Professional Documents

Culture Documents

BB0017 - Financial Reporting - Fall-10

Uploaded by

Safa ShafiqOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BB0017 - Financial Reporting - Fall-10

Uploaded by

Safa ShafiqCopyright:

Available Formats

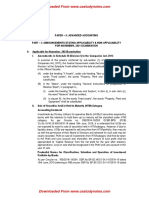

Fall 2010

Bachelor of Business Administration-BBA Semester 4

BB0017 – Financial Reporting - 2 Credits

(Book ID : B0097)

Assignment Set- 1 (30 Marks)

Note: Each question carries 10 Marks. Answer all the questions.

Q1. What is the statutory requirement of schedule VI of company Act, 1956, in regard to

Secured Loans and provision?

Q2. From the following balance sheets of A ltd. Make out Cash Flow Statement as on March

31, 2010

Balance Sheet

2009 2010 2009 2010

Liabilities Assets

Rs. Rs. Rs. Rs.

Equity Share Capital 2,00,000 2,00,000 Cash 8,000 10,000

Profit and Loss A/c 50,000 90,000 Bank 22,000 20,000

Bank Loan 10,000 --- Debtors 10,000 20,000

Creditors 15,000 20,000 Stock 25,000 15,000

Outstanding 5,000 5,000 Fixed Assets 2,35000 2,75,000

Expenses

Provision of 20,000 25,000

Taxation

3,00,000 3,40,000 3,00,000 3,40,000

Depreciation on fixed assets was Rs. 60,000. During the year, company declared equity

dividend @10%, and paid Rs. 15,000 as income tax.

Q3. What is the statutory requirement of schedule VI of company Act, 1956, in regard to

Capital Reserve and Revenue Reserve?

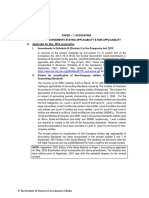

Bachelor of Business Administration-BBA Semester 4

Fall 2010

BB0017 – Financial Reporting - 2 Credits

(Book ID :)

Assignment Set- 2 (30 Marks)

Note: Each question carries 10 Marks. Answer all the questions.

Q1. What are the various Amendments to Clause 32 of Equity Listing Agreement made by

SEBI?

Q2. How expenses during the construction period are capitalized and cost of fixed assets are

determined?

Q3. Write short note on followings :-

• Financial Reporting in India?

• Capital Work in Progress?

• Capitalization of expenses?

• Accounting Standards?

You might also like

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Project Proposal For Freight Transport ServivesDocument14 pagesProject Proposal For Freight Transport ServivesJoey MW100% (2)

- ACCA F3 LRP - Questions PDFDocument64 pagesACCA F3 LRP - Questions PDFAdnanNo ratings yet

- CB Insights The Future InvestingDocument26 pagesCB Insights The Future InvestingAlisaNo ratings yet

- Advanced Part 2 Solman MillanDocument270 pagesAdvanced Part 2 Solman MillanVenz Lacre80% (25)

- Statement of Comprehensive IncomeDocument22 pagesStatement of Comprehensive IncomeAd BeeNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- Intro. To Accounting July 2013Document4 pagesIntro. To Accounting July 2013adv.erumfatimaNo ratings yet

- Paper 33Document6 pagesPaper 33AVS InfraNo ratings yet

- Css Accountancy2 2018 PDFDocument2 pagesCss Accountancy2 2018 PDFMaria NazNo ratings yet

- Financial Reporting & Financial Statement Analysis: Time - 3 Hours Group - ADocument6 pagesFinancial Reporting & Financial Statement Analysis: Time - 3 Hours Group - Atanmoy sardarNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- 3957CL 2. Accounting MA2021Document3 pages3957CL 2. Accounting MA2021Md SiamNo ratings yet

- Nov 18Document43 pagesNov 18Prabhat Kumar MishraNo ratings yet

- CA Inter RTP Nov 2018 Small PDFDocument281 pagesCA Inter RTP Nov 2018 Small PDFSANKAR SIVANNo ratings yet

- FINANCIAL MANAGEMENT October 20172016 PatternSemester IIDocument4 pagesFINANCIAL MANAGEMENT October 20172016 PatternSemester IISwati DafaneNo ratings yet

- Mcom AnnualDocument140 pagesMcom AnnualKiran TakaleNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- CFS Test - 1 Set-A 13-2-2022Document2 pagesCFS Test - 1 Set-A 13-2-2022Hitesh SemwalNo ratings yet

- Management Accounting QBDocument31 pagesManagement Accounting QBrising dragonNo ratings yet

- BEFA MID 2QP 2023 (Updated) - 1Document9 pagesBEFA MID 2QP 2023 (Updated) - 1SAI PRANEETHNo ratings yet

