Professional Documents

Culture Documents

Lin Greene Poster

Uploaded by

Vasanth BhatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lin Greene Poster

Uploaded by

Vasanth BhatCopyright:

Available Formats

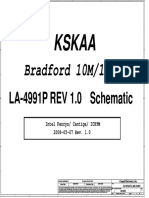

The MA3T model: Projecting Plug-in Hybrid Vehicle Demand and Impact with Detailed Market Segmentation

1. ABSTRACT Zhenhong Lin ( linz@ornl.gov ), David L. Greene ( dlgreene@ornl.gov )

Oak Ridge National Laboratory 5. KEY MESSAGEIS

Plug-in hybrid electric vehicles (PHEV) integrate the energy efficiency of hybrid

powertrain with the ability to partially substitute electricity for petroleum, and are The main development objective of MA3T is to facility policy analysis related to advanced

viewed as one solution to address the growing concerns about energy security

and global warming.

2. VEHICLE CHARACTERIZATION 3. THE MA3T MODEL 4. RESULTS

vehicle technologies.

MA3T provides a logical, transparent, and flexible modeling platform that can be populated

Battery Capacity in kWh with best available information on advanced automotive technologies and consumer behavior.

Sponsored by the Vehicle Technologies Program of the U.S. Department of Source: ANL/PSAT

With the best information available so far, MA3T shows:

Energy, the Market Adoption of Advanced Automotive Technologies (MA3T) model

Base PHEVSuccess

Model Features MA3T Framework

Technology

SI_PHEV10_Car

2010

4.1

2015

3.9

2045

3.5

2010

3.6

2015

2.7

2045

2.0

Vehicle Attributes Likelihood to Buy PHEV by Market Segment o Market acceptance of new technologies varies significantly across market segments.

was developed to project PHEV demand and its impact on energy and Nested Multinomial Logit (NMNL) model among conventional and FreedomCAR V2G Census2000

o The network effect among different adopters plays a critical role in PHEV market

SI_PHEV20_Car 7.8 7.5 6.8 6.8 5.2 3.9

environment. The (MA3T) model features 26 vehicle technologies, 1458 market SI_PHEV40_Car 16.0 15.4 13.7 13.8 10.8 8.1 advanced vehicle technologies (AVT), implemented in MS Excel/VBA Literature

vehicle retail price 25% Reference Segment: transition.

ORC Survey Purchase Discount, Tax

segments, learning-by-doing, chicken-and-egg dynamics, and application flexibility. FC_PHEV10_Car 4.4 4.3 3.9 3.7 2.8 2.1

FC_PHEV20_Car 8.6 8.3 7.6 7.3 5.6 4.2 the U.S. light-duty vehicle market, 2005 to 2050 Credit, Free Parking, fuel and electricity cost SouthAtlantic

o The daily VMT distribution seems to be important, but the effect is yet to be quantified.

Free HOV, etc Suburban

Application of the MA3T model to two scenarios. FC_PHEV40_Car 17.8 17.1 15.5 14.9 11.3 8.6 ANL/PSAT LBD o affected by daily VMT distribution and 20% EarlyAdopter o PHEV with smaller battery appears to be more promising.

EV_Car 65.3 52.6 55.4 56.0 40.2 29.4 estimates potential impact of AVT on energy use and GHG emissions. driving behavior, varying by region, FrequentDriver

o ARRA PHEV subsidy included Suburban vs

Market Share (100%)

SI_PHEV10_Trk 5.7 5.4 5.1 5.0 3.9 3.0 EIA/AEO2009 NMNL

Garage o The amount of electricity required even by a large PHEV fleet appears to be a small

o vehicle performance based on PSAT model

SI_PHEV20_Trk 11.0 10.4 9.6 9.5 7.3 5.8 includes impacts of on AVT success. Module Sales Policy area and driver type Urban

Base SI_PHEV40_Trk 22.4 21.4 19.7 19.6 15.2 11.8 Maker 15% NoWorkRecharge fraction of the existing generation capacity.

case o costs based on DOE Multi-path study FC_PHEV10_Trk 6.1 5.7 5.4 5.1 4.0 3.1 provides a tool for evaluation of program benefits (e.g. VTP) and R&D

