Professional Documents

Culture Documents

Resource Guide For Singapore Budget

Uploaded by

NTUSubjectRoomsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Resource Guide For Singapore Budget

Uploaded by

NTUSubjectRoomsCopyright:

Available Formats

RESOURCEGUIDEFORTHESINGAPOREBUDGET

Introduction

The annual Singapore Budget is a unique source of primary information on government finances and initiatives. For example, the projected revenue sources and proposed expenditures of the Singapore government in the coming financial year (FY) can be accessed throughtheBudget.Viathespending,itispossibletounderstandmoreofsocietysproblems andconcernsatthepointintime.Inaddition,theexpenditureandrevenueforthepreviousFY canbereviewedtoanalysetheproposedandactualspending.TheBudgetisannouncedbefore anewFY,whichbeginson1stAprilandendson31stMarchofthefollowingcalendaryear.

Scopeandobjectives

TheBudgetisatechnicaldocumentwhichcanbedifficulttointerpret.Thegoalofthisguideis to introduce the reader to the various sections of the Budget document, such as the Budget statement,BudgetHighlightsandExpenditureEstimates.Ashortdescriptionofeachsectionis provided,alongwithanintroductiontosecondarysourcestoaidthereaderininterpretingthe primarymaterial. Another objective is to aid the researcher who wishes to research on historical Budget information. Researching on historical budgets can be difficult as the names of the Budget document have changed over time. In addition the older Budget documents before 1996 are only available in print format. This guide therefore includes tables containing the publication historyofasectionoftheBudgetwhereappropriate. TofurtherexplainBudgetterminology,aglossaryhasalsobeencreatedinAppendixII.Please inform theauthor at hytan@ntu.edu.sg if a broken link isfound, or if you will like to make a suggestionregardingtheguide.

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

SingaporeBudgetWebsite

TheSingaporeBudgetWebsitecontainsonlinedatafortheannualBudgetsfrom1996tothe present at this link. Information on the budgets of 1982 to 1999 can be found in the Budget statementperiodicalavailableinhardcopyformatintheNTUBusinessLibraryandtheclosed stacks,whichcanberequestedattheLoanCounter.

BudgetStatement(Primarysource)

Publicationcontents The Budget Statement contains the entire Budget speech given by the Minister of Finance. Occasionally it also includes questions raised in Parliament regarding the Budget. The Budget StatementandthecorrespondingBudgetanalysispublicationsareusefulforunderstandingthe proposed government expenditure. From there the societal problems and concerns can be extrapolated if they are not explicitly mentioned in the speech. For example, a drop in corporatetaxmayindicateincreasingcompetitionpressuretoattractbusinessestoSingapore atthatpointintime. Forinformationonbudgetsbefore1982,youwillneedtorefertotheBudgetspeechestable. PleasenotethattheBudgetStatementdoesnotcontainadetailedbreakdownoftheproposed governmentexpenditure.Toobtainsuchfigures,itwillbenecessarytorefertotheExpenditure Estimatespublication. Publicationhistory Publicationname Daterange Availableat BudgetStatement 1982topresent NLBandNTU Softcopies of budget statements 1996 and after are available at theMOFwebsite. Budgetspeeches Budgetspeechtitle Year Available Deliveredby at Towards higher achievement: budget speech 1981 NLB,NUS GohChokTong 1981 Wemustdaretoachieve:budgetspeech1980 1980 NLB,NUS GohChokTong Forward with cautious confidence: budget 1979 NLB,NUS Goh Chok Tong/Hon

