Professional Documents

Culture Documents

ZZZZZZZZZZZZZZZZZZZ Cost Accounting Controlling 2010-10-11

Uploaded by

Muhammad Azim Khan NiaziOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ZZZZZZZZZZZZZZZZZZZ Cost Accounting Controlling 2010-10-11

Uploaded by

Muhammad Azim Khan NiaziCopyright:

Available Formats

-I-

Literature II

List of Abbreviations III

A. Cost Accounting 1

1 Basics of Cost Accounting 1

1.1 Concept and Structure of Accounting .................................................. 1

1.2 Cost Categories ................................................................................... 2

1.3 Groups and Systems of Cost Accounting ............................................ 2

2 Cost Category Accounting 3

2.1 Tasks of Cost Category Accounting .................................................... 3

2.2 Costs of Materials ................................................................................ 5

2.3 Imputed Depreciations ....................................................................... 12

3 Cost Center Accounting 19

3.1 Tasks of Cost Center Accounting ...................................................... 19

3.2 Steps of Cost Center Accounting ...................................................... 20

3.3 Methods of internal performance allocation ....................................... 26

3.3.1 Step-ladder Method or Step Down Allocation........................... 27

3.3.2 Equation Method or Reciprocal Allocation ............................... 33

4 Cost Unit Accounting 40

4.1 Tasks and Types of Cost Unit Accounting ......................................... 40

4.2. Usual Surcharge Rate Calculation..................................................... 42

4.3 Machine Hour Rate Calculation ......................................................... 49

5 Operating Income Statement 57

5.1 Tasks of an Operating Income Statement ......................................... 57

5.2 Expenditure Style of Presentation ..................................................... 59

5.3 Cost of Sales Style of Presentation ................................................... 65

B. Controlling 72

1. Basics of Controlling 72

2. Operations Management 73

2.1. Direct Costing .................................................................................... 73

2.2. Bottleneck-Analysis ........................................................................... 76

2.3. Break-Even-Analysis ......................................................................... 89

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- II -

2.4. Cost Control 94

2.4.1. Introduction to Cost Control ...................................................... 94

2.4.2. Cumulative Method ................................................................ 100

2.4.3. Differentiated Method ............................................................. 106

3. Strategic Management 110

3.1 Target Costing ................................................................................. 110

3.2 Value Benefit Analysis ..................................................................... 120

3.3 Balanced Scorecard ........................................................................ 125

Literature

Horngren, C.; Bhimani, A.; et al.: Management and Cost Accounting;

New Jersey USA 1999

Horngren, C.; Foster, G.; et al.: Cost Accounting; New Jersey USA

2000

Neuner, J.; Frumer, S.: Cost Accounting; Homewood 1967

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- III -

List of Abbreviations

al depreciation per unit used

at depreciation allowance in period t

A initial value

bi consumption of material for the production of one product unit of

product i

cv variable costs

Cf fixed costs

CC Cost center

CM contribution margin CM = p − c v

d rate of degression

I/J total number counted

L total potential of usage

mij number of u that CC i provides for CC j

Mi total u provided by CC i

n asset life

p price of goods

P Profit P = p×u

p.c. primary costs

PSCi primary costs of CC i

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- IV -

q price of resources

r total consumption r = x×v

Rn remaining value

Rt value in period t

s.c. secondary costs

t considered period

TCM total contribution margin ∑ CM

tpi transfer price for 1 u of CC i

tp1*m12 individual consumption (transfer price of CC 1 times the number of

u provided from CC 1 to CC 2)

TU time unit

u unit

v consumption per unit

xi output per product

xb output breakeven

?p planning data

?a actual data

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

-1-

A. Cost Accounting

1 Basics of Cost Accounting

1.1 Concept and Structure of Accounting

In an industrial plant, factors of production (raw materials, machines,

personnel) are used to produce and sell products. This comprises a

lot of activities within the organization as well as interactions with the

environment. To control these activities, a lot of information has to be

provided, e.g. about cash and product flows. This is the task of ac-

counting.

Accounting = systematic determination, description, analysis and in-

terpretation of numbers (amount and value) of single businesses and

their relations with other business subjects.

Concerning the structure, the following division is common:

external accounting (balance sheet, profit and loss statement)

internal accounting (cost and revenue accounting)

Basically, it can be assumed that external addressees (e.g. creditors,

the state) can only inform themselves through published information,

while internal addressees (owners, employees, management) can

use internal data as well. But this is not always true in practice. For

example, a bank which actually is an extern addressee will usually be

able to demand internal data while a small shareholder, who is an in-

ternal addressee, cannot.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

-2-

1.2 Cost Categories

1) Variable Costs and Fixed Costs

a) variable costs = change in dependency of the

changes of a cost driver

b) fixed costs = do not change despite changes of a

(certain) cost driver,

2) Direct Costs and Indirect Costs

a) direct costs = can be directly assigned to a cost ob-

ject

b) indirect costs (also overheads) = can not be directly

accounted to a cost object

1.3 Groups and Systems of Cost Accounting

Cost accounting is usually divided into the following

groups according to the information objective:

1) Cost category accounting

2) Cost center accounting

3) Cost unit accounting

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

-3-

2 Cost Category Accounting

2.1 Tasks of Cost Category Accounting

The system of cost category accounting is used to an-

swer the question of which costs did occur or are ex-

pected to occur.

Æ recording of all costs, that occurred or are expected

during an accounting period (partly divided into

quantity figures und value figures)

Æ structuring of the recorded costs using certain crite-

ria, usually factors of production, e.g. cost of materi-

als, personnel costs, imputed depreciations, imputed

interests; are used for this

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

-4-

Definitions:

costs of materials = rated consumption quantity of ma-

terial consumer goods, a company buys (especially

raw materials, auxiliary supplies, operating supplies)

personnel costs = costs for personnel

imputed depreciations = the costs that occur by wear

and tear at durable or immaterial goods

imputed interests = in cost accounting, interests are

usually calculated for using capital provided by the

company owners and by creditors

Tasks of cost category accounting:

1) Basis for following calculations (cost center account-

ing and cost unit accounting)

2) Own analysis of cost structure (portions of particular

costs, chronological development)

In this lecture only 2 categories are discussed more

closely. Those will be costs of materials and deprecia-

tions.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

-5-

2.2 Costs of Materials

Definitions:

costs of materials = rated consumption quantity of ma-

terial consumer goods, a company buys (especially

raw materials, auxiliary supplies, operating supplies)

raw materials = material goods, a company takes over

from other companies and changes, and which be-

come a main component of the product (e.g. wood in

the wood-processing industry)

auxiliary supplies = material goods, a company takes

over from other companies and changes, and which

become unessential product components (e.g.

screws, nails, glue)

operating supplies = material goods, which a company

takes over from other companies, and which are

used in the production process, but do not enter the

product (e.g. fuel, lubricant)

Æ quantity and value need to be determined each.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

-6-

1) Determination of the consumption of material:

a) Inventory method:

Both initial inventory and final inventory are deter-

mined by an inventory (physical inventory taking)

b) Return accounting:

Consumption quantities are derived from the pro-

duced units and their composition, which is recorded

in bills of material or receipts, including an additional

quantity for waste and (factory) rejects.

c) Clearing or perpetual inventory method:

The consumption of material is recorded using mate-

rial stores accounts and receipts (material requisition

slips).

