Professional Documents

Culture Documents

Haiti-Key Elements of The Post-Earthquake Strategyfor Revenue Administration and Fiscal Policy, Republic of Haiti

Uploaded by

Heather BlackwellOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Haiti-Key Elements of The Post-Earthquake Strategyfor Revenue Administration and Fiscal Policy, Republic of Haiti

Uploaded by

Heather BlackwellCopyright:

Available Formats

Haiti—Key Elements of the Post-Earthquake Strategy

for Revenue Administration and Fiscal Policy

République d'Haïti

I. BACKGROUND

1. Improving domestic revenue mobilization has been a key challenge in Haiti. At about

11 percent of GDP in FY2009, Haiti's revenue level remains relatively low, in part due to the complex

tax system with many exemptions, and a weak revenue administration. The authorities indicated

their determination to raise revenue by improving the equity of the tax system and actively

combating tax evasion. Prior to the January 12 earthquake, the authorities' objective was to raise

revenue to close to 13 percent of GDP by FY 2012 through a revision of the tax system and

improvements in tax administration. Revenue collection during the first quarter of FY2010 (3.5

percent of GDP) was fully in line with these revenue targets.

2. The January 12 earthquake was a major setback on Haiti's revenue mobilization

strategy. The main buildings --both tax administration and customs headquarters, the large

taxpayer office (LTO), and others operational units -- have collapsed or are seriously damaged. For

the tax administration, 1300 people out of 1920 are now without office. Twenty-five people are

confirmed dead, including the head and four other senior managers. For both the tax and custom

administration, only 60 percent of pre-earthquake employees are accounted for. There is no

information about the others. Revenue administration employees are still traumatized. Many have

lost their homes, and sometimes family members. Many still lieave in the streets, sleeping in tents or

in their cars. After each tremor, employees become fearful and anxious and leave offices to go

home.

3. Both tax and customs administrations have restarted operations and are

progressively recovering their capacity to collect revenue despite very difficult

working conditions. Since February, the tax administration restarted basic operational functions

for the LTO -- it has only registered the tax forms of 84 taxpayers out of 500. The tax authorities are

trying to identify large taxpayers that are still in business. Revenue collection has increased from

January to March from 25 percent to almost 50 percent of pre-earthquake targets. For the entire

fiscal year, revenue collection could well exceed 50 percent the budgeted level. Audits have been

delayed for many months, as the administration is still operating in the context of an emergency

situation. Exemptions have increased with the jump in humanitarian assistance. A large part of

imports arrives through the Dominican Republic and the inability to control the border has

contributed to the increase in fraud. The main challenges are on the management infrastructure,

including office space with the adequate information systems and human resources.

II. TAX AND CUSTOMS ADMINISTRATIONS

4. The authorities have requested technical assistance (TA) from the IMF to help

design a strategy to rebuild a more modern and efficient revenue administration. An

initial assessment of the situation has been done and key areas of the reform strategy identified.

Priority is to restore basic functions and modernize them. . The main objective of our strategy is to

reorganize the revenue administration focusing on fiscal missions, segmentation of taxpayers,

computerization, rationalization of local and regional networks, tighter controls, especially at the

5, Ave. Charles Sumner - Immeuble 2 • Tél.: (509) 2946-4041 / 2946-4040 / 2244-4141

Ministère de l'Économie et des Finances (MEF) 1 mefinfo@mefhaiti.gouv.ht /www.mefhaiti.gouv.ht

Haiti—Key Elements of the Post-Earthquake Strategy

for Revenue Administration and Fiscal Policy

border with the Dominican Republic, and greater monitoring and accountability through a design

and publication of performance indicators. For the success of this strategy, a better coordination is

necessary with other TA partners, including Canada, which had launched prior to the earthquake a

significant TA project to modernize revenue administration.

5. Efforts to strengthening the customs and tax administrations will continue in the

coming months. Many ongoing efforts were launched before the earthquake and the underlying

strategy may have to be revised. They focused on increasing the transparency of fiscal procedures

through the adoption of a tax procedures code, which was prepared before the earthquake, and

despite the lack of office space, increasing cooperation and data exchange between the tax and

customs administrations to help reduce tax evasion. Implementation of the new customs code will

streamline procedures and provide flexibility in the creation of customs control posts. Adoption of

the tax administration organic law and the resumption of the above-mentioned Canadian-led

project will further strengthen revenue administration. Publication of performance indicators will

enhance accountability and ensure that revenue administration efforts result in significant increases

in revenue collection. The authorities and IMF staff already agreed on an initial set of basic

performance indicators that will have to be published regularly to better monitor the performance of

the revenue administration (see Tables 3 and 4).

