Professional Documents

Culture Documents

Kelloggs 13 Brief

Uploaded by

yuktimittal007Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kelloggs 13 Brief

Uploaded by

yuktimittal007Copyright:

Available Formats

THE TIMES 100

Kellogg’s brief

Introduction

Kellogg’s is the world’s leading producer of breakfast cereal. In 2007, it was Britain’s leading grocery brand.

Its lines include both ready-to-eat cereal (like Rice Krispies) and cereal bars. Kellogg’s divides its markets

into six segments so that marketing can be targeted. Each brand has to hold its own in its market. If a brand

is not performing as well as it should, the business must do something about it.

Product life cycle

Each product goes through its own life cycle. It is born, reaches maturity and eventually goes into decline.

There is an important stage before launch, called research and development, when the product is designed

to meet the needs of the market. Nutri-grain was designed to meet the needs of busy people who had

missed breakfast, providing a healthy cereal breakfast in a bar.

· At launch in 1997, Nutri-Grain immediately gained 50% market share;

· Growth was maintained by bringing out new versions and repositioning the bar as an ‘all day snack’.

· At maturity, competitor brands (like Alpen) started to chip away at market share. Some variants (such as

Minis and Twists) struggled, whilst some grew (like Elevenses) but could not halt the overall decline.

· At saturation, the market is ‘full’. Better or cheaper competing products have come to market. By mid-

2004, Nutri-grain faced declining sales in a growing market.

· Decline: at this point Kellogg had to decide whether to let the product die or use an extension strategy to

lengthen its life.

Strategy

Strategically, Kellogg had a strong position in the market for both healthy foods and convenience foods. In

addition, Nutri-Grain fitted the profile of its aims. Kellogg’s therefore planned an extension strategy. It used

Ansoff’s matrix to decide on the most appropriate way forward.

Extending the cycle

Kellogg had to decide whether the problem with Nutri-Grain was the market, the product or both. It could see

that the market was growing, but that customer tastes were changing. The choice was therefore between

product development or diversification. The first of these carries much lower costs and risks. Research

showed Kellogg that:

· the brand message was not strong enough

· some other Kellogg’s products (like Minis) had taken the focus from Nutri-Grain

· Soft Bake and Elevenses did not receive enough marketing support, despite having 80% of sales

· market growth was being driven by discounts, rather than any permanent factors.

Implementing the extension

Kellogg re-branded and re launched Nutri-Grain in 2005. The bars had a new brand image. They also had a

stronger unique selling point (Nutri-Grain is more healthy because it is baked). Kellogg also put more

promotional investment into the core brands and dropped some of the others. As a result, Soft Bake Bar

sales grew, with Elevenses sales up by almost 50%. The Nutri-Grain brand grew at almost three times that

of the market and maintained this even after the re-launch was over.

Conclusion

Kellogg’s could see that Nutri-Grain was a good product. It also fitted well with its aims. It used business

tools to decide on the future of the product and successfully met its aims.

Downloaded from The Times 100 Edition 13 - http://www.thetimes100.co.uk

You might also like

- Extending The Product Life CycleDocument2 pagesExtending The Product Life CycleMurtaza AghaNo ratings yet

- Global Brand Power: Leveraging Branding for Long-Term GrowthFrom EverandGlobal Brand Power: Leveraging Branding for Long-Term GrowthRating: 5 out of 5 stars5/5 (1)

- Kellogg Extends Nutri-Grain's Product Life CycleDocument4 pagesKellogg Extends Nutri-Grain's Product Life CycleAtulSrivastava100% (1)

- KelogsDocument4 pagesKelogsHashim PM SeyadNo ratings yet

- Kellogg'sDocument4 pagesKellogg'sAntonioNo ratings yet

- KELLOGGDocument5 pagesKELLOGGRubinder KheparNo ratings yet

- Extending The Product Life Cycle: WWW - Thetimes100.co - UkDocument4 pagesExtending The Product Life Cycle: WWW - Thetimes100.co - UkNikhil AlvaNo ratings yet

- Kellogg'sDocument8 pagesKellogg'sAntonio Alvino100% (1)

- Kelloggs Case Study 1Document8 pagesKelloggs Case Study 1Rakesh MenonNo ratings yet

