Professional Documents

Culture Documents

US Internal Revenue Service: fw2 - 1992

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: fw2 - 1992

Uploaded by

IRSCopyright:

Available Formats

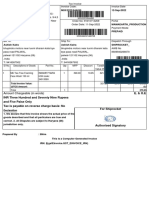

This zero weight rule designates top of sheet (Do not remove).

1 Control number For Official

22222 Use Only ©

OMB No. 1545-0008

2 Employer’s name, address, and ZIP code 6 Statutory Deceased Pension Legal 942 Subtotal Deferred Void

employee plan rep. emp. compensation

7 Allocated tips 8 Advance EIC payment

9 Federal income tax withheld 10 Wages, tips, other compensation

3 Employer’s identification number 4 Employer’s state I.D. number 11 Social security tax withheld 12 Social security wages

5 Employee’s social security number 13 Social security tips 14 Medicare wages and tips

19a Employee’s name (first, middle initial, last) 15 Medicare tax withheld 16 Nonqualified plans

17 See Instrs. for Form W-2 18 Other

19b Employee’s address and ZIP code

20 21 22 Dependent care benefits 23 Benefits included in Box 10

24 State income tax 25 State wages, tips, etc. 26 Name of state 27 Local income tax 28 Local wages, tips, etc. 29 Name of locality

Copy A For Social Security Administration Cat. No. 10134D Department of the Treasury—Internal Revenue Service

Form W-2 Wage and Tax Statement 1992 (Rev. 4-92)

For Paperwork Reduction Act Notice and instructions for completing this form, see separate instructions.

This zero weight rule designates top of sheet (Do not remove).

1 Control number

OMB No. 1545-0008

2 Employer’s name, address, and ZIP code 6 Statutory Deceased Pension Legal 942 Subtotal Deferred Void

employee plan rep. emp. compensation

7 Allocated tips 8 Advance EIC payment

9 Federal income tax withheld 10 Wages, tips, other compensation

3 Employer’s identification number 4 Employer’s state I.D. number 11 Social security tax withheld 12 Social security wages

5 Employee’s social security number 13 Social security tips 14 Medicare wages and tips

19 Employee’s name, address, and ZIP code 15 Medicare tax withheld 16 Nonqualified plans

17 18 Other

20 21 22 Dependent care benefits 23 Benefits included in Box 10

24 State income tax 25 State wages, tips, etc. 26 Name of state 27 Local income tax 28 Local wages, tips, etc. 29 Name of locality

Copy 1 For State, City, or Local Tax Department Department of the Treasury—Internal Revenue Service

Form W-2 Wage and Tax Statement 1992 (Rev. 4-92)

Employee’s and employer’s copy compared

This zero weight rule designates top of sheet (Do not remove).

1 Control number

OMB No. 1545-0008

2 Employer’s name, address, and ZIP code 6 Statutory Deceased Pension Legal 942 Subtotal Deferred Void

employee plan rep. emp. compensation

7 Allocated tips 8 Advance EIC payment

9 Federal income tax withheld 10 Wages, tips, other compensation

3 Employer’s identification number 4 Employer’s state I.D. number 11 Social security tax withheld 12 Social security wages

5 Employee’s social security number 13 Social security tips 14 Medicare wages and tips

19 Employee’s name, address, and ZIP code 15 Medicare tax withheld 16 Nonqualified plans

17 See Instrs. for Box 17 18 Other

20 21 22 Dependent care benefits 23 Benefits included in Box 10

24 State income tax 25 State wages, tips, etc. 26 Name of state 27 Local income tax 28 Local wages, tips, etc. 29 Name of locality

Copy B To Be Filed With Employee’s FEDERAL Tax Return Department of the Treasury—Internal Revenue Service

Form W-2 Wage and Tax Statement 1992 (Rev. 4-92)

This information is being furnished to the Internal Revenue Service.

This zero weight rule designates top of sheet (Do not remove).

1 Control number This information is being furnished to the Internal Revenue Service. If you are

required to file a tax return, a negligence penalty or other sanction may be

OMB No. 1545-0008 imposed on you if this income is taxable and you fail to report it.