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

-7-

2) Valuation of material consumption quantities:

a) average valuation:

valuation with the help of a weighted arithmetic av-

erage of the purchase prices (either period related or

permanent)

Evaluation / criticism:

simplification, relative good results when prices fluc-

tuate in both directions

b) method of process costing:

form of collective valuation

valuation with the help of assumptions concerning

the sequences of consumption, either relating to the

date of entry or the prices (period related or perma-

nent, respectively)

• FIFO: first in-first out

• LIFO: last in-first out

• HIFO: highest in-first out

• LOFO: lowest in-first out

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

-8-

Evaluation / criticism:

• simplification; assumed sequence of consump-

tion should be equal to the actual

• sequence (e.g. FIFO when silo storing, LIFO

when storing on a dump)

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

-9-

Example A.1

quantity price

initial inventory 100 22.-

increase in inventory 01/04 140 20.-

quantity withdrawn 01/09 110 ?

increase in inventory 01/15 120 21.-

quantity withdrawn 01/20 100 ?

final inventory 150

period related average valuation:

100 ∗ 22 + 140 ∗ 20 + 120 ∗ 21

= 20.89

360

material costs = 210 ∗ 20.89 = 4,386.90

FIFO-valuation:

material costs = 100 ∗ 22 + 110 ∗ 20 = 4,400

LIFO-valuation:

material costs = 120 ∗ 21 + 90 ∗ 20 = 4,320

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 10 -

Exercise A.1

For a raw material the following changes in stock occurred:

Change in inventory Amount (kg) Price (€/kg)

Initial inventory 1,000 15.00

Increase in inventory 10,000 12.10

Decrease in inventory 7,000 ?

Increase in inventory 9,000 16.00

Decrease in inventory 5,000 ?

Final inventory 8,000

Calculate the value of the final inventory as well as the value of the

goods used by means of the following methods:

a) period related average valuation,

b) period related FIFO-valuation,

c) period related LIFO-valuation.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 11 -

Exercise A.2

For a raw material the following changes in stock occurred:

Change in Inventory Amount (kg) Price (€/kg) Price (€)

Initial inventory 400 24.00 9,600

Decrease 02/03 300

Increase 03/12 250 25.00 6,250

Increase 04/15 150 28.00 4,200

Decrease 06/18 200

Increase 08/20 100 29.00 2,900

Decrease 11/03 150

Calculate the value of the final inventory as well as the value of the

goods used by means of the following methods:

a) period related average valuation,

b) period related FIFO-valuation,

c) period related LIFO-valuation.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 12 -

2.3 Imputed Depreciations

Definition:

depreciations = the costs that occur by wear and tear at

durable or immaterial goods

usually described as calculatory depreciations, since

a different valuation, compared to the calculation ac-

cording to legal requirements, is used.

Reasons for depreciation:

a) deterioration of time, e.g. at a machine, which

stands outside (even, when it is not used in the

process of production)

b) deterioration of use, e.g. by employment in the proc-

ess of production

c) technical progress, e.g. development of more effi-

cient machines

d) depletion of real estates / property, e.g. at gravel pit

e) expiration of patents

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 13 -

For the determination of the depreciation allowances,

the following questions have to be answered:

1) depreciation base

2) useful life or potential of usage

3) depreciation method

1) Depreciation base:

• historical costs (purchasing price + purchasing

costs)

• replacement / market prices (value at the time of

machine replacement)

2) Useful life:

• technically possible useful life:

• economic asset life: reasonable asset life under an

economic point of view

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 14 -

3) Method of depreciation:

a) time-depending methods

depreciation depending on the time of the calendar

• straight-line depreciation

• declining-balance depreciation

• sum-of-the-years digit depreciation

b) usage-depending method

depreciation depending on the usage of the machine

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 15 -

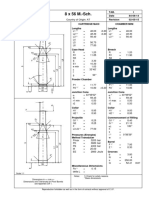

Example A.2

purchasing price 280,000 €

purchasing costs 20,000 €

useful life 6 years

remaining value 60,000 €

total potential of usage 24,000 h

effective usage t1 4,200 h

effective usage t2 4,400 h

effective usage t3 3,800 h

a) straight-line depreciation:

A − Rn

at =

n

(280,000 + 20,000 ) − 60,000 = 40,000 €/ year

depreciation =

6

b) declining – balance depreciation:

⎛ Rn ⎞

⎜

p = 100 ∗ ⎜1 − n ⎟

⎝ A ⎟⎠

at = A ∗ p (p = percentage rate)

⎛ 60,000 ⎞

p = 100 ∗ ⎜⎜1 − 6 ⎟ = 23.5275508 %

⎟

⎝ 300 , 000 ⎠

a1 = 300,000 ∗ 0.235275508 = 70,582.65

a2 = (300,000 − 70,582.65) ∗ 0.235275508 = 53,976.28

a3 = (300,000 − 70,582.65 − 53,976.28) ∗ 0.235275508 = 41,276.99

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 16 -

c) sum-of-the-years digit depreciation:

2 ∗ ( A − Rn )

d=

n(n + 1)

at = (n − t + 1) ∗ d

2 ∗ (300,000 − 60,000 )

d= = 11,428.57

6 ∗ (6 + 1)

a1 = (6 − 1 + 1) ∗ 11,428.57 = 68,571.42

a2 = (6 − 2 + 1) ∗ 11,428.57 = 57,142.85

a3 = (6 − 3 + 1) ∗ 11,428.57 = 45,714.28

d) usage-depending method:

A − Rn

al =

L

at = lt ∗ al

300,000 − 60,000

al = = 10 € / hour

24,000

a1 = 4,200 ∗ 10 = 42,000

a2 = 4,400 ∗ 10 = 44,000

a3 = 3,800 ∗ 10 = 38,000

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 17 -

Evaluation / criticism:

Evaluation depends on reason of depreciation, for the us-

age (wear and tear) the depreciation should be shown

as exactly as possible

a) time related methods are good for deterioration of time

b) depreciations depending on usage are good for dete-

rioration of usage

t since usually both reasons are relevant, a combination

of both methods seems reasonable

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 18 -

Exercise A.3

The following information regarding a machine is available:

Purchasing price 1,000,000 €

Purchasing costs 100,000 €

Useful life 4 years

Remaining value 20,000 €

Total potential of usage 16,000 h

effective usage t1 3,800 h

effective usage t2 4,500 h

effective usage t3 4,200 h

effective usage t4 3,500 h

a) Calculate imputed depreciation and book values for the periods t1

to t4 if straight-line depreciation is to be used.

b) Calculate imputed depreciation and book values for the periods t1

to t4 if declining balance depreciation is to be used.

c) Calculate imputed depreciation and book values for the periods t1

to t4 if sum-of-the-years digit depreciation is to be used.

d) Calculate imputed depreciation and book values for the periods t1

to t4 if usage depending depreciation is to be used.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 19 -

3 Cost Center Accounting

3.1 Tasks of Cost Center Accounting

The system of cost center accounting is supposed to give an answer

to the question in which business areas costs originated or will origi-

nate. In this system the separation into direct and indirect costs is im-

portant.

Direct assignment of indirect costs to cost units is not possible; with-

out the use of cost center accounting, they could only be assigned to

a cost unit by using a total surcharge

Tasks of cost center accounting:

1) Basis for cost unit accounting as down-stream calculation.

