Professional Documents

Culture Documents

Five Year Balance Sheet and Profit & Loss Data for Company

Uploaded by

tanuj_mohantyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Five Year Balance Sheet and Profit & Loss Data for Company

Uploaded by

tanuj_mohantyCopyright:

Available Formats

--------------

----- in

Rs. Cr.

--------------

Balance Sheet -----

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Sources Of Funds

Total Share Capital 285.15 291.80 292.30 293.00 293.60

Equity Share Capital 285.15 291.80 292.30 293.00 293.60

Share Application Money 7.49 3.50 58.00 1.50 1.80

Preference Share Capital 0.00 0.00 0.00 0.00 0.00

Reserves 6,135.30 9,025.10 11,260.40 12,220.50 17,396.80

Revaluation Reserves 0.00 0.00 0.00 0.00 0.00

Networth 6,427.94 9,320.40 11,610.70 12,515.00 17,692.20

Secured Loans 45.06 23.20 4.00 0.00 0.00

Unsecured Loans 5.10 214.80 3,818.40 5,013.90 5,530.20

Total Debt 50.16 238.00 3,822.40 5,013.90 5,530.20

Total Liabilities 6,478.10 9,558.40 15,433.10 17,528.90 23,222.40

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Application Of Funds

Gross Block 2,364.53 1,645.90 2,282.20 5,743.30 6,761.30

Less: Accum. Depreciation 1,246.27 0.00 0.00 2,563.70 3,105.00

Net Block 1,118.26 1,645.90 2,282.20 3,179.60 3,656.30

Capital Work in Progress 612.36 989.50 1,335.00 1,311.80 991.10

Investments 3,459.20 4,348.70 4,500.10 6,895.30 8,966.50

Inventories 148.65 240.40 448.10 459.60 606.90

Sundry Debtors 1,968.07 2,582.30 3,646.60 4,446.40 4,754.70

Cash and Bank Balance 822.42 1,849.20 3,732.10 1,902.10 1,938.30

Total Current Assets 2,939.14 4,671.90 7,826.80 6,808.10 7,299.90

Loans and Advances 1,136.96 1,666.50 4,231.30 4,202.00 5,519.40

Fixed Deposits 0.58 0.00 0.00 2,507.10 3,726.00

Total CA, Loans & Advances 4,076.68 6,338.40 12,058.10 13,517.20 16,545.30

Deffered Credit 0.00 0.00 0.00 0.00 0.00

Current Liabilities 1,776.83 2,998.90 3,361.60 5,564.30 4,706.00

Provisions 1,011.56 765.20 1,380.70 1,810.70 2,230.80

Total CL & Provisions 2,788.39 3,764.10 4,742.30 7,375.00 6,936.80

Net Current Assets 1,288.29 2,574.30 7,315.80 6,142.20 9,608.50

Miscellaneous Expenses 0.00 0.00 0.00 0.00 0.00

Total Assets 6,478.11 9,558.40 15,433.10 17,528.90 23,222.40

Contingent Liabilities 509.18 661.60 749.90 1,045.40 778.00

Book Value (Rs) 45.03 63.86 79.05 85.42 120.49

--------------

----- in

Rs. Cr.

--------------

Profit & Loss account -----

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Income

Sales Turnover 10,264.09 13,758.50 17,658.10 21,612.80 23,006.30

Excise Duty 36.97 74.60 165.50 105.50 84.30

Net Sales 10,227.12 13,683.90 17,492.60 21,507.30 22,922.00

Other Income 151.92 288.70 326.90 -480.40 875.30

Stock Adjustments 24.21 86.30 187.00 -3.80 111.00

Total Income 10,403.25 14,058.90 18,006.50 21,023.10 23,908.30

Expenditure

Raw Materials 1,391.88 1,975.30 3,139.30 3,438.80 4,140.40

Power & Fuel Cost 86.46 0.00 0.00 154.00 141.40

Employee Cost 4,279.03 5,768.20 7,409.10 9,249.80 9,062.80

Other Manufacturing Expenses 934.24 120.50 299.80 1,687.80 2,071.80

Selling and Admin Expenses 801.07 27.60 557.80 1,523.00 1,475.10

Miscellaneous Expenses 274.76 2,624.10 2,558.00 691.40 640.00

Preoperative Exp Capitalised 0.00 0.00 0.00 0.00 0.00

Total Expenses 7,767.44 10,515.70 13,964.00 16,744.80 17,531.50

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Operating Profit 2,483.89 3,254.50 3,715.60 4,758.70 5,501.50