2 Employer’s name, address, and ZIP code 6 Statutory Deceased Pension Legal 942 Subtotal Deferred Void

employee plan rep. emp. compensation

7 Allocated tips 8 Advance EIC payment

9 Federal income tax withheld 10 Wages, tips, other compensation

3 Employer’s identification number 4 Employer’s state I.D. number 11 Social security tax withheld 12 Social security wages

5 Employee’s social security number 13 Social security tips 14 Medicare wages and tips

19 Employee’s name, address, and ZIP code 15 Medicare tax withheld 16 Nonqualified plans

17 See Instrs. for Box 17 18 Other

20 21 22 Dependent care benefits 23 Benefits included in Box 10

24 State income tax 25 State wages, tips, etc. 26 Name of state 27 Local income tax 28 Local wages, tips, etc. 29 Name of locality

Copy C For EMPLOYEE’S RECORDS (See Notice on back.) Department of the Treasury—Internal Revenue Service

Form W-2 Wage and Tax Statement 1992 (Rev. 4-92)

Notice to Employee: Credit for Excess Social Security Tax.—If B—Uncollected Medicare tax on tips (see

more than one employer paid you wages Form 1040 instructions for how to pay this

Getting a Refund.—Even if you do not have

during 1992 and more than the maximum tax)

to file a tax return, you should file to get a

social security employee tax, Medicare tax, C—Cost of group-term life insurance

refund if Box 9 shows Federal income tax

railroad retirement (RRTA) tax, or combined coverage over $50,000

withheld, or if you can take the earned

social security, Medicare, and RRTA tax was

income credit. withheld, you may claim the excess as a D—Section 401(k) contributions

Earned Income Credit.—You must file a tax credit against your Federal income tax. See E—Section 403(b) contributions

return if any amount is shown in Box 8. your income tax return instructions.

F—Section 408(k)(6) contributions

For 1992, if your income is less than Box 6.—If the “Pension plan” box is marked,

G—Section 457 contributions

$22,370 and you have one qualifying child, special limits may apply to the amount of IRA

you may qualify for an earned income credit contributions you may deduct. If the “Deferred H—Section 501(c)(18)(D) contributions (see

(EIC) up to $1,324. If your income is less than compensation” box is marked, the elective 1040 instructions for how to deduct this

$22,370 and you have two or more qualifying deferrals in Box 17 (for all employers, and for all amount)

children, you may qualify for an earned such plans to which you belong) are generally J—Sick pay not includible as income

income credit up to $1,384. Any EIC that is limited to $8,475 ($9,500 for certain section

more than your tax liability is refunded to you, 403(b) contracts and $7,500 for section 457 K—Tax on excess golden parachute

but ONLY if you file a tax return. For example, plans). Amounts over that must be included in payments

if you have no tax liability and qualify for a income. See instructions for Form 1040. L—Nontaxable part of employee business

$300 EIC, you can get $300, but only if you expense reimbursements

Caution: The elective deferral dollar limitation

file a tax return. You may get as much as

of $8,475 is subject to change for 1992. M—Uncollected social security tax on cost of

$1,324 of the EIC in advance by completing group-term life insurance coverage over

Form W-5. The 1992 instructions for Forms Box 7.—For information on how to report tips

on your tax return, see the instructions for $50,000 (former employees only) (see Form

1040 and 1040A, and Pub. 596, explain the 1040 instructions for how to pay this tax)

EIC in more detail. You can get the Form 1040, 1040A, or 1040EZ. The amount of

instructions and the publication by calling allocated tips is not included in Box 10. N—Uncollected Medicare tax on cost of

toll-free 1-800-829-3676. Box 8.—Enter this amount on the advance group-term life insurance coverage over

earned income credit payment line of tax return. $50,000 (former employees only) (see Form

Making Corrections.—If your name, social 1040 instructions for how to pay this tax)

security number, or address is incorrect, Box 9.—Enter this amount on the Federal

correct Copies B, C, and 2 and ask your income tax withheld line of tax return. Box 22.—The amount in this box is the total

employer to correct your employment record. amount of dependent care benefits your

Box 16.—Any amount in Box 16 is a employer paid to you (or incurred on your

Be sure to ask the employer to file Form

distribution made to you from a nonqualified behalf). Any amount over $5,000 has been

