Professional Documents

Culture Documents

Smedsep GP 5-Upscaling 1oct07

Uploaded by

neerajgupta1987Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Smedsep GP 5-Upscaling 1oct07

Uploaded by

neerajgupta1987Copyright:

Available Formats

Information

Brief 5

SME Access to Credit: Enhancement through

Upscaling

Context

One of the major challenges in SME financing is shifting

the mindset of banking institutions from traditional,

collateral based lending to cashflow based approach. GTZ

SMEs, by nature, do not necessarily have an established SMEDSEP

system in doing their business and lack assets to use as Bank Assn DTI SBC

collateral. As such, traditional bankers generally see this Banks

UPSCALING

sector as high risk for lending. Although banks already

appreciate the profitability of SME lending, there remains

a lack of knowledge and skills in providing loans to SMEs.

SME Finance

cashflow based Lending

Through building awareness of and continued education

SME Unit intensive

on the benefits of SME lending, these challenges are SME credit training

incrementally overcome. The strongest convincing tool manual

for bankers to make the shift is the profitability of the SME

loan portfolio.

microfinance

consumer lending

In 2001, the DTI Small Business Corporation (SBC) collateral based lending

initiated the provision of SMEDSEP assistance to banks

Diagram 1

to improve lending to the SME sector. The German

Government through GTZ responded by commissioning

the financial sector study that served as the basis in An SME Unit within the bank with dedicated human resources

defining specific intervention strategies including the use is a basic requirement in implementing the Upscaling

of innovative and tailormade approaches. Approach. This Unit undertakes intensive capacity building

in defining the Lending Manual and going through the

Problem whole process of SME Lending until SME Finance eventually

Banking institutions in the Philippines generally lack becomes a permanent product of the bank. The capacity

knowledge and skills in providing SME lending resulting in building activities include a combination of onsite coaching

the lack of access to credit by SMEs in the country. and traditional classroom based training.

Solution Collaboration of the key players DTI SBC as lead agency

Implement the Upscaling Approach through cashflow with bank associations (for example the Rural Bankers

based lending, providing SMEs better access to credit. Association of the Philippines, RBAP) and GTZ as advisor

is essential.

Approach

Upscaling in SME Financing Upscaling involves two phases: Preparatory Phase and

Operational Phase. It requires significant time of preparation

Upscaling is a technical term in Development Finance. This (see Preparatory Phase Box). A study on the financial sector

is adopted by a bank that decides to move to a new and showing demand for SME credit is helpful in convincing

higher level of market segment using innovative procedure banks on the profitability of SME Lending at this phase. The

like cashflow based method. preparatory stage also includes an accreditation process

wherein banks are preselected based on indicators such as

The case described in Diagram 1 shows rural banks that are stability, profitability and transparency, among others. Those

into microfinance and consumer lending using traditional, preselected go through a Due Diligence Procedure which is

collateral based method of lending. SME lending, which a detailed bank assessment. Finally, the decision to conduct

targets the underserved middle market segment, requires the Upscaling Approach is sealed by a Service Agreement.

the Upscaling Approach.

Information Brief

The Operational Phase takes off from a training EFFECTIVENESS

needs assessment of the partner bank. Capacity • capacities of banks to continuously serve the SME

building strategies are undertaken chronologically clients increased

as described below. The attainment of milestones • banks cover part of the capacity building costs which

proceeds from successful implementation of include onsite coaching and training

each element starting from establishing the SME SUSTAINABILITY

Unit to full adaptation of the SME Lending tools. • SME lending adapted as regular loan product of

Performance monitoring facilitates learning, leading banks

to the expansion of bank’s SME portfolio and making • availability in the market of SME loan products

necessary adjustments. increased and sustained: no market distortion - no

subsidies needed.