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

Budgetspeechtitle

Year

Available at

Deliveredby

speech1979 SuiSen Focus on achievement and growth : text of 1978 NLB,NUS HonSuiSen budgetspeech,Feb.27,1978 Singapore: year of economic recovery: text of 1977 NLB,NUS HonSuiSen budgetspeech 1976 budget statement [with] economic survey 1976 NUS HonSuiSen ofSingapore,1974 Budgetstatement1975 1975 NLB,NUS HonSuiSen [1974]annualbudgetstatement[with]Economic 1974 NUS HonSuiSen surveyofSingaporein1973. Annual budget statement with survey of the 1973 NUS HonSuiSen economicscene Economicpatternintheseventies 1972 NLB,NUS HonSuiSen BudgetspeechoftheMinisterforFinanceatthe 1968 NLB,NUS GohKengSwee sittingofParliamentonTuesday,3rdDecember, 1968 Budget statement by the Minister for Finance, 1966 NLB,NUS LimKimSan Mr.LimKimSan,inParliamenton5thDecember, 1966. Thisishowyourmoneyisspent 1960 NLB,NUS GohKengSwee Expenditureestimates(Primarysource) Thetablebelowliststhevariousnamesgiventothepublicationorsectionofpublicationwhich recordstheproposedgovernmentexpenditureineachnewFY.Itisimportanttonotethatthe figuresandtablesprovidedaretentative.ForexampletheExpenditureestimatesdocumentfor FY2010willdetailproposedexpendituresfortheFYahead.Ifyouareinterestedtoobtainthe actualexpenditureforFY2010,youwillhavetorefertothefollowingyearsbudget.Therefore toobtaintheactualexpenditureforFY2010youwillneedtorefertotheFY2011Budget. Note that revenue estimates are also available from 2007 and after. The Revenue estimates shows the sources of government revenue such as taxes and investments. For more informationonthecontentsoftheRevenueestimates,pleaserefertoAppendixI. Publicationcontents This publication consists mostly of tables detailing expected expenditure by various governmentbodiessuchasministries.Otherinformationincludesapprovedstaffheadcounts. Thisdocumentisbestusedbyresearchersinterestedinobtainingactualexpenditureestimates ofgovernmentbodies,duetothehighlytechnicalnatureofthisdocument.

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

Expenditure is generally divided into two sections, namely Operating expenditure and development expenditure. Operating expenditure refers to the costs of running various government bodies such as staff salaries, or government building utility bills. Development expenditure includes costs for infrastructural development, such as road building or sport facilitiesconstruction. Publicationhistory Publicationname Expenditureestimates

Daterange 2005topresent

TheBudgetforthefinancialyear 19782004 Main and development estimates for 19741978 thefinancialyear Developmentestimates 19551973

Availableat MinistryofFinancewebsite NLB NLB,NUS,NTU NUS,NLB NUS,NLB

BudgetHighlights

TheBudgetissplitintomanysectionswhichmaybeofinteresttodifferentusers.TheBudget Highlightssectioncontainsprimarystatisticaldataforstudy.Therearealsofeaturearticlesto explainvariousgovernmentinitiatives/policiesinthefinancialyear(FY).Forexamplearisein governmentrevenuefromstampdutiesmaybeexplainedorfurtherelaboratedoninthetext. ThusitisoftenusefultoscanforinterestingfeaturearticlesintheBudgetHighlightsorother sections. The Budget Highlights also contains updated figures on the actual spending in the previousfinancialyear. BudgetHighlightscontents: No. Statistical series 1 Notes

Fiscal position Containsthefollowingdatafortheprevious2years for previous 2 - Operatingrevenuefigures years Operatingexpenditurefigures,

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

No. Statistical series

Notes

Developmentexpenditure figures Specialtransferfiguresanddetails Endowmentandtrustfundstopups Investmentincomefigures Overallbudgetsurplus/deficitfigures

Aspikeingovernmentrevenuefromaparticularsourcemaybeworth researching.Forexampleasharpriseinstampdutiesmayindicatean increaseinpropertytransactions/prices 2 Current budget FY ContainsthefollowingfiguresforthecurrentFY AllfiguresforthecurrentFYareestimatedandsubjecttorevision. 3 Historicalfiscal Containshistorical figuresfor position - Operatingrevenuefigures overview Operatingrevenuefigures Operatingexpenditurefigures Developmentexpenditurefigures Specialtransfersfiguresanddetails Endowmentandtrustfundtopups Investmentincomefigures Overallbudgetsurplus/deficitfigures

