Professional Documents

Culture Documents

US Internal Revenue Service: Irb02-26

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: Irb02-26

Uploaded by

IRSCopyright:

Available Formats

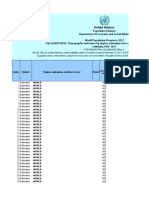

Bulletin No.

2002–26

July 1, 2002

HIGHLIGHTS

OF THIS ISSUE

These synopses are intended only as aids to the reader in

identifying the subject matter covered. They may not be

relied upon as authoritative interpretations.

INCOME TAX

Rev. Rul. 2002–38, page 4. Rev. Proc. 2002–44, page 10.

REIT noncustomary service income. Guidance is provided Appeals mediation procedure. This document formally

under sections 856 and 857(b)(7) of the Code for the situation establishes the Appeals mediation procedure and modifies and

when a REIT forms a taxable REIT subsidiary (TRS) to provide expands the availability of mediation for cases that are already

noncustomary services to tenants of the REIT and no service in the Appeals administrative process. Announcements 98–99

charges are separately stated from the rents paid by the ten-

and 2001–9 superseded.

ants to the REIT.

REG–248110–96, page 19.

T.D. 8997, page 6.

Proposed regulations under section 817A of the Code affect

REG–122564–02, page 25.

insurance companies that define the interest rate to be used

Final and proposed regulations under section 1502 of the Code

with respect to certain insurance contracts that guarantee

provide corporations filing consolidated returns with an elec-

higher returns for an initial, temporary period. Specifically, the

tion to waive the 5-year net operating loss carryback period

proposed regulations define the appropriate interest rate to be

with respect to certain acquired members.

used in the determination of tax reserves and required interest

T.D. 8998, page 1. for certain modified guaranteed contracts. The proposed regu-

REG–123305–02, page 26. lations also address how temporary guarantee periods that

Temporary and proposed regulations under sections 337(d) extend past the end of a taxable year are to be taken into

and 1502 of the Code clarify and amend certain aspects of the account. A public hearing is scheduled for August 27, 2002.

temporary regulations relating to the deductibility of losses rec-

ognized on dispositions of subsidiary stock by members of a EXCISE TAX

consolidated group. The regulations apply to corporations fil-

ing consolidated returns, both during and after the period of REG–106457–00, page 23.

affiliation, and also affect purchasers of the stock of members Proposed regulations under section 4081 of the Code relate to

of a consolidated group. A public hearing on the proposed the definition of diesel fuel and the application of the tax on

regulations is scheduled for July 17, 2002. blended taxable fuel.

Finding Lists begin on page ii.

Index for January through June begins on page vii.

ADMINISTRATIVE

Announcement 2002–59, page 28.

New publications reflect tax law changes. The Service

announces that four new publications are available reflecting

changes enacted by the Job Creation and Worker Assistance

Act of 2002. The new publications are: Publication 3991,

Highlights of the Job Creation and Worker Assistance Act;

Supplement to Publication 463, Travel, Entertainment, Gift,

and Car Expenses; Supplement to Publication 536, Net

Operating Losses (NOLs) for Individuals, Estates, and

Trusts; and Supplement to Publication 946, How To Depreci-

ate Property.

Announcement 2002–60, page 28.

Test of arbitration procedure for Appeals. This announce-

ment extends the test of the arbitration procedures set forth in

Announcement 2000–4, 2000–1 C.B. 317, for an additional

one-year period. Announcement 2000–4 modified.

July 1, 2002 2002–26 I.R.B.

The IRS Mission

Provide America’s taxpayers top quality service by helping applying the tax law with integrity and fairness to all.

them understand and meet their tax responsibilities and by

Introduction

The Internal Revenue Bulletin is the authoritative instrument of and Service personnel and others concerned are cautioned

the Commissioner of Internal Revenue for announcing official against reaching the same conclusions in other cases unless

rulings and procedures of the Internal Revenue Service and for the facts and circumstances are substantially the same.

publishing Treasury Decisions, Executive Orders, Tax Conven-

tions, legislation, court decisions, and other items of general The Bulletin is divided into four parts as follows:

interest. It is published weekly and may be obtained from the

Superintendent of Documents on a subscription basis. Bulletin Part I.—1986 Code.

contents are consolidated semiannually into Cumulative Bulle- This part includes rulings and decisions based on provisions of

tins, which are sold on a single-copy basis. the Internal Revenue Code of 1986.

It is the policy of the Service to publish in the Bulletin all sub- Part II.—Treaties and Tax Legislation.

stantive rulings necessary to promote a uniform application of

This part is divided into two subparts as follows: Subpart A, Tax

the tax laws, including all rulings that supersede, revoke,

Conventions and Other Related Items, and Subpart B, Legisla-

modify, or amend any of those previously published in the Bul-

tion and Related Committee Reports.

letin. All published rulings apply retroactively unless otherwise

indicated. Procedures relating solely to matters of internal

management are not published; however, statements of inter- Part III.—Administrative, Procedural, and

nal practices and procedures that affect the rights and duties Miscellaneous.

of taxpayers are published. To the extent practicable, pertinent cross references to these

subjects are contained in the other Parts and Subparts. Also

Revenue rulings represent the conclusions of the Service on included in this part are Bank Secrecy Act Administrative Rul-

the application of the law to the pivotal facts stated in the rev- ings. Bank Secrecy Act Administrative Rulings are issued by

enue ruling. In those based on positions taken in rulings to tax- the Department of the Treasury’s Office of the Assistant Secre-

payers or technical advice to Service field offices, identifying tary (Enforcement).

details and information of a confidential nature are deleted to

prevent unwarranted invasions of privacy and to comply with Part IV.—Items of General Interest.

statutory requirements. This part includes notices of proposed rulemakings, disbar-

ment and suspension lists, and announcements.

Rulings and procedures reported in the Bulletin do not have the

force and effect of Treasury Department Regulations, but they The first Bulletin for each month includes a cumulative index for

may be used as precedents. Unpublished rulings will not be the matters published during the preceding months. These

relied on, used, or cited as precedents by Service personnel in monthly indexes are cumulated on a semiannual basis, and are

the disposition of other cases. In applying published rulings and

published in the first Bulletin of the succeeding semiannual

procedures, the effect of subsequent legislation, regulations,

period, respectively.

court decisions, rulings, and procedures must be considered,

The contents of this publication are not copyrighted and may be reprinted freely. A citation of the Internal Revenue Bulletin as the source would be appropriate.

For sale by the Superintendent of Documents, U.S. Government Printing Office, Washington, DC 20402.

2002–26 I.R.B. July 1, 2002

Part I. Rulings and Decisions Under the Internal Revenue Code of 1986

Section 337.—Nonrecognition tary. No material changes to this collec- Explanation of Provisions

for Property Distributed to tion of information are made by these

regulations. Since the publication of the temporary

Parent in Complete An agency may not conduct or spon- regulations, several questions have been

Liquidation of Subsidiary sor, and a person is not required to raised concerning the interpretation and

respond to, a collection of information application of the temporary regulations.

26 CFR 1.337(d)–2T: Loss limitation window period unless it displays a valid control number In response to these questions, the IRS

(temporary).

assigned by the Office of Management and Treasury are promulgating the regula-

and Budget. tions in this Treasury decision as tempo-

T.D. 8998 Books or records relating to the collec- rary regulations to clarify and amend the

tion of information must be retained as temporary regulations as described below

Loss Limitation Rules long as their contents may become mate- in this preamble. The following para-

rial in the administration of any internal graphs describe these amendments.

AGENCY: Internal Revenue Service revenue law. Generally, tax returns and

(IRS), Treasury. tax return information are confidential, as Netting Rule

required by 26 U.S.C. 6103.

