Professional Documents

Culture Documents

Honeywell Inc

Uploaded by

Haris IbrahimOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Honeywell Inc

Uploaded by

Haris IbrahimCopyright:

Available Formats

Company Profile: Honeywell

REMEMBER to ANSWER these questions (This is a very important part of the interview – to know why you are interested):

List 2-3 reason why you are interested in this industry?

List 2-3 reasons why you are interested in Honeywell Corporation?

List 2-3 reasons why you are interested in this position?

1. Company general info.

Honeywell International is a diversified technology and manufacturing leader, serving customers

worldwide with aerospace products and services; control technologies for buildings, homes and industry;

automotive products; turbochargers; and specialty materials.

The company's largest business segment is Honeywell Aerospace. It makes products such as

turbofan and turboprop engines and flight safety and landing systems. Honeywell's Automation and

Control segment includes home and industrial heating, ventilation, and manufacturing process products.

Through its Specialty Materials segment, Honeywell makes performance materials used in

semiconductors, polymers for electronics and fibers, and specialty friction materials. Finally, the

company turns out consumer car care products (Prestone, FRAM) through its Transportation Systems

segment.

Honeywell has a number of objectives in each division. In the Aerospace sector, the company's

areas of focus include commercial aerospace aftermarket sales, faster and more efficient product

development, and growth in its Network Centric Warfare operations; strategies for Automation &

Control Solutions include integrating Novar plc's Intelligent Building Systems (IBS) operations with

Honeywell's building controls, life safety, and security businesses; for Specialty Materials, the company

wants to continue restructuring and exiting non-core businesses; lastly, in the Transportation sector,

Honeywell plans to increase its market share in the OEM turbocharger market, reinvigorate its friction

materials business, and focus on its consumer products.

In 2005 Honeywell sold its nylon carpet fibers unit to Shaw Industries, a unit of Berkshire

Hathaway. The same year the company agreed to sell Novar's Indalex Aluminum Solutions to Sun

Capital Partners for $425 million in cash and sold its Clarke American (check printing) business to M&F

Worldwide for $800 million. On the other side, Honeywell bought Dow Chemical's 50% stake in UOP,

their energy refining joint venture. It also agreed to acquire First Technology PLC , a maker of gas

sensing and auto safety equipment, for $366 million and the assumption of $189 million in debt, but it

was later outbid by Danaher.

Honeywell acquired First Technology PLC , a maker of gas sensing, automotive, and safety

equipment, early in 2006. While First Technology's gas sensing operations will be integrated into

Honeywell's Automation and Control Solutions business, Honeywell has sold its crash test dummies

business to HgCapital, a European private equity company, for about $94 million. Honeywell later

agreed to sell First Technology Automotive -- a maker of automotive sensor valves, crash switch

devices, and electromechanical control devices -- to Sensata Technologies for $90 million. The deal was

completed late in 2006.

In 2007 Honeywell acquired the Burtek Systems/Security Systems Division business of

Richardson Electronics for $80 million in cash. Honeywell plans to combine the business with its ADI

security distribution business. Burtek/SSD is a distributor of low-voltage products for commercial and

residential audio, burglar and fire alarm, CCTV, access control, sound, and data/network

communications. Its sales in fiscal 2006 exceeded $108 million.

In mid-2007 Honeywell acquired Dimensions International, a provider of logistics support to the

US military and other defense agencies. The deal was valued at about $230 million. Dimensions became

part of the Honeywell Technology Solutions subsidiary.

Later in 2007 Honeywell completed the purchase of the Netherlands-based Enraf Holding B.V.

for about $260 million. Enraf, a maker of measurement and controls solutions used in the exploration,

Sources: Company website, Businessweek.com, Hoovers.com

production, and transportation of energy products, became part of Honeywell's Process Solutions

division.

