Professional Documents

Culture Documents

US Internal Revenue Service: f2210f - 1994

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: f2210f - 1994

Uploaded by

IRSCopyright:

Available Formats

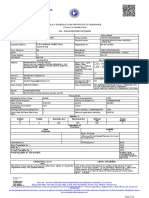

2210-F

OMB No. 1545-0140

Underpayment of Estimated Tax by

Form

Farmers and Fishermen

© Attach to Form 1040, Form 1040NR, or Form 1041.

Department of the Treasury Attachment

Internal Revenue Service © See instructions on back. Sequence No. 06A

Name(s) shown on tax return Identifying number

Note: In most cases, you do not need to file Form 2210-F. The IRS will figure any penalty you owe and send you a bill. File Form

2210-F only if one or both of the boxes in Part I apply to you. If you do not need to file For m 2210-F, you still may use it to

figure your penalty. Enter the amount from line 18 on the penalty line of your retur n, but do not attach For m 2210-F.

Part I Reasons For Filing—If 1a below applies to you, you may be able to lower or eliminate your penalty. But

you MUST check that box and file Form 2210-F with your tax return. If 1b below applies to you, check

that box and file Form 2210-F with your tax return.

1 Check whichever boxes apply (if neither applies, see the Note above Part I):

a You request a waiver. In certain circumstances, the IRS will waive all or part of the penalty. See the instructions for Waiver

of Penalty.

b Your required annual payment (line 13 below) is based on your 1993 tax and you filed or are filing a joint return for either

1993 or 1994 but not for both years.

Part II Figure Your Underpayment

2 Enter your 1994 tax after credits from Form 1040, line 46; Form 1040NR, line 44; or Form 1041,

Schedule G, line 4 2

3 Other taxes. See instructions 3

4 Add lines 2 and 3 4

5 Earned income credit 5

6 Credit for Federal tax paid on fuels 6

7 Add lines 5 and 6 7

8 Current year tax. Subtract line 7 from line 4 8

9 Multiply line 8 by 662⁄3% 9

10 Withholding taxes. Do not include any estimated tax payments on this line. See instructions 10

11 Subtract line 10 from line 8. If less than $500, stop here; do not complete or file this form. You

do not owe the penalty 11

12 Enter the tax shown on your 1993 tax return. Caution: See instructions 12

13 Required annual payment. Enter the smaller of line 9 or line 12. 13

Note: If line 10 is equal to or more than line 13, stop here; you do not owe the penalty. Do not

file For m 2210-F unless you checked box 1b above.

14 Amounts withheld during 1994 and amounts paid or credited by January 17, 1995 14

15 Underpayment. Subtract line 14 from line 13. If the result is zero or less, stop here; you do not

owe the penalty. Do not file Form 2210-F unless you checked box 1b above 15

Part III Figure the Penalty

16 Enter the date the amount on line 15 was paid or April 15, 1995, whichever is earlier 16 / / 95

17 Number of days FROM January 15, 1995, TO the date on line 16 17

Underpayment × Number of days on line 17 × © 18

18 Penalty. .09

on line 15 365

● Form 1040 filers, enter the amount from line 18 on Form 1040, line 65.

● Form 1040NR filers, enter the amount from line 18 on Form 1040NR, line 66.

● Form 1041 filers, enter the amount from line 18 on Form 1041, line 26.

Cat. No. 11745A Form 2210-F (1994)

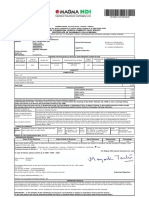

Form 2210-F (1994) Page 2

Paperwork Reduction Act 2. You had no tax liability for 1993, you Exception. If you and your spouse file a joint

were a U.S. citizen or resident for all of 1993, return after the due date to replace separate

Notice and your 1993 tax return was, or would have returns you originally filed by the due date,

We ask for the information on this form to been had you been required to file, for a full use the amounts shown on the joint return to

carry out the Internal Revenue laws of the 12 months. figure your underpayment. This rule applies

United States. You are required to give us the 3. The total tax shown on your 1994 return only if both original separate returns were

information. We need it to ensure that you are minus the amount of tax you paid through filed on time.

complying with these laws and to allow us to withholding is less than $500. To determine

figure and collect the right amount of tax. whether the total tax is less than $500,

Line 3

The time needed to complete and file this complete lines 2 through 11. Enter the total of the following amounts on

form will vary depending on individual line 3:

circumstances. The estimated average time Waiver of Penalty ● Self-employment tax,

is: If you have an underpayment on line 15, all or ● Alternative minimum tax,

part of the penalty for that underpayment will

Recordkeeping 33 min. ● Tax from recapture of investment credit,

be waived if the IRS determines that:

