Professional Documents

Culture Documents

Budget Analysis 2011-12 (RR)

Uploaded by

Gandharav BajajOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

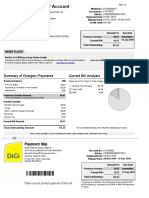

Budget Analysis 2011-12 (RR)

Uploaded by

Gandharav BajajCopyright:

Available Formats

TM

Budget Analysis 2011-12 28th FEB 2011

RR, All rights reserved Page 1 of 10

Budget Analysis - 2011-12

RR View

The budget aims to sustain economic growth, strengthen infrastructure, moderate the price rise, particularly of

agricultural produce and reduce social imbalances through inclusive development.

Overall, the centre’s direct tax reliefs will cost Pranab Mukherjee Rs 11,500 crore, while his indirect tax levies will

bring in Rs 11,300 crore. The fiscal deficit will be contained at 4.6% next year against 5.1% this year, with the

2013-14 target being 3.5%.

Allowing FII investment into the mutual fund is the big positive for the financial market. This will result in

integration of the markets and we will see lot of foreign money coming in next fiscal year. The reduction of

corporate surcharge is good for equity market as it will marginally reduced the tax outgo of companies. Foreign

institutional and non-institutional investors get more options for investment, a good move for market.

Individual taxpayers get a higher basic deduction of Rs 1.8 lakh; now taxpayers get a relief of Rs 2,000. The step

is not enough seeing the inflation in the country. There is an increase in the exemption limit to Rs 2.5 lakh, the

entitlement age for senior citizens reduced to 60.

A new class of super senior citizens aged above 80 introduced with higher IT exemption limit of Rs 5 lakh.

However, this will benefit an insignificant pie of the Indian population.

Service tax to remain constant at 10% with several new services has been added in the list. The move is expected

to be negative for Hotels, five-star restaurants and airlines.

The base excise rate constant at 10%, but exemptions on 130 items has been withdrawn. And a basic rate of 1%

is being levied. This will further push the inflation up. Important to note here is that another 240 items that are

still exempt will be attracting tax when the GST (Goods and Services Tax) is introduced next year.

There was a talk of Inflation, reforms and black money generation, but nothing concrete announcement

witnessed.

Subsidies on fertiliser, kerosene and cooking gas (LPG) will be cash-based by March, 2012. No measures on fuel

deregulation were announced.

The public sector disinvestment target has been upped to Rs 40,000 crore in 2011-12; the current fiscal’s target

was reduced to 22,144 crore due to higher realisations from other sources. We may see further delay in much

talked about ONGC FPO.

Worth Rs 30,000 crore of tax-free bonds will be on offer next year, the Rs 20,000 additional tax deduction

available for investing in infra bonds will be retained for another year. We may see infrastructure growth in line.

Major Announcements

Taxes

¾ Personal income tax exemption limit raised to Rs 180,000 from Rs 160,000 for individual tax payers.

¾ For senior citizens, the qualifying age reduced to 60 years from 65 years and exemption limit raised to Rs 2.50

lakh from Rs 2.40 lakh.

¾ Citizens over 80 years to have exemption limit of Rs 5 lakh.

¾ A new revised income tax return form 'Sugam' to be introduced for small tax payers.

¾ Standard rate of excise duty held at 10 %; no change in CENVAT rates.

¾ Service tax rate kept at 10 %.

¾ Peak rate of customs duty maintained at 10 % in view of the global economic situation.

¾ To reduce surcharge on domestic companies to 5 % from 7.5 %.

¾ To raise MAT (Minimum Alternate Tax) to 18.5 % from 18 %.

¾ Iron ore export duty raised to 20 %.

¾ Nominal one per cent central excise duty on 130 items entering the tax net. Basic food and fuel and precious

stones, gold and silver jewellery will be exempted.

¾ Basic customs duty on agricultural machinery reduced to 4.5 % from 5 %.

¾ Service tax widened to cover hotel accommodation above Rs 1,000 per day, A/C restaurants serving liquor, some

category of hospitals, diagnostic tests.

¾ Service tax on air travel increased by Rs 50 for domestic travel and Rs 250 for international travel in economy

class. On higher classes, it will be 10 % flat.

RR, All rights reserved Page 2 of 10

Budget Analysis - 2011-12

Fiscal Deficit

¾ Fiscal deficit seen at 5.1 % of GDP in 2010-11.

¾ Fiscal deficit seen at 4.6 % of GDP in 2011-12.

¾ Fiscal deficit seen at 3.5 % of GDP in 2013-14.

