Professional Documents

Culture Documents

CVR and USPAP Compliance April 2011

Uploaded by

Bill CobbCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CVR and USPAP Compliance April 2011

Uploaded by

Bill CobbCopyright:

Available Formats

CVR and USPAP Compliance

Many appraisers have asked if the CVR is a USPAP compliant report and how we can help them in their

marketing effort with lenders and potential customers. Below is a list of facts that should help lenders,

customers, appraisers and other interested parties understand that CVR Specialists can be confident

that the appraisal will be USPAP compliant.

1. It is the person who completes the valuation process, and performs an appraisal, who must be

USPAP compliant. A form can never be compliant.

2. The Collateral Valuation Report was designed by experts in the appraisal industry. The report

was reviewed by a number of USPAP instructors, including Mike Brunson of Las Vegas, Nevada

and Alan Hummel, Chief Appraiser of Forsythe Appraisals and their input was incorporated into

the CVR.

3. Many USPAP instructors have taken the training to become a CVR Specialist and provided

additional input.

4. The majority of our regional instructors who teach in our CVR Training program are USPAP

instructors and Mark Linne, EVP of Training and Analytics, was instrumental in the design of the

CompCruncher software and the CVR Report.

5. Alan Hummel, a former national President of the Appraisal Institute, and a USPAP instructor, has

thoroughly reviewed the CVR and has deemed the CVR as a USPAP compliant report.

6. More than 1,000 views and downloads of the sample CVR report online have been made. To

date there has not been a single challenge to the USPAP compliance of the CVR process or

report.

7. U.S. Bank, the nation’s 5th largest lender has rigorously tested the CVR report and decided to

implement CVR across multiple business lines such as a replacement for BPO for home equity

origination, as an alternative to a URAR in non-agency or portfolio loans, in default

management, as an alternative for loan modification programs and as a second valuation for

value dispute resolution.

8. Liability Insurance Administrators (LIA),the largest errors and omissions carrier in the U.S., has

issued a white paper analyzing the CVR. At the READI website, the results of the favorable

review are detailed. Several recommendations were made in the white paper and each one of

the suggestions has been implemented in the CVR.

9. Three other top five lenders are in the final stages of evaluating and implementing a CVR

strategy.

10. One of the nation’s largest Mortgage Insurance Companies their appraisal review staff certified,

and is considering supporting the CVR technology in its business lines and those of its affiliates.

The company is planning to use the CVR as a replacement for field inspection requirements.

11. Analytics staff members from Fannie Mae and Freddie Mac are familiar with the program and

have analyzed the CVR Report. Additional members of the analytics staff have been going

through the CVR training program.

THE SOURCE IS THIS DOCUMENT IS BRADFORD TECHNOLOGIES @

http://www.appraisalworld.com

You might also like

- DocDocument38 pagesDocBill CobbNo ratings yet

- GBRAR Market Indicators 07/2014Document12 pagesGBRAR Market Indicators 07/2014Greater Baton Rouge Association of REALTORS® (GBRAR)No ratings yet

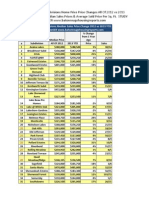

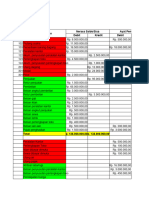

- East Baton Rouge Subdivisions Home Price Price Changes All of 2012 Vs 2013 YTD, Includes Both Median Sales Prices & Average Sold Price Per Sq. Ft. STUDY by BILL COBB APPRAISERDocument5 pagesEast Baton Rouge Subdivisions Home Price Price Changes All of 2012 Vs 2013 YTD, Includes Both Median Sales Prices & Average Sold Price Per Sq. Ft. STUDY by BILL COBB APPRAISERBill CobbNo ratings yet

- 10 Reasons Zachary LA Is A Great Place To Live Zachary Post Woody Jenkins ArticleDocument1 page10 Reasons Zachary LA Is A Great Place To Live Zachary Post Woody Jenkins ArticleBill CobbNo ratings yet

- East Baton Rouge Home Sales September 2013Document1 pageEast Baton Rouge Home Sales September 2013Bill CobbNo ratings yet

- West Baton Rouge Home Sales March 2012 Vs March 2013Document21 pagesWest Baton Rouge Home Sales March 2012 Vs March 2013Bill CobbNo ratings yet

- Greater Baton Rouge Home Sales by Subdivision September 2013Document3 pagesGreater Baton Rouge Home Sales by Subdivision September 2013Bill CobbNo ratings yet

- Baker Louisiana Home PricesDocument1 pageBaker Louisiana Home PricesBill CobbNo ratings yet

- West Baton Rouge Home Sales September 2013Document1 pageWest Baton Rouge Home Sales September 2013Bill CobbNo ratings yet

