Professional Documents

Culture Documents

FDC Economic Monthly Publication For May 2011

Uploaded by

Seun OnayigaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FDC Economic Monthly Publication For May 2011

Uploaded by

Seun OnayigaCopyright:

Available Formats

FINANCIAL DERIVATIVES COMPANY LIMITED Volume 1, Issue 16

June 1, 2011

FDC ECONOMIC MONTHLY

THE ECONOMY

NIGERIA : ECONOMY REMAINS VULNERABLE TO OIL PRICE

SHOCKS INSIDE THIS ISSUE:

The probability of an abrupt reversal of skyrocketing oil prices looks re-

mote, but cannot be totally eliminated. Keeping in mind that the oil price

will not remain high indefinitely, there is a just cause to worry about the Economy Remains Vulnerable to Oil 1

positive but low correlation between the increase in oil revenues and an Price Shocks

accumulation of fiscal savings (in the Excess Crude Account (ECA) and in

the foreign reserves). This predicament has been raised by many analysts Interest Rate Increase to Strengthen the 2

Naira

and multilateral agencies.

More Regulations as CBN Guarantees 4

World oil prices are mainly a function of demand-supply fundamentals. In Haircut for NPL’s above 5%

other words, while the crisis in the MENA region led to price spikes

(supply side), a debt crisis in the Euro zone, US or Japan; the resurgent Economic indicators & Markets 6

Inflation & Interest Rates

commodity prices; and soaring global inflation could depress oil prices Forex Markets

(demand side) by reducing effective demand for oil. Hence, Nigeria, which Oil Markets

depends on oil revenue for 83% of its export earning and 90% of budgetary Stock Market Review and Outlook 7

revenue, will have to undergo painful adjustments in other to cope with the

Corporate Focus : First City Monument 9

harsh reality of an oil revenue reversal. Bank

There are implications for international trade. For example, in the event of a Sector Update 14

Aviation

deepened euro zone crisis, trade flows between Nigeria and the region Power

Real Estate

could be affected. Thus, goods coming from the single currency bloc will be

relatively cheaper while exports will be relatively more expensive. Theoreti- Global Economy: 17

China’s growing presence in Africa

cally, this should worsen Nigeria’s trade balance as import growth is ex- The Wisdom of Elites

pected to outstrip export growth.

If it is any consolation, it has become somewhat popular for conventional

economic theory to run parallel with actual economic realities. For example,

2008 and 2011 share very similar global economic trends (declining com-

modity prices after reaching fresh peaks, weakening markets and currency

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 2

volatility). The difference however lies in the speed of value erosion (which is

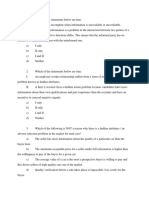

slower today than in 2008) and the trigger of the adjustment, which for 2008 Chart 1 : Oil Revenue & Oil Price

was the housing crisis and 2011, a sovereign debt crisis. 3.0 140

2.5 120

100

2.0

80

The domestic economy front, however, is quite different today compared to 1.5

1.0

60

40

2008: average MPR is 2.65 lower, average savings rate is 7.2% lower, inflation is 0.5 20

0.0 0

0.3% higher, and Naira has depreciated by 21.3% against the Euro. Thus it can M J S D M J S D M J S D M J S D M J S D

be concluded that 2008 presented a greater incentive to import goods from 2005 2006 2007 2008 2009

Oil Revenue (N'trn) - LHS Oil Price ($'pb)_ RHS

Europe based on the relative strength and stability of the Naira against the

Source : NBS & Bloomberg

Euro. But the reality was that people, instead of engaging in import and trade

activities, invested in the financial markets because it offered high and attrac-

tive rates (returns) given the level of inflation at the time. It can also be implied

that some of the funds mobilized in the financial system during this period

helped in fuelling the stock market bubble at that time.

However, it will be ludicrous to think that trade trend in 2008 could reemerge

in 2011. This is because there is a greater incentive to engage in trading activi-

ties compared to keeping the money in the bank at existing low interest rates.

This would explain in part, the soaring demand for forex at the WDAS market. Chart 2 : €/$ and €/N Exchange Rates

The President and his economic team have their work cut out. The fault lines in €/$ €/N

1.7 240

€/N

the global economic recovery are protruding and Nigeria seems to be ill pre- 1.6 220

200

pared for any kind of shock. 1.5

180

1.4

160

1.3

140

1.2

Korede Akeju €/$

120

1.1 100

J-05 A-05 M-06 N-06 J-07 F-08 S-08 M-09 D-09 A-10 M-11

Source : ECB, CBN

INTEREST RATE INCREASE TO STRENGTHEN THE NAIRA

The Naira has witnessed increased volatility in recent months both in the offi-

cial and parallel markets. The premium between the official spot rate and the

parallel cash rate narrowed by 3.2% YTD to N4.9 following a 3% and 1% naira

depreciation at the official and parallel markets, respectively.

The surge in forex demand is making the task of supporting the Naira even

harder for the CBN. In the official WDAS segment an average of $2.8bn per

month has been demanded in the last five months compared to $1.9bn per

month in the corresponding period in 2010.