III. TAX POLICY

6. The authorities will request IMF TA to help design a comprehensive tax reform.

The reform would focus on simplifying the tax system, rationalizing exemptions and privileges in line

with the authorities' reconstruction strategy, and broadening the tax base. These reforms initiatives

would culminate in the approval of a new tax code in the coming years, which will also enhance the

transparency of the tax system.

7. Selected tax policy measures have been taken recently or are under serious

consideration. More than a third of tariff lines were raised on October 1, of which 60 percent were

brought to the CARICOM common external tariff and 40 percent brought closer to this level. This

contributed to strong revenue performances in the first quarter of FY 2010 as pre-earthquake

estimates suggested that this measure could have yielded 0.7 percent of GDP for the whole year. A

tax on incoming international phone calls is still under consideration as well as a car registration fee.

A passport fee was introduced in FY2009, raising a limited amount of revenue.

IV. POSSIBLE REVENUE ENHANCING MEASURES

8. The authorities are currently discussing possible revenue-enhancing measures for

the next two years mentioned below:

I. ADMINISTRATIVE MEASURES

Reinforcement of the Tax authority (Direction Générale des Impôts)

5, Ave. Charles Sumner - Immeuble 2 • Tél.: (509) 2946-4041 / 2946-4040 / 2244-4141

Ministère de l'Économie et des Finances (MEF) 2 mefinfo@mefhaiti.gouv.ht /www.mefhaiti.gouv.ht

Haiti—Key Elements of the Post-Earthquake Strategy

for Revenue Administration and Fiscal Policy

• Implementation of a data management system (fiscal files for taxpayers), to broaden the tax

base (Linking data DGI/AGD/ONA/MCI) ;

• Implementation of optimization programs (tax recovery …); and management program for

tax arrears;

• Reorganization of the Tax Authority will strive to enhance efficiency :i) separate central

functions (liquidation, verification, investigation and information) from operational functions

(creation of tax collection centers); ii) facilitation of voluntary payment through awareness

and information programs, implementation of assistance mechanisms to taxpayers, online

filing, payment by bank transfer, simplified forms;

• Rationalization of Tax Authority personnel: implementation of customized training to

facilitate application of proposed models;

• Implementation of monitoring and follow-up processes; (performance indicators, evaluation

and follow-up).

Reinforcement of Customs Administrations

• Implementation of procedure management and data management systems; (DGI, MCI)

(agreement with partner customs agencies USA, DR);

• Implementation of a unit for processing and management of customs statistics;

• Continuation of Sydonia++ implementation program;

• Rationalization of Customs Administration (AGD) personnel: implementation of customized

training to facilitate application of proposed models;

• Fitting out of customs offices around the provinces and / or facilitate establishments of

entrepot sous douane

II. Modernization of fiscal system

• Drafting the fiscal legislation reform taking into account objectives for reconstruction,

economic growth using a simple, equitable and profitable fiscal system to achieve fiscal

pressure of at least 15%;

• Modernization of customs code and tariff (facilitation and generalization of procedures).

III. Reinforcement of mechanisms for control and monitoring of tax administrations

• Rationalization of allowance and management of exemptions and privileges;

• Reinforcement of mechanisms for control and monitoring of the Fiscal Inspection

Department (joint auditing; monitoring of performance indicators);

• Reinforcement of autonomous capacity to analyze tax and customs data by DEE and DIF with

the appointment of a macro fiscal expert.

5, Ave. Charles Sumner - Immeuble 2 • Tél.: (509) 2946-4041 / 2946-4040 / 2244-4141

Ministère de l'Économie et des Finances (MEF) 3 mefinfo@mefhaiti.gouv.ht /www.mefhaiti.gouv.ht

Haiti—Key Elements of the Post-Earthquake Strategy

for Revenue Administration and Fiscal Policy

USE FOR BUDGET SUPPORT

EXERCISE 2009-2010

5, Ave. Charles Sumner - Immeuble 2 • Tél.: (509) 2946-4041 / 2946-4040 / 2244-4141

Ministère de l'Économie et des Finances (MEF) 4 mefinfo@mefhaiti.gouv.ht /www.mefhaiti.gouv.ht

Haiti—Key Elements of the Post-Earthquake Strategy

for Revenue Administration and Fiscal Policy

5, Ave. Charles Sumner - Immeuble 2 • Tél.: (509) 2946-4041 / 2946-4040 / 2244-4141

Ministère de l'Économie et des Finances (MEF) 5 mefinfo@mefhaiti.gouv.ht /www.mefhaiti.gouv.ht

Haiti—Key Elements of the Post-Earthquake Strategy

for Revenue Administration and Fiscal Policy

5, Ave. Charles Sumner - Immeuble 2 • Tél.: (509) 2946-4041 / 2946-4040 / 2244-4141