- Financial Goal PlanningDocument10 pagesFinancial Goal Planningsharvari kadamNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- General Instructions: All The Questions Are CompulsoryDocument2 pagesGeneral Instructions: All The Questions Are CompulsoryJatin ChaudharyNo ratings yet

- Corporate Accounting Ii 2020Document4 pagesCorporate Accounting Ii 2020joe josephNo ratings yet

- Valuation AssignmentDocument9 pagesValuation AssignmentNicole TaylorNo ratings yet

- Financial Management Semester II 2016 PatternDocument4 pagesFinancial Management Semester II 2016 PatternSwati DafaneNo ratings yet

- Advanced Accounting RTP N21Document39 pagesAdvanced Accounting RTP N21Harshwardhan PatilNo ratings yet

- Jorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Document3 pagesJorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Abin DhakalNo ratings yet

- Funancial StudiesDocument39 pagesFunancial Studiesarhamenterprises5401No ratings yet

- 5 6120800679993803735Document39 pages5 6120800679993803735Harmony Clement-ebereNo ratings yet

- Management Accouting Assignment4 Manish Chauhan (09-1128) .Document17 pagesManagement Accouting Assignment4 Manish Chauhan (09-1128) .manishNo ratings yet

- Accountancy Sample Question PaperDocument8 pagesAccountancy Sample Question PaperSoNam ZaNgmoNo ratings yet

- Paper18 Solution PDFDocument24 pagesPaper18 Solution PDFI'm Just FunnyNo ratings yet

- F-1919-B.b.a. - Semester-Iv - Paper - 119-Financial ManagementDocument2 pagesF-1919-B.b.a. - Semester-Iv - Paper - 119-Financial Managementhimanshu ranjanNo ratings yet

- Managenet AC - Question Bank SSDocument18 pagesManagenet AC - Question Bank SSDharshanNo ratings yet

- EXERCISE Cashflow of The CompanyDocument41 pagesEXERCISE Cashflow of The CompanyDev lakhaniNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Preparation of Financial Statements - QBDocument26 pagesPreparation of Financial Statements - QBHindutav arya100% (1)

- Accounting For Managers MBA (1st Sem)Document1 pageAccounting For Managers MBA (1st Sem)Nikhil KumarNo ratings yet

- 6th Semester Paper 2022Document5 pages6th Semester Paper 2022Chandrarup BanerjeeNo ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- MANAGEMENT ACCOUNTING & CONTROL 306 Ele Paper IIIDocument5 pagesMANAGEMENT ACCOUNTING & CONTROL 306 Ele Paper IIItadepalli patanjaliNo ratings yet

- April 2020-2Document3 pagesApril 2020-2amjuamjath10No ratings yet

- Xii AccDocument4 pagesXii AccSanjayNo ratings yet

- Additional Questions 5Document13 pagesAdditional Questions 5Sanjay SiddharthNo ratings yet

- ACMA Unit 5 Problems - CFS PDFDocument3 pagesACMA Unit 5 Problems - CFS PDFPrabhat SinghNo ratings yet

- Group IV Question 1Document1 pageGroup IV Question 1Kezang WangchukNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- MCA (Revised) Term-End Examination December, 2018: Note: 1 Compulsory ThreeDocument3 pagesMCA (Revised) Term-End Examination December, 2018: Note: 1 Compulsory ThreepayalNo ratings yet

- Question Bank - Management AccountingDocument7 pagesQuestion Bank - Management Accountingprahalakash Reg 113No ratings yet

- PAC All CAF Subjects Mock QP With Solutions Compiled by Saboor AhmadDocument132 pagesPAC All CAF Subjects Mock QP With Solutions Compiled by Saboor AhmadHadeed HafeezNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- II Puc Acc Second Test MQP-1Document3 pagesII Puc Acc Second Test MQP-1yashasbn0No ratings yet

- 3054 Faca-V L 8Document8 pages3054 Faca-V L 8ab6154951No ratings yet

- 69587bos55533-P1.pdf 2Document46 pages69587bos55533-P1.pdf 2pittujb2002No ratings yet

- Analysis of Financial StatementsDocument7 pagesAnalysis of Financial StatementsThakur Anmol RajputNo ratings yet

- BBS 1st Year QuestionDocument2 pagesBBS 1st Year Questionsatya100% (1)

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Modern Retail Management Process and Retail Services: Subject Code: BBR601 BKID - B1940 Edition: Fall 2011Document12 pagesModern Retail Management Process and Retail Services: Subject Code: BBR601 BKID - B1940 Edition: Fall 2011Safa ShafiqNo ratings yet