Revenue

¾ Gross tax receipts seen at 9.32 trillion rupees in 2011-12.

¾ Non-tax revenue seen at 1.25 trillion rupees in 2011-12.

Spending

¾ Total expenditure in 2011-12 seen at 12.58 trillion rupees.

¾ Plan expenditure seen at 4.41 trillion rupees in 2011-12, up 18.3 %

Growth, Inflation Expectations

¾ Economy expected to grow at 9 % in 2012, plus or minus 0.25 %.

¾ Inflation seen lower in the financial year 2011-12.

Disinvestment

¾ Disinvestment in 2011-12 seen at 400 billion rupees.

Borrowing

¾ Net market borrowing for 2011-12 seen at Rs 3.43 trillion compared to Rs 3.45 trillion in 2010-11.

Policy Reforms

¾ To create infrastructure debt funds.

¾ To boost infrastructure development with tax-free bonds of Rs 300 billion.

¾ Food security bill to be introduced this year.

¾ To permit SEBI registered mutual funds to access subscriptions from foreign investments.

¾ Raised foreign institutional investor limit in 5-year corporate bonds for investment in infrastructure by $20 billion.

¾ Public debt bill to be introduced in parliament soon.

Sector Spending

¾ To allocate more than 1.64 trillion rupees to defense sector in 2011-12.

¾ Corpus of rural infrastructure development fund raised to 180 billion rupees in 2011-12.

¾ To provide 201.5 billion rupees capital infusion in state-run banks in 2011-12.

¾ To allocate 520.5 billion rupees for the education sector.

¾ To raise health sector allocation to 267.6 billion rupees.

Agriculture

¾ Removal of supply bottlenecks in the food sector will be in focus in 2011-12.

¾ To raise target of credit flow to agriculture sector to 4.75 trillion rupees.

¾ Gives 3 % interest subsidy to farmers in 2011-12.

¾ Cold storage chains to be given infrastructure status.

¾ Capitalization of National Bank for Agriculture and Rural Development (NABARD) of 30 billion rupees in a phased

manner.

¾ To provide 3 billion rupees for 60,000 hectares under palm oil plantation.

¾ Actively considering new fertilizer policy for urea.

On the State of the Economy

¾ Fiscal consolidation has been impressive. This year has also seen significant progress in those critical institutional

reforms that will pave the way for double digit growth in the near future.

¾ At times the biggest reforms are not the ones that make headlines, but the ones concerned with details of

governance which affect the everyday life of aam aadmi (common man). In preparing this year's budget, I have

been deeply conscious of this fact.

¾ Food inflation remains a concern

¾ Current account deficit situation poses some concern

¾ Must ensure that private investment is sustained

¾ The economy has shown remarkable resilience.

On Governance

¾ "Certain events in the past few months may have created an impression of drift in governance and a gap in public

accountability ... such an impression is misplaced."

¾ Corruption is a problem, must fight it collectively.

RR, All rights reserved Page 3 of 10

Budget Analysis - 2011-12

Aam Aadmi Impact

Budget has more negatives than positives for a common man.

Positives

¾ Personal income tax exemption limit for individual tax payers raised to Rs 1.8 lakh from Rs 1.6 lakh.

¾ Tax exemption limit for senior citizens increased to Rs 2.5 lakh from Rs 2.4 lakh.

¾ Eligible age for senior citizens reduced to 60 years against 65 years.

¾ No new tax exemption limits for women.

¾ Tax exemption limit for ‘very senior’ citizens over 80 years at Rs.5 lakh.

¾ Deduction of Rs. 20000 for investment in Infrastructure bonds has been extended for one more year.

¾ Contribution to New Pension Scheme by employer shall be eligible for tax rebate in addition to Rs. 1 Lakh

deduction allowed under section 80C.

¾ Focus on Agricultural production and stress on giving impetus to growth in agricultural will help increase food

supply and consequent reduction in food inflation.

¾ Items that will become cheaper include solar lanterns, LED lights, hybrid vehicle kits.

Negatives

¾ 5% service tax on all services provided by hospitals with 25 or more beds that have the facility of central air-

conditioning. However, all government hospitals shall be outside this levy. Health Check-Ups in Private hospitals

to become expensive.

¾ Services provided by life insurance companies brought under service tax net.

¾ Hotel stay will also become more expensive as rooms with a tariff of more than Rs 1,000 a day will attract an

effective service tax of 5 per cent. Drinking liquor in air-conditioned restaurants will also be more expensive as it

will now come under the service tax net.