PBDIT 2,635.81 3,543.20 4,042.50 4,278.30 6,376.80

Interest 3.13 7.20 116.80 196.80 108.40

PBDT 2,632.68 3,536.00 3,925.70 4,081.50 6,268.40

Depreciation 292.26 359.80 456.00 533.60 579.60

Other Written Off 0.00 0.00 0.00 0.00 0.00

Profit Before Tax 2,340.42 3,176.20 3,469.70 3,547.90 5,688.80

Extra-ordinary items -33.85 0.00 0.00 0.00 0.00

PBT (Post Extra-ord Items) 2,306.57 3,176.20 3,469.70 3,547.90 5,688.80

Tax 286.10 334.10 406.40 574.10 790.80

Reported Net Profit 2,020.48 2,842.10 3,063.30 2,973.80 4,898.00

Total Value Addition 6,375.55 8,540.40 10,824.70 13,306.00 13,391.10

Preference Dividend 0.00 0.00 0.00 0.00 0.00

Equity Dividend 712.88 873.70 876.50 586.00 880.90

Corporate Dividend Tax 99.98 126.80 148.90 99.60 128.30

Per share data (annualised)

Shares in issue (lakhs) 14,257.54 14,590.00 14,615.00 14,649.81 14,682.11

Earning Per Share (Rs) 14.17 19.48 20.96 20.30 33.36

Equity Dividend (%) 250.00 300.00 300.00 200.00 300.00

Book Value (Rs) 45.03 63.86 79.05 85.42 120.49

--------------

----- in

Rs. Cr.

--------------

Cash Flow -----

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Net Profit Before Tax 2340.43 3176.20 3469.70 3547.90 5688.80

Net Cash From

Operating Activities 1912.25 2674.60 715.90 4344.50 4477.40

Net Cash (used

in)/from

Investing Activities -1694.42 -1881.90 -1127.50 -3662.70 -3064.60

Net Cash (used

in)/from Financing

Activities 59.80 238.50 2290.90 -70.70 -96.20

Net

(decrease)/increase

In Cash and Cash

Equivalents 277.63 1031.20 1879.30 611.10 1316.60

Opening Cash &

Cash Equivalents 545.38 818.00 1852.80 3798.10 4347.70

Closing Cash & Cash

Equivalents 823.00 1849.20 3732.10 4409.20 5664.30

-------------

------ in

Rs. Cr.

