Professional Documents

Culture Documents

Improving SME Competitiveness

Uploaded by

Ayan Sur0 ratings0% found this document useful (0 votes)

65 views4 pagesThis document provides information about an upcoming seminar aimed at improving the competitiveness of small and medium enterprises (SMEs) in India. The seminar will address key issues impacting SME competitiveness such as limited strategies, managing talent, accessing funding, and adapting to globalization. It will take place over two days and include sessions on topics like setting up lean operations, taxation, risk management, and corporate governance. The goal is to help SMEs overcome challenges and strengthen their position in the Indian economy.

Original Description:

Original Title

ImprovingSME1

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides information about an upcoming seminar aimed at improving the competitiveness of small and medium enterprises (SMEs) in India. The seminar will address key issues impacting SME competitiveness such as limited strategies, managing talent, accessing funding, and adapting to globalization. It will take place over two days and include sessions on topics like setting up lean operations, taxation, risk management, and corporate governance. The goal is to help SMEs overcome challenges and strengthen their position in the Indian economy.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

65 views4 pagesImproving SME Competitiveness

Uploaded by

Ayan SurThis document provides information about an upcoming seminar aimed at improving the competitiveness of small and medium enterprises (SMEs) in India. The seminar will address key issues impacting SME competitiveness such as limited strategies, managing talent, accessing funding, and adapting to globalization. It will take place over two days and include sessions on topics like setting up lean operations, taxation, risk management, and corporate governance. The goal is to help SMEs overcome challenges and strengthen their position in the Indian economy.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Improving Competitiveness of

SME’s

The backbone of Indian Economy

This Program is organised by IIA and MCCIA, co-sponsored

by ICICI Bank, with Deloitte as Knowledge Partner

February 19th – 20th, 2010

The Small and Medium Enterprises are aptly regarded upon their existing strengths to take advantage of plethora of

as the backbone of the Indian economy. According to opportunities available worldwide. SMEs also find it difficult to match

the Union Ministry, the SME sector contributes up to the wage rate, job security and career development opportunities,

40% to the gross industrial manufacturing value added available in larger organizations and therefore find it difficult to hire and

to the economy, 35% to India’s exports directly and retain skilled and competent manpower. The trends consistently show

around 8% to India’s GDP. Numbering more than 26 that most of employees of firms in unorganized sector belong to a group

million units and employing around 60 million people, which is predominantly uneducated and therefore unskilled. The labor

the sector is the second largest employer after productivity as measured by value added per worker is lower for SMEs

agriculture. Presently, the SMEs in India are at a than that for large firms.

crossroad and intense debate is centered on questions

like what would be the future of the small enterprises? Funding: The main identified sources of finance to SME units are -

How these enterprises can survive in the international Public Sector/Commercial banks, State Financial Corporations, Small

trade arena? The central issue of concern for the growth Industries Development Bank of India and Informal sources. Out of these

of small and medium scale industry is how to financial resources, banks are a preferred source of financing by virtue of

strengthen its competitiveness. Some of the issues that their better reach and accessibility. Raising finance from the financial

impact the competitiveness of SME’s include: institutions has the following draw backs:

• The rate of interest charged is higher

Strategy and operations: Most SME’s have limited • Insufficient collateral

regional geographic presence or limited customer base • Restrictive and conditional working capital limits

with majority of them supplying to a few customers. • Time consuming and cumbersome procedures

This not only limits their ability in negotiations and • Indifferent attitude of the branch manager/staff

bargaining but also hampers their growth perspective • Non-availability of assistance at banks for completion

based on the conditions experienced by their limited of forms and formalities

customers. With the WTO regime of removing trade • The terms of credit are hard

barriers and increased globalizations, today, SMEs will

need to compete with their counterparts from other Furthermore, SME sector has remained aloof in raising the finance from

parts of the world. While Indian players have the cost capital markets. There has been no separate active platform for providing

advantages due to availability of cheap labor and trading facility for securities of SME sector players. Moreover, the

government incentives for the sector, they will need Venture Capitalists (VCs) who showed enormous interest in financing of

to build their strengths on the technology front and start-up ventures during the high-paced growth era, of lately, have

management and marketing skills in order to survive in become wary of investing in such ventures as an outcome of economic

the global village. downturn across the Globe. The situation is further worsened by limited

exit options for VCs.