The system of cost center accounting is supposed to allow an ex-

act assignment of indirect costs to cost units; it is considered to

which extent a cost unit has used the capacity of a cost center

2) Supervision of operating activities within the single cost centers

regarding their cost-effectiveness and compliance of cost budg-

ets.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 20 -

3.2 Steps of Cost Center Accounting

1st Step: assignment of indirect costs which have been recorded by

the cost category accounting to cost centers

2nd Step: allocation of internal performance

3rd Step: formation of surcharge rates for the cost unit accounting

4th Step: control of cost-efficiency

1st Step: Assignment of Indirect Costs to Cost Centers

The assignment should – if rationally supportable – correspond to the

costs a cost center has caused, i.e. indirect costs should be assigned

to those cost centers that are responsible for their origin.

First of all the question of which of the costs are indirect costs needs

to be solved. For this purpose, we will look at the types of costs again:

1) Material Costs:

are partly direct costs and partly indirect costs

• raw materials: often direct costs; usually they are recorded as

such

• auxiliary supplies: strictly taken, they are direct costs as well,

but for the reason of cost-efficiency they usually are not re-

corded as such (so called fictive indirect costs)

• operating supplies: are mostly real indirect costs

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 21 -

2) Personnel Costs:

are partly direct costs and partly indirect costs

• direct labor (wages for work directly performed to produce the

products): usually handled as direct costs, although the as-

signment can be difficult (meaning, that often, those wages

are not depending on activity, e.g. time or minimum wages)

• auxiliary labor (wages, that are not directly used for produc-

tion, e.g. wages for maintenance): indirect costs; and as far

as they are not provided for single cost units, they are usually

handled as such.

• salaries: indirect costs

• imputed entrepreneur income: indirect costs

• legally required social costs: can be accounted together with

wages and salaries, i.e. they are partly direct costs and partly

indirect costs

• voluntary social costs: indirect costs

• other personnel costs: indirect costs

3) Imputed depreciations:

usually accounted as indirect costs, but can also be direct costs

(e.g. when depreciations, depending on usage, are used)

4) Imputed interests:

normally indirect costs, since there is no information which kind of

capital is used in the cost center

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 22 -

Primary costs are those costs which are directly taken over from

cost category accounting.

2 types can be distinguished:

a) Cost center direct costs:

can be directly assigned to the cost center which caused

them, e.g. costs for wages and salaries of personnel that is

only employed at a particular cost center

b) Cost center overheads:

allocation only possible with the help of units of billing, e.g.

salary of a foreman who is leading more than one cost center

(e.g. allocation in proportion to employees employed in a cost

center or to number of machines)

Please note: I have mentioned the concept of direct and indirect

costs before. Those are strictly taken direct cost unit costs

and indirect cost unit costs.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 23 -

2nd Step: allocation of internal performances

This allocation is necessary, because some cost centers only produce

what is used within the business unit itself and therefore show no di-

rect relation to the cost units.

2 types can be distinguished:

1) Services, products, performances that are usable for several

years:

e.g. a self-generated machine can be capitalized, and there-

fore, they can be handled as a cost unit

they enter the cost center accounting for several periods as

depreciations and interests

2) Services, products, performances that are used within the

same period:

e.g. energy, maintenance

those performances have to be charged between the receiving and

delivering cost center

• indirect cost center: deliver performances, services to differ-

ent cost centers

• final cost center: performances, services can be directly as-

signed to cost units

Normally the following final cost centers are used: material (supply

and storage of material), manufacturing, administration and selling /

distribution

Therefore, the task of internal performance allocation is to allocate the

primary costs, which are assigned to the indirect cost centers, to final

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 24 -

cost centers according to provided and received performance. The

allocated costs are called secondary costs.

The assignment should follow the principle that costs are allocated to

that cost center which causes them. Usually, a proportional relation is

assumed between the reference figure and performance delivery, as

well as between the reference figure and performance utilization. (e.g.

number of hours of repair for the cost center repair)

Methods will be introduced and explained further on.

3rd Step: formation of surcharge rates

After finishing the 2nd step, all costs are assigned to final cost centers.

Now, they have to be allocated to cost units. Therefore, the indirect

costs are set into relation with a reference figure (e.g. direct labor

costs, produced output, provided machine hours). This results in a

surcharge rate. With the help of this surcharge rate, the indirect costs

can be allocated to the cost units.

Step 3 is the connection between cost center accounting and cost

unit accounting (Chapter 4). It is necessary when cost unit account-

ing uses a surcharge calculation. Therefore it is only necessary for

specified forms of cost unit accounting.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 25 -

4th Step: Control of cost-efficiency

simple form:

comparison of actual total costs and allocated total costs of final cost

centers

• positive difference (underapplied costs): less than actual re

corded indirect costs are allocated to the cost units

• negative difference (overapplied costs)

But: no meaningful cost efficiency control, since the allocated total

costs are only an average of historical costs 3.Internal Cost Allocation

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 26 -

3.3 Methods of internal performance allocation

This is the 2nd step of the cost center accounting.

Problems:

• large number of cost centers

• mutual performance interweaving

Different methods have been developed for the internal

performance allocation

1) no consideration of performance interweaving: ex-

pense distribution method

2) consideration of one-sided performance interweav-

ing: stepladder method

3) consideration of mutual performance interweaving:

equation method, iterative methods

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 27 -

3.3.1 Step-ladder Method or Step Down Allo-

cation

a) assignment of costs (indirect cost center) to final

cost centers using other indirect cost centers, i.e.:

• consideration of performance relations of down-

stream cost centers

• no consideration of performance relations of pre-

liminary cost centers

Please note: sequence of cost centers should be se-

lected in a way, that, if possible, minor performance

relations are neglected

b) assignment of primary costs in proportion to the per-

formance utilization

Definition

transfer price = a cost centers primary costs: total of

provided performance units

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 28 -

Please note: only performances provided to down-

stream cost centers count

Indirect Indirect

Final cost Final cost Final cost Final cost

cost cost

center 1 center 2 center 5 center 4

center center

Primary

p.c. p.c. p.c. p.c. p.c. p.c.

costs

Allocation

indirect

CC 1

Primary

and

p.c. + s.c.

secondary

costs

Allocation

indirect

CC 2

Primary

and p.c. p.c. p.c. p.c.

secondary + s.c. + s.c. + s.c. + s.c.

costs

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 29 -

Example A.3

Example: (CC = Cost Center)

Primary costs CC 1 (cost center) (repair shop) 134,000

Primary costs CC 2 (production planning) 64,500

Primary costs CC 3 (final cost center) 112,000

Primary costs CC 4 (final cost center) 97,500

Total 408,000

Reference figure CC 1: provided hours of repair

Total hours of repair provided 3,000

Hours of repair for CC 2 150

Hours of repair for CC 3 1,300

Hours of repair for CC 4 1,550

Reference figure CC 2: number of prepared jobs

Total of prepared jobs 900

Prepared jobs CC 1 200

Prepared jobs CC 3 300

Prepared jobs CC 4 400

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 30 -

1st Step: Determination of cost center sequence

a) in any case, indirect cost centers prior to final cost

centers

b) sequences within indirect cost centers:

approximate determination of value of comparative

performances (1 to 2 as well as 2 to 1)

primary costs

∗ performanc e provided for intitial cost centers

∑ provided performanc es

c) The sequence of final cost centers is optional, since

there are no performance relations between them.

