Professional Documents

Culture Documents

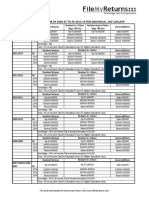

Income Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)

Uploaded by

Achal Mittal0 ratings0% found this document useful (0 votes)

31 views4 pagesThe document outlines income tax rates and slabs in India from assessment years 2001-02 to 2011-12, with lower thresholds for women and senior citizens. Tax rates ranged from 10-30% depending on the taxable income slab. Surcharge was added for incomes over a certain threshold and education cess was also applicable in some years.

Original Description:

Original Title

Income Tax Rates

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines income tax rates and slabs in India from assessment years 2001-02 to 2011-12, with lower thresholds for women and senior citizens. Tax rates ranged from 10-30% depending on the taxable income slab. Surcharge was added for incomes over a certain threshold and education cess was also applicable in some years.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views4 pagesIncome Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)

Uploaded by

Achal MittalThe document outlines income tax rates and slabs in India from assessment years 2001-02 to 2011-12, with lower thresholds for women and senior citizens. Tax rates ranged from 10-30% depending on the taxable income slab. Surcharge was added for incomes over a certain threshold and education cess was also applicable in some years.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Income Tax Rates/Slabs for A.Y.

(2011-12)

Slab (Rs.) Tax (Rs.)

less than 1,60,000 Nil

1,60,000 to 5,00,000 (TI – 1,60,000) * 10%

5,00,000 to 8,00,000 34,000 + (TI – 5,00,000) * 20%

Greater than 8,00,000 94,000 + (TI – 8,00,000) * 30%

Women aged 65 years or less

Slab (Rs.) Tax (Rs.)

less than 1,90,000 Nil

1,90,000 to 5,00,000 (TI – 1,90,000) * 10%

5,00,000 to 8,00,000 31,000 + (TI – 5,00,000) * 20%

Greater than 8,00,000 91,000 + (TI – 8,00,000) * 30%

Senior Citizens (Individuals aged above 65 years)

Slab (Rs.) Tax (Rs.)

less than 2,40,000 Nil

2,40,000 to 5,00,000 (TI – 2,40,000) * 10%

5,00,000 to 8,00,000 26,000 + (TI – 5,00,000) * 20%

Greater than 8,00,000 86,000 + (TI – 8,00,000) * 30%

Income Tax Rates/Slabs for A.Y. (2010-11)

Slab (Rs.) Tax (Rs.)

less than 1,60,000 Nil

1,60,000 to 3,00,000 (TI – 1,60,000) * 10%

3,00,000 to 5,00,000 14,000 + (TI – 3,00,000) * 20%

Greater than 5,00,000 54,000 + (TI – 5,00,000) * 30%

Women aged 65 years or less

Slab (Rs.) Tax (Rs.)

less than 1,90,000 Nil

1,90,000 to 3,00,000 (TI – 1,90,000) * 10%

3,00,000 to 5,00,000 11,000 + (TI – 3,00,000) * 20%

Greater than 5,00,000 51,000 + (TI – 5,00,000) * 30%

Senior Citizens (Individuals aged above 65 years)

Slab (Rs.) Tax (Rs.)

less than 2,40,000 Nil

2,40,000 to 3,00,000 (TI – 2,40,000) * 10%

3,00,000 to 5,00,000 6,000 + (TI – 3,00,000) * 20%

Greater than 5,00,000 46,000 + (TI – 5,00,000) * 30%

Income Tax Rates/Slabs for A.Y. (2009-10)

Slab (Rs.) Tax (Rs.)

less than 1,50,000 Nil

1,50,000 to 3,00,000 (TI – 1,50,000) * 10%

3,00,000 to 5,00,000 15,000 + (TI – 3,00,000) * 20%

Greater than 5,00,000 55,000 + (TI – 5,00,000) * 30%

Women aged 65 years or less

Slab (Rs.) Tax (Rs.)

less than 1,80,000 Nil

1,80,000 to 3,00,000 (TI – 1,80,000) * 10%

3,00,000 to 5,00,000 12,000 + (TI – 3,00,000) * 20%

Greater than 5,00,000 52,000 + (TI – 5,00,000) * 30%

Senior Citizens (Individuals aged above 65 years)

Slab (Rs.) Tax (Rs.)

