Professional Documents

Culture Documents

San Jay

Uploaded by

Jibon Jain0 ratings0% found this document useful (0 votes)

190 views6 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

190 views6 pagesSan Jay

Uploaded by

Jibon JainCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 6

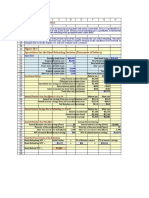

A B C D E F G H I

1 Ch 18 Mini Case 3/9/2001

2

3 Mini Case for Lease Financing

4

5 Lewis Securities Inc. has decided to acquire a new market data and quotation system for its Richmond home office. The

6 system receives current market prices and other information from several on-line data services, then either displays the

7 information on a screen or stores it for later retrieval by the firm's brokers. The system also permits customers to call up

8 current quotes on terminals in the lobby.

9

10 The equipment costs $1,000,000, and, if it were purchased, Lewis could obtain a term loan for the full purchase price at a 10

11 percent interest rate. The equipment is classified as a special-purpose computer, so it falls into the MACRS 3-year class. If the

system were purchased, a 4-year maintenance contract could be obtained at a cost of $20,000 per year, payable at the beginning

12 of each year. The equipment would be sold after 4 years, and the best estimate of its residual value at that time is $100,000.

13 However, since real-time display system technology is changing rapidly, the actual residual value is uncertain.

14

15

16

17

18 As an alternative to the borrow-and-buy plan, the equipment manufacturer informed Lewis that Consolidated Leasing would

be willing to write a 4-year guideline lease on the equipment, including maintenance, for payments of $280,000 at the beginning

19 of each year. Lewis's marginal federal-plus-state tax rate is 40 percent. You have been asked to analyze the lease-versus-

20 purchase decision, and in the process to answer the following questions:

21

22 a. (1) Who are the two parties to a lease transaction?

23 (2) What are the four primary types of leases, and what are their characteristics?

24 (3) How are leases classified for tax purposes?

25 (4) What effect does leasing have on a firm's balance sheet?

26 (5) What effect does leasing have on a firm's capital structure?

27

28 b. (1) What is the present value cost of owning the equipment? (Hint: Set up a time line which shows the net cash flows over

29 the period t = 0 to t = 4, and then find the PV of these net cash flows, or the PV cost of owning.)

30

31 Given Data

32 (all dollar figures in thousands)

33

34 New Equipment cost $1,000 KEY OUTPUT

35 New Equipment life 4

36 Equip. Residual Value $100 LEASE

37 Tax Rate 40% because the net advantage of this alternative is $22.20

38 Loan interest rate 10%

39 Annual rental charge $280

40 After-tax cost of debt 6%

41

42

43 NPV LEASE ANALYSIS

44

45 Year = 0 1 2 3 4

46 Cost of Owning

47 Equipment cost ($1,000)

48 Loan amount $1,000

49 Interest expense ($100) ($100) ($100) ($100)

50 Tax savings from interest 40 40 40 40

51 Principal repayment ($1,000)

52 After tax loan payment ($60) ($60) ($60) ($1,060)

53 Depreciation shield $132 $180 $60 $28

54 Maintenance ($20) ($20) ($20) ($20)

55 Tax savings on maintenance $8 $8 $8 $8 $0

56 Residual value $100

57 Tax on residual value ($40)

A B C D E F G H I

58 Net cash flow ($12) $60 $108 ($12) ($972)

59 PV ownership cost @ 6% ($639.27) all the value have been discounted

60

61

62 (2) Explain the rationale for the discount rate you used to find the PV.

63

64 Leasing is similar to debt financing in that the cash flows have relatively low risk because most are fixed by contract.

65 Therefore the firms 10% cost of debt is a good start. The tax shield of interest payments must be considered.

66 10%(1 - T) = 10%(1 - 0.4) = 6.0%.

67

68 c. What is Lewis's present value cost of leasing the equipment? (Hint: Again, construct a time line.)