-------------

Key Financial Ratios ------

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

Investment Valuation Ratios

Face Value 2.00 2.00 2.00 2.00 2.00

Dividend Per Share 5.00 6.00 6.00 4.00 6.00

Operating Profit Per Share (Rs) 17.42 22.31 25.42 32.48 37.47

Net Operating Profit Per Share (Rs) 71.73 93.79 119.69 146.81 156.12

Free Reserves Per Share (Rs) 42.65 -- -- 81.06 116.54

Bonus in Equity Capital 98.08 95.84 95.68 95.51 95.32

Profitability Ratios

Operating Profit Margin(%) 24.28 23.78 21.24 22.12 24

Profit Before Interest And Tax

Margin(%) 21.19 20.71 18.29 19.22 21.07

Gross Profit Margin(%) 25.08 21.15 18.63 19.64 21.47

Cash Profit Margin(%) 22.36 22.91 19.74 20.27 21.56

Adjusted Cash Margin(%) 22.32 22.91 19.74 20.27 21.56

Net Profit Margin(%) 19.53 20.34 17.19 13.53 20.97

Adjusted Net Profit Margin(%) 19.49 20.34 17.19 13.53 20.97

Return On Capital Employed(%) 35.58 33.3 23.23 26.77 23.06

Return On Net Worth(%) 31.43 30.5 26.51 23.76 27.68

Adjusted Return on Net Worth(%) 31.39 30.5 26.51 31.34 25.19

Return on Assets Excluding

Revaluations 21.8 63.86 79.05 85.42 120.49

Return on Assets Including

Revaluations 21.8 63.86 79.05 85.42 120.49

Return on Long Term Funds(%) 35.87 33.31 23.32 37.17 30.12

Liquidity And Solvency Ratios

Current Ratio 1.42 1.68 2.54 1.1 1.34

Quick Ratio 1.4 1.61 2.44 1.76 2.29

Debt Equity Ratio 0.01 0.03 0.33 0.4 0.31

Long Term Debt Equity Ratio -- 0.03 0.33 0.01 0.01

Debt Coverage Ratios

Interest Cover 735.79 442.14 30.71 23.85 49.41

Total Debt to Owners Fund 0.01 0.03 0.33 0.4 0.31

Financial Charges Coverage Ratio 829.08 492.11 34.61 26.56 54.76

Financial Charges Coverage Ratio

Post Tax 739.19 445.71 31.13 18.82 51.53

Management Efficiency Ratios

Inventory Turnover Ratio 69.56 57.23 39.41 56.15 45.4

Debtors Turnover Ratio 6.06 6.01 5.62 5.32 4.98

Investments Turnover Ratio 78.23 57.23 39.41 56.15 45.4

Fixed Assets Turnover Ratio 7.16 8.31 7.81 3.85 3.47

Total Assets Turnover Ratio 1.58 1.43 1.14 1.24 0.99

Asset Turnover Ratio 4.35 8.31 7.81 3.85 3.47

Average Raw Material Holding 28.45 -- -- 66.55 53.39

Average Finished Goods Held 3.78 -- -- 4.13 6.19

Number of Days In Working Capital 45.35 67.73 150.56 102.81 150.91

Profit & Loss Account Ratios

Material Cost Composition 13.6 14.43 17.94 15.98 18.06

Imported Composition of Raw

Materials Consumed 62.12 -- -- 45 36.83

Selling Distribution Cost Composition 1.67 -- 3.04 1.43 1.64

Expenses as Composition of Total

Sales 69.25 80.05 73.66 77.28 73.26

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit 40.23 35.2 33.47 23.05 20.6

Dividend Payout Ratio Cash Profit 35.14 31.24 29.13 19.54 18.42

Earning Retention Ratio 59.68 64.8 66.53 82.53 77.36

Cash Earning Retention Ratio 64.79 68.76 70.87 84.62 79.97

AdjustedCash Flow Times 0.02 0.07 1.09 1.13 1.1

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

Earnings Per Share 14.17 19.48 20.96 20.3 33.36

Book Value 45.03 63.86 79.05 85.42 120.49

--------------

----- in

Rs. Cr.