Managing talent: A skilled and educated work force

enhances the absorptive capability of a firm. This is

because the human and knowledge capital within a firm

determines the firm’s overall ability to gain sustained

competitive advantage. SMEs are usually managed/

run by entrepreneurs who lack formal management

education due to which they are not able to leverage

All of these factors restrict the SME’s ability to Day & Date :- Friday & Saturday,

increase the capacities and potential benefits that Time :- 09:30 am to 5:30 pm.

could be derived from possible expansion. Therefore Venue :- Hall No 06 & 07, ‘ A ‘ Wing, MCCIA Trade Tower ICC Complex, Senapati

almost Two-thirds of SME’s have to rely on informal Bapat Road, Pune 411 016

sources to meet their financial requirements. Seminar programme

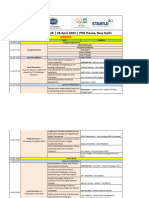

Day – 1: Friday, 19th February 2010

Why Should You Attend? Duration Topic Speaker

As a result of globalization and liberalization, coupled

9:30 to 10:00 Inauguration and Mr. Hemant Joshi (Deloitte)

with WTO regime, Indian SMEs have been passing ICICI Mr. Anant Sardeshmukh (ADG MCCIA)

through a transitional period. With slowing down of Presentation Mr. Harshil Mehta (National Head,

economy in India and abroad, particularly USA and ICICI PSG)

European Union and enhanced competition from China 10:00 to 11:30 Getting the K. Kumar (Deloitte)

strategy right Mr. Ranjit Jakkli (Powercon)

and a few low cost centers of production from abroad

Mr. Vikram Puri (CEO & MD Natasha Consultants)

many units have been facing a tough time. Those SMEs

11:30 to 12:00 - Tea Break

who have strong technological base, international

12:00 to Setting up Lean Mr. Yogesh Vaghani (CEO & MD, Milton)

business outlook, competitive spirit and willingness 13:30 Mr. Arvind Navdikar (MCCIA Faculty)

to restructure themselves shall withstand the present Operations

13:30 to 14:30 - Lunch Break

challenges and come out with shining colors’ to make

14:30 to Direct and Mr. Pramod Joshi (Deloitte)

their own contribution to the Indian economy. This

15:30 Indirect Mr. Anant Awasare (Deloitte)

seminar will address and help you overcome these new Taxation

challenges faced by your organisation. Those SMEs who 15:30 to 16:00 - Tea Break

have strong technological base, international business 16:00 to Managing Talent Dr. Sayali Gankar (Director MIT School of Mgmt)

outlook, competitive spirit and willingness to restructure 17:30 Dr. Shekhar Chitale (Dean Pune University)

Dr. Sonia Yadwadkar

themselves shall withstand the present challenges

Mr. Anant Sardeshmukh (ADG, MCCIA)

and come out with shining colors’ to make their own

contribution to the Indian economy. This seminar

will address and help you overcome the challenges

faced by your organisation and improve your

competitiveness.

Day – 2: Saturday, 20th February 2010

Duration Topic Speaker

9:30 to 10:30 Managing Finance Mr. Nishikant Deshpande (MCCIA Faculty)

10:30 to Understanding Mr. Abhay Gupte (Deloitte)

11:30 Risk

11:30 to 12:00 - Tea Break

12:00 to Corporate Mr. Hemant Joshi (Deloitte)

12:30 Governance

12:30 to Raising Finance Mr. Viren Malhotra (Deloitte)

13:30

13:30 to 14:30 - Lunch Break

14:30 to Panel Discussion Mr. Hemant Joshii (Deloitte)

16:00 Mr. Anant Sardeshmukh (ADG, MCCIA)

Mr. Vikram Salunke (Accurate Sales & Services)

Mr. M. M. Mehta (Finance Controller, Demech)

16:00 to 16:30 - Tea Break

16:30 to Open Floor for (Bankers To be Confirmed)

17:30 discussions with

Financial

Advisors and

Bankers

You might also like

- List The Elements of A New-Venture Team?Document11 pagesList The Elements of A New-Venture Team?Amethyst OnlineNo ratings yet

- AB-02 Small BusinessDocument78 pagesAB-02 Small BusinessAlan OlivierNo ratings yet

- Entry Strategy and Strategic AllianceDocument50 pagesEntry Strategy and Strategic AllianceRana Abdul BasitNo ratings yet

- Noor Mohamed - Working Capital Management-Full ReportDocument94 pagesNoor Mohamed - Working Capital Management-Full ReportananthakumarNo ratings yet

- VP Marketing Medical Devices in Boston MA Hartford CT Resume Anan NatarajanDocument3 pagesVP Marketing Medical Devices in Boston MA Hartford CT Resume Anan NatarajanAnanNatarajanNo ratings yet

- European Crowdfunding Framework Oct 2012Document40 pagesEuropean Crowdfunding Framework Oct 2012Abigail KimNo ratings yet