Continuing Example A.3:

performance of CC 1 for CC 2:

134,000

* 150 = 6,700

3,000

performance of CC 2 for CC 1:

64,500

* 200 = 14,333.33

900

Since the performance of cost center 2 for cost center 1 shows a

higher value than the return service, CC 2 is placed prior to CC 1

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 31 -

2nd Step: Allocation

allocation occurs gradually, e.g.:

a) the primary costs of CC 2 are allocated to down-

stream cost centers 1, 3 and 4 according to the per-

formance provided for those cost centers

b) the primary and the secondary costs of CC 1 are al-

located to the downstream cost centers 3 and 4

Please note: only performances for downstream cost

centers will be considered

Continuing Example A.3:

Indirect CC 2 Indirect CC 1 Final CC 3 Final CC 4

64,500.-- 134,000.-- 112,000.-- 97,500.--

14,333.33 21,500.-- 28,666.67

148,333.33 133,500.-- 126,166.67

67,660.82 80,672.51

201,160.82 206,839.18

64,500

q2 = = 71.67

900

148,333.33

q1 = = 52.05

3,000 − 150

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 32 -

Evaluation / criticism:

• relatively simple calculation

• performances of downstream cost centers for pre-

liminary cost centers are neglected

• at least one-way consideration of performance rela-

tions

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 33 -

3.3.2 Equation Method or Reciprocal Alloca-

tion

Simultaneous allocation of all cost centers costs with

the help of a system of equations, i.e. consideration of

all mutual performance interweaving

one equation for each cost center:

• known figures: primary costs, provided and received

performance units

• unknown figures: transfer costs for a cost centers

performance

Please note: number of transfer prices equal number of

equations, i.e. clear solution

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 34 -

Basic structure of equations:

Total value of provided performance = cost center pri-

mary costs + total value of performance received

Whereas:

Value of received performance = Σ values of indi-

vidually received performances

Value of provided performance = Σ values of indi-

vidually provided performances

Value of individual performance relation = number of

performance units * transfer price

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 35 -

Continuing Example A.3:

CC 1: 134,000 + 200 q2 = 3,000 q1

CC 2: 64,500 + 150 q1 = 900 q2

430 + q1 = 6 q2

q1 = 6 q2 - 430

CC 3: 112,000 + 1,300 q1 + 300 q2 = q3

CC 4: 97,500 + 1,550 q1 + 400 q2 = q4

For CC 3 and CC 4 the provided performance is declared to be 1, be-

cause for this is example, no information, concerning the type as well

as the height of performances of those cost centers, is given, i.e. q3

and q4 equal the total costs for CC 3 and 4.

First of all, the solution for the first 2 equations (2 equations with two

unknown variables):

134,000 + 200 q2 = 3,000 * (6 q2 – 430)

134,000 + 200 q2 = 18,000 q2 – 1,290,000

1,424,000 = 17,800 q2

q2 = 80 €/unit

q1 = 50 €/unit

In the next step, the determined transfer prices will be used in the

other equations:

CC 3: 112,000 + 1,300 * 50 + 300 * 80 = 201,000

CC 4: 97,500 + 1,550 * 50 + 400 * 80 = 207,000

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 36 -

Evaluation / criticism:

• in this case, variations are minimal; but this state-

ment cannot be generalized

• determination of exact total costs of final cost cen-

ters as all performance relations are considered

• high compute time, especially with complex cost

center systems (direct solution often difficult)

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 37 -

Exercise A.4

The following information is given:

to CC1 CC 2 CC 3 CC 4 Sum

from

CC 1 30 50 80 70 230

CC 2 200 0 120 180 500

CC 3 0 0 0 0 800

CC 4 0 0 0 0 500

CC 1 CC 2 CC 3 CC 4

primary costs 66,000 51,000 120,000 200,000

a) Conduct an internal cost allocation by means of the step-ladder

method and calculate the cost of services for the final cost cen-

ters.

b) Set up the complete system of equations in order to simultane-

ously allocate internal costs. Calculate the cost of services for the

final cost centers.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 38 -

Exercise A.5

The following data is given:

primary overall From CC 1 From CC 2 From CC 3

costs performance received received received

performance performance performance

[kWh] [km] [h]

CC1 50,000 € 30,000 kWh -- -- --

CC2 100,000 € 500,000 km 6,000 -- 24,000

CC3 72,000 € 80,000 h -- 150,000 --

CC4 140,000 € 8,000 units (X) 24,000 300,000 40,000

CC5 200,000 € 10,000 units (Y) -- 50,000 16,000

a) Conduct an internal cost allocation by means of the step-ladder

method and calculate the cost of services for the final cost cen-

ters.

b) Set up the complete system of equations in order to simultane-

ously allocate internal costs. Calculate the cost of services for the

final cost centers.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 39 -

Exercise A.6

A company consists of three indirect cost centers (CC1, CC2, CC3)

and two final cost center (CC4, CC5). The relations between those

cost centers are shown in the following table:

to CC1 CC2 CC3 CC4 CC5 Sum

from

CC1 10 20 25 35 20 110

CC2 20 15 0 70 60 165

CC3 30 20 0 80 70 200

The following primary costs are given:

CC1 CC2 CC3 CC4 CC5

Primary costs 100,000 200,000 250,000 400,000 600,000

a) Determine the cost center sequence which leads to the best re-

sults when using the step-ladder method.

b) Set up the complete system of equations in order to simultane-

ously allocate internal costs.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 40 -

4 Cost Unit Accounting

4.1 Tasks and Types of Cost Unit Accounting

The system of cost unit accounting is supposed to answer the ques-

tion for which purpose costs did occur or will occur.

Definition:

Cost units = produced goods or other operational services, which ac-

tivated or will activate wear and tear, e.g.:

• Jobs of single unit production

• Product units or lots of batch, serial or mass production

• Consulting, research, transport or other services for company ex-

ternals

• Internal performance (e.g. self provided facilities)

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 41 -

Tasks of cost unit accounting: (calculation)

Generally: Cost determination for individual units, e.g. unit related

manufacturing costs and unit related prime costs

1) Evaluation whether the profit target for individual products was

achieved or not as well as regulation of production and sales with

regard to a better target achievement

2) Basis for the selection of prices as well as of production and sale

units

Please note: This is just the view of cost accounting. For reaching

a decision you need to consider other aspects as well.

3) Basis for decisions making concerning the question of producing

or not producing, when prices are given / known.