--------------

Key Financial Ratios -----

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

Investment Valuation Ratios

Face Value 1.00 1.00 1.00 1.00 1.00

Dividend Per Share 13.50 11.50 14.00 14.00 20.00

Operating Profit Per Share

(Rs) 68.21 43.95 51.35 61.52 34.06

Net Operating Profit Per Share

(Rs) 229.52 152.67 189.39 228.92 117.74

Free Reserves Per Share (Rs) 113.86 80.25 110.22 134.37 75.24

Bonus in Equity Capital 18.61 59.30 59.30 59.30 79.65

Profitability Ratios

Operating Profit Margin(%) 29.71 28.79 27.11 26.87 28.93

Profit Before Interest And Tax

Margin(%) 27.26 26.34 24.42 24.75 26.62

Gross Profit Margin(%) 30.07 29.17 24.64 25.01 26.89

Cash Profit Margin(%) 26.33 27.29 25.29 26.09 26.44

Adjusted Cash Margin(%) 27.25 26.44 25.29 26.09 26.44

Net Profit Margin(%) 24.05 25.00 24.11 20.74 24.13

Adjusted Net Profit Margin(%) 24.97 24.15 24.11 20.74 24.13

Return On Capital

Employed(%) 55.70 49.87 42.92 43.27 42.46

Return On Net Worth(%) 48.43 46.62 41.34 35.13 37.30

Adjusted Return on Net

Worth(%) 50.28 45.04 39.16 41.06 37.75

Return on Assets Excluding

Revaluations 36.59 82.35 111.43 136.38 76.72

Return on Assets Including

Revaluations 36.59 82.35 111.43 136.38 76.72

Return on Long Term

Funds(%) 55.97 50.12 42.96 43.27 42.46

Liquidity And Solvency Ratios

Current Ratio 2.19 1.93 1.98 1.83 1.49

Quick Ratio 2.22 1.98 1.97 1.83 1.48

Debt Equity Ratio 0.01 0.01 0.01 0.01 0.01

Long Term Debt Equity Ratio -- -- 0.01 0.01 0.01

Debt Coverage Ratios

Interest Cover 700.35 1,179.14 1,383.58 784.41 674.43

Total Debt to Owners Fund 0.01 0.01 0.01 0.01 0.01

Financial Charges Coverage

Ratio 757.67 1,279.26 1,517.73 840.52 723.63

Financial Charges Coverage

Ratio Post Tax 663.42 1,196.54 1,453.50 688.32 639.14

Management Efficiency Ratios

Inventory Turnover Ratio 492.37 1,245.97 1,137.21 1,321.77 3,398.94

Debtors Turnover Ratio 5.93 5.83 5.66 6 6.54

Investments Turnover Ratio 536.84 1,412.30 1,137.21 1,321.77 3,398.94

Fixed Assets Turnover Ratio 9.11 8.2 5.74 5.15 4.74

Total Assets Turnover Ratio 1.99 1.85 1.68 1.66 1.52

Asset Turnover Ratio 6.68 6.49 5.74 5.15 4.74

Average Raw Material Holding 85.76 144.33 98.28 93.98 72.97

Average Finished Goods Held 0.48 0.05 0.03 0.07 0.04

Number of Days In Working

Capital 71.53 63.6 71.55 67.44 55.58

Profit & Loss Account Ratios

Material Cost Composition 1.43 0.14 0.24 0.23 0.1

Imported Composition of Raw

Materials Consumed 80.37 70.79 80.43 79.74 78.67

Selling Distribution Cost

Composition 0.1 0.2 0.14 0.09 0.03

Expenses as Composition of

Total Sales 90.17 92.38 90.51 93.01 92.38

Cash Flow Indicator Ratios

Dividend Payout Ratio Net

Profit 27.72 34.46 35.55 34.2 81.61

Dividend Payout Ratio Cash

Profit 25.32 31.57 32.26 31.41 75.3

Earning Retention Ratio 73.3 64.34 62.47 70.74 19.37

Cash Earning Retention Ratio 75.53 67.42 66.11 72.81 25.53

AdjustedCash Flow Times 0.01 0.01 0 0.01 0.01

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

Earnings Per Share 55.53 38.39 46.07 47.92 28.62

Book Value 114.64 82.35 111.43 136.38 76.72

You might also like

- Wipro Balance Sheet and Financial Statements from 2006-2010Document17 pagesWipro Balance Sheet and Financial Statements from 2006-2010Rekha RaoNo ratings yet

- Balance Sheet: Sources of FundsDocument6 pagesBalance Sheet: Sources of FundsTarun GuptaNo ratings yet

- Maruti-SuzukiDocument20 pagesMaruti-Suzukihena02071% (7)

- 11 - Eshaan Chhagotra - Maruti Suzuki Ltd.Document8 pages11 - Eshaan Chhagotra - Maruti Suzuki Ltd.rajat_singlaNo ratings yet

