Professional Documents

Culture Documents

US Internal Revenue Service: F1120ric - 2000

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: F1120ric - 2000

Uploaded by

IRSCopyright:

Available Formats

Form 1120-RIC U.S. Income Tax Return for OMB No.

1545-1010

Regulated Investment Companies

Department of the Treasury

Internal Revenue Service

For calendar year 2000 or tax year beginning

䊳

, 2000, and ending

Instructions are separate. See page 11 for Paperwork Reduction Act Notice.

, 20 2000

A Year of RIC status Name of fund C Employer identification number

election

Please

type or Number, street, and room or suite no. (If a P.O. box, see page 5 of instructions.) D Total assets (See page 5 of

B Date fund was established print instructions.)

(See page 5 of instructions.)

City or town, state, and ZIP code

$

E Check applicable boxes: (1) Final return (2) Change of address (3) Amended return

F Check if the fund is a personal holding company (attach Sch. PH) or if the fund is not in compliance with Regs. sec. 1.852-6 for this tax year 䊳

Part I—Investment Company Taxable Income (See page 5 of instructions.)

1 Dividends 1

2 Interest 2

3 Net foreign currency gain or (loss) from section 988 transactions (attach schedule) 3

Income

4 Payments with respect to securities loans 4

5 Excess of net short-term capital gain over net long-term capital loss from Schedule D (Form

1120), line 14 (attach Schedule D (Form 1120)) 5

6 Net gain or (loss) from Form 4797, Part II, line 18 (attach Form 4797) 6

7 Other income (see page 5 of instructions—attach schedule) 7

8 Total income. Add lines 1 through 7 䊳 8

9 Compensation of officers (Schedule E, line 2) 9

10 Salaries and wages (less employment credits) 10

11 Rents 11

12

Deductions (See page 5 of instructions.)

12 Taxes and licenses

13 Interest 13

14 Depreciation (attach Form 4562) 14

15 Advertising 15

16 Registration fees 16

17 Insurance 17

18 Accounting and legal services 18

19 Management and investment advisory fees 19

20 Transfer agency, shareholder servicing, and custodian fees and expenses 20

21 Reports to shareholders 21

22 Other deductions (attach schedule) 22

23 Total deductions. Add lines 9 through 22 䊳 23

24 Taxable income before deduction for dividends paid. Subtract line 23 from line 8 24

25 Less: Deduction for dividends paid (Schedule A, line 6a) 25

26 Investment company taxable income. Subtract line 25 from line 24 26

27 Total tax (Schedule J, line 8) 27

28 Payments: a 1999 overpayment credited to 2000 28a

Tax and Payments

b 2000 estimated tax payments 28b

c Less 2000 refund applied for on Form 4466 28c ( ) d Bal 䊳 28d

e Tax deposited with Form 7004 28e

f Credit for tax paid on undistributed capital gains (attach Form 2439) 28f

g Credit for Federal tax paid on fuels (attach Form 4136) 28g 28h

29 Estimated tax penalty (see page 8 of instructions). Check if Form 2220 is attached 䊳 29

30 Tax due. If line 28h is smaller than the total of lines 27 and 29, enter amount owed 30

31 Overpayment. If line 28h is larger than the total of lines 27 and 29, enter amount overpaid 31

32 Enter amount of line 31 you want: Credited to 2001 estimated tax 䊳 Refunded 䊳 32

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

䊳 Signature of officer Date 䊳 Title

Paid

Preparer’s

signature 䊳 Date

Check if self-

employed 䊳

Preparer’s SSN or PTIN

䊳

Preparer’s Firm’s name (or EIN 䊳

Use Only yours if self-employed),

address, and ZIP code Phone no. ( )

Cat. No. 64140B Form 1120-RIC (2000)

Form 1120-RIC (2000) Page 2

Part II—Tax on Undistributed Net Capital Gain Not Designated Under Section 852(b)(3)(D)

1 Net capital gain from Schedule D (Form 1120), line 13 (attach Schedule D (Form 1120)) 1

2 Less: Capital gain dividends from Schedule A, line 6b 2

3 Amount subject to tax. Subtract line 2 from line 1 3

4 Capital gains tax. Multiply line 3 by 35% (.35). Enter tax here and on line 3b, Schedule J 4

Schedule A Deduction for Dividends Paid (Do not include exempt-interest dividends or capital gain dividends

reported on Form 2438, line 9b.) (See page 8 of instructions.)

