Professional Documents

Culture Documents

US Internal Revenue Service: fw4p - 1992

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: fw4p - 1992

Uploaded by

IRSCopyright:

Available Formats

Department of the Treasury

What Is Form W-4P? This form is for

Form W-4P What Do You Need To Do? Recipients who

Internal Revenue Service

When Should I File? File as soon as possible

recipients of income from annuity, pension, want no tax to be withheld can skip the to avoid underwithholding problems.

and certain other deferred compensation worksheet below and go directly to line 1 of Multiple Pensions? More Than One

plans to tell payers whether income tax is to the form. All others should complete lines A Income? To figure the number of allowances

be withheld and on what basis. The options through F of the worksheet. Many recipients you may claim, combine allowances and

available to the recipient depend on whether can stop at line F. income subject to withholding from all

the payment is periodic or nonperiodic Other Income? If you have a large amount of sources on one worksheet. You can file a

(including a qualified total distribution) as income from other sources not subject to Form W-4P with each pension payer, but do

explained on page 3. withholding (such as interest, dividends, not claim the same allowances more than

Recipients can use this form to choose to taxable social security), you should consider once. Your withholding will usually be more

have no income tax withheld from the making estimated tax payments using Form accurate if you claim all allowances on the

payment (except for payments to U.S. 1040-ES, Estimated Tax for Individuals. Call largest source of income subject to

citizens delivered outside the United States or 1-800-829-3676 for copies of Form 1040-ES, withholding.

its possessions) or to have an additional and Pub. 505, Tax Withholding and Estimated Changes for 1992. Please see page 3.

amount of tax withheld. Tax.

Personal Allowances Worksheet For 1992, the value of your personal exemption(s) is reduced if your income is over $105,250 ($157,900 if married

filing jointly, $131,550 if head of household, or $78,950 if married filing separately). Get Pub. 919, Is My Withholding

Correct for 1992?, for details. Call 1-800-829-3676 to order this publication.

A Enter “1” for yourself if no one else can claim you as a dependent A

$ %

● You are single and have only one pension; or

● You are married, have only one pension, and your

B Enter “1” if: spouse has no income subject to withholding; or B

● Your income from a second pension or a job or your spouse’s

pension or wages (or the total of all) is $1,000 or less.

C Enter “1” for your spouse. You may choose to enter -0- if you are married and have either a spouse who has

income subject to withholding or you have more than one source of income subject to withholding. (This may help

you avoid having too little tax withheld.) C

D Enter number of dependents (other than your spouse or yourself) you will claim on your return D

E Enter “1” if you will file as a head of household on your tax return E

F Add lines A through E and enter total here © F

● If you plan to itemize or claim other deductions and want to reduce your withholding, see the

Deductions and Adjustments Worksheet on page 2.

For

● If you have more than one source of income subject to withholding or a spouse with income

accuracy,

subject to withholding AND your combined earnings from all sources exceed $29,000, or $50,000

do all

if you are married filing a joint return, see the Multiple Pensions/More Than One Income

worksheets

Worksheet on page 2 if you want to avoid having too little tax withheld.

that apply.

● If neither of the above situations applies to you, stop here and enter the number from line F on

line 2 of Form W-4P below.

Cut here and give the certificate to the payer of your pension or annuity. Keep the top portion for your records.

Form W-4P Withholding Certificate for OMB No. 1545-0415

Department of the Treasury

Pension or Annuity Payments

Internal Revenue Service

Type or print your full name Your social security number

Home address (number and street or rural route) Claim or identification number

(if any) of your pension or

annuity contract

City or town, state, and ZIP code

Complete the following applicable lines:

1 I elect not to have income tax withheld from my pension or annuity. (Do not complete lines 2 or 3.) ©

2 I want my withholding from each periodic pension or annuity payment to be figured using the number of allowances

and marital status shown. (You may also designate an amount on line 3.) ©

(Enter number

Marital status: Single Married Married, but withhold at higher Single rate of allowances.)

3 I want the following additional amount withheld from each pension or annuity payment. Note: For periodic payments,

you cannot enter an amount here without entering the number (including zero) of allowances on line 2 © $

Your signature © Date ©

Cat. No. 10225T

Form W-4P (1992) Page 2

Deductions and Adjustments Worksheet

NOTE: Use this Worksheet only if you plan to itemize deductions or claim adjustments to income on your 1992 tax return.

