Professional Documents

Culture Documents

02a Finance Function (Accountants Today)

Uploaded by

LUNBABEDAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02a Finance Function (Accountants Today)

Uploaded by

LUNBABEDACopyright:

Available Formats

FINANCE & ACCOUNTING

PROVING THE VALUE OF THE

Finance Function

by Sir Andrew Likierman

The finance function can

no longer rest on its laurels

and assume that everyone

in the business knows it’s

indispensable. How can

financial managers go

about proving their value?

O

nce upon a time, finance did

not have to discuss its own

performance. The function

was seen as essential, al-

though the reasons why it was essential

were understood only hazily by outsiders.

But that’s no longer the case. Inexorable

cost pressures have exposed finance to in-

creasing scrutiny and it is as much a po-

tential target for cost-cutting as any other

activity. Technology and outsourcing are

often the most obvious way to achieve such

savings.

Even without cost pressures, if finance

fails to explain how it adds value, it will lose

out in the competition for scarce resources.

The whole business will suffer as a result,

so good performance measures are essen-

tial weapons for those fighting for the right

resources to do the job.

But first there must be a health warn-

ing. The finance core assumed here is pri-

vate sector (overall lessons may also be

relevant to the public sector), including

external reporting, risk and compliance,

treasury and tax, investor relations, trans-

action processing, costing, planning and

control. But there are huge variations in

April 2005 • ACCOUNTANTS TODAY 35

Proving the Value of the Finance Function

the way departments are organised. It is a “Inexorable cost pressures have cess or failure directly to finance. This

question not only of size, whether you have measurement problem becomes worse the

one part-time unqualified bookkeeper or exposed finance to increasing more the function embeds itself into line

hundreds of trained professionals — but scrutiny and it is as much a management.

also of the degree of centralisation and in-

tegration. The boundaries vary greatly too, potential target for cost-cutting Choosing measures

with IT, strategy, performance and other The implication of these problems is that

functions sometimes inside the finance

as any other activity.” it may be impossible to give an unambigu-

department and sometimes outside it. This ous answer to the question “how well is fi-

article therefore highlights ways to test organisation has not gone bankrupt is nance doing?” The good news is that there

existing practice and does not attempt to hardly a knockout argument. Good rela- are many ways to use performance mea-

give one ‘answer’, regardless of the circum- tions with the bank and the external audi- sures to provide solid evidence.

stances. tors may be a sign of strength, but they 䡲 Connect the performance of the function

could also mean that the organisation is the to objectives and constraints for the

Getting there

When first asked to measure per for-

mance, the understandable temptation for

financial managers is to use their numeri-

cal skills to crack the problem. Popular

measures include cost over the past five

years, numbers employed compared with

last year and the proportion of invoices

paid on time. The advantage of these mea-

sures is that they are precise. The prob-

lem is that the bare numbers give only a

partial picture. What about quality?

So next there are measures to plug gaps,

including customer satisfaction question-

naires, the number of days it takes to pro-

vide financial information and, perhaps, a

balanced scorecard. This gives better in-

formation, yet rarely provides an answer

to the question “how well is finance doing?”

At this stage it is tempting to give up and

simply say that everything is not only es- loser in these key relationships. How organisation as a whole, and to the expec-

sential, but, because of IT and outsourcing, would we measure this issue anyway? tations of its management. This needs to

it is getting cheaper. Resist this temptation. Life isn’t made easier by poor feedback. be done at least once a year at budget

It’s vital to continue asking questions and Unless they have recently worked else- time, when the expectations — including

helping the function to define its perfor- where, most ‘customers’ will not possess trade-offs in cost and time — of line and

mance. enough information to make judgements. senior management are formed. Two ex-

What should finance functions do? Be- Many long-serving managers lack wider amples are understanding the disadvan-

fore even thinking about measurement, experience to be clear about trade-offs, op- tages of an aggressive tax strategy and

they need to recognise the problems. portunity costs and risks. Is it better to have agreeing with the marketing and purchas-

