Professional Documents

Culture Documents

Index of Industrial Production May 12th 2011

Uploaded by

Seema GusainCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Index of Industrial Production May 12th 2011

Uploaded by

Seema GusainCopyright:

Available Formats

May 12th, 2011

Index of Industrial Production (IIP)

Higher growth in the capital goods & manufacturing segment supported plummeting IIP, which registered a growth

of 7.3% in Mar 11 against 3.7% in Feb 11 (above the consensuses estimates of 4%). This was evident as the six core

infrastructure industries in Mar 11 registered a positive growth of 7.4% from 6.8% in Feb 11.

The Manufacturing sector which has largest weightage (~80%) in the IIP accelerated by 8% in Mar 11 from 3.63% in

Feb 11. Besides manufacturing, electricity generation (weightage of 10.1%) also increased by 7.19% against 6.7% in Feb

11, however, mining sector (weightage of 10.4%) declined by 0.2% against 1.03% in Feb 11.

In used based industry, three out of the main four segments registered a lower growth in Mar 11. The basic,

intermediate goods fell to 4.2% and 5.3% in Mar 11 from 6% and 8.6% in Feb 11. The higher inflation numbers has

dampened the consumer sentiment as consumer goods segment registered a slower growth of 7.7% in Mar 11 against

11% in Feb 11. The capital goods segment which consistently for 3 months shown negative growth increased to 12.9%

in Mar 11 against 18.15% in Feb 11. Some of the important items of Capital goods contributing to the high growth in

this category are Turbines (steam/hydro) (67.6%), Process control instruments (42.9%), Boilers (31.5%) and Complete

tractors (30.2%). Alarm time pieces (59.7%), Two wheeler tyres (55.5%) and Passenger cars (33.6%) are some of the

important items contributing towards the high growth of Consumer durable goods.

In terms of industries, 13 out of the 17 industry groups have shown positive growth during the month of Mar 11 as

compared to the corresponding month of the previous year. The industry groups Leather and Leather & Fur Products

have shown the highest growth of 28.6%, followed by 25.6% in Other Manufacturing Industries and 18.4% in Food

Products. On the other hand, the industry groups Wood and Wood Products; Furniture and Fixtures have shown a

negative growth of 66.4% followed by 7.9% in Textile Products (including Wearing Apparel).

Conclusion

The volatility in the IIP numbers is likely to continue on back of higher base and increasing cost (elevated inflation).

Decline in consumer goods growth rate is a concern, project investments slowing down and perhaps higher interest

rates have now started impacting the consumption demand. Unless we get another month of similar strong data we

can not say that the trend has reversed. While data is obviously positive, growth is estimated to be at a lower level.

With high volatility in IIP & high inflation numbers, the Reserve Bank of India would be facing a dilemma on policy

changes in the next policy review.

Wealth Research, Unicon Financial Intermediaries. Pvt. Ltd.

Email: wealthresearch@uniconindia.in Shweta Rane | srane@uniconindia.in

May 12th, 2011

Index of Industrial Production

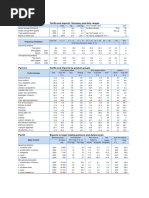

Particulars (% YoY) Weight Mar-11 Mar-10 Feb-11

Sectoral classification

Mining 10.47 0.21 12.30 1.03

Manufacturing 79.36 7.90 24.32 3.63

Electricity 10.17 7.19 8.33 6.75

General 100.00 7.33 22.20 3.65

Use-based classification

Basic Goods 35.57 12.91 68.28 (18.15)

Capital Goods 9.26 12.91 68.28 (18.15)

Intermediate Goods 26.51 5.37 18.49 8.61

Consumer Goods 28.66 7.70 12.86 11.04

Consumer durables 5.36 12.33 35.56 23.46

Consumer non-durables 23.30 5.67 5.17 6.00

20.0

Mining Manufacturing Electricity IIP

18.0

16.6 IIP

18.0 16.0

15.0

16.0 14.0

14.0 12.2 11.3 12.0

12.0

10.0 10.0

7.2 6.9 7.3

8.0 8.0

6.0 4.4 3.6 3.9 3.7 6.0

4.0 2.5

4.0

2.0

0.0 2.0

May-10

Jun-10

Jul-10

Oct-10

Nov-10

Dec-10

Jan-11

Feb-11

Mar-11

Sep-10

Apr-10

Aug-10

0.0

Wealth Research, Unicon Financial Intermediaries. Pvt. Ltd.

