Professional Documents

Culture Documents

Bethesda & Goodweek

Uploaded by

Dian Pratiwi RusdyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bethesda & Goodweek

Uploaded by

Dian Pratiwi RusdyCopyright:

Available Formats

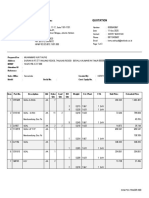

BETHESDA MINING COMPANY

in thousand

Quantity Sales revenue ($) Total Sales

Year Produced

(ton) 34 40 Revenue

1 650 20400 2000 22400

2 725 20400 5000 25400

3 810 20400 8400 28800

4 740 20400 5600 26000

MACRS Schedule

Year 7 Years

1 0.143

2 0.245

3 0.175

4 0.125

5 0.89

6 0.89

7 0.89

In thousand USD

New Mining Equipment 30,000

0 1 2 3 4 5 6

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Investments:

1 New Mining Equipment (30,000) 14,716.8

2 Accumulated depreciation 4,290 11,640 16,890 20,640

3 Adjusted basis of new

mining equipment after

depreciation (end of year) 25,710 18,360 13,110 9,360

4 Opportunity Cost

- Land (5,000) 5,000

5 Net Working capital (end o 5% - 1,120 1,270 1,440 1,300

6 Change in net working capital (1,120) (150) (170) 140

7 Total Cash Flow of Investment (35,000) (1,120) (150) (170) 5,140 - -

Income:

8 Sales revenue 22,400 25,400 28,800 26,000

9 Operating Costs:

- Fixed cost (2,500) (2,500) (2,500) (2,500)

- Variable Cost 13 (8,450) (9,425) (10,530) (9,620)

-Land reclaiming (4,000)

-Charitable expense (6,000)

10 Depreciation (4,290) (7,350) (5,250) (3,750)

11 Income before taxes 7,160 6,125 10,520 6,130 - (6,000)

12 Tax at 38% 38% 2,721 2,328 3,998 2,329 - -

13 Net Income 4,439 3,798 6,522 3,801 - (6,000)

* The taxable amount $8.640 = (60% x 30.000) - $9.360. The aftertax salvage value is $18.000 - (38%($18.000-$9.360)) = $ 14.716,8

1 Net Present Value

Cash Inflow Year 0 1 2 3 4 5 6

Total Inflow - 8,729 11,148 11,772 22,267 - (6,000)

Cash Outflow

Total Outflow 35,000 - - - - - -

Net Cash Flow (35,000) 8,729 11,148 11,772 22,267 - (6,000)

DCF 12% 1.0000 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066

Present Value -35,000 7,794 8,887 8,379 14,151 - (3,040)

NPV 32,296

2 IRR 13.51%

3 Year 0 1 2 3 4 5 6

Accumulated NCF (35,000) (26,271) (15,123) (3,351) 18,917 18,917 12,917

Payback Period 3.1505

4 Profitability Index

Year 0 1 2 3 4 5 6

PV Cash Inflow - 7,794 8,887 8,379 14,151 - (3,040)

PV Cash Outflow 35,000 - - - - - -

Profitability Index 1.0335

5 Average Accounting Return

Average net income= 2,093

Average investment= 35,000

AAR= 6%

6 Modified IRR 5.99%

GOODWEEK TIRES,INC.

Growth of Sales 2%

Inflation Rate 3.25%

Market share

- OEM Market 11%

- Replacement Market 8%

in thousand

Industry Quantity Produced (unit) Quantity Produced (unit) Price ($/unit) Sales revenue ($) Total Sales Variable Cost Variable Cost Total Variable

Year

OEM Replacement OEM Replacement OEM Replacement OEM Replacement Revenue per unit OEM Replacement Cost

1 8,000 14,000 880 1,120 38.00 59.00 33,440.00 51,920.00 85,360.00 18 15,840 20,160 36,000

2 8,160 14,280 898 1,142.4 39.62 61.51 35,558.42 70,266.17 105,824.59 18.77 16,843.46 21,437.14 38,280.60

3 8,323 14,565.60 916 1,165.25 41.30 64.12 37,811.05 74,717.53 112,528.58 19.56 17,910.50 22,795.18 40,705.68

4 8,490 14,856.91 934 1,188.55 43.05 66.85 40,206.38 79,450.89 119,657.27 20.39 19,045.13 24,239.25 43,284.38

MACRS Schedule

Year 7 Years

1 0.143

2 0.245

3 0.175

4 0.125

5 0.89

6 0.89

7 0.89

New Equipment 120,000 In thousand USD

0 1 2 3 4

Year 0 Year 1 Year 2 Year 3 Year 4

Investments:

