Professional Documents

Culture Documents

May 13 - Omax Autos

Uploaded by

Madhukar DasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

May 13 - Omax Autos

Uploaded by

Madhukar DasCopyright:

Available Formats

to r ’s Focus

Inves -Madhukar Das

Issue 14, Vol 1

Omax Autos

-May 13, 2011

The Indian stock market has been on a sluggish mode despite the better than expected IIP

numbers and easing food inflation. However the state assembly election results brought some

cheer amongst the traders as Sensex rose handsomely along with broader indices trading in Other Picks

green. The outlook still remains cautious as these positive cues can easily be overshadowed

by global economic and financial concerns. BUY :

Fundamentally Speaking Arvind Ltd.

The auto ancillary industry in is one of the sunrise sectors in India with promising growth CMP—`70

prospects. Omax Autos Ltd is one of the well known Auto Ancillaries engaged in the busi-

ness of manufacturing auto components for 2-wheeler and 4-wheeler manufacturers in India Target—`77.5

and abroad. Over the years it has grown stronger and has 7 manufacturing facilities located

across India. It has facilities to fabricate sheet metal, machined tubular, and electroplated and

Stop Loss—`66

painted components and has the largest facilities for these components in India. Omax also

has the largest sprockets manufacturing capacity in South East Asia which is the hub of auto

component manufacturers. The company employs all techniques and technologies like TPM, Subex Ltd.

TQM, SAP etc. which make a manufacturing firm lean and efficient. They have also diversi- CMP—`62.5

fied into defence and railway components and metal home furnishings business (with IKEA-

Sweden). Omax is original equipment manufacturer for variety of components for a huge Target—`67

selection of long term customers like Honda, HMSI, Hero Motors, Yamaha, Maruti, TVS,

Carrier, Cummins, Delphi, Piaggio, Supersprox etc. Omax Autos has strong business rela- Stop Loss—`60.7

tions with Hero group and Brijmohan Munjal is also the chairman emeritus. Net profit mar-

gin is low for the company as it is weighed down by expenses and interest payout however Sell :

the interest payout has lowered YoY and the profit and EPS has improved remarkably QoQ.

Q4 result will be announced and dividend will be considered on board meeting on May 28. Indian Oil

P/B ratio is 0.58 and is very low. P/E is 8.95 which is lower than the industry average. The

company is debt loaded and it is advised to not to enter into a long term position and stick to CMP—`351

the given target and stop loss. Target—`328

Technically Speaking Stop Loss—`363

Special points of in-

terest:

Since we are looking

at a trading horizon of

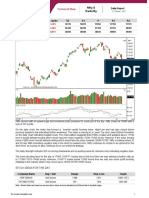

The stochastic chart suggests that The %R also suggests the reversal 15-30 days, we shall

The Price chart has found short stock had reached oversold region hence the indicators are aligned give more weightage

term support at 40-41 and has and has reversed its direction with with each other and the volumes to technical analysis

made a triple moving average bullish trades setting in. have dropped significantly after a and price trend of the

crossover (4,9 & 18 week) fall of about 10% in 1 month, indi- stock.

cating the bears are leaving trades We shall also study the

and bulls may see an opportunity fundamental aspects of

and enter long trades forcing bears a company to avoid

to cover open short positions. getting into loss mak-

ing trade positions in

Recommendation : BUY case of movement of

market in direction

The CCI chart suggests that the CMP : `42 opposite to that of my

stock is far from its average price prediction.

for 20 bar period (short term) and Target Price : `47

The momentum chart shows re- is oversold. Crossover has oc-

versal and suggests that bulls have curred and there may be an up- Stop loss : `39.5

entered into trades. move.

You might also like

- The Complete Beginners Trading Guide - Trader's - SpotDocument73 pagesThe Complete Beginners Trading Guide - Trader's - Spothari100% (1)

- Vietnam Dairy (VNM VN) : EquitiesDocument37 pagesVietnam Dairy (VNM VN) : EquitiesJames ZhangNo ratings yet

- Juan Antonio Perez Search Warrant NDGADocument22 pagesJuan Antonio Perez Search Warrant NDGADan LehrNo ratings yet

- Chapter 3 Test BankDocument13 pagesChapter 3 Test Bankmyngoc1812100% (2)

- Price Action Trading Webinar PowerpointDocument26 pagesPrice Action Trading Webinar PowerpointArrow BuildersNo ratings yet

- Theories of Development 1Document82 pagesTheories of Development 1Hashaira AlimNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- InCred - AMC InitiationDocument92 pagesInCred - AMC Initiationsatyajit03No ratings yet