Six Sigma Approach: At Honeywell, Six Sigma refers to the overall strategy to improve growth

and productivity as well as a measurement of quality. Six Sigma is a way for company to achieve

performance breakthroughs. And it encompasses tools from all of the improvement initiatives, including

those in Operational, Technical and Customer Excellence. It applies to every function in the company,

not just those on the factory floor. That means Marketing, Finance, Product Development, Business

Services, Engineering, and all the other functions of the businesses are included. It also incorporates the

rigorous assessment process used in determining Malcolm Baldrige Award winners.

President and Chief Executive Officer:

Chairman and CEO David M. Cote

SVP and CFO David J. (Dave) Anderson

SVP, Administration and CIO Larry E. Kittelberger

SVP, Government Relations Timothy J. (Tim) Keating

Company Type: Public

Sources: Company website, Businessweek.com, Hoovers.com

ANNUAL INCOME STATEMENTS

2006 2005 2004

Revenue ($ mil.) 31,367.0 27,653.0 25,601.0

Gross Profit ($ mil.) 7,271.0 6,188.0 5,016.0

Operating Income ($ mil.) 3,061.0 2,484.0 1,837.0

Total Net Income ($ mil.) 2,083.0 1,655.0 1,281.0

Diluted EPS (Net Income) 2.52 1.94 1.49

2006 Sales

$ mil. % of total

Market Data

US 19,821 63 Last Close 25-9-2007 $59.09 Price/Sales Ratio 1.34

52-Week High $61.90 Price/Book Ratio 5.63

Europe 7,781 25 52-Week Low $38.19 Price/Earnings Ratio

20.74

Other regions 3,765 12

Total 31,367 100

2. Products

Businesses:

1. Aerospace. Leading global supplier of aircraft components, engines, avionics, and related products and services for

commercial airlines, business and regional aircraft, and spacecraft.

2. Automation & Control Solutions. Honeywell makes homes, buildings, industrial sites, and airport facilities more

efficient, safe and comfortable.

3. Specialty Materials. Honeywell produces high-performance specialty materials such fluorocarbons, specialty films,

advanced fibers, customized research chemicals and intermediates for applications as diverse as

telecommunications, ballistic protection, pharmaceutical packaging, and counterfeiting avoidance.

4. Transportation Systems. As an automotive supplier, Honeywell enhances vehicle performance, efficiency, and

appearance through state-of-the-art technologies, world-class brands, and global solutions to its customers’ needs.

5. Honeywell Technology. Honeywell corporation is a vibrant organization with research being conducted in many

technology disciplines. This research results in exciting products as evidenced by the product lines of the businesses.

Some of the products:

FRAM® Tough Guard® Premium Air Filter

High Speed Data Unit Enhances Flight Crew Safety and Efficiency

Prestone® Fuel Additives Enhance Sport Utility Vehicle Performance

Wireless Smoke and Heat Detectors

Honeywell Humidifiers

Prestone® Windshield De-Icers

Windshear Radar

Zoning Allows Homeowners to Manage Room-by-Room Temperature

Wafer Thinning Materials Helps Chip Manufacturers

Honeywell Reagents for DNA/RNA Research

Honeywell’s Organic Air Vehicle

Thermal Management Materials

3. In the news

Sources: Company website, Businessweek.com, Hoovers.com, other Internet news resources.

09/24/2007 09:04:29 AM EDT AIRLINE INDUSTRY INFORMATION

Honeywell (NYSE:HON) has forecast the delivery of around 14,000 new business aircraft from 2007 to 2017, reportedly

generating industry sales of USD233bn.

Honeywell Aerospace said the number of aircraft delivered year-to-date, has increased by almost 11% compared with the

same period in 2006, with industry-wide sales having increased over 12%. It reported year-to-date new jet orders have

increased over 100% over first half 2006 levels and forecasts deliveries of over 1,000 new business jets for 2007, up from

861 in 2006, while deliveries in 2008 are expected to exceed 1,300.

