Professional Documents

Culture Documents

US Internal Revenue Service: f8815 - 1997

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: f8815 - 1997

Uploaded by

IRSCopyright:

Available Formats

Exclusion of Interest From Series EE OMB No.

1545-1173

Form 8815 U.S. Savings Bonds Issued After 1989 97

Department of the Treasury (For Filers With Qualified Higher Education Expenses) Attachment

Internal Revenue Service (99) © Attach to Form 1040 or Form 1040A. Sequence No. 57

Caution: If your filing status is married filing separately, do not file this form. You cannot take the exclusion even if you paid

qualified higher education expenses in 1997.

Name(s) shown on return Your social security number

1 (a)

(b)

Name of person (you, your spouse, or your dependent) who

Name and address of eligible educational institution

was enrolled at or attended an eligible educational institution

If you need more space, attach additional sheets.

2 Enter the total qualified higher education expenses you paid in 1997 for the persons listed in

column (a) of line 1. See the instructions to find out which expenses qualify 2

3 Enter the total of any nontaxable educational benefits (such as nontaxable scholarship or

fellowship grants) received for 1997 for the persons listed in column (a) of line 1. See instructions 3

4 Subtract line 3 from line 2. If zero or less, stop. You cannot take the exclusion 4

5 Enter the total proceeds (principal and interest) from all series EE U.S. savings bonds issued

after 1989 that you cashed during 1997 5

6 Enter the interest included on line 5. See instructions 6

7 Is line 4 less than line 5?

No. Enter “1.00.”

Yes. Divide line 4 by line 5. Enter the result as a decimal (rounded to two places) % 7 3 .

8 Multiply line 6 by line 7 8

9 Enter your modified adjusted gross income. See instructions 9

Note: If line 9 is $65,850 or more ($106,250 or more if married filing

jointly or qualifying widow(er)), stop. You cannot take the exclusion.

10 Enter $50,850 ($76,250 if married filing jointly or qualifying widow(er)) 10

11 Subtract line 10 from line 9. If zero or less, skip line 12, enter -0- on

line 13, and go to line 14 11

12 Divide line 11 by $15,000 (by $30,000 if married filing jointly or qualifying widow(er)). Enter the

result as a decimal (rounded to two places) 12 3 .

13 Multiply line 8 by line 12 13

14 Excludable savings bond interest. Subtract line 13 from line 8. Enter the result here and on

Schedule B (Form 1040), line 3, or Schedule 1 (Form 1040A), line 3, whichever applies © 14

General Instructions 3. Your filing status is any status except married filing separately.

Section references are to the Internal Revenue Code. 4. Your modified AGI (adjusted gross income) is less than $65,850

(less than $106,250 if married filing jointly or qualifying widow(er)).

Purpose of Form See the line 9 instructions to figure your modified AGI.

If you cashed series EE U.S. savings bonds in 1997 that were issued

after 1989, you may be able to exclude from your income part or all

U.S. Savings Bonds That Qualify for Exclusion

of the interest on those bonds. Use Form 8815 to figure the amount To qualify for the exclusion, the bonds must be series EE U.S.

of any interest you may exclude. savings bonds issued after 1989 in your name, or, if you are married,

they may be issued in your name and your spouse’s name. Also, you

Who May Take the Exclusion must have been age 24 or older before the bonds were issued. A

You may take the exclusion if all four of the following apply: bond bought by a parent and issued in the name of his or her child

1. You cashed qualified U.S. savings bonds in 1997 that were under age 24 does not qualify for the exclusion by the parent or

issued after 1989. child. Bond information may be verified with Department of the

2. You paid qualified higher education expenses in 1997 for Treasury records.

yourself, your spouse, or your dependents.

For Paperwork Reduction Act Notice, see back of form. Cat. No. 10822S Form 8815 (1997)

Form 8815 (1997) Page 2

Recordkeeping Requirements Line 9

Keep the following to verify the amount of interest you exclude: Follow these steps before you fill in the line 9 worksheet below.