Email: wealthresearch@uniconindia.in

May 12th, 2011

Disclaimer

This document has been issued by Unicon Financial Intermediaries Pvt. Ltd (“UNICON”) for the information of its customers only. UNICON is

governed by the Securities and Exchange Board of India. This document is not for public distribution and has been furnished to you solely for your

information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required

to observe these restrictions. The information and opinions contained herein have been compiled or arrived at based upon information obtained in

good faith from public sources believed to be reliable. Such information has not been independently verified and no guarantee, representation or

warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change

without notice. This document has been produced independently of any company or companies mentioned herein, and forward looking statements;

opinions and expectations contained herein are subject to change without notice. This document is for information purposes only and is provided on

an “as is” basis. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document

is not, and should not be construed as an offer, or solicitation of an offer, to buy or sell or subscribe to any securities or other financial instruments.

We are not soliciting any action based on this document. UNICON, its associate and group companies its directors or employees do not take any

responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this

document, including but not restricted to, fluctuation in the prices of the shares and bonds, reduction in the dividend or income, etc. This document

is not directed to or intended for display, downloading, printing, reproducing or for distribution to or use by any person or entity who is a citizen or

resident or located in any locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be

contrary to law or regulation or would subject UNICON or its associates or group companies to any registration or licensing requirement within such

jurisdiction. If this document is inadvertently sent or has reached any individual in such country, the same may be ignored and brought to the

attention of the sender. This document may not be reproduced, distributed or published for any purpose without prior written approval of UNICON.

This document is for the general information and does not take into account the particular investment objectives, financial situation or needs of any

individual customer, and it does not constitute a personalized recommendation of any particular security or investment strategy. Before acting on

any advice or recommendation in this document, a customer should consider whether it is suitable given the customer’s particular circumstances

and, if necessary, seek professional advice. Certain transactions, including those involving futures, options, and high yield securities, give rise to

substantial risk and are not suitable for all investors. UNICON, its associates or group companies do not represent or endorse the accuracy or

reliability of any of the information or content of the document and reliance upon it is at your own risk.

UNICON, its associates or group companies, expressly disclaims any and all warranties, express or implied, including without limitation warranties

of merchantability and fitness for a particular purpose with respect to the document and any information in it. UNICON, its associates or group

companies, shall not be liable for any direct, indirect, incidental, punitive or consequential damages of any kind with respect to the document. No

part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical,

photocopying, recording, or otherwise, without the prior written permission of UNICON Financial Intermediaries Pvt. Ltd.

Address:

Wealth Management

Unicon Financial Intermediaries. Pvt. Ltd.

Ground Floor, Jhawar House,

285, Princess Street, Mumbai-400002

Ph: 022-43591200 / 100

Email: wealthresearch@uniconindia.in

Visit us at www.uniconindia.in

Wealth Research, Unicon Financial Intermediaries. Pvt. Ltd.

Email: wealthresearch@uniconindia.in

You might also like

- Market Cap (% of GDP)Document56 pagesMarket Cap (% of GDP)Md. Real MiahNo ratings yet

- Ethanol A Renaissance For Sugar Industry in India: Ravi GuptaDocument31 pagesEthanol A Renaissance For Sugar Industry in India: Ravi GuptaDebjit AdakNo ratings yet

- Strategy - Kotak - 12th OctDocument38 pagesStrategy - Kotak - 12th OctVasumathi SubramanianNo ratings yet

- Kotak Consolidated Earnings EstimatesDocument50 pagesKotak Consolidated Earnings EstimatesAnkit JainNo ratings yet

- Key Economic IndicatorsDocument30 pagesKey Economic IndicatorsJyotishree PandeyNo ratings yet

- Manufacturing and Mining: 3.1 FY2020: A Synoptic PresentationDocument25 pagesManufacturing and Mining: 3.1 FY2020: A Synoptic Presentationanas ejazNo ratings yet

- Key Economic Indicators PDFDocument30 pagesKey Economic Indicators PDFRitesh JhaNo ratings yet

- Manufacturing and MiningDocument20 pagesManufacturing and MiningShehroz ShyziNo ratings yet

- Macroeconomic analysis of USA GDP, sectors and indicators (2016-17Document13 pagesMacroeconomic analysis of USA GDP, sectors and indicators (2016-17Deepak DharmavaramNo ratings yet