Dec 20, 2006 COMPANY WEBSITE

Honeywell Completes Sale of First Technology Automotive & Special Products

MORRIS TOWNSHIP, N.J., -- December 20, 2006 -- Honeywell (NYSE: HON) announced today that it has completed the

sale of First Technology Automotive and Special Products (FTAS) to Sensata Technologies B.V., a portfolio company of

Bain Capital LLC, for $90 million. FTAS designs, develops and manufactures high-value solutions in three core product

categories: automotive sensors, electromechanical control devices and crash switch devices.

“We are pleased to have completed the divestiture of both non-core First Technology businesses in 2006,” said Dave

Cote, Honeywell Chairman and CEO. “With the sale of FTAS today and First Technology Safety and Analysis earlier this

year, we have finalized acquisition of the First Technology Gas Sensing business at an attractive valuation in an industry

with great growth prospects. We continue to execute on integrating the business into Honeywell Analytics and establishing

our position as a world leader in gas detection technologies.”

FTAS was acquired by Honeywell as part of its acquisition of First Technology plc earlier this year. Honeywell completed

its acquisition of First Technology plc on March 24, and the sale of First Technology Safety and Analysis on May 19.

01/24/2006 THE EXPRESS

HONEYWELL International of the US was rapped yesterday by the Takeover Panel for breaching rules after it said it was

considering raising its takeover offer for crash-test dummies maker First Technology. Later it said there was no certainty it

would raise its bid. On Friday its GBP207million offer was trumped by a GBP251million bid by Danaher.

01/21/2006 US Fed News

HILL AIR FORCE BASE, Utah, Jan. 21 -- The U.S. Air Force has awarded a $149,334 contract to Honeywell International

Inc., operating as Honeywell Aircraft Landing Systems, South Bend, Ind., for pistons and bushings.

The contract was awarded by the Air Force Material Command's Ogden Air Logistics Center, Hill Air Force Base, Utah.

Dec. 15, 2005

Honeywell (NYSE: HON) Electronic Materials today announced it has signed a global patent cross-license agreement with

Cabot Corp. (NYSE: CBT) regarding tantalum (Ta) materials and products for the semiconductor industry.

The agreement will allow Cabot, a supplier of Ta source metal, and Honeywell, a manufacturer of Ta physical vapor

deposition (PVD) sputtering targets for semiconductor chip production, to tap into the broader combined Ta patent portfolio

to better serve semiconductor manufacturing customers. The combined portfolio includes fourteen patents globally related

to the production of high-purity Ta metals and sputtering targets.

4. Top Competitors

• Goodrich Corporation

• Johnson Controls

• United Technologies

Other Competitors

• Akzo Nobel

• American Standard

• ArvinMeritor

• BAE Systems Inc.

• Barber-Coleman

• BASF AG

• Bayer AG

• Beaulieu

• BorgWarner

• Carrier

• Dana Corporation

• Delphi

• Dow Chemical

• Eastman Chemical

• Eaton

• DuPont

Sources: Company website, Businessweek.com, Hoovers.com, other Internet news resources.

• Emerson Electric

• Endress + Hauser

• Federal-Mogul

• GE Aircraft Engines UK

• GE Fanuc Automation

• GE

• Goodrich Corporation

• Hamilton Sundstrand

• Hercules

• Hexcel

• ITT Corp.

• Johnson Controls

• Lockheed Martin

• Northrop Grumman

• Parker Hannifin

• Pratt & Whitney

• Raytheon

• Robert Bosch

• Rockwell Automation

• Rolls-Royce

• Sextant Avionique

• Siemens AG

• Tenneco

• Tyco

• United Technologies

Sources: Company website, Businessweek.com, Hoovers.com, other Internet news resources.