1 New Equipment (120,000) 45,576

2 Accumulated depreciation 17,160 46,560 67,560 82,560

Adjusted basis of new equipment after

3 102,840 73,440 52,440 37,440

depreciation (end of year)

4 Opportunity Cost - - - - -

5 Net Working capital (end of year) 15% 11,000 12,804 15,874 16,879 17,949

6 Change in net working capital (11,000) (1,804) (3,070) (1,006) (1,069)

7 Total Cash Flow of Investment (131,000) (1,804) (3,070) (1,006) (1,069)

Income:

8 Sales revenue 85,360 105,825 112,529 119,657

9 Operating Costs:

- Marketing&General Administration Cost 25,000 25,813 26,651 27,518

- Variable Cost 36,000 38,281 40,706 43,284

10 Depreciation 17,160 29,400 21,000 15,000

11 Income before taxes 7,200 12,331 24,171 33,855

12 Tax at 40% 40% 2,880 4,933 9,669 13,542

13 Net Income 4,320 7,399 14,503 20,313

* The taxable amount is $ 13.560 (=$51.000 - $37.440). The aftertax salvage value $51.000 - ( 40%x($51.000 - $37.440)) = $ 45.576

1 Net Present Value

Cash Inflow Year 0 1 2 3 4

Total Inflow - 21,480 36,799 35,503 80,889

Cash Outflow

Total Outflow 131,000 - - - -

Net Cash Flow (131,000) 21,480 36,799 35,503 80,889

DCF 15.9% 1.0000 0.8628 0.7444 0.6423 0.5542

Present Value -131,000 18,533 27,395 22,804 44,829

NPV (17,439)

2 IRR 10.25%

3 Year 0 1 2 3 4

Payback Period 3.5399

Accumulated NCF (131,000) (109,520) (72,721) (37,218) 43,671

4 Profitability Index

Year 0 1 2 3 4

PV Cash Inflow - 18,533 27,395 22,804 44,829

PV Cash Outflow 131,000 - - - -

Profitability Index 0.8669

5 Average Accounting Return

Average net income= 11,634

Average investment= 65,500

AAR= 17.76%

6 Modified IRR 7.46%

Price ($/unit)

Year

OEM Replacement

1 38 59

2 39.62 61.51

3 41.30 64.12

4 43.05 66.85

New Mining Equipment 30,000

0 1 2 3 4

Year 0 Year 1 Year 2 Year 3 Year 4

Investments:

1 New Mining Equipment (30,000.00) 14,716.80

2 Accumulated depreciation 4,290.00 11,640.00 16,890.00 20,640.00

Adjusted basis of new mining equipment

3 25,710.00 18,360.00 13,110.00 9,360.00

after depreciation (end of year)

4 Opportunity Cost

- Land (5,000.00) 5,000.00

5 Net Working capital (end of year) 0.05 1,120.00 1,270.00 1,440.00 1,300.00

6 Change in net working capital (150.00) (170.00) 140.00

7 Total Cash Flow of Investment (35,000.00) - (150.00) (170.00) 19,856.80

Income:

8 Sales revenue 22,400.00 25,400.00 28,800.00 26,000.00

9 Operating Costs:

- Fixed cost 2,500.00 2,500.00 2,500.00 2,500.00

- Variable Cost 13 8,450.00 9,425.00 10,530.00 9,620.00

-Land reclaiming

-Charitable expense

10 Depreciation 4,290.00 7,350.00 5,250.00 3,750.00

11 Income before taxes 7,160.00 6,125.00 10,520.00 10,130.00

12 Tax at 38% 0.38 2,720.80 2,327.50 3,997.60 3,849.40

13 Net Income 4,439.20 3,797.50 6,522.40 6,280.60

* The taxable amount $8.640 = (60% x 30.000) - $9.360. The aftertax salvage value is $18.000 - (38%($18.000-$9.360)) = $ 14.716,8

Varia

Sales revenue ($) ble Variable Cost

Year Cost

OEM Replacement Total Sales Revenue per OEM Replacement

33,440 51,920 85,360 1 18

unit 15,840 20,160

35,558.42 70,266.17 105,825 2 19 16,843 21,437

37,811.05 74,717.53 112,529 3 20 17,910 22,795

40,206.38 79,450.89 119,657 4 20 19,045 24,239

In thousand USD

5 6

Year 5 Year 6

- -

1 Net Present Value

Cash Inflow

Total Inflow - 4,439.20

4,000.00 Cash Outflow

(6,000.00) Total Outflow (35,000.00) -

Net Cash Flow (35,000.00) 4,439.20

(4,000.00) 6,000.00

2,280.00 DCF 0.12 1.0000 0.8929

(4,000.00) 3,720.00 Present Value (35,000.00) 3,963.57

NPV (6,590.54)