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 3

In response, the CBN has increased the amount of forex sold in the market by

meeting an average of 120% of total demanded. The introduction of forward

Chart 3 : Nigeria’s Trade With the

forex trading has done little to douse these pressures: but has instead resulted Euro Zone

in a marginal accretion in reserves of 0.9% from $32.3bn at the start of the year.

This is in spite of strong crude oil prices and production. 3,500

3,000

2,500

2,000

On the other hand, real interest rates have remained negative even after the re- 1,500

1,000

cent increases in the MPR by the apex bank to 8%. The Monetary Policy Com- 500

mittee (MPC) has raised the monetary policy rate by a cumulative 125 basis -

2005 2006 2007 2008 2009

Import Export Total Trade

points in the first 4-month of 2011.

Source : National Bureau of Statistics

In its last meeting on May 23, the MPC noted that the key policy challenges re-

main weak growth in private sector credit and very high lending rates in spite

of the low cost of funds. However, as the threat of inflation grows, tightening

measures by the CBN become inevitable.

While the efforts taken so far by CBN have somewhat helped to calm the forex

market, there are still considerable downside risks to naira stability in the near Table 1 : Summary Data

Annual Averages 2008 2011` % Change

term. The use of external reserves to defend naira has its limits. The steady de-

MPR (%) 9.85 7 .2 2.65

cline in oil prices seen in the last weeks heightens tension over possible accre-

Term Deposit Rate(%) 1 1 .7 4.5 7 .2

tion in reserves in the near term. Even if oil prices recover, the low level of in-

Inflation (%) 1 1 .5 1 1 .8 0.3

terest rates will continue to impair CBN’s ability to support the Naira indefi-

WDAS ($ Sold) $1 1 .7 bn $1 0.90

nitely. Euro (€/$) 1 7 3.1 21 0 21 .3

Source : CBN

The outlook for the Naira is mixed. In the short run, we expect the naira to re-

main relatively stable at both official and parallel markets. We expect CBN to

continue to support the currency in the official market. The market is expected

to continue to factor in the high crude oil prices.

Higher crude oil prices will lead to increase in external reserves and help the

CBN to continue to support the Naira. The premium between the parallel and

official rates will remain high. What happens to naira in the long run will de-

pend on two imponderables namely oil prices and production.

Fatai Asimi

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 4

BANKING: MORE REGULATIONS AS CBN GUARANTEES HAIRCUT

FOR NPL’S ABOVE 5%

The central bank gave indications that it is targeting a 5% limit on Non-

performing loans as a percentage of total loan books. The governor gave this

indication and noted that the rescued banks had been brought back to a neutral

position due to the activities of AMCON.

Prior to the bailout of the bad bank, the industry’s total non-performing loans

(NPLs) as a percentage of gross loan/advances of 35%. This is subject to the law

of averages as some banks had as high as 60% NPLs/gross loans on their bal-

ance sheets. It means that NPLs above 5% will be conservatively valued i.e.

banks that want their NPLs above 5% purchased will have to sell at punitive

prices.

This new target means banks will have to pay more attention to risk manage-

ment practices and credit analyses. The previous practice of granting credit will

have to be streamlined to ascertain the credit history of clients and potential

borrowers. To this end the roles of the credit bureau in the new dispensation

Prior to the bailout of the bad bank, the indus-

will also come to the fore. try’s total non-performing loans (NPLs) as a

percentage of gross loan/advances of 35%.

The Nigerian financial market seems to be one of the few where credit is

granted without due or proper recourse to the credit history of an applicant be

it with that institution or others. The logic being that the likelihood of a credit

default is higher if the individual has defaulted on an existing loan or has other

credit obligations outstanding.

Other countries seem to have moved on or are making conscious efforts to

move away from a sub-optimal credit appraisal process to a historical-based

credit appraisal process.

Brazil recently passed a bill for the creation of credit bureaus as a repository of

credit data. This is still subject to the president’s approval though.

Recapitalization Remains Goal

The goal of the apex bank therefore remains to recapitalize the banks. The proc-

ess however is experiencing legal bottlenecks as the court only recently placed

discussions between FCMB and Finbank on hold. There seems to be more tech-

nical issues encumbering the process as talks have broken down between other

target banks and interested parties.

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 6

For now, it appears the main obstacles to the negotiations are some erring

shareholders who have been able to resort to the law to put a hold on further

negotiations. It however does not look like this would pose a long-term risk to

the recapitalization process. The negotiations will be allowed to run after the

legal bottlenecks are removed. The only snag could be that the offer by the ac-

quiring banks could be below the targets’ expectation.

The central bank governor has been talking tough in recent days about recapi-

talization deadlines for rescued banks and the outcome of failing to recapitalize

by 30 September 2011. This seems unlikely though given the various stake-

holder interests and the fallout of such actions. Having said his piece, it’s now

left for the negotiating parties to sort out grey areas of negotiations with the

bargaining chip stacked in favour of potential acquirers

The race is therefore on and the time is ticking. The expectation is that the res-

cued banks will take on a more favorable look to offers made by interested par-

ties. They will also have to find ways of soothing disgruntled nerves both

within the management team and shareholders. Simply put, negotiations must

proceed in earnest.

Adedayo Ayeni

INDICATORS AND MARKETS

Inflation

Headline inflation rose by 11.3% in April, according to recent data from the Ni-

gerian Bureau of Statistics. This is lower than the 12.8% recorded in March.