You might also like

- Intelligent Digital Oil and Gas Fields: Concepts, Collaboration, and Right-Time DecisionsFrom EverandIntelligent Digital Oil and Gas Fields: Concepts, Collaboration, and Right-Time DecisionsRating: 4.5 out of 5 stars4.5/5 (5)

- Honey WellDocument8 pagesHoney WelljaideepbakreNo ratings yet

- IT-Driven Business Models: Global Case Studies in TransformationFrom EverandIT-Driven Business Models: Global Case Studies in TransformationNo ratings yet

- Honeywell International Inc.: Company ProfileDocument11 pagesHoneywell International Inc.: Company ProfilerenjuthomasNo ratings yet

- The Biometric Industry Report - Forecasts and Analysis to 2006From EverandThe Biometric Industry Report - Forecasts and Analysis to 2006M LockieNo ratings yet

- Honey WellDocument10 pagesHoney WellVarna Sunder100% (1)

- Honey Well AerospaceDocument16 pagesHoney Well AerospaceKartika Bhuvaneswaran NairNo ratings yet

- Business in the Cloud: What Every Business Needs to Know About Cloud ComputingFrom EverandBusiness in the Cloud: What Every Business Needs to Know About Cloud ComputingRating: 4 out of 5 stars4/5 (1)

- Honeywell Automation 2009 ReportDocument4 pagesHoneywell Automation 2009 ReportmworahNo ratings yet

- Investor Presentation MARCH 2011: A Global Leader in Integrated Clean Air Solutions For IndustryDocument33 pagesInvestor Presentation MARCH 2011: A Global Leader in Integrated Clean Air Solutions For IndustrymynameisvinnNo ratings yet

- Pitch BookDocument80 pagesPitch Bookmmihai1100% (1)

- 2010security CatalogueDocument470 pages2010security CatalogueAHMEDNo ratings yet

- Effective Financial Statement Analysis Requires An Understanding of A Firm S Economic CharacteristicDocument1 pageEffective Financial Statement Analysis Requires An Understanding of A Firm S Economic CharacteristicM Bilal SaleemNo ratings yet

- Background HoneywellDocument15 pagesBackground Honeywellawais shahNo ratings yet

- WD-40 Company Valuation - Final3Document36 pagesWD-40 Company Valuation - Final3Logan DoughertyNo ratings yet

- Case 4 HoneywellDocument17 pagesCase 4 HoneywellShubh AgarwalNo ratings yet

- HoneywellDocument8 pagesHoneywellPavan KumarNo ratings yet

- Syndicate 1 - Financial DetectiveDocument16 pagesSyndicate 1 - Financial DetectiveDyani Nabyla WidyaputriNo ratings yet

- Boeing SWOTDocument12 pagesBoeing SWOTtirath5u100% (3)

- BLEMBA 30 - Syndicate 1 - Financial DetectiveDocument20 pagesBLEMBA 30 - Syndicate 1 - Financial DetectiveDyani Nabyla Widyaputri0% (1)

- The Marketing MixDocument7 pagesThe Marketing MixAsim QureshiNo ratings yet

- Honeywell Automation India LTDDocument19 pagesHoneywell Automation India LTDManish BuxiNo ratings yet

- Dell 1998 Annual ReportDocument29 pagesDell 1998 Annual Reportarundadwal007100% (1)

- AAR Corp. ReportDocument15 pagesAAR Corp. Reportakr200714No ratings yet

- Data Monitor BoeingDocument40 pagesData Monitor BoeingRicardo AmaroNo ratings yet

- Aviall 2000 OpsDocument22 pagesAviall 2000 OpscitcietNo ratings yet

- Chapter 1Document5 pagesChapter 1Мирион НэлNo ratings yet

- Audit Assignment For Harvey NormanDocument14 pagesAudit Assignment For Harvey Normancchiu429No ratings yet

- Effective Financial Statement Analysis Requires An Understanding of A Firm SDocument1 pageEffective Financial Statement Analysis Requires An Understanding of A Firm SM Bilal SaleemNo ratings yet

- Week 3 Problem 1 CompleteDocument3 pagesWeek 3 Problem 1 CompleteRk VrNo ratings yet

- Acquisition Proposal - Teledyne TechnologiesDocument110 pagesAcquisition Proposal - Teledyne TechnologiesAri EngberNo ratings yet