NHTS2001 refueling and recharging accessibility cost SouthAtlantic vs

Stock MiddleAtlantic o About 50% reduction of petroleum use or tailpipe CO2 emissions can be achieved by

FC_PHEV20_Trk 11.9 11.2 10.7 10.1 7.8 6.2 Model policies

o calibrated to AEO 2009 Reference Updated directions UCD Availability 2050 if battery technologies meets the FreedomCAR goals on schedule while

FC_PHEV40_Trk 24.8 23.2 22.1 20.9 16.1 12.3

EV_Trk 91.2 71.1 79.0 78.8 57.1 43.3

PHEV Survey o purchase subsidy, tax credit, HOV 10% Reference Segment

o ARRA PHEV subsidy included is open for update and re-calibration as we learn more from PHEVs, Fuel and

hydrogen technologies do not.

EVs and FCVs, technologies that are still unfamiliar to consumers.

Technology access, free parking, etc FrequentDriver

PHEVSuccess o both performance and costs based on Battery Cost in 2005 USD Range & Fuel Availability Risk Electricity Use

vehicle-to-grid costs and revenues

6. AREAS FOR IMPROVEMENT

vs ModestDriver

case DOE FreedomCAR program goals

Source: Base case based on DOE Multi-path Study, PHEV

1,458 market segments divided by region (9 census divisions), 5%

Success case based on FreedomCAR Goals Refuel&Recharg o implemented but not reflected in the EarlyAdopter vs

Base PHEVSuccess residential area (urban, suburban, rural), technology attitude (early adopter, Infrastructure Parameterization

Results for each scenario by region, area, driver Technology 2010 2015 2045 2010 2015 2045 early majority, late majority), driver types (moderate, average, frequent input Tailpipe and current scenario runs LateMajority Garage vs no parking

SI_PHEV10_Car 4,466 3,156 1,754 2,089 997 369 Vehicle Usage Lifecycle GHG 0% o Price elasticity

type, technology attitude, home/work recharge driver), home recharge availability (garage, off-street, neither) and work output greenness (placeholder)

availability, and vehicle technology:

SI_PHEV20_Car 8,010 5,768 3,274 3,720 1,789 683

recharge availability (with, without) feedback

and Scrappage

ANL/GREET home backup power 2010 2015 2020 2025 o Value of fuel savings

SI_PHEV40_Car 14,375 10,811 6,170 6,617 3,248 1,292

o market penetration and sales FC_PHEV10_Car 4,858 3,402 1,938 2,186 1,026 382

model availability o Value of refueling and recharging convenience

FC_PHEV20_Car 8,897 6,389 3,648 3,997 1,911 733 use parameters that are calibrated based on consensus estimates from

o vehicle stock FC_PHEV40_Car 15,981 11,981 6,970 7,158 3,402 1,380 previous studies, theory, and assumptions technology risk o V2G

EV_Car 48,950 31,548 20,771 22,400 10,060 4,410 Market segment data

o use of gasoline, diesel, hydrogen and electricity battery replacement cost Vehicle Sales and Fuel Use, Base Case

SI_PHEV10_Trk 6,256 4,359 2,530 2,950 1,429 534 include a considerably wide but expandable range of vehicle and Model Calibration

o tailpipe CO2 emission SI_PHEV20_Trk 11,385 7,989 4,625 5,230 2,529 1,004

consumer attributes acceleration o Early adopters

EIA/AEO 2008 Ref Updated MA3T Projection

o fuel and recharge availability SI_PHEV40_Trk 20,200 15,014 8,877 9,387 4,575 1,884 25 10 Home or work recharging

FC_PHEV10_Trk 6,665 4,551 2,712 3,016 1,454 558 14 cargo space SI P10 Others o

o experience-determined vehicle price

consider daily VMT distribution and driver variation 14

SI HEV Car SI P10

FC_PHEV20_Trk 12,278 8,608 5,168 5,577 2,701 1,067 12 towing 9 o Driver and driving distributions

FC_PHEV40_Trk 22,293 16,223 9,925 10,041 4,833 1,976

12

LTK LTK

L. Truck Sales (million)

Car Sales (million)