Food inflation also declined to 10.7% from 12.2% in March, while core inflation

increased to 12.9% from 12.8% in March. Chart 4 : Inflation & Interest Rates

20

Inflation expectation remains high. This is due to elevated risks factors such as 15

11.3 Inflation

the new minimum wage, possible removal of petroleum subsidies and further

10.8 Call

10 9.52 Tbill

liquidity injection from AMCON activities.

8 MPR

5

0

J F M A M J J A S O N D J F M A M

Interbank Rates 2010 2011

The cyclicality of money market rates, in response to large public sector inflows Source : MMA

and outflows, continued in May. Overnight and OBB rates closed the month at

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 7

10.8% and 9.9% respectively. This is 0.21% and 0.5% lower than month end val-

ues in the previous month. Yields on 7 day, 30 day, and 60 day facilities reached Chart 5 : Exchange Rate (N/$)

11.3%, 12.4% and 12.9% respectively. Fund inflows for the period were mainly 190

from FAAC (Federal Account Allocation Committee) of N455.6bn. Short-term 180

170

interest rates are expected to remain around current levels next month. The 2% 160

increase in the Cash Reserve Requirement (CRR) to 4% could squeeze liquidity 150

further, but marginally. 140

J-09 M-09 M-09 J-09 S-09 N-09 J-10 M-10 M-10 J-10 S-10 N-10 J-11 M-11

Parallel(N/$ ) Official(N/$ )

Exchange rate

Source : CBN, FDC

The Naira closed at N153.59 to the Dollar at the official market. Representing a

depreciation of 0.5% compared to the previous month. On a YTD basis, the

Naira depreciated by 3% and 1% in the official and parallel markets, respec-

tively. The spread between the official and parallel rates narrowed by 3.2% to Chart 6 : External Reserves

N4.9. CBN may continue its defence of the currency due to increased forex

earnings (as a result of strong oil prices and production). However, near term

projection however remain mixed and dependent on oil market trends.

External Reserves grows marginal by 0.9% YTD

Nigeria’s external reserves stood at $32.6 bn as at May 26, representing a 0.9%

accretion YTD. The marginal accretion in reserves comes on the back of strong

oil production of 2.2mbpd and high prices (May average of $112). The cost of Source : CBN

defending the Naira is very high when real interest rates are negative and infla-

tion expectations are high.

Oil Markets

Brent crude averaged $115 barrel, 2 cents above the previous month. However,

there was however increased volatility in the market as investors worry about

fiscal sustainability in the Euro zone, Japan and US. The currencies of these

economies also faced great levels of volatility during the period.

The sustained peace in the Niger delta has ensured a rebound in oil production.

Average production for the year currently stands at 2.2mbpd, 10% higher than

the corresponding period in 2010.

Chart 7 : ASI vs Market Capitalization

STOCK MARKET

MAY 2011 REVIEW

The ASI rose by 315 basis points to 25,829.75 points while market cap rose by

322 basis points to 8,258.72bn. The indicators rose amidst reduced activity levels

when compared to April. Source : FDC/NSE

A Financial Derivatives Company Publication

: 7739831, 77398892715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 8

The difference in the movement of the ASI and market cap is due to the listing Table 2 : Market Indicators

of about 828m ordinary shares of 50kobo each in the name of STACO Insurance

Plc being Right Issue subscription and listing of an additional 2.33bn ordinary

shares of 50k each of Great Nigeria Insurance Plc on the Official List of the NSE.

Market drivers

Improved liquidity in the markets, conclusive presidential elections that have

been adjudged as free and fair by international observers all shaped the direc-

tion of the market during the review period.

Source : FDC

Although the market enjoyed positive liquidity the level of activities in terms

of volume and value fell short of the previous month occasioned by corporate

actions. Investors also continued to cautiously take position ahead of the com-

mencement of the inauguration of the president into a full term in anticipation

of the continuation of already proposed reform agenda.

Table 3 : Gainers & Losers

Recently, the MPC at its May meeting agreed to raise MPR by 50 basis points to

8.00% in a bid to defend the Naira from speculative attack as well as manage

inflation associated with currency devaluation in an import-dependent econ-

omy like ours.

Post-election violence notwithstanding, the general consensus was that the

elections were free and fair, reinforcing confidence of international investors.

On the home front local investors interests are less correlated to the political

environment.

The advance/decline line slid to 0.5:1 in May from 0.72:1 in April. It is also

noteworthy that the number of gainers increased from 45 to 51 companies, but

Source : FDC

the decliners in May nearly doubled those in April.

The Banking sector remained the most active in terms of transaction value. At

the time of the report, available data shows that transaction declined by 22.28%. Table 4 : Most active sector by turnover

The other sectors on the table also showed decline with the exception of Brew-

eries and Foreign Listings which recorded transaction growth of 10.78% and

2,611% respectively.

Corporate Announcements Source : FDC

Nearly two-thirds of forty nine corporate announcements released in the re-

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 9

view period showed an improvement. The same trend is observable in year-to- Table 5 : Corporate Announcement

date banking sector corporate announcements except in the case of UBA

(FY2010) and Stanbic IBTC (Q1 2011). The following stocks were marked down

for dividend payments and bonus issues during the reporting period.

