Professional Documents

Culture Documents

Crash of The Cult-Enron's Ethical Issues

Uploaded by

Ayande A.B ProsperOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Crash of The Cult-Enron's Ethical Issues

Uploaded by

Ayande A.B ProsperCopyright:

Available Formats

Leader: Crash of the cult | Business | The Guardian Page 1 of 1

Crash of the cult

Enron tolls the bell for deregulation

Leader

The Guardian, Friday 30 November 2001 11.38 GMT

Until a few weeks ago, a huge banner was strung across the headquarters of Enron in

Houston, emblazoned "The world's leading company". There were plenty who endorsed

the claim and the corporate culture of ambition, arrogance and rapid money-making

which lay behind it. Enron's revenue growth had been spectacular, from $7.6bn in 1986

to $101bn in 2000. The accolades from analysts, management consultants and internet

gurus poured in: as recently as last June, the Economist praised Enron for creating what

might be the "most successful internet venture of any company in any industry

anywhere". But, the banner was recently taken down and in one of the biggest corporate

collapses in US history, Enron's shares fell 85% on Wednesday (and more yesterday).

The corporation is now expected to file for bankruptcy in the next few days. But this is

more than a spectacular corporate saga, it also represents comeuppance for a form of

aggressive capitalism and political manipulation which earned Enron many enemies.

A combination of borrowing heavily and concealing it in "off-balance sheet" deals,

meant that the crisis only became apparent a month ago. The repercussions are now

beginning to emerge as the company's "aggressive accounting" - as the Wall Street

Journal put it - is unravelled, and major lenders such as JP Morgan Chase are likely to

be vulnerable. Not to mention the damage to thousands of Enron employees' pensions,

and the holdings of many investors in the US, who saw it as one of the surest bets of the

dot.com mania. But the energy markets have not been as shaken as was first feared

possible a month ago.

Losers apart, there will be many dancing on Enron's grave. In the US, it had attracted a

degree of notoriety for its part in the bungled privatisation of California's electricity,

which led to black-outs earlier this year. But it was in the developing world that Enron

had a near unparalleled reputation for corporate irresponsibility. It has been the only

company to warrant an entire Amnesty International report, a chilling catalogue of

human rights abuses from India to Latin America. The anti-corporate movement

accused Enron of subverting the political process of virtually every country in which it

operated to advance its interests. Enron was in the thick of one of India's biggest

corruption scandals in which huge sums were paid to politicians in the privatisation of

electricity firms.

Such deals abroad relied on close co-operation from friends back home in Washington,

and once again Enron lavishly paid into election campaign funds, most notably of

George W Bush. Key political figures were signed up as lobbyists and advisers. All the

political manoeuvring served the company's ideological vision of the primacy of free

markets, deregulation and privatisation. Enron was described as an "evangelical cult"

for the fervent advocacy of this vision by Enron founder and chairman, Kenneth Lay - a

vision from which he personally profited by millions. The fact that the finance director is

also now being investigated for possible irregularities suggests a culture of hubris and

greed at the company's core. For the anti-corporate movement, Enron is a major scalp

(though exposure of its wrongdoings was not the cause of the collapse). More

importantly, it is a reproof to stock traders who continued to boost Enron's shares long

after they had lost their understanding of its balance sheet. And it trounces for ever the

idea that public utilities can be subject to light regulation amid such speculative

profiteering.

file:///C:/Users/DELLLA~1/AppData/Local/Temp/Low/7RUSFJOO.htm 3/11/2011

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Index 2 PDFDocument1 pageIndex 2 PDFOmkar KaigudeNo ratings yet

- Weblogic Company Profile v1.3Document20 pagesWeblogic Company Profile v1.3atmoggy2003No ratings yet

- Exam Date Sub - Code/Name: 1 Semester:Forenoon:10 A.M. To 1 P.M. Session: DayDocument3 pagesExam Date Sub - Code/Name: 1 Semester:Forenoon:10 A.M. To 1 P.M. Session: DayMukesh BishtNo ratings yet