ACTION: Temporary regulations. Commentators requested that § 1.337

Background (d)–2T be amended to provide a netting

SUMMARY: This document contains rule similar to that set forth in

amendments to temporary regulations On March 12, 2002, the IRS and Trea- § 1.1502–20(a)(4), pursuant to which

issued under sections 337(d) and 1502. sury published in the Federal Register at gain and loss from certain dispositions of

The amendments clarify certain aspects 67 FR 11034 (T.D. 8984, 2002–13 I.R.B. stock may be netted. This Treasury deci-

of the temporary regulations relating to 668) temporary regulations under sections sion adds § 1.337(d)–2T(a)(4) to provide

the deductibility of losses recognized on 337(d) and 1502 (the temporary regula- such a rule and also adds § 1.337(d)–

dispositions of subsidiary stock by mem- tions). The temporary regulations set 2T(b)(4), which provides a similar netting

bers of a consolidated group. The amend- forth rules that limit the deductibility of rule for basis reductions on deconsolida-

ments in these temporary regulations loss recognized by a consolidated group tions of subsidiary stock.

apply to corporations filing consolidated on the disposition of stock of a subsidiary

returns, both during and after the period member and that require certain basis Time For Filing Election Described in

of affiliation, and also affect purchasers reductions on the deconsolidation of § 1.1502–20T(i)

of the stock of members of a consolidated stock of a subsidiary member. Section

1.1502–20T(i) of the temporary regula- Section 1.1502–20T(i) currently pro-

group. The text of these temporary regu-

tions provides that, in the case of a dispo- vides that an election to determine allow-

lations also serves as the text of the pro-

sition or deconsolidation of a subsidiary able loss by applying § 1.1502–20 (with-

posed regulations (REG–123305–02) set

before March 7, 2002, and for such trans- out regard to the duplicated loss

forth in this issue of the Bulletin.

actions effected pursuant to a binding component of the loss disallowance rule)

DATES: Effective Date: These regula- written contract entered into before or § 1.337(d)–2T must be made by

tions are effective May 31, 2002. March 7, 2002, that was in continuous including a statement with or as part of

Applicability Date: For dates of appli- effect until the disposition or deconsolida- the original return for the taxable year

cability see § 1.337(d)–2T(g) and tion, a consolidated group may determine that includes the later of March 7, 2002,

1.1502–20T(i). the amount of allowable stock loss or and the date of the disposition or decon-

basis reduction by applying § 1.1502–20 solidation of the stock of the subsidiary,

FOR FURTHER INFORMATION CON- in its entirety, § 1.1502–20 without regard or with or as part of an amended return

TACT: Sean P. Duffley (202) 622–7530 to the duplicated loss component of the filed before the date the original return

or Lola L. Johnson (202) 622–7550 (not loss disallowance rule, or § 1.337(d)–2T. for the taxable year that includes March

toll-free numbers). For dispositions and deconsolidations that 7, 2002, is due. Commentators noted that

occur on or after March 7, 2002, and that this provision may not permit the election

SUPPLEMENTARY INFORMATION: are not within the scope of the binding to be made on an original return for the

contract rule, § 1.1502–20T(i) provides 2001 taxable year where the disposition

Paperwork Reduction Act that allowable loss and basis reduction are occurs during the 2001 taxable year. The

determined under § 1.337(d)–2T, not IRS and Treasury believe that it is appro-

The collection of information con- § 1.1502–20. priate to permit the election to be made

tained in these regulations has been previ- on such a return. Therefore, this Treasury

ously reviewed and approved by the decision amends § 1.1502–20T(i) to pro-

Office of Management and Budget under vide that the statement may be filed with

control number 1545–1774. Responses to or as part of a timely filed (including any

this collection of information are volun- extensions) original return for any taxable

2002–26 I.R.B. 1 July 1, 2002

year that includes any date on or before Effect of Election further guidance. These amendments to

March 7, 2002. In addition, if the date of the temporary regulations clarify those

the disposition or deconsolidation of the Finally, a number of questions have rules and simplify their application in

stock of the subsidiary is after March 7, been raised regarding the extent to which order to ease taxpayer compliance.

2002, the statement may be filed with or the election described in § 1.1502–20T(i) Accordingly, good cause is found for dis-

as part of a timely filed (including any affects a taxpayer’s items of income, pensing with notice and public procedure

extensions) original return for the taxable gain, deduction, or loss other than the loss pursuant to 5 U.S.C. 553(b)(B) and with

year that includes such date. This latter allowed on a disposition of subsidiary a delayed effective date pursuant to 5

alternative effectively permits the state- stock. In response to these questions, the U.S.C. 553(d)(1) and (3). It has been

ment to be filed with the original return temporary regulations are amended to determined that this Treasury decision is

that includes the date of the disposition or explain that if, pursuant to an election not a significant regulatory action as

deconsolidation if, as of March 7, 2002, under § 1.1502–20T(i), the loss allowed defined in Executive Order 12866. There-

the disposition or deconsolidation was with respect to a disposition of subsidiary fore, a regulatory assessment is not

subject to a binding written contract stock is increased, but the year of the dis- required.

entered into before March 7, 2002, that position (or the year to which such loss

was in continuous effect until the date of would have been carried back or carried Drafting Information

the disposition or deconsolidation. forward) is closed, to the extent that the

absorption of such excess loss in such The principal authors of these regula-

Requirements for Perfecting Election year would have affected the tax treat- tions are Sean P. Duffley and Lola L.

Described in § 1.1502–20T(i) ment of another item (e.g., another loss Johnson, Office of Associate Chief Coun-

that was absorbed in such year) that has sel (Corporate). However, other personnel

Commentators questioned whether an an effect in an open year, the election will from the IRS and Treasury Department

election to determine allowable loss by participated in their development.

affect the treatment of such other item.

applying § 1.1502–20 (without regard to

In addition, the regulations provide a *****

the duplicated loss component of the loss

special rule for situations in which a sub-

disallowance rule) or § 1.337(d)–2T was

sidiary of the group (the disposing mem- Amendments to the Regulations

valid only if a statement of allowed loss

ber) recognized a loss on the disposition

described in § 1.337(d)–2T(c) or 1.1502–

of stock of a lower-tier subsidiary mem- Accordingly, 26 CFR part 1 is

20(c), as appropriate, was or is filed with

ber of the group, the loss was disallowed amended as follows:

respect to the disposition or deconsolida-

under § 1.1502–20, and, as a result, a Paragraph 1. The authority citation for

tion of subsidiary stock. The amendments

group member’s basis in the stock of the part 1 is amended by removing the entry

to the temporary regulations in this Trea-

disposing member was reduced pursuant for “Section 1.1502–20T(i)” and adding

sury decision clarify that no statement

to § 1.1502–32 (because the disallowed an entry in numerical order to read in part

other than the one described in § 1.1502–

loss was treated as a noncapital, nonde- as follows:

20T(i)(4) is necessary to perfect an elec-

ductible expense). In such cases, to the Authority: 26 U.S.C. 7805 * * *

tion to compute allowable loss or basis

extent that all or some portion of the dis- Section 1.1502–20T also issued under

reduction by applying the provisions

allowed loss is allowed as a result of an the authority of 26 U.S.C. 337(d) and

described in § 1.1502–20T(i)(2)(i) or (ii).

election under § 1.1502–20T(i), but such 1502.

Therefore, an election pursuant to

loss would have been properly absorbed ***

§ 1.1502–20T(i) may be made regardless

or expired in a closed year, the basis in Par. 2. In § 1.337(d)–2T, paragraphs

of whether a statement of allowed loss

the stock of the disposing member may (a)(4) and (b)(4) are added to read as fol-

described in § 1.337(d)–2T(c) or 1.1502–

be increased. This adjustment is to be lows:

20(c) was or is filed with respect to the

made for purposes of determining the

disposition or deconsolidation. § 1.337(d)–2T Loss limitation window

group’s or the shareholder-member’s Fed-

In addition, taxpayers determining period (temporary).

eral income tax liability for all open

allowable loss under § 1.1502–20 in its

years.

entirety will generally be treated as hav- (a) * * *

ing satisfied the requirement to file a Special Analyses (4) Netting. Paragraph (a)(1) of this

statement of allowed loss otherwise section does not apply to loss with respect

imposed by § 1.1502–20(c) even if no In light of the Federal Circuit’s deci- to the disposition of stock of a subsidiary,

such statement is filed. Nothing in the sion in Rite Aid Corp. v. United States, to the extent that, as a consequence of the

temporary regulations or these amend- 255 F.3d 1357 (Fed. Cir. 2001), the tem- same plan or arrangement, gain is taken

ments to the temporary regulations, how- porary regulations were necessary to pro- into account by members with respect to

ever, affects the filing requirements vide taxpayers with immediate guidance stock of the same subsidiary having the

regarding the election provided in regarding allowable loss and basis reduc- same material terms. If the gain to which