These usually start with poor links to monthly management information mostly ing department the implications of man-

organisational objectives. There is no easy right after one week or much more accu- aging working capital to its limits. These

answer here and those outside the func- rately after two? It’s often assumed that cur- expectations should also be part of the

tion rarely know enough to distinguish rent practice is the only way to do things. It targets that are set, perhaps in formal ser-

between what’s optional and what’s re- is only after you add non-financial measures, vice agreements.

quired. This applies as much to traditional forward-looking information, charts, a re- 䡲 Increase the sophistication of the mea-

activities such as budgeting as to newer ally useful commentary and perhaps some sures and the way they are used. This

ones such as risk. Then there’s the thorny colour that the board realises the good old should start by shifting the focus away

issue of measuring the results — outcomes system was in fact pretty terrible. from measuring cost and activity to-

rather than inputs. It’s all very well to chant Lastly, because boundaries are so fluid, wards outcomes, signalling that perfor-

the mantra of the need to add value, but and responsibility for parts of the work is mance is about delivery, not effort. Rather

how would we know? The fact that the shared, it’s often difficult to ascribe suc- than using cost (or even no measure) for

36 ACCOUNTANTS TODAY • April 2005

Proving the Value of the Finance Function

”As finance becomes

more integrated into the

rest of the organisation,

as outsourcing becomes

recognised as a perma-

nent option, as the focus

moves towards added

value, so it becomes

increasingly hard to

define its success.”

reporting, why not use a combination of you talked about performance to HR or IT? cussions allow you to try out new ideas

financial and non-financial measures and When making comparisons, the correct as well as to find out whether other

commentary for external reporting, and unit of analysis will be relevant individual people think finance supports them.

customer feedback and comparisons for activities. For example, response times will You could also tr y using the head of

internal reporting and control? vary for different activities, but you could finance’s annual performance appraisal

The message should be reinforced by discuss the approach with the IT depart- to discuss progress against objectives,

setting targets at levels defined by the ment. Similarly, it may be worth discuss- changes to requirements and quality

organisation’s objectives and customers, ing approaches for quantifying costs and standards and trade-offs. How well was

not by finance. Indeed, people outside benefits with research and development. that unexpected hedging package put to-

the department should be used wher- 䡲 Improve the quality of feedback provided gether? Overall, how did the treasury

ever possible. They could be from an- to, and given by, finance. Customer sat- function cope with the unforeseen dur-

other function (such as HR), from an- isfaction is a crucial indicator of success- ing the year?

other organisation (I’ll appraise yours if ful outcomes, but this is tricky to mea-

you’ll appraise mine), the auditors or an sure because customer perceptions are Conclusion

external consultant. All of these have dominated by current practice — they As finance becomes more integrated into

disadvantages in terms of knowledge, don’t know what they don’t know. You the rest of the organisation, as outsourcing

independence and cost, but the most must not only determine whether cus- becomes recognised as a permanent op-

important benefit is that they have a tomers are satisfied with what finance de- tion, as the focus moves towards added

fresh view on, for example, the extent to cides to provide; you must also help value, so it becomes increasingly hard to

which the function initiates action. them to understand what is possible. For define its success. Financial managers

䡲 Use comparisons wherever possible. Best example, ever yone may be used to a need to deal with these complexities by

practice should involve a constant search, budgeting routine, but they may not see moving away from cost and activity mea-

even by those who reckon they are possible improvements from sharpening surement and towards closer links to ob-

among the leaders. The ideal, obviously, some processes and cutting others. jectives, more sophisticated measurement,

is to compare best practice in functions You should construct questionnaires better comparisons and improved feed-

that are as similar as possible, but this with great care. Comparing what cus- back. Doing so will improve the ability of

may prove difficult. Where do you begin? tomers think with what finance thinks is those in finance to identify their contribu-