69

70 Year = 0 1 2 3 4

71 Cost of Leasing

72 Lease payment ($280) ($280) ($280) ($280)

73 Tax savings from lease $112 $112 $112 $112

74 Net cash flow ($168) ($168) ($168) ($168) $0

75 PV of leasing @ 6% ($617.07)

76

77

78 d. What is the net advantage to leasing (NAL)? Does your analysis indicate that Lewis should buy or lease the equipment?

79 Explain.

80

81 Cost Comparison

82 PV ownership cost @ 6% ($639.27)

83 PV of leasing @ 6% ($617.07)

84 Net Advantage to Leasing $22.20

85

86

87 e. Now assume that the equipment's residual value could be as low as $0 or as high as $200,000, but that $100,000 is the

88 expected value. Since the residual value is riskier than the other cash flows in the analysis, this differential risk should be

89 incorporated into the analysis. Describe how this could be accomplished. (No calculations are necessary, but explain how you

90 would modify the analysis if calculations were required.) What effect would increased uncertainty about the residual value

have on Lewis's lease-versus-purchase decision?

91

92

93 The discount rate applied to the residual value inflow (a positive CF) should be increased to account for the increased risk.

94 If the residual value were included as an outflow (a negative CF) in the cost of leasing cash flows, the increased risk would

95 be reflected by applying a lower discount rate to the residual value cash flow. All other cash flows should be discounted at

96 the original 6% rate.

97 Alter the Residual Discount Rate to see the effect on PV

98

99 Year = 0 1 2 3 4

100 Cost of Owning

101 Equipment cost $(1,000)

102 Loan amount $1,000

103 Interest expense $(100) $(100) $(100) $(100)

104 Tax savings from interest $40 $40 $40 $40

105 Principal repayment $(1,000)

106 After tax loan payment $(60) $(60) $(60) $(1,060)

107 Depreciation shield $132 $180 $60 $28

108 Maintenance $(20) $(20) $(20) $(20)

109 Tax savings on maintenance $8 $8 $8 $8 $-

110 Tax on residual value $(40)

111 Cash flow without residual $(12) $60 $108 $(12) $(1,072)

112 Residual cash flow $- $- $- $100

113 PV minus residual @ 6% $(718.48)

114 PV of residual @ 6% $79.21

115 PV of ownership $(639.27) Residual Discount Rate 6.00%

116

A B C D E F G H I

117

118 f. The lessee compares the cost of owning the equipment with the cost of leasing it. Now put yourself in the lessor's shoes. In a

119 few sentences, how should you analyze the decision to write or not write the lease?

120

121 The lessor owns the equipment when the lease expires. Therefore, residual value risk is passed from the lessee to the

122 lessor. The increased residual value risk makes the lease more attractive to the lessee.

123

124 To the lessor, writing the lease is an investment. Therefore, the lessor must compare the return on the lease investment

125 with the return available on alternative investments of similar risk.

126

127

128 g. (1) Assume that the lease payments were actually $300,000 per year, that Consolidated Leasing is also in the 40 percent tax

129 bracket, and that it also forecasts a $100,000 residual value. Also, to furnish the maintenance support, Consolidated would

130 have to purchase a maintenance contract from the manufacturer at the same $20,000 annual cost, again paid in advance.

131 Consolidated Leasing can obtain an expected 10 percent pre-tax return on investments of similar risk. What would

Consolidated's NPV and IRR of leasing be under these conditions?

132

133

134 NPV LEASOR'S ANALYSIS

135

136 Year = 0 1 2 3 4

137 Cost of Owning

138 Equipment cost ($1,000)

139 Depreciation shield $132 $180 $60 $28

140 Maintenance ($20) ($20) ($20) ($20)

141 Tax savings on maintenance $8 $8 $8 $8 $0

142 Lease payment $300 $300 $300 $300

143 Tax on lease payment ($120) ($120) ($120) ($120)

144 Residual value $100

145 Tax on residual value ($40)

146 Net cash flow ($832) $300 $348 $228 $88

147 PV @ 6% $21.88

148 IRR 7.35% Discount Rate 6.00%

149

150 (2) What do you think the lessor's NPV would be if the lease payments were set at $280,000 per year? (Hint: The lessor's

151 cash flows would be a "mirror image" of the lessee's cash flows.)