- AAPL Buyside Pitchbook.Document22 pagesAAPL Buyside Pitchbook.kn0q00100% (2)

- HONEYWELL - Docx (Business Policy)Document13 pagesHONEYWELL - Docx (Business Policy)kiollNo ratings yet

- A Comparative Marketing Study of LG ElectronicsDocument131 pagesA Comparative Marketing Study of LG ElectronicsAshish JhaNo ratings yet

- Walt Disney Strategic CaseDocument28 pagesWalt Disney Strategic CaseArleneCastroNo ratings yet

- HRM 360: Honeywell Inc. and Global R&DDocument59 pagesHRM 360: Honeywell Inc. and Global R&Dnahy69100% (1)

- Finlatics - Honeywell 2Document5 pagesFinlatics - Honeywell 2KARAN NEMANINo ratings yet

- Strategy Presentation Group 8Document62 pagesStrategy Presentation Group 8Shivani BhatiaNo ratings yet

- Operations Startegy in Global EnvironmentDocument28 pagesOperations Startegy in Global EnvironmentCindy Ortiz Gaston100% (2)

- Of The Board of Directors: (Issued As of 17 February 2021)Document100 pagesOf The Board of Directors: (Issued As of 17 February 2021)Carlos Gomez VillanNo ratings yet

- R&D, Innovation and Growth: Performance of The World's Leading Technology CorporationsDocument21 pagesR&D, Innovation and Growth: Performance of The World's Leading Technology CorporationsRaghuveer ChandraNo ratings yet

- Full Analysis of Dell - 9pm 3rd OctDocument33 pagesFull Analysis of Dell - 9pm 3rd Octhoang-anh-dinh-7688No ratings yet

- Document 1Document41 pagesDocument 1Ella Jade CadizNo ratings yet

- Bear Stearns NortelDocument79 pagesBear Stearns NortelTeresa Carter100% (1)

- TOP20 Operator Funding Report ComprDocument7 pagesTOP20 Operator Funding Report ComprAnonymous loKgurNo ratings yet

- Infsw q12012 FinalDocument2 pagesInfsw q12012 FinalAnonymous Feglbx5No ratings yet

- Case StudyDocument13 pagesCase StudyIvelina Tsekova100% (1)

- B2B Marketing Carrier India: Fadhal Abdulla A VDocument12 pagesB2B Marketing Carrier India: Fadhal Abdulla A VAmit SinghNo ratings yet

- Strengths:: SWOT AnalysisDocument3 pagesStrengths:: SWOT AnalysisPradip SharmaNo ratings yet

- Discussion Forum Unit 2 BUS 5110 - Managerial AccountingDocument4 pagesDiscussion Forum Unit 2 BUS 5110 - Managerial AccountingCasa Relief CNo ratings yet

- Case Study Acquisition of Nokia S Device PDFDocument6 pagesCase Study Acquisition of Nokia S Device PDFManav RizwaniNo ratings yet

- Financial Accounting: Tools For Business Decision Making (6th Ed.) .Document44 pagesFinancial Accounting: Tools For Business Decision Making (6th Ed.) .Avonda Lashell Trader67% (3)

- Research Assignment Financial Analysis: Apple Computer Inc.: Financial and Managerial Accounting (AC 630 B)Document11 pagesResearch Assignment Financial Analysis: Apple Computer Inc.: Financial and Managerial Accounting (AC 630 B)ReenaNaipalNo ratings yet

- Havells (India) LTD: Key Financial IndicatorsDocument4 pagesHavells (India) LTD: Key Financial IndicatorsShivu BiradarNo ratings yet

- Cooper INdustriesDocument119 pagesCooper INdustriesbodiemcdNo ratings yet

- Honeywell Annual Report 2021Document136 pagesHoneywell Annual Report 2021KuldeepNo ratings yet

- B2B Carrier ACDocument12 pagesB2B Carrier ACFadhal AbdullaNo ratings yet

- Boeing Case AnalysisDocument21 pagesBoeing Case AnalysisRohit PantNo ratings yet