EV_Trk 68,389 42,660 29,638 31,504 14,269 6,499

10 10 Including buy or no buy choice

8 20 CI Conv 8

Vehicle Price in 2005 USD Choice Structure Buy LDV 8

Life-cycle GHG (GREET)

Fuel Demand (MBOED)

Vehicle Urban Fuel Economy 6 6 LTK

Sensitivity to Energy Price 7 Vehicle range sensitive to fuel availability

Annual Sales (Million)

Source: Base case based on DOE Multi-path Study, PHEV urban only, unadjusted, EV in Wh/mile, else in MPGGE

Car LD Truck 4 4

Success case based on FreedomCAR Goals Vehicle Choice Coding Source: ANL/PSAT

2 2 Ref Oil and High Oil correspond to Reference and 15 SI HEV Car 6 Your generous advice !

Fully-Learned Vehicle Price: Base Case, Car Urban Fuel Economy: Base Case, Car

x_x_Car one of the 13 passenger car technologies Conv/HEV Hydrogen EV 0 0 High Oil cases in EIA/AEO 2009

120

Urban Fuel Economy

100 x_x_Trk one of the 13 light-duty truck technologies 2005 2010 2015 2020 2025 2030 2005 2010 2015 2020 2025 2030 5

7. ACKNOWLEDGEMENT

100 9

Annual Vehicle Sales (million)

(2005 USD)

80 SI_Conv_x conventional spark-ignition gasoline (MPGGE) HEV H2 ICE

vehicles

80 5 350 Base case 10 SI Conv LTK 4

LD Vehicle Population (million)

60

60 300

CI_Conv_x conventional compression-ignition diesel 6

Vehicle Use (billion VMT)

40 SI HEV CI HEV FC HEV 4

Phil Patterson, Jacob Ward, U.S. Department of Energy

40 250 3

vehicles

20 20 3

non-plug-in hybrid vehicles 200

2010 2015 2030 2045

x_HEV_x

2010 2015 2030 2045 Conv FC PHEV 5 2 Tim Cleary, Sentech, Inc.

Fully-Learned Vehicle Price: PHEVSuccess, Car

x_PHEV#_x plug-in hybrid vehicles with #(=10/20/40) Urban Fuel Economy: PHEVSuccess Case, Car 2 150 3 SI Conv Car

SI_PHEV20 SI_PHEV40 miles rated all-in-electricity range 120 SI_Conv

FC_PHEV40 CI Conv SI Conv H2 FC PHEV10 100 1 Sujit Das, Oak Ridge Natonal Laboratory

60

Urban Fuel Economy

SI_PHEV10 FC_HEV FC_PHEV20 1

SI_PHEV10 H2_Conv

H2_Conv_x hydrogen-powered internal combustion 100

CI_Conv SI_PHEV20

H2_Conv FC_PHEV10 50

CI_HEV FC_HEV

Aymeric Rousseau, Steve Plotkin, Dan Santini, Argonne National Laboratory

(2005 USD)

SI_HEV

50 engine vehicles

SI_PHEV40

0 0 0

(MPGGE)

SI_HEV FC_PHEV10 CI_HEV 0 0

CI_Conv FC_PHEV20 80 SI PHEV H2 FC PHEV20

40 SI_Conv FC_PHEV40 FC_x_x vehicles with PEM fuel cell as the power 2005 2010 2015 2020 2025 2030 2005 2010 2015 2020 2025 2030 2005 2015 2025 2035 2045 2005 2020 2035 2050 2005 2020 2035 2050 Ken Kurani, Tom Turrentine, University of California, Davis

EV 60

30

source SI PHEV10 SI PHEV20 SI PHEV40 H2 FC PHEV40 EV w/ High Oil EV w/ Ref Oil

40

EV_x battery_only_powered vehicles H2 w/ High Oil H2 w/ Ref Oil

20 20

2010 2015 2030 2045 2010 2015 2030 2045

NMNL Theory jkl cijkl PHEV SI w/ High Oil PHEV SI w/ Ref Oil Electricity Consumption