less than 2,25,000 Nil

2,25,000 to 3,00,000 (TI – 2,25,000) * 10%

3,00,000 to 5,00,000 7,500 + (TI – 3,00,000) * 20%

Greater than 5,00,000 47,500 + (TI – 5,00,000) * 30%

Income Tax Rates/Slabs for A.Y. (2008-09)

Slab (Rs.) Tax (Rs.) Surcharge on Income Tax

(if TI > Rs.10 Lakhs)

less than 1,10,000 Nil Nil

1,10,000 to 1,50,000 (TI – 1,10,000) * 10% 10%

1,50,000 to 2,50,000 4,000 + (TI – 1,50,000) * 20% 10%

Greater than 2,50,000 24,000 + (TI – 2,50,000) * 30% 10%

Women aged 65 years or less

Slab (Rs.) Tax (Rs.) Surcharge on Income Tax (if

TI > Rs.10 Lakhs) (Rs.)

less than 1,45,000 Nil Nil

1,45,000 to 1,50,000 (TI – 1,45,000) * 10% 10%

1,50,000 to 2,50,000 500 + (TI – 1,50,000) * 20% 10%

Greater than 2,50,000 20,500 + (TI – 2,50,000) * 30% 10%

Senior Citizens (Individuals aged above 65 years)

Slab (Rs.) Tax (Rs.) Surcharge on Income Tax (if

TI > Rs.10 Lakhs) (Rs.)

less than 1,95,000 Nil Nil

1,95,000 to 2,50,000 (TI – 1,95,000) * 20% 10%

Greater than 2,50,000 11,000 + (TI – 2,50,000) * 30% 10%

Education Cess has to be added on Income-tax and Surcharge @ 2% from AY 2004-05 and

3% from AY 2007-08

Income Tax Rates/Slabs for A.Y. (2006-07 & 2007-08)

Slab (Rs.) Tax (Rs.) Surcharge on Income Tax

(if TI > Rs.10 Lakhs)

less than 1,00,000 Nil Nil

1,00,000 to 1,50,000 (TI – 1,00,000) * 10% 10%

1,50,000 to 2,50,000 5,000 + (TI – 1,50,000) * 20% 10%

Greater than 2,50,000 25,000 + (TI – 2,50,000) * 30% 10%

Women aged 65 years or less

Slab (Rs.) Tax (Rs.) Surcharge on Income Tax (if

TI > Rs.10 Lakhs) (Rs.)

less than 1,35,000 Nil Nil

1,35,000 to 1,50,000 (TI – 1,35,000) * 10% 10%

1,50,000 to 2,50,000 1,500 + (TI – 1,50,000) * 20% 10%

Greater than 2,50,000 21,500 + (TI – 2,50,000) * 30% 10%

Senior Citizens (Individuals aged above 65 years)

Slab (Rs.) Tax (Rs.) Surcharge on Income Tax (if

TI > Rs.10 Lakhs) (Rs.)

less than 1,85,000 Nil Nil

1,85,000 to 2,50,000 (TI – 1,85,000) * 20% 10%

Greater than 2,50,000 13,000 + (TI – 2,50,000) * 30% 10%

Income Tax Rates/Slabs for A.Y. (2004-05 & 2005-06)

Slab (Rs.) Tax (Rs.) Surcharge on Income Tax

(If TI > Rs.8.50 Lakhs) (Rs.)

less than 50,000 Nil Nil

50,000 to 60,000 (TI – 50,000) * 10% 10%

60,000 to 1,50,000 1,000 + (TI – 60,000) * 20% 10%

Greater than 1,50,000 19,000 + (TI – 1,50,000) * 30% 10%

Income Tax Rates/Slabs for A.Y. (2003-04)

Slab (Rs.) Tax (Rs.) Surcharge on Income Tax

(If TI > Rs.60,000) (Rs.)

