Professional Documents

Culture Documents

CEC

Uploaded by

Jyoti BerwalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CEC

Uploaded by

Jyoti BerwalCopyright:

Available Formats

CENTRAL EQUIPMENT COMPANY

In the beginning of January 2009, Mr. L.C. Tandon, Director of Finance of Central Equipment Company

(CEC) was evaluating the pros and cons of debt and equity financing for the purpose of expansion of

CEC’s existing production facilities. At a recent meeting of the board of directors, a heated discussion

took place on the best method of financing the expansion. Mr. K.C. Soni, Chairman and Managing

Director (CMD), had therefore directed Mr. Tandon to critically evaluate the points made by the various

members of the board. He also asked him to prepare a report on behalf of the company’s management to

be presented at the board meeting to be held in the last week of January 2009.

Background of the Company

CEC was started in the late fifties as a government company. It is one of the important engineering

companies in the public sector in India, manufacturing a wide range of products. CEC’s products include

industrial machinery and equipments for chemicals, paper, cement, and fertilizers industries, super

heaters, economizers, and solid material handling and conveying equipments.

CEC had started with a paid-up capital of Rs 10 million in 1959. As per the estimated balance sheet at

the end of the financial year 2009, it has a paid-up capital of Rs 180 million (divided into 1.8 million shares

of Rs 100 each) and reserves of Rs 4459.60 million. The company’s sales have shown a general

increasing trend in spite of a number of difficulties such as recessionary conditions, high input cost,

frequent power cuts and unremunerative regulated prices of certain products. In the last decade, CEC’s

sales have increased from Rs 1,804 million in the financial year 2000 to Rs 3,042 million in 2008. The

sales for year ending 31 March 2009 are estimated to be Rs 3,377 million. Net profit (profit after tax,

PAT) has increased from Rs 17.1 million in FY 2000 to Rs 43.5 million in FY 2008. The company is

projecting a profit after tax of Rs 50.3 million in FY 2009. Due to the recessionary and other economic

factors, sales and profits of the company have shown a cyclical behaviour over the last decade. Table

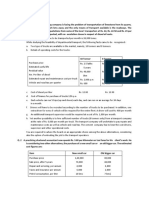

14.1.1 gives sales and profit data since FY 2000.

Table 14.1.1: Central Equipment Company:

Selected Financial Data for the Year ending on 31 March

Sales PBIT PAT Dividend EPS

FY (Rs million) (Rs million) (Rs million) (Rs) (Rs)

2000 1804.0 34.3 17.1 9.0 9.50

2001 1707.8 15.5 7.8 9.0 4.33

2002 1894.0 41.2 20.6 9.0 11.44

2003 2270.8 52.2 26.1 9.0 14.50

2004 2520.0 58.0 29.0 10.8 16.11

2005 2775.0 66.6 33.3 10.8 18.50

2006 2949.2 76.8 38.4 14.4 21.33

2007 2433.8 -5.3 -5.3 9.0 —-

2008 3042.3 66.2 43.5 27.0 24.17

2009$ 3376.9 77.5 50.3 27.0 27.94

$ Estimates

The Expansion Project

The need for expansion was felt because the market was fast growing and the company has at times

reached its existing capacity. The project is expected to cost Rs 200 million, and generate an average

(c) IIM, Ahmedabad: Case written by Professor I M Pandey Page 1

profit before interest and taxes (PBIT) of Rs 40 million per annum, for a period of ten years. It is expected

the new plant will cause significant increase in the firm’s fixed costs. The annual total expenses of the

company after expansion are expected to consist of 55 per cent of fixed and 45 per cent variable

expenses. The company’s financial condition in the year 2009-2010 is projected in Table 14.1.2 without

and with the expansion.

Table 14.1.2: Central Equipment Company:

Sales and Profits Without and With Expansion

Sales PBIT PAT Dividend EPS

FY (Rs million) (Rs million) (Rs million) (Rs) (Rs)

Without Expansion

3579.5 85.0 56.1 27.0 31.2

With Expansion# 4032.3 125.0 82.5 57.0 21.7

# Projections include financial impact of proposed expansion and assuming equity finance at issue price of Rs 100 each share.

The management has already evaluated the financial viability of the project and found it acceptable

even under adverse economic conditions. Mr. Soni felt that there would not be any difficulty in getting the

proposal approved from the board and relevant government authorities. He also thought that the

production could start as early as from April 2009.

