Professional Documents

Culture Documents

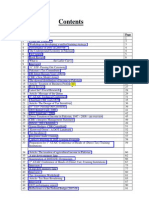

US Internal Revenue Service: p4109

Uploaded by

IRSOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: p4109

Uploaded by

IRSCopyright:

Available Formats

OFFICE OF TAXPAYER BURDEN REDUCTION

How can I contact the Office

of Taxpayer Burden Reduction? Office of Taxpayer

By e-mail:

Burden Reduction

*sbse.otpbr@irs.gov

A member of the

Small Business/Self-Employed Division

www.irs.gov/smallbiz

By mail: [Keyword: TBR]

Internal Revenue Service

What you should know ATTN: Office of TP Burden Reduction SE:S:TBR

5000 Ellin Road C2-470

about the Lanham, MD 20706-1336

Office of Taxpayer

Burden Reduction....

w w w. i r s . g o v

Internal

www.irs.gov Revenue

Service

Pub. 4109 (Rev. 01-2007)

Catalog Number 35107M

P 4109_final07.indd 2 1/24/07 10:56:06 AM

OF FICE OF TA XPAYER BURDEN REDUCTION

What is the How is the Office of Taxpayer Burden Reduction How will IRS Select Burden Reduction Initiatives?

Office of Taxpayer Burden Reduction? Focusing Its Efforts? Burden reduction initiatives will be

The Office of Taxpayer Burden Reduction TBR is focusing its efforts in four major evaluated and prioritized by:

areas: • Determining the number of taxpayers

(TBR) was formed in early 2002, as part

• Simplifying forms and publications; impacted;

of the IRS's effort to reduce burden on

• Streamlining internal policies & • Quantifying the total time and out-of-

taxpayers. procedures; pocket savings for taxpayers;

• Promoting less burdensome rulings • Evaluating any adverse impact on IRS’s

T BR’s mission is to achieve significant

and laws; and voluntary compliance efforts;

burden reduction for taxpayers, by:

• Assisting in the development of • Assessing the feasibility of the initiative,

• Developing burden reduction

a new, more accurate burden given IRS resource limitations; and

proposals;

measurement methodology. • Tying the initiative into IRS objectives.

• Coordinating and championing

burden reduction throughout IRS; Not all burden reduction proposals can be

and Can the Public Submit Ideas for implemented. For example, IRS doesn’t

• Working with Congress, state Reducing Taxpayer Burden? have the ability to change existing tax laws;

and Federal agencies, taxpayers

Yes. Form 13285A, Reducing Tax Burden proposals involving legislative changes

and practitioners to identify and

on America’s Taxpayers, may be used should be submitted directly to congressional

implement meaningful burden

to submit ideas to TBR. The form can be representatives.

reduction efforts.

ordered by calling 1-800-829-3676.

Who will select Burden Reduction Initiatives?

What is Taxpayer Burden? Major burden reduction initiatives will

Taxpayer Burden is defined be selected by the IRS’s Taxpayer Burden

as the time and money Reduction Council. This council consists of

taxpayers spend to top-level executives representing all major

comply with their operating units in the IRS, ensuring the

federal tax obligations. changes required are implemented smoothly.

P 4109_final07.indd 1 1/24/07 10:56:04 AM

OFFICE OF TAXPAYER BURDEN REDUCTION

What is the How is the Office of Taxpayer Burden Reduction How will IRS Select Burden Reduction Initiatives?

Office of Taxpayer Burden Reduction? Focusing Its Efforts? Burden reduction initiatives will be

The Office of Taxpayer Burden Reduction TBR is focusing its efforts in four major evaluated and prioritized by:

areas: • Determining the number of taxpayers

(TBR) was formed in early 2002, as part

• Simplifying forms and publications; impacted;

of the IRS's effort to reduce burden on

• Streamlining internal policies & • Quantifying the total time and out-of-

taxpayers. procedures; pocket savings for taxpayers;

• Promoting less burdensome rulings • Evaluating any adverse impact on IRS’s

TBR’s mission is to achieve significant

and laws; and voluntary compliance efforts;

burden reduction for taxpayers, by:

• Assisting in the development of • Assessing the feasibility of the initiative,

• Developing burden reduction

a new, more accurate burden given IRS resource limitations; and

proposals;

measurement methodology. • Tying the initiative into IRS objectives.