- Ratio Analysis For Maruti Suzuki BY, Abhigna M.P Section C Group 7 PROV/MBA-7-21/079Document10 pagesRatio Analysis For Maruti Suzuki BY, Abhigna M.P Section C Group 7 PROV/MBA-7-21/079AbhignaNo ratings yet

- Cash Flow of ICICI Bank - in Rs. Cr.Document12 pagesCash Flow of ICICI Bank - in Rs. Cr.Neethu GesanNo ratings yet

- Maruti Suzuki India Balance Sheet - Maruti Suzuki India LTD Balance Sheet, Financial StatementDocument1 pageMaruti Suzuki India Balance Sheet - Maruti Suzuki India LTD Balance Sheet, Financial StatementPriyanka GodhaNo ratings yet

- Tech MahindraDocument11 pagesTech MahindraDakshNo ratings yet

- Profit and Loss AccountDocument1 pageProfit and Loss AccountAnonymous HAkNRaNo ratings yet

- Balance Sheet of Axis Bank: - in Rs. Cr.Document37 pagesBalance Sheet of Axis Bank: - in Rs. Cr.rampunjaniNo ratings yet

- Tech Mahindra P&L StatmentDocument6 pagesTech Mahindra P&L StatmentBharat RajputNo ratings yet

- Consolidated Balance Sheet: Wipro TCS InfosysDocument4 pagesConsolidated Balance Sheet: Wipro TCS Infosysvineel kumarNo ratings yet

- Company Info - Print FinancialsDocument1 pageCompany Info - Print FinancialsMehak MehrajNo ratings yet

- Previous Years : Bharti AirtelDocument4 pagesPrevious Years : Bharti AirtelDazzling KriyaNo ratings yet

- Maruti Suzuki India: PrintDocument2 pagesMaruti Suzuki India: PrintSoumya KhatuaNo ratings yet

- Maruti Suzuki Financial Statment NewDocument4 pagesMaruti Suzuki Financial Statment NewMasoud Afzali100% (1)

- IciciDocument9 pagesIciciChirdeep PareekNo ratings yet

- Wipro Statement of Profit and Loss and Balance Sheet 2012-2021Document6 pagesWipro Statement of Profit and Loss and Balance Sheet 2012-2021SatishNo ratings yet

- Bharti Airtel: PrintDocument1 pageBharti Airtel: Printvivek singhNo ratings yet

- Balance Sheet: Hindalco IndustriesDocument20 pagesBalance Sheet: Hindalco Industriesparinay202No ratings yet

- Financial Statements of WiproDocument2 pagesFinancial Statements of WiproPraveen Reddy100% (1)

- Balance Sheet of WiproDocument2 pagesBalance Sheet of WiproNabeelur RahmanNo ratings yet

- Balance Sheet of State Bank of IndiaDocument5 pagesBalance Sheet of State Bank of Indiakanishtha1No ratings yet

- Fruit Bread Bakery Financials Over 5 YearsDocument13 pagesFruit Bread Bakery Financials Over 5 YearsMary Chris Saldon BalladaresNo ratings yet

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- Maruti Suzuki (Latest)Document44 pagesMaruti Suzuki (Latest)utskjdfsjkghfndbhdfnNo ratings yet

- Financial StatementsDocument14 pagesFinancial Statementsthenal kulandaianNo ratings yet

- Data Moneycontrol - Com - Company Info - Print FinancialsDocument2 pagesData Moneycontrol - Com - Company Info - Print FinancialsshreyasNo ratings yet

- Advanced Financial ManagementDocument5 pagesAdvanced Financial ManagementAkshay KapoorNo ratings yet

- Wipro Consolidated Balance SheetDocument2 pagesWipro Consolidated Balance SheetKarthik KarthikNo ratings yet

- Standard-Ceramic-Limited NewDocument10 pagesStandard-Ceramic-Limited NewTahmid ShovonNo ratings yet

- Balance Sheet of DR Reddys Laboratories: - in Rs. Cr.Document14 pagesBalance Sheet of DR Reddys Laboratories: - in Rs. Cr.Anand MalashettiNo ratings yet

