Professional Documents

Culture Documents

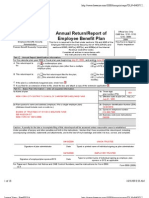

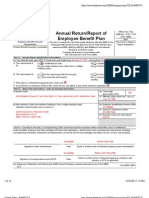

US Internal Revenue Service: f5300q

Uploaded by

IRSOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: f5300q

Uploaded by

IRSCopyright:

Available Formats

SCHEDULE Q

(Form 5300) Elective Determination Requests

(Rev. August 2001) 䊳

OMB No. 1545-0197

File as an attachment to Form 5300, 5307, or 5310 to request specific determinations.

Department of the Treasury

Internal Revenue Service See the instructions before completing this schedule.

Name of plan sponsor (employer, if single-employer plan) as shown on Form 5300, 5307, or 5310 Employer identification number

Name of plan

Yes No

1 Is this a request for a determination on whether a plan that uses the qualified separate lines of business rules

of section 414(r) satisfies the gateway test of section 410(b)(5)(B) or satisfies the special requirements for

employer-wide plans?

If “Yes,” see instructions and attach Demo 1.

2 Sections 401(a)(26) and 410(b). See instructions.

3 Is this a request for a determination that specified benefits, rights, or features meet the nondiscriminatory current

availability requirement?

If “Yes,” see instructions and attach Demo 3.

4 Is this a request for a determination regarding the plan being restructured, mandatorily disaggregated, or

permissively aggregated? (See instructions.)

If “Yes”, see the instructions and attach Demo 4.

5 If Form 5300 line 13 or Form 5307 line 11 is answered “No,” is this a request for a determination regarding

Regulations section 1.410(b)-2(b)(5) average benefit test? If “Yes,” see instructions and attach Demo 5

6 If Form 5300 line 14 or Form 5307 line 12 is answered “No,” is this a request for a determination regarding a

nondesign-based safe harbor or a general test under 401(a)(4)?

If “Yes,” see instructions and attach Demo 6. Also, enter the letter (A, B, or C) corresponding to the

type of determination requested 䊳

Type

A = General test, involving “safety valve” rule in Regulations section 1.401(a)(4)-3(c)(3) (defined benefit plans only)

B = General test, not involving “safety valve” rule

C = Nondesign-based safe harbor

7 (i) Is this a request for a determination regarding a plan provision that provides for pre-participation or imputed

service?

(ii) Is this a request for a determination regarding a plan amendment (or, for an initial determination, a plan

provision) providing a period of past service in excess of the safe harbor?

If (i) or (ii) is “Yes,” see instructions and attach Demo 7.

8 Is this a request for a determination regarding a floor offset arrangement intended to satisfy the safe harbor in

Regulations section 1.401(a)(4)-8(d)?

If “Yes,” see instructions and attach Demo 8.

9 Is this a request for a determination that a definition of compensation is nondiscriminatory? (See instructions.)

If “Yes,” see instructions and attach Demo 9.

10 Is this a request for a determination for a defined benefit plan with employee contributions not allocated to

separate accounts?

If “Yes,” complete lines 11 and 12.

11 Enter the letter (A, B, C, D, or E) corresponding to the method used to determine the employer-provided

benefit: 䊳

Method

A = Composition-of-workforce method

B = Minimum benefit method (also enter the plan factor, if applicable (.4 or .6))

C = Grandfather rule

D = Government plan method

E = Cessation of employee contributions method

If “A,” see instructions and attach Demo 10. If applicable, list the plan provisions and indicate the plan factor

here:

12 Enter the letter (A, B, or C) corresponding to the method used to show that the employee-provided

benefit is nondiscriminatory in amount: 䊳

Method

A = Same rate of contributions

B = Total benefits method

C = Grandfather rule

If “C,” see instructions and attach Demo 11.