• Coordinating and championing

burden reduction throughout IRS; Not all burden reduction proposals can be

and Can the Public Submit Ideas for

implemented. For example, IRS doesn’t

• Working with Congress, state Reducing Taxpayer Burden?

have the ability to change existing tax laws;

and Federal agencies, taxpayers

Yes. Form 13285A, Reducing Tax Burden proposals involving legislative changes

and practitioners to identify and

on America’s Taxpayers, may be used should be submitted directly to congressional

implement meaningful burden

to submit ideas to TBR. The form can be representatives.

reduction efforts.

ordered by calling 1-800-829-3676.

Who will select Burden Reduction Initiatives?

What is Taxpayer Burden? Major burden reduction initiatives will

Taxpayer Burden is defined be selected by the IRS’s Taxpayer Burden

as the time and money Reduction Council. This council consists of

taxpayers spend to top-level executives representing all major

comply with their operating units in the IRS, ensuring the

federal tax obligations. changes required are implemented smoothly.

P 4109_final07.indd 1 1/24/07 10:56:04 AM

OFFICE OF TAXPAYER BURDE N REDUCTION

What is the How is the Office of Taxpayer Burden Reduction How will IRS Select Burden Reduction Initiatives?

Office of Taxpayer Burden Reduction? Focusing Its Efforts? Burden reduction initiatives will be

The Office of Taxpayer Burden Reduction TBR is focusing its efforts in four major evaluated and prioritized by:

areas: • Determining the number of taxpayers

(TBR) was formed in early 2002, as part

• Simplifying forms and publications; impacted;

of the IRS's effort to reduce burden on

• Streamlining internal policies & • Quantifying the total time and out-of

taxpayers. procedures; pocket savings for taxpayers;

• Promoting less burdensome rulings • Evaluating any adverse impact on IRS’s

TBR’s mission is to achieve significant

and laws; and voluntary compliance efforts;

burden reduction for taxpayers, by:

• Assisting in the development of • Assessing the feasibility of the initiative,

• Developing burden reduction

a new, more accurate burden given IRS resource limitations; and

proposals;

measurement methodology. • Tying the initiative into IRS objectives.

• Coordinating and championing

burden reduction throughout IRS; Not all burden reduction proposals can be

and Can the Public Submit Ideas for implemented. For example, IRS doesn’t

• Working with Congress, state Reducing Taxpayer Burden? have the ability to change existing tax laws;

and Federal agencies, taxpayers

Yes. Form 13285A, Reducing Tax Burden proposals involving legislative changes

and practitioners to identify and

on America’s Taxpayers, may be used should be submitted directly to congressional

implement meaningful burden

to submit ideas to TBR. The form can be representatives.

reduction efforts.

ordered by calling 1-800-829-3676.

Who will select Burden Reduction Initiatives?

What is Taxpayer Burden? Major burden reduction initiatives will

Taxpayer Burden is defined be selected by the IRS’s Taxpayer Burden

as the time and money Reduction Council. This council consists of

taxpayers spend to top-level executives representing all major

comply with their operating units in the IRS, ensuring the

federal tax obligations. changes required are implemented smoothly.

P 4109_final07.indd 1 1/24/07 10:56:04 AM

OFFICE OF TAXPAYER BURDEN REDUCTION

How can I contact the Office

of Taxpayer Burden Reduction? Office of Taxpayer

By e-mail:

Burden Reduction

*sbse.otpbr@irs.gov

A member of the

Small Business/Self-Employed Division

www.irs.gov/smallbiz

By mail: [Keyword: TBR]

Internal Revenue Service

What you should know ATTN: Office of TP Burden Reduction SE:S:TBR

5000 Ellin Road C2-470

about the

Lanham, MD 20706-1336

Office of Taxpayer

Burden Reduction....

w w w. i r s . g o v

Internal

www.irs.gov Revenue

Service

Pub. 4109 (Rev. 01-2007)

Catalog Number 35107M

P 4109_final07.indd 2 1/24/07 10:56:06 AM

OFFICE OF TAXPAYER BURDEN REDUCTION

How can I contact the Office

of Taxpayer Burden Reduction?

Office of Taxpayer

By e-mail:

Burden Reduction

*sbse.otpbr@irs.gov

A member of the

Small Business/Self-Employed Division

www.irs.gov/smallbiz

By mail: [Keyword: TBR]

Internal Revenue Service

What you should know ATTN: Office of TP Burden Reduction SE:S:TBR

5000 Ellin Road C2-470

about the Lanham, MD 20706-1336

Office of Taxpayer

w w w. i r s . g o v

Burden Reduction....