- Mb0052 - Strategic Management and Business Policy: 1. Write Short Notes On The Following: (A) Value Chain AnalysisDocument8 pagesMb0052 - Strategic Management and Business Policy: 1. Write Short Notes On The Following: (A) Value Chain AnalysisSafa ShafiqNo ratings yet

- BBA501 B1849 SLM Unit 01Document20 pagesBBA501 B1849 SLM Unit 01Safa ShafiqNo ratings yet

- MB0050 SLM Unit02Document26 pagesMB0050 SLM Unit02Safa ShafiqNo ratings yet

- BB0001 Bba1 VimalaDocument2 pagesBB0001 Bba1 VimalaSafa ShafiqNo ratings yet

- Financial Accounting - Paper 1 SolutionsDocument10 pagesFinancial Accounting - Paper 1 Solutionsahmad.khalif9999No ratings yet

- Financial Analysis Part2Document15 pagesFinancial Analysis Part2Llyod Francis LaylayNo ratings yet

- 117 - 102 - 116 - 234-FINAL REPORT PT Panca Budi Idaman TBK Dan Entitas Anak 31 Desember 2017 PDFDocument138 pages117 - 102 - 116 - 234-FINAL REPORT PT Panca Budi Idaman TBK Dan Entitas Anak 31 Desember 2017 PDFYanNo ratings yet

- 6897 - Cash Accounts Receivable and InventoryDocument6 pages6897 - Cash Accounts Receivable and InventoryAljur SalamedaNo ratings yet

- AASB 3 Is Relevant When Accounting For A Business Combination ThatDocument6 pagesAASB 3 Is Relevant When Accounting For A Business Combination ThatBiruk GultaNo ratings yet

- Caterpillar IndicadoresDocument24 pagesCaterpillar IndicadoresChris Fernandes De Matos BarbosaNo ratings yet

- Liyu - 2021 G.CDocument8 pagesLiyu - 2021 G.CElias Abubeker AhmedNo ratings yet

- Chapter 32 - PFRS 5 Non Current Assets Held For SalesDocument2 pagesChapter 32 - PFRS 5 Non Current Assets Held For SalesLovely AbadianoNo ratings yet

- Manager Selection - CFADocument148 pagesManager Selection - CFAJuliano VieiraNo ratings yet

- 09 Bbfa1103 T5Document37 pages09 Bbfa1103 T5djaljdNo ratings yet

- MID TERM Accountancy PDFDocument6 pagesMID TERM Accountancy PDFGaurang AgarwalNo ratings yet

- Gen008 P1 ExamDocument11 pagesGen008 P1 ExamMary Lyn DatuinNo ratings yet

- The Charles Wolfson Charitable Trust Accounts 2006Document29 pagesThe Charles Wolfson Charitable Trust Accounts 2006Spin WatchNo ratings yet

- IPCA Ratio Analysis TemplateDocument6 pagesIPCA Ratio Analysis TemplatehimavalluriNo ratings yet

- Istiqlal Ramadhan Rasyid - 11180820000040 - Latihan Soal AKM 1Ch.23Document4 pagesIstiqlal Ramadhan Rasyid - 11180820000040 - Latihan Soal AKM 1Ch.23Istiqlal RamadhanNo ratings yet

- International Public Sector Accounting StandardsDocument5 pagesInternational Public Sector Accounting StandardsSirkd ShumbaNo ratings yet

- Advance AccountingDocument39 pagesAdvance Accountinganna rodriguezNo ratings yet

- Section-A Statement of Financial Position As at 31 Dec 2020 Non-Current AssetsDocument4 pagesSection-A Statement of Financial Position As at 31 Dec 2020 Non-Current AssetsFareeha RizwanNo ratings yet

- GCE O Level Principles of Accounts GlossaryDocument6 pagesGCE O Level Principles of Accounts Glossaryebookfish0% (1)

- Umer Solution 2Document21 pagesUmer Solution 2shoaiba1No ratings yet

- Governance Policies Procedures ManualDocument34 pagesGovernance Policies Procedures ManualmojiamaraNo ratings yet

- Financial AnalysisDocument8 pagesFinancial Analysisneron hasaniNo ratings yet

- Chapter 7 PDFDocument9 pagesChapter 7 PDFAtarom9No ratings yet

- 11 3 Demands For Grants Appropriations Current Exp Vol III 2021 22Document837 pages11 3 Demands For Grants Appropriations Current Exp Vol III 2021 22Aamir HamaadNo ratings yet

- Chapter 16 Incomplete Records Q1 SengDocument6 pagesChapter 16 Incomplete Records Q1 Sengmelody shayanwakoNo ratings yet