Professional Documents

Culture Documents

Is Investment - Fixed Income Daily 20.05

Uploaded by

rogdopsinkOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Is Investment - Fixed Income Daily 20.05

Uploaded by

rogdopsinkCopyright:

Available Formats

20/05/11

Fixed Income - Local Markets

As of May 18, 2011

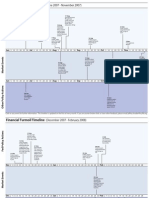

Overnight Funding Rate vs Benchmark Bond

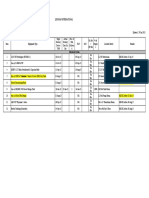

Trade Recommendations Date Agenda

%

18 Overnig Is Investment's View 20/5/11 - Central Government Debt Stock Apr

ht Entry

Trade Current Target PnL Action

15 Supporting Risks Level

20/5/11 - CBRT weekly repo auction redemption TL 2bn

12 Buy the 15/01/20 note for the carry, given the better Political stability,

1 A credibility loss 8.49% 9.46% 8.25% -97 bp HOLD

credit story of Turkey (recommended since 20/10/10) credible CBRT

9

Sell the benchmark note TRT200213T25 as it reached a Overbought in the past Volaitilies in 24/5/11 - 14:30 - Industrial Confidence MAY

2 MENA and oil 9.05% 8.87% 8.50% 18 bp SELL

6 good selling level at current yields few weeks

prices

07/09 01/10 07/10 01/11 24/5/11 - 14:30 - Capacity Utilization MAY

Years

24/5/11 - Auction: 7-yr (24/01/18) Floating Rate Note (sa) (r-o)

Cross Currency Swaps (IYM exp: TL 1bn)

18/05/11 17/05/11 25/5/11 - 11:00 - Foreign Tourist Arrivals YoY APR

%

9

25/5/11 - 14:00 - Benchmark Repo Rate

8 Rates and Relative Value of Most Liquid Bonds

1d Yld 3 mo 3 mo Range 25/5/11 - Settlement: 7-yr (24/01/18) Floating Rate Note (sa) (r-

7 Clean Comp. 3 mo PVBP o)

Coupon Maturity Term Orig. Term Chg Vol Low High

6 Price Yield Avg (%) * 100

(bp) (%) (%) (%) 30/5/11 - Financial Stability Report (s/a)

5 Bills

1 2 3 4 5 6 7 8 9 10 1 TRB200711T14 0.00 20/7/11 2m 12 m 0.23 7.35 8.20 7.78 0.17

Years

2 TRB070911T19 0.00 7/9/11 4m 6m 97.724 7.79 0.22 7.53 8.25 7.89 0.29

Benchmark - Long Bill Steepness Zero Coupon Bonds

5s/10s 2s/5s 1 TRT030811T14 0.00 3/8/11 2m 22 m 98.432 7.78 5 0.23 7.39 8.34 7.95 0.20 Currency Levels

200

2 TRT250412T11 0.00 25/4/12 11 m 21 m 92.563 8.57 -5 0.21 7.99 8.92 8.52 0.80 EUR/TRY USD/TRY Basket

3 TRT200213T25 0.00 20/2/13 21 m 22 m 86.192 8.79 -3 0.18 8.20 8.86 8.51 1.31

100 2.4

Fixed Coupon Bonds

1 TRT070312T14 16.00 7/3/12 10 m 5y 105.850 8.48 0 0.29 7.86 9.24 8.49 0.80 2.2

0 2 TRT290114T18 8.00 29/1/14 2.7 y 3y 97.700 9.27 0 0.14 8.73 9.40 9.17 2.35 2.0

3 TRT150120T16 10.50 15/1/20 8.7 y 10 y 107.350 9.46 -14 0.14 9.24 9.84 9.47 6.17 1.8

-100 FRNs

1.6

Feb-11 1 TRT260613T17 9.56 26/6/13 2.1 y 5y 103.400 13.66 29 2.65 7.19 14.16 12.19 0.00

2 TRT201113T16 9.32 20/11/13 2.5 y 5y 104.835 8.82 0.44 8.13 9.56 9.00 0.00 1.4

Domestic Debt Stock Shares (%) as of 29/04/11 3 TRT260214T10 9.38 26/2/14 2.8 y 7y 103.550 9.28 30 0.50 7.47 9.28 8.38 0.00 1.2

Non-Resident Share CPI Linkers 1.0

Resident Share 1 TRT140813T19 12.00 14/8/13 2.2 y 5y 121.517 2.14 4 0.12 1.68 2.15 1.90 0.01

Jun-09 Dec-09 Jun-10 Dec-10

2 TRT210514T12 9.00 21/5/14 3y 5y 119.900 2.17 -4 0.12 1.79 2.21 1.93 0.02

90% 16%

89% 15% 3 TRT110215T16 4.50 11/2/15 3.7 y 5y 107.510 2.40 1 0.11 1.94 2.40 2.12 0.03

88% 14% 4 TRT290415T14 4.00 29/4/15 3.9 y 5y 106.000 2.41 5 0.10 1.94 2.39 2.14 0.04 Current YTD Chng

87% 13% 5 TRT060121T16 3.00 6/1/21 9.6 y 10 y 101.900 2.79 -6 0.05 2.47 2.86 2.78 Key Rates

86% 12%

85% 11% 1-wk repo 6.25% -75 bp

84% 10% Compounded 6.45% -80 bp

83% 9% Yield Curve Benchmark Note 8.82% 171 bp

82% 8% Currency

Nov-10 Feb-11 Apr-11 % USD/TRY 1.5749 -1.9%

EUR/TRY 2.2459 -8.2%

Treasury Fiscal Reserves as of 29/04/11 9.5

Bn Treasury Debt Service Projections

TRY 8.5 Date

30 Coupon Principal

Mil TRY

25

20 7.5 20 17.2 17.1

14.3 15.3

15 17 bn 13.9 13.1 13.4

18/5/11 17/5/11 11/5/11 15 10.6

10 6.5

10 7.6

5.8 5.5

5

5.5 5 0.8

0

2010 2011 2012 2013 2014 2015 2016 0

Apr-11

Mar-11

Jan-11

Nov-10

Sep-10

Jul-10

May-10

Maturity May Aug Nov Feb

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 1 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

Government Domestic Debt Instruments Yield Curve

40683

As of May 18, 2011

Compounded Yield (%)

Cheap

Buy the ex 07/11/12 benchmark note as it offers a good entry point at current yields

10.00 - Fixed Coupon 10/04/13 @ 9.14

- Zero Coupon 14/03/12 @ 8.6

-- Zero

FixedCoupon

Coupon16/11/11

29/01/14@@8.23

9.27

- Fixed Coupon 17/06/15 @ 9.35

9.50 15-Jan-20

17-Jun-15 27-Jan-16

29-Jan-14

10-Apr-13

9-Oct-13

28-Aug-13

9.00 9-Jan-13 6-Aug-14

7-Nov-12

20-Feb-13 0

14-Mar-128-Aug-12

8.50 25-Apr-12

7-Mar-12

25-Jan-12

16-Nov-11

8.00

12-Oct-11

3-Aug-11

7-Sep-11

7.50

8-Jun-11 Rich

- Zero Coupon 20/02/13 @ 8.79

7.00 - T-Bill 07/09/11 @ 7.79

- Zero Coupon 08/08/12 @ 8.65

- Fixed Coupon 06/08/14 @ 9.15

- Zero Coupon 12/10/11 @ 7.98

6.50

6.00

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Maturity

T- Bills Zero Coupon Bonds Fixed Coupon Bonds

* Rich/Cheap is based on historical yield error versus the fitted curve

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 2 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

Local Markets Debt Instruments

40683

As of May 18, 2011

Amt Daily Weekly Simple Comp Weekly 3mo Yld 3 mo 3 mo Range 3 mo 3 mo Breakeven (bp)

Issue Clean Accrued 1 day Yld

Description Instrument CPN Maturity Term Orig. Term Outstand. Volume Volume Yield Yield Yld Chg Chg Vol Low High Avg Dur. Cnvx PVBP * 100

Date Price Interest Chg (bp) Roll Carry** (R+C)

(Mil TRY) (Mil TRY) (Mil TRY) (%) (%) (bp) (bp) (%) (%) (%) (%)

TL DENOMINATED

T- Bills

2 TURKTBO 07/20/11 TRB200711T14 0 20/07/11 28/07/10 2m 12 m 4,292 0.0 3.5 0 0.23 7.35 8.20 7.78 0.16 0.001 0.17

1 TURKTBO 09/07/11 TRB070911T19 0 07/09/11 09/03/11 4m 6m 754 0.1 6.4 97.724 0 7.59 7.79 20 0.22 7.53 8.25 7.89 47 4134 4181 0.29 0.002 0.29

Zero Coupon Bonds

8 TURKGB 0 06/08/11 TRT080611T11 0 08/06/11 14/04/10 1m 14 m 5,100 8.7 182.8 99.587 0 7.21 7.46 -4 18 29 0.24 7.13 7.94 7.60 0.05 0.000 0.05

2 TURKGB 0 08/03/11 TRT030811T14 0 03/08/11 07/10/09 2m 22 m 11,175 100.2 617.6 98.432 0 7.55 7.78 5 22 18 0.23 7.39 8.34 7.95 0.20 0.001 0.20

7 TURKGB 0 10/12/11 TRT121011T19 0 12/10/11 29/09/10 5m 12 m 3,256 8.7 46.4 96.954 0 7.80 7.98 10 21 38 0.22 7.49 8.34 8.04 41 1430 1471 0.38 0.003 0.38

5 TURKGB 0 11/16/11 TRT161111T14 0 16/11/11 20/01/10 6m 22 m 10,904 38.5 240.7 96.132 0 8.07 8.23 0 23 66 0.23 7.55 8.71 8.16 36 886 922 0.48 0.005 0.46

6 TURKGB 0 01/25/12 TRT250112T14 0 25/01/12 14/04/10 8m 21 m 11,715 33.4 130.1 94.580 0 8.30 8.41 6 21 72 0.25 7.67 9.01 8.39 28 503 530 0.66 0.008 0.62

10 TURKGB 0 03/14/12 TRT140312T15 0 14/03/12 19/01/11 10 m 14 m 2,374 0.5 #N/A 93.421 0 8.54 8.60 4 25 72 0.22 7.86 8.92 8.51 24 392 416 0.79 0.010 0.72

3 TURKGB 0 04/25/12 TRT250412T11 0 25/04/12 14/07/10 11 m 21 m 14,781 86.8 500.7 92.563 0 8.55 8.57 -5 21 58 0.21 7.99 8.92 8.52 21 325 345 0.90 0.012 0.80

9 TURKGB 0 08/08/12 TRT080812T26 0 08/08/12 27/10/10 15 m 21 m 13,412 8.7 249.6 90.322 0 8.73 8.65 -3 10 51 0.20 8.14 9.05 8.68 15 230 245 1.17 0.019 1.00

4 TURKGB 0 11/07/12 TRT071112T14 0 07/11/12 12/01/11 18 m 22 m 18,298 44.2 340.6 88.211 0 9.05 8.87 -4 14 61 0.20 8.24 9.11 8.72 11 188 199 1.41 0.027 1.15

1 TURKGB 0 02/20/13 TRT200213T25 0 20/02/13 13/04/11 21 m 22 m 5,646 827.7 4,556.9 86.192 0 9.08 8.79 -3 16 0.18 8.20 8.86 8.51 9 150 159 1.69 0.037 1.31

Fixed Coupon Bonds

2 TURKGB 16 03/07/12 TRT070312T14 16.00 07/03/12 14/03/07 10 m 5y 9,565 164.0 179.4 105.850 3.12 8.31 8.48 0 21 59 0.29 7.86 9.24 8.49 24 438 462 0.74 0.009 0.80

11 TURKGB 14 09/26/12 TRT260912T15 14.00 26/09/12 03/10/07 16 m 5y 5,646 0.0 0.2 1.92 0.21 8.41 9.45 8.81 1.22 0.021 1.32

10 TURKGB 10 01/09/13 TRT090113T13 10.00 09/01/13 13/01/10 20 m 3y 14,197 0.1 1.6 102.050 0.99 8.65 8.93 9 8 0.23 8.44 9.31 8.94 10 171 181 1.47 0.030 1.54

4 TURKGB 10 04/10/13 TRT100413T17 10.00 10/04/13 14/04/10 23 m 3y 7,903 15.0 57.8 102.000 0.99 8.84 9.14 12 8 56 0.22 8.49 9.44 9.01 8 148 156 1.67 0.038 1.75

9 TURKGB 16 08/28/13 TRT280813T13 16.00 28/08/13 03/09/08 2.3 y 5y 3,071 0.1 11.9 114.400 3.43 8.89 9.09 14 25 0.17 8.73 9.39 9.13 6 130 135 1.89 0.048 2.22

7 TURKGB 8 10/09/13 TRT091013T12 8.00 09/10/13 13/10/10 2.4 y 3y 12,178 0.5 3.4 98.200 0.79 8.84 9.14 -8 22 0.12 8.85 9.40 9.19 5 111 116 2.10 0.057 2.12

3 TURKGB 8 01/29/14 TRT290114T18 8.00 29/01/14 02/02/11 2.7 y 3y 4,322 19.9 31.0 97.700 0.33 8.96 9.27 0 6 30 0.14 8.73 9.40 9.17 4 99 103 2.35 0.070 2.35