152

153 With lease payments of $280,000, the lessor’s cash flows would be equal, but opposite in sign, to the lessee’s NAL.

154 Thus, lessor’s NPV = -$22,201.

155 If all inputs are symmetrical, leasing is a zero-sum game.

156

157

158 h. Lewis's management has been considering moving to a new downtown location, and they are concerned that these plans

159 may come to fruition prior to the expiration of the lease. If the move occurs, Lewis would buy or lease an entirely new set of

160 equipment, and hence management would like to include a cancellation clause in the lease contract. What impact would such a

161 clause have on the riskiness of the lease from Lewis's standpoint? From the lessor's standpoint? If you were the lessor, would

you insist on changing any of the lease terms if a cancellation clause were added? Should the cancellation clause contain any

162

restrictive covenants and/or penalties of the type contained in bond indentures or provisions similar to call premiums?

163

164

165

166 A cancellation clause would lower the risk of the lease to the lessee but raise the lessor’s risk. To account for this, the

167 lessor would increase the annual lease payment or else impose a penalty for early cancellation.

168

169

170

171

172

173

174

A B C D E F G H I

175

176

177

178

179

180

181

182

183

184

185

186

187

188

189

A B C D E F G H I

190

191

192

193

194

195

196

197

198

199

200

201

202

203

204

205

206

207

208

209

210

211

212

213

214

215

216

217

218

219

220

221

222

223

224

225

226

227

228

229

230

231

232

233

234

235

236

237

238

239

240

241

242

243

244

245

246

247

248

A B C D E F G H I

249

250

251

252

253

254

255

256

257

258

259

260

261

262

263

264

265

266

267

268

269

270

271

272

273

You might also like

- Chapter 18. Tool Kit For Lease Financing: LeasingDocument7 pagesChapter 18. Tool Kit For Lease Financing: LeasingHerlambang PrayogaNo ratings yet

- Tugas Pak Sujono Pak Dimas MMDocument2 pagesTugas Pak Sujono Pak Dimas MMDimas GhiffariNo ratings yet

- Chapter 18. Lease Analysis (Ch18boc-ModelDocument16 pagesChapter 18. Lease Analysis (Ch18boc-Modelsardar hussainNo ratings yet

- Kainat Mazhar FM Lab NewDocument16 pagesKainat Mazhar FM Lab Newi234579No ratings yet

- Mini Case 8Document4 pagesMini Case 8JOBIN VARGHESENo ratings yet

- FM11 CH 19 Tool KitDocument14 pagesFM11 CH 19 Tool KitUyanga LkhagvadorjjNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- FM11 CH 11 Mini CaseDocument16 pagesFM11 CH 11 Mini CaseDora VidevaNo ratings yet

- Obtain A Bank Loan For 100% of The Purchase Price, or It Can Lease The Machinery. Assume That The Following Facts ApplyDocument4 pagesObtain A Bank Loan For 100% of The Purchase Price, or It Can Lease The Machinery. Assume That The Following Facts Applydahnil dicardoNo ratings yet

- Chapter 2. Tool Kit For Financial Statements, Cash Flows, and TaxesDocument14 pagesChapter 2. Tool Kit For Financial Statements, Cash Flows, and TaxesAnshumaan SinghNo ratings yet

- Analysis of Expansion Project Cash FlowsDocument368 pagesAnalysis of Expansion Project Cash FlowsRoy HemenwayNo ratings yet

- Liverage Brigham Case SolutionDocument8 pagesLiverage Brigham Case SolutionShahid Mehmood100% (1)