2 IRR 0.04

3 Payback Period 10.38

Accumulated NCF (35,000.00) (30,560.80)

4 Profitability Index

PV Cash Inflow - 3,963.57

PV Cash Outflow (35,000.00) -

Profitability Index (0.67)

5 Average Accounting Return

Average net income= 3,459.95

Average investment= 5,833.33

AAR= 0.59

6 Modified IRR 0.08

Total Variable

Cost

36,000

38,281

40,706

43,284

3,797.50 6,522.40 6,280.60 (4,000.00) 3,720.00

(150.00) (170.00) 19,856.80 - -

3,647.50 6,352.40 26,137.40 (4,000.00) 3,720.00

0.7972 0.7118 0.6355 0.5674 0.5066

2,907.76 4,521.51 16,610.79 (2,269.71) 1,884.67

(26,913.30) (20,560.90) 5,576.50 1,576.50 5,296.50

3,027.34 4,642.52 3,991.43 (2,269.71) 1,884.67

(119.58) (121.00) 12,619.36 - -

You might also like

- Mini Case: Bethesda Mining Company: Disusun OlehDocument5 pagesMini Case: Bethesda Mining Company: Disusun Olehrica100% (2)

- CHAPTER 6 Case SolutionDocument3 pagesCHAPTER 6 Case SolutionJeffy Jan100% (2)

- Goodweek Tires, Inc - A tire producing companyDocument20 pagesGoodweek Tires, Inc - A tire producing companyMai Trần100% (1)

- Goodweek Tires investment analysis and financial projectionsDocument7 pagesGoodweek Tires investment analysis and financial projectionsKishor MahmudNo ratings yet

- LBO Valuation of Cheek ProductsDocument4 pagesLBO Valuation of Cheek ProductsEfri Dwiyanto100% (2)

- Bethesda Mining CompanyDocument2 pagesBethesda Mining CompanyShivam BhasinNo ratings yet

- 2 Solucion Bethesda Mining CompanyDocument4 pages2 Solucion Bethesda Mining CompanyCelia Bonifaz Ordoñez100% (3)

- Fonderia TorinoDocument3 pagesFonderia TorinoMatilda Sodji100% (1)

- Final Exam Financial Management Antonius Cliff Setiawan 29119033Document20 pagesFinal Exam Financial Management Antonius Cliff Setiawan 29119033Antonius CliffSetiawan100% (4)

- Nike CaseDocument7 pagesNike CaseNindy Darista100% (1)

- Bethesda Mining CompanyDocument9 pagesBethesda Mining Companycharles100% (3)

- YVC and TSE Merger ValuationDocument9 pagesYVC and TSE Merger ValuationRizky Yoga Pratama100% (1)

- Answer of Integrative Case 1 (Track Software, LTD)Document2 pagesAnswer of Integrative Case 1 (Track Software, LTD)Mrito Manob67% (3)

- Oracle Systems Corporation CaseDocument3 pagesOracle Systems Corporation CaseDarinho Dos SantosNo ratings yet

- Fonderia Di Torino SDocument15 pagesFonderia Di Torino SYrnob RokieNo ratings yet

- Case Study Bethesda MiningDocument8 pagesCase Study Bethesda MiningAkshay Aggarwal100% (1)

- Eastboro Machine Tools - Class (Version 1)Document12 pagesEastboro Machine Tools - Class (Version 1)Shriniwas Nehete100% (1)

- Investment Detective CaseDocument3 pagesInvestment Detective CaseWidyawan Widarto 闘志50% (2)

- Fonderia Di Torino (Final)Document4 pagesFonderia Di Torino (Final)Tracye Taylor100% (2)

- This Study Resource Was: Integrative Case 7: Casa de DisenoDocument5 pagesThis Study Resource Was: Integrative Case 7: Casa de DisenoFikri N SetyawanNo ratings yet

- Developing Financial Insight - Tugas MBA ITB Syndicate 2 CCE58 2018Document5 pagesDeveloping Financial Insight - Tugas MBA ITB Syndicate 2 CCE58 2018DenssNo ratings yet

- Fonderia Di Torino Case Study GroupDocument15 pagesFonderia Di Torino Case Study GroupFarhan SoepraptoNo ratings yet

- Goodweek TiresDocument9 pagesGoodweek TiresMobeen Habib100% (3)

