Professional Documents

Culture Documents

Max Assignment

Uploaded by

max_dcostaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Max Assignment

Uploaded by

max_dcostaCopyright:

Available Formats

FINANCE & COSTING ASSIGNMENT

Name: Max William D’Costa Course: PGDHR 09-

Roll No.: 4 11

Trimester 1

Topic: Risk Evaluation

Problem

Details of two Projects are given below:

Project A Project B

Cash Flow Probability Cash Flow Probability

1000 0.2 1200 0.2

800 0.6 800 0.6

600 0.2 400 0.2

Which project is more risky?

Solution

A) Let us calculate the ‘Expected Cash Flow’ for Project A

Expected Cash Flow for Project A = (1000 x 0.2) + (800 x 0.6) + (600 x 0.2)

= 800

B) Let us calculate the ‘Expected Cash Flow’ for Project A

Expected Cash Flow for Project B = (1200 x 0.2) + (800 x 0.6) + (400 x 0.2)

= 800

Here we can see that 800 is the mean.

C) Let us calculate the ‘Standard Deviation’ from the Mean for Project A

Max D’Costa Page 1

Following are the steps for the calculation of Standard Deviation from the mean for

Project A.

Step 1: Calculate the Mean

The mean has already been calculated above which is 800

Step 2: Calculation of Deviation from Mean

1000 – 800 = 200

800 – 800 =0

600 – 800 = -200

Step 3: Square each Deviation & Multiply by the corresponding Probabilities

(200)2 x 0.2 = 8000

(0)2 x 0.6 =0

(-200)2 x 0.2 = 8000

Step 4: Summation to find the Total Deviation (i.e.) Variance

= (8000 + 0 + 8000)

= 16000

Step 5: Square Root of the Total Deviation (i.e. Variance) to get the Standard

Deviation

σ = ∫16000

σ = 126.79

D) Let us calculate the ‘Standard Deviation’ from the Mean for Project B

Following are the steps for the calculation of Standard Deviation from the mean for

Project B.

Step 1: Calculate the Mean

The mean has already been calculated above which is 800

Step 2: Calculation of Deviation from Mean

1200 – 800 = 400

800 – 800 =0

400 – 800 = -400

Step 3: Square each Deviation & Multiply by the corresponding Probabilities

Max D’Costa Page 2

(400)2 x 0.2 = 32000

(0)2 x 0.6 =0

(-400)2 x 0.2 = 32000

Step 4: Summation to find the Total Deviation (i.e.) Variance

= (32000 + 0 + 32000)

= 64000

Step 5: Square Root of the Total Deviation (i.e. Variance) to get the Standard

Deviation

σ = ∫64000

σ = 252.98

Since the deviation (skewness) of Project B is more than that of Project A

∴ Project B is more Risky, and hence it may rejected.

E) Also, which Project should I go for?

Project A Project B

Variation of Project A is 126.49 Variation of Project B is 252.98

∴ Co-efficient of Variation = Standard ∴ Co-efficient of Variation = Standard

Deviation (σ) Deviation (σ)

Mean Mean

= 126.49 ÷ 800 = 252.98 ÷ 800

= 0.158 = 0.316

Since the Co-efficient of Variation of Project A is lower.

∴ We will go in for Project A. Investment is recommended in Project A.

Max D’Costa Page 3

You might also like

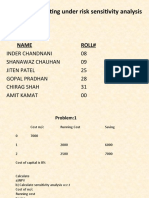

- Capital Budgeting Under Risk Sensitivity Analysis: Presented By: Name Roll#Document10 pagesCapital Budgeting Under Risk Sensitivity Analysis: Presented By: Name Roll#shanawazchauhanNo ratings yet

- Advanced Finanacial Management NotesDocument42 pagesAdvanced Finanacial Management NotesNyaramba DavidNo ratings yet

- Solutions For Capital Budgeting QuestionsDocument7 pagesSolutions For Capital Budgeting QuestionscaroNo ratings yet

- Risk and Uncertainity in Capital BudgetingDocument3 pagesRisk and Uncertainity in Capital Budgeting9909922996No ratings yet