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

No. Statistical series

Notes

Operatingexpenditurefigures Developmentexpenditurefigures Specialtransferfiguresanddetails Endowmentandtrustfundtopupfigures Investmentincomefigures(maybeabbreviatedasNII/NIR) Overallbudgetsurplus/deficitfigures

Adetailedbreakdownforhistoricalspecialtransferitemsispresentin thistable. 4 Revenue collection table ThebreakdownoftheOperatingRevenuesourcesis: Corporateincometax Personalincometax Withholdingtax Statutoryboardcontributions Assetstaxes Customsandexcisetaxes Goodsandservicestax Motorvehiclestaxes Vehiclequotapremiums

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

No. Statistical series

Notes

Bettingtaxes, Othertaxes 1 Otherfeesandcharges Othersources

Revenuesourcesmaydifferslightlyacrosstime.Forexampledataon revenuefromcasinotaxeswillnotbeavailableuntilpost2010. DataisavailableinmillionsofSingaporedollars. Dataisalsoavailableasa%ofGDP. 5 Operating Figuresareavailablefor expenditureby Socialdevelopment sector Securityandexternalrelations Defence Education NationalDevelopment Health EnvironmentandWaterResources CommunityDevelopment,YouthandSports Information,CommunicationandtheArts

Other taxes primarily compose the foreign worker levy and aircraft passenger service charge.

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

No. Statistical series

Notes

HomeAffairs ForeignAffairs

EconomicDevelopment GovernmentAdministration DataispresentedbymillionsofSingaporedollars. 6 Development DataisavailableasforOperatingExpenditurefigures expenditureby sector Developmentexpendituredoesnotincludelandrelatedexpenses. 7. Total DataisavailableasforOperatingExpenditurefigures. expenditureby sector DataisavailableinmillionsofSingaporedollars. Finance Law OrgansofState PrimeMinistersOffice(PMO) Transport TradeandIndustry Manpower InfocommunicationsandMediaDevelopment

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

No. Statistical series

Notes

Dataisalsoavailableasa%ofGDP. Developmentexpendituredoesnotincludelandrelatedexpenses. 8. Total Dataisavailableforthefollowingtypesofexpenses: expenditureby expenditure type OperatingExpenditure Transfers DevelopmentExpenditure DataisavailableinmillionsofSingaporedollars. 9. Headcount by Figuresfor2008andafterindicatethebudgetedmanpowerandnot Ministry theactualmanpowerfigures.Forexampleaministrymaybeallowed tohaveaheadcountof50individualsbutnotall50positionsmaybe filled. Directdevelopment Capitalgrant Capitalinjections Socialtransfers Subventions Expenditureonmanpower Operatinggrant Otheroperatingexpenditures Capitalinjections

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

No. Statistical series

Notes

Figuresfor2007andbeforeareactualmanpowerfigures. Data is available for manpower numbers for the following governmentinstitutions. Civillist AttorneyGeneralsChambers AuditorGeneralsOffice CabinetOffice Judicature Parliament PresidentialCouncils PublicServiceCommission CommunityDevelopment,YouthandSports Defence Education EnvironmentandWaterResources Finance ForeignAffairs Health HomeAffairs Information,CommunicationandtheArts

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

No. Statistical series

Notes

Law Manpower NationalDevelopment PrimeMinistersOffice TradeandIndustry Transport

ParliamentReports

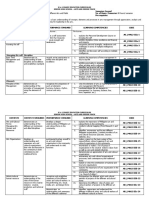

Parliament reports may be a useful source of additional information as Budget matters are often raised and debated there. Parliament Reports after the 2nd of November 2006 can be accessedviatheSingaporeHansard.ItispossibletolimityoursearchforspecificReportsbased on minister or issue debated. This is source is recommended for researchers searching for additionalmaterialonaproposedexpenditure,suchasWorkfare. Budgetanalysispublications(Secondarysource) Anumberofprivatefirmspublishbudgetcommentarieswhichmayaidyourunderstandingof thebudgetmeasuresandwhattheyareintendedtofacilitateoraccomplish.TheBudgetisa very long and technical document. Is it therefore recommended to refer to these budget commentariestogainabetterunderstandingoftheBudgetmeasuresimplemented,andtheir background.Someofthemoreprominentfirmswhichpublishsuchbudgetcommentariesare: No. 1 2 Firm Ernst&Young Pricewaterhouse Coopers Publicationname Singaporebudgetsynopsis Singaporebudgetcommentary