- Pricing Custom Homes in Changing SubdivisionsDocument19 pagesPricing Custom Homes in Changing SubdivisionsBill CobbNo ratings yet

- East Baton Rouge Home Sales April 2012 Vs April 2013Document21 pagesEast Baton Rouge Home Sales April 2012 Vs April 2013Bill CobbNo ratings yet

- Prairieville Gonzales Geismar North Ascension Parish Home Sales April 2012 Versus April 2013Document21 pagesPrairieville Gonzales Geismar North Ascension Parish Home Sales April 2012 Versus April 2013Bill CobbNo ratings yet

- Prairieville, Gonzales, ST Amant, Geismar Ascension Parish Home Sales March 2012 Versus March 2013Document21 pagesPrairieville, Gonzales, ST Amant, Geismar Ascension Parish Home Sales March 2012 Versus March 2013Bill CobbNo ratings yet

- 10 Reasons Zachary LA Is A Great Place To Live Zachary Post Woody Jenkins ArticleDocument1 page10 Reasons Zachary LA Is A Great Place To Live Zachary Post Woody Jenkins ArticleBill CobbNo ratings yet

- Prairieville LA Ascension Parish Parkview Subdivision Home Prices Study 70769 2011-2012Document2 pagesPrairieville LA Ascension Parish Parkview Subdivision Home Prices Study 70769 2011-2012Bill CobbNo ratings yet

- Baker Louisiana Parkwood Terrace Subdivision Home SalesDocument1 pageBaker Louisiana Parkwood Terrace Subdivision Home SalesBill CobbNo ratings yet

- Livingston Louisiana Lakeside Estates Subdivision Home Prices Study 2013Document2 pagesLivingston Louisiana Lakeside Estates Subdivision Home Prices Study 2013Bill CobbNo ratings yet

- Western Livingston Parish Denham Springs Watson Walker Home Sales March 2012 Versus March 2013Document21 pagesWestern Livingston Parish Denham Springs Watson Walker Home Sales March 2012 Versus March 2013Bill CobbNo ratings yet

- East Baton Rouge Home Sales Q1 2012 Vs Q1 2013Document21 pagesEast Baton Rouge Home Sales Q1 2012 Vs Q1 2013Bill CobbNo ratings yet

- East Baton Rouge New Homes Sold Properties February 2012 Versus February 2013Document21 pagesEast Baton Rouge New Homes Sold Properties February 2012 Versus February 2013Bill CobbNo ratings yet

- Denham Springs Real Estate Home Prices in Lakes at MeadowbrookDocument2 pagesDenham Springs Real Estate Home Prices in Lakes at MeadowbrookBill CobbNo ratings yet

- East Baton Rouge Existing Homes Sold Properties February 2012 Versus February 2013Document21 pagesEast Baton Rouge Existing Homes Sold Properties February 2012 Versus February 2013Bill CobbNo ratings yet

- Western Livingston Parish Home Sales Report For November 2011 Versus 2012Document21 pagesWestern Livingston Parish Home Sales Report For November 2011 Versus 2012Bill CobbNo ratings yet

- Easterly Lakes Denham Springs 2012 Home Sales ReportDocument21 pagesEasterly Lakes Denham Springs 2012 Home Sales ReportBill CobbNo ratings yet

- Woodstock Subdivision Greenwell Springs Central Baton Rouge Real Estate 2012 Home Sales ReportDocument3 pagesWoodstock Subdivision Greenwell Springs Central Baton Rouge Real Estate 2012 Home Sales ReportBill CobbNo ratings yet

- East Baton Rouge Home Sales October 2011 Versus October 2012 New Home ConstructionDocument21 pagesEast Baton Rouge Home Sales October 2011 Versus October 2012 New Home ConstructionBill CobbNo ratings yet

- Baton Rouge Real Estate Housing Market StatisticsDocument3 pagesBaton Rouge Real Estate Housing Market StatisticsBill CobbNo ratings yet

- Perkins Rowe Impact On Baton Rouge Home Prices StudyDocument8 pagesPerkins Rowe Impact On Baton Rouge Home Prices StudyBill CobbNo ratings yet

- East Baton Rouge Home Sales November 2011 Versus November 2012Document21 pagesEast Baton Rouge Home Sales November 2011 Versus November 2012Bill CobbNo ratings yet

- East Baton Rouge Home Sales October 2011 Versus October 2012 Existing Homes ResalesDocument21 pagesEast Baton Rouge Home Sales October 2011 Versus October 2012 Existing Homes ResalesBill CobbNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Nonfinancial CorporateDocument2 pagesNonfinancial Corporatenawlen nawlenNo ratings yet