Large organisations with decentralised fi- more useful than simply asking: “Were tion, benefiting all who work in it and the

nance functions should start with intra- you happy with the service (yes, no or organisation as a whole. AT

firm comparisons. Smaller organisations quite)?” Indeed, questionnaires may not

can look at other finance functions, per- even be appropriate. Face-to-face feed- Sir Andrew Likierman is a professor of manage-

haps through a benchmarking club. Also ment practice at the London Business School.

back on questions sent out earlier, prob-

This article is contributed by CIMA and it first

consider using other service functions in ably at budget time, give a better idea appeared in Financial Management, CIMA’s

your organisation. When was the last time about what people really think. Such dis- monthly magazine for accountants in business.

April 2005 • ACCOUNTANTS TODAY 37

You might also like

- Project Profitability: Ensuring Improvement Projects Achieve Maximum Cash ROIFrom EverandProject Profitability: Ensuring Improvement Projects Achieve Maximum Cash ROINo ratings yet

- Good Practice Note: Managing Retrenchment (August 2005)Document28 pagesGood Practice Note: Managing Retrenchment (August 2005)IFC Sustainability100% (1)

- Introduction To Managerial Accounting: Discussion QuestionsDocument5 pagesIntroduction To Managerial Accounting: Discussion QuestionsParth GandhiNo ratings yet

- DR Responsibilities Databarracks.01Document1 pageDR Responsibilities Databarracks.01CarlosNo ratings yet

- The Perform SystemDocument18 pagesThe Perform Systemapi-20008007No ratings yet

- Deloitte Uk Finance Business PartneringDocument16 pagesDeloitte Uk Finance Business PartneringrubenrealperezNo ratings yet

- The Central IssueDocument3 pagesThe Central IssueJosé RodríguezNo ratings yet

- The Power of Procurement A Global Survey of Procurement Functions PDFDocument68 pagesThe Power of Procurement A Global Survey of Procurement Functions PDFTetiana SchipperNo ratings yet

- Gestion de AlmacenDocument11 pagesGestion de Almacenjuan carlosNo ratings yet

- Best Practices in Financial Planning and Analysis: White PaperDocument8 pagesBest Practices in Financial Planning and Analysis: White PaperManikantan NatarajanNo ratings yet

- FM Realising The ValueDocument16 pagesFM Realising The ValueEduardo VianaNo ratings yet

- Outsourcing Fund Administration 1Document5 pagesOutsourcing Fund Administration 1aashinerrNo ratings yet

- CMMS Manwinwin Article - Importance of Maintenance FunctionDocument2 pagesCMMS Manwinwin Article - Importance of Maintenance FunctionFawaaz KhurwolahNo ratings yet

- A Balanced Approach: by Ketan VariaDocument4 pagesA Balanced Approach: by Ketan VariaAmber PreetNo ratings yet

- Making It StickDocument12 pagesMaking It Sticktoya.incorporatedNo ratings yet

- Monitor Getting Off RollercoasterDocument24 pagesMonitor Getting Off Rollercoasterquizzy226No ratings yet

- $study On The Imapct of Change in Organisational Behaviour in Marriott HotelDocument9 pages$study On The Imapct of Change in Organisational Behaviour in Marriott HotelRomiNo ratings yet

- A CEO Guide For Avoiding Ten TrapsDocument9 pagesA CEO Guide For Avoiding Ten TrapsLuis BarretoNo ratings yet

- Maq Winter 2009 Kren PDFDocument12 pagesMaq Winter 2009 Kren PDFarmagedeonNo ratings yet

- WP Corporate Actions ProcessingDocument20 pagesWP Corporate Actions ProcessingAzim BawaNo ratings yet

- Interim Executives Achieve Goals 20 Times Faster: Cutting Perks?Document4 pagesInterim Executives Achieve Goals 20 Times Faster: Cutting Perks?Tim DixonNo ratings yet

- Finance TransformationDocument16 pagesFinance Transformationzavalase100% (1)