Preparatory phase (up to one year)

• financial sector study

• accreditation process of banks Operational phase (until two years)

• service arrangements with bankers • Training Needs Assessment

association, federation and individual • capacity building and trainings

banks 1. establish SME Unit

2. develop and implement SME Credit Manual and

Procedures

In the Philippines, the network of rural bankers is 3. conduct intensive training / coaching on and off the job

comparatively strong under the leadership of the Rural 4. adaptation of SME Lending tools to the

specific needs of individual banks

Bankers Association of the Philippines (RBAP). Making

• monitoring of portfolio performance and quality

the Service Agreement directly with the participating

banks in the Upscaling Program could be more efficient.

However, experience suggests that going through the

meso level like RBAP and also the provincial federations Success Factors

of rural banks not only makes the work feasible but • commitment of bank owners - Board of Directors

also creates bigger impact to the industry since other • dynamic bank management

member rural banks which not directly participating in the • support of bank associations

Upscaling Approach also benefit. • size of the bank - bigger is better

• favorable regulations and environment

Key Results • bank trainings and capacity building activities are

RELEVANCE fee based

• underserved SME segment in the country supported • financial resources for marketing and administration

• profitability of banks strengthened cost of SBC and Bank Associations readily

EFFICIENCY available.

• wholesale financing to banks for midterm to long

term SME loans provided by DTI SBC

• innovative tools on SME lending utilized by banks

while attaining economies of scale CASE: First Agro Industrial Rural Bank (FAIR Bank)

• portfolio growth for banks enhanced

FAIR Bank in Cebu is one of the nine anchor rural banks of

SMEDSEP in the Visayas. It has five branches. The bank orga-

Table 1: MSME Loan Portfolio Performance nized an SME unit headed by the bank President and with dedi-

(SMEDSEP nine Anchor Rural Banks in the Visayas) cated SME account officers. The SME account officers together

Indica- No. of Volume non- MSME ratio with the top management received training from SMEDSEP.

tors loans (mPhP) performing to total loan On the job coaching further exposed the SME unit on cash

loans portfolio flow-based approach on credit appraisal. The bank is now using

credit scoring tool.

Baseline 20 904 440.0 6.0% 59%

(end 2004)

In two years time, FAIR Bank posted a 316 percent increase of

Q4 2006 45 325 726.0 4.4% 76% enterprise loans from PHP37m by end 2004 to PHP154m as of

Increase 117% 65% 29% end 2006.This comprises 56 percent of the total loan portfolio

during the same period. Arrears rate of business loans is less

than one percent.

Source: SMEDSEP Monitoring Data

For more information, please contact Ms Anja Gomm, Program Manager.

You can also email the Program (info@smedsep.ph) and visit our website (smedsep.ph)

You might also like

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Access To Finance For Small and Medium Enterprises: The Sme Credit GapDocument4 pagesAccess To Finance For Small and Medium Enterprises: The Sme Credit GapAnu AmruthNo ratings yet

- Marketing Note JAIBBDocument19 pagesMarketing Note JAIBBGourab ChowhanNo ratings yet

- Financial Performance Analysis of Prime BankDocument44 pagesFinancial Performance Analysis of Prime BankWhite RoseNo ratings yet

- AF2 Basu ArticleDocument4 pagesAF2 Basu ArticleShahan AliNo ratings yet

- SME Financing: Need For A New Business ModelDocument6 pagesSME Financing: Need For A New Business ModelSha HussainNo ratings yet

- Credit Rating ArticleDocument2 pagesCredit Rating ArticleLaweesh KumarNo ratings yet

- 5.1 FindingsDocument9 pages5.1 FindingsSaif Ahmed Khan RezvyNo ratings yet

- Sustainable Business Development Service For MicrofinanceDocument9 pagesSustainable Business Development Service For MicrofinanceLovemore TshumaNo ratings yet

- Executive - AnswersDocument53 pagesExecutive - AnswersRakesh KushwahaNo ratings yet

- Uch There Number of Corporates Ho Models To Gain Competitive Advantage in Global MarketsDocument3 pagesUch There Number of Corporates Ho Models To Gain Competitive Advantage in Global MarketsMohd Ehtesham KhanNo ratings yet