Less than 50,000 Nil Nil

50,000 to 60,000 (TI – 50,000) * 10% 5%

60,000 to 1,50,000 1,000 + (TI – 60,000) * 20% 5%

Greater than 1,50,000 19,000 + (TI – 1,50,000) * 30% 5%

Income Tax Rates/Slabs for A.Y. (2002-03)

Slab (Rs.) Tax (Rs.) Surcharge on Income Tax

(If TI > Rs.60,000)

Less than 50,000 Nil Nil

50,000 to 60,000 (TI – 50,000) * 10% 2%

60,000 to 1,50,000 1,000 + (TI – 60,000) * 20% 2%

Greater than 1,50,000 19,000 + (TI – 1,50,000) * 30% 2%

Income Tax Rates/Slabs for A.Y. (2001-02)

partner-pub-5706 ISO-8859-1 Search

You might also like

- Indian Income Tax Rates (AY 1998-99 To 2011-12)Document5 pagesIndian Income Tax Rates (AY 1998-99 To 2011-12)Himanshu0% (1)

- Income Tax Rates SlabsDocument2 pagesIncome Tax Rates Slabspankaj_adv5314No ratings yet

- Tax Audit Limit & Tax RatesDocument6 pagesTax Audit Limit & Tax RatesPhani SankaraNo ratings yet

- Income Tax Slab For Ay 11Document1 pageIncome Tax Slab For Ay 11mmmukhtarNo ratings yet

- Tax RatesDocument1 pageTax RatesJitendra VyasNo ratings yet

- Slab Rates IncometaxDocument8 pagesSlab Rates IncometaxPPEARL09No ratings yet

- Unit 1 Topic 2ndDocument2 pagesUnit 1 Topic 2ndAnjali. 1999No ratings yet

- Income Tax Slab 2011-2012Document2 pagesIncome Tax Slab 2011-2012Nand Kishore DubeyNo ratings yet

- Types of TaxesDocument15 pagesTypes of TaxesNischal KumarNo ratings yet

- Income Tax AY 2020-21 Sem III B.comh - Naveen MittalDocument99 pagesIncome Tax AY 2020-21 Sem III B.comh - Naveen MittalNisha PatelNo ratings yet

- ASSESSMENT YEAR 2009-2010 Tax Rates For Assessment Year 2009-10 For Resident Woman (Who Is Below 65 Years)Document4 pagesASSESSMENT YEAR 2009-2010 Tax Rates For Assessment Year 2009-10 For Resident Woman (Who Is Below 65 Years)sayyedasif56No ratings yet

- Income Tax Rates For The Past 10 YearsDocument10 pagesIncome Tax Rates For The Past 10 YearsTarang DoshiNo ratings yet

- Tax Rates For IndividualsDocument2 pagesTax Rates For Individualspiyushpandey451876No ratings yet

- Income Tax Slabs 2007-08 To 2010-11Document4 pagesIncome Tax Slabs 2007-08 To 2010-11Manoj ThuthijaNo ratings yet

- 80.1cm (32) HD Flat TV FH4003 Series 4Document6 pages80.1cm (32) HD Flat TV FH4003 Series 4Jose JohnNo ratings yet

- Chidambaram Pranab Mukherjee: Arya Baride. Amruta Bage. Tejas Aptikar. Shital Girigosavi. Pradnya ChaudhariDocument10 pagesChidambaram Pranab Mukherjee: Arya Baride. Amruta Bage. Tejas Aptikar. Shital Girigosavi. Pradnya ChaudhariAnkit JainNo ratings yet

- Income Tax Slab Fy 2020-21Document1 pageIncome Tax Slab Fy 2020-21Nabhya's FamilyNo ratings yet

- Income Tax Slab Fy 2009-10Document1 pageIncome Tax Slab Fy 2009-10naveenNo ratings yet

- Income TaxDocument1 pageIncome TaxManoj KNo ratings yet

- Sekhar (Tax)Document42 pagesSekhar (Tax)sekhar_majiNo ratings yet

- Individual, HUF, AOP or BOIDocument4 pagesIndividual, HUF, AOP or BOIABC 123No ratings yet

- Income Tax SlabDocument2 pagesIncome Tax SlabAnonymous Ur3kifA2D8No ratings yet

- Income TaxDocument2 pagesIncome TaxsunilgswmNo ratings yet

- Direct Taxes CIA 1Document5 pagesDirect Taxes CIA 1Swathy AjayNo ratings yet

- Income Tax RatesDocument1 pageIncome Tax RatesshubhozNo ratings yet

- Radhika Associates: Tax Consultants Roshan Choudhary KolkataDocument8 pagesRadhika Associates: Tax Consultants Roshan Choudhary KolkataPrakash RanaNo ratings yet