- Risk Analysis in Capital Budgeting PDFDocument33 pagesRisk Analysis in Capital Budgeting PDFkeshav RanaNo ratings yet

- Assignment SolutionsDocument9 pagesAssignment SolutionsFranck IRADUKUNDANo ratings yet

- L 15 Degenerate 25-4Document4 pagesL 15 Degenerate 25-4Ranjith KumarNo ratings yet

- Risk in Capital Budgeting: Sensitivity Technique and Standard DeviationsDocument13 pagesRisk in Capital Budgeting: Sensitivity Technique and Standard DeviationsSridhar KodaliNo ratings yet

- Transportation, Assignment, and Transshipment ModelsDocument32 pagesTransportation, Assignment, and Transshipment ModelsCamila Martins SaporettiNo ratings yet

- Formatted Bank Financial Management BFM 5Document10 pagesFormatted Bank Financial Management BFM 5kalai selvanNo ratings yet

- Engineering Economics Take Home Quiz QuiDocument5 pagesEngineering Economics Take Home Quiz QuiMUHAMMAD WAJID SHAHZADNo ratings yet

- Modified Internal Rate of Return (MIRR)Document8 pagesModified Internal Rate of Return (MIRR)JaJ08No ratings yet

- MALec Batch 3Document91 pagesMALec Batch 3duong duongNo ratings yet

- CH0620100916181206Document4 pagesCH0620100916181206Shubharth BharadwajNo ratings yet

- Corrected HW4Document4 pagesCorrected HW4lkdhsbNo ratings yet

- Average Number of Customers Per Hour: A) Optimist CriterionDocument6 pagesAverage Number of Customers Per Hour: A) Optimist Criterionsemetegna she zemen 8ተኛው ሺ zemen ዘመንNo ratings yet

- 0 1 N 2 N 3 N 4 N 2 3 4Document1 page0 1 N 2 N 3 N 4 N 2 3 4MaQsud AhMad SaNdhuNo ratings yet

- Weighted Average Cost of Capital (WACC) : C e D DTDocument6 pagesWeighted Average Cost of Capital (WACC) : C e D DTAditya RathiNo ratings yet

- A2P2Document3 pagesA2P2Michelle LiuNo ratings yet

- Bbmf2093 Revision Question Discussion Week 14 Prepared By: Frederick Chong Chen TshungDocument13 pagesBbmf2093 Revision Question Discussion Week 14 Prepared By: Frederick Chong Chen TshungWONG ZI QINGNo ratings yet

- FEE ISM Ch08 3e OKDocument15 pagesFEE ISM Ch08 3e OKonlydlonlyNo ratings yet

- Tugas 10 - C13 - CASH FLOW ESTIMATION AND RISK ANALYSISDocument11 pagesTugas 10 - C13 - CASH FLOW ESTIMATION AND RISK ANALYSISIqbal BaihaqiNo ratings yet

- Decision TheoryDocument8 pagesDecision Theoryngimwa6131No ratings yet

- Chapter 19 Borrowing Costs ProblemsDocument4 pagesChapter 19 Borrowing Costs ProblemsMahasia MANDIGANNo ratings yet

- Corporate Finance B 11Document56 pagesCorporate Finance B 11iantseriweNo ratings yet

- Inferential StatisticsDocument8 pagesInferential StatisticsDhruv JainNo ratings yet

- Sol. Man. - Chapter 7 - Notes (Part 1)Document13 pagesSol. Man. - Chapter 7 - Notes (Part 1)natalie clyde matesNo ratings yet

- Basics of Capital Budgeting Homework Name: Namata, Mike A. IA21Document7 pagesBasics of Capital Budgeting Homework Name: Namata, Mike A. IA21Jasmin RabonNo ratings yet

- Risk Analysis (Divya Jadi Booti)Document48 pagesRisk Analysis (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Sol. Man. - Chapter 12 - Partnership OperationsDocument10 pagesSol. Man. - Chapter 12 - Partnership OperationsMikhaela Torres0% (1)

- Sol. Man. - Chapter 12 - Partnership OperationsDocument11 pagesSol. Man. - Chapter 12 - Partnership OperationspehikNo ratings yet