- 206 معد الحكيميDocument4 pages206 معد الحكيميfmhi2010No ratings yet

- Marketing Note-1: Q.Elaborate The Problems of Marketing Administration in Bank. (Dec 12)Document21 pagesMarketing Note-1: Q.Elaborate The Problems of Marketing Administration in Bank. (Dec 12)Mamun Enamul HasanNo ratings yet

- Responsive & Responsible Psbs Banking Reforms Roadmap For A New IndiaDocument16 pagesResponsive & Responsible Psbs Banking Reforms Roadmap For A New IndiaAnkur RaiNo ratings yet

- Rural Banking - UpdatesJune17Document59 pagesRural Banking - UpdatesJune17raghuviltapuramNo ratings yet

- 08-11-24 Credit Scoring For SME LendingDocument36 pages08-11-24 Credit Scoring For SME LendingSimon MutekeNo ratings yet

- KMBS Assignment 1Document3 pagesKMBS Assignment 1shivaniNo ratings yet

- Imp Interview TopicsDocument67 pagesImp Interview TopicsHarendra KumarNo ratings yet

- Developing Products For Rural Markets: Annie Duflo Centre For Micro Finance at IFMR February 14, 2007Document57 pagesDeveloping Products For Rural Markets: Annie Duflo Centre For Micro Finance at IFMR February 14, 2007Vinod ChanrasekharanNo ratings yet

- Credit Management PolicyDocument83 pagesCredit Management PolicyVallabh Utpat100% (1)

- BNM - PMF GuidelineDocument23 pagesBNM - PMF GuidelineNURUL MASTURA BINTI KHAIRUDDIN (MOF)No ratings yet

- Internship Report NIB BankDocument19 pagesInternship Report NIB Bankazeem bhatti83% (12)

- Challenge Fund For Smes: State Bank of PakistanDocument8 pagesChallenge Fund For Smes: State Bank of PakistanMansoor InvoicemateNo ratings yet

- Presentation - Private Vs Public Banks :HR PolicyDocument16 pagesPresentation - Private Vs Public Banks :HR Policyminal670% (1)

- Designing Financial IncentivesDocument6 pagesDesigning Financial IncentivesPriyanka HarilelaNo ratings yet

- The Growth of MIFsDocument2 pagesThe Growth of MIFsVincent MakauNo ratings yet

- Funding For: Msme MeterDocument3 pagesFunding For: Msme MeterSharad RaiNo ratings yet

- Sme Financing of Midas Financing Limited: International Islamic University ChittagongDocument11 pagesSme Financing of Midas Financing Limited: International Islamic University ChittagongMd Morshedul AlamNo ratings yet

- AKMDocument60 pagesAKMasimmishraNo ratings yet

- SME Financing - An Industry PerspectiveDocument3 pagesSME Financing - An Industry PerspectiveArun KrishnanNo ratings yet

- Performance and Credit Rating Scheme For Micro & Small EnterprisesDocument9 pagesPerformance and Credit Rating Scheme For Micro & Small Enterprisesaditya upadhyayNo ratings yet

- PNB Summer Internship ReportDocument90 pagesPNB Summer Internship ReportAnil Anayath88% (42)

- Module 1Document30 pagesModule 1Laxmi JLNo ratings yet

- Mid Test - Case Study - CompressedDocument5 pagesMid Test - Case Study - CompressedrakaNo ratings yet

- ProjectDocument57 pagesProjectPraneeth Kumar V RNo ratings yet

- Receivable Management With Ref To Sbi PDFDocument46 pagesReceivable Management With Ref To Sbi PDFSampada GovekarNo ratings yet

- Special Emphasis On Working Capital Finance of Jamuna Bank Ltd.Document18 pagesSpecial Emphasis On Working Capital Finance of Jamuna Bank Ltd.Imam Hasan Sazeeb100% (1)