- Economic Growth, Savings and Investments: 2.1 OverviewDocument22 pagesEconomic Growth, Savings and Investments: 2.1 OverviewZain Ul AbidinNo ratings yet

- Growth Rate and Composition of Real GDPDocument27 pagesGrowth Rate and Composition of Real GDPpallavi jhanjiNo ratings yet

- Msci World Small Cap IndexDocument3 pagesMsci World Small Cap IndexrichardsonNo ratings yet

- Rbi Sectoral Non-Food Credit - March 2023: Mom Growth MomentumDocument6 pagesRbi Sectoral Non-Food Credit - March 2023: Mom Growth MomentumRavichandra BNo ratings yet

- Key Economic IndicatorsDocument36 pagesKey Economic IndicatorsExtraaaNo ratings yet

- Macro5 Lecppt ch02Document75 pagesMacro5 Lecppt ch02meuang68No ratings yet

- EBRD Ukraine Strategy 2011-2014Document70 pagesEBRD Ukraine Strategy 2011-2014consta7751No ratings yet

- 8-Monetary Policy Information Compendium May 2017Document32 pages8-Monetary Policy Information Compendium May 2017Fareed ShahwaniNo ratings yet

- Monetary Policy Compendium HighlightsDocument32 pagesMonetary Policy Compendium HighlightsZainab ImtiazNo ratings yet

- EBLSL Daily Market Update 6th August 2020Document1 pageEBLSL Daily Market Update 6th August 2020Moheuddin SehabNo ratings yet

- Britannia Industries Q4FY22 Result SnapshotDocument3 pagesBritannia Industries Q4FY22 Result SnapshotBaria VirenNo ratings yet

- Part A.1 Tariffs and Imports: Summary and Duty Ranges: SwitzerlandDocument1 pagePart A.1 Tariffs and Imports: Summary and Duty Ranges: SwitzerlandCodrin-TeodorNo ratings yet

- Monetary Policy Information CompendiumDocument29 pagesMonetary Policy Information CompendiumfarriyNo ratings yet

- Select Economic IndicatorsDocument1 pageSelect Economic Indicatorspls2019No ratings yet

- Part A.1 Tariffs and Imports: Summary and Duty Ranges: Viet NamDocument1 pagePart A.1 Tariffs and Imports: Summary and Duty Ranges: Viet NamPrabhuNo ratings yet

- Cloud Computing in BPODocument15 pagesCloud Computing in BPORahul KunwarNo ratings yet

- Msci World Small Cap IndexDocument3 pagesMsci World Small Cap Indexodanodan84No ratings yet

- MODEC, Inc. 2019 Half-Year Financial Results Analysts PresentationDocument16 pagesMODEC, Inc. 2019 Half-Year Financial Results Analysts Presentationfle92No ratings yet

- Tanzania Economy Analysis Report 2013-2018Document10 pagesTanzania Economy Analysis Report 2013-2018Deo CluxNo ratings yet

- INDIA Engineering Exports 2019Document33 pagesINDIA Engineering Exports 2019Vipin LNo ratings yet

- Daily market review sees DSEX rise marginally above 4300Document1 pageDaily market review sees DSEX rise marginally above 4300Moheuddin SehabNo ratings yet

- Monetary Policy Information CompendiumDocument28 pagesMonetary Policy Information CompendiumrehmanejazNo ratings yet

- This Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)Document7 pagesThis Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)karanNo ratings yet

- Part A.1 Tariffs and Imports: Summary and Duty Ranges: BrazilDocument1 pagePart A.1 Tariffs and Imports: Summary and Duty Ranges: BrazilDani FierroNo ratings yet

- Estadísticas Nov 2022Document19 pagesEstadísticas Nov 2022LJL,LLCNo ratings yet

- Data Analysis of Import Inflation Trends in EthiopiaDocument14 pagesData Analysis of Import Inflation Trends in EthiopiaAbdurohmanNo ratings yet

- The Calculations VR 4.0Document39 pagesThe Calculations VR 4.0bbookkss2024No ratings yet

- Paper Code: 304 3nd Term Individual Assignment Case Study: Business StatisticsDocument11 pagesPaper Code: 304 3nd Term Individual Assignment Case Study: Business StatisticsCAO AGRINo ratings yet

- Caraga posts 5.0% economic growth in 2019Document2 pagesCaraga posts 5.0% economic growth in 2019Jacket TralalaNo ratings yet