- Comparison of Tax Liabilities PreDocument2 pagesComparison of Tax Liabilities Presandipon1No ratings yet

- Income Tax SlabDocument2 pagesIncome Tax SlabKalpesh ChudasamaNo ratings yet

- 0 Tax Tables 2011Document3 pages0 Tax Tables 2011rprakash123No ratings yet

- India Income Tax Slabs 2013Document1 pageIndia Income Tax Slabs 2013nkprasathNo ratings yet

- Income Tax Slab FY 2014-15Document3 pagesIncome Tax Slab FY 2014-15zveeraNo ratings yet

- Union Budget of IndiaDocument6 pagesUnion Budget of Indiashalinivd3No ratings yet

- Budget 2011 Tax Structure For MenDocument1 pageBudget 2011 Tax Structure For MenSujan AnnaiahNo ratings yet

- Income Tax Rates For Financial Year 2010-11Document2 pagesIncome Tax Rates For Financial Year 2010-11tekleyNo ratings yet

- TaxTables20062010Document2 pagesTaxTables20062010Moazam FakeyNo ratings yet

- Taxable - Income - Formula - Excel - TemplateDocument8 pagesTaxable - Income - Formula - Excel - TemplateFaizan AhmadNo ratings yet

- 1 Income Tax Chart Fy 09 10Document2 pages1 Income Tax Chart Fy 09 10jayant_2612No ratings yet

- Income Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionDocument4 pagesIncome Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionEr Amit JambhulkarNo ratings yet

- Income Tax Rates PDFDocument1 pageIncome Tax Rates PDFAditi SharmaNo ratings yet

- Tds Rate Chart 10 11Document6 pagesTds Rate Chart 10 11harry_mewadaNo ratings yet

- Income Tax Calculator FY 2023 24 Age Below 60 Years 1Document4 pagesIncome Tax Calculator FY 2023 24 Age Below 60 Years 1naveed ansariNo ratings yet

- Tax Slab Important Changes For The Fy 2015 16 For IndividualDocument8 pagesTax Slab Important Changes For The Fy 2015 16 For IndividualSudhir BansalNo ratings yet

- Income Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)Document2 pagesIncome Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)pankaj goyalNo ratings yet

- Income TaxDocument4 pagesIncome Taxsai santhoshNo ratings yet

- EURION - Union BudgetDocument3 pagesEURION - Union BudgetEurion ConstellationNo ratings yet

- Budget Slab ChangesDocument3 pagesBudget Slab ChangesPaymaster ServicesNo ratings yet

- Tax Sheet - A.Y 2024-25Document3 pagesTax Sheet - A.Y 2024-25bajajvanshica23No ratings yet

- SingaporeCitizen3rdyearSPR PTENPENSep2011Document1 pageSingaporeCitizen3rdyearSPR PTENPENSep2011ksoskNo ratings yet

- Tax Slab 10-11Document2 pagesTax Slab 10-11Mohit TandonNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- Direct Tax BlogDocument3 pagesDirect Tax BlogArpit GuptaNo ratings yet

- CS Professional DT Revision For Dec 19Document117 pagesCS Professional DT Revision For Dec 19Vineela Srinidhi DantuNo ratings yet

- Income Tax Slabs & Rates As Announced in Budget: FY 2017-18 (AY 2018-19)Document6 pagesIncome Tax Slabs & Rates As Announced in Budget: FY 2017-18 (AY 2018-19)vashishthanuragNo ratings yet

- Notes On DTC BillDocument5 pagesNotes On DTC Billshikah sidarNo ratings yet

- Income Tax Slabs A.Y. 2012-2013Document1 pageIncome Tax Slabs A.Y. 2012-2013yogitatanavadeNo ratings yet

- 1 3+part+2Document28 pages1 3+part+2jaspreet kaurNo ratings yet

- Tax Liability For The Assessment Years 2014-15 and 2015-16Document11 pagesTax Liability For The Assessment Years 2014-15 and 2015-16Accounting & TaxationNo ratings yet

- Tax Saving GuideDocument36 pagesTax Saving GuideSamantha JNo ratings yet

- Llamas Vs OrbosDocument14 pagesLlamas Vs OrbosRynbert Anthony MaulionNo ratings yet

- Punjab High CourtDocument12 pagesPunjab High CourtpvigneshwarrajuNo ratings yet