- Assignment 2Document3 pagesAssignment 2Shulav ShresthaNo ratings yet

- Analyze Capital Projects Using NPV, IRR, Payback for Highest ReturnDocument10 pagesAnalyze Capital Projects Using NPV, IRR, Payback for Highest Returnwiwoaprilia100% (1)

- Investment DetectiveDocument5 pagesInvestment DetectiveNadya Rizkita100% (1)

- Mini Case Chapter 19Document10 pagesMini Case Chapter 19ricky setiawan100% (3)

- MANNx Syndicate 7Document8 pagesMANNx Syndicate 7heda kaleniaNo ratings yet

- Casa de DisenoDocument8 pagesCasa de DisenoMarilou Broñosa-PepañoNo ratings yet

- MBA Decision CaseDocument12 pagesMBA Decision CaseOm PrakashNo ratings yet

- An Introduction to the Impact of Debt on Firm ValueDocument9 pagesAn Introduction to the Impact of Debt on Firm ValueBernadeta PramudyaWardhaniNo ratings yet

- Fonderia Di Torino's Case - Syndicate 5Document20 pagesFonderia Di Torino's Case - Syndicate 5Yunia Apriliani Kartika0% (1)

- Calculating the Present Value of Cash Flows from a Potential AcquisitionDocument3 pagesCalculating the Present Value of Cash Flows from a Potential AcquisitionIsmaeel TarNo ratings yet

- Ben's MBA Decision AnalysisDocument11 pagesBen's MBA Decision AnalysisanuragNo ratings yet

- Eastboro Case SolutionDocument22 pagesEastboro Case Solutionuddindjm100% (2)

- Eco Plastics CompanyDocument2 pagesEco Plastics CompanyKhai Eman100% (4)

- The MBA Decision: Current PositionDocument3 pagesThe MBA Decision: Current PositionParshant Gupta100% (1)

- Eastboro - Sindikat 2Document14 pagesEastboro - Sindikat 2Dudy Hatari0% (1)

- Case Analysis Casa DisenoDocument7 pagesCase Analysis Casa DisenoLexNo ratings yet

- Identifying ZOPA: The Potential Zone of AgreementDocument2 pagesIdentifying ZOPA: The Potential Zone of AgreementFadhila Hanif100% (1)

- Negotiation Agreement (Hollyville) - SellerDocument3 pagesNegotiation Agreement (Hollyville) - SellerDimas FathurNo ratings yet

- Birdie Golf-Hybrid Golf Merger AnalysisDocument8 pagesBirdie Golf-Hybrid Golf Merger AnalysisSiska Kurniawan0% (1)

- Case Study On Goodweek Tires, IncDocument10 pagesCase Study On Goodweek Tires, Incmuknerd100% (10)

- UTS / Mid Semester Test Finance Management (M5007) - MBA ITB CCE 58 2018Document28 pagesUTS / Mid Semester Test Finance Management (M5007) - MBA ITB CCE 58 2018DenssNo ratings yet

- Analysis Slides-WACC NikeDocument25 pagesAnalysis Slides-WACC NikePei Chin100% (3)

- 2008-09-28 201134 BethesdaDocument4 pages2008-09-28 201134 BethesdaAfrianto Budi Aan100% (1)

- Bethesda Mining CompanyDocument8 pagesBethesda Mining CompanyKaushik KanumuriNo ratings yet

- The Investment Detective (Answer)Document2 pagesThe Investment Detective (Answer)Eddy ErmanNo ratings yet

- Gainesboro CaseDocument6 pagesGainesboro CaseDanny4118100% (2)

- Kota Fibres IncDocument20 pagesKota Fibres IncMuhamad FudolahNo ratings yet

- Case Study LeasingDocument3 pagesCase Study LeasingNicolaus Chandra100% (2)

- Eastboro Machine Tools Corporation: Exhibit 1Document10 pagesEastboro Machine Tools Corporation: Exhibit 1Angela Lopez100% (1)

- Final Exam - Manfin - EMBA61 - 2020Document12 pagesFinal Exam - Manfin - EMBA61 - 2020NurIndah100% (1)

- Goff Computer's Cost of Capital AnalysisDocument13 pagesGoff Computer's Cost of Capital AnalysisChris Galvez100% (1)

- Fonderia Di Torino ExcelDocument10 pagesFonderia Di Torino Excelpeachrose12100% (1)

- Fonderia DI TorinoDocument19 pagesFonderia DI TorinoA100% (3)