- Financial Analysis of Toyota Indus Motor CompanyDocument33 pagesFinancial Analysis of Toyota Indus Motor CompanyHussnain AwanNo ratings yet

- GE We Bring Good Things To Life - Case Study AssignmentDocument4 pagesGE We Bring Good Things To Life - Case Study AssignmentPyle StyleNo ratings yet

- South Africa Income Tax - Exemptions PBODocument8 pagesSouth Africa Income Tax - Exemptions PBOmusvibaNo ratings yet

- Long Term Investment StrategiesDocument4 pagesLong Term Investment Strategiesskabdurrahman2014No ratings yet

- Business Organizations 631 Assignment 14 Watson 6830Document3 pagesBusiness Organizations 631 Assignment 14 Watson 6830wootenr2002100% (1)

- Construction and Built Environment Sectorassgn2Document31 pagesConstruction and Built Environment Sectorassgn2Suhail KhanNo ratings yet

- Compendium - Part IIDocument486 pagesCompendium - Part IIShiva Raj71% (7)

- Impactful Patterns (IP) - SOP # 13Document11 pagesImpactful Patterns (IP) - SOP # 13Sanchit ShresthaNo ratings yet

- Apr 29 - Godrej IndustriesDocument1 pageApr 29 - Godrej IndustriesMadhukar DasNo ratings yet

- Apr 14 - Allied DigitalDocument1 pageApr 14 - Allied DigitalMadhukar DasNo ratings yet

- Feb 27 - Gammon IndiaDocument1 pageFeb 27 - Gammon IndiaMadhukar DasNo ratings yet

- Dec 12 - Bajaj Auto FinanceDocument1 pageDec 12 - Bajaj Auto FinanceMadhukar DasNo ratings yet

- Jan 30 - Finolex CablesDocument1 pageJan 30 - Finolex CablesMadhukar DasNo ratings yet

- Mar 13 - Jubilant FoodworksDocument1 pageMar 13 - Jubilant FoodworksMadhukar DasNo ratings yet

- Mar 29 - Tata SteelDocument1 pageMar 29 - Tata SteelMadhukar DasNo ratings yet

- Nov 14 - Nava Bharat VenturesDocument1 pageNov 14 - Nava Bharat VenturesMadhukar DasNo ratings yet

- Nirmal Bang (Ipo)Document11 pagesNirmal Bang (Ipo)financeharsh6No ratings yet

- Oct 29 - Reliance InfrastructureDocument1 pageOct 29 - Reliance InfrastructureMadhukar DasNo ratings yet

- Nov 26 - HCL InfosystemsDocument1 pageNov 26 - HCL InfosystemsMadhukar DasNo ratings yet

- Screenshot 2022-08-25 at 10.52.12 AMDocument9 pagesScreenshot 2022-08-25 at 10.52.12 AMakanksha gautamNo ratings yet

- Medium Term Techincal Call: Start Building Short PositionsDocument9 pagesMedium Term Techincal Call: Start Building Short Positionskaushamb100% (2)

- Sep 28 - VideoconDocument1 pageSep 28 - VideoconMadhukar DasNo ratings yet

- PDF 132490607617482980Document22 pagesPDF 132490607617482980Swades DNo ratings yet

- STFC X15Document7 pagesSTFC X15Kajol Keshri100% (1)

- Cement Sector Green Shoots - 03 Dec 18Document56 pagesCement Sector Green Shoots - 03 Dec 18SaranNo ratings yet

- Oct 25 To Nov 07 2021Document68 pagesOct 25 To Nov 07 2021vikramthevictorNo ratings yet

- UEM Land Holdings Berhad: A Chance To Scale Higher To RM1.80 - 19/7/2010Document2 pagesUEM Land Holdings Berhad: A Chance To Scale Higher To RM1.80 - 19/7/2010Rhb InvestNo ratings yet

- Niveshaay Rain Industries LTD Research Report 1653395938Document64 pagesNiveshaay Rain Industries LTD Research Report 1653395938anady135344No ratings yet

- Case 8Document6 pagesCase 8Ashutosh SharmaNo ratings yet

- DailyTechnical-Report-12 October 2022 - 12-10-2022 - 09Document5 pagesDailyTechnical-Report-12 October 2022 - 12-10-2022 - 09vikalp123123No ratings yet

- Brand ExideDocument260 pagesBrand Exideshivani k nairNo ratings yet

- Initiating Coverage by MOSL February 2014Document46 pagesInitiating Coverage by MOSL February 2014Parul ChaudharyNo ratings yet