¾ Pay more for branded jewellery: Government has reintroduced 1% excise duty on branded jewellery and branded

articles made from precious metals like gold, silver and platinum after waiving it two years ago.

¾ Airline travel become expensive: Domestic travel to pay Rs 50 service tax, Rs 250 on international travel

¾ Optional levy on branded garments or made up proposed to be converted into a mandatory levy at unified rate of

10 per cent.

¾ Ready-to-eat food items, such as ketchups, soups, 'mudis' (puffed rice), coffee and tea mixes, flavoured milk,

supari will be dearer as they will now attract higher excise duty.

¾ Notebooks and exercise books, which were earlier exempted from excise duty will now attract one per cent duty

without CENVAT credit facility. Moreover, a general effective rate of 5 per cent has been prescribed for these

items and facilities.

¾ Similarly, fountain pen ink, ball pen ink, geometry boxes, colour boxes and pencil sharpeners will also now attract

a similar levy.

¾ Legal cases will also become a costly affair with Mukherjee proposing to cover all legal consultations, except

individual to individual, under the service tax net.

RR, All rights reserved Page 4 of 10

Budget Analysis - 2011-12

Sectoral Impact

Announcements Rationale

Agriculture

Credit flow for farmers raised from Rs. 3,75,000 crore Positive for FMCG companies like HUL, Dabur, Colgate, Marico,

to Rs. 4,75,000 crore in 2011-12. ITC, GPCL

Interest subvention proposed to be enhanced from 2 Positive for FMCG companies like HUL, Dabur, Colgate, Marico,

per cent to 3 per cent for providing short-term crop ITC, GPCL

loans to farmers who repay their crop loan on time. Positive for Banking Sector as they can expand exposure to

agriculture sector and fulfill priority lending requirements

Airlines

The service tax on air travel has been raised by 50 It will negatively impact shares of Jet Airways , Kingfisher Airlines

rupees for domestic travel and 250 rupees for and SpiceJet

international travel on economy class,

Auto

Higher allocation under NREGA and infrastructure Infrastructure development will be a boon for the auto sector,

schemes specifically CV segment. Beneficial for commercial vehicle segment;

Tata Motors and Ashok Leyland,

Revision in income tax slab By raising the minimum tax limit by Rs 20,000. Demand for 2

wheelers & lower end 4 wheelers will be impacted positively with

increase in disposable income at the lower end of the spectrum.

Maruti, Hero Honda, Bajaj Auto, TVS to be benefited directly.

Standard rate of excise duty will be maintained at Increase of excise duty would have directly impacted the product

10%. prices in auto sector, subsequently affecting the volumes. Stability

in Excise prices has positively impacted all the auto sector

Rate of Export Duty for all types of iron ore enhanced Positively impact Auto Stocks as it will help in reducing the input

and unified at 20 per cent ad valorem. Full exemption costs. However it will be negative for iron ore industry like Visa

from Export Duty to iron ore pellets Steel, Tata Steel, Jindal Steel etc. which will see a drop in net

realisations.

Banking

Rs.6,000 crore to be provided during 2011-12 to Positive for the banking industry with proposed capital infusion to

enable public sector banks to maintain a minimum of enable banks strengthen their capital adequacy levels and fund

Tier I CRAR of 8%. expansion of operations.

Existing housing loan limit enhanced to Rs. 25 lakh for Enhanced limits for housing loans qualifying for priority sector

dwelling units under priority sector lending exposures would act as an incentive for flow of resources to the

affordable housing segment.

To bring bill to enable RBI to grant more banking Negative for private banks as it will entail more competition

licenses

Microfinance (Rs 100 crore) and Self Help Group (Rs. Marginally positive for Microfinance NBFCs viz. SKS Mircrofinance

500 crore) funds set up for supporting the sector etc.

under SIDBI

Mutual Funds allowed to raise subscriptions from Highly positive for mutual fund industry; increases access to larger

foreign investors who meet KYC norms for equity investor base and potential for higher assets under management

schemes.

Cement

Basic Custom Duty on two critical raw materials of Positive for cement stocks like ACC, Ambuja etc. as it will help

cement industry viz. petcoke and gypsum is proposed reduce input stocks

to be reduced to 2.5 per cent.

RR, All rights reserved Page 5 of 10

Budget Analysis - 2011-12

Announcements Rationale

Education

Allocation of Rs. 52057 crore increase of 24% Move is along expected lines and will have positive impact on

Everonn, Educomp, NIIT Aptech Ltd , Edserv Softsystems

Rs. 21,000 crore allocated for Sarva Shiksha Abhiyan, It will have positive impact on Everonn, Educomp, NIIT Aptech Ltd ,

which is 40 per cent higher than Budget for 2010‐11. Edserv Softsystems

Fertiliser

Nutrient based fertiliser policy for urea under Positive for Fertiliser stocks like Nagarjuna fertilisers, Chambal,

consideration Coromandal International etc.