- Disadvantages in Universal BankingDocument3 pagesDisadvantages in Universal Bankingsubbucs100% (1)

- Liben Thesis For AdmasDocument33 pagesLiben Thesis For AdmasKing LiNo ratings yet

- Narrative BodyDocument16 pagesNarrative BodyANDRE MIGUEL SANTIAGONo ratings yet

- Strategic Management Process of Jamuna Bank Ltd.Document20 pagesStrategic Management Process of Jamuna Bank Ltd.SAEID RAHMAN100% (1)

- Anmol - Pandey - Resume - 15 12 2022 01 27 19Document1 pageAnmol - Pandey - Resume - 15 12 2022 01 27 19Anmol PandeyNo ratings yet

- 1.1 Origin of The Report: Prime Bank LimitedDocument93 pages1.1 Origin of The Report: Prime Bank LimitedAami TanimNo ratings yet

- Term End Project: G Siva Prasad 10MBA0105Document10 pagesTerm End Project: G Siva Prasad 10MBA0105Johnson YathamNo ratings yet

- Training Capacity - Building - Needs - and - Challenges - in - AsiaDocument2 pagesTraining Capacity - Building - Needs - and - Challenges - in - Asiapg classNo ratings yet

- EY Global Commercial Banking Survey 2014Document28 pagesEY Global Commercial Banking Survey 2014Share WimbyNo ratings yet

- Report On SME Banking Scope in Bangladesh (Part-9) : FindingsDocument5 pagesReport On SME Banking Scope in Bangladesh (Part-9) : Findingsnahidul202No ratings yet

- Executive SummaryDocument56 pagesExecutive SummaryMurali Balaji M CNo ratings yet

- Funds Management by Banks in India: Solution To A Persisting Optimization ProblemDocument9 pagesFunds Management by Banks in India: Solution To A Persisting Optimization Problemrajesh_katare1No ratings yet

- Credit Appraisal ArticlesDocument3 pagesCredit Appraisal ArticlesSanthosh Soma0% (1)

- Vimal Research ProposalDocument10 pagesVimal Research ProposalVimal RamgoolamNo ratings yet

- "Management of Non Performing Assets": A Project Report ONDocument64 pages"Management of Non Performing Assets": A Project Report ONshivanimittal1737No ratings yet

- Idlc Sme PDFDocument96 pagesIdlc Sme PDFatiqNo ratings yet

- Mergers and Integration of Banks-Allahabad Bank and Indian BankDocument3 pagesMergers and Integration of Banks-Allahabad Bank and Indian Bankrajkumar devarakondaNo ratings yet

- How Commercial Banks Win in Wealth Management: Cover Headline Here (Title Case)Document8 pagesHow Commercial Banks Win in Wealth Management: Cover Headline Here (Title Case)Gufron AmronyNo ratings yet

- NPL in Banking Sector of BangladeshDocument6 pagesNPL in Banking Sector of BangladeshKarthik NathNo ratings yet

- Impact of Credit Rating On MsmeDocument11 pagesImpact of Credit Rating On MsmeGaurav KumarNo ratings yet

- Strategic HRMDocument19 pagesStrategic HRMvvvasimmmNo ratings yet

- Maureen FB Seminar EditedDocument23 pagesMaureen FB Seminar EditedGarba MohammedNo ratings yet

- Study of NPA by Ajinkya (3) FinalDocument70 pagesStudy of NPA by Ajinkya (3) FinalAnjali ShuklaNo ratings yet

- Intro To Forensic Final Project CompilationDocument15 pagesIntro To Forensic Final Project Compilationapi-282483815No ratings yet

- Table of Contents - YmodDocument4 pagesTable of Contents - YmodDr.Prakher SainiNo ratings yet

- CS 252: Computer Organization and Architecture II: Lecture 5 - The Memory SystemDocument29 pagesCS 252: Computer Organization and Architecture II: Lecture 5 - The Memory SystemJonnahNo ratings yet