- Emerging Trends in The IPO Market: Managing Director SBI Capital Markets LTDDocument3 pagesEmerging Trends in The IPO Market: Managing Director SBI Capital Markets LTDNeha PrajapatiNo ratings yet

- Diwali Technical Picks - 2020Document6 pagesDiwali Technical Picks - 2020rasoolvaliskNo ratings yet

- Stock Market Project VaibhavDocument71 pagesStock Market Project VaibhavVaibhav DhayeNo ratings yet

- Himadri Investor Presentation Q3fy20Document35 pagesHimadri Investor Presentation Q3fy20Joya AhasanNo ratings yet

- Smart Money ConceptDocument5 pagesSmart Money ConceptweeleeNo ratings yet

- HDFC Index Fund - Nifty 50 Plan - SID - May 29, 2020Document104 pagesHDFC Index Fund - Nifty 50 Plan - SID - May 29, 2020skandamsNo ratings yet

- Sarfraz FM ToyotaDocument25 pagesSarfraz FM Toyotamsamib4uNo ratings yet

- Fidelity 04 Market OpportunitiesDocument4 pagesFidelity 04 Market OpportunitiesfebrichowNo ratings yet

- You Always Rued Missing These IPO Shares Now Buy Below Issue Prices - The Economic TimesDocument2 pagesYou Always Rued Missing These IPO Shares Now Buy Below Issue Prices - The Economic TimesRommel RodriguesNo ratings yet

- PostDocument6 pagesPostWilliams DennisNo ratings yet

- Cie LKPDocument9 pagesCie LKPRajiv HandaNo ratings yet

- What Are SMEs? What Are The Criteria For A Company To Be Listed On SME Exchanges - HDFC SecuritiesDocument8 pagesWhat Are SMEs? What Are The Criteria For A Company To Be Listed On SME Exchanges - HDFC SecuritiesHDFC SecuritiesNo ratings yet

- Techno Fund A 10Document4 pagesTechno Fund A 10youvsyou333No ratings yet

- Restructuring of L TDocument11 pagesRestructuring of L TRahul BhatiaNo ratings yet

- Alliance Financial Group BHD: A "Double Buy" Signal On The Momentum Indicators - 21/6/2010Document2 pagesAlliance Financial Group BHD: A "Double Buy" Signal On The Momentum Indicators - 21/6/2010Rhb InvestNo ratings yet

- Reportslist Aspx?mpgid 24Document126 pagesReportslist Aspx?mpgid 24Kiran NikateNo ratings yet

- UEM Land Holdings: Confirmed Breakout From The RM1.46 Resistance Level - 29/03/2010Document2 pagesUEM Land Holdings: Confirmed Breakout From The RM1.46 Resistance Level - 29/03/2010Rhb InvestNo ratings yet

- Religare EQUITY FINAL DetailsDocument75 pagesReligare EQUITY FINAL DetailsVarun KumarNo ratings yet

- KNM Group Berhad: Great Chance To Roll Into A Fresh Technical Rebound 03/08/2010Document2 pagesKNM Group Berhad: Great Chance To Roll Into A Fresh Technical Rebound 03/08/2010Rhb InvestNo ratings yet

- MSFL Research: India Weekly RoadmapDocument17 pagesMSFL Research: India Weekly RoadmapNimesh ThakerNo ratings yet

- Bachelor in Business Administration (Hons) FINANCE (BA242) : Future Trading Plan (FTP)Document26 pagesBachelor in Business Administration (Hons) FINANCE (BA242) : Future Trading Plan (FTP)Muhammad FaizNo ratings yet

- Mandarin Version - Scomi Group Berhad: Breaking Out From The Downtrend Resistance Line - 06/04/2010Document2 pagesMandarin Version - Scomi Group Berhad: Breaking Out From The Downtrend Resistance Line - 06/04/2010Rhb InvestNo ratings yet

- Fundsroom Live Project: 1 - Jindal Saw LTDDocument53 pagesFundsroom Live Project: 1 - Jindal Saw LTDShashwat DeshmukhNo ratings yet

- E1 PDFDocument22 pagesE1 PDFArush VermaNo ratings yet

- Kotak Multicap Fund-SIDDocument122 pagesKotak Multicap Fund-SIDsenthilkumarNo ratings yet

- MOSL NFAL Model Portfolio Equity ONE PAGERDocument1 pageMOSL NFAL Model Portfolio Equity ONE PAGERg1sreeNo ratings yet