- MM Case StudiesDocument49 pagesMM Case StudiesSIva KumarNo ratings yet

- Extending Product Life Cycles: Kellogg's Nutri-Grain Case StudyDocument7 pagesExtending Product Life Cycles: Kellogg's Nutri-Grain Case StudyAnkita GuptaNo ratings yet

- SWOT AnalysisDocument8 pagesSWOT AnalysisMohamed Salah Al-ShantafNo ratings yet

- KelloggDocument3 pagesKelloggSneha Patil50% (4)

- London School of Commerce: Masters in Business AdministrationDocument20 pagesLondon School of Commerce: Masters in Business AdministrationSaki Mohammad100% (1)

- Kellogg'sDocument1 pageKellogg'srajan4rajNo ratings yet

- Kohinoor: KBS KhandalaDocument15 pagesKohinoor: KBS KhandalaRitesh RawalNo ratings yet

- Kellog CaseDocument3 pagesKellog CaseVarsha KastureNo ratings yet

- Extending Product Lifecycles with Ansoff's MatrixDocument14 pagesExtending Product Lifecycles with Ansoff's MatrixBikash Kumar ShahNo ratings yet

- KelloggsDocument6 pagesKelloggsSahil KukrejaNo ratings yet

- Meeting Marketing ChallengesDocument17 pagesMeeting Marketing ChallengesNe PaNo ratings yet

- Kelloggs Edition 9 FullDocument5 pagesKelloggs Edition 9 FullNaveen SuntharNo ratings yet

- Kellogg Global StrategiesDocument19 pagesKellogg Global StrategiesHash Ashes100% (1)

- Kelloggs Edition 13 Full PDFDocument4 pagesKelloggs Edition 13 Full PDFMegz OkadaNo ratings yet

- Kellogg's Internationalisation Versus Globalisation of The Marketing MixDocument19 pagesKellogg's Internationalisation Versus Globalisation of The Marketing MixShalinee SewbundhunNo ratings yet

- Extending the Product Life Cycle with Strategic Marketing Mix ChangesDocument6 pagesExtending the Product Life Cycle with Strategic Marketing Mix Changeskashif AliNo ratings yet

- Case 1 Kelloggs - Using New Product Development To Grow A BrandDocument4 pagesCase 1 Kelloggs - Using New Product Development To Grow A BrandJackyHoNo ratings yet

- Kellogg's builds All-Bran brand family to extend fibre cereal product life cyclesDocument4 pagesKellogg's builds All-Bran brand family to extend fibre cereal product life cyclesleo_013No ratings yet

- The Kellogs Connection: Swathipriya VenkatesanDocument8 pagesThe Kellogs Connection: Swathipriya VenkatesanLeo JudeNo ratings yet

- Group Assignment 3 KellogsDocument8 pagesGroup Assignment 3 KellogsRambo DeyNo ratings yet

- plc-4Document1 pageplc-4navalgund12No ratings yet

- Case On KelloggsDocument2 pagesCase On KelloggsSara TanzinaNo ratings yet

- Brand ProjectDocument30 pagesBrand Projectanandpatel2991No ratings yet

- MKT MGMT OF KELLOGG'S CORN FLAKESDocument9 pagesMKT MGMT OF KELLOGG'S CORN FLAKESNafees Imtiaz AhmedNo ratings yet

- Case StudyDocument4 pagesCase StudyMuhammad TaimoorNo ratings yet

- Kellogg 9 FullDocument2 pagesKellogg 9 FullNatarajan AncNo ratings yet

- Kelloggs PLCDocument2 pagesKelloggs PLCManish KalamkarNo ratings yet

- Kellogg's Nutrigrain case analysis focuses on test marketingDocument2 pagesKellogg's Nutrigrain case analysis focuses on test marketingShaina Aragon100% (2)

- Preparing To Make A Strategic ChangeDocument3 pagesPreparing To Make A Strategic ChangeDiego Hernandez CuervoNo ratings yet

- Kellogg's SWOT AnalysisDocument50 pagesKellogg's SWOT AnalysisPrakash Chhabria100% (3)

- Kelloggs Global Marketing Final ReportDocument9 pagesKelloggs Global Marketing Final ReportDustin Glenn Cuevas100% (1)