6 TURKGB 11 08/06/14 TRT060814T18 11.00 06/08/14 05/08/09 3.2 y 5y 7,492 1.1 14.8 105.600 2.99 8.95 9.15 1 4 0.12 8.94 9.42 9.18 3 85 88 2.63 0.090 2.85

8 TURKGB 10 06/17/15 TRT170615T16 10.00 17/06/15 23/06/10 4.1 y 5y 8,514 0.2 31.5 102.850 4.07 9.14 9.35 1 4 30 0.12 9.00 9.58 9.25 2 66 67 3.21 0.133 3.41

5 TURKGB 9 01/27/16 TRT270116T18 9.00 27/01/16 02/02/11 4.7 y 5y 3,134 1.8 17.1 99.590 2.62 9.10 9.31 -3 -3 23 0.11 9.02 9.47 9.27 1 56 57 3.69 0.173 3.76

1 TURKGB 11 01/15/20 TRT150120T16 10.50 15/01/20 27/01/10 8.7 y 10 y 8,798 168.3 327.3 107.350 3.26 9.25 9.46 -14 -6 10 0.14 9.24 9.84 9.47 0 30 30 5.64 0.433 6.17

Floating Rate Notes

5 TURKGB Float 09/07/11 TRT070911T19 10.12 07/09/11 13/09/06 4m 5y 7,926 0.0 0.0 100.727 1.97 7.61 7.76 0.35 6.47 7.31 6.86 0.29 0.002 0.00

5 TURKGB Float 04/03/13 TRT030413T16 9.12 03/04/13 09/04/08 22 m 5y 5,827 0.0 0.0 102.709 1.08 8.38 8.56 0.52 6.77 8.18 7.33 0.41 0.004 0.00

2 TURKGB Float 06/26/13 TRT260613T17 9.56 26/06/13 02/07/08 2.1 y 5y 13,377 0.6 11.1 103.400 1.31 13.01 13.66 29 2.65 7.19 14.16 12.19 0.07 0.000 0.00

3 TURKGB Float 11/20/13 TRT201113T16 9.32 20/11/13 26/11/08 2.5 y 5y 13,164 0.0 0.5 104.835 2.18 8.55 8.82 68 0.44 8.13 9.56 9.00 0.12 0.002 0.00

1 TURKGB Float 02/26/14 TRT260214T10 9.38 26/02/14 07/03/07 2.8 y 7y 13,502 260.8 506.0 103.550 2.01 9.08 9.28 30 0.50 7.47 9.28 8.38 0.32 0.003 0.00

5 TURKGB Float 04/02/14 TRT020414T16 9.56 02/04/14 08/04/09 2.9 y 5y 10,534 0.0 0.0 105.568 1.13 8.45 8.73 0.58 6.52 7.58 7.20 0.25 0.003 0.00

4 TURKGB Float 07/16/14 TRT160714T17 9.08 16/07/14 22/07/09 3.2 y 5y 11,302 0.0 0.1 103.726 0.72 8.32 8.59 0.26 7.56 8.38 7.92 0.27 0.003 0.00

5 TURKGB Float 09/28/16 TRT280916T19 7.56 28/09/16 07/10/09 5.4 y 7y 6,929 0.0 0.0 99.957 0.89 8.69 8.97 0.70 7.20 8.76 7.83 0.30 0.007 0.00

5 TURKGB Float 01/04/17 TRT040117T14 7.56 04/01/17 13/01/10 5.6 y 7y 7,361 0.0 0.0 99.221 0.75 8.85 9.15 0.61 7.19 8.64 7.81 0.84 0.045 0.01

5 TURKGB Float 07/19/17 TRT190717T11 7.46 19/07/17 28/07/10 6.2 y 7y 6,957 0.0 0.0 99.075 2.32 8.95 9.15 0.51 7.12 8.78 8.43 0.41 0.012 0.00

5 TURKGB Float 10/25/17 TRT251017T18 7.68 25/10/17 03/11/10 6.4 y 7y 11,325 0.0 0.0 100.059 0.32 8.69 8.88 0.30 7.69 8.32 7.87 0.67 0.016 0.01

5 TURKGB Float 01/24/18 TRT240118T19 7.46 24/01/18 02/02/11 6.7 y 7y 2,593 0.0 0.0 98.586 2.17 8.94 9.25 0.14 8.11 8.38 8.24 0.45 0.013 0.00

CPI Indexed Notes

6 TURKEY 10 15/02/12 TRT150212T15 10.00 15/02/12 21/02/07 9m 5y 7,469 0.0 2.1 0.3 0.8 1.8 1.3

2 TURKEY 12 14/08/13 TRT140813T19 12.00 14/08/13 20/08/08 2.2 y 5y 7,186 4.0 11.0 121.5 27.5 2.14 4 8 0.1 1.7 2.2 1.9 0.97 0.013 0.01

1 TURKEY 9 21/05/14 TRT210514T12 9.00 21/05/14 27/05/09 3y 5y 8,643 70.8 85.6 119.9 22.3 2.17 -4 0.1 1.8 2.2 1.9 1.28 0.021 0.02

6 TURKEY 7 01/10/14 TRT011014T19 7.00 01/10/14 07/10/09 3.4 y 5y 6,333 0.0 0.0 0.1 1.8 2.1 2.0 1.49 0.027 0.03

4 TURKEY 4.5 11/02/15 TRT110215T16 4.50 11/02/15 17/02/10 3.7 y 5y 8,503 1.2 62.7 107.5 10.0 2.40 1 0.0 37 0.1 1.9 2.4 2.1 1.68 0.034 0.03

5 TURKEY 4 29/04/15 TRT290415T14 4.00 29/04/15 05/05/10 3.9 y 5y 7,162 0.1 37.9 106.0 4.7 2.41 5 9.0 0.1 1.9 2.4 2.1 1.79 0.038 0.04

6 TURKEY 2,5 04/05/16 TRT040516T11 2,5 04/05/16 11/05/11 5y 5y 1.090 0.0 2.5 0.0 2.3 2.3 2.3 2.28 0.059 0.06

6 TURKEY 4 01/04/20 TRT010420T19 4.00 01/04/20 14/04/10 8.9 y 10 y 7,736 0.0 18.1 0.0 2.6 2.8 2.6 3.68 0.159 0.16

3 TURKEY 3 06/01/21 TRT060121T16 3.00 06/01/21 19/01/11 9.6 y 10 y 7,509 3.4 22.6 101.9 2.1 2.79 -6 -2.0 -2 0.1 2.5 2.9 2.8

USD As trading is limited in these securities data is shown whenever available

Fixed Coupon Bonds

#VALUE! TURKGB 6 05/25/11 TRT250511F17 5.50 25/05/11 28/05/08 0m 3y 889 0.0 0.0 0.29 0.36 1.07 0.66 0.02 -0.982 0.51

#VALUE! TURKGB 3 01/18/12 TRT180112F19 2.50 18/01/12 20/01/10 8m 2y 3,034 0.0 0.0 0.30 0.84 1.55 1.15 0.66 0.018 0.65

* Benchmark issues for which primary dealers are required to give quotions for a 3 month period ** Carry calculations are based on compounded yields and assume funding at 6.25% ***Indicative levels used for FRNs that did not trade on the previous day

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 3 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

Local Markets - Zero Coupon Notes

As of May 18, 2011

FRA Table (Compound Yield and DTM)

TRT080611T11TRB200711T14TRT030811T14TRB070911T19TRT121011T19TRT161111T14TRT250112T14TRT140312T15TRT250412T11TRT080812T26TRT071112T14TRT200213T25 TRT200213T25TRT200213T25

Maturity 08/06/11 20/07/11 03/08/11 07/09/11 12/10/11 16/11/11 25/01/12 14/03/12 25/04/12 08/08/12 07/11/12 20/02/13 20/02/13 20/02/13

DTM 21 63 77 112 147 182 252 301 343 448 539 644 644 644

Comp. 7.46% 7.78% 7.79% 7.98% 8.23% 8.41% 8.60% 8.57% 8.65% 8.87% 8.79% 8.79% 8.79%

TRT080611T11 08/06/11 21 7.46%

TRB200711T14 20/07/11 63

42

7.90%

TRT030811T14 03/08/11 77 7.78%

56 0

7.87% 7.82%

TRB070911T19 07/09/11 112 7.79%

91 49 35

8.07% 8.21% 8.60%

TRT121011T19 12/10/11 147 7.98%

126 84 70 35

8.33% 8.57% 8.94% 9.29%

TRT161111T14 16/11/11 182 8.23%

161 119 105 70 35

8.49% 8.68% 8.90% 9.00% 8.85%

TRT250112T14 25/01/12 252 8.41%

231 189 175 140 105 70

8.69% 8.89% 9.09% 9.20% 9.17% 9.62%

TRT140312T15 14/03/12 301 8.60%

280 238 224 189 154 119 49

8.64% 8.80% 8.95% 9.02% 8.96% 9.03% 8.35%

TRT250412T11 25/04/12 343 8.57%

322 280 266 231 196 161 91 42

8.71% 8.83% 8.93% 8.97% 8.93% 8.96% 8.74% 8.89%

TRT080812T26 08/08/12 448 8.65%

427 385 371 336 301 266 196 147 105

8.92% 9.05% 9.15% 9.20% 9.19% 9.27% 9.20% 9.38% 9.95%

TRT071112T14 07/11/12 539 8.87%

518 476 462 427 392 357 287 238 196 91

8.83% 8.92% 9.00% 9.03% 9.01% 9.03% 8.95% 9.03% 9.11% 8.38%

TRT200213T25 20/02/13 644 8.79%

623 581 567 532 497 462 392 343 301 196 105

For example: Assume that you have two options: the first one is to extend out to 20 Feb 2013 today, the second options is to stay short and then extend to the same maturity Implied Forward Curve

some time in the future 3-month 6-month 1-year

Alternative 1 Alternative 2 Current 17/8/11 16/11/11 17/5/12

3-month 7.81% 8.53% 8.95% 9.34%

Buy Today Buy Today and then reinvest on 08/08/12 6-month 8.17% 8.74% 9.07% 9.39%

versus 9-month 8.43% 8.89% 9.16% 9.42%

TRT200213T25 @ 8.79% TRT080812T26 @ 8.65% 196 day zero coupon at 9.11% 12-month 8.62% 9.00% 9.23%

18-month 8.87% 9.16%

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 4 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

Local Markets - Floating Rate Notes

40683

As of Wednesday, May 18, 2011

Versus Bills

Amt 1 day 3 month

Daily Weekly Simple Weekly 3mo Sprd

Current Outstan Clean Comp Sprd to Sprd

Description Instrument Index Spread Next Reset Maturity Issue Date Volume Volume Acc Int Yield Sprd Chg Dur. Cnvx

CPN d (Mil Price Yield (%) 6m Bill Chg Vol Low High Avg Z-

(Mil TRY) (Mil TRY) (%) Chg (bp) (bp)

TRY) (bp) (%) (%) (%) (%) score

Semi-Annual Reset

TURKGB Float 09/07/11 TRT070911T19 10.12 182d Ref Bill Auct Simple Yld 200 bp 07/09/11 07/09/11 13/09/06 7,926 0.0 0.0 100.727 1.97 7.61 7.76 -41 43 -187 -71 -122 1.89 0.30 0.002

TURKGB Float 04/03/13 TRT030413T16 9.12 Avg Yld of Prev. 3mo Zero Auct. 150 bp 05/10/11 03/04/13 09/04/08 5,827 0.0 0.0 102.709 1.08 8.38 8.56 39 52 -117 12 -78 2.24 0.39 0.004

TURKGB Float 02/26/14 TRT260214T10 9.38 Avg Yld of Prev. 3mo Zero Auct. 200 bp 31/08/11 26/02/14 07/03/07 13,502 260.8 506.0 103.550 2.01 9.08 9.28 112 8 57 41 -26 112 35 1.90 0.35 0.004

TURKGB Float 07/19/17 TRT190717T11 7.46 Avg Yld of Prev. 3mo Zero Auct. 0 bp 27/07/11 19/07/17 28/07/10 6,957 0.0 0.0 99.075 2.32 8.95 9.15 98 46 -83 67 36 1.35 0.00 0.002

TURKGB Float 10/25/17 TRT251017T18 7.68 Avg Yld of Prev. 3mo Zero Auct. 0 bp 02/11/11 25/10/17 03/11/10 11,325 0.0 0.0 100.059 0.32 8.69 8.88 71 38 -59 31 -21 2.40 0.46 0.005

Quarterly Reset 3m Bill

TURKGB Float 06/26/13 TRT260613T17 9.56 Avg Yld of Prev. 3mo Zero Auct. 200 bp 29/06/11 26/06/13 02/07/08 13,377 0.6 11.1 103.400 1.31 13.01 13.66 549 7 259 -76 595 407 0.55 0.15 0.001

TURKGB Float 11/20/13 TRT201113T16 9.32 Avg Yld of Prev. 3mo Zero Auct. 200 bp 25/05/11 20/11/13 26/11/08 13,164 0.0 0.5 104.835 2.18 8.55 8.82 66 -66 36 34 165 99 -0.93 0.08 0.001