- IOI Corporation Berhad: A Possible Breakout Rally Ahead - 12/10/2010Document2 pagesIOI Corporation Berhad: A Possible Breakout Rally Ahead - 12/10/2010Rhb InvestNo ratings yet

- Ram Online Trading Project1Document95 pagesRam Online Trading Project1Dilipkumar DornaNo ratings yet

- Mar 29 - Tata SteelDocument1 pageMar 29 - Tata SteelMadhukar DasNo ratings yet

- Feb 11 - Subex LTDDocument1 pageFeb 11 - Subex LTDMadhukar DasNo ratings yet

- Mar 13 - Jubilant FoodworksDocument1 pageMar 13 - Jubilant FoodworksMadhukar DasNo ratings yet

- Jan 14-VIP IndustriesDocument1 pageJan 14-VIP IndustriesMadhukar DasNo ratings yet

- Oct 29 - Reliance InfrastructureDocument1 pageOct 29 - Reliance InfrastructureMadhukar DasNo ratings yet

- Nov 14 - Nava Bharat VenturesDocument1 pageNov 14 - Nava Bharat VenturesMadhukar DasNo ratings yet

- Oct 14 - HCL InfosystemsDocument1 pageOct 14 - HCL InfosystemsMadhukar DasNo ratings yet

- Nov 26 - HCL InfosystemsDocument1 pageNov 26 - HCL InfosystemsMadhukar DasNo ratings yet

- Dec 29 - TitanDocument1 pageDec 29 - TitanMadhukar DasNo ratings yet

- Sep 28 - VideoconDocument1 pageSep 28 - VideoconMadhukar DasNo ratings yet

- (C501) (Team Nexus) Assignment 1Document14 pages(C501) (Team Nexus) Assignment 1Mohsin Md. Abdul KarimNo ratings yet

- Income-Taxation 5-7 ValenciaDocument56 pagesIncome-Taxation 5-7 ValenciaDevonNo ratings yet

- Financial Management (MBOF 912 D) 1Document5 pagesFinancial Management (MBOF 912 D) 1Siva KumarNo ratings yet

- P&A - Local Taxation of PEZADocument2 pagesP&A - Local Taxation of PEZACkey ArNo ratings yet

- Aecon - Project IDocument39 pagesAecon - Project IRaji MohanNo ratings yet

- Mabola TradingDocument2 pagesMabola TradingStye Sense PhNo ratings yet

- Topic 1 Notes S1 2019Document11 pagesTopic 1 Notes S1 2019Rohit KattamuriNo ratings yet

- Du Pont Titanium ADocument15 pagesDu Pont Titanium AEshesh GuptaNo ratings yet

- Feasibility Study Plan: LabadabangoDocument38 pagesFeasibility Study Plan: LabadabangoCocoy Llamas HernandezNo ratings yet

- CH 14 SimulationDocument85 pagesCH 14 SimulationaluiscgNo ratings yet

- Ratio Analysis - BBA ClassDocument27 pagesRatio Analysis - BBA ClassSophiya PrabinNo ratings yet

- Lyceum of The Philippines University Microeconomics 1 Quiz Scope and MethodsDocument33 pagesLyceum of The Philippines University Microeconomics 1 Quiz Scope and MethodsCharithea Jasmine Rana-NaboNo ratings yet

- List of Important Committees in India and Their AreaDocument3 pagesList of Important Committees in India and Their AreaabhiNo ratings yet

- A Donor's Guide: Vehicle DonationDocument10 pagesA Donor's Guide: Vehicle Donationriki187No ratings yet

- Understanding Roth IRA Jonathan BeckDocument10 pagesUnderstanding Roth IRA Jonathan BeckjonathanbeckadvisorNo ratings yet

- Security Selection and Asset AllocationDocument14 pagesSecurity Selection and Asset AllocationUzoamaka Okenwa-OkoyeNo ratings yet

- Rosan LetterDocument2 pagesRosan LettercoalitiontorebuildthepartyNo ratings yet

- Graduate Business School Faculty of Business ManagementDocument17 pagesGraduate Business School Faculty of Business ManagementSyahril NizamNo ratings yet

- Term Loans and LeasesDocument23 pagesTerm Loans and LeasesELLADLZNo ratings yet

- ISC AccountsDocument20 pagesISC AccountsKris BubnaNo ratings yet

- Home Depot Case SolutionDocument4 pagesHome Depot Case SolutionYubaraj AdhikariNo ratings yet