Outlook & Implication

The new MPR regime comes into effect on 8th June 2011. Already, the interbank

rates are beginning to adjust upwards. We expect the bond markets to correct.

This could also have negative impact on the banking sector. Overall a stable Source : FDC

currency is expected to encourage investor participation in the equities market.

Bamidele Ige

CORPORATE FOCUS

FIRST CITY MONUMENT BANK (NSE)

Summary

The playing field in the banking industry is about to change significantly fol-

lowing the recent news that FCMB plans to recapitalize and acquire Finbank,

one of the ten rescued banks. With this proposed acquisition, FCMB with a his-

tory of acquisitions, including that of Cooperative Development Bank, Nigeria-

America Bank Limited and Midas Bank Limited is clearly saying “I want to Price: N7.41 (as of 25 May 2011)

play in the big leagues.” The Bank began as a merchant bank in 1982 and then 12-mth Target Price: N8.87

adopted a universal bank structure in 2001 in order to access the highly lucra- S&P Credit Rating: B+ Beta: 1.1

tive retail segment. Today, FCMB operates in the Retail, Corporate, Institutional

52-Wk Range: N5.19 - N8.70

and Investment banking segments.

PETTM: 12.4

Industry Analysis

EPS: 49k

Following the hotly debated intervention by the CBN, Nigerian banks have No. of Shares: 16,271,192,202

experienced a return to profitability as indicated by recently released FY 2010

and Q1’11 results. This has been due largely to recent activities by AMCON in

purchasing a portion of banks’ non-performing loans (NPL).

The low interest rate environment resulted in low asset yields in 2010, which in

turn put pressure on net interest margins. However, in 2011, the rising interest

rate environment will pose a threat to loan demand and in turn, loan growth.

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 11

Loan growth was sluggish in the first quarter of the year with average loan

growth of around 4%.

High dividend payout ratios in the industry remain worrisome for institutional

Table 6

investors. Banking sectors in other nations have reduced their dividend payout

Average Average

ratios in the wake of the recent global financial crisis, in order to strengthen Payout Dividend

Ratio Yield

their capital base. On the contrary, Nigerian banks have done the opposite, with

Nigeria 75% 4.54%

dividend payout ratios of up to 75% of PAT.

USA* 30% 2.33%

Canada 40% 4.12%

The new wave of consolidations is in the offing and typical of consolidated Europe 36% 2.88%

playing fields. The level of rivalry is set to intensify, particularly in the SME and

* fell to 12% following recent financial

retail segments. Average profitability of the surviving players should increase

crisis

significantly. The industry is also expected to benefit from forecasted GDP

growth rate of 7.5% with a corresponding 15% growth rate.

Company Analysis

Strategy

We sat down with the Bank’s management team to discuss the recently re-

leased FY 2010 and first quarter results for 2011. In our discussions, the team

stressed that FCMB was not focused on becoming the largest bank but rather,

on maximizing shareholder value by becoming among the five most valuable

banks in terms of market capitalization.

As other banks increase their focus on mass retail, FCMB has set a clear strat-

egy of maintaining its investment banking leadership and carving out a niche of

the retail segment i.e. mid-high income earners (≥ N1.2 million) and civil ser-

vants.

The Bank’s retail strategy is at first suspect until you consider the winning suc-

cess of its subsidiary, Credit Direct Limited (CDL). The operational structure of

CDL is fundamentally different from that of banks. CDL is a monoproduct,

monoclient entity created with the strategic objective of offering soft loans to

retail clients. At present, the company’s clients are comprised of civil servants

who are guaranteed 24 hour loan approvals. CDL has been able to maintain low

operational costs and drive higher margins.

The management listed the following as the Bank’s differentiating factor:

Transaction banking- cash management and trade services

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 12

Operational excellence and customer intimacy

Fundamental Analysis

Competitive advantage in the banking sector derives from sustained low costs

and efficient strategy execution. The Bank may have a funding cost disadvan-

tage. Its NIM of 5.3% is strong but could be improved.

This disadvantage is due in part to its history as an investment bank which, by

its very nature relies on purchased funds rather than free current account bal-

ances. The Bank’s low cost deposits (current and savings) in 2010 amounted to

43% of its total deposit compared to an average of 70% for its competitors.

In the rising interest rate environment of 2011 in which the MPC recently in-

creased the MPR from 7.5% p.a to 8%p.a, the issue of funding costs becomes Table 7 : Result Sheet

even more critical for FCMB. The management acknowledged the funding cost N aira b illio n 12 M 2 0 0 7 12 M 2 0 0 8 12 M

2009

8M 2009 12 M

2 0 10

Q1 2 0 11

Gro s s 2 4 .7 50 .1 71.1 3 3 .4 57.8 16 .6

challenge and is working strenuously to address it. In the meantime, the return Earning s

PB T 7.4 18 .4 4 0 .72 7.6 3 .4

on risk assets is lucrative enough to compensate for the funding cost disadvan- PA T 5.8 13 .7 3 .5 0 .6 7 7.3 2 .7

tage. TA 2 6 2 .8 4 6 5.2 514 .4 4 6 0 .1 53 0 .1 59 5.4

TL 8 4 .1 18 8 .9 2 73 .2 2 3 9 .9 3 3 0 .4 4 57.9

TD 18 7 2 51.2 3 2 1.2 266 3 3 4 .8 3 4 2 .1

The high interest rate also has the potential to impact loan demand/growth TS HF 3 1.1 13 3 .6 12 9 .1 12 9 .5 13 4 .8 13 7.4

especially among the Bank’s prime segment of borrowers. Loan growth rate of EPS 63k 13 5K 2 5K 5K 49K 16 k

over 36% achieved by the Bank in 2010 seems unlikely in 2011’s interest rate Source : FCMB Annual Reports

climate.