Learning about the law low-income housing credit, or qualified

or the form 7 min. 1. The underpayment was due to a electric vehicle credit,

casualty, disaster, or other unusual ● Tax on early distributions from a qualified

Preparing the form 20 min.

circumstance, and it would be inequitable to

Copying, assembling, and retirement plan (including your IRA), annuity,

impose the penalty, or

sending the form to the IRS 20 min. or modified endowment contract (entered into

2. In 1993 or 1994, you retired after age 62 after June 20, 1988),

If you have comments concerning the or became disabled, and your underpayment

accuracy of these time estimates or ● Internal Revenue Code section 72(m)(5)

was due to reasonable cause.

suggestions for making this form simpler, we penalty tax,

To request either of the above waivers, do ● Excise tax on golden parachute payments,

would be happy to hear from you. You can

the following:

write to both the IRS and the Office of ● Advance earned income credit payments,

Management and Budget at the addresses a. Check the box on line 1a.

● An increase or decrease in tax as a

listed in the instructions for the tax return b. Complete Form 2210-F up to line 18

shareholder in a qualified electing fund, and

with which this form is filed. without regard to the waiver. Write the

amount you want waived in parentheses on ● Interest due under Internal Revenue Code

the dotted line to the left of line 18. Subtract sections 453(l)(3) and 453A(c) on certain

General Instructions installment sales of property.

this amount from the total penalty you figured

Purpose of Form without regard to the waiver, and enter the Line 10

If you are an individual or a fiduciary for an result on line 18.

Enter the taxes withheld from Form 1040,

estate or trust and at least two-thirds of your c. Attach Form 2210-F and a statement to lines 54 and 58; Form 1040NR, lines 52, 56,

1993 or 1994 gross income is from farming or your return explaining the reasons you were 59, and 60; or Form 1041, line 24e.

fishing, use Form 2210-F to see if you must unable to meet the estimated tax

pay a penalty for underpaying your estimated requirements. Line 12

tax. d. If you are requesting a penalty waiver Figure your 1993 tax by using the taxes and

due to a casualty, disaster, or other unusual credits from your 1993 tax return. Use the

IRS Will Figure the Penalty for You circumstance, attach documentation such as same taxes and credits as shown on lines 2,

In most cases, the IRS will figure the penalty police and insurance company reports. 3, 5, and 6 of this form.

for you. Complete your return as usual, leave e. If you are requesting a penalty waiver If you are filing a joint return for 1994, but

the penalty line on your return blank, and do due to retirement or disability, attach you did not file a joint return for 1993, add

not attach Form 2210-F. If you owe the documentation that shows your retirement the tax shown on your 1993 return to the tax

penalty, we will send you a bill. And as long date (and your age on that date) or the date shown on your spouse’s 1993 return and

as you file your return by April 17, 1995, we you became disabled. enter the total on line 12. If you filed a joint

will not charge you interest if the bill is paid The IRS will review the information you return for 1993 but you are not filing a joint

within 10 days after the notice date. provide and will decide whether to grant your return for 1994, see Pub. 505 to figure your

Note: If you checked either of the boxes in request for a waiver. share of the 1993 tax to enter on line 12. If

Part I of the form, you must figure the penalty you did not file a return for 1993 or if your

yourself and attach the completed form to Additional Information 1993 tax year was less than 12 months, do

your return. For a definition of gross income from farming not complete line 12. Instead, enter the

and fishing, and more information, get Pub. amount from line 9 on line 13. However, see

Who Must Pay the Underpayment 505, Tax Withholding and Estimated Tax. Exceptions to the Penalty on this page.

Penalty

You may be charged a penalty if, for 1994, Specific Instructions Line 14

you did not pay at least 662⁄3% of your 1994 Enter the estimated tax payments you made

If you file an amended return by the due plus any Federal income tax withheld and

tax liability or 100% of your 1993 tax liability

date of your original return, use the amounts excess social security or railroad retirement

(if you filed a 1993 return that covered a full

shown on your amended return to figure your tax paid.

12 months), whichever is less.

underpayment. If you file an amended return

after the due date of your original return, use

Exceptions to the Penalty the amounts shown on the original return.

You will not have to pay the penalty or file

this form if any of the following applies:

1. You file your return and pay the tax due

by March 1, 1995.