Financing of the Project

CEC has so far followed a very conservative financing policy. All these years, the company has financed

its growth through budgetary support from the government in the form of equity capital and internally

generated funds. The company has also been meeting its requirements for working capital finance from

the internal funds. The company has, however, negotiated a standing credit limit of Rs 50 million from a

large nationalized bank. In the past, it has hardly used the bank limit because of sufficient internal

resources. As may be seen from the estimated balance sheet as on March 31, 2009 in Table 14.1.3,

CEC’s capital employed included paid-up share capital and reserves without any debt. The CMD feels

that given the government’s current attitude whereby it would like profitable companies to raise funds

from the capital markets for their investments, it may look odd for CEC to obtain budgetary support from

the government. However, in his assessment, CEC being a profitable company, government may agree

to allow it to come up with an IPO, provided the government’s shareholding remains at least equal to 51

per cent of the total paid up capital and may also be willing to provide budgetary support for the project.

More significantly, he felt that raising equity capital might be difficult and it may dilute equity earnings.

The company’s merchant banker suggested that in case it wants to go for IPO, it may be able to sell its

shares about 20 to 50 per cent above its par value of Rs 100. Given these facts, CMD decided to

reconsider the company’s policy of avoiding long-term debt. It was thought that the use of debt could be

justified by the expected profitable position of the company.

(c) IIM, Ahmedabad: Case written by Professor I M Pandey Page 2

Table 14.1.3: CEC: Estimated Balance Sheet

as on 31 March 2009

Capital Assets

Sundry creditors 151.8 Cash and bank balance 89.0

Tax provision 30.3 Sundry debtors 180.7

Other current liabilities 121.5 Inventory 41.1

Other current assets 47.1

Current Liabilities 303.6 Current assets 357.9

Paid-up share capital 180.0 Gross block 819.9

Reserve & surplus 459.6 Accumulated depreciation 234.6

Net worth 639.6 Net block 585.3

Total Capital 943.2 Total Assets 943.2

Mr. Tandon has determined that the company could sell Rs 1,000 denomination bonds for an amount

of Rs 200 million either to the public or to the financial institutions through private placement. The interest

rate on bonds will be 10 per cent per annum, and they could be redeemed after seven years in three

equal annual instalments. The bonds and interest thereon will be fully secured against the assets of the

company. In Mr. Tandon’s view, the company will have to sell a large number of bonds to the financial

institutions as CEC being a new company in the capital market, the public may not fully subscribe to the

issue. He also felt that from the individual investors’ point of view, CEC might have to give an option to

the bondholders to sell back to the company bonds up to an amount of Rs 10 million each year. Also,

bondholders shall have right to appoint one nominee director on the board of the company which shall

however be exercised by the bond trustees only if the company defaults in the payment of interest or

repayment on the due date.

In Mr. Tandon’s opinion the bond was a cheaper source of finance, since interest amount was tax

deductible. Given the company’s tax rate of 34 per cent, the 10 per cent interest rate was equal to 6.6

per cent from the company’s point of view. On the other hand, he thought that equity capital would be

costly to service, as CEC is currently paying a dividend of 15 per cent on its paid-up capital. Further, as

per the current tax laws in India, the company would have to pay tax on dividends. Thus, the bond

alternative looked attractive to Mr. Tandon on the basis of the comparison of costs.

The expansion proposal was discussed in the January 2009 meeting of the board. As most of the

members were convinced about the profitability and desirability of the project, they did not take much time

to approve it. Immediately after this decision, Mr. Tandon informed the members about the possibility of

raising finance through a bond issue. He then presented his report highlighting the comparison between

bond and equity financing. His conclusions clearly showed that bond financing was better for the

company. Mr. Tandon was surprised to note that substantial disagreement existed among the members

regarding the use of bond.

One director questioned the correctness of Mr. Tandon’s calculation of the cost of the bond as he had

ignored the implications of the annual requirement arising out of investors exercising the option.

According to him, this would mean higher cost of bond as compared to equity capital. Yet another

director emphasized that a lot of annual cash outflow will also take place under the bond alternative. He

felt that the issue of bond would thus add to the company’s risk by pressurizing its liquidity. Most of the

directors, however, were in agreement with the estimate of post expansion profit before interest and taxes

(PBIT) of Rs 125 million.

