Professional Documents

Culture Documents

Finger Print Atm-1

Uploaded by

bhavanatmithun0 ratings0% found this document useful (0 votes)

39 views2 pagesMIDHUN PUBLICATIONS PRESENTS

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMIDHUN PUBLICATIONS PRESENTS

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

39 views2 pagesFinger Print Atm-1

Uploaded by

bhavanatmithunMIDHUN PUBLICATIONS PRESENTS

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

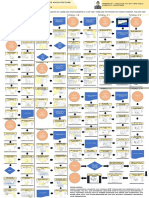

FINGER PRINT BASED ATM SYSTEM

ATM innovation paralleled the growth of the PC and telecommunications industries.

Each machine operated in a local mode without any connection to the banking

systems, and transaction authorization took place based on the information recorded

in the magnetic bands of the cards. The next step in the evolution of this industry

was to connect these devices to the bank’s centralized systems; by then, mid

-1980’s, banks would work in a dual modality, in other words, the ATM would work on

-line but in the event of communication loss it had the ability to authorize the

transaction with the information recorded on the magnetic band.

In the early 90’s, taking advantage of the technological boom in

microcomputers and communications, ATMs started to work exclusively on-line

implying that, if the ATM loss communication with its central system, there would not

be service. Once ATMs were connected directly, the need arose to protect the

information in the card and the client’s PIN (Personal Identification Number) found in

messages that had to travel across public telecommunication lines.

Biometric Technology

The term biometrics comes from the word bio (life) and metric (measurement).

Biometric equipment has the capability to measure, codify, compare, store, transmit,

and/or recognize a specific characteristic of a person with a high level of precision

and trustworthiness. Biometric technology is based on the scientific fact that there

are certain characteristics of living forms that are unique and not repetitive for each

individual; these characteristics represent the only technically viable alternative to

positively identify a person without the use of other forms of identification more

susceptible to fraudulent behavior.

Biometric identification is utilized to verify a person’s identity by measuring digitally

certain human characteristics and comparing those measurements with those that

have been stored in a template for that same person. Templates can be stored at

the biometric device, the institution’s database, a user’s smart card, or a Trusted

Third Party (TTP) Service Provider’s database. Where database storage is more

economic than plastic cards, the method tends to lack public acceptance; however,

Polemi (1997) found that TTPs can provide the confidence that this method is missing

by managing the templates in a trustful way.

Here we are trying to develop an ATM system based on finger print.

Here the system will do all the work of an ATM and will identify a person and the

person can do all transactions based on the finger print only.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Types of CN, Protocols and StandardsDocument29 pagesTypes of CN, Protocols and StandardsbhavanatmithunNo ratings yet

- New Text DocumentDocument1 pageNew Text DocumentbhavanatmithunNo ratings yet

- New Text DocumentDocument1 pageNew Text DocumentbhavanatmithunNo ratings yet

- Blue Eyes Technology: Midhun.TDocument27 pagesBlue Eyes Technology: Midhun.TbhavanatmithunNo ratings yet

- ASSEMBLE A PC EditerdDocument20 pagesASSEMBLE A PC EditerdbhavanatmithunNo ratings yet

- Blue Eyes TechnologyDocument31 pagesBlue Eyes TechnologyKrishna88% (16)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- How To Shrink The SQL Server LogDocument8 pagesHow To Shrink The SQL Server LogAnugerahSentotSudonoNo ratings yet

- Promoção, Ofertas e DescontosDocument809 pagesPromoção, Ofertas e DescontosClassificados DNo ratings yet

- AccentsDocument51 pagesAccentsFred WilpenNo ratings yet

- Personalization in Personalized Marketing - Trends and Ways ForwardDocument34 pagesPersonalization in Personalized Marketing - Trends and Ways ForwardMohamed Wassim SOUSSIANo ratings yet

- Lecture 2Document16 pagesLecture 2Saadia MobeenNo ratings yet

- CHAPTER 3 Data Modeling and Database DesignDocument54 pagesCHAPTER 3 Data Modeling and Database DesignErmi AlemNo ratings yet

- Galero Reanne 04 Task Performance 1Document4 pagesGalero Reanne 04 Task Performance 1Francis CaminaNo ratings yet

- Dicom Questionnaire v3.2Document10 pagesDicom Questionnaire v3.2Shkelzen KomoniNo ratings yet

- Falcon AnnouncementDocument2 pagesFalcon Announcementyimixem432No ratings yet

- Contextualized Online Search and Research SkillsDocument16 pagesContextualized Online Search and Research SkillsloveyNo ratings yet

- SpagoBI TutorialsDocument39 pagesSpagoBI TutorialsShiva RokaNo ratings yet

- ABAP On HANADocument114 pagesABAP On HANAgvrahulNo ratings yet

- Gis 1Document1 pageGis 1Muhd Naim Mohd PadzliNo ratings yet

- 1 s2.0 S2666827022001104 MainDocument9 pages1 s2.0 S2666827022001104 MainKushal MudaliyarNo ratings yet

- Software Requirements Specification FOR Data Storage and ManagementDocument11 pagesSoftware Requirements Specification FOR Data Storage and ManagementGunjan JiwnaniNo ratings yet

- AZ-304 File 1Document91 pagesAZ-304 File 1ANo ratings yet

- Amit BansalDocument11 pagesAmit BansalShray BansalNo ratings yet

- Intro To DDW ProcessesDocument22 pagesIntro To DDW Processesapi-3754320100% (1)

- Requirements of WhatsApp's DesignDocument7 pagesRequirements of WhatsApp's DesignMark FisherNo ratings yet

- Labsheet1 UpdatedDocument11 pagesLabsheet1 UpdateddeftsoftpNo ratings yet

- PBS CPCP Admin GuideDocument29 pagesPBS CPCP Admin GuidesharadcsinghNo ratings yet

- Concerto BrochureDocument2 pagesConcerto Brochureraina715No ratings yet

- Wrap-Up of TIF Databases: Location PublishingDocument14 pagesWrap-Up of TIF Databases: Location PublishingRajat SharmaNo ratings yet

- EOffice Implementation Handbook NewDocument26 pagesEOffice Implementation Handbook NewSuraj Singh RathoreNo ratings yet

- Vertica New Era in Dbms PerformanceDocument10 pagesVertica New Era in Dbms PerformanceRamprasadh KottapalliNo ratings yet

- Modern Computer Architecture Solution by Rafiquzzaman 6dan6nylDocument2 pagesModern Computer Architecture Solution by Rafiquzzaman 6dan6nyladhasbdi2e98qy928e0% (1)

- 5 KeysDocument32 pages5 KeysEshaNo ratings yet

- ID2f15b35da-1996 Ap Chem Scoring GuidelinesDocument2 pagesID2f15b35da-1996 Ap Chem Scoring GuidelinesCarey TirohangaNo ratings yet

- Multimedia Systems: CSE 228FDocument9 pagesMultimedia Systems: CSE 228FAthar Abd AlmonemNo ratings yet

- Dbms Lab ManualDocument144 pagesDbms Lab ManualAamerNo ratings yet