- JD Sdn. BHD Study CaseDocument5 pagesJD Sdn. BHD Study CaseSuperFlyFlyers100% (2)

- Forecasting Brigham Case SolutionDocument7 pagesForecasting Brigham Case SolutionShahid Mehmood100% (1)

- F9 JUNE 17 Mock AnswersDocument15 pagesF9 JUNE 17 Mock AnswersottieNo ratings yet

- Allied Food Products: A Case StudyDocument18 pagesAllied Food Products: A Case StudyMikey MadRatNo ratings yet

- 3.3 Cashflow Estimation and Risk Analysis Data Tables, Goal Seek and Scenario Analysis ExcerciseDocument11 pages3.3 Cashflow Estimation and Risk Analysis Data Tables, Goal Seek and Scenario Analysis ExcerciseRaghavendra NaduvinamaniNo ratings yet

- Dec 2007 - AnsDocument10 pagesDec 2007 - AnsHubbak KhanNo ratings yet

- CapbdgtDocument25 pagesCapbdgtmajidNo ratings yet

- General Data: Lessee:: Input Data: Key OutputDocument10 pagesGeneral Data: Lessee:: Input Data: Key OutputShafiqUr RehmanNo ratings yet

- Ch05 Tool KitDocument31 pagesCh05 Tool KitAdamNo ratings yet

- Chapter 14 LEASINGDocument17 pagesChapter 14 LEASINGKaran KashyapNo ratings yet

- Estimating a Target's Value Using the Compressed APV ApproachDocument20 pagesEstimating a Target's Value Using the Compressed APV ApproachAdamNo ratings yet

- 11042024154808Document15 pages11042024154808agarwalpawan1No ratings yet

- Pickins Mining Case Analysis - NPV, IRR, PaybackDocument5 pagesPickins Mining Case Analysis - NPV, IRR, PaybackWarda AhsanNo ratings yet

- Brealey 5CE Ch09 SolutionsDocument27 pagesBrealey 5CE Ch09 SolutionsToby Tobes TobezNo ratings yet

- Cash+flow+estimation (14-1759)Document9 pagesCash+flow+estimation (14-1759)M shahjamal QureshiNo ratings yet

- FSDocument8 pagesFSjoseNo ratings yet

- Solar Energy Cash Flow Canadian Solar Share XLS Stripped 01Document40 pagesSolar Energy Cash Flow Canadian Solar Share XLS Stripped 01Bhaskar Vijay SinghNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- JamilAhmed - 2355 - 19750 - 1 - Lecture003-Cash Flow EstimationDocument29 pagesJamilAhmed - 2355 - 19750 - 1 - Lecture003-Cash Flow Estimationmuskan.j.talrejaNo ratings yet

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- Ch02 Tool KitDocument18 pagesCh02 Tool KitPopsy AkinNo ratings yet

- Adelia Marhamah. 4C Lat 42 Moonstruck CompanyDocument10 pagesAdelia Marhamah. 4C Lat 42 Moonstruck Companyanisa MuzaqiNo ratings yet

- Chap 007Document19 pagesChap 007Anass B100% (1)

- Capital Budgeting DCFDocument38 pagesCapital Budgeting DCFNadya Rizkita100% (4)

- Paper - 2: Strategic Financial Management: PV of Interest + PV of Maturity Value of BondDocument17 pagesPaper - 2: Strategic Financial Management: PV of Interest + PV of Maturity Value of BondAkshay NagarNo ratings yet

- AmortDocument3 pagesAmortapi-3763644No ratings yet

- 2008-2-00474-TI LampiranDocument3 pages2008-2-00474-TI LampiranMuhamad AzwarNo ratings yet

- Question4 Solved With GraphDocument8 pagesQuestion4 Solved With GraphShafiqUr RehmanNo ratings yet