- Final Report MGT-403Document27 pagesFinal Report MGT-403Ashrafur RahmanNo ratings yet

- COC Level-4Document30 pagesCOC Level-4Nebiyu88% (8)

- Hyundai Ioniq Media Plan DeckDocument52 pagesHyundai Ioniq Media Plan DeckSerenaNo ratings yet

- Vstar 650 Clas ManDocument36 pagesVstar 650 Clas ManNelson KnightNo ratings yet

- RedBus TicketDocument2 pagesRedBus TicketKarteek Kandala100% (1)

- World Class ManufacturingDocument10 pagesWorld Class ManufacturingAhmed ElgazarNo ratings yet

- Auburn Trader - August 14, 2013Document11 pagesAuburn Trader - August 14, 2013GCMediaNo ratings yet

- Guia Bolsillo Auditor Interno AutomotrizDocument42 pagesGuia Bolsillo Auditor Interno Automotrizjuande69No ratings yet

- Thesis AudiDocument6 pagesThesis AudiHelpWritingCollegePapersUK100% (2)

- OFFER DEUTZ BF4L1011F Hernedez Reyes PDFDocument3 pagesOFFER DEUTZ BF4L1011F Hernedez Reyes PDFjorge adalberto hernandez reyesNo ratings yet

- U S D C: Nited Tates Istrict OurtDocument11 pagesU S D C: Nited Tates Istrict OurtGMG EditorialNo ratings yet

- Manual BrontoDocument115 pagesManual BrontoDaniel Reinoso Rojo83% (6)

- Plano de Teste Bosch 0460426344Document2 pagesPlano de Teste Bosch 0460426344Elson DorigonNo ratings yet

- Uganda Road Safety Audit Manual FINAL2-NewDocument41 pagesUganda Road Safety Audit Manual FINAL2-NewKocic Balicevac50% (2)

- The Coach Driver's ChecklistDocument2 pagesThe Coach Driver's ChecklistIRUNo ratings yet

- Audatex Database Reference Manual For Cars & Light TrucksDocument174 pagesAudatex Database Reference Manual For Cars & Light Truckskmcgrath89No ratings yet

- FSAE Rules95th - 2016Document2 pagesFSAE Rules95th - 2016Elias Martinez SantillanNo ratings yet

- Tractor Price and Speci Cations: Tractors in IndiaDocument4 pagesTractor Price and Speci Cations: Tractors in Indiatrupti kadamNo ratings yet

- Bekaert AnalysisDocument25 pagesBekaert AnalysisAlexandre Antonio MaitaNo ratings yet

- Power Steering Ecu Assy: ReplacementDocument22 pagesPower Steering Ecu Assy: ReplacementMusat Catalin-MarianNo ratings yet

- Bikol Reporter February 25 - March 3, 2018 IssueDocument8 pagesBikol Reporter February 25 - March 3, 2018 IssueBikol ReporterNo ratings yet

- 0000004232-Ashok Leyland LTD FullDocument5 pages0000004232-Ashok Leyland LTD FullVenkat Parthasarathy100% (1)

- Bomba Rosenbauer RS3HDocument2 pagesBomba Rosenbauer RS3HPablo López GarcíaNo ratings yet

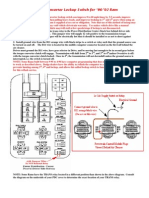

- Torque Converter Lockup SwitchDocument2 pagesTorque Converter Lockup SwitchKenny G Nichol100% (1)

- CSX Industrial Sidetrack Manual 063003 PDFDocument57 pagesCSX Industrial Sidetrack Manual 063003 PDFfbturaNo ratings yet

- Inside The Santa Claus Fund BoxDocument1 pageInside The Santa Claus Fund BoxToronto StarNo ratings yet