4) Basis for the selection of lot sizes while producing more than one

product

5) Valuation of finished and unfinished products as well as self pro-

vided facilities

Types of cost unit accounting:

1) output costing: for one product

2) weighting figure calculation: for different versions of one particular

product

3) surcharge calculation: for different products

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 42 -

4.2. Usual Surcharge Rate Calculation

System of surcharge rate calculation:

Direct material costs

+ material overheads

= Material costs

Direct labor costs

+ Special direct costs of manufacturing

+ Manufacturing overheads

= + Manufacturing costs

= Costs of production

+ Administrative overheads

+ Selling overheads

= Prime costs

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 43 -

Determination of surcharge rates:

Surcharge rate for material overheads [%] =

material overheads

∗ 100

direct material costs

Surcharge rate for manufacturing overheads [%] =

manufactur ing overheads

∗ 100

direct labor costs

Surcharge rate for administrative overheads [%] =

administrative overheads

∗ 100

production costs of units sold

Surcharge rate for selling overheads [%] =

selling overheads

∗ 100

production costs of units sold

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 44 -

Example A.4

Information about all products:

Direct material costs 120,000 €

Material overheads 36,000 €

Direct labor costs cost center 1 200,000 €

Manufacturing overheads cost center 1 160,000 €

Direct labor costs cost center 2 84,000 €

Manufacturing overheads cost center 2 134,400 €

Administrative overheads 55,080 €

Sales overheads 58,752 €

Information about product X:

Direct material costs 160 €/unit

Direct labor costs cost center 1 180 €/unit

Direct labor costs cost center 2 135 €/unit

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 45 -

Calculation:

Direct material costs 160 €/unit

Material overheads 48 €/unit

Material costs 208 €/unit

Direct labor costs cost center 1 180 €/unit

Manufacturing overheads cost center 1 144 €/unit

Direct labor costs cost center 2 135 €/unit

Manufacturing overheads cost center 2 216 €/unit

Manufacturing costs 675 €/unit

Costs of production 883 €/unit

Administrative overheads 66.23 €/unit

Selling overheads 70.64 €/unit

Prime costs 1,019.87 €/unit

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 46 -

Determination of surcharge rates:

36,000

for material overheads: 120,000 = 30%

160,000

for manufacturing overheads cost center 1: 200,000 = 80%

134,400

for manufacturing overheads cost center 2: = 160%

84,000

55,080

for administration overheads: = 7.5%

734,400

58,752

for selling overheads: = 8%

734,400

Determination of indirect costs for product X:

Material overheads 160 ∗ 0.3 = 48 € / unit

Manufacturing overheads cost center 1 180 ∗ 0.8 = 144 € / unit

Manufacturing overheads cost center 2 135 ∗ 1.6 = 216 € / unit

Admin. overheads (160 + 180 + 135 + 48 + 144 + 216) ∗ 0.075 = 66.23 € / unit

Selling overheads (160 + 180 + 135 + 48 + 144 + 216) ∗ 0.08 = 70.64 € / unit

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 47 -

Evaluation / criticism:

• Using differentiated surcharge rates leads to result,

which are more meaningful than the results arising

from only a single surcharge rate

• Precision of results depends on the accurate re-

cording of direct costs:

small rate of direct costs compared to indirect costs

leads to high surcharge rates, which can result in the

fact that mistakes from recording direct costs have a

strong influence on indirect costs

• Precision of results depends on the fact, whether the

assumed proportional relation between indirect costs

and the basis for the surcharge rate (direct costs or

manufacturing costs) really exists or not:

often a proportional relation does not exist; it may

exist between material overheads and direct mate-

rial costs, but not with e.g. manufacturing overheads

and direct labor costs (especially as part of an in-

creasing automation)

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 48 -

Exercise A.7

Calculate the prime costs per unit of products X and Y by using the

following (simplified) data, following the approach of surcharge rate

calculation (all data refers to one period).

Amount of production and of units sold for product X 1,000 u

Amount of production and of units sold for product y 2,000 u

Cost of raw materials product X 1,000,000 €

Cost of raw materials product Y 600,000 €

Direct labor costs for product X 1,400,000 €

Direct labor costs for product Y 1,600,000 €

Straight-line depreciations for machines in production 600,000 €

Wages for workers of the raw materials warehouse 200,000 €

Wages for workers in administrative department 400,000 €

Wages for workers in selling department 200,000 €

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 49 -

4.3 Machine Hour Rate Calculation

Advancement of usual surcharge rate calculation, for the reason, that

the proportional relation between direct labor costs and manufacturing

overheads, which was assumed above, hardly ever exists in reality

(increasing automation).

t The aim is an exact allocation of manufacturing overheads, by

distinction between machine-depending and machine-indepen-

dent manufacturing overheads

The system of machine hour rate calculation is often described as an

individual method. Strictly taken it is version of surcharge rate calcula-

tion since the basic approach is identical. The only difference lies in

the more exact allocation of some manufacturing overheads.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 50 -

Steps of Machine hour rate calculation:

1) Separation of manufacturing overheads into ma-

chine-depending and machine-independent costs:

• machine-depending: e.g. imputed depreciations,

imputed interests, energy costs, operation supply

costs, maintenance costs

• machine-independent: e.g. salaries, auxiliary

supply costs, rent

Example A.5

(For the basic data see Example A.4)

Additional information about CC1:

imputed depreciations 36,000 €

imputed interests 10,400 €

energy costs 10,700 €

operation supply costs 9,600 €

maintenance costs 7,400 €

costs of tools 30,400 €

other costs 31,000 €

TOTAL 135,500 €

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 51 -

2) Allocation of machine depending costs on the basis

of machine hours:

a) determination of costs per machine hour

machine - depending manufactur ing overheads

= costs per machine hour

capacity

whereas the capacity equals the total machine

hours

b) determination of machine-depending indirect

costs:

costs per machine hour ∗ machine hours for the

product =

machine-depending indirect costs for the product

Continuing Example A.5:

Assumption:

total of 3,440 hours per period; 4 hours for product X

135,500

machine hour rate = = 39.39 € / hour

3,440

machine-depending costs of product X = 39.39 ∗ 4 = 157.56 € / unit

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 52 -

3) Allocation of machine-independent costs on the ba-

sis of direct

labor costs:

machine − independin g indirect costs

∗ 100 = surcharge rate

direct labor costs

Continuing Example A.5:

remaining manufacturing overheads = 160,000 – 135,500 = 24,500 €

24,500

surcharge rate = = 12.25 %

200,000

machine-independent costs of product X = 0.1225 * 180 = 22.05 € /

unit

4) Allocation of remaining overheads (material, admin-

istrative and sales overheads):

as in usual surcharge rate calculation

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 53 -

5) System of machine hour rate calculation:

Direct material costs

+ material overheads

= Material costs

Direct labor costs center

+ special direct costs of manufacturing

+ machine-depending

manufacturing overheads

+ machine-independent

manufacturing overheads

= + Manufacturing costs

= costs of production

+ Administrative overheads

+ Sales overheads

= Prime costs

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 54 -

Continuing Example A.5:

Direct material costs 160 €/unit

Material overheads 48 €/unit

Material costs 208 €/unit

Direct labor costs center 1 180 €/unit

machine-depending manufacturing overheads CC 1 157.56 €/unit

remaining manufacturing overheads cost center 1 22.05 €/unit

Direct labor costs center 2 135 €/unit

Manufacturing overheads cost center 2 216 €/unit

Manufacturing costs 710.61 €/unit

Costs of production 918.61 €/unit

Administrative overheads 68.90 €/unit

Sales overheads 73.49 €/unit

Prime costs 1.061 €/unit

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 55 -

Evaluation / criticism of the machine hour rate calcula-

tion:

• Using differentiated surcharge rates for manufac-

turing overheads leads to results, which are more

meaningful than the results arising from only a

single surcharge rate

• Separation into machine-depending and inde-

pendent costs is often difficult and only possible

with primary costs

• More complex system than surcharge rate calcu-

lation

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 56 -

Exercise A.8

A company has obtained the following information about two prod-

ucts:

Product A Product B

Amount of production and of units sold in u/period 1,000 1,500

Costs of raw materials in €/period 80,000 30,000

Costs of production wages in €/period 120,000 200,000

Sales price in €/u 1,000 350

Overhead costs of cost centers in €/period:

Purchasing 220,000

Production 600,000

Administration 125,000

Sales 62,500

The company also calculates that 80 % of overhead costs of produc-

tion are dependent on the usage of machines. The potential of usage

of the machines during a period is 1,600 h. For product A 1,200 h is

used, for product B 400 h.