- Ceci TEAMWORK HW - Case - New and Repaired FurnaceDocument14 pagesCeci TEAMWORK HW - Case - New and Repaired FurnaceMarcela GzaNo ratings yet

- Carbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsDocument1 pageCarbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsRajib Dahal50% (2)

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyDocument1 pageChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalNo ratings yet

- Annisa Harovanta - Business Model Canvas A Tool For Entrepreneurs and Innovators (Project-Centered Course)Document1 pageAnnisa Harovanta - Business Model Canvas A Tool For Entrepreneurs and Innovators (Project-Centered Course)AprfifteenNo ratings yet

- AUD 1206 Case Analysis RisksDocument2 pagesAUD 1206 Case Analysis RisksRNo ratings yet

- Solution Manual For Managerial Economics in A Global Economy 8th Edition by SalvatoreDocument20 pagesSolution Manual For Managerial Economics in A Global Economy 8th Edition by SalvatorePoonam Singh100% (8)

- Case Study On Larry FinkDocument4 pagesCase Study On Larry FinkSash Dhoni7No ratings yet

- Articles of Incorporation Publishing CompanyDocument3 pagesArticles of Incorporation Publishing CompanySheryl VelascoNo ratings yet

- Resume - J.P. DubeyDocument5 pagesResume - J.P. DubeyRanjana DubeyNo ratings yet

- Assignment On Labour Law PDFDocument11 pagesAssignment On Labour Law PDFTwokir A. Tomal100% (1)

- Rek April2023Document14 pagesRek April2023asna simamoraNo ratings yet

- TDS Story - CA Amit MahajanDocument6 pagesTDS Story - CA Amit MahajanUday tomarNo ratings yet

- Bartertrade - Io - WhitepaperDocument41 pagesBartertrade - Io - WhitepaperRandall FlaggNo ratings yet

- Welcome To Mini Project Presentation On A Compartive Financial Performance Analysis of and Power by Means of Ratios Tata Steel and Jindal SteelDocument11 pagesWelcome To Mini Project Presentation On A Compartive Financial Performance Analysis of and Power by Means of Ratios Tata Steel and Jindal Steelब्राह्मण विभोरNo ratings yet

- PT Trakindo Utama: QuotationDocument3 pagesPT Trakindo Utama: QuotationANISNo ratings yet

- Return: Return What Is GST ReturnDocument3 pagesReturn: Return What Is GST ReturnNagarjuna ReddyNo ratings yet

- Error RegconitionDocument15 pagesError RegconitionNguyễn Trần Hoài ÂnNo ratings yet

- Proof of Cash CelticsDocument3 pagesProof of Cash CelticsCJ alandyNo ratings yet

- BCPODocument2 pagesBCPOJaylord AgpuldoNo ratings yet

- MARINE SERRE-Roshni DhandabaniDocument63 pagesMARINE SERRE-Roshni DhandabaniRoshniNo ratings yet

- Compare and Contrast The StandardizedDocument1 pageCompare and Contrast The StandardizedVikram Kumar100% (1)

- E-Commerce 2015 11th Edition Laudon Solutions Manual 1Document36 pagesE-Commerce 2015 11th Edition Laudon Solutions Manual 1joshuamooreqicoykmtan100% (21)

- Viral Marketing and Social Media StatisticsDocument16 pagesViral Marketing and Social Media Statisticsosama haseebNo ratings yet

- Employee Satisfaction Result Period 2023Document15 pagesEmployee Satisfaction Result Period 2023Doppy LianoNo ratings yet

- Global Craft Beer MarketDocument2 pagesGlobal Craft Beer MarkettagotNo ratings yet

- Hindustan TimesDocument65 pagesHindustan TimesPREETNo ratings yet

- Chapter 1Document93 pagesChapter 1Ranrave Marqueda DiangcoNo ratings yet

- Lundstrom Sectional Bookcases - 1921Document42 pagesLundstrom Sectional Bookcases - 1921Dan MarrNo ratings yet

- Jungle Scouts Profit Margin BreakdownDocument14 pagesJungle Scouts Profit Margin BreakdownSivaraja Gopinathan0% (1)

- WTO Philippines Spirits AnalysisDocument11 pagesWTO Philippines Spirits Analysisodin_siegreicher100% (1)

- SOA Platform Basics and Support in J2EE and .NETDocument46 pagesSOA Platform Basics and Support in J2EE and .NETBala SubramanianNo ratings yet

- Bank of Punjab PresentationDocument25 pagesBank of Punjab PresentationUmer AhmadNo ratings yet

- Project ManagementDocument13 pagesProject ManagementAnnaNo ratings yet