For Paperwork Reduction Act Notice, see the Instructions for Form 5300. Cat. No. 21811R Schedule Q (Form 5300) (Rev. 8-2001)

You might also like

- Blue Prism Developer Certification Case Based Practice Question - Latest 2023From EverandBlue Prism Developer Certification Case Based Practice Question - Latest 2023No ratings yet

- Application For Determination For Adopters of Master or Prototype or Volume Submitter PlansDocument4 pagesApplication For Determination For Adopters of Master or Prototype or Volume Submitter PlansIRSNo ratings yet

- 5626 Employee Benefit Plan Miscellaneous Provisions: (Worksheet Number 4 - Determination of Qualification)Document4 pages5626 Employee Benefit Plan Miscellaneous Provisions: (Worksheet Number 4 - Determination of Qualification)IRSNo ratings yet

- Employee Benefit Plans 6: Limitations On Contributions and BenefitsDocument23 pagesEmployee Benefit Plans 6: Limitations On Contributions and BenefitspdizypdizyNo ratings yet

- Employee Benefit Plans 11: Employee and Matching ContributionsDocument25 pagesEmployee Benefit Plans 11: Employee and Matching ContributionspdizypdizyNo ratings yet

- US Internal Revenue Service: p7001Document11 pagesUS Internal Revenue Service: p7001IRSNo ratings yet

- Syllabus ChangesDocument27 pagesSyllabus ChangesSIEGE GAMINGNo ratings yet

- US Internal Revenue Service: f8388Document2 pagesUS Internal Revenue Service: f8388IRSNo ratings yet

- Revelstoke 2017 Statement of Financial InformationDocument44 pagesRevelstoke 2017 Statement of Financial InformationRevelstoke EditorNo ratings yet

- Adoption AgreementDocument51 pagesAdoption Agreementspades24kNo ratings yet

- Mock Xat Answers and Explanations: Part - ADocument10 pagesMock Xat Answers and Explanations: Part - Affhariready22No ratings yet

- THE Institu Ute of Chart Tered A Accoun Ntants Sofind DIADocument3 pagesTHE Institu Ute of Chart Tered A Accoun Ntants Sofind DIAratiNo ratings yet

- Attachment 1 - Prequalification Questionnaire - Main Execution Contract TAR 2023Document13 pagesAttachment 1 - Prequalification Questionnaire - Main Execution Contract TAR 2023BALAKRISHANANNo ratings yet

- Scope Management - AnswersDocument3 pagesScope Management - AnswersLawzy Elsadig SeddigNo ratings yet

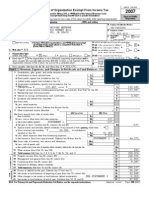

- NCJC 561348186 - 200712 - 990Document28 pagesNCJC 561348186 - 200712 - 990A.P. DillonNo ratings yet

- Compensation 2021 1Z0 Oracle Cloud CertificationDocument62 pagesCompensation 2021 1Z0 Oracle Cloud CertificationSamratChattapadhyayNo ratings yet

- US Internal Revenue Service: F5500ez - 1993Document1 pageUS Internal Revenue Service: F5500ez - 1993IRSNo ratings yet

- QB 06 PersonnelRequirementsDocument6 pagesQB 06 PersonnelRequirementsAmicale SPNo ratings yet

- Employee Benefit Plan Minimum Participation Standards (Worksheet Number 1 - Determination of Qualification)Document2 pagesEmployee Benefit Plan Minimum Participation Standards (Worksheet Number 1 - Determination of Qualification)IRSNo ratings yet

- DT 2007 990Document34 pagesDT 2007 990shimeralumNo ratings yet

- Answer Is B: Share Appreciation RightsDocument8 pagesAnswer Is B: Share Appreciation Rightsdinalsam90No ratings yet

- US Internal Revenue Service: f5500cr - 1991Document6 pagesUS Internal Revenue Service: f5500cr - 1991IRSNo ratings yet

- IRS Publication 4531Document1 pageIRS Publication 4531Francis Wolfgang UrbanNo ratings yet

- Carpenters Welfare Fund 2006Document16 pagesCarpenters Welfare Fund 2006Latisha WalkerNo ratings yet

- US Internal Revenue Service: f5500sb - 1994Document3 pagesUS Internal Revenue Service: f5500sb - 1994IRSNo ratings yet

- ASME Y14.45 - Draft - Public - ReviewDocument97 pagesASME Y14.45 - Draft - Public - ReviewDOR ESHELNo ratings yet

- Carpenters Welfare Fund 2007Document18 pagesCarpenters Welfare Fund 2007Latisha WalkerNo ratings yet

- AF7 2022-23 Practice Test 4 (October 2020 EG) PDFDocument28 pagesAF7 2022-23 Practice Test 4 (October 2020 EG) PDFAnan Guidel AnanNo ratings yet

- Short Form Application For Determination For Minor Amendment of Employee Benefit PlanDocument3 pagesShort Form Application For Determination For Minor Amendment of Employee Benefit PlanIRSNo ratings yet