Base PHEVSuccess Base PHEVSuccess Technology Attitude e 9

Vehicle Sales and Fuel Use, PHEVSuccess Case PHEV Success case

Annual Vehicle Sales (million)

pi| jkl

pi| jkl

Technology 2010 2015 2045 2010 2015 2045 Technology 2010 2015 2045 2010 2015 2045 Conditional probability of choice i in nest j =

SI_Conv_Car 21,541 21,583 23,186 22,485 22,946 23,823 SI_Conv_Car 32.3 34.4 43.5 41.0 42.7 49.0

Perceived Risk of New Technology by Adopter Group

car/truck, k = Conv/H2/EV and l = 1 e jkl chjkl PHEV Success case

25 10

140

US total

Other SI

PHEV,

Electricity Consumption

CI_Conv_Car 24,637 24,408 25,450 25,055 25,118 25,420 CI_Conv_Car 37.0 38.4 45.0 42.6 46.1 53.5 $15 i 6 Other Other 120 electricity

technology type is a function of a price Car &

(billion kWh/year)

h consumption is

SI s

Risk (1000 $/Vehicle)

SI_HEV_Car 27,759 26,305 26,242 26,109 24,451 24,046 SI_HEV_Car 50.1 52.4 61.5 60.7 69.6 86.9 100

9 3,873 billion LTK

p

sensitivity parameter βjkl and

1

CI_HEV_Car 31,045 29,203 28,632 28,826 26,714 25,742 CI_HEV_Car 54.9 56.6 67.7 66.4 75.8 93.9 $10 EV LTK kWh, according

80 to DOE/EIA EV LTK

SI_PHEV10_Car 31,416 28,351 26,951 27,421 24,856 23,912 SI_PHEV10_Car 53.3 56.0 63.8 63.1 72.0 88.4 generalized cost cijkl. i| jkl 3 20 CI EV Car Base Total 8 Mareket Performance by Adopter

SI_PHEV20_Car 36,814 32,396 29,248 29,917 26,070 24,389 SI_PHEV20_Car 53.1 55.4 63.7 62.8 71.9 88.6 $5 i 60 EV Car

Fuel Demand (mboed)

Conv SI P10 PHEV Success case

SI_PHEV40_Car 46,576 40,100 33,733 34,376 28,347 25,297 SI_PHEV40_Car 51.8 54.2 62.3 61.6 70.8 88.6 7 40

SI P10 SI P10 LTK

Annual Sales (million)

EA=Early Adopter; EM=Early Majority; LM=Late Majority

H2_Conv_Car 29,680 27,892 28,243 29,680 27,892 28,243 H2_Conv_Car 26.5 31.3 35.9 26.5 31.3 35.9

$0 The generalized cost cijkl is a function of 0 20 Car

FC_HEV_Car 39,032 34,235 30,640 38,155 33,076 29,334 FC_HEV_Car 67.9 76.6 86.2 67.9 76.6 86.2 technology attributes xzijkl and the 2005 2015 2025 2035 2045 15 6

FC_PHEV10_Car FC_PHEV10_Car

-$5 SI 0 2.5 15%

40,890 34,885 30,773 36,882 31,320 28,438 69.2 78.1 85.4 69.2 78.1 85.4 attribute weight (or value) wzjkl.

FC_PHEV20_Car FC_PHEV20_Car 0 1 2 3 4 5 P10 5 2005 2015 2025 2035 2045

47,154 39,427 33,491 39,805 32,709 29,119 68.3 77.1 84.5 68.3 77.1 84.5

= Likelihood to Buy PHEV

FC_PHEV40_Car 58,244 48,245 38,558 45,010 35,376 30,173 FC_PHEV40_Car 66.4 75.0 82.6 66.4 75.0 82.6 Stock on the Road (million)

Impact of PHEV Subsidy 10 SI HEV 4 2

EA likelihood

10%

EV_Car 95,266 67,792 51,835 54,870 35,152 26,427 EV_Car 268.3 253.0 229.2 229.5 197.7 161.3 Chicken-n-Egg

Market Penetration

SI_Conv_Trk 24,364 24,338 26,282 24,305 24,792 25,559 SI_Conv_Trk 24.1 26.1 30.2 31.5 32.4 37.5 9 LTK Where the Market Goes

