Professional Documents

Culture Documents

Director, VP, Strategy, Business Development, Finance

Uploaded by

api-778181650 ratings0% found this document useful (0 votes)

34 views4 pagesDirector, VP, Strategy, Business Development, Finance

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDirector, VP, Strategy, Business Development, Finance

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views4 pagesDirector, VP, Strategy, Business Development, Finance

Uploaded by

api-77818165Director, VP, Strategy, Business Development, Finance

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 4

Patrick John Meyers

8018 Golden Harbour

Missouri City, TX 77459

(713) 280-4191 (home)

(832) 472-8362 (cell)

Summary

Professional with a MBA and strong experience in project and construction manage

ment, international business development, implementation of new business strateg

ies and conducting valuations, and risk management for US and international mark

ets. Exceptional written and oral skills, with a proven record of success while

presenting to management, investors, potential customers, governmental entities

and the press. Self-starter with a demonstrated history of entrepreneurial initi

ative, dependable team play, innovation, and a track record of applying advanced

technology to develop new businesses. Published author on the topic of creating

internet based water trading markets and option products.

Experience

Hydrolve LLC

President and VP Business Development

2008 - 2010

* Developed the business plan and helped raise seed capital of $1.2mn for a bio

mass fuel energy business located in Redding, CA. The business model included nu

merous innovations in biomass collection, storage and delivery to the biomass el

ectricity generation industry. Hydrolve's innovative business model created a fu

el banking system and allowed for the delivery of biomass fuel via rail to end u

sers.

* Oversaw the construction and project management operations for the constructi

on of Hydrolve's innovative fuel banking yards which were used to receive biomas

s fuel, sort and or process the fuel, and then load the material onto rail or ba

rge for delivery to biomass to end users. Each banking yard had a capital and la

nd cost of between $8 to $10 million dollars.

* Wrote the business case model used to determine the pricing model for the del

ivery of fuel to customers and used the model to negotiate financing terms for t

he acquisition of assets and infrastructure as well as the negotiation of contra

cts and pricing with utility customers.

* Negotiated long term fuel supply contracts with end use customers providing t

he customer with a reliable and consistent fuel supply agreement. The contracts

were structured on a "pass through" basis with a set margin payable to Hydrolve

with contract escalators based on the prevailing cost of diesel fuel. These long

term contracts allowed the customers to obtain a higher valuation for their gen

erating assets due to the reliability and tenor of the fuel supply agreement.

* Negotiated the supply of 70,000 tons annually of ground wood products to a na

tionwide fertilizer company. The contract was 5 year supply contract with the op

tion to renew for an additional 5 year period.

Tara Energy

Director of Finance

2007 - 2008

* Assisted in the negotiations with several investment banks for credit and wor

king capital facilities to assist the day-to-day management of the company's fin

ancial needs. Analyzed the existing credit facilities for competitors to obtain

better ideas as to the current market conditions and terms to further assist neg

otiations.

* Performed financial modeling and worked with outside consultants to help deve

lop and implement strategies for the company to enter new markets, new business

areas and potential product offerings. The financial model and strategic plannin

g were used to position the company for 5-10x growth in the next five years.

* Wrote the company's Industry Update, a monthly newsletter sent to over 15,000

customers. The newsletter analyzed the fundamental and technical trends in the

global energy markets. Also produced and wrote a weekly internal report for seni

or management and trading professionals analyzing the commodity and financial ma

rkets to provide market intelligence and to support trading and risk management

programs.

NATAWA Corp, Carefree, AZ

President and COO

2003 - 2007

* Hired by founder of NATAWA to develop and implement a business plan for entry

into the water and wastewater utility marketplace for "green field" development

s. Company has developed a transaction list of over 50 projects totaling over 50

0,000 homes, primarily in the Southwest.

* Company signed over five transactions that have a combined build out of over

25,000 homes where NATAWA was to provide water, wastewater and/or fiber optic ut

ilities for homeowners. Participated in active negotiations with developers who

were building more than 100,000 homes.

* Managed the entire project delivery for the development of the underground ut

ilities which included water, waste water, and or fiber optic utilities. Hired a

nd managed the engineering firms that were hired to design and build the utiliti

es. A typical 3,000 home subdivision where NATAWA built all three utilities cost

between $30 and $50 million dollars, and was built in several phases to match t

he developers delivery of homes to home buyers.

* Raised seed and investment capital from investors to fund ongoing operations

of over $2.2 million.

* Performed financial management and over site for company, negotiated contract

s with strategic partners and potential customers, developed financials for all

projects and for NATAWA, obtained financing for utility construction, and develo

ped innovative marketing and deal structuring arrangements to secure new busines

s.