Internal

www.irs.gov Revenue

Service

Pub. 4109 (Rev. 01-2007)

Catalog Number 35107M

P 4109_final07.indd 2 1/24/07 10:56:06 AM

You might also like

- Group 2 Consumption Tax FinalDocument16 pagesGroup 2 Consumption Tax Finaljadyn nicholasNo ratings yet

- Calculation of Taxable Interest On P.F. ContributionDocument2 pagesCalculation of Taxable Interest On P.F. ContributionVishnu R NairNo ratings yet

- H02 - Taxes, Tax Laws and Tax AdministrationDocument10 pagesH02 - Taxes, Tax Laws and Tax AdministrationRachel FuentesNo ratings yet

- Behavioural Insights For Better Tax Administration A Brief GuideDocument36 pagesBehavioural Insights For Better Tax Administration A Brief Guideamornchaiw2603No ratings yet

- Treasury Inspector General For Tax AdministrationDocument29 pagesTreasury Inspector General For Tax AdministrationAnonymous Pb39klJNo ratings yet

- Tax Reforms in IndiaDocument9 pagesTax Reforms in IndiaNabeel ZahiriNo ratings yet

- Conceptual FrameworkDocument12 pagesConceptual FrameworkShiela PanglimaNo ratings yet

- TDS CalculatorDocument3 pagesTDS CalculatorFinance SoftSolvers SolutionsNo ratings yet

- Corporate Taxation & Financial PlanningDocument29 pagesCorporate Taxation & Financial PlanningMonalisa BagdeNo ratings yet

- TAXATION Transcript Part 2 PDFDocument16 pagesTAXATION Transcript Part 2 PDFZyshan NainNo ratings yet

- Departments of Transportation, Treas-Ury, The Judiciary, Housing and Urban Development, and Related Agencies Appropriations For Fiscal YEAR 2006Document86 pagesDepartments of Transportation, Treas-Ury, The Judiciary, Housing and Urban Development, and Related Agencies Appropriations For Fiscal YEAR 2006Scribd Government DocsNo ratings yet

- Chapter 3 FINDocument15 pagesChapter 3 FINVince HernandezNo ratings yet

- Tax Administration/ Reforms in Pakistan: Fazal Amin ShahDocument12 pagesTax Administration/ Reforms in Pakistan: Fazal Amin ShahMubashir SheheryarNo ratings yet

- GAO IRS Audit ReportDocument11 pagesGAO IRS Audit ReportAustin DeneanNo ratings yet

- Tax System in Pakistan PDFDocument15 pagesTax System in Pakistan PDFUsmara balochNo ratings yet

- PK Tax News Dec 2008Document2 pagesPK Tax News Dec 2008PKTaxServicesNo ratings yet

- amit pptDocument15 pagesamit pptamitratha77No ratings yet

- TNF Botswana Feb6 2023Document25 pagesTNF Botswana Feb6 2023arsenali damuNo ratings yet

- Real Tax Service (RTS)Document19 pagesReal Tax Service (RTS)JayaNo ratings yet

- 2020 CBO IRS Enforcement ReportDocument40 pages2020 CBO IRS Enforcement ReportStephen LoiaconiNo ratings yet

- Income Taxes: Basic ConceptsDocument7 pagesIncome Taxes: Basic ConceptsTrisha Mae Mendoza MacalinoNo ratings yet

- October 2010 NewsletterDocument2 pagesOctober 2010 NewsletterKen BillburgNo ratings yet

- GST Readiness: A Roadmap for BusinessesDocument140 pagesGST Readiness: A Roadmap for BusinessesJeethender Kummari KuntaNo ratings yet

- Adv & Dis Adv.Document6 pagesAdv & Dis Adv.suyash dugarNo ratings yet

- Should I Include Employer's Contribution To NPS IDocument2 pagesShould I Include Employer's Contribution To NPS IruchitssNo ratings yet

- By: Rob ButlerDocument18 pagesBy: Rob Butlerextramountain63No ratings yet

- Notes For Diploma SLSP HighlightedDocument75 pagesNotes For Diploma SLSP HighlightedsameehaashrafaliNo ratings yet

- Financial Reporting - Advanced - Tax Rate ReconciliationsDocument6 pagesFinancial Reporting - Advanced - Tax Rate ReconciliationsTami ChitandaNo ratings yet

- Income Tax - Income Tax Guide 2023, Latest NewsDocument34 pagesIncome Tax - Income Tax Guide 2023, Latest NewsnandiniNo ratings yet

- 2202-3978375 - 2022 FTL - IRS - and - Form - 990 - Updates - FINALDocument66 pages2202-3978375 - 2022 FTL - IRS - and - Form - 990 - Updates - FINALJamesMinionNo ratings yet