- Investment Law SyllabusDocument4 pagesInvestment Law SyllabusMayank Shekhar (B.A. LLB 16)No ratings yet

- Thesis Report - Highrise Constrxn PDFDocument108 pagesThesis Report - Highrise Constrxn PDFNancy TessNo ratings yet

- Uas MM 2Document20 pagesUas MM 2Max Suyatno SamsirNo ratings yet

- Startup Studio - Fledgling Innovative IdeaDocument6 pagesStartup Studio - Fledgling Innovative IdeaASHOKNo ratings yet

- MoelisDocument24 pagesMoelisBakshi V100% (1)

- Pharma Industry of Karachi Assignment Provides InsightsDocument14 pagesPharma Industry of Karachi Assignment Provides InsightsFilza KaziNo ratings yet

- CORPORATION REVIEWER VillanuevaDocument142 pagesCORPORATION REVIEWER Villanuevabobbys88No ratings yet

- Detailed Programme - 19 Global MSME Business Summit 2022Document5 pagesDetailed Programme - 19 Global MSME Business Summit 2022Arvind KumarNo ratings yet

- First Generation Entrepreneurs: National Leadership ConferenceDocument8 pagesFirst Generation Entrepreneurs: National Leadership ConferencejaisuryabanerjeeNo ratings yet

- A Panel Discussion On: Advertising - Is It All About Creativity or Strategy?Document8 pagesA Panel Discussion On: Advertising - Is It All About Creativity or Strategy?bikash_kediaNo ratings yet

- ICDM PowerTalk On (Re) Building The Board For Innovation - 28 Feb 2023 FinalDocument1 pageICDM PowerTalk On (Re) Building The Board For Innovation - 28 Feb 2023 FinalProf Sattar BawanyNo ratings yet

- Latest Outline ProgrammeDocument8 pagesLatest Outline ProgrammejaisuryabanerjeeNo ratings yet

- 2 Cfos Roundtable Conference: "Challenges For Cfos and The Way Forward"Document3 pages2 Cfos Roundtable Conference: "Challenges For Cfos and The Way Forward"varagg24No ratings yet

- Outsourcing Issue #12Document48 pagesOutsourcing Issue #12sritharan100% (1)

- Erudition Brochure - 2011Document16 pagesErudition Brochure - 2011Avinash Kumar SinghNo ratings yet

- Ebrochure Mekari Conference PDFDocument15 pagesEbrochure Mekari Conference PDFRiyadi NovieNo ratings yet

- The 15th Malaysian Capital Market Summit - ASLI - AgendaDocument3 pagesThe 15th Malaysian Capital Market Summit - ASLI - Agendameor_ayobNo ratings yet

- 4 National Conclave E-Commerce India: "E - C Omme Rce 2 .0: Scop e An D Futu Re Po Te N Tia L"Document4 pages4 National Conclave E-Commerce India: "E - C Omme Rce 2 .0: Scop e An D Futu Re Po Te N Tia L"varagg24No ratings yet

- Updated - Tentative AgendaDocument4 pagesUpdated - Tentative AgendaAjeeta SrivastavaNo ratings yet

- Agenda ASSOCHAM Cluster Development ProgramDocument3 pagesAgenda ASSOCHAM Cluster Development ProgramAnu V PillaiNo ratings yet

- Questions For Key Note 19Document5 pagesQuestions For Key Note 19Kushal SainNo ratings yet

- 2nd CFO Roundtable Conference Challenges & Way ForwardDocument3 pages2nd CFO Roundtable Conference Challenges & Way ForwardHimal VaghelaNo ratings yet

- Recruiting As A Career-CSDocument34 pagesRecruiting As A Career-CSShweta JoshiNo ratings yet

- Recruitment As A Career in IndiaDocument34 pagesRecruitment As A Career in IndiaShweta JoshiNo ratings yet

- MOSt - CONFERENCE REPORT Motilal Oswal 10th Annual Global Investor Conference, 2014Document130 pagesMOSt - CONFERENCE REPORT Motilal Oswal 10th Annual Global Investor Conference, 2014kaua1980No ratings yet

- SME Business Consultancy PlanDocument7 pagesSME Business Consultancy PlanJatin SahnanNo ratings yet

- CII Global Economic Policy Summit 2022 ProgramDocument9 pagesCII Global Economic Policy Summit 2022 ProgramTarique TabrezNo ratings yet

- Summer Training ReportDocument128 pagesSummer Training ReportSALONI KHANDELWALNo ratings yet

- SECE2023Programme PDFDocument4 pagesSECE2023Programme PDFdiscard mailsNo ratings yet