- ITM MaricoDocument8 pagesITM MaricoAdarsh ChaudharyNo ratings yet

- Balance Sheet of Allahabad BankDocument26 pagesBalance Sheet of Allahabad BankMemoona RizviNo ratings yet

- Sources of Funds: Balance Sheet - in Rs. Cr.Document10 pagesSources of Funds: Balance Sheet - in Rs. Cr.mayankjain_90No ratings yet

- Tech Mahindra and Wipro Balance Sheets ComparisonDocument3 pagesTech Mahindra and Wipro Balance Sheets ComparisonPRAVEEN KUMAR M 18MBR070No ratings yet

- Balance Sheet of State Bank of India: - in Rs. Cr.Document17 pagesBalance Sheet of State Bank of India: - in Rs. Cr.Sunil KumarNo ratings yet

- Vedanta Balance Sheet and Profit & Loss AnalysisDocument8 pagesVedanta Balance Sheet and Profit & Loss AnalysisShubham SarafNo ratings yet

- Consolidated Balance Sheet (Rs. in MN)Document24 pagesConsolidated Balance Sheet (Rs. in MN)prernagadiaNo ratings yet

- JSW Steel LimitedDocument35 pagesJSW Steel LimitedNeha SinghNo ratings yet

- Financial+Statements+ +Maruti+Suzuki+&+Tata+MotorsDocument5 pagesFinancial+Statements+ +Maruti+Suzuki+&+Tata+MotorsApoorv GuptaNo ratings yet

- Aman FM Tp2003 FMDocument9 pagesAman FM Tp2003 FMAmandeep SinghNo ratings yet

- 9S-2B Corporation Forecasted FinancialsDocument5 pages9S-2B Corporation Forecasted FinancialsFlora Fil GutierrezNo ratings yet

- Sbi Banlce SheetDocument1 pageSbi Banlce SheetANIKET VISHWANATH KURANENo ratings yet

- Fa - Assignment LaxmiDocument36 pagesFa - Assignment Laxmilaxmi joshiNo ratings yet

- WiproDocument9 pagesWiprorastehertaNo ratings yet

- Balance Sheet of MsDocument2 pagesBalance Sheet of Mspraansuchaudhary713No ratings yet

- Shree Cement DCF ValuationDocument71 pagesShree Cement DCF ValuationPrabhdeep DadyalNo ratings yet

- Bibliography and Ane KumaranDocument6 pagesBibliography and Ane KumaranG.KISHORE KUMARNo ratings yet

- Balance Sheet of Larsen and Toubro: - in Rs. Cr.Document3 pagesBalance Sheet of Larsen and Toubro: - in Rs. Cr.Ashirvad MayekarNo ratings yet

- Hindustan Unilever LTD.: Executive Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. MillionDocument4 pagesHindustan Unilever LTD.: Executive Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. Millionandrew garfieldNo ratings yet

- Marico Combined FinalDocument9 pagesMarico Combined FinalAbhay Kumar SinghNo ratings yet

- Market Share and Comparison To CompetitionDocument5 pagesMarket Share and Comparison To CompetitionNikilaa ManoharanNo ratings yet

- Balance SheetDocument11 pagesBalance SheetPrachi VermaNo ratings yet

- Balance Sheet of Reliance Communications: - in Rs. Cr.Document4 pagesBalance Sheet of Reliance Communications: - in Rs. Cr.Nanvinder SinghNo ratings yet

- Data of BhartiDocument2 pagesData of BhartiAnkur MehtaNo ratings yet

- Kshitij Goyal FM Ass 1 MARUTI SUZUKI INDIA LTDDocument7 pagesKshitij Goyal FM Ass 1 MARUTI SUZUKI INDIA LTDAngle PriyaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 2004-Lewis and Pendrill - Current Cost Accounting Developed-Chapter - 17Document31 pages2004-Lewis and Pendrill - Current Cost Accounting Developed-Chapter - 17EkralcdNo ratings yet