- Log General VentoDocument10 pagesLog General VentoNahui MopsNo ratings yet

- Manual Tr3Document56 pagesManual Tr3tornomanNo ratings yet

- 27S DataSheet 7 PDFDocument2 pages27S DataSheet 7 PDFmaiquelernNo ratings yet

- Company ProfileDocument24 pagesCompany ProfilebaabNo ratings yet

- Designing Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeFrom EverandDesigning Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeRating: 4.5 out of 5 stars4.5/5 (62)

- Steal the Show: From Speeches to Job Interviews to Deal-Closing Pitches, How to Guarantee a Standing Ovation for All the Performances in Your LifeFrom EverandSteal the Show: From Speeches to Job Interviews to Deal-Closing Pitches, How to Guarantee a Standing Ovation for All the Performances in Your LifeRating: 4.5 out of 5 stars4.5/5 (39)

- From Paycheck to Purpose: The Clear Path to Doing Work You LoveFrom EverandFrom Paycheck to Purpose: The Clear Path to Doing Work You LoveRating: 4.5 out of 5 stars4.5/5 (39)

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)

- Summary: 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur by Ryan Daniel Moran: Key Takeaways, Summary & AnalysisFrom EverandSummary: 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur by Ryan Daniel Moran: Key Takeaways, Summary & AnalysisRating: 5 out of 5 stars5/5 (2)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0From EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Rating: 5 out of 5 stars5/5 (1)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- Start.: Punch Fear in the Face, Escape Average, and Do Work That MattersFrom EverandStart.: Punch Fear in the Face, Escape Average, and Do Work That MattersRating: 4.5 out of 5 stars4.5/5 (56)

- The 30 Day MBA: Your Fast Track Guide to Business SuccessFrom EverandThe 30 Day MBA: Your Fast Track Guide to Business SuccessRating: 4.5 out of 5 stars4.5/5 (19)

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (11)

- The First 90 Days: Proven Strategies for Getting Up to Speed Faster and SmarterFrom EverandThe First 90 Days: Proven Strategies for Getting Up to Speed Faster and SmarterRating: 4.5 out of 5 stars4.5/5 (122)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerFrom EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerRating: 4 out of 5 stars4/5 (121)

- Sales Pitch: How to Craft a Story to Stand Out and WinFrom EverandSales Pitch: How to Craft a Story to Stand Out and WinRating: 4.5 out of 5 stars4.5/5 (2)

- Blue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantFrom EverandBlue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantRating: 4 out of 5 stars4/5 (387)

- Work Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkFrom EverandWork Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkRating: 4.5 out of 5 stars4.5/5 (12)

- Happy at Work: How to Create a Happy, Engaging Workplace for Today's (and Tomorrow's!) WorkforceFrom EverandHappy at Work: How to Create a Happy, Engaging Workplace for Today's (and Tomorrow's!) WorkforceNo ratings yet

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsFrom EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsRating: 4.5 out of 5 stars4.5/5 (90)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewFrom EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (104)

- 12 Habits Of Valuable Employees: Your Roadmap to an Amazing CareerFrom Everand12 Habits Of Valuable Employees: Your Roadmap to an Amazing CareerNo ratings yet

- The Proximity Principle: The Proven Strategy That Will Lead to the Career You LoveFrom EverandThe Proximity Principle: The Proven Strategy That Will Lead to the Career You LoveRating: 4.5 out of 5 stars4.5/5 (93)

- The Everything Guide To Being A Paralegal: Winning Secrets to a Successful Career!From EverandThe Everything Guide To Being A Paralegal: Winning Secrets to a Successful Career!Rating: 5 out of 5 stars5/5 (1)

- Summary of Richard Rumelt's Good Strategy Bad StrategyFrom EverandSummary of Richard Rumelt's Good Strategy Bad StrategyRating: 5 out of 5 stars5/5 (1)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffFrom EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffRating: 5 out of 5 stars5/5 (61)

- The 2-Hour Job Search: Using Technology to Get the Right Job FasterFrom EverandThe 2-Hour Job Search: Using Technology to Get the Right Job FasterRating: 4 out of 5 stars4/5 (23)