Professional Documents

Culture Documents

Gold

Uploaded by

Dharam PrakashOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gold

Uploaded by

Dharam PrakashCopyright:

Available Formats

Special Report

Why Invest in Gold

Why Holding Gold in Your Portfolio Isn't

Advisable... It's a Must

15 Fundamental Reasons to Own Gold

1. Global Currency Debasement

The U.S. dollar is fundamentally and technically very weak and should fall

dramatically over the next few years. However, other countries are very reluctant to

see their currencies appreciate and are resisting the fall of the U.S. dollar. Thus, we

are in the early stages of a massive global currency debasement which will see

tangibles, and most particularly gold, rise significantly in price.

2. Rising Investment Demand

When the crowd recognizes what is unfolding, they will seek an alternative to paper

currencies and financial assets and this will create an enormous investment demand

for gold. Own both the physical metal and select mining shares.

3. Alarming Financial Deterioration in the U.S.

In the space of two years, the federal government budget surplus has been

transformed into a yawning deficit, which will persist as far as the eye can see. At the

same time, the current account deficit has reached levels, which has portended

currency collapse in virtually every other instance in history.

4. Negative Real Interest Rates in Reserve Currency (U.S. Dollar)

To combat the deteriorating financial conditions in the U.S., interest rates have been

dropped to rock bottom levels, real interest rates are now negative and, according to

statements from the Fed spokesmen, are expected to remain so for some time.

There has been a very strong historical relationship between negative real interest

rates and stronger gold prices.

5. Dramatic Increases in Money Supply in the US and Other Nations

Authorities are terrified about the prospects for deflation given the unprecedented

debt burden at all levels of society in the U.S. Fed Governor Ben Bernanke is on

record as saying the Fed has a printing press and will use it to combat deflation if

necessary. Other nations are following in the U.S.'s footsteps and global money

supply is accelerating. This is very gold friendly.

6. Existence of a Huge and Growing Gap between Mine Supply and Traditional

Demand

Mined gold is roughly 2,500 tons per year and traditional demand (jewelry, industrial

users, etc.) has exceeded this by a considerable margin for a number of years.

Some of this gap has been filled by recycled scrap but central bank gold has been

the primary source of above-ground supply.

7. Mine Supply is Anticipated to Decline in the next Three to Four Years.

Even if traditional demand continues to erode due to ongoing worldwide economic

weakness, the supply/demand imbalance is expected to persist due to a decline in

mine supply. Mine supply will contract in the next several years, irrespective of gold

prices, due to a dearth of exploration in the post Bre-X era, a shift away from high

grading which was necessary for survival in the sub-economic gold price

environment of the past five years and the natural exhaustion of existing mines.

8. Large Short Positions

To fill the gap between mine supply and demand, Central Bank gold has been

mobilized primarily through the leasing mechanism, which facilitated producer

hedging and financial speculation. Strong evidence suggests that between 10,000

and 16,000 tons (30-50% of all Central Bank gold) is currently in the market. This is

owed to the Central Banks by the bullion banks, which are the counter party in the

transactions.

9. Low Interest Rates Discourage Hedging

Rates are low and falling. With low rates, there isn't sufficient contango to create

higher prices in the out years. Thus there is little incentive to hedge and gold

producers are not only not hedging, they are reducing their existing hedge positions,

thus removing gold from the market.

10. Rising Gold Prices and Low Interest Rates Discourage Financial

Speculation on the Short Side.

When gold prices were continuously falling and financial speculators could access

Central Bank gold at a minimal leasing rate (0.5 - 1% per year), sell it and reinvest

the proceeds in a high yielding bond or Treasury bill, the trade was viewed as a lay-

up. Everyone did it and now there are numerous stale short positions. However,

these trades now make no sense with a rising gold price and declining interest

rates.

11. The Central Banks are Nearing an Inflection Point when they will be

Reluctant to Provide more Gold to the Market.

The Central Banks have supplied too much already via the leasing mechanism. In

addition, Far Eastern Central Banks who are accumulating enormous quantities of

U.S. Dollars are rumored to be buyers of gold to diversify away from the U.S. Dollar.

12. Gold is Increasing in Popularity

Gold is seen in a much more positive light in countries beginning to come to the

forefront on the world scene. Prominent developing countries such as China, India

and Russia have been accumulating gold. In fact, China with its 1.3 billion people

recently established a National Gold Exchange and relaxed control over the asset.

Demand in China is expected to rise sharply and could reach 500 tons in the next

few years.

13. Gold as Money is Gaining Credence

Islamic nations are investigating a currency backed by gold (the Gold Dinar), the new

President of Argentina proposed, during his campaign, a gold backed peso as an

antidote for the financial catastrophe which his country has experienced and Russia

is talking about a fully convertible currency with gold backing.

14. Rising Geopolitical Tensions

The deteriorating conditions in the Middle East, the U.S. occupation of Iraq, the

nuclear ambitions of North Korea and the growing conflict between the U.S. and

China due to China's refusal to allow its currency to appreciate against the U.S.

dollar headline the geopolitical issues, which could explode at anytime. A fearful

public has a tendency to gravitate towards gold.

15. Limited Size of the Total Gold Market Provides Tremendous Leverage

All the physical gold in existence is worth somewhat more than $1 trillion U.S.