- Hedge Fund Start-Up Guide - Bloomberg, AIMADocument43 pagesHedge Fund Start-Up Guide - Bloomberg, AIMAgchagas6019100% (1)

- McKinsey - A Better Way To Cut CostsDocument4 pagesMcKinsey - A Better Way To Cut Costsgweberpe@gmailcomNo ratings yet

- Toward A Leaner Finance DepartmentDocument6 pagesToward A Leaner Finance DepartmentRafnunNo ratings yet

- IFAC Future Fit Accountant ROLES V5 SinglesDocument16 pagesIFAC Future Fit Accountant ROLES V5 SinglesssasfNo ratings yet

- BAIN BRIEF When The Front Line Should Lead A Major TransformationDocument8 pagesBAIN BRIEF When The Front Line Should Lead A Major TransformationsilmoonverNo ratings yet

- Lu Uk Value Creation Through MaDocument24 pagesLu Uk Value Creation Through MaVijayavelu AdiyapathamNo ratings yet

- Alignment GapDocument2 pagesAlignment GapLeor FranksNo ratings yet

- 10 Principles of ManufacturingDocument4 pages10 Principles of Manufacturingsarwan85806167% (3)

- 5 Essential Principles For A Better Strategy Review (Palladium 2015)Document8 pages5 Essential Principles For A Better Strategy Review (Palladium 2015)Grant MillinNo ratings yet

- Future Finance Report FinanceDocument46 pagesFuture Finance Report Financesteve.tranNo ratings yet

- Why BSCs FailDocument6 pagesWhy BSCs Failshepherd junior masasiNo ratings yet

- G, Z:,%GR,: Bringing Quality Management Into FocusDocument5 pagesG, Z:,%GR,: Bringing Quality Management Into Focusabdullah aashif aliNo ratings yet

- What Are The Pitfalls of Outsourcing Your Facilities Management?Document12 pagesWhat Are The Pitfalls of Outsourcing Your Facilities Management?Sahana GowdaNo ratings yet

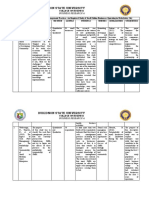

- Bukidnon State University: Business Research ADocument9 pagesBukidnon State University: Business Research AkwyncleNo ratings yet

- Todays-Interdisciplinary-Auditors Joa Eng 0919Document5 pagesTodays-Interdisciplinary-Auditors Joa Eng 0919Koyel BanerjeeNo ratings yet

- LO27 Epstein & Wisner 2011 Using A BSC To Implement SustainabilityDocument11 pagesLO27 Epstein & Wisner 2011 Using A BSC To Implement SustainabilitymiguelNo ratings yet

- The Role of Performance Appraisal System in Hindustan Unilever LimitedDocument5 pagesThe Role of Performance Appraisal System in Hindustan Unilever LimitedSaahi Seenivasan100% (1)

- 1 OneTelDocument7 pages1 OneTelLordson Ramos100% (1)

- This Study Resource Was: Philippine Christian UniversityDocument3 pagesThis Study Resource Was: Philippine Christian UniversityFred Nazareno Cerezo100% (2)

- CAREERS 10 Qualities of Successful Financial ExecutivesDocument2 pagesCAREERS 10 Qualities of Successful Financial ExecutivesmariaNo ratings yet

- A New Blueprint For SuccessDocument7 pagesA New Blueprint For Successgelir30719No ratings yet

- F1 and F2 Fmarticleseptember 09Document2 pagesF1 and F2 Fmarticleseptember 09Md. Mostafizur RahmanNo ratings yet

- Hedge Fund AdministrationDocument3 pagesHedge Fund AdministrationRDNo ratings yet

- Third-party-Risk-Management Joa Eng 0317Document6 pagesThird-party-Risk-Management Joa Eng 0317jmonsa11No ratings yet

- Next Generation Internal Audit ProtivitiDocument20 pagesNext Generation Internal Audit ProtivitiFandi Arya PratamaNo ratings yet