FCMB has responded to the pressures on net interest margins by boosting its

non interest income from areas such as corporate finance fees, commissions,

and trading income. FCMB was able to offset an 18% decline in net interest in-

come with a 59% growth in non-interest income in 2010. This trend in non-

interest income growth is expected to continue in 2011.

FCMB bottom-line has also been bolstered by significant declines in loan loss

provisions from (N3.96) billion in 2009 to N439 million in 2010. This was due to

the Bank’s much healthier NPL ratio of 6% and loan recovery of N1.6 billion.

Merger & Acquisition

FCMB recently announced that it had signed an MoU to recapitalize and merge

with Finbank. Is this merger based on a portfolio decision or a strategic deci-

sion? i.e. Does FCMB intend to acquire Finbank, nurse it back to health and

then sell it off for huge profits or does it intend to merge the operations of both

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 13

banks? The management has stated emphatically that this was foremost a stra-

tegic decision in which Finbank operations would be merged with that of

FCMB within a 6-12 month period after acquisition. The reasons given for the

decision include:

To grow commercial banking and strengthen retail segment Chart 8 : FCMB vs NSE

Improve national presence especially in the North and East using Finbank’s

stronger branch network

Increase non-interest income using Finbank’s highly developed e-payment

platform

Improve liquidity (Finbank’s current LDR at 25%)

Risk Source : NSE, FDC

FCMB was among the 12 banks that passed the CBN stress test in 2009. The

Bank has relatively low volatility and has come through the 2010 financial year

with a healthier balance sheet and lower NPL ratio. However, the higher inter-

est rate environment will have more of an impact on the interest earnings of

FCMB since its deposits are skewed towards wholesale deposits. In addition,

the proposed merger with Finbank will no doubt stress the Bank’s management

and capital resources and may do more harm that good if the process is im-

properly managed.

Valuation

FCMB currently trades at a PE of 12.47 and 0.9x its book value, slightly cheaper

than the industry average of 12.83 and 1.0x respectively. We believe that the

stock is trading slightly above its computed fair value of N7.48, at the current

price of N7.41. We are therefore neutral in the short-term. Our 12 month target

price of N8.87 is based on a combination of price multiples and residual income

valuation methods. We have also taken into consideration the Bank’s funda-

mentals, the stock’s trading pattern and the sector’s operating environment.

Efemena Esalomi

Disclaimer & Disclosure

This report is for information purposes and should therefore not form the sole basis for investment decision. Information contained in this report has been

sourced from several reliable sources and no representation is made that it is correct, complete or timely.

Mr. Bismarck J. Rewane, MD of Financial Derivatives company, is a non-executive director of FCMB. It is imperative that we emphasize that Mr Rewane

did not contribute, in any form, to this write up. The opinions expressed are the analyst’s.

The analyst also has a FCMB current account, opened and maintained in the normal course of business.

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 14

SECTOR UPDATE

AVIATION SECTOR: ALLIANCE IS A COMPETITIVE STRATEGY

After a challenging 2009 and 2010 during which most network, regional and

domestic airlines traffic and capacity declined, the cynical may still have cause

to fear this year may yet be another challenging one for the air transport indus-

try.

Profit margins looks set to shrink for most operators and opportunities for

growth are constrained by a number of factors including high fuel prices, frag-

ile economic recovery and excess capacity. Nonetheless, year 2011 may not pre-

sent a gloomy picture for the aviation sector as some would want to believe.

Oil prices, which reached a peak of $127pb in March, have eased to $98pb as of

writing, while global recovery seems set to remain broadly on track despite re-

newed sovereign debt concerns in the Euro Area.

However, there is a much more fundamental problem that had faced the do-

mestic air transport industry (besides poor aviation infrastructure). And that is

how to extricate itself from domestic debt burden which is adversely impacting

operations.

Very recently the Asset Management Corporation of Nigeria (AMCON) is be-

lieved to have granted Arik Air N4.5bn lifeline to support its operation and en-

hance its capacity for debt repayment. The capital injection probably follows the

acquisition of most of the airlines’ debts by AMCON from two Deposit Money

Banks in December 2010.

That said, the question that readily comes to mind is whether government bail-

out is what domestic players really need to remain competitive. In a sense, this

is welcome. But while Arik’s lifeline is expected to help save jobs that would

otherwise be lost if the airline was to go under, the company and other domes-

tic players may have to reassess their business model in an industry where cut-

throat competition has become the name of the game.

To this end, a key strategy would be to team up with stronger foreign carriers

through code-shares and joint ventures. This would make good economic sense

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 16

since these local carriers possess insufficient financial capacity and aircraft fleet

to fully exploit local and international business opportunities.