§ 1.1502–20(g). tions in connection with dispositions and this paragraph applies is less than the

deconsolidations of subsidiary stock and amount of the loss with respect to the dis-

to carry out the principles of General position of the subsidiary’s stock, the gain

Utilities repeal pending the issuance of is applied to offset loss with respect to

July 1, 2002 2 2002–26 I.R.B.

each share disposed of as a consequence year of the disposition (or the year to year that includes March 7, 2002, is due

of the same plan or arrangement in pro- which such loss would have been carried (including any extensions). Filing a state-

portion to the amount of the loss deduc- back or carried forward) is a year for ment in accordance with the provisions of

tion that would have been disallowed which a refund of overpayment is pre- this paragraph satisfies the requirement to

under paragraph (a)(1) of this section vented by law, to the extent that the file a “statement of allowed loss” other-

with respect to such share before the absorption of such excess loss in such wise imposed under § 1.1502–20(c)(3) or

application of this paragraph (a)(4). If the year would have affected the tax treat- § 1.337(d)–2T(c)(3). The statement

same item of gain could be taken into ment of another item (e.g., another loss required by this paragraph satisfies the

account more than once in limiting the that was absorbed in such year) that has requirement that a statement be filed in

application of paragraphs (a)(1) and an effect in a year for which a refund of order to claim allowable loss or basis

(b)(1) of this section, the item is taken overpayment is not prevented by any law reduction by applying the provisions

into account only once. or rule of law, the election will affect the described in paragraph (i)(2)(i) or (ii).

(b) * * * treatment of such other item. Therefore, if The statement filed under this paragraph

(4) Netting. Paragraph (b)(1) of this the absorption of the excess loss in the shall be entitled “Allowed Loss under

section does not apply to reduce the basis year of the disposition (which is a year Section [Specify Section under Which

of stock of a subsidiary, to the extent that, for which a refund of overpayment is pre- Allowed Loss Is Determined] Pursuant to

as a consequence of the same plan or vented by law) would have prevented the Section 1.1502–20T(i)” and must include

arrangement, gain is taken into account absorption of another loss (the second the following information—

by members with respect to stock of the loss) in such year and such loss would (i) The name and employer identifica-

same subsidiary having the same material have been carried to and used in a year tion number (E.I.N.) of the subsidiary and

terms. If the gain to which this paragraph for which a refund of overpayment is not of the member(s) that disposed of the

applies is less than the amount of basis prevented by any law or rule of law (the subsidiary stock;

reduction with respect to shares of the other year), the election makes the second (ii) In the case of an election to deter-

subsidiary’s stock, the gain is applied to loss available for use in the other year. mine allowable loss or basis reduction by

offset basis reduction with respect to each (B) Special rule. If a member’s basis applying the provisions described in para-

share deconsolidated as a consequence of in stock of a subsidiary was reduced pur- graph (i)(2)(i) of this section, a statement

the same plan or arrangement in propor- suant to § 1.1502–32 because a loss with that the taxpayer elects to determine

tion to the amount of the reduction that respect to stock of a lower-tier subsidiary allowable loss or basis reduction by

would have been required under para- was treated as disallowed under applying such provisions;

graph (b)(1) of this section with respect to § 1.1502–20, then, to the extent such dis- (iii) In the case of an election to deter-

such share before the application of this allowed loss is allowed as a result of an mine allowable loss or basis reduction by

paragraph (b)(4). election under paragraph (i) of this sec- applying the provisions described in para-

tion but would have been properly graph (i)(2)(ii) of this section, a statement

***** absorbed or expired in a year for which a that the taxpayer elects to determine

Par. 3. Section 1.1502–20T is amended refund of overpayment is prevented by allowable loss or basis reduction by

by revising paragraphs (i)(3)(v) and (i)(4) law or rule of law, the member’s basis in applying such provisions;

to read as follows: the subsidiary stock may be increased for (iv) If an election described in

purposes of determining the group’s or § 1.1502–20(g) was made with respect to

§ 1.1502–20T Disposition or deconsoli-

the shareholder-member’s Federal income the disposition of the stock of the subsid-

dation of subsidiary stock (temporary).

tax liability in all years for which a iary, the amount of losses originally

***** refund of overpayment is not prevented treated as reattributed pursuant to such

by law or rule of law. election and the amount of losses treated

(i) * * * ***** as reattributed pursuant to paragraph

(3) * * * (4) Time and manner of making the (i)(3)(i) or (ii) of this section;

(v) Items taken into account in open election. An election to determine allow- (v) If an apportionment of a separate

years—(A) General rule. An election able loss or basis reduction by applying section 382 limitation, a subgroup section

under paragraph (i)(2) of this section the provisions described in paragraph 382 limitation, or a consolidated section

affects a taxpayer’s items of income, (i)(2)(i) or (ii) of this section is made by 382 limitation is adjusted pursuant to

gain, deduction, or loss only to the extent including the statement required by this paragraph (i)(3)(iii)(A), (B), or (C) of this

that the election gives rise, directly or paragraph with or as part of any timely section, the original and redetermined

indirectly, to items or amounts that would filed (including any extensions) original apportionment of such limitation; and

properly be taken into account in a year return for a taxable year that includes any (vi) If the application of paragraph

for which an assessment of deficiency or date on or before March 7, 2002, or, if the (i)(3)(i) or (ii) of this section results in a

a refund of overpayment, as the case may date of the disposition or deconsolidation reduction of the amount of losses treated

be, is not prevented by any law or rule of of the stock of the subsidiary is after as reattributed pursuant to an election

law. Under this paragraph, if the election March 7, 2002, then such date, or with or described in § 1.1502–20(g), a statement

increases the loss allowed with respect to as part of an amended return filed before that the notification described in para-

a disposition of subsidiary stock, but the the date the original return for the taxable graph (i)(3)(iv) of this section was sent to

2002–26 I.R.B. 3 July 1, 2002

the subsidiary and, if the acquirer was a ants of R’s apartment buildings. The ser- from real property” are among the

member of a consolidated group at the vices do not qualify as customary services sources listed in both of those sections.

time of the stock sale, to the person that under § 1.856–4(b)(1) of the Income Tax Section 856(d)(1) defines rents from real

was the common parent of such group at Regulations. R and T jointly elect under property to include rents from interests in

such time, as required by paragraph § 856(l) to treat T as a TRS of R. real property, charges for services cus-

(i)(3)(iv) of this section. Employees of T perform all of the tomarily rendered in connection with the

housekeeping services received by R’s rental of real property, and rent attribut-

*****

tenants, including administration and able to certain leased personal property.

Robert E. Wenzel,

management of the services. T pays all However, § 856(d)(2)(C) excludes

Deputy Commissioner of

costs of providing the services, such as its “impermissible tenant service income”

Internal Revenue.

employees’ salaries and the costs of their from the definition of rents from real

Approved May 20, 2002. uniforms, equipment, and supplies. To property. Pursuant to § 856(d)(7)(A),

carry out the housekeeping operations, T impermissible tenant service income

Pamela F. Olson, also rents space in R’s apartment build- means, with respect to any real property,

Acting Assistant Secretary ings in accordance with § 856(d)(8)(A). T any amount received by a REIT for ser-

of the Treasury. makes no payments to R other than its vices rendered by the REIT to tenants of

rental payments for that space. The the property. Section 856(d)(7)(C)(i) pro-

(Filed by the Office of the Federal Register on May

30, 2002, 8:45 a.m., and published in the issue of

annual value of the housekeeping services vides that services rendered through a

the Federal Register for May 31, 2002, 67 F.R. provided at each property exceeds one TRS are not treated as rendered by its

37998) percent of the total annual amount REIT for purposes of § 856(d)(7)(A).

received by R from the property. Thus, services rendered by a TRS do not

Charges to the tenants for the house- give rise to impermissible tenant service

Section 856.—Definition of keeping services are not separately stated income.