- Narrative Reporting: Give Yourself A Head StartDocument22 pagesNarrative Reporting: Give Yourself A Head StartBaiq AuliaNo ratings yet

- CIMA - P2 - Performance Management - Useful Articles - Ian Herbert - EmpowermentDocument3 pagesCIMA - P2 - Performance Management - Useful Articles - Ian Herbert - Empowermente_NomadNo ratings yet

- Sample Business Development PlanDocument6 pagesSample Business Development PlanlaylaNo ratings yet

- Finance Effectiveness Benchmark 2017Document72 pagesFinance Effectiveness Benchmark 2017aditya mishraNo ratings yet

- Seminar 4 - Zoe RadnorDocument22 pagesSeminar 4 - Zoe RadnortpapadopNo ratings yet

- Ch1 - Managerial Accounting and The Business EnvironmentDocument29 pagesCh1 - Managerial Accounting and The Business EnvironmentehtikNo ratings yet

- Disruption To BusinessDocument4 pagesDisruption To Businessregina.phalangeNo ratings yet

- Makalah Business FinanceDocument18 pagesMakalah Business FinanceDaniel SihotangNo ratings yet

- 5minutes of PowerDocument6 pages5minutes of PowerHassan AskaryNo ratings yet

- TEI of Microsoft Dynamics 365 Business CentralDocument26 pagesTEI of Microsoft Dynamics 365 Business Centraljain0287ankitNo ratings yet

- CHAPTER 5 Hansen Mowen Solution ManualDocument37 pagesCHAPTER 5 Hansen Mowen Solution ManualMark SaysonNo ratings yet

- The Pitfalls of Pay-For-Performance: by Wim Van Der StedeDocument4 pagesThe Pitfalls of Pay-For-Performance: by Wim Van Der StedeDwii CheerzNo ratings yet

- Frequent Downsizing BlundersDocument5 pagesFrequent Downsizing BlundersRight Management100% (1)

- Questionnaire On Relevance of Plastic MoneyDocument5 pagesQuestionnaire On Relevance of Plastic MoneyUtsav Shah87% (15)

- Proposed Date Sheet For Exam April-2013as On 5-2-2013Document60 pagesProposed Date Sheet For Exam April-2013as On 5-2-2013princerattanNo ratings yet

- Role of Financial Institutional Investors in Capital Market in IndiaDocument86 pagesRole of Financial Institutional Investors in Capital Market in Indiaron8772100% (13)

- Gaurav's SlidesDocument9 pagesGaurav's SlidesLUNBABEDANo ratings yet

- Primary and Secondary DataDocument25 pagesPrimary and Secondary DataHemant MewaraNo ratings yet

- Assembly Line BalancingDocument4 pagesAssembly Line BalancingLUNBABEDANo ratings yet

- Assembly Line BalancingDocument4 pagesAssembly Line BalancingLUNBABEDANo ratings yet

- Episode Transcript: Episode 34 - Chinese Han Lacquer CupDocument2 pagesEpisode Transcript: Episode 34 - Chinese Han Lacquer CupParvathy SubramanianNo ratings yet

- Nokia 3g Full Ip CommissioningDocument30 pagesNokia 3g Full Ip CommissioningMehul JoshiNo ratings yet

- Letter of Intent Date: 18-Feb-2019 Mr. Ravi Mishra,: For Multiplier Brand Solutions PVT LTDDocument2 pagesLetter of Intent Date: 18-Feb-2019 Mr. Ravi Mishra,: For Multiplier Brand Solutions PVT LTDRavi MishraNo ratings yet

- SRM 7 EHP 4 Release Notes PDFDocument18 pagesSRM 7 EHP 4 Release Notes PDFMOHAMMED SHEHBAAZNo ratings yet