Calculate the prime cost per unit of products A and B using the nor-

mal surcharge calculation and the method of machine hour rate calcu-

lation.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 57 -

5 Operating Income Statement

5.1 Tasks of an Operating Income Statement

Shall answer the question, which operating revenue a

company reached within a period

t comparison of revenues and costs of a period to de-

termine the operation income

also called cost unit period accounting or short term in-

come statement (the term cost unit period accounting is

ambiguous since you consider not only costs but also

revenues)

Tasks of a operating income statement:

1) Evaluation whether the profit target of the company

has been reached or not

2) Analysis of reasons for success or failure for short

term regulation

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 58 -

Period of time:

Normally relatively short (1 month), else regulation

would be impossible

t problems to assign costs, which occurred for a

longer period to a shorter period (e.g. Christmas

gratification, usually constant assignment)

Classification:

To increase the informative value, a differentiated clas-

sification of costs and revenues seems reasonable, e.g.

by factors of production, operating units or products

Methods:

• expenditure style of presentation (ESP)

• cost of sales style of presentation (CSSP)

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 59 -

5.2 Expenditure Style of Presentation

Characteristics: assignment of costs and revenues

within the period, the products are produced

Profits:

• sales proceeds, i.e. profits for sold products (sales

prices as valuation basis)

• inventory increase of finished and unfinished goods

(costs of production as valuation basis or market

price if it is lower)

determination can be problematic if sold products

come from different periods, i.e. an inventory existed

at the beginning of the period

t use of average costs of production

t application of collective valuation methods, e.g.

FIFO

• self generated assets (analog inventory increase,

shall be neglected in this lecture)

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 60 -

Costs:

• operating expenses for all units produced within the

period (finished and unfinished goods, self gener-

ated assets)

• inventory decrease, surely a negative figure, but no

costs; only a correcting entry to sales proceeds, be-

cause costs for incoming inventory and a revenue

(inventory increase) in equal amount have already

been assessed within the period

Structure:

• revenues are usually structured as seen above; as

well as a division of sales proceeds by types of

products

• costs are usually structured by types of production

factors, i.e. material costs, personnel costs, depre-

ciations

• in cost accounting, an account structure is normal:

- left side (debit): costs

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 61 -

- right side (credit) : revenues

- operating income to balance both sides (need to

be identical), i.e.

- profit on the left side (revenues > costs)

- loss on the right side (costs > revenues)

operating income account according (ESP)

• period costs, differentiated by • sales proceeds, differentiated by

types of costs types of products

• inventory decrease of finished and • inventory increase of finished and

unfinished goods valuated with unfinished goods valuated with

costs of production costs of production

• operating profit • operating loss

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 62 -

Evaluation / criticism:

• costs and revenues are related to the units produced

within the actual period, i.e. all costs and revenues

of the period are assigned

• evaluation of expenses:

a) ESP can be easily integrated into the system of

financial accounting (there, usually applica-

tion of total cost method)

b) changes in inventory need to be determined

• using a structure according to types of production

factors, as it is usually done, operating income reve-

nue for individual products can not be determined

But: basically, using the expenditure style of presenta-

tion, costs can be structured differently as well (typi-

cal for the method is only the relation to produced

units)

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 63 -

Example A.6

For the X-corporation, the following facts are known about product A

for the year 2002:

raw material costs 600 €/unit

direct labor costs 700 €/unit

depreciations for machines 500,000 €/period

administration salaries 400,000 €/period

distribution salaries 250,000 €/period

Initial inventory of product A 0 units

produced units of product A 1,000 units

sold units of product A 500 units

selling price 2,800 €/unit

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 64 -

To set up an operating income statement according to the ESP, first

of all, it is necessary to valuate the inventory.

In this case, all units are produced in 2002 (leaving an initial inventory

of 0). Therefore it is not necessary to take into account whether there

are still products left in inventory of the former period(s).

Here, a valuation based on cost of production is used. Generally, oth-

er valuation bases are imaginable.

This results in the following:

raw material costs (direct costs) 600 * 1,000 = 600,000

direct labor costs (direct costs) 700 * 1,000 = 700,000

depreciations (indirect costs) 500,000

costs of production (PC) of produced units per period 1,800,000

PC of produced units per unit 1,800

PC of sold units per period 900,000

PC of inventory 900,000

operating income account according (ESP)

material costs 600,000 revenues 1,400,000

personnel costs 1,350,000 inventory increase 900,000

depreciations 500,000 operating loss 150,000

2,450,000 2,450,000

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 65 -

5.3 Cost of Sales Style of Presentation

Characteristics: assignment of costs and revenues

within the period, the products are sold

revenues:

• sales proceeds, i.e. revenues for sold products

(sales prices as valuation basis)

• no assessment of value of inventory increase of fin-

ished and unfinished goods as well as self gener-

ated assets

Costs:

• operating expenses for all units sold within the pe-

riod

• inventory decrease, is contained in the costs for

units sold

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 66 -

Structure:

• sales proceeds are usually structured by types of

products

• costs are usually structured by areas of activity (pro-

duction, administration, selling / distribution) and

types of products or only by types of products (i.e.

prime costs)

• in cost accounting, an account structure is normal:

operating income account according to CSSP

• costs of products sold, • sales proceeds, differentiated by

differentiated by types of products types of products

(if necessary, split into area of • operation loss

activity)

• operating profit

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 67 -

Evaluation / criticism:

• costs and revenues are related to the units sold

within this period, i.e. not all costs and revenues are

assigned

• evaluation of expenses:

a) CSSP can hardly be integrated into the system of

financial accounting (there, usually application of

expenditure style of presentation)

b) Cost unit accounting for sold products necessary

c) Following the information in the literature,

changes in inventory need no determination

but this is only valid, if manufacturing costs are

assessed with average values; else, inventory

needs determination as well to determine the

manufacturing costs for sold products

• using a structure according to areas of activity and

products, as it is usually done, operating income re-

sults for individual products can be determined

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 68 -

But: characteristically for the costs of sales style of

presentation is the relation to units sold, i.e. the ad-

vantage counts only for a certain design of presenta-

tion

Continuing Example A.6:

operating income account according to CSSP

PC (of units sold) 900,000 sales proceeds 1,400,000

Administrative costs 400,000 operating loss 150,000

Distribution costs 250,000

1,550,000 1,550,000

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 69 -

Comparison of ESP and CSSP:

1) Results are always equal

• having an increase in inventory in the ESP, costs

and revenues are higher by this amount

• having a decrease in inventory in the ESP, costs

and revenues are lower by this amount (if de-

crease in inventory is seen as a correcting entry)

2) Differing assignment of costs and revenues

to the periods for the reason of different interpreta-

tions

3) Usually different structure of costs and revenues

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 70 -

Exercise A.9

The following data of an industrial enterprise is established for the

year 2003:

Product A Product B

Initial inventory [u] 0 0

Amount of production [u/period] 15,000 5,000

Sales [u/period] 15,000 4,500

Sales price [€/u] 25.- 20.-

Material costs [€/u] 10.- 4.-

Manufacturing costs [€/u] 6.- 8.-

Costs of distribution €/u] 4.- 1.-

Assume the costs of production per unit of the initial inventory to be

the same as the costs of production of 2003. The valuation is to be

carried out at production costs.

