Professional Documents

Culture Documents

Risk 77

Uploaded by

MIRLOdhiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk 77

Uploaded by

MIRLOdhiCopyright:

Available Formats

Risk & Return, a trade off

77

rate or flag this pageTweet this

By hafeezrm

What is a risk?

Dictionary meaning of risk could be exposure, hazard, uncertainty, and chance. It

conveys a negative sense like possibility of incurring loss or misfortune or injury. It is the

probability that a hazard may turn into a disaster or, in other words, the probability that a

disaster may happen. Fortunately, risk can be foreseen and managed by various ways

such as (i) passing it on to others through insurance, guarantees and sub-contracting, (ii)

sharing it by formation of consortium or syndicates, or (iii) reducing it by diversification

of possessions or portfolio.

What is a return?

It means compensation, gain, income, reward, pay off or yield. It would be notice that the

word ‘return’ conveys a positive sense as against the word ‘risk’ which forewarns of

dangers.

See all 8 photos

Risk & Return Trade Off

When one says high risk, high returns, it means that chance of getting high returns are

most uncertain or lower. To be blunt, an investor can get high return if he or she is

willing to sustain a total losse like in a lottery.

One may purchase a share in the stock-exchange in the hope of making a big profit over a

short period of time. This is not investing but gambling as there is no guarantee that one

will get the desired returns. Some shares in the past have shown a tremendous growth but

such occurrences are rare.

Source: wikipedia.org

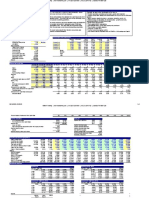

Risk & Return

Two Major Investment Soundness Indicators

1 - Internal Rate of Return (IRR)

Simply put, IRR is a rate of return just like Annual Compound Growth Rate or

Annualized ROI (Return on Investment). To be formal, it is a rate of discount which

equates the future cash flow to the present investment or opportunity.

It is widely used as it conveys rate of return in % which can be easily compared with any

of the following called hurdle rates:

• Average Weighted Cost of Fund

• Opportunity cost

• Desired Rate of Return

• Market Rate.

The internal rate of return is also useful in ranking competing investment projects.

There are, however, some problems with IRR when used alone.

• It neglects size of the project and treat big and small projects on equal footing.

• It presumed that cash flows are re-invested at a constant rate i.e. at the same IRR.

• When cash flows change from negative or positive, or vice versa, a unique

internal rate of return cannot be calculated

Usually, a financial calculator is used for finding out IRR but it can be found manually

through and error.

2- Net Present Value

NPV works out present value of a future income stream. It discounts future income of

each year by multiplying by a corresponding Present Value Interest Factor (PVIF). It

means if some income is expected in fourth year, the relevant PVIF would also be of the

fourth year. Besides, PVIF is decided keeping in view a discount rate based on the same

factor used for comparing IRR such as:

• Average Weighted Cost of Fund

• Opportunity cost

• Desired Rate of Return

• Market Rate.

3 - NPV and IRR compared:

While IRR is a rate, NPV is a value based on a particular discount rate. (NPV is also

known as dollar-weighted rate of return).

Applying NPV using different discount rates will result in different values and

consequently different decisions. The IRR method always gives the same results and

decision would have to be made keeping in view the factors cited above.

Both NPV and IRR are based on a discounted cash flow and lead to the same conclusion

when a single project is under consideration. However, both may differ in a decision-

context when there are mutually exclusive projects based on different durations or

different scales or both. In such cases, NPV is preferred.

Shares and Bond

Recent variations in valuation methods

MIRR

The Modified Internal Rate of Return assumes that the positive cash flows are

immediately re-invested until the end of the project. To make these calculations, it is

common practice to use the weighted average cost of capitalas interest rate on the

positive cash flows. This is an improvement over IRR which assumes that positive

cashflows are immediately re-invested at the same rate as the IRR. This means that when

a project earns a very low rate of return say 2%, any income from the project is

reinvested at the same low rate. This is obviously an un-wise decision which is taken care

of by MIRR.

The Adjusted Present Value (APV) Method

In this method, first a base-case is found by calculating NPV based entirely on equity

finance, not a shred of debt. Then this base is adjusted with for tax-benefits through debt

financing. In essence, APV valuation is the same as discounted cash flow but there would

be some adjustment due to different capital structure. It is designed for projects with debt.

The formula is :

APV = Base-case NPV + PV of financing effect

The Profitability Index (PI) Method

This is modeled after the NPV Method. It measures the total present value of future cash

inflows divided by the initial investment. This method tends to favor smaller projects

and is best used by firms with limited resources and high costs of capital. This is the same

as Cost-Benefit Ratio used for appraising public welfare project.