- Msme Sector: Challenges and Opportunities: Neha Singh, Dr. Sneh P. DanielDocument4 pagesMsme Sector: Challenges and Opportunities: Neha Singh, Dr. Sneh P. DanielSmriti SFS 79No ratings yet

- Role of Entrepreneur as an Innovator in Economic GrowthDocument21 pagesRole of Entrepreneur as an Innovator in Economic GrowthSumi ChandraNo ratings yet

- SWOT FOR MSME NewDocument69 pagesSWOT FOR MSME Newnakulm416No ratings yet

- Brochure IMS-Final 22 NovDocument4 pagesBrochure IMS-Final 22 Novanku858No ratings yet

- India Summit: Policy - Technology - Finance - Exports - Service SectorDocument4 pagesIndia Summit: Policy - Technology - Finance - Exports - Service SectorArun ChaudharyNo ratings yet

- IHCS 2017 - Sponsorship and Exhibition Proposal 171020Document26 pagesIHCS 2017 - Sponsorship and Exhibition Proposal 171020Anto PangestuNo ratings yet

- Editorial Consolidation (November) 2022Document44 pagesEditorial Consolidation (November) 2022Sachin SharmaNo ratings yet

- Summer Training ReportDocument119 pagesSummer Training ReportSALONI KHANDELWALNo ratings yet

- Submitted ToDocument5 pagesSubmitted Tosrabon ahmedNo ratings yet

- Agenda VSO & IBM Event PDFDocument3 pagesAgenda VSO & IBM Event PDFShailendra Kumar JhaNo ratings yet

- Saanya - Summer ProjectDocument68 pagesSaanya - Summer ProjectSaanya SanghviNo ratings yet

- Horasis Global India Business Meeting 2010 - Programme BrochureDocument32 pagesHorasis Global India Business Meeting 2010 - Programme BrochuresaranshcNo ratings yet

- Maassmerize 2010 AgendaDocument2 pagesMaassmerize 2010 AgendaVibhav UpadhyayNo ratings yet

- Human Capital Journal 201111 Talent WarDocument40 pagesHuman Capital Journal 201111 Talent Warsafrijal sutan kayoNo ratings yet

- Smes Financing Constraints in Zimbabwe: The Case of Midlands ProvinceDocument7 pagesSmes Financing Constraints in Zimbabwe: The Case of Midlands ProvinceBARNABAS MUFAROWASHENo ratings yet

- Challenges Before Indian SME's & Consultancy Interventions NeededDocument44 pagesChallenges Before Indian SME's & Consultancy Interventions NeededRavi ManglaniNo ratings yet

- Panel Discussion Summary Report, 30 June'12: Symbiosis Institute of Telecom Management, PuneDocument32 pagesPanel Discussion Summary Report, 30 June'12: Symbiosis Institute of Telecom Management, PuneArun Koshy ThomasNo ratings yet

- Paper8 ICSSRSeminarPaperDocument12 pagesPaper8 ICSSRSeminarPaperima doucheNo ratings yet

- Malaysia’s Fast Moving Companies ChallengesDocument6 pagesMalaysia’s Fast Moving Companies ChallengesIzaham ZinNo ratings yet

- Unit I: Steps in Setting-Up A Msme: (30 Marks)Document18 pagesUnit I: Steps in Setting-Up A Msme: (30 Marks)Vishal GaonkarNo ratings yet

- Macro & Micro Finance in Dena Bank: T I M SDocument56 pagesMacro & Micro Finance in Dena Bank: T I M Skomal1989No ratings yet

- MSME Sector Backbone of Indian EconomyDocument20 pagesMSME Sector Backbone of Indian EconomyHimanshu chauhanNo ratings yet

- Topic: Micro, Small and Medium Enterprises (Msmes)Document27 pagesTopic: Micro, Small and Medium Enterprises (Msmes)palak bansalNo ratings yet

- Building Intelligent EnterprisesDocument3 pagesBuilding Intelligent Enterprisesspsenthil123No ratings yet

- Man MPDocument8 pagesMan MPsaikrishnamithapalli053No ratings yet

- Placement Brochure PGDM-FMDocument23 pagesPlacement Brochure PGDM-FManupamifmNo ratings yet

- Sudhir Dash Profile HistoryDocument3 pagesSudhir Dash Profile HistorySudhir Kumar DashNo ratings yet

- Future Skills of Leadership - Millennial ASN - 4 Agustus 2022 - Signing MoU GNIK & LAN RIDocument21 pagesFuture Skills of Leadership - Millennial ASN - 4 Agustus 2022 - Signing MoU GNIK & LAN RIEsti FitriningsihNo ratings yet