a) Draw up the operating income statement using ESP style.

b) Draw up the operating income statement using CSSP style.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 71 -

Exercise A.10

The following data of an industrial enterprise is established for the

year 2003:

Product A Product B

Initial inventory [u] 1,000 500

Amount of production [u/period] 10,000 4,000

Sales [u/period] 9,200 4,500

Sales price [€/u] 36.- 16.-

Material costs [€/u] 8.- 5.-

Manufacturing costs [€/u] 12.- 7.-

Costs of distribution €/u] 4.- 2.-

Assume the costs of production per unit of the initial inventory to be

the same as the costs of production of 2003. The valuation is to be

carried out at production costs.

a) Draw up the operating income statement using ESP style. If nec-

essary, use FIFO and LIFO valuation.

b) Draw up the operating income statement using CSSP style. If

necessary, use FIFO and LIFO valuation.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 72 -

B. Controlling

1. Basics of Controlling

Controlling consists of 3 parts:

1) Industrial information system

2) Industrial budgeting and management system

3) Industrial control system

typically divided into

- operations management ⇒ short run

- strategic management ⇒ long run

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 73 -

2. Operations Management

2.1. Direct Costing

Definitions:

Full costing = all costs are assigned to the product or to

a product unit

Direct costing = just a part of the costs are assigned to

the product or a product unit

Implementation of Direct Costing

Feature: cost division into variable and fixed compo-

nents

variable costs: change when a cost driver changes

fixed costs: do not change when a cost driver changes

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 74 -

Example B.1

A company uses the surcharge calculation. For products A and B, the

following information is given:

Product A Product B

Output (units/TU) 100 200

Operating expenses for raw materials 1,000 3,000

Wages for production workers 800 2,200

Imputed interest for capital bound for inventory 4,000

Operating expenses for auxiliary supplies 1,500

Depreciations on machines 4,500

Salaries for administrative employees 1,700

Salaries for selling / distribution employees 3,400

a) Determine the relevant prime costs for product A and B according

to the system of full costing.

b) Determine the relevant prime costs for product A and B according

to the system of direct costing.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 75 -

Full Costing:

Product A Product B

Direct material costs 1,000 3,000

Material overheads [4,000/4,000=100%] 1,000 3,000

Direct labor costs 800 2,200

Manufacturing overheads

1,600 4,400

[(1,500+4,500)/3,000=200%]

Costs of production 4,400 12,600

Administrative overheads [1,700/17,000=10%] 440 1,260

Selling overheads [3,400/17,000=20%] 880 2,520

Prime costs 5,720 16,380

Prime costs per unit 57.20 81.90

Direct Costing:

It is probable that only auxiliary supplies are variable costs (possibly

imputed interest).

Product A Product B

Direct material costs 1,000 3,000

Variable material overheads 0 0

Direct labor costs 800 2,200

Variable manufacturing overheads

400 1,100

[1,500/3,000=50%]

Variable costs of production 2,200 6,300

Administrative overheads 0 0

Selling overheads 0 0

Prime costs 2,200 6,300

Prime costs per unit 22.-- 31.50

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 76 -

2.2. Bottleneck-Analysis

Bottleneck-analysis is part of a planning of production in

a multi-product operation and is used to resolve the

problem of one or more bottlenecks when producing

more than one product.

Steps for a bottleneck-analysis:

1) Determination of unit contribution margins per unit

2) Determination of available capacity

3) Determination of unit contribution margins per

bottleneck unit

4) Determination of an order of priority

5) Determination of (temporary) output

6) Considering different facts

7) If needed, additional actions

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 77 -

To determine a bottom price for an additional prod-

uct, the following steps are necessary:

1) Determination of variable costs for the new product

2) Determination of contribution margins for the

replaced products

3) Determination of the lower limit on returns

4) Comparison of lower limit on returns with possible

returns

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 78 -

Example B.2

A company has to plan their production program for the next period. It

is possible to produce 4 different products, which require a certain

packing machine, respectively. For the coming period, the following

information exists:

Products

A B C D

Possible sales [unit/TU] 1,000 900 1,500 700

Sales price [€/unit] 20 100 70 145

Variable costs [€/unit] 11 60 50 95

Duration in the packing machine [min/unit] 1 5 20 2

Within the next period, the packing machine has a running time of

100 h maximum. Fixed costs of the coming period will be 45,000 €.

a) Determine the optimal production program and calculate the net

proceeds of the coming period.

b) Specify possible changes of the optimal production program and

net proceeds, if, with other parameter staying constant, the com-

pany receives an additional inquiry for delivering 150 units of

product E for the price of 90 €/unit.

Product E can be produced with the existing machines. It has

variable costs of 45 € per unit and uses the packing machine

4.5 min per unit.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 79 -

1) Optimal production program and net proceeds:

a)Determination of the priority order:

Product Product Product Product

A B C D

Price 20 100 70 145

Variable costs 11 60 50 95

Unit contribution margin per unit 9 40 20 50

Order of priority 4 2 3 1

Bottleneck utilization 1 5 20 2

Specified unit contribution

9 8 1 25

margin per time unit

Order of priority 2 3 4 1

Order of priority using specified unit contribution margins:

D–A–B–C

b)Determination of the optimal production program:

Possible Bottleneck Used Remaining

Product Output

sales utilization capacity capacity

6,000

D 700 2 700 1,400 4,600

A 1,000 1 1,000 1,000 3,600

B 900 5 720 3,600 0

C 1,500 20 0

The inquiry for D and A can be satisfied completely, the inquiry for

B only partly and for C not at all.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 80 -

2) Decision about the inquiry for product E:

a) decision using a new bottleneck analysis:

specified unit contribution margin of E: 10 €, i.e. rank 2

b) decision based on the determination of a bottom price:

variable costs of product E 45 ∗ 150 = 6,750

+ replaced contribution margin of product B

[(150 ∗ 4.5) ∗ 8] = 675 ∗ 8 = 5,400

= lower limit on returns 12,150

return of order 90 ∗ 150 = 13,500

return of order > lower limit on return t accept order

c) Determination of net proceeds:

Old net proceeds + difference between return of order and lower

limit on return: 27,800 + (13,500 – 12,150) = 29,150

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 81 -

Exercise B.1

The fun company has to plan their production program for next pe-

riod. It is possible to produce 2 different engines, one for a snowmo-

bile and one for a boat. Both engines must be tested on a very ex-

pensive machine before they shipped to the costumers. Production

data are as follows:

Available Capacity in hours:

Testing Department 120 testing-hours

Production Department 600 machine hours

Use of capacity in hours per unit of product

Snowmobile Boat

Production Department 2 5

Testing Department 1 0.5

Operating Data for fun company:

Selling Price Variable costs Contribution margin

Snowmobile 800 € 560 € 240 €

Boat 1,000 € 625 € 375 €

Material shortages for boat engines will limit production to 110 boat

engines per period.

Try to find the optimal solution by using graphic approach and linear

programming.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 82 -

Exercise B.2

Combustion Ltd supplies components to a major aircraft manufactur-

er. A new aircraft is now being produced and Combustion Ltd can

supply either component Alpha or component Beta. However, it does

not have the production capacity to supply both.

Both components are made from the same metal, of which there is

only 10,000 kg available at € 10 per kg. Both components must pass

through two high-technology machine lines - Line P and Line R - each

of which has capacity limitations.