(c) IIM, Ahmedabad: Case written by Professor I M Pandey Page 3

One of the directors argued that given the expected higher PBIT, the post-expansion equity return

would significantly increase if the funds are raised by issuing bonds. He even emphasized that the job of

the management should be to maximize profitability of equity owners by taking reasonable risks. Another

director countered this argument by stating that the equity return could be diluted if the company was

unable to earn sufficient profit from the existing business and the new project. The discussion on bond

versus equity financing was so involved that there did not seem to be any sign of a unanimous agreement

being reached. At this juncture, Mr. Tandon suggested that the discussion on financing alternatives might

be postponed until January end to allow him sufficient time to come up with a fresh analysis incorporating

the various points raised in the current meeting. Mr. Tandon was wondering what he should do so that a

unanimous decision could be reached.

(c) IIM, Ahmedabad: Case written by Professor I M Pandey Page 4

You might also like

- Case Summary FMDocument7 pagesCase Summary FMnrngshshNo ratings yet

- Tata Motors:cost of CapitalDocument10 pagesTata Motors:cost of CapitalAnkit GuptaNo ratings yet

- Assignment2 FMDocument2 pagesAssignment2 FMSiva Kumar0% (1)

- Tata Motors Cost of CapitalDocument10 pagesTata Motors Cost of CapitalMia KhalifaNo ratings yet

- Maruti Suzuki 16S517Document6 pagesMaruti Suzuki 16S517Himanshu JhaNo ratings yet

- 1.infosys PPT FinalDocument13 pages1.infosys PPT FinalTapan ShahNo ratings yet

- Analysis of L&T's Dividend PolicyDocument39 pagesAnalysis of L&T's Dividend PolicyAmber GuptaNo ratings yet

- An Analysis of Annual Ratio of TCS FinalDocument106 pagesAn Analysis of Annual Ratio of TCS FinalChandan Srivastava100% (1)

- (Rs MN.) : Case 10.1: Hind Petrochemicals CompanyDocument1 page(Rs MN.) : Case 10.1: Hind Petrochemicals Companylefteris82No ratings yet

- CH 4 and 5 Sanjay Ind Sol Finacman 6th EdDocument8 pagesCH 4 and 5 Sanjay Ind Sol Finacman 6th EdAnshika100% (2)

- Continuous Assignments: Ram Kumar KakaniDocument10 pagesContinuous Assignments: Ram Kumar KakaniKabeer KarnaniNo ratings yet

- AFSA Certification Test - FinShiksha - SolutionDocument20 pagesAFSA Certification Test - FinShiksha - SolutionAnil Kumar SharmaNo ratings yet

- Tata Motors Financial Anlysis Project Report 2021Document19 pagesTata Motors Financial Anlysis Project Report 2021Karan Jadhav100% (1)

- Cap Bud - HeroDocument13 pagesCap Bud - HeroMohmmedKhayyumNo ratings yet

- Modern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingDocument7 pagesModern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingbansalparthNo ratings yet

- TATA MOTORS Atif PDFDocument9 pagesTATA MOTORS Atif PDFAtif Raza AkbarNo ratings yet

- Service CostingDocument6 pagesService Costingbinu100% (1)

- Strategic Alliance of Maruti SuzukiDocument2 pagesStrategic Alliance of Maruti SuzukiAbhishekKumar100% (1)

- SolutionsDocument5 pagesSolutionsSahil NandaNo ratings yet

- Ratio Analysis of Maruti Suzuki: Prepared & Submitted byDocument18 pagesRatio Analysis of Maruti Suzuki: Prepared & Submitted bymahbobullah rahmaniNo ratings yet

- Case Study - Tata Capital PDFDocument1 pageCase Study - Tata Capital PDFHaley HopperNo ratings yet

- Central Equipment CompanyDocument6 pagesCentral Equipment CompanySiddhanth MunjalNo ratings yet

- Casestudy Kalsi AgroDocument3 pagesCasestudy Kalsi AgroGPLNo ratings yet

- TATA Case StudyDocument7 pagesTATA Case StudyRoshNo ratings yet

- HCL Technology Financial Analysis: A Project Report OnDocument22 pagesHCL Technology Financial Analysis: A Project Report OnGoutham SunderNo ratings yet

- EIC Analysis Sun PharmaDocument7 pagesEIC Analysis Sun PharmaDeepakNo ratings yet