- Retirement & Pension Plan For NYCDCC Employees 2007Document13 pagesRetirement & Pension Plan For NYCDCC Employees 2007Latisha WalkerNo ratings yet

- US Internal Revenue Service: n-98-52Document23 pagesUS Internal Revenue Service: n-98-52IRSNo ratings yet

- Kaiser Supplemental Savings and Retirement Plan Annual Report Form 5500Document37 pagesKaiser Supplemental Savings and Retirement Plan Annual Report Form 5500James LindonNo ratings yet

- RFI - Prequalification QuestionnaireDocument4 pagesRFI - Prequalification Questionnaireshane.ramirez1980No ratings yet

- Union Security Trust Fund 2007Document10 pagesUnion Security Trust Fund 2007Latisha WalkerNo ratings yet

- Professional IndemnityDocument7 pagesProfessional IndemnitywanNo ratings yet

- 0625 PHYSICS: MARK SCHEME For The October/November 2010 Question Paper For The Guidance of TeachersDocument6 pages0625 PHYSICS: MARK SCHEME For The October/November 2010 Question Paper For The Guidance of TeachersAr Ar ViNo ratings yet

- Americans For Prosperity 990 2007Document14 pagesAmericans For Prosperity 990 2007justdafactsNo ratings yet

- Labor Relations Process 11th Edition Holley Test BankDocument14 pagesLabor Relations Process 11th Edition Holley Test Banknuadeliaxgzi100% (29)

- Labor Relations Process 11Th Edition Holley Test Bank Full Chapter PDFDocument35 pagesLabor Relations Process 11Th Edition Holley Test Bank Full Chapter PDFNancyWardDDSrods100% (9)

- Retirement & Pension Plan For NYCDCC Employees 2006Document13 pagesRetirement & Pension Plan For NYCDCC Employees 2006Latisha WalkerNo ratings yet

- US Internal Revenue Service: f5500 - 1991Document6 pagesUS Internal Revenue Service: f5500 - 1991IRSNo ratings yet

- Basic Format of ProjectDocument13 pagesBasic Format of ProjectKryxtal KruzNo ratings yet

- Carpenters Vacation Fund 2006Document14 pagesCarpenters Vacation Fund 2006Latisha WalkerNo ratings yet

- CCP-Actual Test Module BDocument50 pagesCCP-Actual Test Module BAmr ElsisiNo ratings yet

- Carpenters Vacation Fund 2007Document8 pagesCarpenters Vacation Fund 2007Latisha WalkerNo ratings yet

- BSBFIM501 Assessment 1Document3 pagesBSBFIM501 Assessment 1samra azad0% (3)

- Description: Tags: Ed524-HkfcDocument2 pagesDescription: Tags: Ed524-Hkfcanon-522517No ratings yet

- Retirement Plan of Trustees 2007Document14 pagesRetirement Plan of Trustees 2007Latisha WalkerNo ratings yet

- AF7 2022-23 Practice Test 3 (July 2020 EG) PDFDocument26 pagesAF7 2022-23 Practice Test 3 (July 2020 EG) PDFAnan Guidel AnanNo ratings yet

- FreedomWorks Foundation 521526916 2006 0317E2DASearchableDocument25 pagesFreedomWorks Foundation 521526916 2006 0317E2DASearchablecmf8926No ratings yet

- Return of Organization Exempt From Income TaxDocument26 pagesReturn of Organization Exempt From Income TaxLeonila Ordonio NoolNo ratings yet

- Installment Request Checklist IFD ApprovedDocument12 pagesInstallment Request Checklist IFD ApprovedVivek Kankipati100% (1)

- Exam 1 AnswersDocument28 pagesExam 1 AnswersHussain ElboshyNo ratings yet

- Advanced Concepts 2009 Answer GuideDocument10 pagesAdvanced Concepts 2009 Answer Guidemacsen.malacaiNo ratings yet

- IOGP423 ScalableQuestionnaire032021Document4 pagesIOGP423 ScalableQuestionnaire032021Akhosh KrishnaNo ratings yet

- US Internal Revenue Service: rp-99-13Document19 pagesUS Internal Revenue Service: rp-99-13IRSNo ratings yet

- Advanced Concepts 2009 Answer GuideDocument10 pagesAdvanced Concepts 2009 Answer Guidemacsen.malacaiNo ratings yet

- Practice Questions for Tableau Desktop Specialist Certification Case BasedFrom EverandPractice Questions for Tableau Desktop Specialist Certification Case BasedRating: 5 out of 5 stars5/5 (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)