1 Dividends paid (other than dividends paid after the end of the tax year). Do (a) Ordinary dividends (b) Capital gain dividends

not include dividends considered paid in the preceding tax year under section

852(b)(7) or 855(a), or deficiency dividends as defined in section 860 1

2 Dividends paid in the 12-month period following the close of the tax year that

the fund elects to treat as paid during the tax year under section 855(a) 2

3 Dividends declared in October, November, or December and deemed

paid on December 31 under section 852(b)(7) 3

4 Consent dividends (section 565) (attach Forms 972 and 973) 4

5 Foreign tax paid deduction (section 853(b)(1)(B)), if applicable 5

6 Deduction for dividends paid:

a Ordinary dividends. Add lines 1 through 5 of column (a). Enter here and on page 1, line 25 6a

b Capital gain dividends. Add lines 1 through 4 of column (b). Enter here

and on Part II, line 2, above 6b

Schedule B Information Required With Respect to Income From Tax-Exempt Obligations

1 Did the fund qualify under section 852(b)(5) to pay exempt-interest dividends for 2000? 䊳 Yes No

If “Yes,” complete lines 2 through 5. If “No,” go to Schedule E. (See page 8 of instructions.)

2 Amount of interest excludible from gross income under section 103(a) 2

3 Amounts disallowed as deductions under sections 265 and 171(a)(2) 3

4 Net income from tax-exempt obligations. Subtract line 3 from line 2 4

5 Amount of line 4 designated as exempt-interest dividends 5

Schedule E Compensation of Officers (See instructions for line 9, page 1.)

Note: Complete Schedule E only if total receipts (line 8, Part I, plus net capital gain from line 1, Part II, and line 9a,

Form 2438) are $500,000 or more.

(b) Social security (c) Percent of time (d) Percent of fund (e) Amount of

(a) Name of officer

number devoted to business stock owned compensation

1 % %

% %

2 Total compensation of officers. Enter here and on line 9, page 1 2

Schedule J Tax Computation (See page 8 of instructions.)

1 Check if the fund is a member of a controlled group (see sections 1561 and 1563) 䊳

Important: Members of a controlled group, see instructions on page 8.

2a If the box on line 1 is checked, enter the fund’s share of the $50,000, $25,000, and $9,925,000

taxable income brackets (in that order):

(1) $ (2) $ (3) $

b Enter the fund’s share of:

(1) Additional 5% tax (not more than $11,750) $

(2) Additional 3% tax (not more than $100,000) $

3a Tax on investment company taxable income 3a

b Capital gains tax. Enter amount from Part II, line 4, above 3b

c Alternative minimum tax (attach Form 4626) 3c

d Income tax. Add lines 3a through 3c 3d

4a Foreign tax credit (attach Form 1118) 4a

b Check: Nonconventional source fuel credit QEV credit (attach Form 8834) 4b

c General business credit. Enter here and check which forms are attached:

3800 3468 5884 6478 6765

8586 8830 8826 8835 8844

8845 8846 8820 8847 8861 4c

d Credit for prior year minimum tax (attach Form 8827) 4d

e Total credits. Add lines 4a through 4d 4e

5 Subtract line 4e from line 3d 5

6 Personal holding company tax (attach Schedule PH (Form 1120)) 6

7 Recapture taxes. Check if from: Form 4255 Form 8611 7

8 Total tax. Add lines 5 through 7. Enter here and on line 27, page 1 8

Form 1120-RIC (2000)

Form 1120-RIC (2000) Page 3

Schedule K Other Information (See page 10 of instructions.) Yes No

1 Check method of accounting:

a Cash

b Accrual

c Other (specify) 䊳

2 At the end of the tax year, did the RIC own, directly or indirectly, 50% or more of the voting stock of a domestic corporation?

(For rules of attribution, see section 267(c).)

If “Yes,” attach a schedule showing (a) name and identification number, (b) percentage owned, and (c) taxable income or

(loss) before a net operating loss (NOL) and special deductions of such corporation for the tax year ending with or within

your tax year.

3 Is the RIC a subsidiary in a parent-subsidiary controlled group?

If “Yes,” enter the employer identification number and the name of the parent corporation 䊳

4 At the end of the tax year, did any individual, partnership, corporation, estate, or trust own, directly or indirectly, 50% or

more of the RIC’s voting stock? (For rules of attribution, see section 267(c).)