- Notes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsDocument13 pagesNotes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsPaula Bautista100% (2)

- Pure Mathematics IA: Ms. TimsonDocument11 pagesPure Mathematics IA: Ms. TimsonGhh FyjNo ratings yet

- Chapter 2 Construction Contract PricingDocument38 pagesChapter 2 Construction Contract Pricingsamrawit aysheshimNo ratings yet

- Engineering Economics LESSON 3a BackupDocument6 pagesEngineering Economics LESSON 3a BackupEdsel DiestaNo ratings yet

- Group Assignment QAFMDM Bedelle 2Document16 pagesGroup Assignment QAFMDM Bedelle 2Dejen TagelewNo ratings yet

- Introduction To Risk Analysis in Capital Budgeting: Practical ProblemsDocument14 pagesIntroduction To Risk Analysis in Capital Budgeting: Practical ProblemsDangerous GamerNo ratings yet

- Seminar Outline 19Document9 pagesSeminar Outline 19cccqNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)Document4 pagesNanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)asdsadsaNo ratings yet

- Cost Estimation and ForecastingDocument8 pagesCost Estimation and ForecastingRuth NyawiraNo ratings yet

- Pure Mathematics IA: Ms. TimsonDocument11 pagesPure Mathematics IA: Ms. TimsonGhh FyjNo ratings yet

- Assignmnt AccountingDocument14 pagesAssignmnt AccountingAqsa AnumNo ratings yet

- Fin322 Week2 2018Document12 pagesFin322 Week2 2018chi_nguyen_100No ratings yet

- 92 13 Chapter 10 Risk DecisionDocument11 pages92 13 Chapter 10 Risk DecisionHrvoje ErorNo ratings yet

- Rectangular column design by PROKONDocument6 pagesRectangular column design by PROKONmohamedabdelalNo ratings yet

- Tutorial 4 SolutionDocument3 pagesTutorial 4 Solutionsissy.he.7No ratings yet

- Draw A Flow Chart of Decision Theory With Imaginary FiguresDocument3 pagesDraw A Flow Chart of Decision Theory With Imaginary Figuresshreyas hattiNo ratings yet

- CapitalBudgeting - Solved ProblemsDocument7 pagesCapitalBudgeting - Solved ProblemsDharmesh GoyalNo ratings yet

- Quiz 3 PoolDocument9 pagesQuiz 3 PoolLara FloresNo ratings yet

- EEE - Assignment 2 Sanjeev 16001174 PDFDocument7 pagesEEE - Assignment 2 Sanjeev 16001174 PDFSanjeev Nehru100% (1)

- W 06Document25 pagesW 06kdk4916No ratings yet

- Final Exam - Decision TreeDocument2 pagesFinal Exam - Decision Treevinilima9No ratings yet

- 10 Quantitative Risk Assessment (Cost Benefit and Risk)Document40 pages10 Quantitative Risk Assessment (Cost Benefit and Risk)theresia windiNo ratings yet

- Operations Management. Assignment1Document3 pagesOperations Management. Assignment1Isaac GumboNo ratings yet

- Linear Programming: Sensitivity Analysis and Interpretation of SolutionDocument6 pagesLinear Programming: Sensitivity Analysis and Interpretation of SolutionCovidNo ratings yet

- 6-Risk and Managerial (Real) Options in Capital Budgeting-Chapter FourteenDocument17 pages6-Risk and Managerial (Real) Options in Capital Budgeting-Chapter FourteenSharique KhanNo ratings yet

- 2022 CE Preboard ProblemDocument9 pages2022 CE Preboard Problembrycg.1998No ratings yet

- 33/11Kv Wadi Bin Shami Primary: Input TablesDocument6 pages33/11Kv Wadi Bin Shami Primary: Input Tableshameed6101986No ratings yet

- Instructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYFrom EverandInstructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYNo ratings yet

- Govt allows 100% FDI in telecom, hikes insurance cap to 49Document2 pagesGovt allows 100% FDI in telecom, hikes insurance cap to 49max_dcostaNo ratings yet

- Urgent Important MatrixDocument1 pageUrgent Important Matrixjasonjbleavins7900No ratings yet