To move to direct cash subsidy for kerosene, fertiliser Positive for Fertiliser stocks like Nagarjuna fertilisers, Chambal,

Coromandal International etc.

General Industry

Current surcharge of 7.5 per cent on domestic Positive for domestic companies with reduced tax outflow

companies proposed to be reduced to 5 per cent.

Rate of Minimum Alternative Tax proposed to be Move will have neutral impact on the industry as a whole.

increased from 18 per cent to 18.5 per cent of book However, industry must have heaved a sigh of relief as it was

profits. expecting the rise to 20%

Infrastructure Sector

Plan to allow FII limit in infrastructure bonds to $25 More Investment in Infrastructure sector will have positive impact

bn on fund flow in already fund starved infrastructure in the economy.

It will have positive impact on Cement Stocks like ACC, Ambuja,

Engineering Companies like L&T and BHEL which will see rise in

order book. Also infra companies like Reliance Infra, LANCO Infra,

Jaypee Associates, GMR Infra etc.

Allocation of Rs. 2,14,000 crore for infrastructure in

2011‐12. This is an increase of 23.3 per cent over

2010‐11. This also amounts to 48.5 per cent of total

plan allocation.

IIFCL to achieve cumulative disbursement target of

Rs. 20,000 crore by March 31, 2011 and Rs. 25,000

crore by March 31, 2012.

To boost infrastructure development, tax free bonds

of Rs. 30,000 crore proposed to be issued by

Government undertakings NHAI, Railways during

2011‐12.

Additional deduction of Rs. 20,000 for investment in

long‐term infrastructure bonds proposed to be

extended for one more year.

Media

Concessional basic Custom Duty of 5 per cent and Will help reduce input costs of Media and positive for stocks like

CVD of 5 per cent available to newspaper Jagran Prakashan, Orient Paper, HTMedia.

establishments for high speed printing presses

extended to mailroom equipment.

Power

Parallel Excise Duty exemption for domestic suppliers It will have positive impact on Power Stocks

producing capital goods needed for expansion of

existing mega or ultra mega power projects.

RR, All rights reserved Page 6 of 10

Budget Analysis - 2011-12

Announcements Rationale

Realty

Rural housing fund corpus raised to Rs 3,000 cr vs Rs Positive for Realty stocks like HDIL, Unitech, DLF, Sobha Developers,

2,000 cr Ansal etc.

Low‐cost housing loans of Rs 15 lakh will be eligible Positive for Realty stocks offering budget housing like HDIL,

for one per cent interest subsidy, where the cost of Unitech, Sobha Developers, Ansal etc.

house does not exceed Rs 25 lakh.

MAT to be charged on SEZ developers and units Gives wrong signal to investors in such projects. And will negatively

impact the Units operating in such SEZs and companies engaged in

SEZ development.

Increase in the priority Housing Loan Limit from Rs. Positive for Realty stocks offering budget housing like HDIL,

20 Lakhs to Rs. 25 Lakhs Unitech, Sobha Developers, Ansal etc.

Shipping

Exemption from Import Duty for spares and capital Positive for Sesa Goa, GE Shipping, Shipping Corp, ABG Shipyard

goods required for ship repair units extended to etc.

import by ship owners.

RR, All rights reserved Page 7 of 10

Budget Analysis - 2011-12

2009-10 2010-11 2010-11 2011-12

Particulars Actuals Budget Estimates Revised Estimates Budget Estimates

Revenue Receipts 572811 682212 783833 789892

Tax Revenues 456536 534094 563685 664457

Non-Tax Revenues 116275 148118 220148 125435

Capital Receipts 451676 426537 432743 467837

Recoveries of Loans 8613 5129 9001 15020

Other Receipts 24581 40000 22744 40000

Borrowings and other Liabilities 418482 381408 400998 412817

Total Receipts 1024487 1108749 1216576 1257729

Non-Plan Expenditure 721096 735657 821552 816182

On Revenue Account of which, 657925 643599 726749 733558

Interest Payment 213093 248664 240757 267986

On Capital Account 63171 92058 93803 82624

Plan Expenditure 303391 373092 395024 441547

On Revenue Account 253884 315125 326928 363604

On Capital Account 49507 57967 68096 77943

Total Expenditure 1024487 1108749 1216576 1257729

Revenue Expenditure 911809 958724 1053677 1097162

Of which, Grants for creation of Capital

Assets 31317 90792 146853

Capital Expenditure 112678 150025 162899 160567

Revenue Deficit 338998 276512 269844 307270

(5.2) (4.0) (3.4) (3.4)

Effective Revenue Deficit 245195 179052 160417

(3.5) (2.3) (1.8)

Fiscal Deficit 418482 381408 400998 412817

(6.4) (5.5) (5.1) (4.6)

Primary Deficit 205389 132744 160241 144831

(3.1) (1.9) (2.0) (1.6)

RR, All rights reserved Page 8 of 10

Budget Analysis - 2011-12

For Further Details/Clarifications please contact:

RR Information & Investment Research Pvt. Ltd.

47, MM Road Jhandewalan New Delhi-110055 (INDIA)

Tel: 011-23636362/63

research@rrfcl.com

www.rrfinance.com

www.rrfcl.com

RR Research Products and Services:

Online Equity Calls during Market Hours (9:00 AM to 3:30 PM)

Online Commodity Calls during Market Hours (10:00 AM to 11:30 PM)

Daily Morning Pack

¾ Equity Fundamental - Daily

¾ Equity Technical Analysis - Daily

¾ Derivative – Daily

¾ Debt - Daily

¾ Commodity - Daily

¾ Currency – Daily

Daily Market Review

Weekly Pack

¾ Equity Fundamental - Weekly

¾ Equity Technical Analysis - Weekly

¾ Derivative – Weekly

¾ Debt - Weekly

¾ Commodity - Weekly

¾ Currency – Weekly

¾ Mutual Fund Watch

Fundamental Research

¾ Economic Analysis

¾ Industry Analysis

¾ Company Research & Valuations

¾ Result Updates

¾ News Updates

IPO Analysis

Mutual Fund Analysis

Investment Monitor – The complete monthly magazine design for Indian investors

Share Views with Zee Business.

And many more…

RR Research can also be viewed and downloaded from following websites:

www.moneycontrol.com

www.valuenotes.com

www.reportjunction.com

www.capitalmarket.com

www.myiris.com

RR, All rights reserved Page 9 of 10

Budget Analysis - 2011-12

Disclaimer:

Kindly read the Risk Disclosure Documents carefully before investing in Equity Shares, Derivatives or other instruments

traded on the Stock Exchanges. RR would include RR Financial Consultants Ltd. and its subsidiaries, group companies,

employees and affiliates. The information contained herein is strictly confidential and meant solely for the selected

recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person

or to the media or reproduced in any form, without prior written consent of RR. The information contained herein is

obtained from public sources and sources believed to be reliable, but independent verification has not been made nor is

its accuracy or completeness guaranteed. RR or their employees may have or may not have an outstanding buy or sell

position or holding or interest in the products mentioned herein. The contents and the information herein is solely for

informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or

subscribe for securities or other financial and insurance products and instruments. Nothing in this report constitutes

investment, legal, accounting and/or tax advice or a representation that any investment or strategy is suitable or

appropriate to recipients specific circumstances. The securities and products discussed and opinions expressed in this

report may not be suitable for all investors, who must make their own investment decisions, based on their own

investment objectives, financial positions and needs. Please note that fixed deposits, bonds, debentures are loans/lending

instruments and the investor must satisfy himself/herself on the financial health of the company/bank/institution before

making any investment. RR and/or its affiliates take no guarantee of soundness of any company or scheme. RR has/will

make available all required information to the prospective investor if asked for in respect of any scheme/fixed

deposit/bond/loan/debenture. RR is only acting as a broker/distributor and is not representing any company in any

manner except to distribute its schemes. Mutual Fund Investments are subject to market risks, read the offer document

carefully before investing. Any recipient herein may not take the content in substitution for the exercise of independent

judgment. The recipient should independently evaluate the investment risks of any scheme of a mutual fund. RR and its

affiliates accept no liability for any loss or damage of any kind arising out of the use of any information contained herein.

Past performance is not necessarily a guide to future performance. Actual results may differ materially from those set forth

in projections. RR may have issued other reports that are inconsistent with and reach different conclusion from the

information presented in this report. The information herein is not directed or intended for distribution to, or use by, any

person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject RR and its affiliates

to any registration or licensing requirement within such jurisdiction. The securities and products described herein may or

may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this

document may come are required to inform them of and to observe such restriction(s). The display, description or

references to any products, services, publications or links herein shall not constitute an endorsement by RR. Insurance is

a subject matter of solicitation. Kindly also note all the risk disclosure documents carefully before investing in Equity

Shares, IPO’s, Mutual Fund Schemes, Insurance Schemes, Fixed Deposit schemes, Debt offers, Hybrid Instruments, or

other instruments traded on Stock Exchanges or otherwise. Prospective investors can get all details and information from

the sites of SEBI, IRDA, AMFI or respective Mutual Fund Companies, Insurance Companies, Rating Agencies, Stock

Exchanges and individual corporate websites. Prospective investors are advised to fully satisfy themselves before making

any investment decision.

NSE - INB 231219636, INF 231219636

BSE - INB 011219632

RR, All rights reserved Page 10 of 10

You might also like

- BudgetDocument20 pagesBudgetAditya DigheNo ratings yet

- Bangladesh Quarterly Economic Update: September 2014From EverandBangladesh Quarterly Economic Update: September 2014No ratings yet

- Budget 2011Document4 pagesBudget 2011viv_nitjNo ratings yet

- Union Budget 2012Document3 pagesUnion Budget 2012anyashikaNo ratings yet

- Taxes : Pranab MukherjeeDocument4 pagesTaxes : Pranab Mukherjeevignesh9099No ratings yet

- NA Me: Ankit Sharma RO LL NO: 20Document7 pagesNA Me: Ankit Sharma RO LL NO: 20Ankit SharmaNo ratings yet

- India Union Budget 2011Document4 pagesIndia Union Budget 2011ajithtv3No ratings yet

- Financial Bill 2009Document10 pagesFinancial Bill 2009Tanuj GuptaNo ratings yet

- Read Full Story On TaxesDocument4 pagesRead Full Story On TaxesjosefrancisalapaatNo ratings yet

- Budget 2011 HighlightsDocument5 pagesBudget 2011 HighlightsGPrabha PrabhaNo ratings yet

- Pranab Mukherjee: TaxesDocument4 pagesPranab Mukherjee: TaxesabhishekniranjanNo ratings yet

- India Budget 2011Document22 pagesIndia Budget 2011ashishgautamNo ratings yet

- BudgetDocument6 pagesBudgetPriyanka DaveNo ratings yet

- Unio Nbu Dget - 12H Ighli GhtsDocument32 pagesUnio Nbu Dget - 12H Ighli GhtsMayur BulchandaniNo ratings yet

- Budget 1 March 2011Document6 pagesBudget 1 March 2011pulki1989No ratings yet

- Budget 1Document30 pagesBudget 1Karishma SarodeNo ratings yet

- Census Imp. PointsDocument4 pagesCensus Imp. PointsMax MullerNo ratings yet

- Current Affairs March 1Document19 pagesCurrent Affairs March 1Puneet_TryLoNo ratings yet

- Highlights of Union Budget 2011Document5 pagesHighlights of Union Budget 2011Sanjay NasitNo ratings yet

- Farm Loans at 4% Credit Target Raised To Rs 4,75,000cr: For Senior CitizensDocument4 pagesFarm Loans at 4% Credit Target Raised To Rs 4,75,000cr: For Senior CitizensSumit DaraNo ratings yet

- Union Budget 2011: Presented by Vidhi Sharma Jimit Pathak Richa SharmaDocument31 pagesUnion Budget 2011: Presented by Vidhi Sharma Jimit Pathak Richa Sharmarajchaurasia143No ratings yet

- Budget Highlights February 2013: Economy Assessment: TaxesDocument3 pagesBudget Highlights February 2013: Economy Assessment: TaxesRobs KhNo ratings yet

- Budget 2012Document6 pagesBudget 2012Divya HdsNo ratings yet

- Business Environment: Budget 2013-2014 AnalysisDocument11 pagesBusiness Environment: Budget 2013-2014 AnalysisKyle BaileyNo ratings yet

- New Delhi: Finance Minister Pranab Mukherjee Presented The Union Budget For The YearDocument3 pagesNew Delhi: Finance Minister Pranab Mukherjee Presented The Union Budget For The YearTapas KumarNo ratings yet

- India Union Budget 2011: "Quality Service Is Not What You Put Into It - It's What The Client Gets Out of It"Document41 pagesIndia Union Budget 2011: "Quality Service Is Not What You Put Into It - It's What The Client Gets Out of It"Jacob JheraldNo ratings yet

- Despite This Slowdown in FY 2012, in Cross Country Comparison, India Still Remains Amongst The Highest Grown EconomyDocument8 pagesDespite This Slowdown in FY 2012, in Cross Country Comparison, India Still Remains Amongst The Highest Grown EconomyGurunam Singh DeoNo ratings yet

- Budget HighlightsDocument3 pagesBudget HighlightsSanket ShahNo ratings yet

- Budget 2010 Review: India-An Economic OverviewDocument6 pagesBudget 2010 Review: India-An Economic OverviewAIMS_2010No ratings yet

- Union Budget 2011-2012: Eastern Financiers LTDDocument17 pagesUnion Budget 2011-2012: Eastern Financiers LTDsiddharth_mehta_10No ratings yet

- 20.highlights of Union Budget 2011-2012Document6 pages20.highlights of Union Budget 2011-2012mercatuzNo ratings yet

- Budget 2012Document20 pagesBudget 2012Dinu ChackoNo ratings yet

- BudgetDocument5 pagesBudgetAswathy PkNo ratings yet

- 2011 BudgetDocument7 pages2011 BudgetGIMPIRAWALNo ratings yet

- Budget Analysis 2011 12Document7 pagesBudget Analysis 2011 12s lalithaNo ratings yet

- BUDGET 2012: HighlightsDocument22 pagesBUDGET 2012: HighlightsSamridhi TrikhaNo ratings yet

- Analysis On Union Budget 2011Document7 pagesAnalysis On Union Budget 2011Dnyaneshwar BhadaneNo ratings yet

- Budget Review:: Zeebiz BureauDocument11 pagesBudget Review:: Zeebiz BureauMilan MeeraNo ratings yet

- Highlights of Union Budget For 2013-14 Personal TaxDocument13 pagesHighlights of Union Budget For 2013-14 Personal Taxindia1965No ratings yet

- Crux 3.0 - 01Document12 pagesCrux 3.0 - 01Neeraj GargNo ratings yet

- Budget AnalysisDocument9 pagesBudget AnalysisAdeel AshrafNo ratings yet

- Impact Analysis: Budget 2014-15Document4 pagesImpact Analysis: Budget 2014-15Raj AraNo ratings yet

- Budget AuroDocument38 pagesBudget AuroSrihari PatelNo ratings yet

- Click Here For Pakistan Budget 2011-12 DetailsDocument6 pagesClick Here For Pakistan Budget 2011-12 DetailsSaim AhamdNo ratings yet

- Union Budget 2012Document4 pagesUnion Budget 2012Siddhant SekharNo ratings yet

- AnalysisDocument19 pagesAnalysisMaaz Aslam KhanNo ratings yet

- Union Budget 2010-2011: Symphony of Fiscal Consolidation and Continued GrowthDocument7 pagesUnion Budget 2010-2011: Symphony of Fiscal Consolidation and Continued GrowthChand AnsariNo ratings yet

- Union Budget 2013-14 - Highlights and AnalysisDocument28 pagesUnion Budget 2013-14 - Highlights and AnalysisNaureen FatimaNo ratings yet

- Budget 2010-11: by Karan Singh, MBA (General) Section - ADocument32 pagesBudget 2010-11: by Karan Singh, MBA (General) Section - AscherrercuteNo ratings yet

- Balancing Fiscal Consolidation With Growth: Uncertainty Over GAARDocument42 pagesBalancing Fiscal Consolidation With Growth: Uncertainty Over GAARChinmay ShirsatNo ratings yet

- Budget 2012 13 HighlightsDocument66 pagesBudget 2012 13 HighlightsvickyvikashsinhaNo ratings yet

- Ventura - Budget 2013Document47 pagesVentura - Budget 2013Manish SachdevNo ratings yet

- Budget 2011Document2 pagesBudget 2011Gaurav BansalNo ratings yet

- Bangladesh Budget 2010-2011: Submitted To: Dr. Mohammad Ayub Islam Submitted By: Ahmad Mufassir Masum ID: 0821037Document12 pagesBangladesh Budget 2010-2011: Submitted To: Dr. Mohammad Ayub Islam Submitted By: Ahmad Mufassir Masum ID: 0821037SironamhinNo ratings yet

- Microeconomics Budget Line GoodsDocument12 pagesMicroeconomics Budget Line GoodsRahul DubeyNo ratings yet

- Budget 2011 HighlightsDocument4 pagesBudget 2011 Highlightsthesrajesh7120No ratings yet

- Budget 2011-12 - Analysis: Tax ProjectDocument19 pagesBudget 2011-12 - Analysis: Tax ProjectSaurabh SadaniNo ratings yet

- Budget Chemistry 2010Document44 pagesBudget Chemistry 2010Aq SalmanNo ratings yet

- CEO in United States Resume Valerie PerlowitzDocument10 pagesCEO in United States Resume Valerie PerlowitzValeriePerlowitzNo ratings yet

- Assignment 1 BAN 100 Edwin CastilloDocument11 pagesAssignment 1 BAN 100 Edwin CastilloEdwin CastilloNo ratings yet

- Caf 6 All PDFDocument80 pagesCaf 6 All PDFMuhammad Yahya100% (1)

- Affidavit of TenancyDocument1 pageAffidavit of Tenancybhem silverio100% (1)

- Chapter 1Document37 pagesChapter 1bhawesh agNo ratings yet

- Note 6 Situs (Sources) of IncomeDocument3 pagesNote 6 Situs (Sources) of IncomeJason Robert MendozaNo ratings yet

- Surya Semesta Internusa Tbk. (S) : Company Report: January 2015 As of 30 January 2015Document3 pagesSurya Semesta Internusa Tbk. (S) : Company Report: January 2015 As of 30 January 2015Halim RachmatNo ratings yet

- ACC 291 Week 4 ProblemsDocument8 pagesACC 291 Week 4 ProblemsGrace N Demara BooneNo ratings yet

- Final Annual NGBIRR FY 2022.23Document208 pagesFinal Annual NGBIRR FY 2022.23Dunson MuhiaNo ratings yet

- A Level Business Unit One DefinitionsDocument4 pagesA Level Business Unit One DefinitionsmehlabNo ratings yet

- Marian Grajdan CVDocument7 pagesMarian Grajdan CVMarian GrajdanNo ratings yet

- Bbma MHV - Ms.enDocument15 pagesBbma MHV - Ms.enXeno WerkNo ratings yet

- Referralprogramtermsandconditions: Ection Xisting Ustomer Nvestor EferrerDocument3 pagesReferralprogramtermsandconditions: Ection Xisting Ustomer Nvestor EferrermikeNo ratings yet

- Bubble and Bee Lecture TemplateDocument2 pagesBubble and Bee Lecture TemplateMavin JeraldNo ratings yet

- Full Download Solution Manual For Financial Accounting 5th Edition by Spiceland PDF Full ChapterDocument36 pagesFull Download Solution Manual For Financial Accounting 5th Edition by Spiceland PDF Full Chapterunwill.eadishvj8p94% (17)

- Chapter 18Document30 pagesChapter 18Hery PrambudiNo ratings yet

- Module 5 Using Mathematical TechniquesDocument57 pagesModule 5 Using Mathematical Techniquessheryl_morales100% (5)

- Maynard Case 3 1 PDFDocument2 pagesMaynard Case 3 1 PDFTating Bootan Kaayo YangNo ratings yet

- BS Digi PDFDocument1 pageBS Digi PDFFaruq TaufikNo ratings yet

- Bret 7 UDocument31 pagesBret 7 UQuint WongNo ratings yet

- Enriquez v. de VeraDocument2 pagesEnriquez v. de Veralaurana amataNo ratings yet

- An Evaluation of The Digital Marketing Operations of AL-Arafah Islami Bank LimitedDocument32 pagesAn Evaluation of The Digital Marketing Operations of AL-Arafah Islami Bank LimitedNafiz FahimNo ratings yet

- To Trade or Not To Trade Informed Trading With Short Term Signals For Long Term InvestorsDocument15 pagesTo Trade or Not To Trade Informed Trading With Short Term Signals For Long Term Investorsrobert mcskimmingNo ratings yet

- UEM Annual Report 2011Document248 pagesUEM Annual Report 2011aimran_amirNo ratings yet

- Certificate of Attendance: Serafin Umali Magsalin JRDocument1 pageCertificate of Attendance: Serafin Umali Magsalin JRSerafin Jr. MagsalinNo ratings yet

- 10 Suico vs. Philippine National Bank 531 SCRA 514, August 28, 2007 PDFDocument20 pages10 Suico vs. Philippine National Bank 531 SCRA 514, August 28, 2007 PDFSamantha NicoleNo ratings yet

- Senate Finds Massive Fraud Washington Mutual: Special Delivery For Wamu Victims!Document666 pagesSenate Finds Massive Fraud Washington Mutual: Special Delivery For Wamu Victims!DinSFLA100% (9)

- Manoj Batra 120 MCQDocument14 pagesManoj Batra 120 MCQAjay BalachandranNo ratings yet

- Sunnix Memo To BoardDocument4 pagesSunnix Memo To BoardDennie IdeaNo ratings yet

- Health Insurance IsDocument2 pagesHealth Insurance IsSaleh RehmanNo ratings yet