Real Estate Investment Trust from the rents that the tenants pay to R Section 857(b)(7)(A) imposes for each

for the use of their apartments. T does not taxable year of a REIT a tax equal to 100

(Also § 857.) enter into contracts with the tenants for percent of “redetermined rents.” Section

the performance of the housekeeping ser- 857(b)(7)(B)(i) provides that redeter-

REIT noncustomary service income. vices. R compensates T for providing the mined rents mean rents from real property

Guidance is provided under sections 856 services by paying T an amount that is (as defined in § 856(d)) to the extent the

and 857(b)(7) of the Code when a REIT 160 percent of T’s direct cost of providing amount of the rents would (but for

forms a taxable REIT subsidiary (TRS) to the services. T reports the full amount of § 857(b)(7)(E)) be reduced on allocation

provide noncustomary services to tenants R’s payment as gross income on T’s fed- under § 482 to clearly reflect income as a

of the REIT and no service charges are eral income tax return. result of services rendered by a TRS to a

separately stated from the rents paid by tenant of its REIT. Section 482 provides

the tenants to the REIT. Situation 2

that when two or more organizations,

trades, or businesses are owned or con-

Rev. Rul. 2002–38 The facts are the same as in Situation

trolled directly or indirectly by the same

1 except that R compensates T for provid-

interests (controlled organizations), the

ISSUE ing the services by paying T an amount

that is 125 percent of T’s direct cost of Secretary may allocate gross income

providing the services, and that payment between or among those controlled orga-

If a real estate investment trust (REIT)

is less than the arm’s length charge under nizations if the Secretary determines that

forms a taxable REIT subsidiary (TRS) to

§ 482 for providing the services. such allocation is necessary to clearly

provide noncustomary services to tenants

reflect the income of any of those con-

of the REIT and no service charges are

LAW trolled organizations. Pursuant to

separately stated from the rents paid by

§ 1.482–1(b)(1), the standard applied in

the tenants to the REIT, how is the

For taxable years beginning after determining the true taxable income of a

REIT’s income from the services treated

December 31, 2000, §§ 856 and 857(b)(7) controlled organization is that of an orga-

under §§ 856 and 857(b)(7) of the Inter-

provide special rules for a corporation nization dealing at arm’s length with an

nal Revenue Code?

that is a TRS within the meaning of uncontrolled organization. Section 1.482–

FACTS § 856(l). Those rules, which allow a TRS 2(b)(3) defines an arm’s length charge for

to provide noncustomary services to ten- services provided between controlled

Situation 1 ants of its REIT, govern the relationship organizations, regardless of whether the

between the REIT and the TRS. services are an integral part of either

Corporation R, which has elected to be To qualify as a REIT, an entity must organization’s business activity (the § 482

a REIT as defined in § 856, owns residen- derive at least 95 percent of its gross arm’s length charge). Section 857(b)

tial apartment buildings. R forms a income from sources listed in § 856(c)(2) (7)(E) provides that the imposition of tax

wholly-owned subsidiary, corporation T, and at least 75 percent of its gross income under § 857(b)(7)(A) is in lieu of alloca-

to provide housekeeping services to ten- from sources listed in § 856(c)(3). “Rents tion under § 482.

July 1, 2002 4 2002–26 I.R.B.

Section 857(b)(7)(B)(ii) through (vii) space to carry out the housekeeping taxable income, but not its gross income.

contains exceptions, or safe harbors, from operations and makes no payments to R Such allocation under § 482 would not

the 100 percent tax on redetermined rents. other than its rental payments for that cause any portion of the rents received by

For example, pursuant to § 857(b)(7)(B) space. For purposes of § 856(d)(7)(C)(i), R to fail to qualify as rents from real

(vi), the definition of redetermined rents in those circumstances the services are property under § 856(d).

does not apply to any service rendered by considered to be rendered by T, rather In Situation 2, R compensates T by

a TRS to a tenant of its REIT if the gross than R, even though no service charges paying it an amount that is 125 percent of

income of the TRS from the service is at are separately stated from the tenants’ T’s direct cost of providing the services,

least 150 percent of the TRS’s direct cost rents. Accordingly, the services do not and that payment is less than the § 482

in rendering the service. Other safe har- give rise to impermissible tenant service arm’s length charge. In Situation 2, no

bors in § 857(b)(7)(B) cover customary income and thus do not cause any portion safe harbor protects R from imposition of

services, services giving rise to de mini- of the rents received by R to fail to the 100 percent tax on redetermined rents.

mis amounts, services priced comparably qualify as rents from real property under As a result, § 857(b)(7)(A) imposes on R

to those provided by the TRS to unrelated § 856(d). a tax equal to the amount that would (but

persons, certain services with separately As rents from real property, those rents for imposition of that tax) be allocated

stated charges, and services excepted by are subject to being treated as redeter- under § 482 from R to T to reflect the

the Secretary. mined rents under § 857(b)(7)(B)(i). That § 482 arm’s length charge for providing

section provides that redetermined rents the services. In other words, the tax is

ANALYSIS mean rents from real property (as defined equal to the amount by which the § 482

in § 856(d)) to the extent the amount of arm’s length charge exceeds the payment

If a REIT forms a TRS to provide non- from R to T. Pursuant to § 857(b)(7)(E),

the rents would (but for § 857(b)(7)(E))

customary services to the REIT’s tenants imposition of that tax is in lieu of alloca-

be reduced on allocation under § 482 to

and no service charges are separately tion of the same amount from R to T

clearly reflect income as a result of ser-

stated from the tenants’ rents, a primary under § 482. Imposition of that tax does

vices rendered by a TRS to a tenant of its

question in determining the treatment of not cause any portion of the rents

REIT. Section 482 allows the Secretary to

the REIT’s income from the services is received by R to fail to qualify as rents

allocate income from a REIT to its TRS

whether they are considered to be ren- from real property under § 856(d).

to reflect the § 482 arm’s length charge

dered by the REIT, or by the TRS, for

purposes of § 856(d)(7). If rendered by for the TRS’s services. However, the 100

HOLDINGS

the TRS and hence described in percent tax on redetermined rents is not

§ 856(d)(7)(C)(i), the services do not give imposed with respect to services (1) In Situation 1, the housekeeping

rise to impermissible tenant service described in a safe harbor of § 857(b) services are considered to be rendered by

income. All relevant facts and circum- (7)(B). T, rather than R, for purposes of

stances must be considered in determin- In Situation 1, R compensates T for § 856(d)(7)(C)(i). Accordingly, the ser-

ing the provider of the services for this providing the housekeeping services by vices do not give rise to impermissible

purpose. paying it an amount that is 160 percent of tenant service income and thus do not

In Situations 1 and 2, charges to the T’s direct cost of providing the services, cause any portion of the rents received by

tenants for the housekeeping services are and T reports the full amount of R’s pay- R to fail to qualify as rents from real

not separately stated from the rents that ment as gross income on T’s federal property under § 856(d). The safe harbor

the tenants pay to R for the use of their income tax return. Pursuant to the safe of § 857(b)(7)(B)(vi) protects R from

apartments. As a result, the amounts of harbor of § 857(b)(7)(B)(vi), the defini- imposition of the 100 percent tax on rede-

the rents reflect the availability and use of tion of redetermined rents does not apply termined rents. However, if the amount

those services. In other words, R receives to any service rendered by a TRS to a paid by R to T represents less than the

greater rental payments than it would tenant of its REIT if the TRS’s gross § 482 arm’s length charge for providing

have received if the services had not been income from the service is at least 150 the services, income is allocable from R

provided to its tenants. However, the percent of its direct cost in rendering the to T under § 482. Income so allocated

structure of the 100 percent tax on rede- service. In Situation 1, that safe harbor from R to T under § 482 would be

termined rents indicates that Congress did protects R from imposition of the 100 deductible by R under § 162 and thus

not intend the lack of a separately stated percent tax on redetermined rents. How- would reduce R’s taxable income, but not

service charge, by itself, to cause services ever, if the amount paid by R to T is less its gross income. Such allocation under

to be treated as rendered by a REIT, than the § 482 arm’s length charge for § 482 would not cause any portion of the

rather than its TRS. In Situations 1 and 2, providing the services, income is allo- rents received by R to fail to qualify as

employees of T perform all of the house- cable from R to T under § 482 to reflect rents from real property under § 856(d).