- Ch14 P13 ModelDocument6 pagesCh14 P13 ModelJusto Valverde0% (4)

- QUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDocument4 pagesQUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDaffa Ramadhan ArcheryNo ratings yet

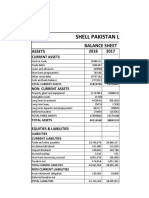

- Shell Pakistan LTD: Assets 2018 2017Document11 pagesShell Pakistan LTD: Assets 2018 2017mohammad bilalNo ratings yet

- Financial Statement PertaminaDocument10 pagesFinancial Statement PertaminaAgnes Grace Florence SimanjuntakNo ratings yet

- Annual Report 2018 PDFDocument284 pagesAnnual Report 2018 PDFHussain MarviNo ratings yet

- Commissioner of Internal Revenue vs. CA (301 SCRA 152, 1999)Document4 pagesCommissioner of Internal Revenue vs. CA (301 SCRA 152, 1999)eunice demaclidNo ratings yet

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- 6.annexure F-HFMN330-1-JAN-JUN2023-FA1-GT-V3-31012023-3Document7 pages6.annexure F-HFMN330-1-JAN-JUN2023-FA1-GT-V3-31012023-3Katlego MosehleNo ratings yet

- Mergers & Acquisitions Qs on EPS, P/E, Exchange RatiosDocument4 pagesMergers & Acquisitions Qs on EPS, P/E, Exchange RatiosRiya GargNo ratings yet

- Practice Exam 1gdfgdfDocument49 pagesPractice Exam 1gdfgdfredearth2929100% (1)

- Financial Management Notes SPCCDocument43 pagesFinancial Management Notes SPCCriteshkumar07956No ratings yet

- International Business Simulation Strategy AnalysisDocument19 pagesInternational Business Simulation Strategy AnalysisAnh Thư Nguyễn TrangNo ratings yet

- Financial Statement Sivaswathi TEXTILESDocument103 pagesFinancial Statement Sivaswathi TEXTILESSakhamuri Ram'sNo ratings yet

- Group Financial Results & Update for FY2017Document40 pagesGroup Financial Results & Update for FY2017vignespoonganNo ratings yet

- CashflowsDocument6 pagesCashflowsJAN CHRISTOPHER CABADINGNo ratings yet

- Polytechnic University Accounting ExamDocument10 pagesPolytechnic University Accounting Examyugyeom rojasNo ratings yet

- LQ 1 Sec C Solution PDFDocument14 pagesLQ 1 Sec C Solution PDFmaria evangelistaNo ratings yet

- ch12 TBDocument25 pagesch12 TBsofikhdyNo ratings yet

- Fundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONDocument21 pagesFundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONRiyaz RangrezNo ratings yet

- I. Short Answer Questions: Ample XAM UestionsDocument6 pagesI. Short Answer Questions: Ample XAM UestionsTimothy HuangNo ratings yet

- Corporate Finance MCQs PDFDocument63 pagesCorporate Finance MCQs PDFNhat QuangNo ratings yet

- Estimating Capital RequirementDocument7 pagesEstimating Capital RequirementVishwo ShresthaNo ratings yet

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- Machinery, Expenses, Ratios, Cash Flow AnalysisDocument3 pagesMachinery, Expenses, Ratios, Cash Flow AnalysisAjit KumarNo ratings yet

- Fin701 - Module2 9.17Document6 pagesFin701 - Module2 9.17Krista CataldoNo ratings yet

- Stock ValuationDocument73 pagesStock ValuationRona Mae Alcayaga Aringo100% (1)

- Financial Litigation Dividend and Stock Split CalculatorDocument5 pagesFinancial Litigation Dividend and Stock Split CalculatorAjeet YadavNo ratings yet

- ProblemSet Cash Flow EstimationQA-160611 - 021520Document25 pagesProblemSet Cash Flow EstimationQA-160611 - 021520Jonathan Punnalagan100% (2)

- CorpF ReviseDocument5 pagesCorpF ReviseTrang DangNo ratings yet