* Worked on developing international business opportunities in the Mexico and C

aribbean areas for joint desalination and waste water reuse projects in resort c

ommunities and for new large scale housing/resort properties.

RWE / Thames Water, Voorhees, NJ

Director of Strategy and Business Development

2002 - 2003

* Recruited to Thames Water Americas to assist in business development and stra

tegy for the Americas Region and for the acquisition of American Water Works, th

e U.S.'s largest publicly traded water utility.

* Developed and managed implementation of the corporate strategy for desalinati

on activities in North America and the Caribbean. Developed a project list, nego

tiated with potential partners, and analyzed the acquisition of several operator

s and project development companies. Attended Thames Water International desalin

ation conference as the representative of the Americas region.

* Conducted a complete bottom-up review of the American Water strategy for Seni

or RWE Management in order to help focus future business development in selected

sectors, with a focus on Desalination, the Resource and Supply and Industrial m

arkets. Reviewed and recommended both Regulated and Non-Regulated strategies.

* Performed project development, modeling and deal analysis for several busines

s opportunities in water supply projects, acquisitions and in new technological

offerings. Analyzed, valued and made specific recommendations to management conc

erning the benefits of keeping/selling various business units. Recommendations w

ere adopted by management.

Enron Capital and Trade / Azurix, Houston, TX

Director Business Development

1998 - 2001

* Developed and implemented the company's Caribbean Desalination Strategy and i

dentified, structured and negotiated the acquisition agreement of a $14.5 millio

n desalination company as deal team lead, with NPV of $4.5 million. Also analyze

d the possibility of purchasing and combining the operations with another public

ly traded desalination company.

* Created, structured and marketed Drought Reliability Insurance (DRIs) derivat

ive program, which allowed municipalities to obtain additional water supplies in

drought years at a substantially lower cost than prior alternatives. Product pr

icing required a deep understanding of how to value exotic options using Monte C

arlo and non-traditional option pricing methods.

* Launched and managed the creation of Azurix's online water exchange and marke

tplace, Water2Water.com, in February 2000. Responsibilities included technologic

al development, business strategy, marketing, public relations, and ultimately c

reating a commercially viable business. The site was selected by Forbes.com as o

ne of the Top 10 B2B sites in the Energy and Utilities sector and as one of the

100 Best B2B sites. Created the first online water market in the US (Lower Rio G

rande, TX) and conducted the first online auction of water rights (West Basin, C

A). Negotiated MOU with the Texas Natural Resource Conservation Committee as the

sole provider of market creation and management services for water pollution cr

edit trading program.

* One of six presenters at Azurix Corp's first Wall Street analyst presentation

and participated in over 30 media interviews discussing the company's vision. I

nterviews conducted by Wall Street Journal, ABC News Tonight, Financial Times an

d CNN.

* In conjunction with Azurix senior management, formulated the Industrial Waste

water Strategy for the company. Analyzed the industrial water market to determin

e which industries represented the best future potential. Modeled and negotiated

for the acquisition of a hazardous waste water treatment plant.

* Analyzed and valued approximately 20 current assets in the Enron Capital and

Trade portfolio. Responsibilities included reviewing the valuation model, determ

ining an appropriate discount rate and developing a method to mark the assets to

market. A majority of the assets were private transactions and ranged from pure

equity investment, warrants, options and debt instruments for non-publicly trad

ed companies. Created a synthetic proxy-portfolio and conducted VAR analysis all

owing the hedge fund traders to manage the portfolios risks and exposures throug

h the trading of publicly traded assets.

Investor's Fax Weekly, Los Angeles, CA

Registered Representative and Sole Proprietor

1991 - 1996

* Founded a SEC Registered Investment Advisory newsletter providing investment

management recommendations primarily to registered representatives and instituti

onal clients to supplement their internal research. Company ultimately had $60,0

00 annual revenues.

* Performed a weekly analysis of public information on over 1,000 companies.

* Established investment consulting service, leveraging my relationships develo

ped through Investor's FAX Weekly, to identify and introduce investment opportun

ities to institutional clients. The Company was one of the nation's first fax de

livered newsletters.

* Presented investment recommendations in a BUY/SELL/HOLD format to portfolio m

anagers and traders after performing a valuation and modeling future expected re

turns.

* Provided clients a weekly Institutional Investor newsletter on a soft-dollar

basis.

Education

University of Chicago, Graduate School of Business

Master of Business Administration (MBA)

1998

University of California, Los Angeles (UCLA)

Bachelor of Science in Civil Engineering -- Soil Mechanics, Environmental and Ci

vil Engineering

1992

Additional

* Moderated the Financial Times Energy Conference on Water Trading, Dublin, Ire

land November 2000.