keeping services received by R’s tenants, that charge. Section 857(b)(7)(E) does not (2) In Situation 2, the housekeeping

including administration and management preclude allocation under § 482 of services are considered to be rendered by

of the services. T pays all costs of provid- income on which the 100 percent tax is T for purposes of § 856(d)(7)(C)(i).

ing the services, such as its employees’ not imposed. Income so allocated from R Accordingly, the services do not give rise

salaries and the costs of their uniforms, to T under § 482 would be deductible by to impermissible tenant service income

equipment, and supplies. T also rents R under § 162 and thus would reduce R’s and thus do not cause any portion of the

2002–26 I.R.B. 5 July 1, 2002

rents received by R to fail to qualify as SUMMARY: This document contains proposed rulemaking published in the

rents from real property under § 856(d). regulations under section 1502 that affect Proposed Rules section of the Federal

However, no safe harbor protects R from corporations filing consolidated returns. Register.

imposition of the 100 percent tax on rede- These regulations permit certain acquir- Books or records relating to the collec-

termined rents. Section 857(b)(7)(A) ing consolidated groups to elect to waive tion of information must be retained as

imposes on R a tax equal to the amount all or a portion of the pre-acquisition por- long as their contents may become mate-

by which the § 482 arm’s length charge tion of the 5-year carryback period under rial in the administration of any internal

for providing the services exceeds the section 172(b)(1)(H) for certain losses revenue law. Generally, tax returns and

payment from R to T. Imposition of that attributable to certain acquired members. tax return information are confidential, as

tax is in lieu of allocation of that amount The text of these temporary regulations required by 26 U.S.C. 6103.

from R to T under § 482 and does not also serves as the text of the proposed

Background

cause any portion of the rents received by regulations set forth in the notice of pro-

R to fail to qualify as rents from real posed rulemaking (REG–122564–02) on On July 2, 1999, the IRS and Treasury

property under § 856(d). this subject in this issue of the Bulletin. published in the Federal Register (64 FR

DRAFTING INFORMATION DATES: Effective Date: These temporary 36092 (T.D. 8823, 1999–2 C.B. 34)) final

regulations are effective May 31, 2002. regulations regarding certain deductions

The principal author of this revenue Applicability Date: These regulations and losses of members that join a consoli-

ruling is Jonathan D. Silver of the Office apply to consolidated net operating losses dated group. These regulations added

of Associate Chief Counsel (Financial arising in taxable years ending during § 1.1502–21(b)(3)(ii)(B), which permits

Institutions and Products). For further 2001 and 2002. an acquiring consolidated group to elect

information regarding this revenue ruling, to waive, with respect to all consolidated

contact Mr. Silver at (202) 622–3920 (not FOR FURTHER INFORMATION CON- net operating losses attributable to certain

a toll-free call). TACT: Marie Milnes-Vasquez of the acquired members, the portion of the car-

Office of Associate Chief Counsel (Cor- ryback period for which the corporation

porate), (202) 622–7770 (not a toll-free was a member of another group.

number). Section 172(b)(1) provides, in part,

Section 857.—Taxation of

that a net operating loss for any taxable

Real Estate Investment Trusts year must generally be carried back to

and Their Beneficiaries SUPPLEMENTARY INFORMATION: each of the 2 taxable years preceding the

taxable year of the loss. Section 172(b)(3)

If a REIT forms a taxable REIT subsidiary to Paperwork Reduction Act

provides that any taxpayer entitled to a

provide noncustomary services to tenants of the

carryback period under section 172(b)(1)

REIT and no service charges are separately stated These regulations are being issued

from the rents paid by the tenants to the REIT, how may elect to relinquish the carryback

without prior notice and public procedure

is the REIT’s income from the services treated under period with respect to a loss for any tax-

pursuant to the Administrative Procedure

section 857(b)(7). See Rev. Rul. 2002–38, page 4. able year. An election to relinquish the

Act (5 U.S.C. 553). For this reason, the

carryback period under section 172(b)(3)

collection of information contained in

must be made by the due date (including

Section 1502.— Regulations these regulations has been reviewed and,

extensions) of the taxpayer’s return for

pending receipt and evaluation of public

the taxable year of the loss and in the

26 CFR 1.1502–21: Net operating losses. comments, approved by the Office of

manner prescribed by the Secretary. Nor-

Management and Budget under control mally, this election is irrevocable.

T.D. 8997 number 1545–1790. Responses to this Section 172(b)(1)(H), which was

collection of information are required to enacted as part of the Job Creation and

obtain a benefit.

DEPARTMENT OF THE Worker Assistance Act of 2002 (the Act),

An agency may not conduct or spon- extended the 2-year carryback period to 5

TREASURY sor, and a person is not required to years for losses arising in taxable years

Internal Revenue Service respond to, a collection of information ending during 2001 and 2002 (hereafter,

26 CFR Parts 1 and 602 unless it displays a valid control number 2001 and 2002). Section 172(j), which

assigned by the Office of Management was also enacted as part of the Act,

Carryback of Consolidated and Budget. allows a taxpayer entitled to the 5-year

Net Operating Losses to For further information concerning carryback period under section

Separate Return Years this collection of information, and where 172(b)(1)(H) to elect to relinquish that

to submit comments on the collection of carryback period with respect to a loss for

AGENCY: Internal Revenue Service information and the accuracy of the esti- any taxable year. A taxpayer making this

(IRS), Treasury. mated burden, and suggestions for reduc- election generally must apply the 2-year

ing this burden, please refer to the pre- carryback period set forth in section

ACTION: Temporary regulations. amble to the cross-referencing notice of 172(b)(1), unless the taxpayer also elects

July 1, 2002 6 2002–26 I.R.B.

to relinquish that carryback period under which the acquired member was previ- or 2002 losses are not carried back to pre-

section 172(b)(3). ously a member. acquisition years of the acquired member.

As described in Revenue Procedure Pursuant to the second election, an

2002–40 (2002–23 I.R.B. 1096), in order acquiring group may waive the portion of Special Analyses

to give effect to the intent of Congress to the pre-acquisition carryback period for

allow taxpayers a 5-year carryback period 2001 and 2002 losses attributable to a These temporary regulations are neces-

to the maximum extent possible, the Ser- member acquired from another group to sary to provide taxpayers with immediate

vice is permitting any taxpayer that previ- the extent that the Act increased the car- elective relief from section 172(b)(1)(H),

ously elected under section 172(b)(3) to ryback period for such losses. This sec- which was enacted as the part of the Job

forgo the carryback period for losses aris- ond election effectively permits a waiver Creation and Worker Assistance Act of

ing in 2001 or 2002 to revoke such elec- of the third, fourth, and fifth carryback 2002. These regulations permit certain

tion in order to take advantage of the years to the extent that such years are acquiring consolidated groups to elect to

5-year carryback period, provided the tax- prior to the acquisition and is available waive the 5-year carryback period with

payer revokes the election no later than even where 2001 or 2002 losses have respect to certain acquired members. The

October 31, 2002. Revenue Procedure been carried back to the first or second regulations apply to losses arising in tax-

2002–40 also permits a taxpayer that filed carryback years of the acquired member able years ending in 2001 and 2002.

an application for a tentative carryback that are pre-acquisition years. This second Based on these considerations, it is deter-

adjustment or an amended return using election, however, is only available with mined that this temporary regulation will

the 2-year carryback period for a net respect to consolidated net operating provide taxpayers with the necessary

operating loss arising in 2001 or 2002 to losses arising in a particular taxable year guidance and authority to ensure equi-

file certain forms to claim the 5-year car- where none of such losses have been car- table administration of the tax laws.

ryback period provided under section ried back to a taxable year of a group of Because of the need for immediate guid-

172(b)(1)(H). which the acquired member was previ- ance, notice and public procedure are

Given the enactment of section ously a member that is prior to the second impracticable and contrary to the public

172(b)(1)(H) and taxpayers’ ability to taxable year preceding the taxable year of interest pursuant to 5 USC 553(b)(B) and

revoke prior elections under section the loss. delayed effective date is not required pur-

172(b)(3) and to make certain other fil- Unlike the election under § 1.1502– suant to 5 USC 553(d)(1) and (3).