- Idc Newsletter May2012Document4 pagesIdc Newsletter May2012max_dcostaNo ratings yet

- Average Student Checks Phone 11 Times Per Day While in ClassDocument1 pageAverage Student Checks Phone 11 Times Per Day While in Classmax_dcostaNo ratings yet

- Is Your State Posting Good GDP GrowthDocument12 pagesIs Your State Posting Good GDP Growthmax_dcostaNo ratings yet

- How To Write A Thesis ABSTRACTDocument1 pageHow To Write A Thesis ABSTRACTNeelesh UmachandranNo ratings yet

- GE MatrixDocument6 pagesGE Matrixmax_dcosta0% (2)

- IGNOU MBA Prospectus 2014Document230 pagesIGNOU MBA Prospectus 2014manas routNo ratings yet

- Dave Ulrich Outlines Old Myths and New Realities of HRDocument2 pagesDave Ulrich Outlines Old Myths and New Realities of HRmax_dcostaNo ratings yet

- Why Yuan Cannot Replace Dollar For Intl CurrencyDocument15 pagesWhy Yuan Cannot Replace Dollar For Intl Currencymax_dcostaNo ratings yet

- Cyber CrimeDocument14 pagesCyber Crimemax_dcostaNo ratings yet

- Bluetooth AirdefenseDocument7 pagesBluetooth Airdefensemax_dcostaNo ratings yet

- 03 - Human Resource AccountingDocument57 pages03 - Human Resource Accountingmax_dcostaNo ratings yet

- Web Form Design Patterns SignUp Forms Part 2Document14 pagesWeb Form Design Patterns SignUp Forms Part 2max_dcostaNo ratings yet

- Bell CurveDocument3 pagesBell Curvemax_dcostaNo ratings yet

- Govt Approves National Policy On ITDocument5 pagesGovt Approves National Policy On ITmax_dcostaNo ratings yet

- About E-Business in BrazilDocument4 pagesAbout E-Business in Brazilmax_dcostaNo ratings yet

- India's Economic Engagement With AfricaDocument8 pagesIndia's Economic Engagement With AfricaKaran JhanwerNo ratings yet

- !KPCB Internet Meeker 12.2012Document88 pages!KPCB Internet Meeker 12.2012PricepointsNo ratings yet

- ICT in India 2011Document3 pagesICT in India 2011max_dcostaNo ratings yet

- Russias Economic Engagement With AfricaDocument7 pagesRussias Economic Engagement With Africamax_dcostaNo ratings yet

- 5 Top Trends in LATAM Mobile MKTDocument2 pages5 Top Trends in LATAM Mobile MKTmax_dcostaNo ratings yet

- HTTP - 15 Security ConsiderationsDocument5 pagesHTTP - 15 Security Considerationsmax_dcostaNo ratings yet

- How Draft NTP 2011 Affect Foreign Equipment VendorsDocument4 pagesHow Draft NTP 2011 Affect Foreign Equipment Vendorsmax_dcostaNo ratings yet

- Pattern LanguageDocument15 pagesPattern Languagemax_dcostaNo ratings yet

- Iranian Crude For GoldDocument3 pagesIranian Crude For Goldmax_dcostaNo ratings yet

- Wise Driving TipsDocument29 pagesWise Driving TipsSunderraj PrabakaranNo ratings yet

- Indias Most Investment Friendly StatesDocument6 pagesIndias Most Investment Friendly Statesmax_dcostaNo ratings yet

- 360 Degree Feedback FormDocument2 pages360 Degree Feedback Formmax_dcostaNo ratings yet

- 360 Degree Feedback FormDocument2 pages360 Degree Feedback Formmax_dcostaNo ratings yet

- 7-Seater MPV: Kia SingaporeDocument16 pages7-Seater MPV: Kia SingaporeadiNo ratings yet

- Wheatstone Bridge Circuit and Theory of OperationDocument7 pagesWheatstone Bridge Circuit and Theory of OperationAminullah SharifNo ratings yet

- Project Proposal ApprovedDocument2 pagesProject Proposal ApprovedRonnel BechaydaNo ratings yet