- Kellogg's RebrandingDocument2 pagesKellogg's Rebrandingjackooo98No ratings yet

- KashiDocument34 pagesKashiEl'dar IbraimovNo ratings yet

- Cases Study of Kellogg's Failure in Indian Market FullDocument17 pagesCases Study of Kellogg's Failure in Indian Market FullAjay PillaiNo ratings yet

- Kelloggs Re Branding A Corporate ImageDocument3 pagesKelloggs Re Branding A Corporate ImageRaj0% (1)

- Kellogg's Failed Indian Launch Due to Product-Market MismatchDocument6 pagesKellogg's Failed Indian Launch Due to Product-Market Mismatchritika rustagiNo ratings yet

- Kollgg's Case StudyDocument4 pagesKollgg's Case Studysimsim sasaNo ratings yet

- BSBMKG414Document8 pagesBSBMKG414brunos cleaningNo ratings yet

- Kellogg's Indian Turnaround: Correcting MistakesDocument46 pagesKellogg's Indian Turnaround: Correcting MistakesJeremiah Miko LepasanaNo ratings yet

- Kellogg's Marketing Strategy in IndiaDocument56 pagesKellogg's Marketing Strategy in IndiaNeha Goyal100% (1)

- Kellogg's New Product LaunchDocument4 pagesKellogg's New Product Launcharpita nayakNo ratings yet

- Kellogs PIC CaseDocument2 pagesKellogs PIC Casehamna0354No ratings yet

- Rebranding Strategy of KellogsDocument2 pagesRebranding Strategy of KellogsNagendra ManralNo ratings yet

- Kellogs Case StudyDocument22 pagesKellogs Case StudyAshish Kumar Banka100% (1)

- Marketing Research Paper - KelloggDocument44 pagesMarketing Research Paper - Kellogggreiwec100% (2)

- Kellogg CompanyDocument17 pagesKellogg CompanyAlex Tom100% (2)

- Kellogg's Brand AuditDocument31 pagesKellogg's Brand Auditapi-281107514100% (2)

- Personal and Household Finance ExplainedDocument5 pagesPersonal and Household Finance ExplainedMuhammad SamhanNo ratings yet

- TAXATION OF PARTNERSHIPS AND JOINT VENTURESDocument6 pagesTAXATION OF PARTNERSHIPS AND JOINT VENTURESAngelie Lecapare0% (1)

- Mortgages and Charges Over Land PDFDocument49 pagesMortgages and Charges Over Land PDFKnowledge GuruNo ratings yet

- 1 Acc-ExamDocument10 pages1 Acc-Examsachin2727No ratings yet

- Tobin - The Interest Elasticity of Transactions Demand For CashDocument8 pagesTobin - The Interest Elasticity of Transactions Demand For CashWalter ArceNo ratings yet

- Jack Welch's Impact on GE ManagementDocument6 pagesJack Welch's Impact on GE ManagementSunil Patil100% (1)

- Indian Financial System: DCOM304/DCOM503Document318 pagesIndian Financial System: DCOM304/DCOM503Bhavana MurthyNo ratings yet

- Arbitrage in India: Past, Present and FutureDocument22 pagesArbitrage in India: Past, Present and FuturetushartutuNo ratings yet

- Chap 02 Aem 421Document41 pagesChap 02 Aem 421trollingandstalkingNo ratings yet

- Chap 11 Taxation, Prices, Efficiency, and The Distribution of IncomeDocument22 pagesChap 11 Taxation, Prices, Efficiency, and The Distribution of IncomeNasir Mazhar100% (1)

- Lista Empresas PanamaPapers PDFDocument8 pagesLista Empresas PanamaPapers PDFChristopher André DíazNo ratings yet

- OGDCLDocument30 pagesOGDCLMahmood AliNo ratings yet

- 150 Richest Indonesians - June 2016 - GlobeAsiaDocument62 pages150 Richest Indonesians - June 2016 - GlobeAsiaIndraTedjaKusumaNo ratings yet

- Article by Opue Job A. On Economic Appraisal of Ponzi Schemes and Living Standards in NigeriaDocument18 pagesArticle by Opue Job A. On Economic Appraisal of Ponzi Schemes and Living Standards in NigeriaJob OpueNo ratings yet

- Why Accounting Research Skills Matter for Career SuccessDocument18 pagesWhy Accounting Research Skills Matter for Career SuccessRudy0% (1)