If “Yes,” attach a schedule showing name and identification number. (Do not include any information already entered in 3

above.) Enter percentage owned 䊳

5 At any time during the tax year, did one foreign person own, directly or indirectly, at least 25% of:

a The total voting power of all classes of stock of the fund entitled to vote or

b The total value of all classes of stock of the fund?

If “Yes”:

(1) Enter percentage owned 䊳

(2) Enter owner’s country 䊳

(3) The fund may have to file Form 5472. Enter number of Forms 5472 attached 䊳

6 During this tax year, did the fund pay dividends (other than stock dividends and distributions in exchange for stock) in

excess of the fund’s current and accumulated earnings and profits? (See sections 301 and 316.)

If “Yes,” file Form 5452.

7 Check this box if the fund issued publicly offered debt instruments with original issue discount 䊳

If checked, the fund may have to file Form 8281.

8 Enter the amount of tax-exempt interest received or accrued during the tax year. 䊳 $

9 If this return is being filed for a series fund (as defined in section 851(g)(2)):

a Enter the name of the regulated investment company in which the fund is a series 䊳

b Enter the date the regulated investment company was incorporated or organized 䊳

10 Section 853 election. Check this box if the fund meets the requirements of section 853(a) and section 901(k) and elects

to pass through the deduction or credit for foreign taxes it paid to its shareholders. See the instructions on

page 10 for additional details and requirements 䊳

11 Regulations section 1.852-11 election. Check this box if, for purposes of computing taxable income, the fund elects

under Regulations section 1.852-11(f)(1) to defer all or part of its post-October capital loss or post-October currency

loss for this tax year 䊳

If the election is made, enter the amounts deferred:

a Post-October capital loss 䊳

b Post-October currency loss 䊳

Note: If the corporation, at any time during the tax year, had assets or operated a business in a foreign country or U.S. possession, it may

be required to attach Schedule N (Form 1120), Foreign Operations of U.S. Corporations, to this return. See Schedule N for more details.

Form 1120-RIC (2000)

Form 1120-RIC (2000) Page 4

Schedule L Balance Sheets per Books Beginning of tax year End of tax year

Assets (a) (b) (c) (d)

1 Cash

2a Trade notes and accounts receivable

b Less allowance for bad debts ( ) ( )

3 U.S. government obligations

4 Tax-exempt securities (see page 10 of instructions)

5 Other current assets (attach schedule)

6 Loans to shareholders

7 Mortgage and real estate loans

8 Other investments (attach schedule)

9a Buildings and other fixed depreciable assets

b Less accumulated depreciation ( ) ( )

10 Land (net of any amortization)

11a Intangible assets (amortizable only)

b Less accumulated amortization ( ) ( )

12 Other assets (attach schedule)

13 Total assets

Liabilities and Shareholders’ Equity

14 Accounts payable

15 Mortgages, notes, bonds payable in less than 1 year

16 Other current liabilities (attach schedule)

17 Loans from shareholders

18 Mortgages, notes, bonds payable in 1 year or more

19 Other liabilities (attach schedule)

20 Capital stock

21 Additional paid-in capital

22 Retained earnings—Appropriated (attach schedule)

23 Retained earnings—Unappropriated

24 Adjustments to shareholders’ equity (attach schedule)

25 Less cost of treasury stock ( ) ( )

26 Total liabilities and shareholders’ equity

Note: The fund is not required to complete Schedules M-1 and M-2 if the total assets on line 13, column (d), of Schedule L are less than $25,000.

Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return (See page 10 of instructions.)

1 Net income (loss) per books 7 Income recorded on books this year

2 Federal income tax not included on this return (itemize):

3 Excess of capital losses over capital gains Tax-exempt interest $

4 Income subject to tax not recorded on

books this year (itemize): 8 Deductions on this return not charged

against book income this year (itemize):

a Depreciation $

5 Expenses recorded on books this year not b Deduction for dividends

deducted on this return (itemize): paid (line 25, page 1) $

a Depreciation $

b Expenses allocable to tax-exempt interest 9 Net capital gain from Form 2438, line 9a

income $ 10 If the fund did not file Form 2438,

c Section 4982 tax $ enter the net capital gain from

d Travel and entertainment $ Schedule D (Form 1120), line 13.