TURKGB Float 04/02/14 TRT020414T16 9.56 Avg Yld of Prev. 3mo Zero Auct. 200 bp 06/07/11 02/04/14 08/04/09 10,534 0.0 0.0 105.568 1.13 8.45 8.73 56 79 -181 -42 -91 1.86 0.20 0.002

TURKGB Float 07/16/14 TRT160714T17 9.08 Avg Yld of Prev. 3mo Zero Auct. 100 bp 20/07/11 16/07/14 22/07/09 11,302 #N/A 0.1 103.726 0.72 8.32 8.59 42 40 -65 70 -10 1.30 0.22 0.002

TURKGB Float 09/28/16 TRT280916T19 7.56 Avg Yld of Prev. 3mo Zero Auct. 0 bp 06/07/11 28/09/16 07/10/09 6,929 0.0 0.0 99.957 0.89 8.69 8.97 80 75 -104 69 -31 1.48 0.13 0.001

TURKGB Float 01/04/17 TRT040117T14 7.56 Avg Yld of Prev. 3mo Zero Auct. 0 bp 13/07/11 04/01/17 13/01/10 7,361 0.0 0.0 99.221 0.75 8.85 9.15 98 65 -109 57 -31 1.98 0.14 0.000

TURKGB Float 01/24/18 TRT240118T19 7.46 Avg Yld of Prev. 3mo Zero Auct. 0 bp 03/08/11 24/01/18 02/02/11 2,593 0.0 0.0 98.586 2.17 8.94 9.25 108 30 -11 47 13 3.11 0.17 -0.001

Spreads to T-Bill versus Average Volume per day over the last month Repricing Guidance

Volume Spread to Bills Weighted average yield of zero coupon auctions held in the last three months 7.52%

549 bps

quarterly re-pricing reference (term) 1.83%

semi-annual re-pricing reference (term) 3.69%

TL 30.9mn

Composition of zero coupon auctions held in the last three months

6mo ref bill 0%

6mo - 1yr 3%

1yr - 1.5yr 11%

112 bps 98 bps 98 bps 108 bps 1.5yr - 2yr 85%

66 bps 80 bps 71 bps

39 bps 56 bps 42 bps

-41 bps The most recent issues of floating rate notes reprice of the weighted average yield of the zero

TL 0.1mn TL 0.0mn TL 0.5mn TL 1.5mn TL 0.0mn TL 0.1mn TL 0.0mn TL 0.0mn TL 0.1mn TL 0.0mn TL 0.0mn coupon auctions held in the previous 91 days. Zero coupon issuance in Turkey has been

historically upto 2 years. Meanwhile the re-pricing is based on the total nominal issuance to

TRT070911T19 TRT030413T16 TRT260613T17 TRT201113T16 TRT260214T10 TRT020414T16 TRT160714T17 TRT280916T19 TRT040117T14 TRT190717T11 TRT251017T18 the markets (both non-competitive and ompetitive). Term coupon is determined as

[(1+WAY)^(d/364)-1] where d is 91 days or 182 days.

Yields Spread to T-Bills

15.00 8.20 Spread (bps)

Zero Curve 600

14.00 6/13 8.00

6/13

13.00 7.80 500

12.00 7.60

400

7.40

11.00

7.20 300

10.00 9.15 9/16 1/17 1/18

11/13 4/14 7.00

9.00 2/14

6.80 200

8.00 9/11 4/13 6.60

100 1/17 2/14

7.00 6.40 11/13 9/16

7/144/14 4/13

6.00 6.20 0

-0.20 -0.10 0.00 0.10 0.20 0.30 0.40 0.50 0.0 0.1 0.2 0.3 0.4 0.5

Duration

*Indicative levels are used for securities that did not trade on the previous day ** Carry calculations are based on compounded yields and assume funding at 6.25%

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 5 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

20/05/11

Local Markets - CPI Linked Securities

###

As of 18 May 2011

3 mo Range

Amt Daily Weekly Comp Wk Yld 3mo Yld

Issue Clean Dirty 1d Yld 3 mo 3 mo Spread Inflation

Description Instrument CPN Maturity Term Orig. Term Outstand. Volume Volume Yield Chg Chg

Date Price Price Chg (bp) Vol (%) Low (%) High Avg (%) Index Ratio to Breakeve IRP Dur.

PVB

(Mil TRY) (Mil TRY) (Mil TRY) (%) (bp) (bp) (%) P

Nominal n

TURKEY 10 15/02/12 TRT150212T15 10.00 15/02/12 21/02/07 9m 5y 7,469 0.0 2.1 0.27 0.84 1.80 1.34 1.37 s

TURKEY 12 14/08/13 TRT140813T19 12.00 14/08/13 20/08/08 2.2 y 5y 7,186 4.0 11.0 121.517 149.043 2.14 4 8 0.12 1.68 2.15 1.90 1.19 -695 6.80 -3.2 0.97 0.01

TURKEY 9 21/05/14 TRT210514T12 9.00 21/05/14 27/05/09 3y 5y 8,643 70.8 85.6 119.900 142.198 2.17 -4 0.12 1.79 2.21 1.93 1.14 -704 6.89 15.5 1.28 0.02

TURKEY 7 01/10/14 TRT011014T19 7.00 01/10/14 07/10/09 3.4 y 5y 6,333 0.0 0.0 0.07 1.82 2.07 1.97 1.13 1.49 0.03

TURKEY 4.5 11/02/15 TRT110215T16 4.50 11/02/15 17/02/10 3.7 y 5y 8,503 1.2 62.7 107.510 117.543 2.40 1 37 0.11 1.94 2.40 2.12 1.08 -688 6.72 16.7 1.68 0.03

TURKEY 4 29/04/15 TRT290415T14 4.00 29/04/15 05/05/10 3.9 y 5y 7,162 0.1 37.9 106.000 110.744 2.41 5 9 0.10 1.94 2.39 2.14 1.04 -689 6.73 21 1.79 0.04

TURKEY 2,5 04/05/16 TRT040516T11 2,5 04/05/16 11/05/11 5y 5y 1.090 0.0 2.5 0.02 2.29 2.32 2.31 1.00 2.28 0.06

TURKEY 4 01/04/20 TRT010420T19 4.00 01/04/20 14/04/10 8.9 y 10 y 7,736 0.0 18.1 0.05 2.57 2.83 2.64 1.05 3.68 0.16

TURKEY 3 06/01/21 TRT060121T16 3.00 06/01/21 19/01/11 9.6 y 10 y 7,509 3.4 22.6 101.900 104.013 2.79 -6 -2 -2 0.05 2.47 2.86 2.78 1.01 -668 6.50 106

Inflation Breakeven Inflation Risk Premium (IRP)* Inflation realized and expectations

Inflation 3-month 3-month YOY (%)

Description IRP

Breakeven Change Average High Low Z-score Change Average High Low Z-score 14.00

TURKEY 10 15/02/12 6.57 6.93 7.82 6.39 73 172 10 12.00

TURKEY 12 14/08/13 6.80 6.74 7.02 7.48 6.61 -0.91 -3 -20 32 80 -21 -1.21 10.00

TURKEY 9 21/05/14 6.89 7.10 7.15 7.45 6.74 -1.53 16 #N/A 50 84 8 -1.72 8.00

TURKEY 7 01/10/14 7.04 7.13 7.32 6.95 58 80 35 6.00

TURKEY 4.5 11/02/15 6.72 6.98 6.97 7.28 6.75 -1.67 17 -19 49 83 17 -1.88 4.00

TURKEY 4 29/04/15 6.73 6.82 6.89 6.94 6.82 -1.13 21 -35 63 68 56 -8.66 Inflation realized and expectations IYM Inflation Forecast CBRT Inflation Forecast

2.00

TURKEY 2,5 04/05/16 6.82 6.89 6.94 6.82 63 68 56

0.00

TURKEY 4 01/04/20 6.65 6.61 6.79 6.35 103 122 77

TURKEY 3 06/01/21 6.50 6.54 6.47 6.79 6.12 0.17 106 8 105 138 70 0.05 2007 2008 2009 2010 2011 2012

* Calculated using Is Investment most recent CPI Forecast for the remainder of the security's life

Compounded Yield (%) Inflation Breakevens

Nominal Yield Curve %

9.00 8.50

8.00 8.00

7.00 7.50

6.00 7.00

5.00 6.50

6.00

4.00

11-Feb-15 Real Yield Curve 5.50

3.00 14-Aug-13 21-May-14 6-Jan-21 5.00

29-Apr-15

2.00 4.50

1.00 1-Oct-14 4-May-16 4.00

0.00 15-Feb-12 1-Apr-20 Feb-11 Mar-11 Apr-11 May-11

2011 2012 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Maturity

TRT150212T15 TRT140813T19 TRT210514T12 TRT011014T19

Inflation Risk Premium versus Inflation Expectations

TRT110215T16 TRT040516T11 TRT010420T19

Inflation Risk Premiums

Inflation Expectation Inflation Breakeven

TRT150212T15 TRT140813T19 TRT210514T12 TRT011014T19

bps TRT110215T16 TRT010420T19 TRT040516T11

200

6.60 IRP= 21bps 150

6.03 IRP= -3bps 6.56

IRP= 16bps 6.48 6.42 6.39 5.57 IRP= 106bps 100

IRP= 17bps

50

5.42

6.80 6.89 6.72 6.73 6.50 0

-50

TRT150212T15 TRT140813T19 TRT210514T12 TRT011014T19 TRT110215T16 TRT290415T14 TRT040516T11 TRT010420T19 Feb-11 Mar-11 Apr-11 May-11

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 6 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

20/05/11

Relative Value - Local Markets

40683

As of May 18, 2011

Curve Trades

Liquidi

ty Duration Yield 1 mo 3 mo

Sell Yield Index Buy Yield Liquidity Index Impact Pick-up Low High Avg Zscore Percentile Low High Avg Zscore Percentile

Upto 3-month Extension

TRT080812T26 8.65 8 TRT071112T14 8.87 2 0.24 22 -15 23 5 1.49 86% -15 23 3 2.51 95%

TRT250112T14 8.41 7 TRT250412T11 8.57 3 0.24 16 2 23 11 0.94 81% 2 39 15 0.19 63%

TRT121011T19 7.98 14 TRT161111T14 8.23 5 0.09 25 -6 77 18 0.40 71% -17 77 12 0.96 90%

Upto 6-month Extension

TRT161111T14 8.23 5 TRT250412T11 8.57 3 0.42 34 12 41 27 0.77 67% 12 54 35 -0.11 36%

TRT071112T14 8.87 2 TRT200213T25 8.79 1 0.28 -8 -23 -7 -11 0.73 81% -23 -6 -11 0.72 81%

TRT121011T19 7.98 14 TRT250112T14 8.41 7 0.28 43 6 88 34 0.53 71% 2 88 32 0.72 75%

TRT071112T14 8.87 2 TRT100413T17 9.14 18 0.26 27 11 58 30 -0.24 44% 4 58 30 -0.22 48%

TRT250412T11 8.57 3 TRT080812T26 8.65 8 0.27 8 8 29 17 -1.45 0% 4 29 16 -1.47 3%

Upto 12-month Extension

TRT080812T26 8.65 8 TRT200213T25 8.79 1 0.51 14 -31 15 -6 1.46 95% -31 15 -6 1.59 96%

TRT080812T26 8.65 8 TRT100413T17 9.14 18 0.50 49 15 56 36 1.09 83% 11 56 33 1.29 88%

TRT250112T14 8.41 7 TRT071112T14 8.87 2 0.75 46 5 55 33 0.84 76% 5 60 34 0.98 84%

TRT250412T11 8.57 3 TRT200213T25 8.79 1 0.79 22 -20 31 11 0.78 76% -20 31 11 0.86 81%

TRT161111T14 8.23 5 TRT071112T14 8.87 2 0.94 64 17 74 48 0.77 71% 17 79 54 0.65 70%

12-month + Extension

TRT121011T19 7.98 14 TRT200213T25 8.79 1 1.30 81 3 102 56 0.89 76% 3 102 55 1.00 81%

TRT250112T14 8.41 7 TRT200213T25 8.79 1 1.03 38 -18 46 22 0.87 76% -18 46 23 0.89 81%

TRT121011T19 7.98 14 TRT071112T14 8.87 2 1.03 89 21 112 66 0.85 71% 21 112 66 1.26 86%

TRT161111T14 8.23 5 TRT200213T25 8.79 1 1.21 56 -6 66 38 0.81 76% -6 66 38 0.85 81%

Butterfly Trades

Liqdty Liqdty Duration Yield 1 mo 3 mo

Sell Yield Liqdty Index Sell Yield Index Buy Yield Index Impact Pick-up Low High Avg Zscore Percentile Low High Avg Zscore Percentile