- Break even Analysis Feasibility Study - Chapter 12 - مهمDocument11 pagesBreak even Analysis Feasibility Study - Chapter 12 - مهمwskrebNo ratings yet

- Solution CH 12 - 15Document11 pagesSolution CH 12 - 15Chintya ChrismatinNo ratings yet

- Supplier VFH Template: Security Warning: Enable Macros Before Entering DataDocument17 pagesSupplier VFH Template: Security Warning: Enable Macros Before Entering DataEFREN JUAN DE LA CRUZ ARANGO HERRERANo ratings yet

- Manufacturing Cost Savings vs Purchase Cost AnalysisDocument5 pagesManufacturing Cost Savings vs Purchase Cost AnalysisPunkruk McentNo ratings yet

- Oceaasnic Corp Balance Sheet and FinancialsDocument9 pagesOceaasnic Corp Balance Sheet and FinancialsMariaAngelicaMargenApeNo ratings yet

- Chapter 16Document25 pagesChapter 16Semh ZavalaNo ratings yet

- Ch18 Tool KitDocument10 pagesCh18 Tool KitNino NatradzeNo ratings yet

- LeasingDocument14 pagesLeasingSana SarfarazNo ratings yet

- Bacani HW FinalsDocument10 pagesBacani HW FinalsKyle BacaniNo ratings yet

- Chapter 6 Mini Case: SituationDocument9 pagesChapter 6 Mini Case: SituationUsama RajaNo ratings yet

- Chapter 6Document32 pagesChapter 6SyedAunRazaRizviNo ratings yet

- More On Capital BudgetingDocument56 pagesMore On Capital BudgetingnewaznahianNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Private Real Estate Investment: Data Analysis and Decision MakingFrom EverandPrivate Real Estate Investment: Data Analysis and Decision MakingRating: 5 out of 5 stars5/5 (2)

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyFrom EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNo ratings yet

- What Every Real Estate Investor Needs to Know About Cash Flow...And 36 Other Key FInancial MeasuresFrom EverandWhat Every Real Estate Investor Needs to Know About Cash Flow...And 36 Other Key FInancial MeasuresNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- General Banking MGTDocument16 pagesGeneral Banking MGTJibon JainNo ratings yet

- LRM QDocument2 pagesLRM QJibon JainNo ratings yet

- Bangking Diploma Suggestion December-2015Document2 pagesBangking Diploma Suggestion December-2015Jibon JainNo ratings yet

- New Text DocumentDocument1 pageNew Text DocumentJibon JainNo ratings yet

- LRM QDocument2 pagesLRM QJibon JainNo ratings yet

- Performance Evaluation of Sonali BankDocument31 pagesPerformance Evaluation of Sonali BankJibon Jain0% (1)

- The Story of Carbanak Began When A Bank From Ukraine Asked Us To Help With A Forensic InvestigationDocument8 pagesThe Story of Carbanak Began When A Bank From Ukraine Asked Us To Help With A Forensic InvestigationJibon JainNo ratings yet

- Translation BBDocument10 pagesTranslation BBJibon JainNo ratings yet

- Gnbexam 10 FJJJDocument4 pagesGnbexam 10 FJJJJibon JainNo ratings yet

- DownloadDocument4 pagesDownloadJibon JainNo ratings yet

- IncotermsDocument3 pagesIncotermsJibon JainNo ratings yet

- 2 EnglishDocument93 pages2 EnglishJibon JainNo ratings yet

- 5000 GRE Word ListDocument140 pages5000 GRE Word Listsravan_kacha86% (28)

- Mamun Cover LetterDocument1 pageMamun Cover LetterJibon JainNo ratings yet

- BrainDocument2 pagesBrainJibon JainNo ratings yet

- Foreign Aid and Third World DevelopmentDocument16 pagesForeign Aid and Third World DevelopmentJibon JainNo ratings yet

- About IBA: Degree RequirementsDocument18 pagesAbout IBA: Degree RequirementsJibon JainNo ratings yet

