Professional Documents

Culture Documents

Eternal and Stokes Cases

Uploaded by

kireijay0 ratings0% found this document useful (0 votes)

116 views5 pagesPhilamlife entered into a Creditor Group Life Policy agreement with Eternal Gardens Memorial. The policy was to be effective for a period of one year, renewable on a yearly basis. After more than one year, Philamlife did not anymore reply to Eternal's insurance claim. The mere inaction of the insurer on the insurance application cannot be interpreted as a termination of the insurance contract by the insurer.

Original Description:

Original Title

Eternal and Stokes cases

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPhilamlife entered into a Creditor Group Life Policy agreement with Eternal Gardens Memorial. The policy was to be effective for a period of one year, renewable on a yearly basis. After more than one year, Philamlife did not anymore reply to Eternal's insurance claim. The mere inaction of the insurer on the insurance application cannot be interpreted as a termination of the insurance contract by the insurer.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

116 views5 pagesEternal and Stokes Cases

Uploaded by

kireijayPhilamlife entered into a Creditor Group Life Policy agreement with Eternal Gardens Memorial. The policy was to be effective for a period of one year, renewable on a yearly basis. After more than one year, Philamlife did not anymore reply to Eternal's insurance claim. The mere inaction of the insurer on the insurance application cannot be interpreted as a termination of the insurance contract by the insurer.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 5

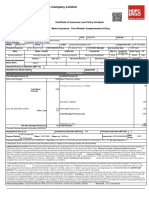

Automatic Insurance Coverage approving the application.

ETERNAL GARDENS MEMORIAL PARK CORPORATION vs.

THE

PHILIPPINE AMERICAN LIFE INSURANCE COMPANY

G.R. No. 166245, 9 April 2008 HELD:

FACTS:

YES. An insurance contract covering the lot purchaser is

Respondent insurance company entered into a Creditor created and the same is effective, valid, and binding until

Group Life Policy agreement with Eternal Gardens terminated by Philamlife by disapproving the insurance

Memorial. Under said policy, the clients of Eternal who application. The second sentence of Creditor Group Life

purchased burial lots from Policy No. P-1920 on the Effective Date of Benefit is in the

nature of a resolutory condition which would lead to the

it on installment basis would be insured by Philamlife. The cessation of the insurance contract. Moreover, the mere

amount of insurance coverage depended upon the existing inaction of the insurer on the insurance application must

balance of the purchased burial lots. The policy was to be not work to prejudice the insured; it cannot be interpreted

effective for a period of one year, renewable on a yearly as a termination of the insurance contract. The

basis. As required under the said policy, Eternal submitted termination of the insurance contract by the insurer must

a list of all new lot purchasers, including the application of be explicit and unambiguous.

each purchaser and their corresponding unpaid balances.

Included in this list is a certain John Chuang. More often than not, insurance contracts are contracts of

adhesion containing technical terms and conditions of the

When Chuang died, Eternal sent a letter, together with the industry, confusing if at all understandable to laypersons,

pertinent papers, to Philamlife which served as an that are imposed on those who wish to avail of insurance.

insurance claim for Chuang’s death. Philamlife required As such, insurance contracts are imbued with public

that Eternal submit certain documents relative to its interest that must be considered whenever the rights and

insurance claim for Chuang’s death. Eternal transmitted obligations of the insurer and the insured are to be

said documents which Philamlife was able to received. delineated. Hence, in order to protect the interest of

However, after more than one year, Philamlife did not insurance applicants, insurance companies must be

anymore reply to Eternal’s insurance claim. This prompted obligated to act with haste upon insurance applications, to

Eternal to demand the insurance claims. However, either deny or approve the same, or otherwise be bound to

Philamlife denied the said claim, prompting Eternal to file honor the application as a valid, binding, and effective

a case before the RTC of Makati. insurance contract.

ISSUE: WHEREFORE, we GRANT the petition

Whether or not Philamlife assumed the risk of loss without

When estoppel not applied to insurance contracts terms and conditions of the contract, he is not entitled as

a rule to recover for the loss or damage suffered. For the

JAMES STOKES vs. MALAYAN INSURANCE CO., INC. terms of the contract constitute the measure of the

G.R. No. L-34768, 24 February 1984 insurer’s liability, and compliance therewith is a condition

127 SCRA 766 precedent to the right of recovery.

FACTS: At the time of the accident, Stokes had been in the

Philippines for more than 90 days. Hence, under the law,

Daniel Adolfson had a subsisting Malayan car insurance he could not drive a motor vehicle without a Philippine

policy with coverage against own damage as well as 3rd driver’s license. He was therefore not an “authorized

party liability when his car figured in a vehicular accident driver” under the terms of the insurance policy in

with another car, resulting to damage to both vehicles. At question, and Malayan was right in denying the claim of

the time of the accident, Adolfson’s car was being driven the insured.

by James Stokes, who was authorized to do so by Adolfson.

