities mentioned in this report. In particular,

the report takes no account of the investment objectives, financial situation and particular needs of investors who should seek further professional advice or

rely upon their own judgment before making any investment.

You might also like

- Case Assignment 8 - Diamond Energy Resources PDFDocument3 pagesCase Assignment 8 - Diamond Energy Resources PDFAudrey Ang100% (1)

- CheckingStatement BoA 30 11 2020 30 12 2020Document3 pagesCheckingStatement BoA 30 11 2020 30 12 2020xxalias100% (3)

- Commercial Project ManagementDocument17 pagesCommercial Project ManagementMuzny Zakey100% (1)

- Strategic Business and Risk AnalysisDocument3 pagesStrategic Business and Risk AnalysisCH NAIRNo ratings yet

- Discrete Cosine Transform: Algorithms, Advantages, ApplicationsFrom EverandDiscrete Cosine Transform: Algorithms, Advantages, ApplicationsNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- Annual Report 2002Document59 pagesAnnual Report 2002Enamul HaqueNo ratings yet

- Listed Companies Highlights: Financial FocusDocument1 pageListed Companies Highlights: Financial FocusT'Tee MiniOns'TmvsNo ratings yet

- Antonellini CRUISEIN2022 UpDocument16 pagesAntonellini CRUISEIN2022 UpParag PiseNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- Financials of PAFDocument26 pagesFinancials of PAFAbhishek PandaNo ratings yet

- Q3 FY 08 - Investors' Update: Parsvnath Developers LTDDocument36 pagesQ3 FY 08 - Investors' Update: Parsvnath Developers LTDshradha01No ratings yet

- 14 - Karan Singh - BHELDocument12 pages14 - Karan Singh - BHELrajat_singlaNo ratings yet

- Final Project For Marketing PuneetDocument21 pagesFinal Project For Marketing PuneetSankalp KayathNo ratings yet

- Earnings Release - Results Tables in ExcelDocument133 pagesEarnings Release - Results Tables in ExcelMateus MesquitaNo ratings yet

- Final Costing CalculationsDocument33 pagesFinal Costing CalculationsErrist YuanJinNo ratings yet

- Balance Sheet of Indian Oil Corporation of 18-19 & 17-18Document3 pagesBalance Sheet of Indian Oil Corporation of 18-19 & 17-18Prakash ShuklaNo ratings yet

- Audited Fin Results Mar 2021 (ESFBS 0458 24 05 21)Document1 pageAudited Fin Results Mar 2021 (ESFBS 0458 24 05 21)Deepak KanojiaNo ratings yet

- AssignmentDocument6 pagesAssignmentAnkita KumariNo ratings yet

- NPV Is Present Value of The Present Values of All Cash Inflows and Outflows From Particular ProjectDocument3 pagesNPV Is Present Value of The Present Values of All Cash Inflows and Outflows From Particular ProjectHumair UddinNo ratings yet

- Diamond Energy ResourcesDocument3 pagesDiamond Energy ResourcesMuhammad FikryNo ratings yet

- Financial Analysis of Astrazeneca (2014-2015)Document12 pagesFinancial Analysis of Astrazeneca (2014-2015)Hyceinth KumNo ratings yet

- Anand Kumar GourDocument8 pagesAnand Kumar GourMayank ChoukseyNo ratings yet

- 18 - Nacchhater - Tata MotorsDocument17 pages18 - Nacchhater - Tata Motorsrajat_singlaNo ratings yet

- Task 1 and Task 2Document10 pagesTask 1 and Task 2Sarah BunoNo ratings yet

- NestleDocument2 pagesNestleMd WasimNo ratings yet

- Classic Tent HouseDocument20 pagesClassic Tent HouseAMIT SRIVASTAVANo ratings yet

- Deshmukh Gruh UdyogDocument10 pagesDeshmukh Gruh UdyogJITNo ratings yet

- NBL Annual Report 2017Document282 pagesNBL Annual Report 2017Rumana ShornaNo ratings yet