1. Enter an estimate of your 1992 itemized deductions. These include: qualifying home mortgage interest,

charitable contributions, state and local taxes (but not sales taxes), medical expenses in excess of 7.5%

of your income, and miscellaneous deductions. (For 1992, you may have to reduce your itemized

deductions if your income is over $105,250 ($52,625 if married filing separately). Get Pub. 919 for details.) 1 $

$ %

$6,000 if married filing jointly or qualifying widow(er)

$5,250 if head of household 2 $

2. Enter:

$3,600 if single

$3,000 if married filing separately

3. Subtract line 2 from line 1. If line 2 is greater than line 1, enter -0- 3 $

4. Enter estimate of your 1992 adjustments to income. These include alimony paid and deductible IRA contributions 4 $

5. Add lines 3 and 4 and enter the total 5 $

6. Enter an estimate of your 1992 income not subject to withholding (such as dividends or interest income) 6 $

7. Subtract line 6 from line 5. Enter the result, but not less than zero 7 $

8. Divide the amount on line 7 by $2,500 and enter the result here. Drop any fraction 8

9. Enter the number from Personal Allowance Worksheet, line F, on page 1 9

10. Add lines 8 and 9 and enter the total here. If you plan to use the Multiple Pensions/More Than One

Income Worksheet, also enter the total on line 1, below. Otherwise stop here and enter this total on

Form W-4P, line 2 on page 1 10

Multiple Pensions/More Than One Income Worksheet

NOTE: Use this Worksheet only if the instructions under line F on page 1 direct you here. This applies if you

(and your spouse if married filing a joint return) have more than one source of income subject to withholding

(such as more than one pension, or a pension and a job, or you have a pension and your spouse works).

1. Enter the number from line F on page 1 (or from line 10 above if you used the Deductions and

Adjustments Worksheet) 1

2. Find the number in Table 1 below that applies to the LOWEST paying pension or job and enter it here 2

3. If line 1 is GREATER THAN OR EQUAL TO line 2, subtract line 2 from line 1. Enter the result here (if

zero, enter -0-) and on Form W-4P, line 2, page 1. Do not use the rest of this worksheet 3

4. If line 1 is LESS THAN line 2, enter -0- on Form W-4P, line 2, page 1, and enter the number from line

2 of this worksheet here 4

5. Enter the number from line 1 of this worksheet 5

6. Subtract line 5 from line 4 and enter the result here 6

7. Find the amount in Table 2 below that applies to the HIGHEST paying pension or job and enter it here 7 $

8. Multiply line 7 by line 6 and enter the result here 8 $

9. Divide line 8 by the number of pay periods in each year. (For example, divide by 12 if you are paid every

month.) Enter the result here and on Form W-4P, line 3, page 1. This is the additional amount to be

withheld from each payment 9 $

Table 1: Multiple Pensions/More Than One Income Worksheet

Married Filing Jointly All Others

If amount from LOWEST Enter on If amount from LOWEST Enter on

paying pension or job is— line 2, above paying pension or job is— line 2, above

0 - $4,000 0 0 - $6,000 0

4,001 - 8,000 1 6,001 - 10,000 1

8,001 - 13,000 2 10,001 - 14,000 2

13,001 - 18,000 3 14,001 - 18,000 3

18,001 - 22,000 4 18,001 - 22,000 4

22,001 - 26,000 5 22,001 - 45,000 5

26,001 - 30,000 6 45,001 and over 6

30,001 - 35,000 7

35,001 - 40,000 8

40,001 - 60,000 9

60,001 - 80,000 10

80,001 and over 11

Table 2: Multiple Pensions/More Than One Income Worksheet

Married Filing Jointly All Others

If amount from HIGHEST Enter on If amount from HIGHEST Enter on

paying pension or job is— line 7, above paying pension or job is— line 7, above

0 - $50,000 $340 0 - $27,000 $340

50,001 - 100,000 640 27,001 - 58,000 640

100,001 and over 710 58,001 and over 710

Form W-4P (1992) Page 3

Paperwork Reduction Act Notice.— We Withholding From Pensions payment is a qualified total distribution.

ask for the information on this form to Tax will be withheld from a qualified total

carry out the Internal Revenue laws of the

and Annuities distribution using tables furnished payers

United States. The Internal Revenue Code Generally, withholding applies to payments and prescribed by the Treasury

requires this information under sections made from pension, profit-sharing, stock Department. Distributions from an IRA that

3405 and 6109 and their regulations. bonus, annuity, and certain deferred are payable upon demand are treated as

Failure to provide this information may compensation plans, from individual nonperiodic payments. You can elect to

result in withholding on your payment(s). retirement arrangements (IRAs), and from have no income tax withheld from a

commercial annuities. The method and rate nonperiodic payment by filing Form W-4P

The time needed to complete this form of withholding depends upon the kind of

will vary depending on individual with the payer and checking the box on

payment you receive. line 1. Generally, your election to have no

circumstances. The estimated average time

is: Periodic payments from all of the items tax withheld will apply to any later payment

above are treated as wages for the from the same plan. You cannot use line 2

Recordkeeping 40 min. purpose of withholding. A periodic to change the way tax is withheld. But you

Learning about the law or the payment is one that is includible in your may use line 3 to specify that an additional

form 20 min. income for tax purposes and that you amount be withheld.