Stokes, an Irish tourist who had been in the Philippines for Acceptance of premium within the stipulated period for

only 90 days, had a valid and subsisting Irish driver’s payment thereof, including the agreed period of grace,

license but without a Philippine driver’s license. merely assures continued effectivity of the insurance

policy in accordance with its terms. Such acceptance does

Adolfson filed a claim with Malayan but the latter refused not estop the insurer from interposing any valid defense

to pay contending that Stokes was not an authorized under the terms of the insurance policy.

driver under the “Authorized Driver” clause of the

insurance policy in relation to Section 21 of the Land The principle of estoppel is an equitable principle rooted

Transportation Office. upon natural justice which prevents a person from going

back on his own acts and representations to the prejudice

ISSUE:

of another whom he has led to rely upon them. The

Whether or not Malayan is liable to pay the insurance

claim of principle does not apply to the instant case. In accepting

Adolfson the premium payment of the insured, Malayan was not

HELD: guilty of any inequitable act or representation. There is

NO. A contract of insurance is a contract of indemnity nothing inconsistent between acceptance of premium due

upon the terms and conditions specified therein. When the under an insurance policy and the enforcement of its

insurer is called upon to pay in case of loss or damage, he terms.

has the right to insist upon compliance with the terms of

the contract. If the insured cannot bring himself within the WHEREFORE, the appealed judgment is reversed. The

complaint

is dismissed. Costs against appellees

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- INS 22 - Sample ExamDocument24 pagesINS 22 - Sample ExamPrasoon Banerjee100% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Car Insurance Policy Icici LombardDocument4 pagesCar Insurance Policy Icici Lombardrksingh02100% (1)

- Root Declarations Page 20211023Document3 pagesRoot Declarations Page 20211023SMART CHOICE AUTO GROUPNo ratings yet

- Certificate of Motor InsuranceDocument2 pagesCertificate of Motor Insurancemehrdad95.hNo ratings yet

- MCQ Chapter5645644645632Document15 pagesMCQ Chapter5645644645632bharath834No ratings yet

- Maybe Somehow in The Middle Their Lives Will MeetDocument1 pageMaybe Somehow in The Middle Their Lives Will MeetkireijayNo ratings yet

- 2002 Phil Report To The HRC Under IccprDocument231 pages2002 Phil Report To The HRC Under IccprkireijayNo ratings yet

- Labo Vs ComelecDocument10 pagesLabo Vs ComelecMirellaNo ratings yet

- G.R. No. 112019Document29 pagesG.R. No. 112019Henson MontalvoNo ratings yet

- Reshop Your Car Insurance: FundamentalsDocument3 pagesReshop Your Car Insurance: FundamentalsAlejandra RoseroNo ratings yet

- MR Magan Lal: Private Motor 4 WheelerDocument12 pagesMR Magan Lal: Private Motor 4 WheelerAjay KumarNo ratings yet

- 1.0 PM - Toyota Hilux Estimated Price List (IP) PDFDocument1 page1.0 PM - Toyota Hilux Estimated Price List (IP) PDFjeey irisNo ratings yet

- S B Goddard and Son Co: Prepared ForDocument5 pagesS B Goddard and Son Co: Prepared ForBernie McLaughlinNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 1002 1642 6400 000Document5 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2312 1002 1642 6400 000YATINDER DAHIYANo ratings yet

- Tpyqq PDFDocument8 pagesTpyqq PDFAbrahamsen11VaughnNo ratings yet

- To Renew SMS, REN To 9222211100Document7 pagesTo Renew SMS, REN To 9222211100sukarma acharyaNo ratings yet

- Section A. Total of 50 Points. Answer ALL The Questions at 5 PointsDocument3 pagesSection A. Total of 50 Points. Answer ALL The Questions at 5 PointsIka Puspa SatrianyNo ratings yet

- SB4 Audio ScriptDocument10 pagesSB4 Audio ScriptThanh ThuyNo ratings yet

- Ic s01 Motor InsuranceDocument57 pagesIc s01 Motor InsuranceRanjithNo ratings yet

- Certificate of Automobile Insurance (Ontario) : Described AutomobilesDocument6 pagesCertificate of Automobile Insurance (Ontario) : Described AutomobilesAndy OseiNo ratings yet

- PolicyScehdule - 2023-09-23T194106.545Document4 pagesPolicyScehdule - 2023-09-23T194106.545Sandip PatraNo ratings yet

- United India Insurance Company LimitedDocument13 pagesUnited India Insurance Company LimitedKARTHIKEYAN K.DNo ratings yet

- CHAPTER-: 11: Research Methodology & Review of LiteratureDocument53 pagesCHAPTER-: 11: Research Methodology & Review of Literaturejyoti wadhwaNo ratings yet

- Digit Two Wheeler Package Policy - Long TermDocument9 pagesDigit Two Wheeler Package Policy - Long TermDeleter DoraNo ratings yet

- VikasDocument4 pagesVikasrajuranjan0522No ratings yet

- Client Personal Injury Intake FormDocument15 pagesClient Personal Injury Intake Formk20220723No ratings yet

- Price List For Peninsular Malaysia: Medium Roof Window Van 2.5L Common Rail Turbo Diesel With Intercooler - 12 SeatersDocument1 pagePrice List For Peninsular Malaysia: Medium Roof Window Van 2.5L Common Rail Turbo Diesel With Intercooler - 12 SeatersRianah Hj JidiwinNo ratings yet

- Avoidance of Certain Terms and Rights of Recovery"Document1 pageAvoidance of Certain Terms and Rights of Recovery"Hitesh MutrejaNo ratings yet

- 1 PDFDocument7 pages1 PDFMariusNo ratings yet

- Motor Insurance Claim FormDocument2 pagesMotor Insurance Claim FormKancharla Naveen Reddy0% (1)

- Motor Endorsement IMT Exam PrintDocument4 pagesMotor Endorsement IMT Exam Printsekkilarji92% (13)

- BGR Brochure - 2021 - HDFC BankDocument2 pagesBGR Brochure - 2021 - HDFC BankPrameshwar KumarNo ratings yet

- Digit Two-Wheeler Package Policy: Go Digit General Insurance LTDDocument2 pagesDigit Two-Wheeler Package Policy: Go Digit General Insurance LTDPROFESSIONAL WORK ROHITNo ratings yet

- Motor PolicyDocument2 pagesMotor PolicySahil KumarNo ratings yet