- Fundamental Analysis of ACCDocument10 pagesFundamental Analysis of ACCmandeep_hs7698100% (2)

- Enel Snapshot Analysis - Manfredi SopraniDocument9 pagesEnel Snapshot Analysis - Manfredi SopraniManfredi SopraniNo ratings yet

- Etisalat Fact SheetDocument1 pageEtisalat Fact SheetAyaz Ahmed KhanNo ratings yet

- The Calculations VR 4.0Document39 pagesThe Calculations VR 4.0bbookkss2024No ratings yet

- FY2019-20 q3 RESULTDocument4 pagesFY2019-20 q3 RESULTgauravkrastogiNo ratings yet

- Projection Cash Flow Masjid Sec 24 - Shah AlamDocument12 pagesProjection Cash Flow Masjid Sec 24 - Shah Alamabd razak haronNo ratings yet

- Ebit Capex Change in WC FCF: Risk Free Rate 1.67% Market Return (S&P 500) 9.30% Beta 1.13Document5 pagesEbit Capex Change in WC FCF: Risk Free Rate 1.67% Market Return (S&P 500) 9.30% Beta 1.13Paul GhanimehNo ratings yet

- Balance Sheet of Reliance IndustriesDocument6 pagesBalance Sheet of Reliance IndustrieskushkheraNo ratings yet

- Aditya nuVODocument12 pagesAditya nuVOPriyanshi yadavNo ratings yet

- Aman FM Tp2003 FMDocument9 pagesAman FM Tp2003 FMAmandeep SinghNo ratings yet

- DSCR Case Study FinalDocument7 pagesDSCR Case Study FinalVISHAL PATILNo ratings yet

- Asian Paints: BSE: 500820 - NSE: ASIANPAINT - ISIN: INE021A01018 - Paints/VarnishesDocument6 pagesAsian Paints: BSE: 500820 - NSE: ASIANPAINT - ISIN: INE021A01018 - Paints/Varnishesopenid_ovmLEUQfNo ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDparika khannaNo ratings yet

- Lenich Ratios 2024Document2 pagesLenich Ratios 2024mumbinganga6No ratings yet

- CF AssignmentDocument44 pagesCF AssignmentSwarnendu GhoshNo ratings yet

- Milk PasteurizationDocument12 pagesMilk PasteurizationShreyans Tejpal ShahNo ratings yet

- Akash Cost AssignmentDocument10 pagesAkash Cost AssignmentAkash HedaooNo ratings yet

- Croydon Green Bank Reconciliation Question 2013Document3 pagesCroydon Green Bank Reconciliation Question 2013Shweta SinghNo ratings yet

- Balance Sheet Sin PhrmaDocument2 pagesBalance Sheet Sin PhrmaSilpaPriyadarsani BehuriaNo ratings yet

- UltraTech Cements and Jaiprakash AssociatesDocument8 pagesUltraTech Cements and Jaiprakash AssociatesanushaNo ratings yet

- Case 8 - Diamond DCF ModelDocument2 pagesCase 8 - Diamond DCF ModelAudrey AngNo ratings yet

- BS As On 23-09-2023Document28 pagesBS As On 23-09-2023Farooq MaqboolNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- Manufacturing Shellac Insulating Varnish (Document2 pagesManufacturing Shellac Insulating Varnish (Philip KotlerNo ratings yet

- BPFL FS - 21-22Document10 pagesBPFL FS - 21-22Tanvir Ahmed ChowdhuryNo ratings yet

- DCF Template BofA - VFDocument1 pageDCF Template BofA - VFHunter Hearst LevesqueNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- Particulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018Document6 pagesParticulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018MOHIT MARHATTANo ratings yet

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- History of Philippine Money XXDocument7 pagesHistory of Philippine Money XXBlezelle CalpitoNo ratings yet