Otherwise, enter -0-

11 Add lines 7 through 10

12 Investment company taxable income

6 Add lines 1 through 5 (line 26, page 1)—line 6 less line 11

Schedule M-2 Analysis of Unappropriated Retained Earnings per Books (Line 23, Schedule L)

1 Balance at beginning of year 5 Distributions:a Cash

2 Net income (loss) per books b Stock

3 Other increases (itemize): c Property

6 Other decreases (itemize):

7 Add lines 5 and 6

4 Add lines 1, 2, and 3 8 Balance at end of year (line 4 less line 7)

Form 1120-RIC (2000)

You might also like

- Educated REIT Investing: The Ultimate Guide to Understanding and Investing in Real Estate Investment TrustsFrom EverandEducated REIT Investing: The Ultimate Guide to Understanding and Investing in Real Estate Investment TrustsNo ratings yet

- US Internal Revenue Service: F1120ric - 1996Document4 pagesUS Internal Revenue Service: F1120ric - 1996IRSNo ratings yet

- US Internal Revenue Service: F1120ric - 2001Document4 pagesUS Internal Revenue Service: F1120ric - 2001IRSNo ratings yet

- US Internal Revenue Service: F1120rei - 2000Document4 pagesUS Internal Revenue Service: F1120rei - 2000IRSNo ratings yet

- US Internal Revenue Service: F1120rei - 2001Document4 pagesUS Internal Revenue Service: F1120rei - 2001IRSNo ratings yet

- US Internal Revenue Service: f1120 - 1998Document4 pagesUS Internal Revenue Service: f1120 - 1998IRSNo ratings yet

- US Internal Revenue Service: f1120 - 2000Document4 pagesUS Internal Revenue Service: f1120 - 2000IRSNo ratings yet

- US Internal Revenue Service: F1120rei - 1999Document4 pagesUS Internal Revenue Service: F1120rei - 1999IRSNo ratings yet

- US Internal Revenue Service: F1120a - 2000Document2 pagesUS Internal Revenue Service: F1120a - 2000IRSNo ratings yet

- US Internal Revenue Service: F1120rei - 2005Document4 pagesUS Internal Revenue Service: F1120rei - 2005IRSNo ratings yet

- US Internal Revenue Service: f1120 - 2001Document4 pagesUS Internal Revenue Service: f1120 - 2001IRSNo ratings yet

- US Internal Revenue Service: f1120 - 1996Document4 pagesUS Internal Revenue Service: f1120 - 1996IRSNo ratings yet

- US Internal Revenue Service: f1120 - 2002Document4 pagesUS Internal Revenue Service: f1120 - 2002IRSNo ratings yet

- US Internal Revenue Service: f1120 - 1995Document4 pagesUS Internal Revenue Service: f1120 - 1995IRSNo ratings yet

- US Internal Revenue Service: f1065 - 2000Document4 pagesUS Internal Revenue Service: f1065 - 2000IRSNo ratings yet

- US Internal Revenue Service: f1120l - 1992Document7 pagesUS Internal Revenue Service: f1120l - 1992IRSNo ratings yet

- US Internal Revenue Service: f1065 - 1991Document4 pagesUS Internal Revenue Service: f1065 - 1991IRSNo ratings yet

- US Internal Revenue Service: F1120rei - 2004Document4 pagesUS Internal Revenue Service: F1120rei - 2004IRSNo ratings yet

- US Internal Revenue Service: F1120a - 1995Document2 pagesUS Internal Revenue Service: F1120a - 1995IRSNo ratings yet

- US Internal Revenue Service: F1120a - 1992Document2 pagesUS Internal Revenue Service: F1120a - 1992IRSNo ratings yet

- US Internal Revenue Service: f1120l - 1993Document8 pagesUS Internal Revenue Service: f1120l - 1993IRSNo ratings yet

- US Internal Revenue Service: f1065 - 1995Document4 pagesUS Internal Revenue Service: f1065 - 1995IRSNo ratings yet

- US Internal Revenue Service: F1120rei - 1993Document4 pagesUS Internal Revenue Service: F1120rei - 1993IRSNo ratings yet

- US Internal Revenue Service: F1120rei - 1992Document4 pagesUS Internal Revenue Service: F1120rei - 1992IRSNo ratings yet

- US Internal Revenue Service: f1120s - 1992Document4 pagesUS Internal Revenue Service: f1120s - 1992IRSNo ratings yet

- US Internal Revenue Service: F1120ric - 2004Document4 pagesUS Internal Revenue Service: F1120ric - 2004IRSNo ratings yet