W-2c, Statement of Corrected Income and

deferred compensation plan. This amount is included in Box 10. Part or all of this amount

Tax Amounts, with the Social Security

also included in Box 10 and is taxable for may be taxable unless you complete

Administration (SSA) to correct any name or

Federal income tax purposes. Schedule 2 of Form 1040A or Form 2441. See

number error reported to them on Copy A of

the Form W-2. If your name and number are Box 17.—If there is an amount in Box 17, the instructions for Forms 1040 and 1040A.

correct but are not the same as shown on there should be a code (letter) next to it. You Box 23.—This amount has already been

your social security card, you should ask for a can find out what the code means from the included as wages in Box 10. Do not add this

new card at any Social Security office. list below. You may need this information to amount to Box 10. If there is an amount in

complete your tax return. The codes are: Box 23, you may be able to deduct expenses

If you already filed a return and receive a

corrected Form W-2 or Form W-2c, amend A—Uncollected social security tax on tips that are related to fringe benefits; see the

your income tax return by filing Form 1040X. (see Form 1040 instructions for how to pay instructions for your income tax return.

this tax)

This zero weight rule designates top of sheet (Do not remove).

1 Control number

OMB No. 1545-0008

2 Employer’s name, address, and ZIP code 6 Statutory Deceased Pension Legal 942 Subtotal Deferred Void

employee plan rep. emp. compensation

7 Allocated tips 8 Advance EIC payment

9 Federal income tax withheld 10 Wages, tips, other compensation

3 Employer’s identification number 4 Employer’s state I.D. number 11 Social security tax withheld 12 Social security wages

5 Employee’s social security number 13 Social security tips 14 Medicare wages and tips

19 Employee’s name, address, and ZIP code 15 Medicare tax withheld 16 Nonqualified plans

17 18 Other

20 21 22 Dependent care benefits 23 Benefits included in Box 10

24 State income tax 25 State wages, tips, etc. 26 Name of state 27 Local income tax 28 Local wages, tips, etc. 29 Name of locality

Copy 2 To Be Filed With Employee’s State, City, or Local Income Tax Return Department of the Treasury—Internal Revenue Service

Form W-2 Wage and Tax Statement 1992 (Rev. 4-92)

Employee’s and employer’s copy compared

This zero weight rule designates top of sheet (Do not remove).

1 Control number

OMB No. 1545-0008

2 Employer’s name, address, and ZIP code 6 Statutory Deceased Pension Legal 942 Subtotal Deferred Void

employee plan rep. emp. compensation

7 Allocated tips 8 Advance EIC payment

9 Federal income tax withheld 10 Wages, tips, other compensation

3 Employer’s identification number 4 Employer’s state I.D. number 11 Social security tax withheld 12 Social security wages

5 Employee’s social security number 13 Social security tips 14 Medicare wages and tips

19 Employee’s name, address, and ZIP code 15 Medicare tax withheld 16 Nonqualified plans

17 See Instrs. for Form W-2 18 Other

20 21 22 Dependent care benefits 23 Benefits included in Box 10

24 State income tax 25 State wages, tips, etc. 26 Name of state 27 Local income tax 28 Local wages, tips, etc. 29 Name of locality

Copy D For Employer Department of the Treasury—Internal Revenue Service

Form W-2 Wage and Tax Statement 1992 (Rev. 4-92)

For Paperwork Reduction Act Notice and instructions for completing this form, see separate instructions.

You might also like

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Presentation ON: Goods and Service Tax: Applicability, Itc and ReturnsDocument31 pagesPresentation ON: Goods and Service Tax: Applicability, Itc and ReturnsSonal AggarwalNo ratings yet

- MIA Competency Framework Exposure DraftDocument58 pagesMIA Competency Framework Exposure DraftLuqman HakimNo ratings yet

- Tax Digest Estate To VatDocument28 pagesTax Digest Estate To Vatada mae santonia100% (1)

- Offer Letter-IntelenetDocument2 pagesOffer Letter-Intelenetkkarthi557No ratings yet

- SAP - VAT On Customer Down-PaymentDocument5 pagesSAP - VAT On Customer Down-PaymentBhagiradha PinnamareddyNo ratings yet