- Minor Project 3Document54 pagesMinor Project 3chaitamahajan10No ratings yet

- Examining The Determinants and Consequences of Financial Constraints Faced by Micro, Small and Medium Enterprises ' OwnersDocument22 pagesExamining The Determinants and Consequences of Financial Constraints Faced by Micro, Small and Medium Enterprises ' OwnersMUHAMMAD KAISNo ratings yet

- AB Mauri - NCYM Paper 2010 - Ver 4.0Document16 pagesAB Mauri - NCYM Paper 2010 - Ver 4.0ksridevi12No ratings yet

- HR Conclave explores rewiring of workplacesDocument10 pagesHR Conclave explores rewiring of workplacestitiksha ranaNo ratings yet

- Dena Bank DenaDocument40 pagesDena Bank DenaRashmi ShettyNo ratings yet

- 2011 Dec Smart TechieDocument33 pages2011 Dec Smart TechiesudhirramaraoNo ratings yet

- Insights On Supply Chain Needs and Issues in Indian Smes: Journal of Industrial & Engineering Chemistry December 2018Document16 pagesInsights On Supply Chain Needs and Issues in Indian Smes: Journal of Industrial & Engineering Chemistry December 2018arushi srivastavaNo ratings yet

- E Ffect of Entrepreneurial Competencies On Micro-Enterprises Income and Assets in MalaysiaDocument13 pagesE Ffect of Entrepreneurial Competencies On Micro-Enterprises Income and Assets in MalaysiaMUHAMMAD KAISNo ratings yet

- News 1Document1 pageNews 1Ayan SurNo ratings yet

- NirmaDocument2 pagesNirmaAyan SurNo ratings yet

- Hul - Group IIDocument19 pagesHul - Group IIAyan SurNo ratings yet

- Problems in Rural MarketingDocument15 pagesProblems in Rural MarketingAyan SurNo ratings yet

- Assignment 2 Setting Up A New BusinessDocument6 pagesAssignment 2 Setting Up A New BusinessBilly OkumuNo ratings yet

- Final - Welingkar - Private Equity CompaniesDocument60 pagesFinal - Welingkar - Private Equity Companiessam coolNo ratings yet

- New Venture Creation Entrepreneurship For The 21St Century 10Th Edition Spinelli Solutions Manual Full Chapter PDFDocument31 pagesNew Venture Creation Entrepreneurship For The 21St Century 10Th Edition Spinelli Solutions Manual Full Chapter PDFmichaelkrause22011998gdj100% (8)

- TICIL Case StudyDocument7 pagesTICIL Case Studygoutam2303No ratings yet

- 9959 A Review of Fast Growing Blockchain Hubs in AsiaDocument16 pages9959 A Review of Fast Growing Blockchain Hubs in AsiaImran JavedNo ratings yet

- Launching A New VentureDocument15 pagesLaunching A New VentureAnonymous ntbYN167% (3)

- Crowdfunding Industry Report 2013Document96 pagesCrowdfunding Industry Report 2013Alejandro Montenegro100% (2)

- Mba Internship ReportDocument23 pagesMba Internship ReportAkshaySaxenaNo ratings yet

- Platforms in Sub-Saharan Africa: Startup Models and The Role of Business IncubationDocument36 pagesPlatforms in Sub-Saharan Africa: Startup Models and The Role of Business Incubationpriyankabatra.nicmNo ratings yet

- Reaction Paaper No 7. - Mutual Funds As VCs - April 2022Document3 pagesReaction Paaper No 7. - Mutual Funds As VCs - April 2022Nazanin SangestaniNo ratings yet

- Chapter 6: Business Financing: Internal Sources (Equity Capital)Document6 pagesChapter 6: Business Financing: Internal Sources (Equity Capital)betsega shiferaNo ratings yet

- Ezine Final 15th OctoberDocument2 pagesEzine Final 15th Octoberconor038493No ratings yet

- Ey Ivca Monthly Pe VC Roundup March 2023Document50 pagesEy Ivca Monthly Pe VC Roundup March 2023Mohnish KhianiNo ratings yet

- Akot Business PlanDocument41 pagesAkot Business PlanBOL AKETCHNo ratings yet

- Topic 5 Notes-EntrepreneurshipDocument12 pagesTopic 5 Notes-EntrepreneurshipCainan Ojwang100% (1)

- SABIS Ventures Into AfricaDocument1 pageSABIS Ventures Into Africaawesley5844No ratings yet

- Fintech in Asean 2022Document52 pagesFintech in Asean 2022Trần Thị Hà MyNo ratings yet

- Internship ReportDocument54 pagesInternship ReportKeerat KhoranaNo ratings yet