50:50 weighted

TRT161111T14 8.23 5 TRT150120T16

9.46 6 TRT250412T11 8.57 3 -4.32 -55 -95 -55 -76 2.23 100% -95 -19 -60 2.23 64%

TRT080812T26 8.65 8 TRT150120T16

9.46 6 TRT071112T14 8.87 2 -3.99 -37 -104 -37 -77 2.06 100% -104 -37 -73 2.06 100%

TRT071112T14 8.87 2 TRT150120T16

9.46 6 TRT200213T25 8.79 1 -3.68 -75 -136 -75 -103 1.98 100% -136 -71 -98 1.98 88%

TRT080812T26 8.65 8 TRT150120T16

9.46 6 TRT200213T25 8.79 1 -3.44 -53 -142 -53 -99 1.90 100% -142 -53 -93 1.90 100%

TRT250412T11 8.57 3 TRT150120T16

9.46 6 TRT071112T14 8.87 2 -3.72 -29 -87 -29 -60 1.71 100% -87 -18 -57 1.71 94%

TRT250112T14 8.41 7 TRT150120T16

9.46 6 TRT250412T11 8.57 3 -4.50 -73 -112 -67 -92 1.67 90% -112 -46 -81 1.67 66%

TRT080812T26 8.65 8 TRT290114T18

9.27 10 TRT071112T14 8.87 2 -0.70 -18 -82 -10 -53 1.60 95% -82 13 -45 1.60 91%

TRT080812T26 8.65 8 TRT150120T16

9.46 6 TRT100413T17 9.14 18 -3.47 17 -54 23 -14 1.60 94% -54 23 -14 1.60 96%

TRT250112T14 8.41 7 TRT150120T16

9.46 6 TRT071112T14 8.87 2 -3.48 -13 -85 -13 -49 1.57 100% -85 -7 -42 1.57 95%

TRT080812T26 8.65 8 TRT290114T18

9.27 10 TRT200213T25 8.79 1 -0.15 -34 -118 -30 -75 1.57 95% -118 -30 -73 1.57 96%

Duration Neutral

TRT161111T14 8.23 5 TRT150120T16

9.46 6 TRT250412T11 8.57 3 0 -55 -95 -55 -76 2.23 100% -95 -19 -60 2.23 64%

TRT080812T26 8.65 8 TRT150120T16

9.46 6 TRT071112T14 8.87 2 0 -37 -104 -37 -77 2.06 100% -104 -37 -73 2.06 100%

TRT071112T14 8.87 2 TRT150120T16

9.46 6 TRT200213T25 8.79 1 0 -75 -136 -75 -103 1.98 100% -136 -71 -98 1.98 88%

TRT080812T26 8.65 8 TRT150120T16

9.46 6 TRT200213T25 8.79 1 0 -53 -142 -53 -99 1.90 100% -142 -53 -93 1.90 100%

TRT250412T11 8.57 3 TRT150120T16

9.46 6 TRT071112T14 8.87 2 0 -29 -87 -29 -60 1.71 100% -87 -18 -57 1.71 94%

TRT250112T14 8.41 7 TRT150120T16

9.46 6 TRT250412T11 8.57 3 0 -73 -112 -67 -92 1.67 90% -112 -46 -81 1.67 66%

TRT080812T26 8.65 8 TRT290114T18

9.27 10 TRT071112T14 8.87 2 0 -18 -82 -10 -53 1.60 95% -82 13 -45 1.60 91%

TRT080812T26 8.65 8 TRT150120T16

9.46 6 TRT100413T17 9.14 18 0 17 -54 23 -14 1.60 94% -54 23 -14 1.60 96%

TRT250112T14 8.41 7 TRT150120T16

9.46 6 TRT071112T14 8.87 2 0 -13 -85 -13 -49 1.57 100% -85 -7 -42 1.57 95%

TRT080812T26 8.65 8 TRT290114T18

9.27 10 TRT200213T25 8.79 1 0 -34 -118 -30 -75 1.57 95% -118 -30 -73 1.57 96%

* Liquidity index has been calculated by ranking the instruments accordng to their monthly trading volume

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 7 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

Turkey Eurobonds

40683

May 18, 2011

3mo Breakeven (bp) Spread to Treasuries (bps) Asset Swap Spread (bps)

Amt

Orig. Clean Yield Bid - Ask 1 day Yld PVBP *

Description Instrument CPN Maturity Issue Date Term Outstd. Acc. Int. 1 day 3mo 3 mo 3 mo Range 3 mo 1 day 3mo 3 mo 3 mo Range 3 mo Dur. Cnvx

Term Price (%) Sprd Chg (bp) Roll Carry* (R+C) Last Z-score Last Z-score 100

(Bil) Chg Chg Vol Avg Chg Chg Vol Avg

Low High Low High

USD Denominated USD Denominated

TURKEY 9 06/30/11 ED522190 9.00 30/06/11 30/06/04 1m 7y 0.75 101.000 3.58 0.00 216 63 -55 -74 -148 51 -74 130 49 -2.05 -75 -75 -149 52 -96 110 28 -1.99 0.10 0.00 0.00

TURKEY 11 1/2 01/23/12 EC508181 11.50 23/01/12 22/01/02 8m 10 y 1.00 107.250 3.83 0.71 49 -4 96 662 758 66 -19 -61 27 -7 156 103 -1.35 49 -20 -65 22 44 144 91 -1.87 0.64 0.01 0.01

TURKEY 11 01/14/13 EC815686 11.00 14/01/13 14/01/03 20 m 10 y 1.50 115.450 3.94 1.48 22 -1 55 199 254 115 -2 -37 25 63 179 134 -0.74 110 -3 -35 23 99 177 132 -0.95 1.49 0.03 0.02

TURKEY 9 1/2 01/15/14 ED155118 9.50 15/01/14 24/09/03 3y 10 y 1.75 118.050 3.38 2.43 14 -1 21 111 132 169 -1 -31 16 145 207 177 -0.47 164 -2 -28 17 136 202 173 -0.53 2.34 0.07 0.03

TURKEY 7 1/4 03/15/15 ED635916 7.25 15/03/15 07/10/04 4y 10 y 2.75 114.400 1.37 3.21 10 0 10 67 77 196 0 -16 15 164 227 193 0.21 186 -1 -17 16 152 215 183 0.19 3.36 0.14 0.04

TURKEY 7 09/26/16 EF698872 7.00 26/09/16 26/09/06 5y 10 y 2.00 114.900 1.11 3.89 8 -2 5 48 54 200 0 -13 16 157 223 194 0.35 195 -1 -11 15 151 215 189 0.41 4.55 0.25 0.05

TURKEY 7 1/2 07/14/17 EH678845 7.50 14/07/17 14/01/09 6y 9y 2.25 118.000 2.69 4.15 7 -4 4 44 48 200 -2 -9 15 158 220 192 0.50 200 -3 -9 15 157 219 193 0.51 5.01 0.31 0.06

TURKEY 6 3/4 04/03/18 EG876423 6.75 03/04/18 03/10/07 7y 11 y 2.25 114.000 0.94 4.37 8 -4 3 38 41 196 -2 -8 17 153 224 190 0.36 197 -2 -5 15 153 219 190 0.49 5.65 0.39 0.06

TURKEY 7 03/11/19 EH539794 7.00 11/03/19 11/09/08 8y 11 y 1.50 115.400 1.40 4.63 7 -2 3 34 37 199 -2 -6 16 157 225 193 0.41 202 -2 -1 14 156 220 193 0.60 6.21 0.47 0.07

TURKEY 7 1/2 11/07/19 EH814308 7.50 07/11/19 07/05/09 8y 11 y 1.50 119.000 0.33 4.75 7 3 2 33 35 197 4 -5 17 157 225 191 0.38 205 4 -1 15 162 227 197 0.55 6.60 0.54 0.08

TURKEY 7 06/05/20 ED966375 7.00 05/06/20 07/06/05 9y 15 y 2.00 115.250 3.27 4.89 6 0 2 30 32 197 -1 -3 16 159 224 190 0.43 203 0 2 14 163 222 194 0.62 6.85 0.59 0.08

TURKEY 5 5/8 03/30/21 EI1855820 5.63 30/03/21 18/03/10 10 y 11 y 2.00 104.800 0.83 5.00 6 -2 1 20 22 194 1 -7 17 152 224 188 0.32 189 1 2 14 146 207 179 0.68 7.76 0.73 0.08

TURKEY 7 3/8 02/05/25 ED777753 7.38 05/02/25 24/01/05 14 y 20 y 3.25 118.400 #N/A 5.45 5 -1 1 20 22 214 1 -5 15 179 241 209 0.33 213 2 4 13 172 228 202 0.81 9.08 1.10 0.11

TURKEY 11 7/8 01/15/30 EC214944 11.88 15/01/30 18/01/00 19 y 30 y 1.50 169.750 4.22 5.74 3 -2 1 17 18 214 1 1 12 178 232 206 0.65 297 2 12 14 244 308 280 1.18 9.81 1.42 0.17

TURKEY 8 02/14/34 ED283287 8.00 14/02/34 14/01/04 23 y 30 y 1.50 124.000 2.20 6.04 4 -2 1 13 14 223 2 -4 14 186 250 217 0.45 253 3 7 12 209 266 239 1.09 11.66 2.04 0.14

TURKEY 6 7/8 03/17/36 EF231561 6.88 17/03/36 17/01/06 25 y 30 y 2.75 109.850 1.26 6.10 4 -1 1 11 12 216 2 -5 13 183 244 212 0.36 231 3 6 10 194 243 220 1.09 12.58 2.39 0.14

TURKEY 7 1/4 03/05/38 EH238684 7.25 05/03/38 05/03/08 27 y 30 y 1.00 114.750 1.57 6.12 3 -2 1 11 11 209 2 -4 13 176 236 204 0.42 241 3 7 11 202 252 228 1.15 12.81 2.54 0.14

TURKEY 6 3/4 05/30/40 900123BG4 6.75 30/05/40 12/01/10 29 y 30 y 2.00 107.750 3.24 6.17 4 -1 0 0 0 200 2 -2 13 168 227 195 0.39 230 2 9 10 194 241 218 1.18 13.18 2.79 0.14

TURKEY 6 01/14/41 900123BJ8 6.00 14/01/41 12/01/11 30 y 30 y 1.00 97.500 2.18 6.18 4 -2 0 0 0 199 2 -1 12 168 225 193 0.44 214 2 9 9 180 222 202 1.29 13.70 2.99 0.13

YEN Denominated

EUR Denominated TURKEY 1.87 03/18/21 EI6053504 1.87 18/03/21 18/03/11 10 y 10 y 180.00 104.500 0.34 1.35 ####### 1 0 0 0 21 0 16 14 66 34 -0.80 21 0 15 13 65 32 -0.71 9.13 0.92 0.09

EUR Denominated

TURKEY 4 3/4 07/06/12 ED994796 4.75 06/07/12 06/07/05 14 m 7y 1.00 102.500 4.18 2.47 45 0 344 158 502 118 0 -25 16 100 158 124 -0.37 66 -1 -19 14 51 101 70 -0.28 1.05 0.02 0.01

TURKEY 6 1/2 02/10/14 ED309964 6.50 10/02/14 10/02/04 3y 10 y 1.00 107.000 1.82 3.75 19 0 3 85 88 188 -4 -37 15 167 229 195 -0.50 137 -3 -27 14 114 173 141 -0.29 2.48 0.09 0.03

TURKEY 5 03/01/16 EF292598 5.00 01/03/16 01/03/06 5y 10 y 0.75 102.600 1.13 4.38 18 0 9 43 52 201 -2 -3 13 163 211 189 0.94 156 -3 -1 11 125 164 147 0.90 4.22 0.23 0.04

TURKEY 5 1/2 02/16/17 ED811620 5.50 16/02/17 16/02/05 6y 12 y 1.50 104.400 1.45 4.61 15 0 7 38 45 210 3 3 12 171 219 197 1.05 170 2 1 11 139 181 161 0.79 4.90 0.31 0.05

TURKEY 5 7/8 04/02/19 EG138108 5.88 02/04/19 02/02/07 8y 12 y 1.25 106.400 0.82 4.87 11 0 4 29 33 207 5 8 12 164 210 190 1.39 174 3 -1 12 140 184 164 0.86 6.35 0.51 0.07

TURKEY 5 1/8 05/18/20 EI2212989 5.13 18/05/20 22/04/10 9y 10 y 2.00 100.250 0.07 5.09 11 2 0 0 0 212 3 10 11 169 214 195 1.55 174 1 1 10 141 181 164 0.97 7.24 0.66 0.07

USD Denominated Yield Curve EUR Denominated Yield Curve Turkey Eurobond Spreads vs CDS

Yield (%)

Yield (%) Spread (bps)

8.00 6.00

300

20

7.00 19

40 5.00 17 36 40

34 36 38 250

30 16 30

6.00 25 25

14 18 19 21

2021 4.00 16

5.00 1919 200 15

18

17 14

16

4.00 3.00 150 19 20

15 17

14 16

3.00 14 12

2.00 100

12

2.00 13 13 CDS

12 1.00 50 USD denominated

1.00

11 12 EUR Denoinated

0.00 0.00 0

1/6/11 1/6/16 1/6/21 1/6/26 1/6/31 1/6/36 1/1/09 1/1/11 1/1/13 1/1/15 1/1/17 1/1/19 0 2 4 6 8 10 12

Duration

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 8 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

Emerging Markets Performance

Based on Most Recent Data As of 18 May 2011

40683

Currency (USD / LC) Local Bonds (2yr maturities, bp yield change) Eurobonds (YTD Change)

(YTD %) (bps) (YTD %)

12.00

12.00 153.67

10.00 200 10.00

8.00 150 8.00

6.00 100 6.00

4.00 - 50 4.00 1.16

2.00 -

0 2.00

0.00 -50

-2.00 0.00

-4.00 -100

Buy the ex 07/11/12 benchmark note as it offers a good entry point at current yields -2.00