ings in order to take advantage of the 21(b)(3)(ii)(B), the elections provided in Further, it has been determined that

5-year carryback period, the IRS and these regulations apply only to losses for this Treasury decision is not a significant

Treasury believe that it is appropriate to 2001 and 2002. In addition, the elections regulatory action as defined in Executive

afford certain acquiring consolidated are made on a year-by-basis. That is, one Order 12866. Therefore, a regulatory

groups that did not make an election election may be made for 2001 losses assessment is not required. Pursuant to

described in § 1.1502–21(b)(3)(ii)(B) while another election, or no election, section 7805(f) of the Internal Revenue

with respect to certain acquired members may be made for 2002 losses. An election Code, these regulations will be submitted

an opportunity to waive the portion of the that relates to consolidated net operating to the Chief Counsel for Advocacy of the

entire carryback period or the portion of losses attributable to a taxable year end- Small Business Administration for com-

the extended carryback period for 2001 ing during 2001 must be filed with the ment on their impact on small business.

and 2002 losses attributable to the acquiring consolidated group’s timely

acquired members, for pre-acquisition filed (including extensions) original or Drafting Information

years. In this regard, the regulations in amended return for the taxable year end-

The principal author of these tempo-

this Treasury decision add § 1.1502– ing during 2001, provided that such origi-

rary regulations is Marie Milnes-Vasquez.

21T(b)(3)(ii)(C), which sets forth two nal or amended return is filed on or

However, other personnel from the IRS

elections. before October 31, 2002. An election that

Pursuant to the first election, an relates to consolidated net operating and Treasury Department participated in

acquiring group may waive the portion of losses attributable to a taxable year end- their development.

the 5-year carryback period for 2001 and ing during 2002 must be filed with the *****

2002 losses attributable to a member acquiring consolidated group’s timely

acquired from another group after June filed (including extensions) original or Adoption of Amendments to the

25, 1999, for which the member was a amended return for the taxable year end- Regulations

member of another group. While this ing during 2001 or 2002, provided that

election effectively permits a waiver of such original or amended return is filed Accordingly, 26 CFR part 1 is

the entire 5-year carryback period to the on or before September 15, 2003. amended as follows:

extent that it is prior to the acquisition If the acquiring consolidated group PART 1—INCOME TAXES

with respect to a consolidated net operat- files or filed a valid election described in

ing loss arising in a particular taxable § 1.1502–21(b)(3)(ii)(B) with respect to Paragraph 1. The authority citation for

year, it is only available where none of the acquisition of a member, no election part 1 is amended by adding an entry in

such losses have previously been carried under § 1.1502–21T(b)(3)(ii)(C) needs to numerical order to read in part as follows:

back to a taxable year of a group of be (or should be) filed to ensure that 2001 Authority: 26 U.S.C. 7805 * * *

2002–26 I.R.B. 7 July 1, 2002

Section 1.1502–21T also issued under solidated net operating losses arising in a which the acquired member was previ-

26 U.S.C. 1502. * * * particular taxable year if any carryback is ously a member and such claim is filed

Par. 2. Section 1.1502–21 is amended claimed, as provided in paragraph on or before the date the election

by adding paragraph (b)(3)(ii)(C) to read (b)(3)(ii)(C)(4) of this section, with described in this paragraph is filed. The

as follows: respect to any such losses on a return or election must be made in a separate state-

other filing by a group of which the ment entitled “THIS IS AN ELECTION

§ 1.1502–21 Net operating losses. acquired member was previously a mem- UNDER SECTION 1.1502–21T(b)(3)

ber and such claim is filed on or before (ii)(C)(3) TO WAIVE THE PRE-[insert

***** the date the election described in this first day of the first taxable year for

paragraph is filed. The election must be which the member (or members) was a

(b) * * *

made in a separate statement entitled member of the acquiring group]

(3) * * *

“THIS IS AN ELECTION UNDER SEC- EXTENDED CARRYBACK PERIOD

(ii) * * *

TION 1.1502–21T(b)(3)(ii)(C)(2) TO FOR THE CNOLS ATTRIBUTABLE TO

(C) [Reserved]. For further guidance,

WAIVE THE PRE-[insert first day of the THE [insert taxable year of losses] TAX-

see § 1.1502–21T(b)(3)(ii)(C).

first taxable year for which the member ABLE YEAR(S) OF [insert names and

***** (or members) was a member of the employer identification numbers of mem-

Par. 3. Section 1.1502–21T is added to a c q u i r i n g g r o u p ] C A R RY B A C K bers].” Such statement must be filed as

read as follows: PERIOD FOR THE CNOLS ATTRIBUT- provided in paragraph (b)(3)(ii)(C)(5) of

ABLE TO THE [insert taxable year of this section.

§ 1.1502–21T Net operating losses losses] TAXABLE YEAR(S) OF [insert (4) Claim for a carryback. For pur-

(temporary). names and employer identification num- poses of paragraphs (b)(3)(ii)(C)(2) and

bers of members].” Such statement must (3) of this section, a carryback is claimed

(a) through (b)(3)(ii)(B) [Reserved]. be filed as provided in paragraph with respect to a consolidated net operat-

For further guidance, see § 1.1502–21(a) (b)(3)(ii)(C)(5) of this section. ing loss if there is a claim for refund, an

through (b)(3)(ii)(B). (3) Partial waiver of pre-acquisition amended return, an application for a ten-

(C) Partial waiver of carryback period extended carryback period. If one or tative carryback adjustment, or any other

for 2001 and 2002 losses—(1) Applica- more members of a consolidated group filing that claims the benefit of the net

tion. The acquiring group may make the become members of another consolidated operating loss in a taxable year prior to

elections described in paragraphs group, then, with respect to all consoli- the taxable year of the loss, whether or

(b)(3)(ii)(C)(2) and (3) of this section dated net operating losses attributable to not subsequently revoked in favor of a

with respect to an acquired member or the member for the taxable year ending claim based on a 5-year carryback period.

members only if it did not file a valid during either 2001 or 2002, or both, the (5) Time and manner for filing state-

election described in § 1.1502–21(b)(3) acquiring group may make an irrevocable ment. A statement described in paragraph

(ii)(B) with respect to such acquired election to relinquish the portion of the (b)(3)(ii)(C)(2) or (3) of this section that

member or members on or before May carryback period for such losses for relates to consolidated net operating

31, 2002. which the corporation was a member of losses attributable to a taxable year end-

(2) Partial waiver of entire pre- another group to the extent that such car- ing during 2001 must be filed with the

acquisition carryback period. If one or ryback period includes one or more tax- acquiring consolidated group’s timely

more members of a consolidated group able years that are prior to the taxable filed (including extensions) original or

become members of another consolidated year that is 2 taxable years preceding the amended return for the taxable year end-

group after June 25, 1999, then, with taxable year of the loss, provided that any ing during 2001, provided that such origi-

respect to all consolidated net operating other corporation joining the acquiring nal or amended return is filed on or

losses attributable to the member for the group that was affiliated with the member before October 31, 2002. A statement

taxable year ending during either 2001 or immediately before it joined the acquiring described in paragraph (b)(3)(ii)(C)(2) or

2002, or both, the acquiring group may group is also included in the waiver and (3) of this section that relates to consoli-

make an irrevocable election to relinquish that the conditions of this paragraph are dated net operating losses attributable to a

the portion of the carryback period for satisfied. The acquiring group cannot taxable year ending during 2002 must be

such losses for which the corporation was make the election described in this para- filed with the acquiring consolidated

a member of another group, provided that graph with respect to any consolidated net group’s timely filed (including exten-

any other corporation joining the acquir- operating losses arising in a particular sions) original or amended return for the

ing group that was affiliated with the taxable year if a carryback to one or more taxable year ending during 2001 or 2002,

member immediately before it joined the taxable years that are prior to the taxable provided that such original or amended

acquiring group is also included in the year that is 2 taxable years preceding the return is filed on or before September 15,

waiver and that the conditions of this taxable year of the loss is claimed, as pro- 2003.

paragraph are satisfied. The acquiring vided in paragraph (b)(3)(ii)(C)(4) of this (iii) through (h) [Reserved]. For fur-

group cannot make the election described section, with respect to any such losses ther guidance, see § 1.1502–21(b)(3)(iii)

in this paragraph with respect to any con- on a return or other filing by a group of through (h).