- PNL CompanyDocument14 pagesPNL Companyhanumanthaiahgowda100% (1)

- Presentation On PNBDocument20 pagesPresentation On PNBShubhra MamgainNo ratings yet

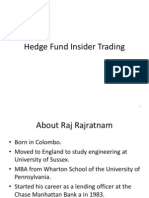

- Hedge Fund Insider TradingDocument15 pagesHedge Fund Insider TradingToral ShahNo ratings yet

- Report - Divis LabDocument7 pagesReport - Divis LabAnonymous y3hYf50mTNo ratings yet

- BFS1001 - Session 2 - Resume Templates To Help You For Your Assignment - Uploaded Onto IVLEDocument3 pagesBFS1001 - Session 2 - Resume Templates To Help You For Your Assignment - Uploaded Onto IVLEJavier ThooNo ratings yet

- BitRoyal Exchange Ltd. Is Globally Launching A New Crypto Trading PlatformDocument2 pagesBitRoyal Exchange Ltd. Is Globally Launching A New Crypto Trading PlatformPR.comNo ratings yet

- An Insight Into The Capital Structure Determinants Lima-LibreDocument17 pagesAn Insight Into The Capital Structure Determinants Lima-LibreБекзат АсановNo ratings yet

- Water Utility Industry Analysis and OutlookDocument2 pagesWater Utility Industry Analysis and OutlookAkshay BhatnagarNo ratings yet

- Series-V-A: Mutual Fund Distributors Certification ExaminationDocument218 pagesSeries-V-A: Mutual Fund Distributors Certification ExaminationAjithreddy BasireddyNo ratings yet

- Chapter 02Document50 pagesChapter 02Huy HoangNo ratings yet

- Group 3 Section B SwissArmyDocument8 pagesGroup 3 Section B SwissArmypiyali dasNo ratings yet

- Co Living 1.0Document17 pagesCo Living 1.0abdullahNo ratings yet

- Project On Summer Internship at Jindal Stainless Limited-HisarDocument57 pagesProject On Summer Internship at Jindal Stainless Limited-HisarSidharth GargNo ratings yet

- DB 45 PDFDocument120 pagesDB 45 PDFzaheeruddin_mohdNo ratings yet

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- Crushing It!: How Great Entrepreneurs Build Their Business and Influence-and How You Can, TooFrom EverandCrushing It!: How Great Entrepreneurs Build Their Business and Influence-and How You Can, TooRating: 5 out of 5 stars5/5 (887)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (85)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- Creative Personal Branding: The Strategy To Answer What's Next?From EverandCreative Personal Branding: The Strategy To Answer What's Next?Rating: 4.5 out of 5 stars4.5/5 (3)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (24)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (19)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisFrom EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (3)

- Built to Serve: Find Your Purpose and Become the Leader You Were Born to BeFrom EverandBuilt to Serve: Find Your Purpose and Become the Leader You Were Born to BeRating: 5 out of 5 stars5/5 (23)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (794)

- AI Money Machine: Unlock the Secrets to Making Money Online with AIFrom EverandAI Money Machine: Unlock the Secrets to Making Money Online with AINo ratings yet

- How to Prospect, Sell and Build Your Network Marketing Business with StoriesFrom EverandHow to Prospect, Sell and Build Your Network Marketing Business with StoriesRating: 5 out of 5 stars5/5 (21)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsFrom EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsRating: 4 out of 5 stars4/5 (6)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- Summary of The 33 Strategies of War by Robert GreeneFrom EverandSummary of The 33 Strategies of War by Robert GreeneRating: 3.5 out of 5 stars3.5/5 (20)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessFrom EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessRating: 4.5 out of 5 stars4.5/5 (407)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesFrom EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesRating: 4.5 out of 5 stars4.5/5 (99)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeFrom EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeRating: 5 out of 5 stars5/5 (22)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceFrom EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceRating: 5 out of 5 stars5/5 (363)

- Company Of One: Why Staying Small Is the Next Big Thing for BusinessFrom EverandCompany Of One: Why Staying Small Is the Next Big Thing for BusinessRating: 3.5 out of 5 stars3.5/5 (14)

- Invention: A Life of Learning Through FailureFrom EverandInvention: A Life of Learning Through FailureRating: 4.5 out of 5 stars4.5/5 (28)