-6.00 -150 -4.00

Turkey

India

Thailand

Singapore

China

Russia

Hungary

Mexico

Poland

South Africa

South Korea

CzechRepublic

Turkey

Russia

Argentina

Hungary

Hungary

Turkey

EMBI+

Romania

Poland

Mexico

South Korea

Brazil

China

Ukraine

Thailand

India

Argentina

South Africa

Composite

Kazakhstan

Mexico

Brazil

Russia

South Africa

Poland

Romania

China

Singapore

Kazakhstan

Ukraine

CzechRepublic

CzechRepublic

Stock Indices 5-yr Cross Currency Swaps (YTD BPs Change) 5-yr Credit Default Swaps (YTD BPs Change)

(YTD %) (bps)

140

(bps)

10.00 120 0.0

- - 40

5.00 - 100 0.0 20

- - - - - - - 80 0

0.00 - - - - - - 60 -20

-3.44 -40

-5.00 40 -60

20 0 -80

-10.00 0 -100

-20 -120

-15.00 -140

-40 -160

Turkey -60

Russia

Hungary

Romania

Thailand

South Korea

Ukraine

Poland

China

South Africa

Singapore

Argentina

Brazil

Mexico

India

Kazakhstan

CzechRepublic

Turkey

Thailand

Argentina

China

Russia

Hungary

South Korea

Poland

South Africa

Brazil

Mexico

Kazakhstan

Romania

Ukraine

Turkey

Hungary

South Korea

Mexico

Thailand

Russia

India

China

Singapore

Rating Rates

Outlook Local Currency Debt Foreign Currency Debt Last Action Real Yields CDS

(Long-term / Short-term) Fitch Moody's S&P Fitch Moody's S&P Fitch Moody's S&P Official Policy Rate Level Date Action Amount Inflation* 2y NomYld Real Yield 5-year

Europe

Turkey POS POS POS BB+ / n.a. Ba2 / n.a.BB+ / B BB+ / BBa2 / n.a.BB / B 1-wk repo rate 6.25 21/04/11 unch 0 6.53% 8.50% 1.86% 159

CzechRepublic POS STABLE POS AA- / n.a. A1 / n.a. A+ / A-1 A+ / F1 A1 / n.a. A / A-1 2-week Repo Rate 0.75 05/05/11 unch 0 0.99% 1.78% 0.78% n.a.

Hungary NEG NEG NEG BBB / n.a. Baa3 / n.a.

BBB- / A-3 BBB- / F3

Baa3 / n.a.

BBB- / A-3 Base Rate 6.00 16/05/11 5.60% 6.10% 0.47% 248

Kazakhstan POS STABLE STABLE BBB / n.a. WR / n.a.

BBB+ / A-2 BBB- / F3WR / n.a.

BBB / A-3 Refinancing Rate 7.50 09/03/11 n.a. n.a. 6.20% n.a n.a 143

Poland STABLE STABLE STABLE A / n.a. A2 / n.a. A / A-1 A- / F2 A2 / n.a.A- / A-2 7-day Money Market Rate4.25 12/05/11 tightened 25 3.65% 5.06% 1.36% 137

Romania STABLE STABLE STABLE BBB- / n.a. n.a. / n.a.

BBB- / A-3 BB+ / n.a.

Baa3 / n.a.BB+ / B 1-week Deposit Rate 6.25 03/05/11 unch 0 4.74% n.a n.a 228

Russia POS STABLE STABLE BBB / n.a. Baa1 / n.a.

BBB+ / A-2 BBB / n.a.

Baa1 / P-2

BBB / A-3 Refinancing Rate 8.25 18/05/11 unch 0 8.80% 6.04% -2.53% 135

Ukraine STABLE STABLE STABLE B / n.a. B2 / n.a. BB- / B B / B B2 / n.a. B+ / B Discount Rate 7.75 18/05/11 unch 0 12.30% n.a n.a 435

Africa and Middle East

South Africa STABLE STABLE STABLE A / n.a. A3 / n.a. A / A-1 BBB+ / F2A3 / P-2

BBB+ / A-2 Repo Rate 5.50 16/05/11 unch 0 6.81% 6.81% 57

Asia

China n.a. POS STABLE AA- / n.a. Aa3 / n.a.

AA- / A-1+ A+ / F1 Aa3 / n.a.

AA- / A-1+ 1-yr Lending Rate 6.31 18/05/11 tightened 100 1.90% 3.16% 1.24% 71

India STABLE n.a. STABLE BBB- / n.a. Ba1 / NP

BBB-u / A-3u BBB- / n.a.

n.a. / n.a.

BBB-u / A-3u Repo Rate 7.25 03/05/11 #VALUE! ###### 15.10% 8.19% -6.00% 0

Singapore STABLE STABLE STABLE AAA / n.a. Aaa / n.a.

AAAu / A-1+u AAA / F1+n.a. / n.a.

AAAu / A-1+u Does not adapt a target rate policy -0.53% 0.47% 1.01% 0

South Korea STABLE STABLE STABLE AA / n.a. A1 / n.a. A+ / A-1 A+ / F1 A1 / n.a. A / A-1 Base Rate 3.00 13/05/11 unch 0 13.80% 3.68% -8.89% 98

Thailand STABLE STABLE STABLE A- / n.a. Baa1 / n.a.A- / A-2 BBB / F3Baa1 / P-2

BBB+ / A-2 1-day Repo Rate 2.75 20/04/11 tightened 75 3.53% 3.33% -0.19% 121

Latin America

Argentina STABLE STABLE STABLE B / n.a. WR / n.a. Bu / Bu B / B B3 / n.a. Bu / Bu Does not adapt a target rate policy 7.69% n.a n.a 604

Brazil STABLE POS STABLE BBB / n.a. Baa3 / n.a.

BBB+ / A-2 BBB / F2

Baa3 / n.a.

BBB- / A-3 SELIC Rate 12.00 17/05/11 tightened 75 3.65% #VALUE! #VALUE! 101

Mexico STABLE STABLE STABLE BBB+ / n.a. Baa1 / WRA / A-1 BBB / n.a.

Baa1 / WR

BBB / A-3 Overnight Funding Rate 4.50 17/05/11 unch 0 3.57% 5.49% 1.85% 99

*Inflation is assumed to remain unchanged over the net year for simplicity purposes

**Average yield is based on average 1yr bond portfolio duration

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 9 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

Turkish Corporates

As of May 18, 2011

Spread to Treasuries (bps)

Next Amt Ratings Last

Cpn Clean Acc. Yield 1 day Yld PVBP *

Ticker Instrument CPN Maturity Issue Date

Freq

Coupon Coupon/ Option Details Outstd. (S-S&P, M-Moody, F- Price as

Price Int. (%) Chg (bp) 1 day 3 mo Range 3 mo Dur. Cnvx

100

Date (Mil) Fitch, JCR) of Last

Chg Low High Avg

TRY Corporates

TRY Denominated

Financial Services

21 AKBNK TRQAKBK61118 0.00 10/06/11 14/12/10 10/06/11 Zero Coupon 1000 M: Ba1 F: BBB- 17/05/11 99.477 0.00 8.31 0 120 31 120 59 0.06 0.00 0.00

17 AKBNK TRQAKBK71117 0.00 29/07/11 01/02/11 29/07/11 Zero Coupon 500 M: Ba1 F: BBB- 12/05/11 98.336 0.00 8.17 0 141 22 141 141 141 0.19 0.00 0.00 12

15 ISCTR TRQTISB81113 0.00 03/08/11 08/02/11 03/08/11 Zero Coupon 500 18/05/11 98.356 0.00 8.17 69 -51 69 69 69 0.20 0.00 0.00

AKFEN

13 TSKBTI TRQTSKB00028 0.00 15/08/11 20/08/10 15/08/11 Zero Coupon 48 M: Ba3 F: BB+ 17/05/11 95.463 0.00 7.44 87 68 68 68 68 0.24 0.00 0.00 11

7 GARAN TRQGRAN11210 0.00 26/01/12 31/01/11 26/01/12 Zero Coupon 1000 11/05/11 94.481 0.00 8.30 87 18 -2 75 33 0.66 0.01 0.01 KCHOL BNKPOZ

10

9 ISCTR TRQTISBE1117 0.00 12/10/11 19/04/11 12/10/11 Zero Coupon 700 11/05/11 100.616 0.00 8.49 -781 75 18 -2 0.40 0.00 0.00

8 DENIZB TRQDZBKK1114 0.00 02/11/11 10/05/11 02/11/11 Zero Coupon 350 18/05/11 96.243 0.00 8.67 58 -109 58 58 0.44 0.00 0.00 9

DENIZB ISCTR

6 ISCTR TRSTISB31213 0.00 07/03/12 08/02/11 07/03/12 Zero Coupon 600 17/05/11 93.452 0.00 8.74 123 53 123 86 0.77 0.01 0.01 #N/A

GARAN

GARANDENIZB

5 SKBNK TRSSKBK31218 0.00 15/03/12 14/03/11 15/03/12 Zero Coupon 150 05/04/11 91.610 0.00 9.72 123 123 123 123 0.78 0.01 0.01 8

2 DENIZB TRQDZBK41211 0.00 25/04/12 10/05/11 25/04/12 Zero Coupon 150 16/05/11 91.928 0.00 8.35 96 0 96 1 0.90 0.01 0.01

7

20 SKBNK TRSSKBK91212 9.80 10/09/12 14/03/11 4 13/06/11 Floater (2yr Trsy Bench+210bps) 200 M:A2 F: A 09/05/11 100.616 1.80 0.00 -788 88 -10 -10 0.07 0.00 0.00

18 SKBNK TRSSKBK31317 9.72 28/03/13 31/03/11 4 30/06/11 Floater (2yr Trsy Bench+110bps) 115 06/05/11 91.281 1.34 0.00 169 -781 169 169 0.10 0.00 0.00 6

23 CRDFA TRSTPFC61210 10.20 01/06/12 08/06/10 2 03/06/11 Floater (2yr Trsy Bench+245bps) 50 JCR: AA- 18/05/11 99.400 4.70 12.14 -30 474 207 478 348 0.04 0.00 0.00

22 LDRFAK TRSLDFK61216 10.28 08/06/12 16/06/10 2 10/06/11 Floater (2yr Trsy Bench+275bps) 50 Fitch: BBB+ 04/05/11 100.525 4.55 11.01 353 273 392 346 0.06 0.00 0.00 5

24 CRDFA TRSTPFCK1211 9.78 27/11/12 02/12/10 2 31/05/11 Floater (2yr Trsy Bench+225bps) 50 JCR: AA- 18/05/11 99.500 4.58 11.68 -12 430 152 453 327 0.03 0.00 0.00 3mo 6mo 1yr 2yr

3 SKBNK TRSSKBK41217 0.00 02/04/12 31/03/11 0 02/04/12 Zero Coupon 35 05/05/11 99.700 0.00 11.56 0 169 453 430 152 0.87 0.01 0.01

1 BNKPOZ TRSCKKBE1316 10.08 02/10/13 07/10/10 2 05/10/11 Fixed 100 M: Baa3 F: BBB- 18/05/11 99.910 1.22 10.37 1 133 87 166 131 2.05 0.05 0.02

4 KCHOL TRSKCTF41213 8.93 16/04/12 18/10/10 2 17/10/11 Fixed 100 28/04/11 99.900 0.78 10.38 0 31 166 133 87 0.86 0.01 0.01

9 ISCTR TRQTISBE1117 0.00 12/10/11 19/04/11 12/10/11 Zero Coupon 700 01/04/11 96.489 0.00 8.49 189 57 57 57 #### 0.40 0.00 0.00

11 GARAN TRQGRANE1117 0.00 14/10/11 21/04/11 14/10/11 Zero Coupon 750 04/04/11 91.610 0.00 8.49 189 171 267 171 171 0.36 0.00 0.00

Industrials

12 AKFEN TRSAKFH31213 11.10 02/03/12 08/03/10 2 02/09/11 Floater (2yr Trsy Bench+250bps) 100 18/05/11 99.910 2.34 11.33 -43 347 18 49 698 320 0.28 0.00 0.00

19 MERINO TRSMRNH61214 12.36 19/06/12 22/06/10 4 21/06/11 Floater (2yr Trsy Bench+395bps) 50 Fitch: B 18/05/11 101.850 2.00 11.32 -1 381 -30 166 561 375 0.09 0.00 0.00 USD Corporates

16 BIMEKS TRSBMKS71210 11.78 27/07/12 30/07/10 2 29/07/11 Floater (2yr Trsy Bench+425bps) 31 04/05/11 100.052 3.62 12.84 513 469 599 488 0.19 0.00 0.00

14 BOYNR TRSCRSI81210 10.96 16/08/12 19/08/10 4 16/11/11 Floater (2yr Trsy Bench+300bps) 40 n.a. n.a. 0.03 0.00 n.a. n.a. n.a. n.a. n.a. n.a. 0.23 0.00 0.00 8

GARAN

USD Denominated YKBNK

7

Financial Services GARAN

GARAN

BNKPOZ EG5828405 7.82 27/06/12 27/06/07 2 27/06/11 Fixed 150 F: BBB- 17/05/11 104.000 3.17 4.04 -3 448 18 290 446 419 1.03 0.02 0.01 6 BNKPOZ