- Bank Asia HRM 410Document20 pagesBank Asia HRM 410Mona RahamanNo ratings yet

- IRP-1 Form First Time RegistrationDocument2 pagesIRP-1 Form First Time Registrationbella FlorNo ratings yet

- Subiecte Engleza Economie Iulie 2021Document7 pagesSubiecte Engleza Economie Iulie 2021Fishu FishuNo ratings yet

- From press-to-ATM - How Money Travels - The Indian ExpressDocument14 pagesFrom press-to-ATM - How Money Travels - The Indian ExpressImad ImadNo ratings yet

- Central Bank and Its FunctionsDocument4 pagesCentral Bank and Its FunctionsHassan Sardar Khattak100% (4)

- Chapter 4 - Foriegn Direct Investment and Balance of PaymentDocument48 pagesChapter 4 - Foriegn Direct Investment and Balance of PaymentHay JirenyaaNo ratings yet

- Current Affairs Q&A PDF Free - September 2018Document35 pagesCurrent Affairs Q&A PDF Free - September 2018shamaNo ratings yet

- ICICI Bank StructureDocument13 pagesICICI Bank StructureSonaldeep100% (1)

- Perjanjian Kerjasama ESPAY Payment Gateway (Indo - Eng Version) With Newest ChannelDocument23 pagesPerjanjian Kerjasama ESPAY Payment Gateway (Indo - Eng Version) With Newest ChannelZaynull Abideen NoahNo ratings yet

- Kadali Enviro Projects PVT - LTD: Salary CertificateDocument2 pagesKadali Enviro Projects PVT - LTD: Salary Certificatekumar swamyNo ratings yet

- Module 2Document41 pagesModule 2Sujata SarkarNo ratings yet

- Simple Interest (Future Value)Document21 pagesSimple Interest (Future Value)アンジェロドンNo ratings yet

- Finance FunctionDocument10 pagesFinance Functionadmire007No ratings yet

- Commercial BankDocument29 pagesCommercial BankMahesh RasalNo ratings yet

- Financial Performance of State Bank of India: Dr.G. KanagavalliDocument13 pagesFinancial Performance of State Bank of India: Dr.G. KanagavalliANKIT GUPTANo ratings yet

- Energia NovoDocument3 pagesEnergia Novofaninhalemes25No ratings yet

- Corporate BondDocument14 pagesCorporate BondRavi WadherNo ratings yet

- Reviewer MPCBDocument7 pagesReviewer MPCBMJ NuarinNo ratings yet

- Hermenegildo Z. Narvaez Francisco Javier P. Bonoan Reginaldo Anthony B. CariasoDocument19 pagesHermenegildo Z. Narvaez Francisco Javier P. Bonoan Reginaldo Anthony B. CariasoCarlo NicolasNo ratings yet

- Finma ReviewerDocument129 pagesFinma ReviewerMIAKAHNo ratings yet

- October 7-13, 2012Document10 pagesOctober 7-13, 2012Bikol ReporterNo ratings yet

- RM Model For R & SME and Corporate Customers Final Draft April 27 2021Document27 pagesRM Model For R & SME and Corporate Customers Final Draft April 27 2021daniel nugusieNo ratings yet

- What Is Political BehaviorDocument16 pagesWhat Is Political Behaviornazia_malikNo ratings yet

- Commercial Bank Management Sem IIIDocument11 pagesCommercial Bank Management Sem IIIJanvi MhatreNo ratings yet

- Procurement of Hexagonal Drill Rod 22 M.M. Dia X 1800 M.M. Length As Per NIT Specification.Document28 pagesProcurement of Hexagonal Drill Rod 22 M.M. Dia X 1800 M.M. Length As Per NIT Specification.sharang shankerNo ratings yet

- 05 Anti Money LaunderingDocument15 pages05 Anti Money LaunderingRaghu PalatNo ratings yet