- Rainfall Data 2018Document12 pagesRainfall Data 2018IsaiahogedaNo ratings yet

- Maple BrownAbbott Australian Geared Equity Fund Factsheet RetailDocument2 pagesMaple BrownAbbott Australian Geared Equity Fund Factsheet RetailpetrioravainenNo ratings yet

- Vie Key Indicators 2021Document4 pagesVie Key Indicators 2021Nguyên NguyễnNo ratings yet

- Infosys Q4 revenue up 9.6% YoY to $3.6 bnDocument4 pagesInfosys Q4 revenue up 9.6% YoY to $3.6 bnV KeshavdevNo ratings yet

- Engineering & Capital Goods Industry Trends and StatisticsDocument1 pageEngineering & Capital Goods Industry Trends and StatisticsrohitNo ratings yet

- Untuk Kestabilan HayatiDocument3 pagesUntuk Kestabilan HayatiM Fahmi NNo ratings yet

- MPS Jan 2024 CompendiumDocument32 pagesMPS Jan 2024 Compendiummaryamshah63neduetNo ratings yet

- From Existing Consumer Add Load From New Consumer Migrate From JVBL New Establishment Financail Year Connected Load As On 1st AprilDocument3 pagesFrom Existing Consumer Add Load From New Consumer Migrate From JVBL New Establishment Financail Year Connected Load As On 1st AprilSuman MandalNo ratings yet

- Singapore Workplace Safety & Health ReportDocument1 pageSingapore Workplace Safety & Health ReportAris RahmanNo ratings yet

- Investor Presentation: April 2021Document47 pagesInvestor Presentation: April 2021PARAS KAUSHIKKUMAR DAVENo ratings yet

- 18-statistics-key-economic-indicatorsDocument17 pages18-statistics-key-economic-indicatorsjohnmarch146No ratings yet

- Economic Analysis (H&S Farms)Document7 pagesEconomic Analysis (H&S Farms)Fahad KhanNo ratings yet

- MPS Jan 2019 CompendiumDocument32 pagesMPS Jan 2019 CompendiumSyed Abbas Haider ZaidiNo ratings yet

- 2 Wheelers in A Sweet Spot - Flag Bearer of The Recovery in Automotive SegmentDocument23 pages2 Wheelers in A Sweet Spot - Flag Bearer of The Recovery in Automotive SegmentayushNo ratings yet

- I. Economic Environment (1) I: The Philippines WT/TPR/S/59Document15 pagesI. Economic Environment (1) I: The Philippines WT/TPR/S/59Roselyn MonsayNo ratings yet

- Equity Portfolio SGDocument208 pagesEquity Portfolio SGdharmendra_kanthariaNo ratings yet

- Natural Gas Supply, Disposition, and PricesDocument9 pagesNatural Gas Supply, Disposition, and PricesNancy yepesNo ratings yet

- Black Naturals Golden Race Aug - Sep - Oct: C1 - Internal UseDocument9 pagesBlack Naturals Golden Race Aug - Sep - Oct: C1 - Internal UseDHANLAXMI SALESNo ratings yet

- Product Market Performance and Policy Indicators TablesDocument16 pagesProduct Market Performance and Policy Indicators TablesMNo ratings yet

- 2018 2019 SALARY SURVEY REPORT ContentDocument2 pages2018 2019 SALARY SURVEY REPORT Contentye yintNo ratings yet

- Apr FileDocument1 pageApr FileAshwin GophanNo ratings yet

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- HDFC Bank Q2FY12 Result UpdateDocument3 pagesHDFC Bank Q2FY12 Result UpdateSeema GusainNo ratings yet

- YES Bank Q1FY12 Result UpdateDocument3 pagesYES Bank Q1FY12 Result UpdateSeema GusainNo ratings yet

- Biocon LTD Q2FY12 Result UpdateDocument4 pagesBiocon LTD Q2FY12 Result UpdateSeema GusainNo ratings yet

- Zee Entertainment Enterprises LTD - Q2FY12 Result UpdateDocument3 pagesZee Entertainment Enterprises LTD - Q2FY12 Result UpdateSeema GusainNo ratings yet

- Indusind Bank Q2FY12 Result UpdateDocument3 pagesIndusind Bank Q2FY12 Result UpdateSeema GusainNo ratings yet

- IDBI Bank Q2FY12 Result UpdateDocument3 pagesIDBI Bank Q2FY12 Result UpdateSeema GusainNo ratings yet