Lawrence Oseafiana

POWER SECTOR: TARIFF SET TO RISE BY JULY

The Nigerian Electrical Regulatory Commission (NERC) is conducting a Major

review of the Multi Year Tariff Order (MYTO) which will take effect in July this

year. The review was originally scheduled for 2013 but has been fast tracked

due to its importance to the current power sector reform.

The commission introduced the Multi Year Tariff Order (MYTO) in 2008 as a

framework intended to determine a pricing structure that is transparent and

produces fair outcomes.

The primary objective of this major review is to develop a new industry pricing

structure. The new pricing structure will allow for a reasonable rate of return

for investments in the sector. It will give incentives to improve efficiency and

quality, send efficient cost signals to customer and ultimately phase out or re-

duces cross subsidies.

Based on the revised framework, end users are expected to pay significantly

more for electricity. However, it is expected that the overall cost of electricity

(assuming supply improves significantly) will be lower than the extra cost in-

curred from the use of alternative energy.

REAL ESTATE: BABY STEPS TO A MILLION MILE JOURNEY

The Federal Housing Authority (FHA) has indicated that it plans to build

106,000 houses in the next four years (that is approximately 26,500 units annu-

ally). The FHA has only managed to build only 37, 000 houses since it was es-

tablished 37 years ago (that is equivalent to a rate of just 1000 per year).

The new housing project, if achieved, will contribute to the reduction of the cri-

sis level housing deficit, currently estimated at 16 million units. To achieve its

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 17

objective, the FHA must tackle problems such as inadequate capital, an under-

developed mortgage industry, land ownership and administrative bottlenecks

etc. These issues and many more, are fundamental to solving the housing crisis.

As part of the means to at least address some of the funding issues, the Federal

Mortgage Bank of Nigeria (FMBN) is considering raising its second Mortgage-

Backed Bond from the capital Market in July 2011. The amount to be raised will

bring the cumulative beneficiaries under the MBB programme to 16,108 home

buyers. In 2007, the FMBN successfully floated its first tranche of the N100

Mortgage-Backed Bond worth N26 billion.

Korede Akeju

GLOBAL POLICY PERSPECTIVE

CHINA’S GROWING PRESENCE IN AFRICA

By Mark Mobius

There are some key forces both pushing and pulling China into Africa. First,

China now has the world’s largest amount of foreign reserves, reaching $3 tril-

lion, more than twice that of Japan and far larger than most other countries. Up

to now a large portion of these reserves have gone into U.S. government debt

but increasingly China is finding the necessity to diversify those reserves be-

cause of the growing precarious situation with the U.S. Dollar and concerns

about U.S. government debt.

At the same time, China’s burgeoning economy is demanding more and more

natural mineral resources whether it is oil, copper, nickel, gold, etc. Looking

further into the future, the demands of China’s more sophisticated diets means

that imports of food will be increasing as well. In both areas, minerals and food,

Africa has great promise. It is well known that Africa is rich in a wide variety of

minerals from oil to copper. Africa’s vast amount of land could fit the entire

land mass of not only China but also India, the United States, Mexico, France,

Italy and a number of other countries. Besides land, and more importantly, Af-

rica has huge resources of water essential for bountiful harvests.

China’s attraction to Africa is clear. Africa is also attracted to China — China is

a developing country demonstrating a successful growth model and this is an

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 18

opportunity for African leaders to learn from them. China has the money to

import Africa’s resources and the money to help build Africa’s urgent need for

infrastructure: roads, railroads, ports, electric power systems, etc.

In 2000, the Forum on China-Africa Cooperation (FOCAC) was established to

enhance economic and trade cooperation. Trade has expanded rapidly, moving

from $12 million in 1950 to over $120,000 million now. China is now Africa’s

largest trading partner and, surprisingly, China has a trade deficit with Africa,

importing more than it exports to Africa. Visit any shopping center in any coun-

try in Africa and it is clear that China is flooding Africa with consumer goods

and also machinery, automobiles and electronic items.

Africa’s exports to China are about 80% raw materials like oil but increasingly it

is also manufactured and agricultural such as Egyptian oranges, South African

wines, Ghana’s cocoa beans, Ugandan coffee, Tunisian olive oil and more. In

order to promote that trade, China has bilateral trade agreements with 45 Afri-

can countries, a number of which now have zero tariff preference with China.

In addition to trade, investment from China into Africa between 2003 and 2009

grew from $490 million to $9,300 billion in 49 African countries in mining,

manufacturing, construction, tourism, forestry and fisheries. Part of the China’s

efforts is to sign a bilateral agreement, now with 33 African countries, for pro-

tection of Chinese investments. A China-Africa Development

Fund has already been created to invest in African equities. That fund has al-

ready reached $1 billion by investing in over 30 projects in agricultural machin-

ery manufacturing such as electric power and mining. Plans call for the fund to

expand to $5 billion.

China is also promoting economic and trade zones in Zambia, Mauritius, Nige-

ria, Egypt and Ethiopia where companies can establish manufacturing and trad-

ing operations with appropriate infrastructure and certain government conces-

sions. So far over $600 million has been invested in such zones employing over

6,000 jobs.

As early as the 1970s China was helping to build infrastructure projects in Af-

rica such as the 1,860 kilometer Tanzania-Zambia railway, the 58,000 square

meter Cairo International Conference Center and over 500 other projects such as

highway in Somalia, a harbor in Mauritania, a canal in Tunisia, a National Sta-

dium in Tanzania and many others.