Preparing the form 49 min. receive in installments at regular intervals

over a period of more than 1 full year from Exemption From Income Tax

If you have comments concerning the

accuracy of these time estimates or the starting date of the pension or annuity. Withholding

suggestions for making this form more The intervals can be annual, quarterly, The election to be exempt from income tax

monthly, etc. withholding does not apply to any periodic

simple, we would be happy to hear from

you. You can write to both the Internal You can use Form W-4P to change the payment or nonperiodic distribution that is

Revenue Service, Washington, DC 20224, amount of tax to be withheld by using lines delivered outside the United States or its

Attention: IRS Reports Clearance Officer, 2 and 3 of the form or to exempt the possessions to a U.S. citizen or resident

T:FP; and the Office of Management and payments from withholding by using line 1 alien.

Budget, Paperwork Reduction Project of the form. This exemption from Other recipients who have these

(1545-0415), Washington, DC 20503. DO withholding does not apply to certain payments delivered outside the United

NOT send the tax form to either of these recipients who have payments delivered States or its possessions can elect

offices. Instead, give it to your payer. outside the United States or its exemption only if an individual certifies to

possessions. See Exemption From the payer that the individual is not: (1) a

Changes for 1992 Income Tax Withholding later. U.S. citizen or resident alien or (2) an

Changes in the law may affect your 1992 Caution: Remember that there are individual to whom section 877 of the

tax liability. You may use your 1991 tax penalties for not paying enough tax during Internal Revenue Code applies (concerning

return as a guide in figuring your estimated the year, either through withholding or expatriation to avoid tax). The certification

taxes, but be sure to consider the tax law estimated tax payments. New retirees, can be made in a statement to the payer

changes in this section. especially, should see Pub. 505. It explains under the penalties of perjury. A

the estimated tax requirements and nonresident alien who elects exemption

Standard Deduction penalties in detail. You may be able to from withholding under section 3405, is

The standard deduction has been avoid quarterly estimated tax payments by subject to withholding under section 1441.

increased for all taxpayers. For 1992, the having enough tax withheld from your

pension or annuity using Form W-4P. Revoking the Exemption From

amounts are:

Standard Unless you tell your payer otherwise, tax Withholding

Filing Status Deduction must be withheld on periodic payments as If you want to revoke your previously filed

Married filing joint return and if you are married and claiming three exemption from withholding for periodic

qualifying widow(er) $6,000* withholding allowances. This means that payments, file another Form W-4P with the

Head of household $5,250* tax will be withheld if your pension or payer. If you want tax withheld at the rate

annuity is more than $883 a month set by law (married with three allowances),

Single $3,600* write the word “Revoked” by the checkbox

($10,600 a year).

Married filing separately $3,000* on line 1 of the form. If you want tax

There are some kinds of periodic

*To this amount, add the Additional payments for which you cannot use Form withheld at any different rate, complete line

Amount below if you are elderly or blind. W-4P since they are already defined as 2 on the form.

Additional Amount for the Elderly or the wages subject to income tax withholding. If you want to revoke your previously

Blind.— An additional standard deduction Retirement pay for service in the Armed filed exemption for nonperiodic payments,

amount of $700 is allowed for a married Forces of the United States generally falls write the word ‘‘Revoked’’ by the

individual (whether filing jointly or into this category. Certain nonqualified checkbox on line 1 and file Form W-4P

separately) or for a qualifying widow(er) deferred compensation plans and state with the payer.

who is 65 or over or blind ($1,400 if the and local deferred compensation plans

described in section 457 also fall into this Statement of Income Tax

individual is both 65 or over and blind,

$2,800 on a joint return if both spouses are category. Your payer should be able to tell Withheld From Your Pension or

65 or over and blind). An additional you whether Form W-4P will apply. Social Annuity

standard deduction amount of $900 is security payments are not subject to By January 31 of next year, you will

allowed for an unmarried individual (single withholding but may be includible in receive a statement from your payer

or head of household) who is 65 or over or income. showing the total amount of your pension

blind ($1,800 if both 65 or over and blind). For periodic payments, your certificate or annuity payments and the total income

stays in effect until you change or revoke tax withheld during the year.