July 1, 2002 8 2002–26 I.R.B.

PART 602—OMB CONTROL NUM- Authority: 26 U.S.C. 7805. *****

BERS UNDER THE PAPERWORK Par. 5. In § 602.101, paragraph (b) is (b) * * *

REDUCTION ACT amended by adding an entry to the table

in numerical order to read as follows:

Par. 4. The authority citation for part

602 continues to read as follows: § 602.101 OMB Control numbers.

CFR part or section where Current OMB

identified and described control No.

*****

1.1502–21T .............................................................................................................................................................. 1545–1790

*****

David A. Mader, Section 7123.—Appeals The announcement extends the test of the arbi-

Acting Deputy Commissioner tration procedures set forth in Announcement

Dispute Resolution 2000–4, 2000–1 C.B. 317, for an additional one-

of Internal Revenue.

Procedures year period. See section 7123(b)(2) and Announce-

ment 2002–60, page 28.

Approved May 20, 2002.

The revenue procedure formally establishes the

Pamela F. Olson, Appeals Mediation Procedure, and modifies and

expands the availability of mediation for cases that

Acting Assistant Secretary

are already in the Appeals administrative process.

of the Treasury. See section 7123(b)(1) and Rev. Proc. 2002–44,

(Filed by the Office of the Federal Register on May page 10.

30, 2002, 8:45 a.m., and published in the issue of

the Federal Register for May 31, 2002, 67 F.R.

38000)

2002–26 I.R.B. 9 July 1, 2002

Part III. Administrative, Procedural, and Miscellaneous

26 CFR 601.106: Appeals functions. Appeals mediation procedure; and modi- .01 Mediation is no longer limited to

(Also §§ 601.202, 601.203; and Part I, fies and expands the availability of issues involving an adjustment of $1 mil-

§ 7123(b)(1).)

mediation for cases that are already in the lion or more; it is now available for any

Appeals administrative process. qualifying issues, as described in this rev-

Rev. Proc. 2002–44 This revenue procedure supersedes enue procedure, that are already in the

Announcement 98–99, 1998–2 C.B. 650, Appeals administrative process;

CONTENTS and Announcement 2001–9. .02 Section 4.02(1) provides that legal

SECTION 1. PURPOSE issues are now eligible for mediation;

SECTION 2. BACKGROUND

.03 Section 4.02(3) provides that

SECTION 2. BACKGROUND Industry Specialization Program (ISP)

The mission of Appeals is to resolve

tax controversies, without litigation, on a issues and Appeals Coordinated Issues

SECTION 3. SIGNIFICANT CHANGES

basis which is fair and impartial to both (ACI) are now eligible for mediation;

SECTION 4. SCOPE OF MEDIATION the Government and the taxpayer. Media- .04 Section 4.02(5) provides that

tion is an extension of the Appeals pro- mediation is now available for an issue

.01 In general. for which the taxpayer intends to seek

cess and will enhance voluntary compli-

.02 Applicability. competent authority assistance, provided

ance. Mediation is a nonbinding process

.03 Inapplicability. a request for competent authority assis-

that uses the services of a mediator, as a

SECTION 5. MEDIATION PROCESS neutral third party, to help Appeals and tance has not as yet been filed;

the taxpayer reach their own negotiated .05 Section 4.02(6) provides that

.01 Mediation is optional. settlement. (References herein to “media- mediation is now available after unsuc-

.02 Filing requirements. tor” include any non-Internal Revenue cessful attempts to enter into a closing

(1) Where to file. Service co-mediator, as appropriate (see agreement under § 7121;

(2) Required information. sections 5.06 and 5.08 of this revenue .06 Section 4.03(2) provides that Col-

.03 Review of mediation request. procedure). To accomplish this goal, the lection cases are excluded from media-

(1) Request approved. mediator will act as a facilitator, assist in tion;

(2) Request denied. defining the issues, and promote settle- .07 Section 4.03(3) provides that

.04 Agreement to mediate. ment negotiations between Appeals and issues for which mediation would not be

.05 Participants. the taxpayer. The mediator will not have consistent with sound tax administration

.06 Selection of mediator and ex- settlement authority in the mediation pro- are excluded from mediation;

penses. cess and will not render a decision .08 Section 4.03(4) provides that frivo-

.07 Appeals personnel as mediators regarding any issue in dispute. The lous issues are excluded from mediation;

and conflict statement. mediator should inform and discuss with .09 Section 4.03(5) provides that cases

.08 Criteria for selection of non- Appeals and the taxpayer the rules and where the taxpayer did not act in good

Internal Revenue Service co-mediator. procedures concerning the mediation pro- faith during settlement negotiations are

.09 Discussion summaries. cess. excluded from mediation;

.10 Confidentiality. Section 7123(b)(1) of the Internal Rev- .10 Section 5.02(2) includes new filing

.11 Ex Parte Contacts Prohibited enue Code, as enacted by § 3465 of the

.12 Section 7214(a)(8) disclosure. requirements;

Internal Revenue Service Restructuring .11 Section 5.04 includes express time-

.13 Disqualification of the non- and Reform Act of 1998, Pub. L. No.

Internal Revenue Service co-mediator. lines to complete the agreement to medi-

105–206, 112 Stat. 685, provides for ate and proceed to mediation. A taxpay-

.14 Withdrawal. expansion of the Appeals mediation pro-

.15 Mediator’s report. er’s inability to adhere to these

gram. The Service previously allowed timeframes, without reasonable cause,

.16 Appeals procedures apply. taxpayers to request mediation for factual

.17 Use as precedent. may result in Appeals’ withdrawal from

issues involving an adjustment of $1 mil- the mediation process;

SECTION 6. EFFECTIVE DATE lion or more that were already in the

.12 Section 5.06 requires the use of

Appeals administrative process. See

SECTION 7. EFFECT ON OTHER Appeals personnel who are trained

Announcements 98–99 and 2001–9.

DOCUMENTS mediators. Headquarters Appeals will pay

SECTION 3. SIGNIFICANT CHANGES the expenses associated with Appeals

mediators. Taxpayers may also elect to

SECTION 1. PURPOSE use a non-Internal Revenue Service

The mediation procedure has been

modified, and expanded to allow for addi- mediator, at taxpayers’ expense;

On January 15, 2002, Appeals com-

tional cases in Appeals to be eligible for .13 Section 5.11 provides that there

pleted an additional one-year test of its

mediation. Significant changes to will be no ex parte contacts with the

mediation procedure. See Announcement

Announcements 98–99 and 2001–9 made mediator outside the mediation session,

2001–9, 2001–1 C.B. 357. This revenue

by this revenue procedure include: except as provided by that section;

procedure formally establishes the

July 1, 2002 10 2002–26 I.R.B.

.14 Section 5.16 provides that if the taxpayer has requested competent author- 20005, Attn: Appeals LBSP Operations.

taxpayer and Appeals do not reach an ity assistance or the simultaneous (See Exhibit 1 of this revenue procedure

agreement on an issue being mediated, Appeals/Competent Authority procedure for a listing of the addresses for each

they may then request arbitration for the described in section 8 of Rev. Proc. Appeals Area Director.)

issue provided the mediation issue meets 96–13, 1996–1 C.B. 616, or any subse- (2) Required information. The

the requirements for arbitration and the quent revenue procedure. Taxpayers are mediation request should:

taxpayer acted in good faith during the cautioned that if they enter into a (a) Provide the taxpayer’s

mediation process. settlement with Appeals (including an name, TIN, address and the name, title,