* Wrote several White Papers on how to implement various governmental policies,

including the CALFED Environmental Water Account using a water trading eHub.

* Published author in Reinventing Water and Wastewater Systems, which showed ho

w various derivative products would help alleviate some of the strain in the wat

er resource marketplace.

* Ability to speak and understand Spanish.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Op-Amp Comparator: Astable (Or Free-Running) Multivibrators Monostable MultivibratorsDocument5 pagesOp-Amp Comparator: Astable (Or Free-Running) Multivibrators Monostable MultivibratorsYuvaraj ShanNo ratings yet

- Greek MathemaDocument6 pagesGreek MathemaSebastian GhermanNo ratings yet

- Qanooneislamorcu 00 JafaDocument646 pagesQanooneislamorcu 00 JafaawNo ratings yet

- Soal Big A Tukpd 2011-2012 RevisiDocument5 pagesSoal Big A Tukpd 2011-2012 RevisiTriana WatiNo ratings yet

- Portland Traffic Crash Report 2021Document11 pagesPortland Traffic Crash Report 2021KGW NewsNo ratings yet

- IOM Paquetes DX Precedent RT-SVX22U-EN - 03072018Document82 pagesIOM Paquetes DX Precedent RT-SVX22U-EN - 03072018Mario Lozano100% (1)

- Network 18Document44 pagesNetwork 18Ashok ThakurNo ratings yet

- 405 Econometrics Odar N. Gujarati: Prof. M. El-SakkaDocument27 pages405 Econometrics Odar N. Gujarati: Prof. M. El-SakkaKashif KhurshidNo ratings yet

- r48 2000e3 Rectifier User ManualDocument26 pagesr48 2000e3 Rectifier User Manualjose luis rivera sotoNo ratings yet

- Router ScriptDocument10 pagesRouter ScriptfahadNo ratings yet

- Descent of Darwin - Theosophy WatchDocument17 pagesDescent of Darwin - Theosophy Watchjorge_lazaro_6No ratings yet

- Wiper & Washer Circuit PDFDocument1 pageWiper & Washer Circuit PDFluis eduardo corzo enriquezNo ratings yet

- Got 1000 Connect To Alpha 2Document42 pagesGot 1000 Connect To Alpha 2supriyo110No ratings yet

- PV Elite ResultDocument18 pagesPV Elite ResultVeny MartianiNo ratings yet

- Minicap FTC260, FTC262: Technical InformationDocument20 pagesMinicap FTC260, FTC262: Technical InformationAmanda PorterNo ratings yet

- Operator Identities 2Document3 pagesOperator Identities 2jasmonNo ratings yet

- Khalid DL 01 ProfileDocument2 pagesKhalid DL 01 ProfileRipunjay MishraNo ratings yet

- Understanding the Process of OogenesisDocument52 pagesUnderstanding the Process of OogenesisBharat ThapaNo ratings yet

- Price List Grand I10 Nios DT 01.05.2022Document1 pagePrice List Grand I10 Nios DT 01.05.2022VijayNo ratings yet

- Incorrect Fuel Level Indication RepairDocument3 pagesIncorrect Fuel Level Indication RepairBogdan StefanNo ratings yet

- The Indonesian Food Processing Industry (Final)Document48 pagesThe Indonesian Food Processing Industry (Final)patalnoNo ratings yet

- Ajhgaa English O6Document28 pagesAjhgaa English O6dhirumeshkumarNo ratings yet

- Manual CastingDocument64 pagesManual CastingDjRacksNo ratings yet

- LRV Reference TableDocument6 pagesLRV Reference TableVaishnavi JayakumarNo ratings yet

- Exercise - 8.1 NewDocument24 pagesExercise - 8.1 NewAkriti Sharma 757No ratings yet

- Zip Grade 100 Question V2Document1 pageZip Grade 100 Question V2Jesus Daniel Anaya AlvaradoNo ratings yet

- Diversification in Flavoured Milk: A ReviewDocument6 pagesDiversification in Flavoured Milk: A ReviewInternational Journal of Clinical and Biomedical Research (IJCBR)No ratings yet

- Finger Print Based Voting System For Rigging Free Governing SystemDocument2 pagesFinger Print Based Voting System For Rigging Free Governing SystemArvind TilotiaNo ratings yet

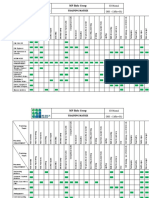

- MP Birla Group: Training MatrixDocument3 pagesMP Birla Group: Training MatrixAprilia kusumaNo ratings yet

- Sektion Installation Guide Fy21 Web ADocument16 pagesSektion Installation Guide Fy21 Web AmroliverridleyNo ratings yet