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 19

Preferential loans amounting to over $10 billion to finance projects for airports,

housing and hydropower plants have been made.

The Chinese government has always supported African countries in their effort

to reduce their debts, which have helped relieve their burden of debts to China.

From 2000 to 2009, China canceled 312 debts of 35 African countries, totaling

18.96 billion yuan. That demonstrates China’s determination to help Africa de-

velop, and to help Africa reduce the debt it owes to other countries.

With that kind of flow of money, banks have followed. The China Development

Bank, Export-Import Bank of China, Industrial and Commercial Bank of China,

Bank of China and China Construction Bank are all now active on the continent.

China has also supported the African Development Bank and the West African

Development Bank by injecting funds, cancelling debts and establishing funds

for specific projects.

Tourism is growing as well, with over 300,000 Chinese tourists visiting Africa

each year. African airlines have direct flights to China and a number of Chinese

airlines have direct flights to Africa.

All of this trade and investment is not without problems. Like other countries

around the world, there have been scandals, corruption and disputes such as a

Chinese infrastructure project in Algeria mired in a bribery scandal or arbitrary

seizure of property in Zimbabwe, among other issues.

There is no denying, though, that capital markets in Africa are developing rap-

idly. We have been investing in South Africa for many years and its stock mar-

ket is one of the world’s most sophisticated. In our frontier market funds we

have been active in countries like Kenya, Ghana, Mauritius and others. Nigerian

companies now constitute the largest portion of those forfeiter funds which

now have assets of over $1 billion and growing. We expect to expand even fur-

ther in Africa and invest in many more countries. The future is certainly in Af-

rica for investors from China seeking high growth and new opportunities.

Culled from Reuters, May 2011

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 21

THE UNWISDOM OF ELITES

By Paul Krugman

The past three years have been a disaster for most Western economies. The

United States has mass long-term unemployment for the first time since the

1930s. Meanwhile, Europe’s single currency is coming apart at the seams. How

did it all go so wrong?

Well, what I’ve been hearing with growing frequency from members of the pol-

icy elite — self-appointed wise men, officials, and pundits in good standing —

is the claim that it’s mostly the public’s fault. The idea is that we got into this

mess because voters wanted something for nothing, and weak-minded politi-

cians catered to the electorate’s foolishness. So this seems like a good time to

point out that this blame-the-public view isn’t just self-serving, it’s dead wrong.

The fact is that what we’re experiencing right now is a top-down disaster. The

policies that got us into this mess weren’t responses to public demand. They

were, with few exceptions, policies championed by small groups of influential

people — in many cases, the same people now lecturing the rest of us on the

need to get serious. And by trying to shift the blame to the general populace,

elites are ducking some much-needed reflection on their own catastrophic mis-

takes. Let me focus mainly on what happened in the United States, then say a

few words about Europe.

These days Americans get constant lectures about the need to reduce the

budget deficit. That focus in itself represents distorted priorities, since our im-

mediate concern should be job creation. But suppose we restrict ourselves to

talking about the deficit, and ask: What happened to the budget surplus the

federal government had in 2000?

The answer is, three main things. First, there were the Bush tax cuts, which

added roughly $2 trillion to the national debt over the last decade. Second,

there were the wars in Iraq and Afghanistan, which added an additional $1.1

trillion or so. And third was the Great Recession, which led both to a collapse in

revenue and to a sharp rise in spending on unemployment insurance and other

safety-net programs.

So who was responsible for these budget busters? It wasn’t the man in the

street. President George W. Bush cut taxes in the service of his party’s ideology,

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 22

not in response to a groundswell of popular demand — and the bulk of the cuts

went to a small, affluent minority.

Similarly, Mr. Bush chose to invade Iraq because that was something he and his

advisers wanted to do, not because Americans were clamoring for war against a

regime that had nothing to do with 9/11. In fact, it took a highly deceptive sales

campaign to get Americans to support the invasion, and even so, voters were

never as solidly behind the war as America’s political and pundit elite.

Finally, the Great Recession was brought on by a runaway financial sector, em-

powered by reckless deregulation. And who was responsible for that deregula-

tion? Powerful people in Washington with close ties to the financial industry,

that’s who. Let me give a particular shout-out to Alan Greenspan, who played a

crucial role both in financial deregulation and in the passage of the Bush tax

cuts — and who is now, of course, among those hectoring us about the deficit.

So it was the bad judgment of the elite, not the greediness of the common man

that caused America’s deficit. And much the same is true of the European crisis.

Needless to say, that’s not what you hear from European policy makers. The

official story in Europe these days is that governments of troubled nations ca-

tered too much to the masses, promising too much to voters while collecting too

little in taxes. And that is, to be fair, a reasonably accurate story for Greece. But

it’s not at all what happened in Ireland and Spain, both of which had low debt

and budget surpluses on the eve of the crisis.

The real story of Europe’s crisis is that leaders created a single currency, the

euro, without creating the institutions that were needed to cope with booms

and busts within the euro zone. And the drive for a single European currency

was the ultimate top-down project, an elite vision imposed on highly reluctant

voters.

Does any of this matter? Why should we be concerned about the effort to shift

the blame for bad policies onto the general public?