● Bills, receipts, canceled checks, or other documents showing you

paid qualified higher education expenses in 1997. Step Action

● A written record of each post-1989 series EE U.S. savings bond

that you cash. Your written record must include the serial number, 1 If you received social security benefits, use Pub. 915 to

issue date, face value, and total redemption proceeds (principal and figure the taxable amount of your benefits.

interest) of each bond. You may use Form 8818, Optional Form To

Record Redemption of Series EE U.S. Savings Bonds Issued After 2 If you made IRA contributions for 1997 and you were

1989. covered by a retirement plan at work or through

self-employment, use Pub. 590 to figure your IRA

Specific Instructions deduction.

Line 1 3 Complete the following lines on your return if they apply.

Column (a).—Enter the name of the person who was enrolled at or

attended an eligible educational institution. This person must be you, IF you file Form... THEN complete lines...

your spouse, or your dependent(s) claimed on line 6c of Form 1040

1040 8b, 9–21, and 23–31

or Form 1040A. An eligible educational institution is a college,

university, or vocational education school. 1040A 8b, 9–13b, and 15

Column (b).—Enter the name and address of the institution. If the

person was enrolled at or attended more than one, list all of them. 4 If any of the following apply, see Pub. 550:

Line 2 ● You file Form 2555 or 2555-EZ (relating to foreign

Qualified higher education expenses include only tuition and fees earned income), or Form 4563 (exclusion of income

required for the enrollment or attendance of the person(s) listed on for residents of American Samoa),

line 1, column (a), at the institution(s) listed in column (b). They do ● You have employer-provided adoption benefits for

not include expenses for: 1997,

● Room and board, or ● You exclude income from Puerto Rico, or

● Courses involving sports, games, or hobbies that are not part of a ● You have investment interest expense attributable to

degree or certificate granting program. royalty income.

Do not include on line 2 expenses that were covered by

nontaxable educational benefits paid directly to, or by, the

educational institution. Worksheet—Line 9

(keep a copy for your records)

Line 3

1. Enter the amount from line 2 of Schedule B

Enter on this line the total qualified higher education expenses (Form 1040) or Schedule 1 (Form 1040A) 1.

included on line 2 that were covered by nontaxable educational

%

benefits. Nontaxable educational benefits include: 2. Form 1040 filers, add the amounts on lines

● Scholarship or fellowship grants excludable from income under 7, 9 through 14, 15b, 16b, 17 through 19,

20b, and 21. Enter the total. 2.

section 117.

● Veterans’ educational assistance benefits. Form 1040A filers, add the amounts on lines

7, 9, 10b, 11b, 12, and 13b. Enter the total.

● Employer-provided educational assistance benefits that are not

included in box 1 of your W-2 form(s). 3. Add lines 1 and 2 3.

● Payments, waivers, or reimbursements of educational expenses 4. Enter the amount from Form 1040, line 31,

under a qualfied state tuition program. or Form 1040A, line 15 4.

● Any other payments (but not gifts, bequests, or inheritances) for 5. Subtract line 4 from line 3. Enter the result

educational expenses that are exempt from income tax by any U.S. here and on Form 8815, line 9 5.

law.

Do not include on line 3 nontaxable educational benefits paid

directly to, or by, the educational institution. Paperwork Reduction Act Notice. We ask for the information on

this form to carry out the Internal Revenue laws of the United States.

Example. You paid $10,000 of qualified higher education expenses You are required to give us the information. We need it to ensure

in 1997 to the college your son attended. You claim your son as a that you are complying with these laws and to allow us to figure and

dependent on line 6c of your 1997 tax return. Your son received a collect the right amount of tax.

$2,000 nontaxable scholarship grant for 1997, which was paid

directly to him. In this case, enter $10,000 on line 2 and $2,000 on You are not required to provide the information requested on a

line 3. form that is subject to the Paperwork Reduction Act unless the form

displays a valid OMB control number. Books or records relating to a

Line 6 form or its instructions must be retained as long as their contents

Did you use Form 8818 to record bonds you cashed in 1997? may become material in the administration of any Internal Revenue

Yes. Enter on line 6 the amount from Form 8818, line 5. law. Generally, tax returns and return information are confidential, as

No. Use the worksheet below to figure the amount to enter on line 6. required by section 6103.

The time needed to complete and file this form will vary depending

Worksheet—Line 6 on individual circumstances. The estimated average

(keep a copy for your records) time is: Recordkeeping, 53 min.; Learning about the law or the

form, 13 min.; Preparing the form, 35 min.; and Copying,

1. Enter the face value of all post-1989 bonds assembling, and sending the form to the IRS, 34 min.

cashed in 1997 1.