- CAIIB BFM Sample Questions by Murugan-Dec 19 Exams PDFDocument890 pagesCAIIB BFM Sample Questions by Murugan-Dec 19 Exams PDFPaviNo ratings yet

- Free Credit Score and Report - Free Monthly Credit CheckDocument3 pagesFree Credit Score and Report - Free Monthly Credit CheckSagar Chandra KhatuaNo ratings yet

- Witzany Credit Risk ManagementDocument259 pagesWitzany Credit Risk ManagementPeterParker1983100% (4)

- ACCA FM (F9) Course Notes PDFDocument229 pagesACCA FM (F9) Course Notes PDFBilal AhmedNo ratings yet

- Raphael LTD Is A Small Engineering Business Which Has AnnualDocument2 pagesRaphael LTD Is A Small Engineering Business Which Has AnnualAmit PandeyNo ratings yet

- bài ôn tập cho vayDocument6 pagesbài ôn tập cho vayQuynh NguyenNo ratings yet

- Advocates For Truth in Lending, Inc. & Olaguer v. Bangko Sentral Monetary Board, G.R. No. 192986, 15 January 2013, 688 SCRA 530.Document4 pagesAdvocates For Truth in Lending, Inc. & Olaguer v. Bangko Sentral Monetary Board, G.R. No. 192986, 15 January 2013, 688 SCRA 530.JMae MagatNo ratings yet

- Generic Life Insurance Needs Analysis Worksheet 2014-10Document3 pagesGeneric Life Insurance Needs Analysis Worksheet 2014-10Christophe BernardNo ratings yet

- Credit Risk and Profitability of Deposit Money Banks in NigeriaDocument3 pagesCredit Risk and Profitability of Deposit Money Banks in NigeriaGodwinUddinNo ratings yet

- Unit # 5 Problems Related TVMDocument5 pagesUnit # 5 Problems Related TVMZaheer Ahmed SwatiNo ratings yet

- FM Eco Marathon Notes by CA Namit Arora SirDocument257 pagesFM Eco Marathon Notes by CA Namit Arora SirahmedNo ratings yet

- MODULE 2 Lecture Notes (Jeff Madura)Document5 pagesMODULE 2 Lecture Notes (Jeff Madura)Romen CenizaNo ratings yet

- Plaintiffs Allege Massive Mortgage FraudDocument80 pagesPlaintiffs Allege Massive Mortgage FraudpolychromeNo ratings yet

- MSC Thesis ProposalDocument47 pagesMSC Thesis ProposalEric Osei Owusu-kumihNo ratings yet

- EFFECTS OF E-COMMERCE ADOPTION ON FINANCIAL PERFORMANCE OF SMESDocument27 pagesEFFECTS OF E-COMMERCE ADOPTION ON FINANCIAL PERFORMANCE OF SMESHamzaNo ratings yet

- UNIT ONE Introduction To Banking Principle and PracticeDocument7 pagesUNIT ONE Introduction To Banking Principle and PracticewubeNo ratings yet

- 21 Problems For CB New 1Document11 pages21 Problems For CB New 1Trần Bảo LyNo ratings yet

- Working Capital Management StrategiesDocument11 pagesWorking Capital Management StrategiesiBEAYNo ratings yet

- 5 Minutes to Crack RRB PO InterviewDocument41 pages5 Minutes to Crack RRB PO Interviewvishalgupta90No ratings yet

- Naman Mall Management Company - R - 06112020Document7 pagesNaman Mall Management Company - R - 06112020Bholey RiftNo ratings yet

- SHG's Role in Women Empowerment in TelanganaDocument46 pagesSHG's Role in Women Empowerment in TelanganabagyaNo ratings yet

- Loan risk analysis for personal loan requestDocument25 pagesLoan risk analysis for personal loan requestsanjeebani swainNo ratings yet

- Federal Funds RateDocument2 pagesFederal Funds RateNicolas JaramilloNo ratings yet

- TYPES OF CREDIT Week13Document61 pagesTYPES OF CREDIT Week13Richard Santiago JimenezNo ratings yet

- Private Bank Credit Risk Management Policy With Bangladesh BankDocument60 pagesPrivate Bank Credit Risk Management Policy With Bangladesh Bankgalib8323No ratings yet

- Neraca Lajur - Kertas KerjaDocument6 pagesNeraca Lajur - Kertas KerjaAdmin Anak PanahNo ratings yet

- Report On Credit Appraisal of Industrial FinanceDocument69 pagesReport On Credit Appraisal of Industrial FinanceRoyal ProjectsNo ratings yet

- Final Exam Maia Jeriashvili EconomicsDocument9 pagesFinal Exam Maia Jeriashvili Economicsdavit kavtaradzeNo ratings yet