- Post Graduate Diploma in Tax Management 303 (C) : Tax Audit (Direct & Indirect Taxation)Document16 pagesPost Graduate Diploma in Tax Management 303 (C) : Tax Audit (Direct & Indirect Taxation)Md. Abu NaserNo ratings yet

- Google search for incomw taxDocument3 pagesGoogle search for incomw taxannnoyynnmussNo ratings yet

- Treasury Inspector General For Tax AdministrationDocument26 pagesTreasury Inspector General For Tax AdministrationIRSNo ratings yet

- VAT Compliance Challenges of SMEsDocument20 pagesVAT Compliance Challenges of SMEsElla LuceroNo ratings yet

- Factors Affecting Turnover Tax Collection Performance A Case of West Shoa Selected WoredasDocument22 pagesFactors Affecting Turnover Tax Collection Performance A Case of West Shoa Selected Woredasedwin shikukuNo ratings yet

- Manage Taxes - 8Document1 pageManage Taxes - 8I'm RangaNo ratings yet

- Fiscal Policy 2023-24Document17 pagesFiscal Policy 2023-24priyanshu15678No ratings yet

- Tax Avoidance and Tax EvasionDocument6 pagesTax Avoidance and Tax EvasionDavis Deo KagisaNo ratings yet

- Student Assessment Tasks: BSBFIM501 Manage Budgets and Financial PlansDocument37 pagesStudent Assessment Tasks: BSBFIM501 Manage Budgets and Financial PlansLovepreetNo ratings yet

- Corporate Tax Services: The Power of Being UnderstoodDocument2 pagesCorporate Tax Services: The Power of Being Understoodgra8leoNo ratings yet

- Ainsworth Accountants' Guide To Limited Company TaxDocument3 pagesAinsworth Accountants' Guide To Limited Company Taxviper99309No ratings yet

- Consulting Company Provides Tax Services and Accounting SupportDocument5 pagesConsulting Company Provides Tax Services and Accounting SupportsuhemiNo ratings yet

- summer trainning presentationDocument20 pagessummer trainning presentationUnpacked MusicNo ratings yet

- Tax Credit Certificate - 2018 : PPS No: 1793106MADocument4 pagesTax Credit Certificate - 2018 : PPS No: 1793106MAAlexandru CiobanuNo ratings yet

- Materials For How To Handle BIR Audit Procedures of BIR Audit - 2021 Sept 21Document83 pagesMaterials For How To Handle BIR Audit Procedures of BIR Audit - 2021 Sept 21cool_peach100% (2)

- Provision of Train Law UpdatedDocument91 pagesProvision of Train Law UpdatedAldrich De VeraNo ratings yet

- GST PPT June19Document65 pagesGST PPT June19yash bhushanNo ratings yet

- Adamawa TaxDocument11 pagesAdamawa Taxfope afrikaNo ratings yet

- Tax Roundtable 2019Document4 pagesTax Roundtable 2019Danielle BrodyNo ratings yet

- Assessment and Taxation Department - City of WinnipegDocument5 pagesAssessment and Taxation Department - City of WinnipegT NgNo ratings yet

- Package One - Lowering The Personal Income Tax - #TaxReformNowDocument4 pagesPackage One - Lowering The Personal Income Tax - #TaxReformNowJarwikNo ratings yet

- SGV and Co Presentation On TRAIN LawDocument48 pagesSGV and Co Presentation On TRAIN LawPortCalls100% (8)

- SYBCom Budget Types DeficitDocument13 pagesSYBCom Budget Types DeficitPriPat GamingNo ratings yet

- Recent tax reforms in IndiaDocument18 pagesRecent tax reforms in IndiaSatyam KanwarNo ratings yet

- Doing Business in Malaysia 2021-2022Document26 pagesDoing Business in Malaysia 2021-2022sktay1128No ratings yet

- Tax Laws June2020 Old Syllabus - CS ExecutiveDocument824 pagesTax Laws June2020 Old Syllabus - CS ExecutivePravinNo ratings yet

- Tax Function Effectiveness Best Practice ChecklistDocument2 pagesTax Function Effectiveness Best Practice ChecklistGbengaNo ratings yet

- World Bank Assessment For Doing Business Report-2021: Starting A Business & Paying TaxesDocument12 pagesWorld Bank Assessment For Doing Business Report-2021: Starting A Business & Paying TaxesAdarsh ShettyNo ratings yet