If you have comments concerning the accuracy of these time

2. Enter the amount from Form 8815, line 5 2. estimates or suggestions for making this form simpler, we would be

3. Multiply line 1 above by 50% (.50) 3. happy to hear from you. See the instructions for Form 1040 or Form

1040A.

4. Subtract line 3 from line 2. This is the interest

on the bonds. Enter the result here and on

Form 8815, line 6 4.

You might also like

- Current Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-NegotiableDocument1 pageCurrent Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-Negotiablekevin kuhnNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturntabithaNo ratings yet

- 2021 W-2 Earnings SummaryDocument2 pages2021 W-2 Earnings Summaryseguins0% (1)

- ADP Pay Stub TemplateDocument1 pageADP Pay Stub Templateenudo Solomon67% (3)

- WWW - Irs.gov Pub Irs-PDF f4506tDocument2 pagesWWW - Irs.gov Pub Irs-PDF f4506tJennifer GonzalezNo ratings yet

- Interest and Ordinary DividendsDocument1 pageInterest and Ordinary DividendsBetty Ann LegerNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Joijamison 2019taxes PDFDocument26 pagesJoijamison 2019taxes PDFrose ownes100% (1)

- Affidavit To Claim Tax Exemption For Dependent Child - BIR Exemption For Dependent Child - BIRDocument1 pageAffidavit To Claim Tax Exemption For Dependent Child - BIR Exemption For Dependent Child - BIRHector Jamandre Diaz100% (3)

- Request Ltr2Bank For OIDsDocument2 pagesRequest Ltr2Bank For OIDsricetech100% (15)

- Certificate of Affiliation 2 1Document3 pagesCertificate of Affiliation 2 1Zyra Manalo Melad100% (1)

- ZZZZZZDocument12 pagesZZZZZZCruz100% (4)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- US Internal Revenue Service: f8815 - 1996Document2 pagesUS Internal Revenue Service: f8815 - 1996IRSNo ratings yet

- US Internal Revenue Service: f8815 - 1994Document2 pagesUS Internal Revenue Service: f8815 - 1994IRSNo ratings yet

- US Internal Revenue Service: f8815 - 1995Document2 pagesUS Internal Revenue Service: f8815 - 1995IRSNo ratings yet

- US Internal Revenue Service: f8815 - 1992Document2 pagesUS Internal Revenue Service: f8815 - 1992IRSNo ratings yet

- US Internal Revenue Service: f8815 - 1993Document2 pagesUS Internal Revenue Service: f8815 - 1993IRSNo ratings yet

- US Internal Revenue Service: f8814 - 1997Document2 pagesUS Internal Revenue Service: f8814 - 1997IRSNo ratings yet

- US Internal Revenue Service: f8814 - 1996Document2 pagesUS Internal Revenue Service: f8814 - 1996IRSNo ratings yet

- US Internal Revenue Service: f8814 - 1993Document2 pagesUS Internal Revenue Service: f8814 - 1993IRSNo ratings yet

- US Internal Revenue Service: f8863 - 2002Document3 pagesUS Internal Revenue Service: f8863 - 2002IRSNo ratings yet

- US Internal Revenue Service: f8814 - 1995Document2 pagesUS Internal Revenue Service: f8814 - 1995IRSNo ratings yet

- US Internal Revenue Service: f8917Document2 pagesUS Internal Revenue Service: f8917IRSNo ratings yet

- US Internal Revenue Service: F1040as1 - 2003Document2 pagesUS Internal Revenue Service: F1040as1 - 2003IRSNo ratings yet

- View your interest and dividend incomeDocument1 pageView your interest and dividend incomeJuanDickinsonNo ratings yet

- US Internal Revenue Service: fw4p - 1993Document3 pagesUS Internal Revenue Service: fw4p - 1993IRSNo ratings yet

- US Internal Revenue Service: fw4s - 2005Document2 pagesUS Internal Revenue Service: fw4s - 2005IRSNo ratings yet

- US Internal Revenue Service: fw4s - 1994Document2 pagesUS Internal Revenue Service: fw4s - 1994IRSNo ratings yet