- Tata Moters" 2011-2013 A Project Report On Financial Analysis of "Tata Motors"Document46 pagesTata Moters" 2011-2013 A Project Report On Financial Analysis of "Tata Motors"Arpkin_loveNo ratings yet

- Case Asignment On Central Equipment CompanyDocument2 pagesCase Asignment On Central Equipment Companykeshav18125% (4)

- Tata Cost SheetDocument6 pagesTata Cost SheetDebanjan BanerjeeNo ratings yet

- M3 - Valuation Question SetDocument13 pagesM3 - Valuation Question SetHetviNo ratings yet

- A Study On The Fundamental Analysis On Bajaj Auto LimitedDocument65 pagesA Study On The Fundamental Analysis On Bajaj Auto Limitedprayas sarkar50% (2)

- Infosys Ratio AnalysisDocument61 pagesInfosys Ratio AnalysisGaurav Bhalgat0% (1)

- Case Study 2Document5 pagesCase Study 2what_the_fukNo ratings yet

- Compensation Management at Tata Consultancy Services LTDDocument4 pagesCompensation Management at Tata Consultancy Services LTDNishaant S Prasad0% (2)

- Environmental Analysis of Tata MotorDocument3 pagesEnvironmental Analysis of Tata MotorVikash KumarNo ratings yet

- Capital Structure Analysis of "Bajaj Auto LTD Thesis001Document55 pagesCapital Structure Analysis of "Bajaj Auto LTD Thesis001Ayush GoelNo ratings yet

- Financial Analysis of Crompton Greaves - R.priyaDocument82 pagesFinancial Analysis of Crompton Greaves - R.priyaVigneshNo ratings yet

- DCF Valuation ExerciseDocument18 pagesDCF Valuation ExerciseAkram MohiddinNo ratings yet

- Cost of Capital - Mcom II ProjectDocument36 pagesCost of Capital - Mcom II ProjectKunal KapoorNo ratings yet

- To Study The Capital Structure of Wipro in Comparison To Industry Standard SynopsisDocument4 pagesTo Study The Capital Structure of Wipro in Comparison To Industry Standard SynopsisAssise ThankappanNo ratings yet

- Numericals On Cost of Capital and Capital StructureDocument2 pagesNumericals On Cost of Capital and Capital StructurePatrick AnthonyNo ratings yet

- Cool-Aid Private LimitedDocument8 pagesCool-Aid Private Limitedpankajbhatt1993No ratings yet

- Valuation of HDFCDocument21 pagesValuation of HDFCG Nagarajan0% (1)

- Tata Motors ValuationDocument38 pagesTata Motors ValuationAkshat JainNo ratings yet

- A Study On Customer Acquisition On EcomitramDocument28 pagesA Study On Customer Acquisition On EcomitramTanvi Rastogi100% (1)

- Ava Case SolutionDocument50 pagesAva Case Solution121923601018No ratings yet

- Capital Structure Analysis of Hero HondaDocument8 pagesCapital Structure Analysis of Hero HondaHari ShankarNo ratings yet

- Srinath SirDocument19 pagesSrinath Sirmy Vinay100% (1)

- A Study On Financial Performance Analysis Ppt-MuthusamiDocument16 pagesA Study On Financial Performance Analysis Ppt-MuthusamiSwarna RavichandranNo ratings yet

- Null 5 PDFDocument620 pagesNull 5 PDFJames100% (2)

- Balance Sheet of Tata MotorsDocument10 pagesBalance Sheet of Tata Motorssarvesh.bhartiNo ratings yet

- Corporate Finance Paper MidDocument2 pagesCorporate Finance Paper MidAjmal KhanNo ratings yet

- Mahindra & MahindraDocument20 pagesMahindra & Mahindralynette rego0% (2)

- Capital Structure Analysis of IndiaDocument14 pagesCapital Structure Analysis of IndiaMahbubul Islam KoushickNo ratings yet

- SIP REPORT, 57, SNEHA YADAV MBA 2nd SEM (E), PimgDocument39 pagesSIP REPORT, 57, SNEHA YADAV MBA 2nd SEM (E), PimgSHWETA GUPTA80% (5)

- Asian Paint Cost AnalysisDocument22 pagesAsian Paint Cost AnalysisRadhika ChhabraNo ratings yet