- Hexaware Technologies LTD - Q3FY11 Result UpdateDocument3 pagesHexaware Technologies LTD - Q3FY11 Result UpdateSeema GusainNo ratings yet

- Tata Consultancy Services LTD - Q2FY12 Result UpdateDocument4 pagesTata Consultancy Services LTD - Q2FY12 Result UpdateSeema GusainNo ratings yet

- Unicon Quarterly Earnings Preview - Q2FY12Document38 pagesUnicon Quarterly Earnings Preview - Q2FY12Seema GusainNo ratings yet

- Weekly - 111015Document15 pagesWeekly - 111015Seema GusainNo ratings yet

- HCL Technologies LTD - Q1FY12 Result UpdateDocument3 pagesHCL Technologies LTD - Q1FY12 Result UpdateSeema GusainNo ratings yet

- WeeklyDocument17 pagesWeeklySeema GusainNo ratings yet

- Development Credit Bank LTD Q2FY12 Result UpdateDocument3 pagesDevelopment Credit Bank LTD Q2FY12 Result UpdateSeema GusainNo ratings yet

- Persistent Systems LTD - Result Update Q2FY12Document3 pagesPersistent Systems LTD - Result Update Q2FY12Seema GusainNo ratings yet

- Infosys Ltd-Q2 FY12Document4 pagesInfosys Ltd-Q2 FY12Seema GusainNo ratings yet

- Persistent Systems LTD - Initiating CoverageDocument24 pagesPersistent Systems LTD - Initiating CoverageSeema GusainNo ratings yet

- Index of Industrial Production October 12th 2011Document2 pagesIndex of Industrial Production October 12th 2011Seema GusainNo ratings yet

- Eadlines: German Lawmakers Approved An Expansion of The Euro-Area Rescue Fund The Food Price Index Rose 9.13% WowDocument16 pagesEadlines: German Lawmakers Approved An Expansion of The Euro-Area Rescue Fund The Food Price Index Rose 9.13% WowSeema GusainNo ratings yet

- WeeklyDocument16 pagesWeeklySeema GusainNo ratings yet

- Development Credit Bank LTD - Initiating CoverageDocument15 pagesDevelopment Credit Bank LTD - Initiating CoverageSeema GusainNo ratings yet

- Eadlines: Saturday, September 24, 2011Document16 pagesEadlines: Saturday, September 24, 2011Seema GusainNo ratings yet

- Tribue-29 August 2011Document1 pageTribue-29 August 2011Seema GusainNo ratings yet

- Agrochemical Sector Outlook & Peer AnalysisDocument3 pagesAgrochemical Sector Outlook & Peer AnalysisSeema Gusain0% (1)

- RBI Draft Report - New Banking LicensesDocument3 pagesRBI Draft Report - New Banking LicensesSeema GusainNo ratings yet

- TATA Steel LTD - Q1FY12 Result UpdateDocument4 pagesTATA Steel LTD - Q1FY12 Result UpdateSeema GusainNo ratings yet

- TD Power Systems LTD - IPO NoteDocument6 pagesTD Power Systems LTD - IPO NoteSeema GusainNo ratings yet

- Eadlines: Us GDP Q2 Growth Revised To 1% Food Inflation Rises To 9.8% (Wow)Document16 pagesEadlines: Us GDP Q2 Growth Revised To 1% Food Inflation Rises To 9.8% (Wow)Seema GusainNo ratings yet

- Opto Circuits Q1FY12 Result UpdateDocument4 pagesOpto Circuits Q1FY12 Result UpdateSeema GusainNo ratings yet

- RBI Monetary Policy Sep 2011Document2 pagesRBI Monetary Policy Sep 2011Seema GusainNo ratings yet

- Rallis India LTD - Result Update Q1 FY12Document3 pagesRallis India LTD - Result Update Q1 FY12Seema GusainNo ratings yet

- Aitel Joint Mock Examinations: of East Africa) Paper 2Document2 pagesAitel Joint Mock Examinations: of East Africa) Paper 2Owani JimmyNo ratings yet

- Quasi Contracts Torts DamagesDocument171 pagesQuasi Contracts Torts DamagesKat KatNo ratings yet

- Suspected Leakage From Four Circuit Protection Valves: (Including Those Fitted To Air Processing Units (Apus) )Document2 pagesSuspected Leakage From Four Circuit Protection Valves: (Including Those Fitted To Air Processing Units (Apus) )Raul LazaroNo ratings yet