- Master 10 Project Management ProcessesDocument14 pagesMaster 10 Project Management ProcessesredvalorNo ratings yet

- What Is EEO?: Enforcing The LawDocument5 pagesWhat Is EEO?: Enforcing The LawAishaNo ratings yet

- Bs Architecture CurriculumDocument2 pagesBs Architecture CurriculumJohn Mathew BrionesNo ratings yet

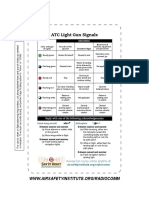

- At C Light Gun SignalsDocument1 pageAt C Light Gun SignalsJorge CastroNo ratings yet

- Answer Sheet Arts8 Q1Document12 pagesAnswer Sheet Arts8 Q1Nancy GelizonNo ratings yet

- Ae12 Economic DevelopmentDocument17 pagesAe12 Economic DevelopmentVanessaNo ratings yet

- Teachers Manual in Araling Panlipunan Grade 6Document3 pagesTeachers Manual in Araling Panlipunan Grade 6Angelica Rumbaua Guillermo56% (34)

- ENC101 SyllabusDocument4 pagesENC101 SyllabusbschwartzapfelNo ratings yet

- Comparison Between MRTP ACT and Goa, Diu and Daman Country Planning ActDocument17 pagesComparison Between MRTP ACT and Goa, Diu and Daman Country Planning ActaishwaryaumbarjeNo ratings yet

- Lakeside Park Subdivision San Pablo City LagunaDocument2 pagesLakeside Park Subdivision San Pablo City LagunaRose VecinalNo ratings yet

- Checklist Before Taking Possession of Your New ApartmentDocument2 pagesChecklist Before Taking Possession of Your New Apartmentjamy862004100% (1)

- MFT TransponderDocument1 pageMFT TransponderAntony Jacob AshishNo ratings yet

- ARTICLE VI Legislative PowerDocument18 pagesARTICLE VI Legislative PowerMelvin PernezNo ratings yet

- Toward A Theory of Second Language Acquisition (SLA)Document134 pagesToward A Theory of Second Language Acquisition (SLA)dinaNo ratings yet

- Artigo Sobre Estratégia MintzbergDocument31 pagesArtigo Sobre Estratégia Mintzbergarr3000No ratings yet

- Foundation of EducationDocument106 pagesFoundation of Educationsweetgirlyanne1491% (11)

- Electoral Reforms in India - Indian PolityDocument4 pagesElectoral Reforms in India - Indian PolityShweta Jain100% (1)

- AAU Prospective Graduates of 2020 PDFDocument343 pagesAAU Prospective Graduates of 2020 PDFyakadimaya4388% (17)

- The Time of The SelfDocument304 pagesThe Time of The SelfJonny Hudson100% (1)

- Home-based learning English phonicsDocument4 pagesHome-based learning English phonicseiza13No ratings yet

- Level 1: Wilmont Pharmacy'S Organizational ChartDocument4 pagesLevel 1: Wilmont Pharmacy'S Organizational ChartHVNo ratings yet

- MSBTE Diploma 6th Semister Management MCQDocument15 pagesMSBTE Diploma 6th Semister Management MCQDevendra KanadeNo ratings yet

- L9 1 Lis Read Homework 20 9Document5 pagesL9 1 Lis Read Homework 20 9Rikki RoukiNo ratings yet

- Split Approach Sched G7 G10Document20 pagesSplit Approach Sched G7 G10Aaron James LicoNo ratings yet

- Dialogue VII Half Yearly 2019Document6 pagesDialogue VII Half Yearly 2019Tashdid RahmanNo ratings yet

- CambridgeDocument34 pagesCambridgeNatali SidorenkoNo ratings yet

- Epistemic Colonialism Is It Possible To PDFDocument23 pagesEpistemic Colonialism Is It Possible To PDFNarciso Meneses ElizaldeNo ratings yet