One answer is simple accountability. People who advocated budget-busting

policies during the Bush years shouldn’t be allowed to pass themselves off as

deficit hawks; people who praised Ireland as a role model shouldn’t be giving

lectures on responsible government. But the larger answer, I’d argue, is that by

making up stories about our current predicament that absolve the people who

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

Page 23

put us here there, we cut off any chance to learn from the crisis. We need to

place the blame where it belongs, to chasten our policy elites. Otherwise, they’ll

do even more damage in the years ahead.

Culled from The New York Times, May 2011

Important Notice

This document is issued by Financial Derivatives Company. It is for information purposes only. It does not constitute any offer, recommendation or solicitation to any person to enter into

any transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices or any representation that any such

future movements will not exceed those shown in any illustration. All rates and figures appearing are for illustrative purposes. You are advised to make your own independent judgment with

respect to any matter contained herein.

A Financial Derivatives Company Publication

: 7739831, 7739889, 2715414; Email: fdc@hyperia.com; Website: www.fdc-ng.com

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Kuratko 8 e CH 11Document37 pagesKuratko 8 e CH 11waqasNo ratings yet

- Commrev Doctrines Busmente FinalsDocument15 pagesCommrev Doctrines Busmente Finalsdenbar15No ratings yet

- Lagos State Investor Handbook FinalsDocument35 pagesLagos State Investor Handbook Finalsdavid patrick50% (2)

- Concept Note On Livelihood Enhancement of Poor in South Odisha: by Harsha TrustDocument12 pagesConcept Note On Livelihood Enhancement of Poor in South Odisha: by Harsha TrustAlok Kumar Biswal100% (1)

- Chapter-6 Gitman FinanceDocument46 pagesChapter-6 Gitman FinanceShoyeb ImteazNo ratings yet

- 2 Corinthians 1: 20 - 22 Explains God's Promises in ChristDocument39 pages2 Corinthians 1: 20 - 22 Explains God's Promises in ChristYu BabylanNo ratings yet

- Banking Law PART - A (12 Marks)Document4 pagesBanking Law PART - A (12 Marks)PrakashNo ratings yet

- Franchise MacdonaldDocument5 pagesFranchise MacdonaldrahulvjainNo ratings yet

- European Monetary SystemDocument2 pagesEuropean Monetary SystemMelissa Muñoz100% (1)

- Corporate Law ProjectDocument15 pagesCorporate Law ProjectAyushi VermaNo ratings yet

- Simple and General Annuities: LessonDocument18 pagesSimple and General Annuities: LessonLyka MercadoNo ratings yet

- Lien On Shares PushpendraDocument5 pagesLien On Shares PushpendraashishNo ratings yet

- Dizon Vs GaborroDocument2 pagesDizon Vs GaborroOyi Lorenzo-LibanNo ratings yet

- Ackman's Letter To PWC Regarding HerbalifeDocument52 pagesAckman's Letter To PWC Regarding Herbalifetheskeptic21100% (1)

- Mobile Bill July 11Document8 pagesMobile Bill July 11Kothamasu PrasadNo ratings yet

- Free Money from Government Accounts? Risks of Using Treasury Direct AccountsDocument30 pagesFree Money from Government Accounts? Risks of Using Treasury Direct Accountslerosenoir100% (10)

- BuwisDocument23 pagesBuwisshineneigh00No ratings yet

- PNB Vs CADocument2 pagesPNB Vs CAArnold Rosario ManzanoNo ratings yet

- Microeconomics - Problem Set 4Document4 pagesMicroeconomics - Problem Set 4Juho ViljanenNo ratings yet

- AUS Backpay Tax TbleDocument6 pagesAUS Backpay Tax TbleBunda MollyNo ratings yet

- Money MarketDocument67 pagesMoney MarketAvinash Veerendra TakNo ratings yet

- English - FINAL DRAFT UNS P1-11 HUMAN OBLIGATION GENERAL LEDGER EXAMPLE FOR DISTRIBUTION PHASE 2Document5 pagesEnglish - FINAL DRAFT UNS P1-11 HUMAN OBLIGATION GENERAL LEDGER EXAMPLE FOR DISTRIBUTION PHASE 2UN Swissindo100% (1)

- Employee Clearance FormDocument1 pageEmployee Clearance FormRrichard Prieto Mmallari100% (1)

- Guide to the Negotiable Instruments LawDocument13 pagesGuide to the Negotiable Instruments LawPaul Christopher PinedaNo ratings yet

- TILA Shared PDFDocument8 pagesTILA Shared PDFGretchen Alunday SuarezNo ratings yet

- SME'sDocument7 pagesSME'sJiezelEstebeNo ratings yet

- Unpaid SellerDocument17 pagesUnpaid SellersiddharthaNo ratings yet

- Secured Transactions Flow Chart (Collateral)Document10 pagesSecured Transactions Flow Chart (Collateral)Kathleen Alcantara94% (16)

- Topic 3 - Stock ValuationDocument50 pagesTopic 3 - Stock ValuationBaby KhorNo ratings yet

- 8.0 Instructions To Candidates For Examination 8.1 Filling of Application Form A. Offline OMR ApplicationDocument4 pages8.0 Instructions To Candidates For Examination 8.1 Filling of Application Form A. Offline OMR ApplicationMohan KumarNo ratings yet