- U.S. Return of Income For Electing Large Partnerships: Taxable Income or Loss From Passive Loss Limitation ActivitiesDocument5 pagesU.S. Return of Income For Electing Large Partnerships: Taxable Income or Loss From Passive Loss Limitation ActivitiesIRSNo ratings yet

- US Internal Revenue Service: f1120l - 2000Document8 pagesUS Internal Revenue Service: f1120l - 2000IRSNo ratings yet

- US Internal Revenue Service: F1120pol - 2000Document6 pagesUS Internal Revenue Service: F1120pol - 2000IRSNo ratings yet

- US Internal Revenue Service: F1120a - 1996Document2 pagesUS Internal Revenue Service: F1120a - 1996IRSNo ratings yet

- US Internal Revenue Service: f1120l - 1994Document8 pagesUS Internal Revenue Service: f1120l - 1994IRSNo ratings yet

- US Internal Revenue Service: f1120l - 1999Document8 pagesUS Internal Revenue Service: f1120l - 1999IRSNo ratings yet

- US Internal Revenue Service: f1120h - 2004Document6 pagesUS Internal Revenue Service: f1120h - 2004IRSNo ratings yet

- US Internal Revenue Service: f1041 - 1991Document2 pagesUS Internal Revenue Service: f1041 - 1991IRS0% (1)

- US Internal Revenue Service: F1120a - 2005Document2 pagesUS Internal Revenue Service: F1120a - 2005IRSNo ratings yet

- US Internal Revenue Service: F1120pol - 2001Document5 pagesUS Internal Revenue Service: F1120pol - 2001IRSNo ratings yet

- US Internal Revenue Service: f1065 - 1997Document4 pagesUS Internal Revenue Service: f1065 - 1997IRSNo ratings yet

- US Internal Revenue Service: f5227 - 1999Document4 pagesUS Internal Revenue Service: f5227 - 1999IRSNo ratings yet

- Schedule K-1 (Form 1120S) : Shareholder's Share of Current Year Income, Deductions, Credits, and Other ItemsDocument2 pagesSchedule K-1 (Form 1120S) : Shareholder's Share of Current Year Income, Deductions, Credits, and Other ItemsAnonymous JqimV1ENo ratings yet

- US Internal Revenue Service: F1120pol - 1994Document4 pagesUS Internal Revenue Service: F1120pol - 1994IRSNo ratings yet

- US Internal Revenue Service: f1065 AccessibleDocument4 pagesUS Internal Revenue Service: f1065 AccessibleIRSNo ratings yet

- U.S. Corporation Income Tax Return: Sign HereDocument4 pagesU.S. Corporation Income Tax Return: Sign HeresweetchaeNo ratings yet

- US Internal Revenue Service: f1066 - 1997Document4 pagesUS Internal Revenue Service: f1066 - 1997IRSNo ratings yet

- US Internal Revenue Service: F1120pol - 1999Document4 pagesUS Internal Revenue Service: F1120pol - 1999IRSNo ratings yet

- US Internal Revenue Service: f1120l - 1995Document8 pagesUS Internal Revenue Service: f1120l - 1995IRSNo ratings yet

- US Internal Revenue Service: F1120pol - 1998Document4 pagesUS Internal Revenue Service: F1120pol - 1998IRSNo ratings yet

- US Internal Revenue Service: f1066 - 2001Document4 pagesUS Internal Revenue Service: f1066 - 2001IRSNo ratings yet

- US Internal Revenue Service: f1120pc - 1998Document8 pagesUS Internal Revenue Service: f1120pc - 1998IRSNo ratings yet

- U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnDocument4 pagesU.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnIRSNo ratings yet

- US Internal Revenue Service: f1120h - 2001Document4 pagesUS Internal Revenue Service: f1120h - 2001IRSNo ratings yet

- US Internal Revenue Service: f1065 - 1996Document4 pagesUS Internal Revenue Service: f1065 - 1996IRSNo ratings yet

- US Internal Revenue Service: f5227 - 1995Document4 pagesUS Internal Revenue Service: f5227 - 1995IRSNo ratings yet

- US Internal Revenue Service: f1120h - 1993Document4 pagesUS Internal Revenue Service: f1120h - 1993IRSNo ratings yet

- US Internal Revenue Service: f1120pc - 1999Document8 pagesUS Internal Revenue Service: f1120pc - 1999IRSNo ratings yet