Appeals settlement through the media- address and telephone number of a person

SECTION 4. SCOPE OF MEDIATION tion process), and then request compe-

to contact;

tent authority assistance, the U.S. com-

.01 In general. The mediation proce- (b) Provide the Team Case

petent authority will endeavor only to

dure will attempt to resolve issues in Leader’s or Appeals Officer’s name;

obtain a correlative adjustment with

cases that qualify under this revenue pro- the treaty country and will not take (c) Identify the taxable period(s)

cedure while they are in the jurisdiction any actions that would otherwise involved;

of Appeals. This procedure may be used amend the settlement. See section 7.05 (d) Describe the issue for which

only after Appeals settlement discussions of Rev. Proc. 96–13; and mediation is being requested, including

are unsuccessful, and, generally, when all (6) Unsuccessful attempts to enter the dollar amount of the adjustment in

other issues are resolved but for the into a closing agreement under § 7121. dispute; and

issue(s) for which mediation is being .03 Inapplicability. Mediation will not (e) Contain a representation that

requested. be available for: the issue is not an excluded issue listed in

.02 Applicability. Mediation is avail- (1) An issue designated for litiga- the “Scope of Mediation” section above.

able for: tion or docketed in any court. [For the .03 Review of Mediation Request. Gen-

(1) Legal issues; Chief Counsel mediation program involv- erally, the Appeals Team Manager will

(2) Factual issues; ing issues in docketed cases, see Chief respond to the taxpayer and the Team

(3) An Industry Specialization Pro- Counsel Directives Manual (CCDM)(35) Case Leader or Appeals Officer within

gram (ISP) issue or an Appeals Coordi- 3(20)0]; two weeks after the Appeals Team Man-

nated Issue (ACI). [ISP issues are listed (2) Collection cases;

in Exhibit 8.7.1–1, and ACI issues are ager receives the taxpayer’s request for

(3) Issues for which mediation mediation.

listed in section 8.7.1–3, of the Internal would not be consistent with sound tax

Revenue Manual.] However, an ISP or (1) Request approved. If Appeals

administration, e.g. issues governed by

ACI issue will not be eligible for media- approves the mediation request, the

closing agreements, by res judicata, or

tion when the taxpayer has declined the Appeals Team Manager will inform the

controlling Supreme Court precedent;

opportunity to discuss the ISP or ACI taxpayer and the Team Case Leader or

(4) Frivolous issues, such as, but

issue with the Appeals ISP or ACI coordi- not limited to, those identified in Rev. Appeals Officer, and schedule a confer-

nator during the course of the Appeals Proc. 2001–41, 2001–33 I.R.B.173; and ence or conference call that may include

settlement discussions; (5) Cases where the taxpayer did a representative from Appeals LBSP

(4) An early referral issue when an not act in good faith during settlement Operations, Headquarters Appeals — to

agreement is not reached, provided the negotiations, e.g., failure to respond to discuss the mediation process.

early referral issue meets the require- document requests, failure to respond (2) Request denied. If Appeals

ments for mediation (see section 2.16 of timely to offers to settle, failure to denies the mediation request, the Appeals

Rev. Proc. 99–28, 1999–2 C.B. 109, or address arguments and precedents raised Team Manager will promptly inform the

any subsequent revenue procedure); by Appeals. taxpayer and the Team Case Leader or

(5) Mediation is now available for Appeals Officer. Although no formal

an issue for which the taxpayer intends to SECTION 5. MEDIATION PROCESS appeal procedure exists for the denial of a

seek competent authority assistance, pro-

mediation request, a taxpayer may request

vided a request for competent authority .01 Mediation is optional. A taxpayer

a conference with the Appeals Team

assistance has not as yet been filed. In and an Appeals Team Case Leader or

Manager to discuss the denial. The denial

such a case, the taxpayer may not request Appeals Officer may request mediation

competent authority assistance until the after consultation with each other. of a mediation request is not subject to

mediation process is completed. How- .02 Filing requirements. judicial review.

ever, competent authority assistance may (1) Where to file. The taxpayer .04 Agreement to mediate. The tax-

be requested while mediation is pending seeks approval for mediation by sending a payer and Appeals will enter into a writ-

if such request is necessary to keep open written request to the appropriate Appeals ten agreement to mediate. See Exhibit 2

a statute of limitations in the treaty coun- Team Manager. The taxpayer should also of this revenue procedure for a model

try. In such a case, the U.S. competent send a copy of the written request to the agreement to mediate. This agreement

authority will suspend action on the case appropriate Appeals Area Director and to will be negotiated at an administrative

until mediation is competed. Mediation is the Chief Appeals, 1099 14th Street, NW, conference or conference call — that may

not available for an issue for which the Suite 4200 — East, Washington, DC include a representative from Appeals

2002–26 I.R.B. 11 July 1, 2002

LBSP Operations, Headquarters Appeals. the Appeals Team Manager, and they not be disclosed by any party, participant,

The agreement to mediate: (a) should be agree that the mediator may serve. See 5 observer or mediator except as provided

as concise as possible, (b) will specify the U.S.C. § 573. by statute, such as in § 6103 of the Inter-

issue(s) that the parties have agreed to This mediation procedure requires the nal Revenue Code and 5 U.S.C § 574. A

mediate, and (c) should identify the loca- use of an Appeals employee who is a dispute resolution communication

tion and the proposed date of the media- trained mediator. Headquarters Appeals includes all oral or written communica-

tion session. will pay the expenses associated with the tions prepared for the purposes of a dis-

The Appeals Team Manager, in consul- Appeals mediator. The taxpayer may also pute resolution proceeding. See 5 U.S.C.

tation with the Team Case Leader or elect to use a non-Internal Revenue Ser- § 571(5).

Appeals Officer, will sign the agreement vice co-mediator, at the taxpayer’s In executing the mediation agreement,

to mediate on behalf of Appeals. expense. the taxpayer consents under § 6103(c) to

Generally, it is expected that the par- .07 Appeals personnel as mediators the disclosure by the IRS of the taxpay-

ties will complete the agreement to medi- and conflict statement. The taxpayer and er’s returns and return information inci-

ate within three weeks after being notified the Appeals Team Manager will select an dent to the mediation to any participant or

that Appeals approved the mediation Appeals mediator from a list of eligible observer identified in the initial lists of

request and proceed to mediation within individuals who, generally, will be from participants and observers and to any sub-

60 days after signing the agreement to the same Appeals office or geographic sequent participants and observers identi-

mediate. A taxpayer’s inability to adhere area, but not the same group, where the fied in writing by the parties. (See section

to these timeframes, without reasonable case is assigned. 5.05 of this revenue procedure.) If the

cause, may result in Appeals’ withdrawal Due to the inherent conflict that results mediation agreement is executed by a

from the mediation process. because the Appeals mediator is an person pursuant to a power of attorney

.05 Participants. The parties to the employee of the IRS, the Appeals media- executed by the taxpayer, that power of

mediation process will be the taxpayer tor will provide to the taxpayer a state- attorney must clearly express the taxpay-

and Appeals. Absent an agreement to the ment confirming his/her proposed service er’s grant of authority to consent to dis-

contrary, each party must have at least as a mediator, that he/she is a current close the taxpayer’s returns and return

one participant attending the mediation employee of the IRS, that a conflict information by the IRS to third parties,

session with decision-making authority. results from his/her continued status as an

and a copy of that power of attorney must

The mediation agreement will set forth IRS employee, and that this conflict will

be attached to the agreement.

the procedures by which the parties not interfere in the mediator’s ability to

IRS and Treasury employees who par-

inform the other party and the mediator of impartially facilitate the case. The written

ticipate in or observe the mediation pro-

the participants in the mediation and will agreement to mediate will include this

cess in any way, and any person under

set forth any limitation on the number, statement.

contract to the IRS pursuant to § 6103(n)

identity or participation by such partici- .08 Criteria for selection of non-

that the IRS invites to participate or

pants. In general, the parties are encour- Internal Revenue Service co-mediator. If

observe, will be subject to the confidenti-

aged to include, in addition to the the taxpayer elects to use a non-Internal

ality and disclosure provisions of the

required decision-makers, those persons Revenue Service co-mediator, the tax-

Internal Revenue Code, including

with information and expertise that will payer and the Appeals Team Manager

§§ 6103, 7213, and 7431.

be useful to the decision-makers and the should make the selection from any local

mediator. In order to minimize the possi- or national organization that provides a .11 Ex Parte Contacts Prohibited. To

bility of a last-minute disqualification of roster of neutrals. Criteria for selecting a ensure that one party is not in a position

the mediator, each party must notify the non-Internal Revenue Service co-medi- to exert undue influence on the mediator,

mediator and the other party no later than ator may include: completion of media- there will be no ex parte contacts with the