Annual PHEV Sales (million)

Driving and Driver Distribution Recharge Availability and PHEV Stock SI

PHEV Sales (million)

CI_Conv_Trk 26,619 26,197 27,321 26,933 26,844 27,079 CI_Conv_Trk 29.1 30.4 33.1 33.3 35.9 41.1 0.035

Driver Type 3 PHEV Success case, year 2015

8 Conv SI HEV 1.5 5%

SI_HEV_Trk SI_HEV_Trk 120% 12 Rural Suburban Urban Sales (thousand)

32,362 30,267 29,417 29,601 27,056 26,115 35.0 37.0 41.7 41.8 47.9 56.9 Daily VMT Distribution 0.030 Modest Driver X = Γ(1.68, 14.11) 7 EM likelihood

PHEVSuccess

5 Car 2 0 20 40 60 80 100

PHEV Stock (million)

Recharge Availability

CI_HEV_Trk 34,895 32,527 31,238 31,773 28,967 27,624 CI_HEV_Trk 39.5 41.3 47.3 47.0 53.2 62.4

probability density

0.018 0.025 100% Availability 10 PHEVSuccess PHEVSuccess

SI_PHEV10_Trk SI_PHEV10_Trk

6 01_NENG

37,837 33,394 30,787 31,698 27,923 26,112 37.2 39.5 43.7 43.6 49.2 57.8 0.016 40 mile CD range w/ ARRA w/o ARRA

1 0%

Average Driver X = Γ(1.90, 23.20) 80% 8 1 LM likelihood

probability density

0.020 5

SI_PHEV20_Trk 45,649 38,939 34,032 35,204 29,616 26,842 SI_PHEV20_Trk 36.9 39.2 43.3 43.3 49.0 57.6 0.014

PHEVSuccess SI Conv 02_MATL

LM Sales

0.012 0.015 4

SI_PHEV40_Trk 59,100 49,711 40,539 41,665 32,781 28,196 SI_PHEV40_Trk 36.3 38.3 42.5 42.4 48.2 57.2 60% Stock 6 Car 03_ENCL

H2_Conv_Trk H2_Conv_Trk

0.01 0.010 Frequent Driver X = Γ(1.80, 43.05) Base w/ 0 0

33,024 32,010 32,104 33,024 32,010 32,104 20.9 24.4 27.8 20.9 24.4 27.8 mostly electricity, 40%

3 04_WNCL

0.5 -5%

0.008 Base Stock 4 ARRA 2005 2020 2035 2050 2005 2020 2035 2050

FC_HEV_Trk 47,656 40,225 36,057 46,655 38,859 34,505 FC_HEV_Trk 47.2 54.7 58.1 47.2 54.7 58.1 little gasoline 0.005 2 05_SATL

0.006 Base w/o EM Sales

FC_PHEV10_Trk FC_PHEV10_Trk 20% 2

50,350 41,736 36,438 44,877 37,091 33,207 47.9 55.1 57.6 47.9 55.1 57.6 0.004 gasoline and 0.000 1 ARRA 06_ESCL

FC_PHEV20_Trk FC_PHEV20_Trk electricity, Base Availability EA Sales

59,082 48,120 40,335 49,031 39,259 34,183 47.3 54.4 56.9 47.3 54.4 56.9 0.002 0 50 100 150 200 250 0% 0 07_WSCL 0 -10%

battery fully 0

FC_PHEV40_Trk 74,907 60,010 47,846 56,528 42,924 35,921 FC_PHEV40_Trk 45.9 53.0 55.5 45.9 53.0 55.5 0 2005 2015 2025 2035 2045 08_MNTN

EV_Trk 127,311 86,852 67,202 70,829 43,305 31,080 EV_Trk 391.7 364.1 345.6 340.2 295.5 255.4 0 10 20 30 40 50 60 70 80 90 100

X = Daily Vehicle Usage (mile) 2005 2020 2035 2050 2010 2015 2020

09_PCFC

Daily Vehcle-miles-traveled

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Wi-Fi Planning and Design Questionnaire 2.0Document12 pagesWi-Fi Planning and Design Questionnaire 2.0Free Space67% (3)