- Project 2 - Financial Leverage Case StudyDocument9 pagesProject 2 - Financial Leverage Case StudyChirag Maheshwari100% (1)

- MD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeDocument4 pagesMD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeAyushi somaniNo ratings yet

- LKP Moldtek 01feb08Document2 pagesLKP Moldtek 01feb08nillchopraNo ratings yet

- Note For Investment Operation CommitteeDocument4 pagesNote For Investment Operation CommitteeAyushi somaniNo ratings yet

- Assignment FSADocument5 pagesAssignment FSAgeo023No ratings yet

- Vadero Inc SolutionDocument5 pagesVadero Inc Solutionmike aboladeNo ratings yet

- Financials WorksheetDocument3 pagesFinancials WorksheetSiddharthNo ratings yet

- Shell Financial Data BloombergDocument48 pagesShell Financial Data BloombergShardul MudeNo ratings yet

- Balance SheetDocument7 pagesBalance SheetKashyap PandyaNo ratings yet

- Fabm1 - Reviewer: AccountingDocument7 pagesFabm1 - Reviewer: AccountingBaluyut, Kenneth Christian O.No ratings yet

- Burger KingDocument6 pagesBurger KingAditya SapraNo ratings yet

- 1 PhototecDocument3 pages1 PhototecKaishe RamosNo ratings yet

- Corporate Liquidation & ReorganizationDocument6 pagesCorporate Liquidation & ReorganizationNahwi KimpaNo ratings yet

- Balance Sheet: Alexei Alvarez Drobush, CFA, FRM Fabricio Chala, CFA, FRMDocument43 pagesBalance Sheet: Alexei Alvarez Drobush, CFA, FRM Fabricio Chala, CFA, FRMJhonatan Perez VillanuevaNo ratings yet

- Oracle EBS Financials Setups WhitepaperDocument33 pagesOracle EBS Financials Setups WhitepaperMoh'd AdamNo ratings yet

- ROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements3 - BloombergDocument1 pageROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements3 - BloombergImmanuel Billie AllenNo ratings yet

- Background KnowledgeDocument7 pagesBackground Knowledgeanamsaeed1No ratings yet

- 02 Conceptual Framework - RevisedDocument13 pages02 Conceptual Framework - RevisedRazel MhinNo ratings yet

- Jessbel G. Mahilum - IA3-CD1 - Assignment4Document6 pagesJessbel G. Mahilum - IA3-CD1 - Assignment4Jessbel MahilumNo ratings yet

- Executive SummaryDocument10 pagesExecutive SummaryMuneeb RasoolNo ratings yet

- FINMANDocument11 pagesFINMANJenny Shane UmaliNo ratings yet

- Nia Annual Report 2010Document44 pagesNia Annual Report 2010Junior LubagNo ratings yet

- What Is The Current Ratio?Document10 pagesWhat Is The Current Ratio?Rica Princess MacalinaoNo ratings yet

- Dfa Case Analysis - FinalDocument16 pagesDfa Case Analysis - FinalLou Marvin SantosNo ratings yet

- Accounting of Carbon Credits: Learning OutcomesDocument22 pagesAccounting of Carbon Credits: Learning OutcomesIsavic AlsinaNo ratings yet

- Chapter 1 Afar (Bus Com)Document24 pagesChapter 1 Afar (Bus Com)jajajaredredNo ratings yet

- Intangible Asset Valuation Approaches and MethodsDocument22 pagesIntangible Asset Valuation Approaches and MethodsJihane AdnaneNo ratings yet

- Test Series: October, 2019 Mock Test Paper Final (Old) Course: Group - I Paper - 1: Financial ReportingDocument8 pagesTest Series: October, 2019 Mock Test Paper Final (Old) Course: Group - I Paper - 1: Financial ReportingDev ReddyNo ratings yet

- Financial Analysis of Dubai Islamic BankDocument21 pagesFinancial Analysis of Dubai Islamic BankEjaz BadizaiNo ratings yet

- Applicant Profile Sheet - Revolt - New DealershipDocument11 pagesApplicant Profile Sheet - Revolt - New DealershipDheeraj Chowdary DhanekulaNo ratings yet

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership Formationpehik100% (2)

- Term Paper On Financial Statement AnalysisDocument5 pagesTerm Paper On Financial Statement Analysisbujuj1tunag2100% (1)

- Important McqsDocument14 pagesImportant Mcqskamal sahabNo ratings yet