- Key plan and area statement comparison for multi-level car park (MLCPDocument1 pageKey plan and area statement comparison for multi-level car park (MLCP121715502003 BOLLEMPALLI BINDU SREE SATYANo ratings yet

- User Interface Analysis and Design TrendsDocument38 pagesUser Interface Analysis and Design TrendsArbaz AliNo ratings yet

- Semi Detailed Lesson Format BEEd 1Document2 pagesSemi Detailed Lesson Format BEEd 1Kristine BuenaventuraNo ratings yet

- Admission Form BA BSC Composite PDFDocument6 pagesAdmission Form BA BSC Composite PDFKhurram ShahzadNo ratings yet

- Daraz PKDocument4 pagesDaraz PKshavais100% (1)

- What Are The Main Purpose of Financial Planning AnDocument2 pagesWhat Are The Main Purpose of Financial Planning AnHenry L BanaagNo ratings yet

- MGN 363Document14 pagesMGN 363Nitin PatidarNo ratings yet

- I-Plan Marketing List On Installments 11-Aug-23Document10 pagesI-Plan Marketing List On Installments 11-Aug-23HuxaifaNo ratings yet

- Martek Navgard BnwasDocument4 pagesMartek Navgard BnwasСергей БородинNo ratings yet

- ENGLISH COACHING CORNER MATHEMATICS PRE-BOARD EXAMINATIONDocument2 pagesENGLISH COACHING CORNER MATHEMATICS PRE-BOARD EXAMINATIONVaseem QureshiNo ratings yet

- Automatic Transaxle System GuideDocument23 pagesAutomatic Transaxle System GuideChristian Linares AbreuNo ratings yet

- Particulars Unit BOQ NO. BOQ QTY: Bill of Quantity Bill of QuantityDocument8 pagesParticulars Unit BOQ NO. BOQ QTY: Bill of Quantity Bill of QuantityAbbasNo ratings yet

- Task and Link Analysis AssignmentDocument4 pagesTask and Link Analysis AssignmentAzeem NawazNo ratings yet

- FS 1 Observations of Teaching-Learning in Actual School EnvironmentDocument8 pagesFS 1 Observations of Teaching-Learning in Actual School EnvironmentJessie PeraltaNo ratings yet

- Environment Health: European Research OnDocument73 pagesEnvironment Health: European Research OnDaiuk.DakNo ratings yet

- MCQ InflationDocument6 pagesMCQ Inflationashsalvi100% (4)

- Geography Lesson PlanDocument4 pagesGeography Lesson Planapi-204977805100% (3)

- Installation Guide for lemonPOS POS SoftwareDocument4 pagesInstallation Guide for lemonPOS POS SoftwareHenry HubNo ratings yet

- Image Authentication ENFSIDocument43 pagesImage Authentication ENFSIIolanda OprisanNo ratings yet

- Index and Sections Guide for Medical DocumentDocument54 pagesIndex and Sections Guide for Medical DocumentCarlos AndrésNo ratings yet

- 9Document2 pages9هلال العمديNo ratings yet

- March 17, 2017 - Letter From Dave Brown and Megan McCarrin Re "Take Article Down" - IRISH ASSHOLES TODAY!Document459 pagesMarch 17, 2017 - Letter From Dave Brown and Megan McCarrin Re "Take Article Down" - IRISH ASSHOLES TODAY!Stan J. CaterboneNo ratings yet

- VRLA Instruction ManualDocument11 pagesVRLA Instruction Manualashja batteryNo ratings yet

- The Government-Created Subprime Mortgage Meltdown by Thomas DiLorenzoDocument3 pagesThe Government-Created Subprime Mortgage Meltdown by Thomas DiLorenzodavid rockNo ratings yet

- Human Resource Planning and Corroporate Strategies: Meaning and Definition of StrategyDocument19 pagesHuman Resource Planning and Corroporate Strategies: Meaning and Definition of StrategyRashmi KhublaniNo ratings yet

- Ec010 505 Applied Electromagnetic TheoryDocument2 pagesEc010 505 Applied Electromagnetic Theorywalternampimadom100% (1)

- Nord Lock Washers Material Type GuideDocument1 pageNord Lock Washers Material Type GuideArthur ZinkeNo ratings yet