- My Crusade Against Permanent Gold BackwardationDocument12 pagesMy Crusade Against Permanent Gold BackwardationlarsrordamNo ratings yet

- Benefiting From Innovation Value Creation, Value Appropriation and The Role of Industry ArchitecturesDocument22 pagesBenefiting From Innovation Value Creation, Value Appropriation and The Role of Industry Architecturesapi-3851548No ratings yet

- Chapter 6Document20 pagesChapter 6Federico MagistrelliNo ratings yet

- Understanding The Luxury MarketDocument14 pagesUnderstanding The Luxury MarketNiku DuttaNo ratings yet

- Understanding Business Environment FactorsDocument36 pagesUnderstanding Business Environment FactorsRakshith RaiNo ratings yet

- NCBJ Unaudited Consolidated Financial Results For The Three Months Ended December 31st 2010Document22 pagesNCBJ Unaudited Consolidated Financial Results For The Three Months Ended December 31st 2010Cedric ThompsonNo ratings yet

- SSRN Id1120857Document32 pagesSSRN Id1120857Laxmikant MaheshwariNo ratings yet

- ExamView - Homework CH 10Document9 pagesExamView - Homework CH 10Brooke LevertonNo ratings yet

- 핸드아웃Document9 pages핸드아웃hanselNo ratings yet

- Guidance Note On Audit of Abridged Financial StatementsDocument13 pagesGuidance Note On Audit of Abridged Financial Statementsstarrydreams19No ratings yet

- StrategicManagementPracticesbyMorrisonPLCUK AnalysisLessonsandImplications PDFDocument8 pagesStrategicManagementPracticesbyMorrisonPLCUK AnalysisLessonsandImplications PDFanushanNo ratings yet

- Chapter 05 AnsDocument42 pagesChapter 05 AnsLuisLoNo ratings yet

- Establishing Wood Pole Treatment Plant in GhanaDocument59 pagesEstablishing Wood Pole Treatment Plant in GhanaFasilNo ratings yet

- GSCL Annual Report 2008-10Document46 pagesGSCL Annual Report 2008-10Sasmita Mishra SahuNo ratings yet

- CH 23Document16 pagesCH 23Madiyar Mambetov100% (1)

- Govt. InterventionDocument20 pagesGovt. InterventionRadhika IyerNo ratings yet

- Key Account ManagementDocument17 pagesKey Account Managementadedoyin123100% (2)

- FNMA Form 4517Document16 pagesFNMA Form 4517rapiddocsNo ratings yet

- Curriculum VitaéDocument3 pagesCurriculum VitaéKaushik MukherjeeNo ratings yet

- Investment Memorandum (v7)Document36 pagesInvestment Memorandum (v7)adventurer0512No ratings yet

- Statement of Changes in EquityDocument24 pagesStatement of Changes in EquityChristine SalvadorNo ratings yet

- Financial Accounting Fundamentals: John J. Wild 2009 EditionDocument39 pagesFinancial Accounting Fundamentals: John J. Wild 2009 EditionKhvichaKopinadze100% (1)

- Insead Mba Employment Statistics 2010Document27 pagesInsead Mba Employment Statistics 2010ian_plugge817No ratings yet

- Liberty - March 7 2022Document1 pageLiberty - March 7 2022Lisle Daverin BlythNo ratings yet

- ImarexDocument19 pagesImarexDom DeSiciliaNo ratings yet

- Assignment Public SectorDocument3 pagesAssignment Public SectorCeciliaNo ratings yet

- Land Trust AgreementDocument11 pagesLand Trust Agreementchadhp92% (12)

- CNG StationDocument53 pagesCNG Stationshani27100% (5)

- Module B Corporate Financing - Part 2Document333 pagesModule B Corporate Financing - Part 2Darren Lau100% (1)

- Indonesia Country Code DataDocument480 pagesIndonesia Country Code Datasiti nurhidayahNo ratings yet