- US Internal Revenue Service: f1120pc - 2002Document8 pagesUS Internal Revenue Service: f1120pc - 2002IRSNo ratings yet

- US Internal Revenue Service: F1120pol - 2004Document6 pagesUS Internal Revenue Service: F1120pol - 2004IRSNo ratings yet

- Craig Hayward - 2021 - 1065 - K1 3Document6 pagesCraig Hayward - 2021 - 1065 - K1 3Craig HaywardNo ratings yet

- US Internal Revenue Service: f1120h - 1994Document4 pagesUS Internal Revenue Service: f1120h - 1994IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Distributor Conference SlobaDocument16 pagesDistributor Conference SlobaИлија РадосављевићNo ratings yet

- Resumes Cover LettersDocument22 pagesResumes Cover LettersaahsaaanNo ratings yet

- Operation FloodDocument3 pagesOperation Floodscarlett23No ratings yet

- FIIs in India.........Document12 pagesFIIs in India.........JogenderNo ratings yet

- LIC Bonus and FAB Rates 2019 PDFDocument24 pagesLIC Bonus and FAB Rates 2019 PDFAtul A Sharan50% (2)

- Regulatory Risk AnalysisDocument2 pagesRegulatory Risk AnalysisArmand LiviuNo ratings yet

- Johnson Elevator Case StudyDocument5 pagesJohnson Elevator Case StudyPJNo ratings yet

- Financial Analysis and ManagementDocument19 pagesFinancial Analysis and ManagementMohammad AnisuzzamanNo ratings yet

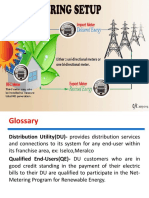

- Solar Net-Metering and Grid Tie SystemDocument30 pagesSolar Net-Metering and Grid Tie SystemBilly Twaine Palma Fuerte100% (1)

- De Grauwe Keynes' Saving ParadoxDocument20 pagesDe Grauwe Keynes' Saving ParadoxecrcauNo ratings yet

- Insight Title Company, LLC - Company ProfileDocument2 pagesInsight Title Company, LLC - Company ProfilebmarcuzzoNo ratings yet

- Value Investing: Guide ToDocument19 pagesValue Investing: Guide ToDomo TagubaNo ratings yet

- Income Tax MCQ 1Document9 pagesIncome Tax MCQ 1mohammedumair100% (3)

- Comparative Study and Financial Analysis of Ginni Filaments LTDDocument61 pagesComparative Study and Financial Analysis of Ginni Filaments LTDAditi SinghNo ratings yet

- Life Insurance Company The Whole Life Policy-Single PremiumDocument13 pagesLife Insurance Company The Whole Life Policy-Single PremiumNazneenNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupNo ratings yet

- A Summer Project ReportDocument57 pagesA Summer Project Reportanshu276No ratings yet

- Tax StructureDocument23 pagesTax StructureAsif Rasool ChannaNo ratings yet

- Section 50C and 56 (2) (Vii) of The Income Tax ActDocument14 pagesSection 50C and 56 (2) (Vii) of The Income Tax Acthari01011954No ratings yet

- Bibiano Reynoso IV Vs Court of AppealsDocument1 pageBibiano Reynoso IV Vs Court of AppealsAnonymous oDPxEkdNo ratings yet

- FIS WorldpayDocument1 pageFIS WorldpayharikaNo ratings yet

- 1 Internship Report MCBDocument68 pages1 Internship Report MCBAbdullah Afzal100% (1)

- Investment and Portfolio Management Session 3 QuestionsDocument2 pagesInvestment and Portfolio Management Session 3 Questions李佳南No ratings yet

- 13 Accounting Cycle of A Service Business 2Document28 pages13 Accounting Cycle of A Service Business 2Ashley Judd Mallonga Beran60% (5)

- ISBM Financial & Cost AccountingDocument3 pagesISBM Financial & Cost AccountingMadhumohan543No ratings yet

- Org Chart BHELDocument1 pageOrg Chart BHELchinum10% (2)

- N ShortDocument12 pagesN Shortkh8120005280No ratings yet

- Direct Tax Article Taxation of Agricultural LandDocument7 pagesDirect Tax Article Taxation of Agricultural LandmanishdgNo ratings yet

- Quiz 1Document3 pagesQuiz 1carlos9abrNo ratings yet

- Life Insurance Trust AgreementDocument2 pagesLife Insurance Trust AgreementThea BaltazarNo ratings yet