- Poe v. Van Nort Et Al - Document No. 4Document1 pagePoe v. Van Nort Et Al - Document No. 4Justia.comNo ratings yet

- OR DMV Court ReportDocument3 pagesOR DMV Court ReportJeffrey FarrowNo ratings yet

- People v. SolidumDocument2 pagesPeople v. SolidumJames Amiel VergaraNo ratings yet

- Amiga Inc v. Hyperion VOF - Document No. 39Document25 pagesAmiga Inc v. Hyperion VOF - Document No. 39Justia.comNo ratings yet

- Admission and ConfessionDocument9 pagesAdmission and ConfessionAmmirul AimanNo ratings yet

- Family Code QDocument14 pagesFamily Code QpapaTAYNo ratings yet

- VICEU Vs Visayan Electric Company (2021)Document5 pagesVICEU Vs Visayan Electric Company (2021)Joshua DulceNo ratings yet

- Petition For Review 2 San GabrielDocument8 pagesPetition For Review 2 San GabrielRaffy PangilinanNo ratings yet

- BCI Moves Plea Urging SC To Direct Govt To Provide Interest-Free Loans Up To Rs 3 Lakhs Each For Lawyers in Need Due To COVID-19Document36 pagesBCI Moves Plea Urging SC To Direct Govt To Provide Interest-Free Loans Up To Rs 3 Lakhs Each For Lawyers in Need Due To COVID-19JAGDISH GIANCHANDANINo ratings yet

- Types of LeasingDocument7 pagesTypes of LeasingsanjuNo ratings yet

- Saqina Homework 1Document7 pagesSaqina Homework 1Shaqina Qanidya PNo ratings yet

- Doctrine of Part Performance Part - 1Document27 pagesDoctrine of Part Performance Part - 1Ankit SahniNo ratings yet

- UPDATED Judicial Affidavit of King StefanDocument5 pagesUPDATED Judicial Affidavit of King StefanKristine Lara Virata EspirituNo ratings yet

- People vs. OrdonoDocument2 pagesPeople vs. OrdonoCreshan Ellah Combate Soliven100% (1)

- Saratoga Springs City School District: Fund BalanceDocument13 pagesSaratoga Springs City School District: Fund BalanceBethany BumpNo ratings yet

- MB110715 OptDocument54 pagesMB110715 OptVince Bagsit PolicarpioNo ratings yet

- Disciplinary Action and Preventive SuspensionDocument29 pagesDisciplinary Action and Preventive SuspensionMar Jan GuyNo ratings yet

- G.R. No. L-36142. March 31, 1973 DigestDocument3 pagesG.R. No. L-36142. March 31, 1973 DigestMaritoni RoxasNo ratings yet

- Affidavit of Complaint: Page 3 1 VI. Certification Page 6Document12 pagesAffidavit of Complaint: Page 3 1 VI. Certification Page 6Trevor BallantyneNo ratings yet

- SenatorsDirectory PDFDocument200 pagesSenatorsDirectory PDFSajhad HussainNo ratings yet

- UNCITRALDocument2 pagesUNCITRALAnika zareenNo ratings yet

- Guide To Netaji MysteryDocument6 pagesGuide To Netaji MysteryLaxman DuggiralaNo ratings yet

- 8th Merit List BS Nursing Group A College of Nursing BAHAWALPUR Nursing Male Open Quota FA2023 Fall 2023Document1 page8th Merit List BS Nursing Group A College of Nursing BAHAWALPUR Nursing Male Open Quota FA2023 Fall 2023Muhammad ShahidNo ratings yet

- Rochester Police Department Pursuit PolicyDocument18 pagesRochester Police Department Pursuit PolicyRochester Democrat and ChronicleNo ratings yet

- Clark Clifford Politics of 1948Document25 pagesClark Clifford Politics of 1948whentheycomeNo ratings yet

- Sample Production Contract: DateDocument4 pagesSample Production Contract: DatePrashanthNo ratings yet

- Petitioner vs. vs. Respondent: en BancDocument14 pagesPetitioner vs. vs. Respondent: en BancRafie BonoanNo ratings yet

- 14 - Interview Transcript of Marc Elias (December 13, 2017)Document103 pages14 - Interview Transcript of Marc Elias (December 13, 2017)Monte AltoNo ratings yet