- Solution Manual For Concepts in Federal Taxation 2018 25th Edition Murphy, HigginsDocument2 pagesSolution Manual For Concepts in Federal Taxation 2018 25th Edition Murphy, Higginsa882650259No ratings yet

- US Internal Revenue Service: fw4s 06Document2 pagesUS Internal Revenue Service: fw4s 06IRSNo ratings yet

- Instructions For Form 943: Pager/SgmlDocument4 pagesInstructions For Form 943: Pager/SgmlIRSNo ratings yet

- US Internal Revenue Service: fw4s - 1995Document2 pagesUS Internal Revenue Service: fw4s - 1995IRSNo ratings yet

- US Internal Revenue Service: f8919Document2 pagesUS Internal Revenue Service: f8919IRSNo ratings yet

- US Internal Revenue Service: fw4p 06Document4 pagesUS Internal Revenue Service: fw4p 06IRSNo ratings yet

- US Internal Revenue Service: fw4s - 1999Document2 pagesUS Internal Revenue Service: fw4s - 1999IRSNo ratings yet

- US Internal Revenue Service: fw4p - 1994Document3 pagesUS Internal Revenue Service: fw4p - 1994IRSNo ratings yet

- US Internal Revenue Service: f8863 - 2004Document3 pagesUS Internal Revenue Service: f8863 - 2004IRSNo ratings yet

- US Internal Revenue Service: fw4p - 1995Document3 pagesUS Internal Revenue Service: fw4p - 1995IRSNo ratings yet

- Form W-4P Withholding Certificate for Pension or Annuity PaymentsDocument4 pagesForm W-4P Withholding Certificate for Pension or Annuity Paymentsts0m3No ratings yet

- US Internal Revenue Service: f8814 - 2005Document3 pagesUS Internal Revenue Service: f8814 - 2005IRSNo ratings yet

- Uncollected Social Security and Medicare Tax On WagesDocument2 pagesUncollected Social Security and Medicare Tax On Wagesnujahm1639No ratings yet

- Interest and Ordinary DividendsDocument2 pagesInterest and Ordinary DividendsSarah KuldipNo ratings yet

- US Internal Revenue Service: fw4s07 AccessibleDocument2 pagesUS Internal Revenue Service: fw4s07 AccessibleIRSNo ratings yet

- US Internal Revenue Service: f8814 - 1998Document2 pagesUS Internal Revenue Service: f8814 - 1998IRSNo ratings yet

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetDocument4 pagesWithholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetIRSNo ratings yet

- US Internal Revenue Service: fw4p - 2003Document4 pagesUS Internal Revenue Service: fw4p - 2003IRSNo ratings yet

- US Internal Revenue Service: fw4s - 1998Document2 pagesUS Internal Revenue Service: fw4s - 1998IRSNo ratings yet

- US Internal Revenue Service: p967 - 2005Document7 pagesUS Internal Revenue Service: p967 - 2005IRSNo ratings yet

- Schedule 1 Interest and Ordinary Dividends For Form 1040A FilersDocument2 pagesSchedule 1 Interest and Ordinary Dividends For Form 1040A FilersIRSNo ratings yet

- Instructions For Form 943: Pager/SgmlDocument4 pagesInstructions For Form 943: Pager/SgmlIRSNo ratings yet

- Complete A Separate Part III On Page 2 For Each Student For Whom You're Claiming Either Credit Before You Complete Parts I and IIDocument2 pagesComplete A Separate Part III On Page 2 For Each Student For Whom You're Claiming Either Credit Before You Complete Parts I and IIYum BuckerNo ratings yet

- US Internal Revenue Service: fw4p - 1996Document3 pagesUS Internal Revenue Service: fw4p - 1996IRSNo ratings yet

- US Internal Revenue Service: f8814 - 2004Document3 pagesUS Internal Revenue Service: f8814 - 2004IRSNo ratings yet

- Interest and Ordinary DividendsDocument1 pageInterest and Ordinary DividendsMihaela PrunaNo ratings yet

- Instructions For Form 943: Pager/SgmlDocument4 pagesInstructions For Form 943: Pager/SgmlIRSNo ratings yet

- US Internal Revenue Service: fw4p - 2001Document4 pagesUS Internal Revenue Service: fw4p - 2001IRSNo ratings yet