Printed on recycled paper

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cox and KingsDocument237 pagesCox and KingsSagar SonawaneNo ratings yet

- Tax-Free Savings Account (TFSA), Guide For Individuals: RC4466 (E) Rev. 13/11Document22 pagesTax-Free Savings Account (TFSA), Guide For Individuals: RC4466 (E) Rev. 13/11baxterNo ratings yet

- The Financial System: Opportunities and Dangers: Chapter 20 of Edition, by N. Gregory Mankiw ECO62Document97 pagesThe Financial System: Opportunities and Dangers: Chapter 20 of Edition, by N. Gregory Mankiw ECO62Usman FaruqueNo ratings yet

- Representation - Concealment - Q and A - For DistributionDocument3 pagesRepresentation - Concealment - Q and A - For DistributionKenneth Bryan Tegerero TegioNo ratings yet

- Assignment: Course Code: STA101 Section: 05 Instructor: Mohammad Mastak Al Amin (MMA)Document10 pagesAssignment: Course Code: STA101 Section: 05 Instructor: Mohammad Mastak Al Amin (MMA)i CrYNo ratings yet

- Fixed Income SecuritiesDocument1 pageFixed Income SecuritiesRaghuveer ChandraNo ratings yet

- Uts Tak Bhs IngDocument2 pagesUts Tak Bhs IngKarleen PutriNo ratings yet

- Claim ProcessDocument7 pagesClaim Processbipin1989No ratings yet

- Porters Five Force ModelDocument4 pagesPorters Five Force Modelnaveen sunguluru50% (2)

- This Study Resource Was: ACC/280 Week 3 Individual AssignmentDocument2 pagesThis Study Resource Was: ACC/280 Week 3 Individual AssignmentMiya 76No ratings yet

- EmbokDocument71 pagesEmbok_hola-chico_100% (1)

- Lesson 40: Pay Restructuring in Mergers and Acquisitions: Learning Objective Merger and Acquisition Check-ListDocument7 pagesLesson 40: Pay Restructuring in Mergers and Acquisitions: Learning Objective Merger and Acquisition Check-ListMohammed ImranNo ratings yet

- A Project SynopsisDocument25 pagesA Project SynopsisAnkit SharmaNo ratings yet

- Tata Aia Project ReportDocument123 pagesTata Aia Project ReportHimanshu Jadon82% (11)

- D2c Insurance Broking PVT LTD - (BR00000204) : The New India Assurance Co. Ltd. (Government of India Undertaking)Document2 pagesD2c Insurance Broking PVT LTD - (BR00000204) : The New India Assurance Co. Ltd. (Government of India Undertaking)kartik bamrautwarNo ratings yet

- Ape Auto Magma CHP - RemovedDocument1 pageApe Auto Magma CHP - Removedsarath potnuriNo ratings yet

- CH 5-Time Value of Money-Gitman - pmf13 - ppt05 GeDocument94 pagesCH 5-Time Value of Money-Gitman - pmf13 - ppt05 Gekim taehyung100% (1)

- Nhis 2Document36 pagesNhis 2Saravanakumar RajaramNo ratings yet

- Ca 3821Document4 pagesCa 3821sleepybrownzzzNo ratings yet

- ComputerDocument3 pagesComputerKiran DNo ratings yet

- M5 Handout Dislocation AnalysisDocument52 pagesM5 Handout Dislocation AnalysisStanley WangNo ratings yet

- Seminar About HR MatterDocument14 pagesSeminar About HR MatterJay AmistosoNo ratings yet

- CACI Insurance Qualifications FrameworkDocument1 pageCACI Insurance Qualifications FrameworkAshwin PrakashNo ratings yet

- Repairing and Rebuilding Houses Affected by The Canterbury EarthquakesDocument425 pagesRepairing and Rebuilding Houses Affected by The Canterbury EarthquakesJavier MtNo ratings yet

- IRDA RegulationsDocument36 pagesIRDA Regulations9990255764No ratings yet

- Rythu Bandhu Group Life Insurance Scheme Form 971Document5 pagesRythu Bandhu Group Life Insurance Scheme Form 971CHETTI SAGARNo ratings yet

- Notice Concerning Fiduciary Relationship of Financial InstitutionDocument2 pagesNotice Concerning Fiduciary Relationship of Financial Institutiondouglas jonesNo ratings yet

- Insurable Interest in LifeDocument3 pagesInsurable Interest in LifeEnp Gus AgostoNo ratings yet

- Rizal SuretyDocument2 pagesRizal SuretytyranickelNo ratings yet

- Contract Outline SpringDocument91 pagesContract Outline SpringnooyyllibNo ratings yet