- 2023 Notice of Appraised Value: Collin Central Appraisal District 250 Eldorado Pkwy MCKINNEY, TX 75069-8023Document1 page2023 Notice of Appraised Value: Collin Central Appraisal District 250 Eldorado Pkwy MCKINNEY, TX 75069-8023Fuzzy PandaNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- House No L - 1311, Sector 5-B/3, North KARACHI, Karachi Central North Karachi Town Arsalan AkkilDocument6 pagesHouse No L - 1311, Sector 5-B/3, North KARACHI, Karachi Central North Karachi Town Arsalan AkkilMuhammad AhsanNo ratings yet

- HERON - D 2 2 - Annex 5 GreeceDocument25 pagesHERON - D 2 2 - Annex 5 GreeceMoldoveanu BogdanNo ratings yet

- E-Auctions - MSTC Limited-IOBL BGBG-01.12.2020Document4 pagesE-Auctions - MSTC Limited-IOBL BGBG-01.12.2020mannakauNo ratings yet

- Lecture Note 1 2Document163 pagesLecture Note 1 2Đỗ Thủy Tiên NguyễnNo ratings yet

- Alemnesh Mixed Use Project ProposalDocument20 pagesAlemnesh Mixed Use Project ProposalAbduselam AhmedNo ratings yet

- E-Way Bill 02.07.2021Document1 pageE-Way Bill 02.07.2021sathish pullela8No ratings yet

- CASE DIGEST - GR No. 186739-960Document10 pagesCASE DIGEST - GR No. 186739-960Juvy CambayaNo ratings yet

- Mcom Semester IIIDocument11 pagesMcom Semester IIIuma deviNo ratings yet

- A Study On Customer Awareness at Bajaj Allianz Project ReportDocument88 pagesA Study On Customer Awareness at Bajaj Allianz Project ReportBabasab Patil (Karrisatte)No ratings yet

- Welcome To The Official Web Site of Andhra Pradesh Tourism Development Corporation LimitedDocument1 pageWelcome To The Official Web Site of Andhra Pradesh Tourism Development Corporation LimitedDilip VemulaNo ratings yet

- College of Accountancy & Business Administration Taxation I: Santiago City, PhilippinesDocument3 pagesCollege of Accountancy & Business Administration Taxation I: Santiago City, PhilippinesVel JuneNo ratings yet

- Chapter 1: Decision Making and The Role of Accounting: Discussion QuestionsDocument8 pagesChapter 1: Decision Making and The Role of Accounting: Discussion Questionschi_nguyen_100No ratings yet

- On Line Ups DGS&D RCDocument35 pagesOn Line Ups DGS&D RCPRADEEPNo ratings yet

- Rmo 1984Document139 pagesRmo 1984Mary graceNo ratings yet

- TYB - Practical Questions - Final PDFDocument321 pagesTYB - Practical Questions - Final PDFChandana RajasriNo ratings yet

- SUF Technical DocumentationDocument237 pagesSUF Technical DocumentationDjordjeNo ratings yet

- Britannia Annual Report 2005Document60 pagesBritannia Annual Report 2005akash_metNo ratings yet

- Summary Notes - Deductions From Gross EstateDocument3 pagesSummary Notes - Deductions From Gross EstateKiana FernandezNo ratings yet

- Assignment B.om Final YearDocument12 pagesAssignment B.om Final Yearsuved0810No ratings yet

- Polisi Perakauan, Anggaran Dan KesilapanDocument27 pagesPolisi Perakauan, Anggaran Dan KesilapanPavitra MohanNo ratings yet

- INR Three Hundred and Seventy Nine Rupees and Five Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EDocument1 pageINR Three Hundred and Seventy Nine Rupees and Five Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EArnav KalraNo ratings yet

- Beginner's Tax Quiz Beginner's Tax Quiz: Business Taxation (Silliman University) Business Taxation (Silliman University)Document4 pagesBeginner's Tax Quiz Beginner's Tax Quiz: Business Taxation (Silliman University) Business Taxation (Silliman University)Water MelonNo ratings yet

- 1801 Estate Tax Return FormDocument2 pages1801 Estate Tax Return FormMay DinagaNo ratings yet