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

Databases(Secondarysource) Certain databases contain consolidated time series data on the Singapore economy. An exampleofsuchadatabaseisCEIC.Howeverintheeventofanyconflictindata,theBudget should be viewed as the authoritative source. This is as the CEIC is considered a secondary source.

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

AppendixI

Governmentrevenuesources

The table below lists the various government revenue sources, from taxes, stamp duties and investments.Theresearchermayfinditusefultorefertothisdocument,todeterminewhich are the main sources of government revenue. Alternatively a spike in revenue from a source mayindicateanunusualeventinthepastyear.Forexamplearelativelylowrevenuefromthe GoodsandServicesTax(B50)mayindicateaslowdownintheeconomy. Account code B00 B10 Revenuesource Notes

Totaltaxrevenue Incometax

TotalofB10B113 Assessed based on individual previousyearsincome

B11 B111 B112 B113

Corporateandpersonaltax CorporateIncometax PersonalIncometax Withholdingtax Not presented separately until 2008

B12 B120 B20 B21 Statutoryboardcontributions Statutoryboardcontributions Assetstaxes Propertytax Totalof B21B219 Assessed on transactions current year Nofurtherbreakdownavailable

B211

Privateproperties

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

Account code B212 B219 B22 B221 B30 B31 B311 B312 B313 B314 B318 B32 B323 B329 B40 B401 B402 B403 B404

Revenuesource

Notes

Statutoryboards Otherproperties

Estateduty Estateduty Customsandexcisetaxes Exciseduties Petroleumproducts Tobacco Liquors Motorvehicles Otherexciseduty Customsduties Liquors Othercustomsduties TotalofB323B329 TotalofB31B329 TotalofB311B318 Nofurtherbreakdownavailable

Motorvehicletaxes Additionalregistrationfees Roadtax Specialtaxonheavyoilengines Nonmotorvehiclelicenses

TotalofB401B406

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

Account code B405 B406 B50 B60 B601 B602 B70 B701 B80 B802 B90 C00 C10 C11 C12

Revenuesource

Notes

Passengervehicleseatingfees Conversionpremium

Goodsandservicestax

Bettingtaxes Bettingandsweepstakeduties Privatelotteryduties

TotalofB601andB602

Stampduty Stampduty Nofurtherbreakdownavailable

Selectiveconsumptiontaxes Waterconservationtax

Othertaxes

Nodetailsavailable

Feesandcharges

Nodetailsavailable

Licenseandpermits Environment Homeaffairs

TotalofC11C19

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

Account code C13 C14 C15 C16 C17 C19 C20 C21 C22 C23 C25 C27 C28 C29 C30 C32 C33 C34 C39

Revenuesource

Notes

Housingandproperties Medicalandhealth Commerce Transportandcommunication Customsandexcise Others

Servicesfees Admissioncharges Environmentalfees FireandPoliceServicesfees Inspectionandcertificationfees Professionalservicesfees Schoolsandinstitutionsfees Others

TotalofC21C29

Salesofgoods Publications Commercialgoods Searchandsupplyofinformation Storesandothergoods

TotalofC32C39

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

Account code C40 C41 C42 C43 C44 C49 C50 C51 C52 C53 C59 C60 C61 C62 C63 C69 C90 J00

Revenuesource

Notes

Rental Residentialproperties LocalandOverseasquarters Premisesforbusinesses Schoolpremises Otherpremises

TotalofC41C49

Finesandforfeitures Courtfinesandforfeitures Trafficfines Compositionfinesandpenalties Otherfinesandpenalties

TotalofC51C59

Reimbursements Recoverofcosts/expenses Reimbursementforservices Secondment/loanofstaff Others