BNKPOZ EH2127114 7.10 20/02/13 20/02/08 2 20/08/11 Fixed 150 17/05/11 103.750 1.83 4.82 -1 481 14 385 468 436 1.62 0.04 0.02 FINBN

5

FINBN EF3449693 6.50 24/03/13 24/03/06 2 24/09/11 Fixed 101 1.07 348 348 348 1.69 0.04 0.02 Industrial

Fixed F: BBB- 4 s

BNKPOZ EI0224267 7.00 28/10/14 28/10/09 2 28/10/11 150 17/05/11 103.500 0.49 5.86 0 484 -5 390 489 442 3.05 0.11 0.03

AKBNK EI3261720 5.13 22/07/15 22/07/10 2 22/07/11 Fixed 1000 M: Ba1 F: BBB- 17/05/11 101.250 1.72 4.72 -12 341 -1 274 363 318 3.71 0.17 0.04 3 Industrial

Fixed SP: BB F: BBB- s

YKBNK EI4258022 5.19 13/10/15 13/10/10 2 13/10/11 750 0.58 342 0 260 354 310 3.93 0.18 0.04

2

ISCTR EI5507807 5.10 01/02/16 01/02/11 2 01/08/11 Fixed 500 M: Ba1 F: BBB- 1.59 328 -3 259 352 302 4.14 0.20 0.04

GARAN EG143020 6.95 06/02/17 05/02/07 2 06/08/11 Callable Stepup (NC sa) 500 M: Baa3 17/05/11 102.300 2.07 7.31 1 313 -61 227 409 351 5.54 0.37 0.06 1 BNKPOZ

AKBNK

GARAN EI6471797 2.77 20/04/16 20/04/11 4 20/07/11 Quartl US LIB +250 300 M: Ba1 F: BBB- 0.25 7.49 0.70 0.07 0 ISCTR

FINBN EI6678144 5.50 11/05/16 11/05/11 2 11/11/11 Fixed 500 M: Ba1 F: BBB- 17/05/11 97.130 0.18 6.18 -9 447 -4 448 452 450 ####

#N/A Invalid

#N/ASecurity

Invalid Security 1 AKBNK

2 3 4

AKBNK EI5999889 6.50 09/03/18 09/03/11 2 09/09/11 Fixed 500 M: Ba1 F: BBB- 17/05/11 104.250 1.34 5.73 -4 330 -6 273 379 323 0.77 0.01 0.01

GARAN EI6469999 6.25 20/04/21 20/04/11 2 20/10/11 Fixed 500 M: Ba1 F: BBB- 17/05/11 99.300 0.57 6.35 -2 327 3 290 325 305 0.94 0.01 0.01

Industrials EUR Corporates

CALIK EG2276244 8.50 05/03/12 05/03/07 2 05/09/11 Fixed 200 F: B- 17/05/11 100.625 1.84 6.97 868 83 612 865 784 0.77 0.01 0.01

8

VESTL ED925875 8.75 09/05/12 09/05/05 2 09/11/11 Fixed 225 SP: B- M: B3 F: B 17/05/11 105.000 0.34 3.41 -68 388 21 286 715 530 0.94 0.01 0.01

TEBNK

GLYHOT EG6616999 9.25 31/07/12 31/07/07 2 31/07/11 Fixed 100 F: B- 17/05/11 97.000 2.90 11.07 -4 1287 19 1081 1436 1301 1.07 0.02 0.01 7

YASAR EI4222879 9.63 07/10/15 07/10/10 2 07/10/11 Callable (4NC2y annual) 250 M: B2 F: B 17/05/11 107.875 1.23 7.48 -92 606 5 561 666 610 3.53 0.16 0.04 6

YUKSEL EI4609299 9.50 10/11/15 10/11/10 2 10/11/11 Callable (4NC2y annual) 200 M:B1 F:B 17/05/11 97.500 0.34 10.21 891 8 781 917 858 3.58 0.16 0.03 5

EUR DenominatedEUR Denominated

4

YASAR EF5885886 9.50 10/08/11 10/08/06 1 10/08/11 Fixed 76 F: B 17/05/11 101.300 7.44 3.21 -21 293 -55 320 506 424 0.22 0.00 0.00 YASAR

3

INETTR 030341066 10.00 29/05/12 29/05/07 4 30/06/11 Poison Put 110 1.47 1171 666 1.03 0.01 0.01

Putable 2

MERINO EG5296397 11.75 08/06/12 11/06/07 1 30/06/11 8 10.53 1.05 0.02 0.01

TEBNK EF7916515 6.10 31/10/16 31/10/06 2 31/10/11 Callable Stepup (5.5NC5m 1x) 110 F: BBB- 17/05/11 101.250 0.39 6.73 0 272 -174 443 493 465 5.45 -0.01 0.00 1

MERINO

Upcoming issuances Latest Publications 0 INETTR

`16/05/11 Akfen Holding recorded a net loss of TL 1.6mn in 1Q11 mainly derived from losses in Tav Construction and Airports. Net debt stands at TL330mn, 10% up fromYE10 `12/04/11 Merinos 2010 Financials short analysis 1 2 3 4 5

`11/05/11 Competition Board has approved the privatization tender for 100% block sale of IDO which was acquired by the consortium between Akfren-Tepe- Souter and Sera "23/12/10 Fixed Income Strategy- 2011 Outlook " Long" for long

`05/05/11 Garanti has applied to the Capital Markets Board to issue TL 750mn of corporate bonds with 6-month maturity `11/06/10 Merinos Hali- Domestic sales to drive growth

`28/04/11 YKB has applied to the Capital Markets Board to issue bank bonds of TL 3.2 bn "03/06/10 Yasar- Greater focus on debt management

`26/04/11 Isbank completed the issuance of its TL 700mn domestic bond at a rate of 8.34% simple (8.52% comp)between April 13th-15th

Please ask your sales rep for corporate snapshots containing bond specific data as well as key financials of the company

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 10 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

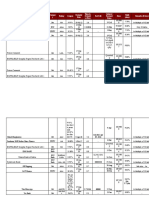

Treasury Debt Service (TRY denominated)

As of 18 May 2011

Markets Public Institutions Total

Payment Term Coupon Principal Markets Total Coupon Principal PI Total Coupon Principal Grand Total

May-11 695 10,003 10,698 79 3,095 3,174 774 13,097 13,872 11,224

Jun-11 600 3,799 4,400 145 1,301 1,446 745 5,100 5,846 11,224

Jul-11 2,158 5,080 7,238 345 0 345 2,503 5,080 7,583 11,224 Treasury Debt Service Projections (next 12 months)

Aug-11 2,619 10,592 13,210 517 583 1,100 3,135 11,175 14,310 11,224

Million TRY

Sep-11 1,751 8,212 9,963 130 469 599 1,881 8,681 10,562 11,224

Oct-11 1,971 2,769 4,740 322 487 809 0 3,256 5,549 11,224 20

Nov-11 1,226 10,511 11,737 210 1,182 1,392 1,436 11,693 13,129 11,224 17.2 17.1

18

Dec-11 600 0 600 145 42 187 745 42 787 11,224 15.3

16 14.3

Jan-12 2,150 12,156 14,306 345 2,593 2,938 2,495 14,750 17,245 11,224 13.9 13.4

14 13.1

Feb-12 2,612 9,752 12,363 517 2,431 2,948 3,129 12,183 15,312 11,224

Mar-12 1,374 11,939 13,313 106 0 106 1,480 11,939 13,419 11,224 12 10.6

3-yr Debt Service Schedule (Monthly)

Apr-12 1,971 13,276 15,247 322 1,504 1,826 2,293 14,781 17,074 11,224 10

7.6

May-12 1,204 0 1,204 210 0 210 1,414 0 1,414 8

5.8 5.5

Jun-12 600 0 600 145 0 145 745 0 745 6

Jul-12 2,112 0 2,112 345 0 345 2,457 0 2,457 4

Aug-12 2,169 12,355 14,523 395 1,537 1,932 2,564 13,892 16,455 2 0.8

Sep-12 609 5,202 5,810 106 445 551 715 5,646 6,361

0

Oct-12 2,496 0 2,496 462 541 1,003 2,958 541 3,499

May/11Jun/11Jul/11Aug/11Sep/11Oct/11Nov/11Dec/11Jan/12Feb/12Mar/12Apr/12

Nov-12 679 14,288 14,968 70 4,009 4,080 750 18,298 19,047

Date

Dec-12 600 0 600 145 0 145 745 0 745

Jan-13 2,276 13,020 15,296 398 1,177 1,574 2,673 14,197 16,870 Coupon Principal Debt Service 12 month Average

Feb-13 1,987 4,187 6,174 331 1,459 1,790 2,318 5,646 7,964

Mar-13 245 0 245 75 0 75 320 0 320

Apr-13 1,645 11,899 13,545 282 1,830 2,112 1,927 13,730 15,657

May-13 1,204 0 1,204 210 0 210 1,414 0 1,414

Jun-13 600 10,232 10,832 145 3,145 3,291 745 13,377 14,123 Domestic Debt Repricing

Jul-13 1,783 0 1,783 338 0 338 2,121 0 2,121

Amount of Debt Percentage of

Aug-13 1,987 9,561 11,548 331 2,069 2,401 2,318 11,631 13,949 Repricing Million Total Debt

Sep-13 0 0 0 0 0 0 0 0 0 TRY Repricing

Oct-13 1,765 11,321 13,087 363 1,457 1,819 2,128 12,778 14,906 18,000 4.0%

Nov-13 679 10,732 11,411 70 2,433 2,503 750 13,164 13,914 3.4%

16,000 3.2% 3.5%

Dec-13 356 2,305 2,661 70 0 70 426 2,305 2,731

14,000 2.9%

Jan-14 1,557 3,855 5,411 308 467 775 1,865 4,322 6,187 2.7% 2.6% 2.6% 3.0%

2.5%

Feb-14 1,126 11,435 12,561 126 2,066 2,193 1,252 13,502 14,754 12,000

2.0% 2.5%

Mar-14 0 0 0 0 0 0 0 0 0 10,000

2.0%

Apr-14 1,462 7,547 9,009 324 2,986 3,310 1,786 10,534 12,320 8,000

1.1%1.3% 1.5%

10-yr Debt Service Schedule

2011 11,620 50,966 62,586 1,894 7,158 9,052 13,514 58,124 71,638 6,000 0.8%

2012 18,575 78,968 97,543 3,170 13,061 16,231 21,746 92,028 113,774 4,000 1.0%

2013 14,527 73,257 87,784 2,614 13,570 16,184 17,141 86,828 103,968 2,000 0.1% 0.5%

2014 8,378 56,046 64,424 1,373 8,680 10,053 9,751 64,726 74,477

0 0.0%

(Annual)

2015 4,268 20,353 24,621 768 5,194 5,961 5,035 25,546 30,582

May/11

Jun/11Jul/11Aug/11

Sep/11

Oct/11

Nov/11

Dec/11

Jan/12

Feb/12

Mar/12

Apr/12

2016 3,410 8,850 12,260 528 1,213 1,741 3,938 10,063 14,001

Date

2017 2,600 20,486 23,086 387 5,157 5,544 2,986 25,643 28,630 Pubilc Institutions Markets

2018 1,376 0 1,376 82 0 82 1,459 0 1,459

2019 1,376 0 1,376 82 0 82 1,459 0 1,459 Notes:

2020 779 15,565 16,344 63 969 1,032 842 16,534 17,376 - Coupon and Principal payments of FRNs and CPI linked notes are calculated assuming that

2021 91 6,067 6,158 22 1,443 1,464 113 7,509 7,622 they will reprice at current market levels.

- Beware that these are Is Investment projections and the actual debt service might deviate from

Total 67,002 330,558 397,559 10,981 56,444 67,425 77,983 387,002 464,985 these figures

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 11 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

IS Investment Trade Recommendations Tracker

As of 18 May 2011

Trade Securitie Entry Entry Current Target P/L

Strategy Trade Summary s Traded Entry Date Level Price Level Current Price Level P/L (bp) (TRY)

Outstanding Trades

Domestic Debt

Buy the 10-yr nominal for the carry, given the better credit story of Turkey (recommended since

Duration Buy 15/01/20 15/01/20 8.49% 116.194 9.46% 110.610 8.25% -97 bp -0.335

20/10/10)

Duration Sell the benchmark as it offers a good selling level at current yields Sell `20/02/13 20/02/2012 9.05% 86.386 8.87% 88.211 8.50% 18 bp 1.825

External Debt

Buy the 7.5% 14-July-17 USD eurobond as the the liquidity of the issue has improved while it still offers

Buy 14/07/17 28/07/09 6.70% 105.842 5.45% #N/A 3.00% 125 bp

Duration attractive yields vs surrounding issues

Entry Net Exit Exit Exit Target P/L

Strategy Trade Entry Date Level Cash Date Level Price Level P/L (bp) (TRY)

Trade History

Domestic Debt

Sell 23/06/10 - Buy 03/11/10 Cash Neutral Switch: Switch to a more liquid issue with an 11 bp pickup. Buy 100% 03/11/10 15.25% 77.845 15.20% 78.732 6 bp

Duration Buy the benchmark as the CBRT is likely to stay on hold for a prolonging period. Buy 11/05/11 30/07/09 10.81% 83.297 20/08/09 9.57% 85.446 9.75% 124 bp 2.149

Duration Buy the benchmark as the CBRT is likely to stay on hold for a prolonging period. Buy 28/08/13 30/07/09 12.24% 119.505 21/08/09 11.28% 123.471 11.50% 96 bp 3.966

Relative Value Sell 23-Jun-10 - Buy 05-May-10 Cash Neutral Switch: Earn the same yield with 0.25 lower duration. 24/08/09 -2 bp 0.00 25/08/09 -9 bp -0.063 -5 bp 7 bp 0.063

Buy 100% 05/05/10 8.79% 94.304 8.92% 94.251 -12 bp

Sell 100% 23/06/10 8.81% 93.228 9.01% 93.113 19 bp

Buy 11/05/11 02/09/09 9.96% 85.191 07/09/09 9.41% 86.031 9.25% 56 bp 0.840

Duration Buy the 11-May-11 benchmark note in anticipation of further rate cuts by the CBRT

Buy 03/07/12 02/09/09 11.05% 118.985 07/09/09 10.21% 121.018 10.25% 84 bp 2.033

Duration Buy the 7-Mar-12 fixed coupon note in anticipation of further rate cuts by the CBRT

Buy the 9mo to 1yr section of the curve as the carry and roll is attractive providing a buffer for rising Buy 05/05/10 21/05/09 11.78% 89.926 18/09/09 8.12% 95.221 9.00% 366 bp 5.295

Duration rates.