Sales prices have been set and the following data are available for

Budget Period 1 of 1995:

ALPHA BETA

Maximum number of components 4,250 6,100

required by aircraft manufacturer

Sales price per component € 195 € 160

Metal use per component 2 kg 2 kg

Machine line times per component

Line P 0.75 hours 0.40 hours

Line R 0.50 hours 0.60 hours

Machine line details

LINE P LINE R

Total hours available 3,000 hours 3,600 hours

Variable overheads per machine hour € 90 € 110

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 83 -

Required:

(a) Calculate which component should be manufactured by

Combustion Ltd. to maximize contribution.

(b) Calculate the contribution which Combustion Ltd will earn and,

based on (a) above, whether the company will be capable of

meeting the maximum capacity required for either of the two

components.

(c) The aircraft manufacturer has offered an alternative pricing struc-

ture per component as follows: Sales price less 10% per compo-

nent plus € 60 per hour for each hour any of the production lines

are unused.

Indicate how this alternative pricing arrangement might affect your

choice, in (a) above, of component to be manufactured and, if it

does affect your choice, calculate the new contribution.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 84 -

Exercise B.3

The following data is given:

Product A Product B Product C

Maximum Sales [u/period] 3,000 4,800 1,600

Sales Price [€/u] 100 40 160

Variable Costs [€/u] 40 10 80

Fixed Costs [€/period] 140,000

Total Capacity of Bottleneck [min/period] 35,600

Usage of Bottleneck [min/u] 6 2 16

a) Compute the optimal production program and the earnings of the

period. Explain your calculations.

b) Discuss other aspects that have to be taken into account when

computing a production program.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 85 -

Exercise B.4

Products A and B have to be processed on the same machine. On

average the machine can be used 7 hours a day, 20 days a month.

Monthly fixed costs are 600 €.

The following data is given about products A and B:

Usage of Variable Sales Price Sales

Product

Bottleneck [min/u] Costs [€/u] [€/u] Forecast [u/month]

A 20 8.00 10.00 300

B 30 5.00 8.00 150

a) Discuss how the production program can be determined.

b) Product A now needs to be processed on the machine 25 min/u

because of a product change. The other data is still the same.

b1) Compute the new production program.

b2) Compute the bottom price of product C. It is planned to sell

80 units per month. Variable costs per month are 5.00 €/u,

the usage of the bottleneck is 40 min/u.

b3) Discuss measures that could be taken by the organization

in order to prevent the existence of a bottleneck.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 86 -

Exercise B.5

A manufacturer of sports supplies produces jerseys for the sale of

merchandise of BSC Freiberg and Erzgebirge Aue.

The jerseys of the Aue team are made with long sleeves. 3 m of cloth

is necessary to produce them. To produce a short-sleeved jersey of

Freiberg 2 m of cloth is needed. In a period, 1,800 m of cloth is avail-

able.

Producing an Aue jersey takes 2 time units. The jersey of the BSC

Freiberg takes 4 time units due to the complicated design. Working

time of 1,600 time units is available during a period.

According to market analysis a maximum of 300 jerseys of BSC

Freiberg can be sold, while there are no restrictions for the sale of jer-

seys of Erzgebirge Aue. The variable costs from producing a jersey of

Aue is 80 €, producing one of Freiberg costs 70 €. A sales price of

100 € is projected for both types of jerseys.

Compute the optimal production program using a graphical solution

method.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 87 -

Exercise B.6

A manufacturer of trouser produces jerseys for the sale of Esprit and

S´Oliver.

The jerseys of Esprit are made with shorter legs. 5 m of cloth is ne-

cessary to produce them. To produce a trouser of S´Oliver 8 m are

needed. In a period 4,000 m of cloth is available.

Producing an Esprit trouser takes 2.5 time units. The trouser of

S´Oliver takes 2 time units. Working time of 1,500 time units is availa-

ble during a period.

According to market analysis a maximum of 400 Esprit trousers can

be sold, while there are no restrictions for the sale of S´Oliver trous-

ers. The variable costs from producing a jersey of Esprit is 60 €, pro-

ducing one of S´Oliver costs 50 €. A sales price of 120 € is projected

for both types of jerseys.

a) Compute the optimal production program using a graphical solu-

tion method.

b) Discuss other aspects that have to be taken into account when

computing a production program.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 88 -

Exercise B.7

The following data is given:

Product A Product B Product C Product D

Maximum sales (u/period) 1,000 600 1,500 300

Sales price (€/u) 30 40 15 75

Variable costs (€/u) 18 25 9 45

Fixed costs of the coming period will be 25,000 €. All of these prod-

ucts have to be produced on the same machine. Within the next pe-

riod the machine can be used 20 days. The maximum running time

per day is 7.5 hours. Following data about machine usage is given:

Product A Product B Product C Product D

Usage (min./u.) 3 5 4 12

a) Compute the optimal production program and the earnings of this

period. Explain your calculations.

b) The company receives an inquiry for delivering 900 units of prod-

uct E for the price of 50 €/unit. Product E has to be processed on

the same machine as all other products and requires 5 min./unit

on this machine. Variable costs are 25 €/unit. Discuss, if, with all

other parameters staying constant, the company should accept

this inquiry. Determine possible changes of the production pro-

gram and the earnings of this period.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 89 -

2.3. Break-Even-Analysis

also called cost-volume profit analysis

Break even point = point from which a profit is gained,

i.e. the point at which the turnover covers the full

costs or the unit contribution margin covers the fixed

costs

Break-Even-Analysis in a Single-Product-Operation

Break-even point means

P = 0, whereas P = sales proceeds – costs

straight-line sales and cost functions

p ∗ x b – cv ∗ xb – Cf =0

(p – cv) ∗ xb – Cf =0

Cf

CM per unit

= xb

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 90 -

Additional information:

Coefficient of safety =

(total sales – break-even sales) / total sales

Indicates, by which percentage the planned sales

can drop, before the company reaches the break-

even point and therefore the loss wedge

Safety distance =

given quantity of sales – critical quantity sold

Please note: term is also partly used for the coeffi-

cient of safety

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 91 -

Exercise B.8

Knitwear, Inc., is considering three countries for the sole manufactur-

ing site of its new sweater - Singapore, Thailand, and the United

States. All sweaters are to be sold to retail outlets in the United States

at € 32 per unit. These retail outlets add their own markup when sell-

ing to final customers. The three countries differ in their fixed costs

and variable costs per sweater.

Annual Fixed Variable Variable Marketing &

Costs Manufacturing Costs Distribution Costs Per

Per Sweater Sweater

Singapore € 6.5 million € 8.00 € 11.00

Thailand € 4.5 million € 5.50 €11.50

United States € 12.0 million €13.00 € 9.00

1. Compute the breakeven point of Knitwear, Inc., in both (a) units

sold, and (b) revenues for each of the three countries considered

for manufacturing the sweaters.

2. If Knitwear Inc. sells 800,000 sweaters in 1999, what is the budg-

eted operating income for each of the three countries considered

for manufacturing the sweaters? Comment on the results.

IMRE Cost Accounting & Controlling 2010 M.Sc. Angela Freche

- 92 -

Break-Even-Analysis in a Multi-Product Operation

In a multi-product operation it is not easy to determine

the break-even-point, since all unit contribution margins

help to cover the fixed costs.

Solutions

1) Fixed ratio between the products:

- Critical sales quantity

- Critical turnover