TotalofC61C69

Otherfeesandcharges

Nofurtherdetailsavailable

Others

Nofurtherdetailsavailable

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

Account code L00 L10 L11 L13 L20 L40 M00 M10 M20 M30

Revenuesource

Notes

Investmentandinterestincome Interest Interestoninvestments Interestonbankaccounts

TotalofL10L13

Dividends

Nofurtherdetailsavailable

Interestonloans

Nofurtherdetailsavailable

Capitalreceipts Salesofland Salesofcapitalgoods Othercapitalreceipts

TotalofM10M30

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

AppendixII

Terminology

ThereareanumberoftechnicaltermsrecurrentlyusedintheBudgetstatementwhichmaybe unfamiliartothegeneralreader.Itisimportanttogainanunderstandingofsomeoftheterms tofacilitatebetterunderstandingofthebudgetdetails.Thusitisrecommendedtorefertothe glossary section at the end of the Budget Highlights statement which explains some of these terms.Forconvenience,sometermsintheglossaryareprovidedbelow. Term FinancialYear SpecialTransfers Explanation ThefinancialyearinSingaporespansfrom1stAprilto31stMarch. Special transfers are one off government initiatives to distribute funds to the public. Examples are New Singapore Shares, Growth DividendsandtheGSTOffsetPackage. Government Endowment This refers to 5 funds (Lifelong learning fund, Eldercare fund, Fund Medifund,EdusavefundandfinallytheComcarefund)established withthesupportofthegovernment.Theincomefromthefundis usedtopayforspecificprogrammes. DevelopmentExpenditure This refers to government spending which is expected to have futurecapitalgains.Examplesincludeconstructionofbuildingsand infrastructure.Thiscanbelikenedtoinvestmentcosts. OperationalExpenditure This refers to government spending for the running of regular government activities and services. An example is staff pay, or utilitybillsforgovernmentbuildings. Totalexpenditure This is the sum of the development and operational expenditure.

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

Term

Explanation Note that this sum does not include any special transfers in the financialyear,unlessspecificallymentioned.

Customsduty

ThisreferstoataxoncertaingoodsimportedintoSingapore.

Stampduty

Thisisataximposedonproperty,stocksandshares.

Excisetax

This is a tax which is imposed on certain goods regardless of whether it was manufactured locally or imported. Examples includetobacco,motorvehiclesandpetroleum.

CivilList

ThisisalistofindividualswhichaidthePresidentofSingaporein performing his official duties. A composition of the Civil List for 2008to2010canbeviewedatthislink.

Created by Tan Han Yong for Sociology on 15 December 2010 All Rights Reserved. NTU Library

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Linguistics and Multilingual Studies AV ListDocument9 pagesLinguistics and Multilingual Studies AV ListNTUSubjectRoomsNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- LC Classification For Chemistry & Biological ChemistryDocument3 pagesLC Classification For Chemistry & Biological ChemistryNTUSubjectRoomsNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Designing With EurocodesDocument7 pagesDesigning With EurocodesNTUSubjectRoomsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Primatology Guide: 1. Books 2. Ebooks 3. Ejournals 4. Videos 5. Web ResourcesDocument9 pagesPrimatology Guide: 1. Books 2. Ebooks 3. Ejournals 4. Videos 5. Web ResourcesNTUSubjectRoomsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

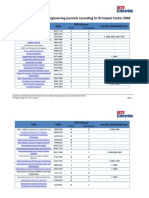

- Top Chemistry Journals According To ISI Impact Factor 2009Document4 pagesTop Chemistry Journals According To ISI Impact Factor 2009NTUSubjectRoomsNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- English Language Reference MaterialsDocument4 pagesEnglish Language Reference MaterialsNTUSubjectRoomsNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Selected List of E-Books in ChemistryDocument1 pageSelected List of E-Books in ChemistryNTUSubjectRoomsNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Top Biological Sciences Journals According To Subjects and ISI Impact Factor 2008Document6 pagesTop Biological Sciences Journals According To Subjects and ISI Impact Factor 2008NTUSubjectRoomsNo ratings yet