Personal Exemption it. Your payer must notify you each year of Copies of Form W-4P will not be sent to

The amount of the personal exemption has your right to elect to have no tax withheld the IRS by the payer, regardless of the

been increased to $2,300 for the individual, or to revoke your election. number of allowances claimed on line 2 of

the spouse, and for each dependent. Nonperiodic payments will have income Form W-4P.

tax withheld at a flat 10% rate unless the

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BDO vs. Republic, G.R. No. 198756, January 13, 2015Document26 pagesBDO vs. Republic, G.R. No. 198756, January 13, 2015Your Public ProfileNo ratings yet

- Facilities Planning and Design - Lecture NotesDocument162 pagesFacilities Planning and Design - Lecture NotesVitor Moreira100% (4)

- f4f0880 33401Document3 pagesf4f0880 33401uschandraNo ratings yet

- 2022 Comprehensive Real Estate Property Due Diligence Checklist For Land SalesDocument4 pages2022 Comprehensive Real Estate Property Due Diligence Checklist For Land SalesLupang HinirangNo ratings yet

- Spouses Pacquiao vs. CtaDocument3 pagesSpouses Pacquiao vs. CtaEM DOMINGO100% (2)

- Factsheet Supply Chain S Ge en 2018Document4 pagesFactsheet Supply Chain S Ge en 2018voumeregistrarNo ratings yet

- Deutsche Bank Annual Review 2009 StrengthDocument436 pagesDeutsche Bank Annual Review 2009 StrengthCebotar AndreiNo ratings yet

- Abdul Rehman 2022 ReturnDocument4 pagesAbdul Rehman 2022 Returnbalawal mirzaNo ratings yet

- Earnest Money Receipt Agreement-1Document2 pagesEarnest Money Receipt Agreement-1Asisclo CastanedaNo ratings yet

- Item Name HSN Code GST Rate QTY Taxable Rate Taxable ValueDocument5 pagesItem Name HSN Code GST Rate QTY Taxable Rate Taxable ValueAnup gurungNo ratings yet

- Tax Digest (Siao Tiao Hong V Cir)Document2 pagesTax Digest (Siao Tiao Hong V Cir)Alex CustodioNo ratings yet

- Turkish Political Economy: 1923 - 1939: INTL 410 / ECIR 410 Prof. Ziya ÖnişDocument15 pagesTurkish Political Economy: 1923 - 1939: INTL 410 / ECIR 410 Prof. Ziya ÖnişEce ErdoğanNo ratings yet

- Angeles City Vs Angeles City Electric CorporationDocument1 pageAngeles City Vs Angeles City Electric CorporationJesse MoranteNo ratings yet

- Bos 44566Document24 pagesBos 44566Bhavani KannanNo ratings yet

- Dark Side of Valuation NotesDocument11 pagesDark Side of Valuation Notesad9292No ratings yet

- Udhayakumar Rice MillDocument12 pagesUdhayakumar Rice Millcachandhiran0% (1)

- Eco C12 MacroEconomicsDocument110 pagesEco C12 MacroEconomicskane2123287450% (2)

- Court Rules Expropriation for Private Subdivision Not Valid Public UseDocument489 pagesCourt Rules Expropriation for Private Subdivision Not Valid Public UseNico FerrerNo ratings yet

- Ajay Bio-Tech (India) Limited: Gat No 879-At Post - Khalad-Taluka - PurandharDocument1 pageAjay Bio-Tech (India) Limited: Gat No 879-At Post - Khalad-Taluka - PurandharDnyaneshwar Dattatraya PhadatareNo ratings yet

- Caspian Oil and Gas Potential and Export ChallengesDocument285 pagesCaspian Oil and Gas Potential and Export ChallengespauldmeNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentAnonymous e9EIwbUY9No ratings yet

- Final ExamDocument10 pagesFinal ExamAllen Fey De JesusNo ratings yet

- Which of The Following Is The Correct Tax Implication of The Foregoing Data With Respect To Payment of Income Tax?Document3 pagesWhich of The Following Is The Correct Tax Implication of The Foregoing Data With Respect To Payment of Income Tax?ROSEMARIE CRUZNo ratings yet

- Circular and Orders Under GSTDocument404 pagesCircular and Orders Under GSTRaviJodidar AccountsNo ratings yet

- Zeian Cover RevisedDocument13 pagesZeian Cover Revisedcherry valeNo ratings yet

- LESCO - Web BillDocument1 pageLESCO - Web BillMalik IrfanNo ratings yet

- Financial Times UK. September 06, 2022Document24 pagesFinancial Times UK. September 06, 2022Mãi Mãi LàbaoxaNo ratings yet

- BIR Quiz Remedies September 2020Document8 pagesBIR Quiz Remedies September 2020Randy ManzanoNo ratings yet

- Cash Flow StatementsDocument48 pagesCash Flow StatementsApollo Institute of Hospital Administration60% (5)

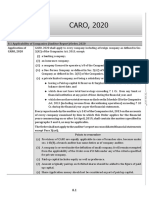

- Caro 2020 Main Book Pankaj GargDocument23 pagesCaro 2020 Main Book Pankaj Gargajay adhikariNo ratings yet