- Direct Tax - The Boost For EconomyDocument10 pagesDirect Tax - The Boost For EconomySagar DhanakNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Credit Cards SO APIDocument430 pagesCredit Cards SO APIsudeepk_sapNo ratings yet

- Balance Sheet of Union Bank of IndiaDocument2 pagesBalance Sheet of Union Bank of Indiajini02No ratings yet

- Research Paper On Fiscal Performance of Haryana A Critical Study - Sushil KumarDocument11 pagesResearch Paper On Fiscal Performance of Haryana A Critical Study - Sushil Kumarvoldemort1989100% (1)

- A Study On Brand Image of Icici Prudential Life Insurance LTDDocument44 pagesA Study On Brand Image of Icici Prudential Life Insurance LTDRanjit PandaNo ratings yet

- Gravestone DojiDocument2 pagesGravestone Dojilaba primeNo ratings yet

- Statement of Purpose - MS in EconomicsDocument2 pagesStatement of Purpose - MS in EconomicsVishal KuthialaNo ratings yet

- Irrevocable Power of AttorneyDocument6 pagesIrrevocable Power of AttorneyAlpesh ThakkarNo ratings yet

- LU20 - Tax StrategyDocument56 pagesLU20 - Tax StrategyAnil HarichandreNo ratings yet

- CREDIT CARD STATEMENT SUMMARYDocument4 pagesCREDIT CARD STATEMENT SUMMARYAravind SunithaNo ratings yet

- Indian Banking Sector MergersDocument10 pagesIndian Banking Sector MergersVinayrajNo ratings yet

- Weekly Choice - Section B - April 05, 2012Document6 pagesWeekly Choice - Section B - April 05, 2012Baragrey DaveNo ratings yet

- Session 13 14 Dividend Policy ClassDocument22 pagesSession 13 14 Dividend Policy ClassHenielene Davidson West PariatNo ratings yet

- Head Hunter ListDocument5 pagesHead Hunter ListJulius Yasdi0% (1)

- 0 DTE MEIC - January 16, 2023 by Tammy ChamblessDocument19 pages0 DTE MEIC - January 16, 2023 by Tammy Chamblessben44No ratings yet

- AACE Cash FlowDocument17 pagesAACE Cash FlowFrancois-No ratings yet

- Small BusinessDocument11 pagesSmall BusinessSaahil LedwaniNo ratings yet

- A Stduy of Working Capital Management of Everest Bank Limited LaxmiDocument7 pagesA Stduy of Working Capital Management of Everest Bank Limited LaxmiMukesh CnghNo ratings yet

- Intermediate: AccountingDocument74 pagesIntermediate: AccountingTiến NguyễnNo ratings yet

- Business Differences in Developing CountriesDocument2 pagesBusiness Differences in Developing CountriesSevinc SalmanovaNo ratings yet

- DOTgazette - Aug06 - July08.Document196 pagesDOTgazette - Aug06 - July08.M Munir Qureishi100% (1)

- Property Investment Tips Ebook - RWinvest PDFDocument40 pagesProperty Investment Tips Ebook - RWinvest PDFddr95827No ratings yet

- Final Course Outline-Marketing of Financial Products & ServicesDocument3 pagesFinal Course Outline-Marketing of Financial Products & ServicesDivya AhujaNo ratings yet

- Advanced Partnership AccountingDocument24 pagesAdvanced Partnership AccountingElla Mae TuratoNo ratings yet

- Tarun Das CV For Public Financial Management ReformsDocument13 pagesTarun Das CV For Public Financial Management ReformsProfessor Tarun DasNo ratings yet

- Financial Accounting & Reporting First Grading Examination: Name: Date: Professor: Section: ScoreDocument15 pagesFinancial Accounting & Reporting First Grading Examination: Name: Date: Professor: Section: ScoreCUSTODIO, JUSTINE A.No ratings yet

- DocumentDocument16 pagesDocumentKiko FinanceNo ratings yet

- Presentation by Bikramjeet Singh ON Study On Working Capital Management On Iffco-Phulpur UnitDocument14 pagesPresentation by Bikramjeet Singh ON Study On Working Capital Management On Iffco-Phulpur UnitPreetaman SinghNo ratings yet

- Total Item Description Unit PriceDocument3 pagesTotal Item Description Unit PriceMartin Kyuks100% (2)

- Fast Path NavigationsDocument8 pagesFast Path Navigationsakshay sasidhar100% (1)

- Employees Provident Fund RulesDocument74 pagesEmployees Provident Fund RulesRAKESH NANDANNo ratings yet