- APS PresentationDocument32 pagesAPS PresentationRozack Ya ZhackNo ratings yet

- R35 Credit Analysis Models - AnswersDocument13 pagesR35 Credit Analysis Models - AnswersSakshiNo ratings yet

- File 1) GRE 2009 From - Nov - 18 PDFDocument84 pagesFile 1) GRE 2009 From - Nov - 18 PDFhuyly34No ratings yet

- Welding and Heat Treatment Requirements For Equipment and PipingDocument34 pagesWelding and Heat Treatment Requirements For Equipment and Pipingonur gunesNo ratings yet

- T10 - PointersDocument3 pagesT10 - PointersGlory of Billy's Empire Jorton KnightNo ratings yet

- Subsea Pipeline Job DescriptionDocument2 pagesSubsea Pipeline Job DescriptionVijay_DamamNo ratings yet

- Ken Holt 06 The Secret of Hangman's InnDocument216 pagesKen Holt 06 The Secret of Hangman's InnPastPresentFuture100% (2)

- No Experience ResumeDocument2 pagesNo Experience ResumeNatalia PantojaNo ratings yet

- Rich Gas and Lean GasDocument7 pagesRich Gas and Lean GasManish GautamNo ratings yet

- International Rice Research Newsletter Vol12 No.4Document67 pagesInternational Rice Research Newsletter Vol12 No.4ccquintosNo ratings yet

- Job Sheet 1Document5 pagesJob Sheet 1Sue AzizNo ratings yet

- Test Cases: Project Name: Virtual ClassroomDocument5 pagesTest Cases: Project Name: Virtual ClassroomTina HernandezNo ratings yet

- TEFL Entrance ExamDocument3 pagesTEFL Entrance ExammerekNo ratings yet

- Sorting Algorithms in Fortran: Dr. Ugur GUVENDocument10 pagesSorting Algorithms in Fortran: Dr. Ugur GUVENDHWANIT MISENo ratings yet

- Lesson Plan Wid Awt Method 2Document7 pagesLesson Plan Wid Awt Method 2Yan LianNo ratings yet

- 064 DIR - Launching Whipping Creme & Skimmed Milk Di Channel Horeka (Subdist Masuya)Document3 pages064 DIR - Launching Whipping Creme & Skimmed Milk Di Channel Horeka (Subdist Masuya)indra sapta PrahardikaNo ratings yet

- Review Problems On Gas TurbineDocument9 pagesReview Problems On Gas TurbinejehadyamNo ratings yet

- 28 ESL Discussion Topics Adult StudentsDocument14 pages28 ESL Discussion Topics Adult StudentsniallNo ratings yet

- Preliminary Voters ListDocument86 pagesPreliminary Voters Listمحمد منيب عبادNo ratings yet

- GENUS Clock Gating Timing CheckDocument17 pagesGENUS Clock Gating Timing Checkwasimhassan100% (1)

- Cell Structure, Cellular Respiration, PhotosynthesisDocument14 pagesCell Structure, Cellular Respiration, PhotosynthesisAmr NasserNo ratings yet

- ISO 11064-12000 Ergonomic Design of Control Centres - Part 1 Principles For The Design of Control Centres by ISO TC 159SC 4WG 8Document6 pagesISO 11064-12000 Ergonomic Design of Control Centres - Part 1 Principles For The Design of Control Centres by ISO TC 159SC 4WG 8marcianocalvi4611100% (2)

- Electric Machinery and Transformers - I. L. Kosow PDFDocument413 pagesElectric Machinery and Transformers - I. L. Kosow PDFzcjswordNo ratings yet

- 2019q123.ev3-Descon Engro Level Gauges-QDocument7 pages2019q123.ev3-Descon Engro Level Gauges-Qengr_umer_01No ratings yet

- Theben Timer SUL 181DDocument2 pagesTheben Timer SUL 181DFerdiNo ratings yet

- MT4 EA Installation Guide Digital - EnglishDocument7 pagesMT4 EA Installation Guide Digital - EnglishThe Trading PitNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet