Professional Documents

Culture Documents

The Year of The Sovereign Debt Crisis 2011

Uploaded by

JarvisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Year of The Sovereign Debt Crisis 2011

Uploaded by

JarvisCopyright:

Available Formats

The Year of the

TIE ASKED a number of top thinkers

to focus on the outlook for sovereign

debt. How likely are countries in the

eurozone’s periphery (Greece, Ireland,

Portugal, and Spain) to default outright

or face significant “haircuts” on their

Crisis

sovereign debt over the next three to

five years? What is the probability in

the next three to five years that any of

the major industrialized countries (the

United States, Japan, Germany, France,

and the United Kingdom) lose their top

ratings*? And how might the increased

prospect of default in the eurozone

periphery and the loss of triple-A ratings

in the major industrialized countries

affect the global economy?

*Note: on January 27, the Standard & Poor’s rating

agency downgraded Japan to AA-minus. Other rating

agencies have left Japan’s credit rating untouched.

THE MAGAZINE OF

INTERNATIONAL ECONOMIC POLICY

888 16th Street, N.W.

Suite 740

Washington, D.C. 20006

Phone: 202-861-0791

Fax: 202-861-0790

www.international-economy.com

editor@international-economy.com

12 THE INTERNATIONAL ECONOMY WINTER 2011

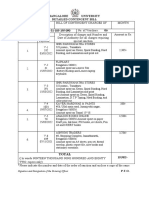

DESMOND LACHMAN

Resident Fellow, American

Enterprise Institute Likelihood of default or “haircuts”

on the periphery?

he seriousness of any

T intensification of the

eurozone debt crisis

for the global economic

Greece:

Ireland:

✔ Certain

✔ Certain

recovery should not be Portugal: ✔ Certain

underestimated. This crisis Spain: ✔ Probable

has the potential to deliver a

major blow to the European Major industrial countries

banking system, which is the main holder of the European

periphery’s US$2 trillion in sovereign debt obligations. losing their top rating?

Over the next twelve to eighteen months, there is every

United States: ✔ Probable

prospect that Greece and Ireland will choose to restructure

their sovereign debt. They will do so as their economies sink Japan: ✔ Certain

further into the deepest of recessions under the weight of the Germany: ✔ Won’t happen

draconian fiscal adjustment being imposed on these coun-

France: ✔ Probable

tries by the International Monetary Fund and the European

Union within the straightjacket of their euro membership. United Kingdom: ✔ Probable

A Greek or Irish sovereign debt restructuring would

constitute the largest such restructuring in history. It would

also more than likely result in an escalation in contagion to closure crisis continues unabated, and international oil

Portugal and Spain, since both of these countries have extra- prices are again at high levels.

ordinarily large external financing needs in 2011. A deepening in the European crisis must be expected to

A banking crisis in Europe, coupled with a renewed result in a further weakening in the euro, which would put

European economic downturn, will have serious implica- U.S. exporters at a competitive disadvantage, since it would

tions for the global economic recovery. In particular, it heighten existential questions about the euro. It must also be

would heighten the risks of a petering-out in the U.S. eco- expected to result in an increased degree of global risk aver-

nomic recovery, since it would come at precisely a time sion given the great degree of interconnectedness of the

when U.S. unemployment remains unusually high, the fore- world’s financial system.

Likelihood of default or “haircuts”

on the periphery?

Greece: ✔ Certain Praise the Lord and

Ireland: ✔ Certain pass the ammunition.

Portugal: ✔ Certain

✔ Unlikely he check-marks tell the story,

T

Spain:

or at least my view of the

story. Too many words have

Major industrial countries already been written as to the whys

losing their top rating? and wherefores. Praise the Lord

and pass the ammunition.

United States: ✔ Won’t happen

Japan: ✔ Probable BARTON M. BIGGS

Germany: ✔ Won’t happen Managing Partner,

France: ✔ Unlikely Traxis Partners

United Kingdom: ✔ Unlikely

WINTER 2011 THE INTERNATIONAL ECONOMY 13

Likelihood of default or “haircuts”

on the periphery?

Greece: ✔ Certain LOUIS BACON

Founder, Chairman, Chief

Ireland: ✔ Certain

Executive Officer, and Principal

Portugal: ✔ Probable Investment Manager,

Spain: ✔ Unlikely Moore Capital Management

Major industrial countries

losing their top rating?

United States: ✔ Won’t happen

Japan: ✔ Probable

Germany: ✔ Unlikely

France: ✔ Probable

United Kingdom: ✔ Unlikely Likelihood of default or “haircuts”

on the periphery?

Greece: ✔ Probable

Ireland: ✔ Unlikely

SAMUEL BRITTAN

Portugal: ✔ Probable

Columnist, Financial Times

Spain: ✔ Probable

O bstinate refusal to write down

debt is the greater threat. Major industrial countries

Alas, I don’t rate rating losing their top rating?

agencies. The most important policy

aim should be to free market United States: ✔ Won’t happen

economies from bondage to finan- Japan: ✔ Won’t happen

cial market prejudices.

Germany: ✔ Won’t happen

France: ✔ Unlikely

United Kingdom: ✔ Unlikely

Likelihood of default or “haircuts”

on the periphery?

Greece: ✔ Probable

Ireland: ✔ Probable

Portugal: ✔ Probable

Spain: ✔ Probable

Major industrial countries ROBERT K. STEEL

Deputy Mayor for Economic

losing their top rating? Development, New York City, and

United States: ✔ Won’t happen former Undersecretary for

Domestic Finance, U.S. Treasury

Japan: ✔ Unlikely

Germany: ✔ Unlikely

France: ✔ Unlikely

United Kingdom: ✔ Unlikely

14 THE INTERNATIONAL ECONOMY WINTER 2011

Likelihood of default or “haircuts”

on the periphery?

Greece: ✔ Unlikely

Ireland: ✔ Unlikely

Portugal: ✔ Unlikely

Spain: ✔ Unlikely

Major industrial countries

losing their top rating?

United States: ✔ Won’t happen

KARL OTTO PÖHL

Japan: ✔ Won’t happen

Former President,

German Bundesbank Germany: ✔ Won’t happen

France: ✔ Won’t happen

United Kingdom: ✔ Unlikely

“haircuts”

Likelihood of default or

on the periphery?

Greece: ✔ Unlikely

Ireland: ✔ Unlikely

Portugal: ✔ Unlikely

Spain: ✔ Won’t happen The risk of government

Major industrial countries

defaults threatening the

losing their top rating? recovery is a somewhat

✔ Unlikely exaggerated fear.

United States:

Japan: Already AA-

Germany: ✔ Won’t happen

JIM O’NEILL

France: ✔ Probable Chairman, Asset

United Kingdom: ✔ Unlikely Management, Goldman

Sachs International

here is growing evidence of accelerat- revenues grow and spending becomes less

T ing global recovery, and if there is a

surprise this year, it might be that the

developed countries, led by the United

pressured. In this context, I personally

believe that the risk of government defaults

threatening the recovery is a somewhat

States, will positively surprise. We may see exaggerated fear. By the way, unless I

a number of quarters of 3 percent to 4 per- missed something, Japan lost its AAA status

cent or more real GDP growth in the United many years ago! If there were to be prob-

States. If this is correct, the size of some fis- lems, then the country that concerns me

cal deficits will come down as government most is actually Japan, not the United States.

WINTER 2011 THE INTERNATIONAL ECONOMY 15

Likelihood of default or

“haircuts”

TADASHI NAKAMAE on the periphery?

President, Nakamae

Greece: ✔ Certain

International Economic

Research Ireland: ✔ Probable

Portugal: ✔ Certain

apan’s fiscal woes are no Spain:

J secret, but its currency is

the strongest and its gov-

ernment bonds are the most

✔ Certain

Major industrial countries

losing their top rating?

secure, as witnessed by the fact

that its yields are the lowest in

the world. Moreover, unlike

United States: ✔ Probable

the United States, Britain, France, and Germany, Japan’s gov- Japan: Already AA-

ernment bonds are mostly held by domestic rather than foreign Germany: ✔ Probable

investors, who as stakeholders are unlikely to cause their coun-

try to default on its debt.

France: ✔ Certain

Thus, if credit ratings truly reflect default risk, it is ridicu- United Kingdom: ✔ Certain

lous that Japanese government bonds (JGBs) are rated AA-

minus, while the other G4 countries are still rated AAA. Over

the past decade or so, investment banks and hedge funds have

constantly tried to make money by short-selling JGBs (on the answer to today’s problems. For countries that can shift to

assumption that Japan’s fiscal troubles would cause yields to supply-side policies that enable the private sector to become

rise), neatly enabled by credit rating agencies, whose reports more efficient and grow, this poses few problems. For coun-

backed up their beliefs. Yet these short sales rarely, if ever, tries in the eurozone periphery, this means immense and

turned out to be profitable as JGB yields sunk to ever-lower painful economic upheaval.

record-breaking levels. This turmoil will be reflected in the global economy.

If credit rating agencies were to lower the ratings of the Europe’s economy and balance sheet is likely to deteriorate

remaining G4 countries equal to that of Japan—or lower— first. The United States will probably be next. Japan’s decline

they might regain some credibility and legitimacy. is likely to be the slowest because it has already seen twenty

As fiscal deficits balloon, countries become increasingly years of recession and has slowly started to implement struc-

incapable of funding their debt. This then shatters the myth tural reform—something Europe and the United States have

that free-spending Keynesian demand-side policies are the yet to do.

Likelihood of default or “haircuts”

on the periphery?

Greece: ✔ Probable

Ireland: ✔ Probable

Portugal: ✔ Unlikely

Spain: ✔ Won’t happen

HARALD DETTENBORN

Major industrial countries

losing their top rating?

United States: ✔ Unlikely

HORST M. TELTSCHIK

Japan: ✔ Unlikely Former President, Boeing Germany,

Germany: ✔ Unlikely and former National Security Advisor

France: ✔ Probable to Chancellor Helmut Kohl

United Kingdom: ✔ Probable

16 THE INTERNATIONAL ECONOMY WINTER 2011

Likelihood of default or “haircuts”

RICHARD N. COOPER on the periphery?

Maurits C. Boas Professor of

International Economics, Greece: ✔ Probable

Harvard University Ireland: ✔ Unlikely

Portugal: ✔ Unlikely

f any of these events were to hap-

I pen within the next five years,

there would be black headlines in

the financial press, but the world

Spain: ✔ Won’t happen

Major industrial countries

would move on. Any of these losing their top rating?

events would cause some consternation, but none would be

devastating, and the global recovery would not be aborted on United States: ✔ Unlikely

these grounds. If the recovery were aborted for some other Japan: ✔ Unlikely

reason, of course, the probability of these events would rise,

Germany: ✔ Unlikely

since government revenues of all these countries would be

adversely affected. Some “haircut” has already been priced France: ✔ Unlikely

into the public debt of the four eurozone countries, so debt United Kingdom: ✔ Unlikely

holders could hardly argue that they were surprised or

aggrieved. And the reputation of the rating agencies has been

sufficiently compromised by their performance during 2006–09

that any changes in ratings they make will be viewed with greater

skepticism than would have been the case several years ago.

MICHAEL J. BOSKIN

Likelihood of default or “haircuts” Tully M. Friedman Professor of

on the periphery? Economics and Hoover Institution

Senior Fellow, Stanford University,

Greece: ✔ Probable and former Chair, President’s

Ireland: ✔ Fifty-fifty Council of Economic Advisors

Portugal: ✔ Fifty-fifty

ny increased prospect of some

Spain: ✔ Fifty-fifty

Major industrial countries

A type of default on the eurozone

periphery—Greece more likely

than not, whereas Ireland, Portugal, and Spain are fifty-

losing their top rating? fifty—would temporarily send shockwaves through global

financial markets. It would further strain especially

United States: ✔ Unlikely Europe’s undercapitalized banks, dampen European (and

✔ Certain to a lesser extent, global) economic growth, and further

Japan: stress monetary union.

Germany: ✔ Unlikely Downgrades of sovereign debt of the major industri-

France: ✔ Unlikely alized countries—Japan has recently earned this dubious

✔ Unlikely distinction, the others remain possibilities unless budgets

United Kingdom: improve—would likewise raise interest costs, worsen

budget balances, depress asset values, and slow growth.

Finally, these financial risks might just as well be the

result as the cause of slower global recovery, as public

debt dynamics typically worsen in sluggish economies.

WINTER 2011 THE INTERNATIONAL ECONOMY 17

Likelihood of default or “haircuts”

on the periphery?

Greece: ✔ Probable

Ireland: ✔ Probable

Portugal: ✔ Probable

Spain: ✔ Probable

Major industrial countries

losing their top rating?

United States: ✔ Unlikely

Japan: ✔ Probable

MAYA BHANDARI Germany: ✔ Unlikely

Head of Emerging Markets Analysis, France: ✔ Unlikely

Lombard Street Research

United Kingdom: ✔ Unlikely

he answers are not independent. Spain, Greece, German GDP—every year forever. Germany’s

T Portugal and Ireland are insolvent within EMU,

at any feasible euro exchange rate, absent per-

manent, ongoing unrequited transfers to

credit rating, and possibly its political stability,

would not survive that. France has an unsustainable

current account deficit, but is almost

deficit countries (that is, current The answers are certain to be bailed out by Germany; its

account deficit countries). The only fea-

sible candidate for making those trans-

not independent. default risk (though possibly not its

first-move ratings risk) is thus probably

fers is Germany. The burden on Germany, were it to smaller than Germany’s.

accept that role, could be something like 8 percent of Globally higher sovereign credit-risk premiums

would just mean a need for even lower “risk-free”

real yields to sustain the continuing global Ponzi

or “h air cuts” game, in which China is increasingly uncomfortably

Likelihood of default aware that it will be called upon to play a role vis-à-

on the periphery? vis the United States similar to the one EMU coun-

rta in tries want Germany to play. The underlying problem

Greece: ✔ Ce

is a real-side one—dynamic inefficiency. The finan-

Ireland: ✔ Certain cial bubble which is re-forming is one particular

Po rtuga l: ✔ Ce rta in channel through which dynamic inefficiency oper-

rta in ates. Even complete default/debt forgiveness

Spain: ✔ Ce

throughout the world would not resolve the problem

of dynamic inefficiency.

Major industrial countries

losing their top rating?

United States: ✔ Unlikely

Japan: ✔ Certain

Germany: ✔ Unlikely

France: ✔ Unlikely BERNARD CONNOLLY

Managing Director, Connolly

United Kingdom: ✔ Won’t happen

Global Macro Advisers

18 THE INTERNATIONAL ECONOMY WINTER 2011

Likelihood of default or

WENDY DOBSON “haircuts”

Former Associate Deputy Minister of on the periphery?

Finance, Canada, and Co-Director,

Greece: ✔ Certain

Institute of International Business,

Rotman School of Management, Ireland: ✔ Certain

University of Toronto Portugal: ✔ Probable

Spain: ✔ Unlikely

ncertainty about defaults in

U the eurozone periphery is

already a drag on economic

recovery. Since Greece and Ireland

Major industrial countries

losing their top rating?

have defaulted in everything but

name, let them get on with it—but

United States: ✔ Unlikely

not just yet. Within the next year, their investors should Japan: ✔ Won’t happen

have had sufficient time to strengthen their balance sheets. Germany: ✔ Won’t happen

That is when both governments should reduce principal and

extend repayment terms to sustainable levels and get on

France: ✔ Won’t happen

with their lives. Eurozone institutional arrangements are United Kingdom: ✔ Unlikely

inching towards dealing

Uncertainty about with future fiscal crises,

but faster movement is

defaults in the eurozone desirable to ensure fiscal

periphery is already a drag discipline in the first Prospects in major countries are brighter because of

place. Voters in the two strong government action (United Kingdom), strong fun-

on economic recovery. countries have already damentals (Germany), and domestic debt holders (Japan).

experienced painful austerity and now see public services In the United States, the noisy, often-surreal debate about

displaced by debt servicing costs as far as the eye can see. how to cut debt and deficits may require a wakeup call

The longer the delay, the more investor uncertainty and from the markets in order to concentrate legislators’ minds

reluctance to acquire troubled country bonds which, in turn, on agreeing to a credible medium-term plan for fiscal con-

shrink the investor pool and concentrate future risk. solidation.

Likelihood of default or “haircuts”

on the periphery?

Greece: ✔ Unlikely

Ireland: ✔ Probable

Portugal: ✔ Unlikely

Spain: ✔ Won’t happen

Major industrial countries

losing their top rating?

BENJAMIN M. FRIEDMAN

United States: ✔ Probable William Joseph Maier

Japan: ✔ Unlikely Professor of Political Economy,

Germany: ✔ Won’t happen Harvard University

France: ✔ Won’t happen

United Kingdom: ✔ Probable

WINTER 2011 THE INTERNATIONAL ECONOMY 19

MAKOTO UTSUMI

President and CEO, Japan Credit

Likelihood of default or “haircuts”

Rating Agency, Ltd., and former Vice on the periphery?

Minister of Finance for International

Affairs, Japan Greece: ✔ Won’t happen

Ireland: ✔ Won’t happen

conomists, especially in Anglo- Portugal:

E

✔ Won’t happen

Saxon countries, have the per-

Spain: ✔ Won’t happen

sistent tendency to overlook the

determination of the eurozone poli-

cymakers and the European Central Major industrial countries

Bank to defend the euro and its losing their top rating?

member countries. Regardless of the

unproductive statements sometimes United States: ✔ Won’t happen

uttered by politicians in the core Japan: ✔ Unlikely

euro countries who are moti-

Confusion in Japanese vated by domestic politics, Ger ma ny: ✔ Won’t happen

Fra nce : ✔ Won’t happen

politics will not allow a the euro’s defenders would

never choose the suicide of United Kingdom: ✔ Unlikely

reliable plan for the the euro and the eurozone.

budget reduction. higherIn savings

the United States, the

rate of the household sec-

tor and the budget reductions likely by the

Republican-dominated Congress will improve

that country’s current account balance. to tackle the budget deficits and the people are

For Japan, confusion in Japanese politics showing the endurance to accept higher taxes

will not allow a reliable plan for budget reduc- and lower public services, so far. However, the

tion in the medium term. inflation and the interest rate hikes on the hori-

In the United Kingdom, Prime Minister zon, together with severe budget cuts, might

David Cameron is making respectable efforts cause serious shrinkage of the UK economy.

“haircuts”

Likelihood of default or

on the periphery?

Greece: ✔ Certain

Ireland: ✔ Unlikely

Portugal: ✔ Unlikely

Spain: ✔ Unlikely

Major industrial countries

losing their top rating?

United States: ✔ Unlikely

Japan: ✔ Probable

Germany: ✔ Won’t happen EDWARD YARDENI

France: ✔ Unlikely President, Yardeni Research

United Kingdom: ✔ Unlikely

20 THE INTERNATIONAL ECONOMY WINTER 2011

Likelihood of default or “haircuts”

on the periphery?

nder this scenario—Greece and

U Ireland restructure, Portugal

maybe, but everyone else mud-

dles along—the global economy actu-

Greece:

Ireland:

✔ Certain

✔ Certain

ally does better than if Greece, Portugal: ✔ Unlikely

Ireland, and Portugal keep on rolling Spain: ✔ Won’t happen

over debt that won’t be repaid. The

experience of Latin America in the Major industrial countries

1980s is instructive. Giving up on the

Baker liquidity plan and restructuring losing their top rating?

the debt according to the Brady Plan

CATHERINE L. MANN United States: ✔ Won’t happen

created the foundation for renewed

Barbara ’54 and Richard M. lending and growth in Latin America. Japan: Already AA-

Rosenberg Professor of Like the Brady Plan, the European Germany: ✔ Won’t happen

Global Finance, Brandeis Financial Stability Facility should

International Business France: ✔ Won’t happen

use guarantees, not outright pur-

School, Brandeis University chases of sovereign obligations. United Kingdom: ✔ Won’t happen

Guarantees are a much more effi-

cient use of limited funds.

RONALD MCKINNON s long as the United States, Japan, and the United

Professor Emeritus of

International Economics,

Stanford University

A Kingdom own their own central banks, they won’t

default on their respective Treasury bonds out-

standing—which are denominated in dollars, yen, and

pounds respectively. Each central bank can buy back its

own Treasury bonds by just “printing” money. Hence

there is long-run inflation risk but not default risk.

Likelihood of default or “haircuts” For Germany and France, the situation is more com-

on the periphery? plex because their

national central banks Defaults could restart

Greece: ✔ Probable cannot directly print a banking crisis.

euros. But Germany is a

Ireland: ✔ Probable

major international creditor and France is probably, on

Portugal: ✔ Probably net balance, a creditor also. So I would not expect either

Spain: ✔ Unlikely to default on Treasury bonds outstanding.

The big threat to European recovery is that defaults

on its periphery could restart a banking crisis. German

Major industrial countries banks in particular have lent heavily to governments and

losing their top rating? firms in southern and Eastern Europe.

The United States has a similar problem should

United States: ✔ Won’t happen there be substantial defaults by its state and local govern-

Japan: ✔ Won’t happen ments—particularly on their unsustainable defined-

Germany: ✔ Won’t happen benefit pension plans. But municipal bonds are owned

mainly by wealthy individuals, and pensioners might be

France: ✔ Won’t happen out of pocket. So defaults are much less likely to directly

United Kingdom: ✔ Won’t happen impact U.S. banks.

WINTER 2011 THE INTERNATIONAL ECONOMY 21

Likelihood of default or “haircuts”

on the periphery?

JEAN-PIERRE PATAT Greece: ✔ Probable

Advisor, Centre d’Etudes Ireland: ✔ Unlikely

Prospectives et

Portugal: ✔ Unlikely

d’Informations

Internationales, and Thierry Spain: ✔ Unlikely

Apoteker Consulting

Major industrial countries

reece will probably losing their top rating?

G be downgraded,

considering

heavy burden of its debt

the United States:

Japan:

✔ Won’t happen

Already AA-

and poor prospects for economic growth. At the

moment, Greek debt is protected by the European

Germany: ✔ Won’t happen

Financial Stability Facility with a deadline of France: ✔ Unlikely

2013. After this, the fund will be replaced by a per- United Kingdom: ✔ Unlikely

manent new organization. But efforts by creditors

to make settlements cannot be ruled out. Ireland

and Portugal have better growth prospects. The

existence and apparently the brilliant start of the nomic reversal in this country is, obviously,

EFSF lend it high credibility. Ireland and Portugal unlikely for the next three and even five years.

have two years during which they can benefit from France’s sovereign debt is average for an

this credibility and prove that they can manage industrialized country and even lower if one takes

sound economic and fiscal policy. into account the retail pension burden (France’s

Spain is unfairly put in the disagreeable PIGS demographic situation is better than that of other

category. Spanish sovereign debt is less important countries). But its policy for reducing deficits is

than most other advanced economies’ debts. Of much too timid and political consensus on public

course, private debt is high and the current account finances, globalization, and markets is not evident.

largely umbalanced, but Spain’s economy can ben- The United Kingdom has been suffering from

efit from an improvement in the real estate market. spectacular deterioration of its economic and fiscal

Its international banks are solid and well-managed situation which could justify questions about its

and the government has begun a severe program rating. But the government has engaged in a very

for reducing deficits. severe and credible plan for reducing deficits. In

The United addition, playing host to the largest financial and

The United States States has a very bad money markets in the world is strategic protection.

fiscal situation and An increased prospect of default in the euro-

has a very bad the government has zone periphery would not have a significant

fiscal situation. failed to take mea- impact on recovery, considering the weak share

sures to improve it. of Greece, Portugal, and Ireland in the global

But rating agencies will never take the risk of GDP, and if the successor in 2013 to the EFSF is

downgrading the country which issues the major credible.

international reserve currency—and with which The loss of triple-A ratings for major industri-

they do so large a part of their business. alized countries could encourage new fiscal cut-

Japan was just downgraded to AA-minus. Is backs and, theoretically, have some impact on

further downgrading possible? This country has by economic growth, especially if the United States is

far the heaviest sovereign debt among big industri- concerned, but in my opinion this country will not

alized economies. Even if domestic saving is be downgraded. If other counties lose their rating,

important, Japan’s economic growth is hesitant the exact reasons are important, otherwise rating

and its policy situation sometimes blurred. agency credibility could be questioned.

For Germany, everything is possible, including Nevertheless, it is uncertain such an issue could

the worst (that is the secret motto of central have significant impact on fiscal policies if eco-

bankers!). But a spectacular policy and/or eco- nomic growth remains weak.

22 THE INTERNATIONAL ECONOMY WINTER 2011

Likelihood of default or “haircuts”

on the periphery?

JAMES E. GLASSMAN Greece: ✔ Unlikely

Managing Director and

Senior Economist, Ireland: ✔ Unlikely

JPMorgan Chase Portugal: ✔ Unlikely

Spain: ✔ Unlikely

hen it comes to

W assessing the cred-

itworthiness of the

large industrial economies,

Major industrial countries

losing their top rating?

the global bond market is

United States: ✔ Unlikely

the only “rating agency”

that matters. Bond Japan: ✔ Unlikely

investors must weigh all manner of risks, polit- Germany: ✔ Unlikely

ical and economic. For that reason, the histori-

France: ✔ Unlikely

cally low level of real interest rates on the

sovereign debt of the large industrial United Kingdom: ✔ Unlikely

economies implies that bond investors must be

assuming that the fiscal picture for many will

improve as the global economy recovers. structural fiscal deficits, enough so to be cred-

It is very unlikely that any of the periph- ible to financial markets.

ery countries will default on their outstanding On the probability that the rating agen-

debt. The Europeans cies will lose their top ratings—oops, that the

The global bond eventually will trans- major industrial economies lose theirs—

market is the only form the European

Financial Stability

highly unlikely, because the fiscal erosion is

largely the result of deep economic reces-

“rating agency” Facility into a more sions (cyclical factors) and the global recov-

effective mechanism ery now in place will begin to restore fiscal

that matters. for dealing with liq- balance. This will be seen as a positive devel-

uidity strains. Economic recovery will restore opment by the rating agencies. (I am not sure

some fiscal balance in the region, as it will in if a downgrade of industrial country debt

the United States. The alternatives would be would carry much meaning for financial mar-

less disruptive, such as developing a fiscal kets, because default by these countries is

transfer mechanism or subsidizing the interest assumed to be negligible.) The recent down-

rates a sovereign must pay. grade of Japan’s debt (and possible down-

The long-term consequences of default grades of other large countries), given the

are more punishing than the alternatives. breadth and depth of the investor appetite for

There is a deep historical and political com- sovereign debt of the big players, is likely to

mitment to the monetary union and the euro, create more noise in the media than in the

which has brought many benefits to the euro- financial market.

zone, and a default by one of the members, A default in the eurozone would be pun-

and inability of the members to prevent it, ishing, not only for Europe but also for the

would call into question the euro’s survivabil- global economy, which is a strong argument

ity. A default could easily trigger a wider against taking such an action. It would

financial crisis across the region, harming require the defaulting party to implement

even the strong economies. And these coun- austerity measures, with negative implica-

tries will take sufficient action to address their tions for growth.

WINTER 2011 THE INTERNATIONAL ECONOMY 23

NORBERT WALTER

Likelihood of default or “haircuts”

Walter and Töchter Consult, and on the periphery?

Chief Economist Emeritus,

Deutsche Bank

Greece: ✔ Probable

Ireland: ✔ Probable

Portugal: ✔ Unlikely

he world is in for higher

T real rates of interest

(financing costs) than

over the last few years. And

Spain: ✔ Unlikely

Major industrial countries

for good reason: There will be more differentiation of losing their top rating?

financing costs between governments and companies.

However, the present focus on some countries in United States: ✔ Probable

deep trouble (due to mismanaged banks or inflated real

Japan: ✔ Probable

estate/construction sectors) is misplaced. Some, like

Ireland, have a strong constitu- Germany: ✔ Unlikely

Goldilocks is over. tion and can and will grow out France: ✔ Unlikely

of their problems. Others, who

United Kingdom: ✔ Unlikely

still do not understand that being on drugs may make

you “high” but not “sound,” will soon have to swallow

bitter medicine and will thus fall below in trend growth

for a number of years. This is not just true for Spain, but graphic decline.

for the United States. Thus, Germany clearly is overrated. And by 2020—

But misperceptions about rating countries go fur- when China still is anything but rich—it will age

ther. Quite a few countries today perceived to be natural aggressively. Today’s sobering views about financial

candidates to act as donor countries in international res- prospects foreshadow an unattractive future for more

cue operations are heading toward unsustainable fiscal than just the short term. Goldilocks is over, for good.

positions, particularly because of their imminent demo-

Likelihood of default or “haircuts”

on the periphery?

Greece: ✔ Certain

Ireland: ✔ Certain

Portugal: ✔ Probable

Spain: ✔ Unlikely

Major industrial countries

losing their top rating?

BOWMAN CUTTER

United States: ✔ Won’t happen

Senior Fellow,

Japan: ✔ Unlikely Roosevelt Institute

Germany: ✔ Won’t happen

France: ✔ Unlikely

United Kingdom: ✔ Won’t happen

24 THE INTERNATIONAL ECONOMY WINTER 2011

CHARLES WOLF

“haircuts”

Likelihood of default or Senior Economic Adviser and

on the periphery? Distinguished Corporate Chair in

International Economics and

Greece: ✔ Unlikely Professor, Pardee Rand Graduate

Ireland: ✔ Unlikely School, RAND, and Senior Research

Fellow, Hoover Institution

Portugal: ✔ Unlikely

Spain: ✔ Unlikely he increased precariousness

Major industrial countries

losing their top ratin g?

T

bank

of sovereign debt, coupled

with the extensive EU inter-

holdings of this debt, are

likely to slow global economic recovery. Two other effects

United States: ✔ Won’t happen are no less important but with more ambiguous conse-

✔ W on ’t ha ppen quences for recovery.

Japan: First, the jeopardy to debt repayment and to bond rat-

Germany: ✔ Won’t happen ings is likely to result in lower priority accorded in OECD

France: ✔ Unlikely countries’ budgeting processes to “stimulus”

✔ Un lik ely spending than to so-called “austerity,” that Recovery is

United Kingdom: is, to curtailing government spending. A

concomitant effect among economists and

likely to

bankers will be diminished attention to the Keynesian be slowed.

legacy of the “multiplier,” and increased attention to

how to affect the crucial as well as more elusive state of confidence

and expectations in global markets. While this change may dampen the

pace of recovery, it’s also likely to enhance the recovery’s robustness.

Second, the worries that adhere to EU and U.S. Treasury bonds

are likely to encourage and accelerate China’s efforts to make the ren-

minbi an international currency. A consequence of recent events in

undermining the dollar’s primacy as the world’s favored reserve cur-

rency and its predominance as the invoicing currency of first recourse

will be to boost receptivity among global bankers and traders to

China’s efforts on behalf of the renminbi.

Likelihood of default or “haircuts”

on the periphery?

Greece: ✔ Probable

Ireland: ✔ Probable

Portugal: ✔ Unlikely

Spain: ✔ Unlikely

Major industrial countries

losing their top rating?

United States: ✔ Unlikely

Japan: ✔ Unlikely

Germany: ✔ Won’t happen

DAVID K.P. LI

France: ✔ Unlikely Chairman and Chief Executive,

United Kingdom: ✔ Unlikely Bank of East Asia, Limited

WINTER 2011 THE INTERNATIONAL ECONOMY 25

Likelihood of default or “haircuts”

on the periphery?

Greece: ✔ Certain

Ireland: ✔ Certain

Portugal: ✔ Probable

Spain: ✔ Probable

Major industrial countries

ROBERT J. SHAPIRO losing their top rating?

Chairman, Sonecon, LLC, and former

U.S. Under Secretary of Commerce United States: ✔ Won’t happen

for Economic Affairs Japan: ✔ Unlikely

Germany: ✔ Won’t happen

ithout the extraordinary interventions of

W the European Union and the

International Monetary Fund, Greece

already would be in default and Ireland would be

France:

United Kingdom:

✔ Won’t happen

✔ Unlikely

on the edge of doing so. The irony here is that

default has been staved off thus far by the political

commitment of Germany and France to the euro—

yet the rules of the eurozone prevented Greek and slow the two countries’ fast-rising debt burdens has

Irish policymakers from taking normal steps to proved to be politically difficult, if not impossible.

avoid default and rebuild confidence through cur- It’s also economically counterproductive, since the

rency devaluations and interest rate adjustments. cutbacks stall the growth needed to generate the

The differences between the two countries’ revenues to stave off or at least limit the extent of a

predicaments, however, are also instructive. The default.

seeds of Greece’s problems lie in years of fiscal There is no prospect of default by the United

profligacy, which in States, Germany, or France, and virtually no

The rules of the itself was a political prospect of such a dire development in Japan or

eurozone prevented response in order to

maintain employment

the United Kingdom. All have fundamentally

sound economies, as financial markets recognize.

Greek and Irish while the eurozone Long-term interest rates remain historically low in

policymakers from precluded their using

interest rate and cur-

all of these countries, signaling investors’ confi-

dence in their long-term solvency. All of these

taking normal steps rency policies to nations also have mature political systems capable

improve their competi- of quickly addressing any impending debt crisis,

to avoid default. tiveness. Dublin, by as each has demonstrated in the past when deficits

contrast, has been a model of fiscal responsibility have expanded sharply.

for years; but like the United States, lax oversight However, a special caveat applies to the

of the domestic financial system allowed the coun- United States. As the only nation of the group

try’s dominant financial institutions to pursue reck- without parliamentary arrangements, there is a the-

less overleveraging built helter-skelter on a huge oretical possibility of a politically driven default if

housing bubble. the political opposition were to block an increase

When the U.S. financial crisis and subsequent in the legal debt limit. However, this almost cer-

deep recession reached Greece and Ireland, the tainly is an empty threat. Congressional opponents

Greeks found themselves with unmanageable pub- of sitting presidents have threatened such action

lic debt while Irish banks quickly turned insolvent. many times in recent decades, and the president

And in both cases, the fiscal austerity required to has won the debate and the fight every time.

26 THE INTERNATIONAL ECONOMY WINTER 2011

Likelihood of default or “haircuts”

on the periphery?

MURRAY WEIDENBAUM Greece: ✔ Certain

Mallinckrodt Distinguished Ireland: ✔ Probable

University Professor,

Portugal: ✔ Certain

Washington University

in St. Louis Spain: ✔ Probable

ontinued international Major industrial countries

C conversation on weak-

nesses in sovereign debt

is bound to have a depressing effect on the finances of

losing their top rating?

United States: ✔ Won’t happen

marginal economies in southern Europe, if not else- Japan: ✔ Unlikely

where. This negative impact may be offset in part by

the continued economic strength of Germany and also

Germany: ✔ Unlikely

the United States. France: ✔ Unlikely

Practical reasons will inhibit the rating agencies United Kingdom: ✔ Unlikely

from seriously contemplating downgrading the

Treasury issues of the United States These agencies

may have escaped tough government oversight for

the time being. However, substantial discussions of

downgrading Treasuries could lead congressional United States will not lose its triple-A rating for sov-

committees and perhaps some regulators to initiate ereign debt and such an eventuality is unlikely for

investigations and public hearings. Any sensible Germany, France, the United Kingdom, and Japan.

management would try to avoid opening itself to The peripheral countries will not all enjoy such

such potential problems. luxury. Haircuts are initially certain for Greece and

Thus, for the major industrialized nations, mud- Portugal and, to a lesser degree, probably for Ireland

dling through is the most likely outcome. The and Spain.

Likelihood of default or “haircuts”

on the periphery?

Greece: ✔ Certain

Ireland: ✔ Probable

Portugal: ✔ Probable

Spain: ✔ Won’t happen

Major industrial countries

losing their top rating?

JAMES CAPRA

United States: ✔ Unlikely Capra Asset Management

Japan: ✔ Unlikely

Germany: ✔ Won’t happen

France: ✔ Won’t happen

United Kingdom: ✔ Unlikely

WINTER 2011 THE INTERNATIONAL ECONOMY 27

You might also like

- Patents in Biotechnology: What, How & Why?Document32 pagesPatents in Biotechnology: What, How & Why?JarvisNo ratings yet

- ChernobylDocument55 pagesChernobylFacundo BaróNo ratings yet

- 35% of American Adults Own A SmartphoneDocument24 pages35% of American Adults Own A SmartphoneAndy SternbergNo ratings yet

- Energy Critical Elements: Securing Materials For Emerging TechnologiesDocument28 pagesEnergy Critical Elements: Securing Materials For Emerging TechnologiesJarvisNo ratings yet

- Energy Critical Elements: Securing Materials For Emerging TechnologiesDocument28 pagesEnergy Critical Elements: Securing Materials For Emerging TechnologiesJarvisNo ratings yet

- The World's Most Attractive Employers - Global Top 50 RankingsDocument4 pagesThe World's Most Attractive Employers - Global Top 50 RankingsJarvisNo ratings yet

- Knowledge, Networks and NationsDocument114 pagesKnowledge, Networks and NationsJarvisNo ratings yet

- Singapore Internet Version 6 (IPv6) ProfileDocument27 pagesSingapore Internet Version 6 (IPv6) ProfileJarvisNo ratings yet

- Regulatory Effectiveness of The Station Blackout RuleDocument87 pagesRegulatory Effectiveness of The Station Blackout RuleJarvisNo ratings yet

- White Paper On Mark I ContainmentDocument21 pagesWhite Paper On Mark I ContainmentJarvisNo ratings yet

- Singapore Salary Survey 2011Document32 pagesSingapore Salary Survey 2011JarvisNo ratings yet

- HongKong Salary Survey 2011Document29 pagesHongKong Salary Survey 2011JarvisNo ratings yet

- The NRC and Nuclear Power Plant Safety in 2010Document64 pagesThe NRC and Nuclear Power Plant Safety in 2010JarvisNo ratings yet

- IPOS Examination (Patentability) Guidelines 2010Document72 pagesIPOS Examination (Patentability) Guidelines 2010JarvisNo ratings yet

- China Salary Survey 2011Document34 pagesChina Salary Survey 2011JarvisNo ratings yet

- Small Liquid Metal Cooled Reactor Safety StudyDocument63 pagesSmall Liquid Metal Cooled Reactor Safety StudyJarvisNo ratings yet

- USA Salary Survey 2011Document9 pagesUSA Salary Survey 2011JarvisNo ratings yet

- Switzerland Salary Survey 2011Document5 pagesSwitzerland Salary Survey 2011JarvisNo ratings yet

- United Kingdom Salary Survey 2011Document62 pagesUnited Kingdom Salary Survey 2011Jarvis100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- M. Rahul Ananta - Rudito, BambangDocument5 pagesM. Rahul Ananta - Rudito, BambangMuhammad Rahul AnantaNo ratings yet

- Kalish GI ProtocolsDocument5 pagesKalish GI Protocolsgoosenl100% (1)

- Data Analytics IntroductionDocument9 pagesData Analytics IntroductionsumitNo ratings yet

- Why Facts Don't Change Our MindsDocument9 pagesWhy Facts Don't Change Our MindsYoshio MatsuoNo ratings yet

- EX 1 Draw & Write A Few Lines On The Peacock: SR - Kg. Annual Exam Assignment. G.KDocument11 pagesEX 1 Draw & Write A Few Lines On The Peacock: SR - Kg. Annual Exam Assignment. G.Kapi-259347411No ratings yet

- Substantive Testing in The Revenue CycleDocument3 pagesSubstantive Testing in The Revenue CycleGeorgia FlorentinoNo ratings yet

- Gas Rating Summary 2010Document2 pagesGas Rating Summary 2010ahmadhadraniNo ratings yet

- Pic 18 F 46 K 40Document594 pagesPic 18 F 46 K 40Nelson FreitasNo ratings yet

- BCM Notes Unit No. IIDocument14 pagesBCM Notes Unit No. IIMahesh RamtekeNo ratings yet

- First ContingencyDocument2 pagesFirst Contingencymanju bhargavNo ratings yet

- SyllabusDocument3 pagesSyllabuspan tatNo ratings yet

- Professionalism in The Dental Office, Part One: I Chairside Conscience IDocument3 pagesProfessionalism in The Dental Office, Part One: I Chairside Conscience IKingjokerNo ratings yet

- The BoarderDocument3 pagesThe BoarderAnonymous iX6KV9LZzoNo ratings yet

- We Live in An Electromagnetic WorldDocument7 pagesWe Live in An Electromagnetic Worlddocorof634No ratings yet

- Discuss The Nature and Extent of Slavery As An Institution in Greco-Roman SocietyDocument4 pagesDiscuss The Nature and Extent of Slavery As An Institution in Greco-Roman SocietySouravNo ratings yet

- Lembar Observasi Kimia PKL 2023Document41 pagesLembar Observasi Kimia PKL 2023Nur Sri WahyuniNo ratings yet

- ApplianceDocument2 pagesApplianceTatanHenckerNo ratings yet

- Govt. College of Nusing C.R.P. Line Indore (M.P.) : Subject-Advanced Nursing PracticeDocument17 pagesGovt. College of Nusing C.R.P. Line Indore (M.P.) : Subject-Advanced Nursing PracticeMamta YadavNo ratings yet

- Industrial Automation Lab: Project ProposalDocument3 pagesIndustrial Automation Lab: Project ProposalAmaan MajidNo ratings yet

- Evaporator Pressure Regulating Valve SporlanDocument16 pagesEvaporator Pressure Regulating Valve SporlanSubramanian gokul100% (1)

- Jurnal Kacang Hijau Dan MaduDocument7 pagesJurnal Kacang Hijau Dan Madusri margiatiNo ratings yet

- Discursive and Factual PassageDocument2 pagesDiscursive and Factual PassageBrinda Mehta100% (1)

- 01-CPD-8, Civil Aviation Procedure Document On Airworthiness-MinDocument884 pages01-CPD-8, Civil Aviation Procedure Document On Airworthiness-Minnishat529100% (1)

- O-Ring UKDocument12 pagesO-Ring UKAan Sarkasi AmdNo ratings yet

- A044 2019 20 Readiness Review Template For EAC 3-12-2018 FinalDocument25 pagesA044 2019 20 Readiness Review Template For EAC 3-12-2018 FinalMohamed AbdelSalamNo ratings yet

- AwanishTrivedi PastryChefDocument3 pagesAwanishTrivedi PastryChefChandra MohanNo ratings yet

- Exercises Problem 2 Lesson 4Document2 pagesExercises Problem 2 Lesson 4Marianne DevillenaNo ratings yet

- Constitutions and ConstitutionalismDocument10 pagesConstitutions and ConstitutionalismmylovebhuNo ratings yet

- QSLP 150 Bulk CompressorDocument56 pagesQSLP 150 Bulk CompressorJ&CNo ratings yet

- Antiphon - Caritas - Habundat - in - Omnia - Hildegard Von BingenDocument3 pagesAntiphon - Caritas - Habundat - in - Omnia - Hildegard Von BingenGStarkNo ratings yet