Ministère de l'Économie et des Finances (MEF) 6 mefinfo@mefhaiti.gouv.ht /www.mefhaiti.gouv.ht

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Economic SBADocument19 pagesEconomic SBANadine Davidson25% (4)

- 2013 Min WageDocument10 pages2013 Min WagejspectorNo ratings yet

- 07-17-12 Federal Reserve Bank Routing Numbers-May2009Document13 pages07-17-12 Federal Reserve Bank Routing Numbers-May2009thenjhomebuyer100% (1)

- Joachim Becker & Johannes Jaeger - From An Economic Crises To A Crisis of European IntegrationDocument27 pagesJoachim Becker & Johannes Jaeger - From An Economic Crises To A Crisis of European IntegrationAndraž MaliNo ratings yet

- Schedule Se (Form 1040)Document2 pagesSchedule Se (Form 1040)Vita Volunteers WebmasterNo ratings yet

- Prospects and Challenges For Developing Securities Markets in Ethiopia An Analytical ReviewDocument16 pagesProspects and Challenges For Developing Securities Markets in Ethiopia An Analytical ReviewSinshaw Bekele100% (10)

- IBA Finance Club ProposalDocument14 pagesIBA Finance Club ProposalSyed Mustafa NadeemNo ratings yet

- History APECDocument12 pagesHistory APECWan Harith Wan AzmiNo ratings yet

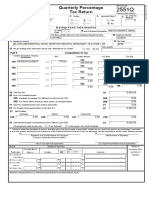

- Quarterly Percentage Tax Return: 12 - DecemberDocument1 pageQuarterly Percentage Tax Return: 12 - DecemberralphalonzoNo ratings yet

- Final Examination: All Final Answers Must Be Reflected On The Answer Sheet GivenDocument3 pagesFinal Examination: All Final Answers Must Be Reflected On The Answer Sheet GivenkhatedeleonNo ratings yet

- Sources and Expenditure of Government RevenueDocument5 pagesSources and Expenditure of Government RevenueCharles100% (1)

- Your Tax Is-: Instructions For Form 1040EZDocument9 pagesYour Tax Is-: Instructions For Form 1040EZSamNo ratings yet

- Monetary Policy in East TimorDocument1 pageMonetary Policy in East TimorWarren WrightNo ratings yet

- Assessment 3 - Module 3 Quiz - Coursera PDFDocument1 pageAssessment 3 - Module 3 Quiz - Coursera PDFCarla MissionaNo ratings yet

- Quarterly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocument1 pageQuarterly Value-Added Tax Declaration: Kawanihan NG Rentas Internaschiahwalousette100% (1)

- Economic StabilizationDocument11 pagesEconomic Stabilizationopenid_aku6f5n8No ratings yet

- Chapter 17 Solutions BKM Investments 9eDocument11 pagesChapter 17 Solutions BKM Investments 9enpiper29100% (1)

- Lesson 2 Globalization of World EconomicsDocument17 pagesLesson 2 Globalization of World EconomicsKent Aron Lazona Doromal57% (7)

- Fiscal Policy Practice Test Questions - You DoDocument3 pagesFiscal Policy Practice Test Questions - You DoredkarravinaNo ratings yet

- Purchasing Power ParityDocument24 pagesPurchasing Power ParityrudraarjunNo ratings yet

- US Government Module 3Document3 pagesUS Government Module 3AnikaNo ratings yet

- Joint Study Group Report For Indonesia Chile CepaDocument258 pagesJoint Study Group Report For Indonesia Chile Cepadyah ayuNo ratings yet

- A Level Essay Questions by Topics (1998-2012) : Microeconomics Topic 1 Central Economics Problems and Resource AllocationDocument11 pagesA Level Essay Questions by Topics (1998-2012) : Microeconomics Topic 1 Central Economics Problems and Resource AllocationToh Qin KaneNo ratings yet

- European UnionDocument15 pagesEuropean UnionKeahlyn Boticario CapinaNo ratings yet

- 2016pk Panels8-17Document18 pages2016pk Panels8-17pkconferenceNo ratings yet

- AnnualReportAppendix PDFDocument231 pagesAnnualReportAppendix PDFDeepika SundarNo ratings yet

- Paragraf Siklus BisnisDocument2 pagesParagraf Siklus BisnisMaryaNo ratings yet

- Essays in Macro Economic Policy The Indonesian ExperienceDocument6 pagesEssays in Macro Economic Policy The Indonesian Experienceandisumange0% (1)

- Bt11703 Course Outline 2015Document4 pagesBt11703 Course Outline 2015Jasz Azliey AzzamNo ratings yet

- MacroeconDocument502 pagesMacroeconOrhun Ersoy100% (1)