- Regd. & Head Office: 3, Middleton Street, Kolkata-700 001 Address For Policy Issuing OfficeDocument2 pagesRegd. & Head Office: 3, Middleton Street, Kolkata-700 001 Address For Policy Issuing OfficeNimesh ThakkarNo ratings yet

- m78741 p383721Document2 pagesm78741 p383721Sameh_Abd_AzizNo ratings yet

- Chap 8 Transfer PricingDocument14 pagesChap 8 Transfer PricingjohanNo ratings yet

- QP - SSC - Q8113 - v2.0 - AI Machine Learning EngineerDocument40 pagesQP - SSC - Q8113 - v2.0 - AI Machine Learning Engineerprakash subramanianNo ratings yet

- B Arch - Timetable - Allotment - Even Sem - 2023-15-12-2023.Document4 pagesB Arch - Timetable - Allotment - Even Sem - 2023-15-12-2023.Soundarya SahooNo ratings yet

- Human Rights ReportDocument39 pagesHuman Rights ReportBipin RethinNo ratings yet

- CBMS consent form for household data collectionDocument1 pageCBMS consent form for household data collectionMarjo Ursula50% (2)

- List of CharactersDocument4 pagesList of CharactersWenn Mark BurerosNo ratings yet

- Term Paper - Premarital SexDocument8 pagesTerm Paper - Premarital SexCarlo Lopez Cantada100% (1)

- Taking Sides EssayDocument7 pagesTaking Sides EssayJulie CaoNo ratings yet

- Where The Spirit of The Lord Is (Key of G) The Cross Stands (Key of G) Love So High (Key of B) Jesus Paid It All (Key of B)Document1 pageWhere The Spirit of The Lord Is (Key of G) The Cross Stands (Key of G) Love So High (Key of B) Jesus Paid It All (Key of B)Chadly307No ratings yet

- Registration certificate for health benefitsDocument1 pageRegistration certificate for health benefitsBarangay TaguiticNo ratings yet

- SRM OverviewDocument31 pagesSRM OverviewPunita01No ratings yet

- Asstt - Library Information OfficerDocument6 pagesAsstt - Library Information OfficerSanjit MandalNo ratings yet

- BSC Health System Management Development Fees Structure - 40% Scholarship Award - Full TimeDocument1 pageBSC Health System Management Development Fees Structure - 40% Scholarship Award - Full TimeCheruiyot KipkemoiNo ratings yet

- Employment Application Form: EssayDocument2 pagesEmployment Application Form: EssayCharles Edward BiasonNo ratings yet

- Teaching Multigrade Classes HistoryDocument4 pagesTeaching Multigrade Classes HistoryVia Marie DadoNo ratings yet

- Kanefield Fann Document.01Document9 pagesKanefield Fann Document.01KTARNo ratings yet

- Advantages and Disadvantage of ProtectionismDocument3 pagesAdvantages and Disadvantage of ProtectionismMai Anh NguyễnNo ratings yet

- Kensington Practice Pension Letter Joiner Mrs K. Paraiso Da Rocha 01-07-2023Document2 pagesKensington Practice Pension Letter Joiner Mrs K. Paraiso Da Rocha 01-07-2023Mia ZhandNo ratings yet

- Cebu City Profile-EditedDocument66 pagesCebu City Profile-EditedGrace NiloNo ratings yet

- Spring 2009Document60 pagesSpring 2009DePauw University100% (59)

- Origins of The American Civil WarDocument61 pagesOrigins of The American Civil WarHHprofiel202No ratings yet

- India TV - Why Gandhi Opted For Nehru and Not Sardar Patel For PMDocument12 pagesIndia TV - Why Gandhi Opted For Nehru and Not Sardar Patel For PMPiyush GuptaNo ratings yet

- Yoo Young ChulDocument10 pagesYoo Young ChulmanasaNo ratings yet

- Vidal Vs - Judge Dojillo, 463 SCRA 264, A.M. MTJ-05-1591, July 14, 2005 - MIRADORDocument1 pageVidal Vs - Judge Dojillo, 463 SCRA 264, A.M. MTJ-05-1591, July 14, 2005 - MIRADOREvander ArcenalNo ratings yet

- Why Not Play 30K ArticleDocument10 pagesWhy Not Play 30K ArticleCorwen Broch100% (2)