- F 1040 SBDocument2 pagesF 1040 SBapi-333587870No ratings yet

- US Internal Revenue Service: f8839 - 2004Document2 pagesUS Internal Revenue Service: f8839 - 2004IRSNo ratings yet

- W4 SheetDocument2 pagesW4 Sheetnaru_vNo ratings yet

- Form 1040 Schedule BDocument1 pageForm 1040 Schedule BGwo GwppyNo ratings yet

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetDocument4 pagesWithholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetIRSNo ratings yet

- US Internal Revenue Service: fw4p - 2000Document4 pagesUS Internal Revenue Service: fw4p - 2000IRSNo ratings yet

- US Internal Revenue Service: F1040ez - 1992Document2 pagesUS Internal Revenue Service: F1040ez - 1992IRSNo ratings yet

- Instructions For Form 943: Pager/SgmlDocument4 pagesInstructions For Form 943: Pager/SgmlIRSNo ratings yet

- US Internal Revenue Service: f8859 - 1997Document2 pagesUS Internal Revenue Service: f8859 - 1997IRSNo ratings yet

- US Internal Revenue Service: p967Document7 pagesUS Internal Revenue Service: p967IRSNo ratings yet

- US Internal Revenue Service: F1040as1 - 1991Document1 pageUS Internal Revenue Service: F1040as1 - 1991IRSNo ratings yet

- US Internal Revenue Service: f8859 - 2002Document2 pagesUS Internal Revenue Service: f8859 - 2002IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- LABORATORY LISTDocument440 pagesLABORATORY LISTHuls LsNo ratings yet

- Apple Broached Time Warner Bid As Growth Hunt Turns To ContentDocument24 pagesApple Broached Time Warner Bid As Growth Hunt Turns To ContentstefanoNo ratings yet

- Solifi GLR 2022Document16 pagesSolifi GLR 2022Snoussi OussamaNo ratings yet

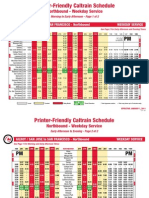

- CAL TRAIN Weekday+Northbound+Printer-FriendlyDocument2 pagesCAL TRAIN Weekday+Northbound+Printer-FriendlyMinzhi LvNo ratings yet

- Wage Breakdown StructureDocument10 pagesWage Breakdown StructureMulans MulanNo ratings yet

- Montgomery County PPP Loan RecipientsDocument29 pagesMontgomery County PPP Loan RecipientsBethesda MagazineNo ratings yet

- UnitedHealth Group Stage Seating ChartDocument1 pageUnitedHealth Group Stage Seating ChartChildren's Theatre CompanyNo ratings yet

- List of HOA For Region 4Document2 pagesList of HOA For Region 4Paolo LucionNo ratings yet

- Form 2106Document2 pagesForm 2106Weiming LinNo ratings yet

- Aleishia Logan: Paycom Tax Credit QuestionnaireDocument1 pageAleishia Logan: Paycom Tax Credit Questionnairemia downingNo ratings yet

- PDF 1Document1 pagePDF 1manolo IamanditaNo ratings yet

- q22023 Macro-Outlook PortalDocument14 pagesq22023 Macro-Outlook PortalM. Fatah YasinNo ratings yet

- RMC No. 46-2022Document1 pageRMC No. 46-2022Reena Rose BernabeNo ratings yet

- Case 01 Buffett 2015 F1769Document36 pagesCase 01 Buffett 2015 F1769Josie KomiNo ratings yet

- 07 BpqyDocument1 page07 BpqyMichael Van EssenNo ratings yet

- Momentum First Half Review - July 2014Document11 pagesMomentum First Half Review - July 2014David BriggsNo ratings yet

- Economy DA - DDI 2018Document282 pagesEconomy DA - DDI 2018Curtis LiuNo ratings yet

- Sail May Mis 2022Document15 pagesSail May Mis 2022Richard DassNo ratings yet

- Estate Tax Changes Under TRAIN Law SimplifiedDocument4 pagesEstate Tax Changes Under TRAIN Law SimplifiedMargz CafifgeNo ratings yet

- Banking Strategies For The FutureDocument11 pagesBanking Strategies For The FutureMarco MolanoNo ratings yet

- Additional Child Tax Credit: Schedule 8812Document1 pageAdditional Child Tax Credit: Schedule 8812Ishfaq Ali KhanNo ratings yet