- Product Management GemsDocument14 pagesProduct Management GemsVijendra GopaNo ratings yet

- Impact of Carding Segments On Quality of Card Sliver: Practical HintsDocument1 pageImpact of Carding Segments On Quality of Card Sliver: Practical HintsAqeel AhmedNo ratings yet

- Method Statement For Backfilling WorksDocument3 pagesMethod Statement For Backfilling WorksCrazyBookWorm86% (7)

- Define Constitution. What Is The Importance of Constitution in A State?Document2 pagesDefine Constitution. What Is The Importance of Constitution in A State?Carmela AlfonsoNo ratings yet

- Business en Pre Above S+T ReadingDocument3 pagesBusiness en Pre Above S+T Readingsvetlana939No ratings yet

- Method Statement: Vetotop XT539Document4 pagesMethod Statement: Vetotop XT539محمد عزتNo ratings yet

- Teshome Tefera ArticleDocument5 pagesTeshome Tefera ArticleMagarsa GamadaNo ratings yet

- DuraBlend 4T Newpi 20W50Document2 pagesDuraBlend 4T Newpi 20W50Ashish VashisthaNo ratings yet

- 99990353-Wsi4-2 C1D2-7940022562 7950022563 7940022564Document2 pages99990353-Wsi4-2 C1D2-7940022562 7950022563 7940022564alltheloveintheworldNo ratings yet

- Microsoft Software License Terms Microsoft Windows Media Player Html5 Extension For ChromeDocument2 pagesMicrosoft Software License Terms Microsoft Windows Media Player Html5 Extension For ChromeOmar PiñaNo ratings yet

- CreatorsXO JuneDocument9 pagesCreatorsXO JuneGaurav KarnaniNo ratings yet

- BroucherDocument2 pagesBroucherVishal PoulNo ratings yet

- VM PDFDocument4 pagesVM PDFTembre Rueda RaúlNo ratings yet

- FIP & CouponsDocument5 pagesFIP & CouponsKosme DamianNo ratings yet

- OD426741449627129100Document1 pageOD426741449627129100SethuNo ratings yet

- Case Study 05 PDFDocument5 pagesCase Study 05 PDFSaltNPepa SaltNPepaNo ratings yet

- DX DiagDocument16 pagesDX DiagMihaela AndronacheNo ratings yet

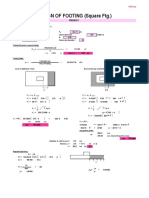

- Design of Footing (Square FTG.) : M Say, L 3.75Document2 pagesDesign of Footing (Square FTG.) : M Say, L 3.75victoriaNo ratings yet

- VMC Ballscrew 32mm Horizontal Plane ReplacementDocument11 pagesVMC Ballscrew 32mm Horizontal Plane ReplacementMarlon GeronimoNo ratings yet

- PDS Air CompressorDocument1 pagePDS Air Compressordhavalesh1No ratings yet

- Solution Problem 1 Problems Handouts MicroDocument25 pagesSolution Problem 1 Problems Handouts MicrokokokoNo ratings yet

- Goal of The Firm PDFDocument4 pagesGoal of The Firm PDFSandyNo ratings yet

- Wind Flow ProfileDocument5 pagesWind Flow ProfileAhamed HussanNo ratings yet

- ITMC (International Transmission Maintenance Center)Document8 pagesITMC (International Transmission Maintenance Center)akilaamaNo ratings yet

- SS 531 2006 Code of Practice For Lighting of Work Places Part 1 PDFDocument13 pagesSS 531 2006 Code of Practice For Lighting of Work Places Part 1 PDFEdmund YoongNo ratings yet

- Comprehensive Drug Abuse Prevention and Control Act of 1970Document2 pagesComprehensive Drug Abuse Prevention and Control Act of 1970Bryan AbestaNo ratings yet

- Level of Life Skills Dev 5Document59 pagesLevel of Life Skills Dev 5MJ BotorNo ratings yet