The Bailout Payback Method

A variation of the Payback Method. It includes the ‘junk’ value of any equipment

purchased in its calculations

The Real Options Approach.

It allows flexibility and encourages constant reassessment based on the riskiness of the

project's cash flows. It takes into account various business opportunities in the form of

option.

Dietz Method

As per Investopedia, this is a method of evaluating a portfolio's return based upon a time

weighted analysis. This can be modified to measure the return on the portfolio than a

simple geometric return method. This is because the Modified Dietz Method identifies

and accounts for the timing of all random cash flows while a simple geometric return

does not.

Capital Asset Pricing Model

RISK ASSESSMENT

For an investor, it is imperative to find out how much risk he or she is taking. There are

various technique to work-out level of risk. Some are briefly stated below:

CAPITAL ASSET PRICING MODEL (CAPM)

It is an important technique to observe the relationship between risk and reward. It is a

model for pricing of security. A security market line (SML) is drawn which shows

riskiness of a security or share. It guides an investor how much return to expect given a

certain risk in a particular stock market. In other words, it proves the old maxim, “Higher

the Risk, Higher the Reward”. It shows the reward-to-risk ratio for any security compared

to overall market risk. According to CAPM expected return on a security or portfolio

should be equal to (i) a rate on a risk-free security in a specific market and (ii) a risk

premium.

CAPM over-simplifies the investment conditions like no taxes, all investors having

identical investment horizons and opinions about expected returns, volatility and

correlation of available investments. CAPM differentiates between random risk and

market risk (also called systematic risk). Systematic risk is the risk that remains after no

further diversification benefits can be achieved. Such a risk can be measured through

using beta. If beta = 0, the investment is risk-free, if beta =1, the investment would give

the same return as a particular market, if beta >1, investment is riskier than market index,

if beta <1, investment is less riskier than market indication.

2. ARBITRAGE PRICE MODEL (APM)

Another model based on the idea that an asset's returns can be predicted using the

relationship between that same asset and many common risk factors. Often considered as

an alternative to CAPM. The difference is that APM is more general and flexible as it

takes into account many factors such as inflation, industrial production, prevailing

interest rates. In this way, CAPM would be termed as a special case of APM with one

factor of market risk premium.

3. Other MODELS

Apart from this, there are other models like Fama And French Three Factor Model and

Multi-Factor Model. These are briefly described at the end of this hub under “Relevant

Terms”.

RELEVANT TERMS

It shows efficiency or return in excess of the compensation for the risk

Alpha borne. It assesses managers’ performance. Briefly stated, Alpha is a risk-

adjusted measure of ROI.

The amount of risk that the stock contributes to the market portfolio. A

Beta widely fluctuating stock will have a high standard deviation as well as a

high beta.

Market It is a presumption that stocks would always trade at their fair value on

Efficiency stock exchanges, making it impossible for investors to either purchase

Hypothesis undervalued stocks or sell stocks for inflated prices.

Fama and The basic idea of the approach is the use of a time series (first pass)

French _ Three regression to estimate betas and the use of a cross–sectional (second

Model Factor pass) regression to test the hypothesis derived from the CAPM

A fundamental analysis method of analyzing a firm's costs of capital as it

uses additional financial leverage, and how that relates to the overall

Hamada

riskiness of the firm. The measure is used to summarize the effects this

Equation

type of leverage has on a firm's cost of capital (over and above the cost

of capital as if the firm had no debt).

A financial model that employs multiple factors in its computations to

explain market phenomena and/or equilibrium asset prices. The multi-

Multi-factor factor model can be used to explain either an individual security or a

Model portfolio of securities. It will do this by comparing two or more factors

to analyze relationships between variables and the security’s resulting

performance.

Conclusion

An investor in securities (shares and bonds) is faced with two types of risk: Market Risk

and Inflation Risk. A good investor should know how much risk to take. First, risk should

be identified, second it should be assessed and third it should be managed. Points to be

pondered at are (i) How much one is willing to lose, (ii) Is there enough liquidity to buy

and sell promptly, (iii) determination of profit or loss limits, (iv) buying stock only an

acceptable price level and (v) selling when the price reaches at a predetermined level

corresponding to the profit target. These are nothing but prudent guidelines to save the

investor from losses.

At the same time, one should have a well-diversified port-folio (possession of a variety of

shares and bonds). It is recommended to diversify your investment in at least six or more

different stocks.