Duration Buy the benchmark note in anticipation of further rate cuts Buy 11/05/11 18/09/09 9.13% 86.616 06/10/09 7.69% 88.863 8.75% 145 bp 2.247

Duration Buy the 5-year note in anticiation of further rate cuts and a tame inflation Buy 06/08/14 18/09/09 11.07% 101.962 10/11/09 9.97% 107.487 9.00% 110 bp 5.525

Duration Buy the 16mo to 22mo tenor of the curve in anticipation of further rate cuts Buy 11/05/11 15/10/09 7.91% 88.731 10/11/09 8.59% 88.384 7.50% -67 bp -0.347

Relative Value Buy inflation protection through CPI linkers Buy 15/02/12 22/12/08 14.40% 110.376 12/03/10 1.56% 149.337-50 bp IRP1284 bp 38.961

Switch from the 2012 CPI linked notes to the 2013s, as the 2012s richened carrying an IRP of 22bps Buy 14/08/13 12/03/10 2.60% 146.172 31/03/10 2.53% 148.398-50 bp IRP 7 bp 2.226

Relative Value

Relative Value Switch from the 2012 and 2013 CPI linked notes to the 2015s Buy 11/02/15 31/03/10 3.41% 107.650 19/10/10 1.38% 117.925 0 bp IRP 203 bp 10.275

Duration Buy the 12mo to 16mo tenor of the curve as the steepness of the curve provides attractive roll Buy 03/11/10 10/11/09 7.94% 92.783 19/10/10 7.40% 99.707 7.50% 54 bp 6.924

External Debt

Relative Value Swith the USD 2030 into USD 2025, in a cash neutral switch. The swicth eneables investors to reduce 25/03/09 32 bp 0.00 28/05/09 32 bp 0.47 0 bp -0.466

duration exposure while picking up 9 bps in yield. Buy 100% 05/02/25 8.65% 91.524 7.71% 100.565 94 bp

Sell 100% 15/01/30 8.44% 137.809 7.50% 151.887 -94 bp

Buy the 15-Jan-14 USD eurbond as the issue offers attractive roll and carry and should perform

Duration Buy 15/01/14 08/06/09 6.30% 116.774 11/06/09 6.24% 117.103 7 bp 0.329

relativly better in a bear market.

Buy the 15-Mar-15 USD eurbond as the issue offers attractive roll and carry and should perform

Duration Buy 15/03/15 29/05/09 6.67% 104.740 15/06/09 6.51% 105.813 16 bp 1.072

relativly better in a bear market.

Relative Value Swith the USD 2030 into USD 2025, in a cash neutral switch. 29/06/09 33 bp 0.00 13/07/09 29 bp -0.35 4 bp 0.350

Buy 100% 05/02/25 7.37% 104.200 7.34% 104.737 3 bp

Sell 100% 15/01/30 7.15% 157.660 7.15% 158.122 0 bp

Duration Buy the 7.5% 7-Nov-19 USD eurobond in anticipation of a flattening in the 5s/10s curve Buy 07/11/09 15/06/09 7.21% 103.792 02/10/09 6.15% 113.125 6.25% 106 bp 9.333

* Trades are unwind at the levels of the 1st trades executed after 11 am local time during the day.

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 12 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

Domestic Debt Outstanding (million TRY)

As of 18 May 2011

TL Denominated FX Denominated Domestic Debt 40683

T- Bills Zero Coupon Fixed Coupon Floating Rate CPI-linked Total Zero Coupon Fixed Coupon Floating Rate Total TOTAL

May-11 0 12,208 0 0 0 12,208 0 889 0 889 13,097 Type Breakdown

Jun-11 0 5,100 0 0 0 5,100 0 0 0 0 5,100

Jul-11 4,292 0 0 0 0 4,292 0 789 0 789 5,080

CPI- T- Bills

Aug-11 0 11,175 0 0 0 11,175 0 0 0 0 11,175 1% Zero

linked

Sep-11 754 0 0 7,926 0 8,681 0 0 0 0 8,681 16% Coupon

Oct-11 0 3,256 0 0 0 3,256 0 0 0 0 3,256 33%

Nov-11 0 10,904 0 0 0 10,904 0 789 0 789 11,693

Jan-12 0 11,715 0 0 0 11,715 0 3,034 0 3,034 14,750

Feb-12 0 0 0 421 10,243 10,663 0 0 77 77 10,741 Floating

Rate

Mar-12 0 2,374 9,565 0 0 11,939 0 0 0 0 11,939 Fixed

26%

Apr-12 0 14,781 0 0 0 14,781 0 0 0 0 14,781 Coupon

24%

Aug-12 0 13,412 0 0 0 13,412 0 0 0 0 13,412

Sep-12 0 0 5,646 0 0 5,646 0 0 0 0 5,646

Nov-12 0 18,298 0 0 0 18,298 0 0 0 0 18,298

Jan-13 0 0 14,197 0 0 14,197 0 0 0 0 14,197

Feb-13 0 5,646 0 0 0 5,646 0 0 0 0 5,646

Currency Breakdown

Apr-13 0 0 7,903 5,827 0 13,730 0 0 0 0 13,730

Jun-13 0 0 0 13,377 0 13,377 0 0 0 0 13,377

Aug-13 0 0 3,071 0 8,560 11,631 0 0 0 0 11,631 USD EUR

1% 0%

Oct-13 0 0 12,178 0 0 12,178 0 0 0 0 12,178

Nov-13 0 0 0 13,164 0 13,164 0 0 0 0 13,164

Feb-14 0 0 0 13,502 0 13,502 0 0 0 0 13,502

May-14 0 0 0 0 9,843 9,843 0 0 0 0 9,843

Jul-14 0 0 0 11,302 0 11,302 0 0 0 0 11,302

Aug-14 0 0 7,492 0 0 7,492 0 0 0 0 7,492 TRY

Oct-14 0 0 0 0 7,131 7,131 0 0 0 0 7,131 99%

Feb-15 0 0 0 0 9,191 9,191 0 0 0 0 9,191

Apr-15 0 0 0 0 7,162 7,162 0 0 0 0 7,162

Jun-15 0 0 8,514 0 0 8,514 0 0 0 0 8,514

Jan-16 0 0 3,134 0 0 3,134 0 0 0 0 3,134

Sep-16 0 0 0 6,929 0 6,929 0 0 0 0 6,929

Term Breakdown

Total 5,046 108,869 76,022 85,287 52,129 327,353 0 5,501 77 5,578 332,931

5yr+ 0-3mo 3-6mo

% of Debt Outstanding 1.5% 32.7% 22.8% 25.6% 15.7% 98.3% 0.0% 1.7% 0.0% 1.7% 6% 6-9mo

9% 7% 7%

Avg Months to Maturity 1.4 9.5 65.8 0 5.6 8.5 5.6

Amount of Debt Outstanding Along the Curve 9-12mo

2-5yr 8%

Amount (million TRY) CPI-linked Floating Rate Fixed Coupon Zero Coupon T- Bills 42%

20,000 12-18mo

18-24mo

18,000 10%11%

16,000

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

May-11 Nov-11 May-12 Nov-12 May-13 Nov-13 May-14 Nov-14 May-15 Nov-15 May-16

Maturity

** Excludes non-cash instruments

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 13 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

Treasury Debt Stock Holder Breakdown

As of 18 May 2011

TRY Denominated Domestic Debt Market Breakdown (%) Eurobond Market Breakdown (%) #

Current (mil TRY) 0.8 nominal Non-

1wk 60%

As of 29/04/11 Net Chg YoY Chg As of 29/04/11

mil USD 1wk Chg YoY Chg Resident,

0.7

Banks, 0.5273901

0.652620374 55%

Non Resident 66,252 -0.5% 54.4% Non Resident

20,507 0.68% 26.8% 88

0.6

Banks 277,203 0.0% 0.0% Banks 23,655 0.00% 2.2% 50%

0.5

Corporates 56,296 0% 5.8% Corporates 883 0.34% 15.0%

0.4 45%

Households 23,637 0.4% -8.1% Households2,018 0.35% 6.8% Resident,

Non-Bank Financials 7,320 -0.1% 24.4% Non-Bank Financials

159 0.63% 38.3% 0.4726098

0.3 Corp, 40% 12

Total 430,708 0.0% 6.4% 0.155864793 Insurance Companies

354 0.28% -8.1%

0.2 Househld, 35%

0.101070984 Total 47,576 0.35% 13.1%

0.1 Non-Res, 30%

0.071324537

0 Oth-Fin, Dec- Jul- Feb- Oct- May- Jan- Aug- Mar-

0.015772002 10 10 10 09 09 09 08 08

Apr-11 Oct-10 Apr-10 Oct-09 Apr-09

Source: BRSA

Non-Residents

Time to Maturity of Domestic Debt Stock Held by Non-Residents (Nominal) Maturity Breakdown of GDDI's held by Non-Residents (Market Value)

Bn USD

million USD As of December 3rd, 2010 May 2010 Jan-00 20

< 3 months 6,742 2,771 143.3% 18

16

4 - 6 months 1,705 2,300 -25.9% 14

7 - 9 months 4,150 6,111 -32.1% 12

10

10 - 12 months 3,435 1,303 163.6% 8

13 - 18 months 14,696 6,398 129.7% 6

4

19 - 24 months 1,321 10,236 -87.1% 2

> 2 years 15,268 11,461 33.2% 0

Total 47,316 40,581 16.6% 2010 2011 2012 2013 2014 2015 2016 2017 2020

Households Manufact., Trade, Serv. Other Financials Banks

Source: Central Bank of Turkey - International Investment Position

Banks

Maturity Breakdown of Domestic Debt Stock under custody Portfolio Breakdown of Domestic Debt Stock held

TRY Bn

140

million TRY 26/11/10 15/11/10 Dec-09 1wk Chg YoY Chg

120

<1 month 1,786 1,755 0 1.8% 0.0% 100 AFS, 95.6 bn

1 - 3 months 6,568 6,112 9,524 7.5% -31.0% 80

3 - 6 months 6,568 6,112 9,524 7.5% -31.0% 60 HTM, 67.2 bn

6 - 12 months 9,260 4,673 18,423 98.2% -49.7% 40

1 - 2 years 23,934 27,982 19,796 -14.5% 20.9% 20

> 2 years 38,554 38,152 28,804 1.1% 33.8% 0 Trading, 3.9 bn

Nov-10

Oct-10

Oct-10

Sep-10

Aug-10

Jul-10

Jun-10

May-10

Apr-10

Apr-10

Mar-10

Feb-10

Jan-10

Dec-09

Source: BRSA

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 14 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

Calendar

As of 18 May 2011

Monday Tuesday Wednesday Thursday Friday

19-May 20-May

Central Government Debt Stock Apr

CBRT weekly repo auction

redemption TL 2bn

23-May 24-May 25-May 26-May 27-May

14:30 - Industrial Confidence MAY 11:00 - Foreign Tourist Arrivals YoY

APR

14:30 - Capacity Utilization MAY 14:00 - Benchmark Repo Rate

Auction: 7-yr (24/01/18) Floating Rate Settlement: 7-yr (24/01/18) Floating

Note (sa) (r-o) (IYM exp: TL 1bn) Rate Note (sa) (r-o)

30-May 31-May 1-Jun 2-Jun 3-Jun

Financial Stability Report (s/a) 10:00 - Trade Balance APR 10:00 - Turkey May Manufacturing PMI 10:00 - Consumer Prices (MoM)

MAY

Domestic Borrowing Strategy (Jun-Aug) 10:00 - Consumer Prices (YoY) MAY

10:00 - Producer Prices (MoM) MAY

10:00 - Producer Prices (YoY) MAY

6-Jun 7-Jun 8-Jun 9-Jun 10-Jun

10:00 - Industrial Production NSA YoY

APR

10:00 - Industrial Production WDA SA

(MoM) APR

10:00 - Industrial Production WDA

13-Jun 14-Jun 15-Jun 16-Jun 17-Jun

10:00 - Unemployment Rate MAR 10:00 - Consumer Confidence MAY

Ugur N. Kucuk, PhD Ugursel Onder Recai Gunesdogdu, PhD

ukucuk@isyatirim.com.tr, +902123502514 uonder@isyatirim.com.tr, +902123502536 15 of 15 rgunesdogdu@isyatirim.com.tr, +902123502310