- Top Chemistry Journals According To ISI Impact Factor 2009Document4 pagesTop Chemistry Journals According To ISI Impact Factor 2009NTUSubjectRoomsNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Quick Style Guide - ASADocument2 pagesQuick Style Guide - ASANTUSubjectRoomsNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Annual Review of SociologyDocument1 pageAnnual Review of SociologyNTUSubjectRoomsNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Linguistics and Multilingual Studies AV ListDocument9 pagesLinguistics and Multilingual Studies AV ListNTUSubjectRoomsNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Singapore Crime StatisticsDocument6 pagesSingapore Crime StatisticsNTUSubjectRoomsNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Journal List in PsychologyDocument2 pagesJournal List in PsychologyNTUSubjectRoomsNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- APA Citation GuideDocument2 pagesAPA Citation GuideNTUSubjectRoomsNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- LC Classification For Biological SciencesDocument5 pagesLC Classification For Biological SciencesNTUSubjectRoomsNo ratings yet

- American Sociological ReviewDocument2 pagesAmerican Sociological ReviewNTUSubjectRoomsNo ratings yet

- List of E-Books For PsychologyDocument1 pageList of E-Books For PsychologyNTUSubjectRoomsNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- LC Classification For PsychologyDocument3 pagesLC Classification For PsychologyNTUSubjectRoomsNo ratings yet

- LC Classification For EconomicsDocument3 pagesLC Classification For EconomicsNTUSubjectRoomsNo ratings yet

- Other Core Journals in EconomicsDocument1 pageOther Core Journals in EconomicsNTUSubjectRoomsNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Top Journals in Economics According To ISI Web of Science, JCR Social Science Edition 2008Document1 pageTop Journals in Economics According To ISI Web of Science, JCR Social Science Edition 2008NTUSubjectRoomsNo ratings yet

- LC Classification For Mechanical EngineeringDocument4 pagesLC Classification For Mechanical EngineeringNTUSubjectRoomsNo ratings yet

- Top Cited Mechanical Engineering Journals According To ISI Impact Factor 2009Document8 pagesTop Cited Mechanical Engineering Journals According To ISI Impact Factor 2009NTUSubjectRoomsNo ratings yet

- Core Journals in Materials Science and Engineering According To ISI Impact Factor 2008Document1 pageCore Journals in Materials Science and Engineering According To ISI Impact Factor 2008NTUSubjectRoomsNo ratings yet

- LC Classification For Mathematical SciencesDocument2 pagesLC Classification For Mathematical SciencesNTUSubjectRoomsNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Resource Guide On Bunker FuelDocument4 pagesResource Guide On Bunker FuelNTUSubjectRoomsNo ratings yet

- Selected E-Books For Materials Science and EngineeringDocument1 pageSelected E-Books For Materials Science and EngineeringNTUSubjectRoomsNo ratings yet

- LC Classification For Materials Science & EngineeringDocument6 pagesLC Classification For Materials Science & EngineeringNTUSubjectRoomsNo ratings yet

- Declaration 3520228712048Document5 pagesDeclaration 3520228712048hinamuzammil.acaNo ratings yet

- CUBDocument22 pagesCUBsathishNo ratings yet

- The Wall Street Journal LetterDocument1 pageThe Wall Street Journal LetterVovan VovanNo ratings yet

- Venture of Joint Nature Class NotesDocument22 pagesVenture of Joint Nature Class NotesDbNo ratings yet

- Chapter 1 - Business Combinations: New Rules For A Long-Standing Business PracticeDocument38 pagesChapter 1 - Business Combinations: New Rules For A Long-Standing Business PracticeDina AlfawalNo ratings yet

- Latihan Soal Bab 9 - Kelompok 2Document17 pagesLatihan Soal Bab 9 - Kelompok 2Penduduk MarsNo ratings yet

- Company Profile: Tullow Oil PLCDocument8 pagesCompany Profile: Tullow Oil PLCXolani Radebe RadebeNo ratings yet

- Fintech and Transformation in Financial Services: Seminar Report OnDocument25 pagesFintech and Transformation in Financial Services: Seminar Report Onrobert juniorNo ratings yet