A piece of advice: Act quickly to get out of losing situation -'Never trade with money you

can't afford to lose'.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Raising Venture Capital - Comprehenseive Plan With TimelineDocument6 pagesRaising Venture Capital - Comprehenseive Plan With Timelinejaknap1802No ratings yet

- Advanced Accounting Test Bank Chapter 07 Susan HamlenDocument60 pagesAdvanced Accounting Test Bank Chapter 07 Susan HamlenWilmar AbriolNo ratings yet

- Free Cash Flow To Firm DCF Valuation Model Base DataDocument3 pagesFree Cash Flow To Firm DCF Valuation Model Base DataTran Anh VanNo ratings yet

- The Convertibility of A Currency: Unit-IDocument7 pagesThe Convertibility of A Currency: Unit-ITuki Das100% (1)

- Article-T.v.mohandas Pai & Siddarth PaiDocument2 pagesArticle-T.v.mohandas Pai & Siddarth Paidelhi residentNo ratings yet

- MBA711 - Answers To Book - Chapter 3Document17 pagesMBA711 - Answers To Book - Chapter 3noisomeNo ratings yet

- DM22118 - Dinakaran SDocument11 pagesDM22118 - Dinakaran SDinakaranNo ratings yet

- Tarc Acc t8Document3 pagesTarc Acc t8Shirley VunNo ratings yet

- Zawya Collaborative Sukuk ReportDocument130 pagesZawya Collaborative Sukuk ReportBRR_DAG100% (4)

- Triple S Strategy PDFDocument18 pagesTriple S Strategy PDFVinay Handral100% (2)

- Account Closure FormDocument1 pageAccount Closure FormChetan ChaudhariNo ratings yet

- Accounting Principles Canadian Volume II 7th Edition Weygandt Solutions Manual Full Chapter PDFDocument67 pagesAccounting Principles Canadian Volume II 7th Edition Weygandt Solutions Manual Full Chapter PDFEdwardBishopacsy100% (17)

- V1 20171229 阶段测试测试(产品&估值)题目 PDFDocument24 pagesV1 20171229 阶段测试测试(产品&估值)题目 PDFIsabelle ChouNo ratings yet

- Business PlanDocument15 pagesBusiness PlanMARIA ORCHID SUMUGATNo ratings yet

- FalseDocument13 pagesFalseJoel Christian Mascariña100% (1)

- Spinoff Investing Checklist: - Greggory Miller, Author of Spinoff Investing Simplified Available OnDocument2 pagesSpinoff Investing Checklist: - Greggory Miller, Author of Spinoff Investing Simplified Available OnmikiNo ratings yet

- Agreement of Program TermsDocument144 pagesAgreement of Program TermsAnil BatraNo ratings yet

- R30 Discounted Dividend Valuation Q Bank PDFDocument9 pagesR30 Discounted Dividend Valuation Q Bank PDFZidane KhanNo ratings yet

- Under The Supervision of MR .Pradeep Singh Kala Isd Head Sbi Mutual Fund (J & K)Document57 pagesUnder The Supervision of MR .Pradeep Singh Kala Isd Head Sbi Mutual Fund (J & K)Faizan NazirNo ratings yet

- The Richter Company A Technology Company Has Been Growing RapidlyDocument1 pageThe Richter Company A Technology Company Has Been Growing RapidlyHassan JanNo ratings yet

- M08 - Gitman14 - MF - C08 Risk and ReturnDocument71 pagesM08 - Gitman14 - MF - C08 Risk and ReturnLeman SingleNo ratings yet

- Tutorial - Investments - For StudentsDocument3 pagesTutorial - Investments - For StudentsBerwyn GazaliNo ratings yet

- How The Sensex Is CalculatedDocument2 pagesHow The Sensex Is CalculatedsumantrabagchiNo ratings yet

- LMBO Candlestick Patterns GuideDocument33 pagesLMBO Candlestick Patterns GuideSangeen Khan100% (2)

- SEBI JurisdictionDocument14 pagesSEBI JurisdictionTanmay TiwariNo ratings yet

- LBO Valuation Model 1 ProtectedDocument14 pagesLBO Valuation Model 1 ProtectedYap Thiah HuatNo ratings yet

- Harshad Mehta ScamDocument5 pagesHarshad Mehta ScamKriti ShahNo ratings yet

- Mba 3 Sem Investment Analysis and Portfolio Management Kmbnfm01 2022Document2 pagesMba 3 Sem Investment Analysis and Portfolio Management Kmbnfm01 2022Nomaan TanveerNo ratings yet

- Advance Sniper Trading Strategy PDFDocument30 pagesAdvance Sniper Trading Strategy PDFHarminder Suman100% (1)

- Metallgesellschaft Brief SolutionsDocument2 pagesMetallgesellschaft Brief SolutionsarunzexyNo ratings yet