- 1 48 Volt Parallel Battery System PSS-SOC - Step-By-Step VolvoDocument11 pages1 48 Volt Parallel Battery System PSS-SOC - Step-By-Step VolvoEyosyas NathanNo ratings yet

- List of Newly and Migrated Programs For September 2022 - WebsiteDocument21 pagesList of Newly and Migrated Programs For September 2022 - WebsiteRMG REPAIRNo ratings yet

- Splunk Certification: Certification Exam Study GuideDocument18 pagesSplunk Certification: Certification Exam Study GuidesalemselvaNo ratings yet

- UNIT 6 - Dr. Cemre Erciyes PDFDocument24 pagesUNIT 6 - Dr. Cemre Erciyes PDFMaries San PedroNo ratings yet

- LIC Product PositioningDocument15 pagesLIC Product PositioningRasika Pawar-HaldankarNo ratings yet

- ADAMDocument12 pagesADAMreyNo ratings yet

- Bridging: Transportation: Chapter 3: The Transportation Planning ProcessDocument28 pagesBridging: Transportation: Chapter 3: The Transportation Planning ProcesspercyNo ratings yet

- ShapiroDocument34 pagesShapiroTanuj ShekharNo ratings yet

- 4439 Chap01Document28 pages4439 Chap01bouthaina otNo ratings yet

- Low Cost CompaniesDocument9 pagesLow Cost CompaniesIvan RodriguezNo ratings yet

- Man 3Document38 pagesMan 3Paylo KatolykNo ratings yet

- DPWH Cost EstimationDocument67 pagesDPWH Cost EstimationAj Abe92% (12)

- Schema Elctrica Placa Baza Toshiba A500-13wDocument49 pagesSchema Elctrica Placa Baza Toshiba A500-13wnicmaxxusNo ratings yet

- Statement of Facts:: State of Adawa Vs Republic of RasasaDocument10 pagesStatement of Facts:: State of Adawa Vs Republic of RasasaChristine Gel MadrilejoNo ratings yet

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Document12 pagesReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.No ratings yet

- Output Vat Zero-Rated Sales ch8Document3 pagesOutput Vat Zero-Rated Sales ch8Marionne GNo ratings yet

- Question: To What Extent Do You Agree or Disagree?Document5 pagesQuestion: To What Extent Do You Agree or Disagree?tien buiNo ratings yet

- PCIB Vs ESCOLIN (G.R. No. L-27860 & L-27896)Document61 pagesPCIB Vs ESCOLIN (G.R. No. L-27860 & L-27896)strgrlNo ratings yet

- Poverty Eradication Cluster HLPF Position Paper With Case StudiesDocument4 pagesPoverty Eradication Cluster HLPF Position Paper With Case StudiesJohn Paul Demonteverde ElepNo ratings yet

- FAA PUBLICATIONS May Be Purchased or Downloaded For FreeDocument4 pagesFAA PUBLICATIONS May Be Purchased or Downloaded For FreeFlávio AlibertiNo ratings yet

- 11.traders Virtual Mag OTA July 2011 WebDocument68 pages11.traders Virtual Mag OTA July 2011 WebAde CollinsNo ratings yet

- Management by ObjectivesDocument30 pagesManagement by ObjectivesJasmandeep brar100% (4)

- Network Protection Automation Guide Areva 1 PDFDocument500 pagesNetwork Protection Automation Guide Areva 1 PDFEmeka N Obikwelu75% (4)

- 1.1 Cruz v. DENR PDFDocument7 pages1.1 Cruz v. DENR PDFBenBulacNo ratings yet

- Inkt Cables CabinetsDocument52 pagesInkt Cables CabinetsvliegenkristofNo ratings yet

- Beijing-Michael PageDocument71 pagesBeijing-Michael Pagejohndavsg8022No ratings yet

- MLCP - Area State Ment - 09th Jan 2015Document5 pagesMLCP - Area State Ment - 09th Jan 201551921684No ratings yet

- Part List SR-DVM70AG, SR-DVM70EUDocument28 pagesPart List SR-DVM70AG, SR-DVM70EUAndrea BarbadoroNo ratings yet