You might also like

- Sheela Foam LTD - Initiaiting Coverage - 18092018 - 19!09!2018 - 08Document32 pagesSheela Foam LTD - Initiaiting Coverage - 18092018 - 19!09!2018 - 08Mansi Raut PatilNo ratings yet

- Crisis TimelineDocument8 pagesCrisis TimelineSoberLookNo ratings yet

- Lecture SlidesDocument51 pagesLecture SlidesAshish MalhotraNo ratings yet

- Tins 060831Document2 pagesTins 060831Cristiano DonzaghiNo ratings yet

- Empirical Asset Pricing: Classes 17-20: Debt Markets and BanksDocument23 pagesEmpirical Asset Pricing: Classes 17-20: Debt Markets and BanksJoe23232232No ratings yet

- 2023 SEP Fund Fact Sheet v1Document35 pages2023 SEP Fund Fact Sheet v1Zarah MercadoNo ratings yet

- Equity Fact Sheet SEP2015Document1 pageEquity Fact Sheet SEP2015Ron CatalanNo ratings yet

- Average Score: Lpi Capital (Lpi-Ku)Document11 pagesAverage Score: Lpi Capital (Lpi-Ku)Zhi_Ming_Cheah_8136No ratings yet

- FAF Ratio SheetDocument1 pageFAF Ratio Sheetdanielleobeck1No ratings yet

- Faysal Active Principal Preservation Plan: OctoberDocument17 pagesFaysal Active Principal Preservation Plan: OctoberKhanMuhammadNo ratings yet

- What Does The Fund Invest In?: Sun Life Grepa Growth PLUS FundDocument1 pageWhat Does The Fund Invest In?: Sun Life Grepa Growth PLUS FundBee ThreeallNo ratings yet

- Have FunDocument2 pagesHave FunAbhishek BidhanNo ratings yet

- Newfield Expl Co: Bond DetailDocument2 pagesNewfield Expl Co: Bond DetailAlecChengNo ratings yet

- TALF PPIP v2Document5 pagesTALF PPIP v2ZerohedgeNo ratings yet

- TALF PPIP v2Document4 pagesTALF PPIP v2Zerohedge100% (1)

- RHB Equity 360° - 14 September 2010 (MREITS Technical: IJM)Document2 pagesRHB Equity 360° - 14 September 2010 (MREITS Technical: IJM)Rhb InvestNo ratings yet

- UBL Fund Manager's Report - February 2024Document49 pagesUBL Fund Manager's Report - February 2024aniqa.asgharNo ratings yet

- Bond Overview - Fidelity InvestmentsDocument1 pageBond Overview - Fidelity InvestmentsDr LipseyNo ratings yet

- Kinesic State of Tech Report (July 2022)Document47 pagesKinesic State of Tech Report (July 2022)Maxim MounierNo ratings yet

- Economic Review Jul-Mar 2019Document7 pagesEconomic Review Jul-Mar 2019FaisalNo ratings yet

- NAFA Stock Fund: Investment GuideDocument16 pagesNAFA Stock Fund: Investment GuidePunjabi LarkaNo ratings yet

- Coupon RateDocument3 pagesCoupon RateLokesh NayalNo ratings yet

- Automotive Axles LTDDocument25 pagesAutomotive Axles LTDLK CoolgirlNo ratings yet

- Address To Joint Oireachtas Committee On Finance and The PublicDocument8 pagesAddress To Joint Oireachtas Committee On Finance and The PublicgrumpyfeckerNo ratings yet

- CFA ScheduleDocument3 pagesCFA SchedulevenilshahNo ratings yet

- Collateral Consistent Derivatives Pricing 2 PDFDocument27 pagesCollateral Consistent Derivatives Pricing 2 PDFshih_kaichihNo ratings yet

- Eisure Ntertainment: Industry ReportDocument8 pagesEisure Ntertainment: Industry ReportlvslvslvsNo ratings yet

- A Project Is Not A Black Box: Eighth EditionDocument28 pagesA Project Is Not A Black Box: Eighth EditionFelix Owusu DarteyNo ratings yet

- ALL - Initiation of Coverage - 29abr09 BanifDocument8 pagesALL - Initiation of Coverage - 29abr09 Banifbenjah2No ratings yet

- Andhra Bank: Operating Performance Inline Slippages RiseDocument5 pagesAndhra Bank: Operating Performance Inline Slippages RiseearnrockzNo ratings yet

- Lbs June 2019Document99 pagesLbs June 2019musu35No ratings yet

- To The: BanokoDocument10 pagesTo The: BanokoGilbertGalopeNo ratings yet

- The Security Market Line (SML) Is A Line Drawn On A Chart That Serves As A The SML Can Help To Determine Whether An Investment Product Would Offer ADocument2 pagesThe Security Market Line (SML) Is A Line Drawn On A Chart That Serves As A The SML Can Help To Determine Whether An Investment Product Would Offer AVineetha Chowdary GudeNo ratings yet

- Tata Balanced Advantage Fund - NFO PresentationDocument23 pagesTata Balanced Advantage Fund - NFO Presentationabhishek sharmaNo ratings yet

- AlphaIndicator SCHB 20230212Document11 pagesAlphaIndicator SCHB 20230212Zhi_Ming_Cheah_8136No ratings yet

- Average Score: G Capital (Gcap-Ku)Document11 pagesAverage Score: G Capital (Gcap-Ku)Zhi_Ming_Cheah_8136No ratings yet

- High Noon: December 17, 2018Document4 pagesHigh Noon: December 17, 2018sbvaNo ratings yet

- RHB Report My - Luxchem - Mids Results Review - 20200615 - RHB 119388617818399315ee6afbd9bc7dDocument6 pagesRHB Report My - Luxchem - Mids Results Review - 20200615 - RHB 119388617818399315ee6afbd9bc7dseliper biruNo ratings yet

- RHB Equity 360° - 20 October 2010 (Property, Motor, Quill Capita Technical: Kump. Hartanah Selangor)Document3 pagesRHB Equity 360° - 20 October 2010 (Property, Motor, Quill Capita Technical: Kump. Hartanah Selangor)Rhb InvestNo ratings yet

- JPMorgan Tactical 75-25 ETF Model Vs 75% MSCI ACWI - 23% US Agg - 2% CashDocument39 pagesJPMorgan Tactical 75-25 ETF Model Vs 75% MSCI ACWI - 23% US Agg - 2% CashofficeNo ratings yet

- OHI - RatingsDocument4 pagesOHI - RatingsJeff SturgeonNo ratings yet

- Public Aggressive Growth Fund (PAGF) - April 2011 Fund ReviewDocument1 pagePublic Aggressive Growth Fund (PAGF) - April 2011 Fund ReviewMun YiNo ratings yet

- Economics - Curriculum and Assessment Plan 2023 To 24Document5 pagesEconomics - Curriculum and Assessment Plan 2023 To 24isabel.roca1984No ratings yet

- Malaysian Banks: Malaysia Industry FocusDocument9 pagesMalaysian Banks: Malaysia Industry FocuscarldaveNo ratings yet

- PMS Guide August 2019Document88 pagesPMS Guide August 2019HetanshNo ratings yet

- Springleaf Fin Corp: Bond DetailDocument2 pagesSpringleaf Fin Corp: Bond DetailAlecChengNo ratings yet

- (Electrical) M & E Major Equipment Delivery ScheduleDocument1 page(Electrical) M & E Major Equipment Delivery SchedulePaul KwongNo ratings yet

- (Epelbaum) Vol Risk PremiumDocument25 pages(Epelbaum) Vol Risk PremiumrlindseyNo ratings yet

- Axis Detailed Report - May 2020 PDFDocument118 pagesAxis Detailed Report - May 2020 PDFRohan AdlakhaNo ratings yet

- Average Score: Fima Corp (Fimacor-Ku)Document11 pagesAverage Score: Fima Corp (Fimacor-Ku)Zhi_Ming_Cheah_8136No ratings yet

- MF Service Ratecard UpdatedDocument1 pageMF Service Ratecard UpdatedfinoraclesNo ratings yet

- Https Secure - Icicidirect.com IDirectTrading Trading Equity IClick2GainDocument1 pageHttps Secure - Icicidirect.com IDirectTrading Trading Equity IClick2GainVijay KurkureNo ratings yet

- Quality Concrete Holdings Berhad: Returns To The Black in 1HFY01/11 - 30/09/2010Document3 pagesQuality Concrete Holdings Berhad: Returns To The Black in 1HFY01/11 - 30/09/2010Rhb InvestNo ratings yet

- MOPSStrip UpdatedDocument30 pagesMOPSStrip UpdatednarutorazNo ratings yet

- 22 May 19 PDFDocument6 pages22 May 19 PDFAnshuman GuptaNo ratings yet

- As Cabanatuan RFO BungalowDocument1 pageAs Cabanatuan RFO BungalowMao WatanabeNo ratings yet

- Average Score: Velesto Energy (Velesto-Ku)Document11 pagesAverage Score: Velesto Energy (Velesto-Ku)Afiq de WinnerNo ratings yet

- Mutual Fund Report Jun-19Document45 pagesMutual Fund Report Jun-19muddasir1980No ratings yet

- Chapter 2: The Present ValueDocument4 pagesChapter 2: The Present ValueVân ĂnggNo ratings yet

- FIM Question Practice 2Document15 pagesFIM Question Practice 2Bao Khanh HaNo ratings yet

- Chapter 3Document12 pagesChapter 3HuyNguyễnQuangHuỳnhNo ratings yet

- Presentation1.Ppt Ass - PPT 222Document8 pagesPresentation1.Ppt Ass - PPT 222kegnataNo ratings yet

- Spanish Banks Report - Still Waiting For Godot PDFDocument57 pagesSpanish Banks Report - Still Waiting For Godot PDFamedina7800No ratings yet

- My ProjectDocument72 pagesMy ProjectPrashob Koodathil0% (1)

- Finance L6Document39 pagesFinance L6Rida Rehman100% (1)

- Risk Management in Banking Sector Main01Document42 pagesRisk Management in Banking Sector Main01Azim Samnani0% (1)

- Studying Different Systematic Value Investing Strategies On The Eurozone MarketDocument38 pagesStudying Different Systematic Value Investing Strategies On The Eurozone Marketcaque40No ratings yet

- Valuation Calculations 101 Worked ExamplesDocument3 pagesValuation Calculations 101 Worked ExamplesPoovarasu ArulmozhiMurugesanNo ratings yet

- 15 Numerical RAROCDocument1 page15 Numerical RAROCVenkatsubramanian R IyerNo ratings yet

- Principles of Corporate Finance 10 Ed PDFDocument57 pagesPrinciples of Corporate Finance 10 Ed PDFOlivia BaluNo ratings yet

- BUS20269 Financial Management Final ExamDocument7 pagesBUS20269 Financial Management Final Examshiyingyang98No ratings yet

- Ubs Strategy Guide 7.17Document13 pagesUbs Strategy Guide 7.17shayanjalali44No ratings yet

- FNCE623 Solution To Final Exam 2021 WinterDocument4 pagesFNCE623 Solution To Final Exam 2021 Winteralka murarkaNo ratings yet

- Lighthouse Precious Metals Report - 2014 - AugustDocument40 pagesLighthouse Precious Metals Report - 2014 - AugustAlexander GloyNo ratings yet

- 46 Interpretation of AccountsDocument32 pages46 Interpretation of Accountstuga100% (1)

- Matalan Write UpDocument5 pagesMatalan Write Upccohen6410No ratings yet

- 1915314-Security Analysis and Portfolio ManagementDocument14 pages1915314-Security Analysis and Portfolio ManagementArun ArunNo ratings yet

- Basis Trading BasicsDocument51 pagesBasis Trading BasicsTajinder SinghNo ratings yet

- Banking Law& PracticeDocument682 pagesBanking Law& Practicemavado vidukaNo ratings yet

- ValuationDocument20 pagesValuationNirmal ShresthaNo ratings yet

- Bearer BondsDocument16 pagesBearer Bondssushantgk9No ratings yet

- Financial Numerical Recipes in C++Document152 pagesFinancial Numerical Recipes in C++Francisco Javier Villaseca AhumadaNo ratings yet

- Financial Management: Unit 3Document47 pagesFinancial Management: Unit 3muralikarthik31No ratings yet

- Accounting Ratios - NotesDocument7 pagesAccounting Ratios - NotesgiloralaboraNo ratings yet

- Test Bank Chapter12Document24 pagesTest Bank Chapter12Jessa Mae Muñoz100% (2)

- Icici Prudential Asset Management Company LTD.: Revision and Practice Test Kit Version 3Document21 pagesIcici Prudential Asset Management Company LTD.: Revision and Practice Test Kit Version 3Neeraj KumarNo ratings yet

- GIOA Conference March 23 2016: Core Bloomberg Analytics For Our Current Market EnvironmentDocument37 pagesGIOA Conference March 23 2016: Core Bloomberg Analytics For Our Current Market EnvironmentazertyNo ratings yet

- Stock Valuation NotesDocument11 pagesStock Valuation NotesMurnizahayati AripinNo ratings yet