- Cash and Marketable Securities Seatworks PDFDocument3 pagesCash and Marketable Securities Seatworks PDFGirl Lang AkoNo ratings yet

- Class Work & Home Work Question of Final Account of Banking Conpany 22-23Document23 pagesClass Work & Home Work Question of Final Account of Banking Conpany 22-23DARK KING GamersNo ratings yet

- "Are Historical Costs Useless in Rapidly Changing Environment" Essays and Research PapersDocument13 pages"Are Historical Costs Useless in Rapidly Changing Environment" Essays and Research Paperselsana philipNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Dar Al Arkan, 6.875% 26feb2027, USDDocument14 pagesDar Al Arkan, 6.875% 26feb2027, USDshahzadahmadranaNo ratings yet

- Differences Between Hire Purchase and Credit SaleDocument7 pagesDifferences Between Hire Purchase and Credit SaleSN KhairudinNo ratings yet

- Fixed IncomeDocument213 pagesFixed IncomeMia Cristiana100% (1)

- WWW Edccblockchain IdDocument9 pagesWWW Edccblockchain IdFathan IbraNo ratings yet

- Accounting QuizDocument14 pagesAccounting QuizMarthen YoparyNo ratings yet

- Tax Invoice: Original-CustomerDocument4 pagesTax Invoice: Original-CustomerAbi Nan ThanNo ratings yet

- Republic V Del Monte G.R. No. 156956 October 9, 2006Document6 pagesRepublic V Del Monte G.R. No. 156956 October 9, 2006Angela B. LumabasNo ratings yet

- IC-85 Reinsurance PDFDocument342 pagesIC-85 Reinsurance PDFYesu Babu100% (1)

- DLMI Annual Report - 2019 - (Part 1)Document27 pagesDLMI Annual Report - 2019 - (Part 1)MeteorFreezeNo ratings yet

- Capital and Revenue Income and ExpenditureDocument31 pagesCapital and Revenue Income and ExpenditureMahesh Chandra Sharma100% (2)

- 2 - Chapter 1 - Banking Operations OverviewDocument29 pages2 - Chapter 1 - Banking Operations OverviewNgô KhánhNo ratings yet

- Session 7 Valuation of ITC Using DDMDocument24 pagesSession 7 Valuation of ITC Using DDMSnehil BajpaiNo ratings yet

- True / False Questions: Accounting in BusinessDocument101 pagesTrue / False Questions: Accounting in BusinesskiomeNo ratings yet

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiNo ratings yet

- Discounts: Trade and Cash: Mcgraw-Hill/Irwin ©2008 The Mcgraw-Hill Companies, All Rights ReservedDocument23 pagesDiscounts: Trade and Cash: Mcgraw-Hill/Irwin ©2008 The Mcgraw-Hill Companies, All Rights Reservedmohamed atlamNo ratings yet

- Philippine Deposit Insurance Corporation Act (RA 3591)Document22 pagesPhilippine Deposit Insurance Corporation Act (RA 3591)BellaDJNo ratings yet

- Official Receipts Accountable FormDocument14 pagesOfficial Receipts Accountable Formjoy elizondoNo ratings yet

- Revisionary Test Paper - Intermediate - Syllabus 2008 - June 2013: Paper - 8: Cost and Management AccountingDocument70 pagesRevisionary Test Paper - Intermediate - Syllabus 2008 - June 2013: Paper - 8: Cost and Management AccountingsengurlulaNo ratings yet

- Arts and Design - Leadership and Management in Different Arts Fields CGDocument10 pagesArts and Design - Leadership and Management in Different Arts Fields CGKarl Winn Liang100% (1)

- Arizona, Utah & New Mexico: A Guide to the State & National ParksFrom EverandArizona, Utah & New Mexico: A Guide to the State & National ParksRating: 4 out of 5 stars4/5 (1)

- The Bahamas a Taste of the Islands ExcerptFrom EverandThe Bahamas a Taste of the Islands ExcerptRating: 4 out of 5 stars4/5 (1)