Dollars while the value of all the publicly traded gold companies in the world is less

than $100 billion US dollars. When the fundamentals ultimately encourage a strong

flow of capital towards gold and gold equities, the trillions upon trillions worth of

paper money could propel both to unfathomably high levels.

Conclusion

Gold is under-valued, under-owned and under-appreciated. It is most assuredly not

well understood by most investors. At the beginning of the 1970's when gold was

about to undertake its historic move from $35 to $800 per ounce in the succeeding

ten years, the same observations would have been valid. The only difference this

time is that the fundamentals for gold are actually better.

P.S. It's simple, really. Demand is soaring. Supplies are plummeting. And if you

don't buy gold now, you may not get the chance to later. To get your limited-time

discount on physical gold, plus access to our portfolio of incredibly bargain-priced

junior gold stocks, simply follow this link.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Acc101 - 4Document14 pagesAcc101 - 4Nguyen Thi My Ngan (K17CT)No ratings yet

- Business Finance Week 1 and 2Document56 pagesBusiness Finance Week 1 and 2Jonathan De villaNo ratings yet

- The Accounting Cycle of A Merchandising Business What I KnowDocument2 pagesThe Accounting Cycle of A Merchandising Business What I KnowAngela MortelNo ratings yet

- Solution Manual For Advanced Accounting 12th EditionDocument5 pagesSolution Manual For Advanced Accounting 12th EditionDrAndrewFarrelleqdy100% (39)

- Advanced Management Accounting PDFDocument204 pagesAdvanced Management Accounting PDFptgo100% (1)

- Loading On Minimum WagesDocument2 pagesLoading On Minimum WagesnitbabhishekNo ratings yet

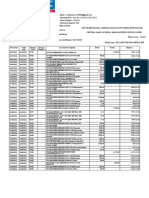

- A Presentation Account Receivables Management ofDocument16 pagesA Presentation Account Receivables Management ofParamjeet SinghNo ratings yet

- Accounting For Debt Srvice FundDocument10 pagesAccounting For Debt Srvice FundsenafteshomeNo ratings yet

- Feasibility Study PresentationDocument22 pagesFeasibility Study PresentationCarryl MañoscaNo ratings yet

- Financial Regulatory Bodies of IndiaDocument6 pagesFinancial Regulatory Bodies of IndiaShivangi PandeyNo ratings yet

- Sample DVDocument1 pageSample DVchatNo ratings yet

- AccountStatement 3286686240 Aug04 185310 PDFDocument2 pagesAccountStatement 3286686240 Aug04 185310 PDFDarren Joseph VivekNo ratings yet

- Accounting ReviewDocument14 pagesAccounting ReviewMelessa Pescador100% (1)

- Karvy Report On Comparative Study On Mutual FundsDocument57 pagesKarvy Report On Comparative Study On Mutual FundsNishant GoldyNo ratings yet

- Sap Fi /co Course Content in Ecc6 To Ehp 5Document8 pagesSap Fi /co Course Content in Ecc6 To Ehp 5Mahesh JNo ratings yet

- MFMRI. Commerce Faculty BHU, Placement ReportDocument3 pagesMFMRI. Commerce Faculty BHU, Placement ReportALOK KUMAR100% (1)

- AE-MGT FlowchartDocument9 pagesAE-MGT FlowchartJean Thor Renzo MutucNo ratings yet

- Final Exam Schedule 2013 EntryDocument10 pagesFinal Exam Schedule 2013 Entrysemetegna she zemen 8ተኛው ሺ zemen ዘመንNo ratings yet

- Information MemorandumDocument38 pagesInformation Memorandumsun6raj18100% (1)

- TEST BANK For Government and Not For Profit Accounting Concepts and Practices 6th Edition by Granof Khumawala20190702 86031 1d2i3lg PDFDocument16 pagesTEST BANK For Government and Not For Profit Accounting Concepts and Practices 6th Edition by Granof Khumawala20190702 86031 1d2i3lg PDFMaria Ceth SerranoNo ratings yet

- FN 200 - Financial Forecasting Seminar QuestionsDocument7 pagesFN 200 - Financial Forecasting Seminar QuestionskelvinizimburaNo ratings yet

- Bank Management P 52Document62 pagesBank Management P 52revathykchettyNo ratings yet

- Bank StatementDocument2 pagesBank StatementhanhNo ratings yet

- CFAS With KeyDocument5 pagesCFAS With KeyChesca Marie Arenal PeñarandaNo ratings yet

- Quotation - Hemas, SERVICE AND REPAIRS PDFDocument2 pagesQuotation - Hemas, SERVICE AND REPAIRS PDFW GangenathNo ratings yet

- Invoicediscounting Factsheet NW BusDocument2 pagesInvoicediscounting Factsheet NW BusSinoj ASNo ratings yet

- Compare Housing Loan Rates in The PhilippinesDocument6 pagesCompare Housing Loan Rates in The PhilippinesAppraiser PhilippinesNo ratings yet

- NMC GOLD FINANCE LIMITED - Forensic Report 1Document11 pagesNMC GOLD FINANCE LIMITED - Forensic Report 1Anand KhotNo ratings yet

- CBDCs and AMMDocument19 pagesCBDCs and AMMGopal DubeyNo ratings yet

- PWB VR VUer 6 NW SG2 CDocument5 pagesPWB VR VUer 6 NW SG2 CManeendra ManthinaNo ratings yet