Professional Documents

Culture Documents

CS Dec07 India

Uploaded by

amitc5Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CS Dec07 India

Uploaded by

amitc5Copyright:

Available Formats

Dubai, 3 October 2007 India Equity Research Chirag Shah, +971 4 3620123 chirag.shah@credit-suisse.

com

Research Flash

Investment Ideas Initiating on India The Dancing Elephant

Private Banking

India an emerging global power No power on earth can stop an idea whose time has come. These words by the former Finance Minister and current Prime Minister Dr Manmohan Singh in 1991 marked the beginning of Indias rise in the world economy. In the last five years, India has been one of the fastest growing economies with an average GDP growth rate of approximately 7.6% p.a., with the last two years registering growth rates above 9% p.a. Consequently, India has become the latest entrant to the elite trillion dollar economy club and the Rupee has been one of the best performing currencies with 10% (ytd) appreciation. According to the United Nations, with the current growth rates, India will command 17% of world GDP by the year 2050, compared with just 2% in 2004 (Figure 1). Figure 1 India to become third largest economy by 2050 (GDP)

100% 2% 4% 20% 12% 60% 34% 10% 4% 15% 20% 28% 0% 2004 US Europe Japan Others 2050E China India 26% 28% 17%

Highlights

Increased infrastructure focus and a strong young population with rising income levels bodes well for Indias growth rates in the long term. Consumption and investment-led economic growth makes India less vulnerable to a probable slowdown in the world economy. Stretched valuations make us neutral on the Indian markets. Our cautious stand is primarily due to the deteriorating risk/ reward ratio (upside of less than 5% to our one-year Sensex target), rather than any concerns on the growth prospects.

80%

Investment ideas

Larsen and Toubro (HOLD) Indias largest engineering company, proxy to the massive infrastructure capex, good earnings visibility, positives built into the price Bharat Heavy Electricals Ltd. (HOLD) One of Indias biggest power equipment and engineering companies, play on the increasing power sector capex, strong order-book position drives earnings growth, positives built into the price. Crompton Greaves Ltd. (HOLD) Indias leading company in the power transmission and distribution (T&D) sector, play on the increasing investments in the domestic power T&D sector and the strong corporate capex cycle, restructuring of international operations to drive faster bottom line growth, positives built into the price.

40%

Source: Credit Suisse, United Nations

India From 19912007 Before discussing the strengths and the future investment themes in India, let us step back a little in history to briefly discuss the reasons for Indias rise. The foundation of the current growth rates were laid in the early 1990s with the opening of the Indian economy in response to the balance of payment

Important disclosures are found in the Disclosure appendix

Dubai, 3 October 2007

crises triggered by the Gulf War. The Liberalization program, as it is called, dismantled the license raj (government permits for import/export/ capacity expansions), reduced red tape and government monopolies and more importantly opened a number of sectors for automatic Foreign Direct Investment (FDI). In other words, it marked a shift from the socialist/mixed economy approach to a capitalist economy and offered the private sector the chance to play a more dominant role. Since then, the overall development of the liberalization program has remained more or less in the same direction with initiatives such as deregulation of interest rates, lowering of entry barriers in the banking sector for domestic/foreign players, higher foreign ownership limits in listed companies, abolition of the Capital Issues Committee, disinvestment of public sector companies, higher FDI levels etc. In the late 1990s and early 2000s, three important events enabled India to move to a higher growth trajectory: Rise of the Information Technology industry. While everybody is aware of the rise of the Indian IT industry and India being the back-office of the developed economies, the underplayed fact is the significant employment opportunities created by the sector. Based on NASSCOM (industry body) estimates, the sector directly/indirectly employed more than seven million people in FY2007 compared with less than a million employed in 1998. Increased government spending on infrastructure. Recognizing the need for better infrastructure to promote higher growth rates, the government of India initiated programs for roads (Golden Quadrilateral project, NSEW corridor), power (Power for all by 2012) and upgrading of the airport with the help of private participation, amongst others. Increased infrastructure spending was good news for the underutilized capacities of Indian corporates. Fall in lending/interest rates. Between January 2001 and August 2003, the yield on 10-year G-sec fell from 10.8% to 5.5% a significant decline of 500 bp. The softer interest rate regime gave a tremendous push to the housing sector and created a market for retail products such as home, auto and personal loans, thereby kicking off a wave of consumer spending. It also lowered the cost of borrowFigure 2 Indias GDP growth rate (p.a.)

% 8 7 6 5 4 3 2 1 0 FY52-61 FY62-71 FY72-81 FY82-91 FY92-01 FY02-07 3.9% 3.8% 3.2% 5.6% 5.6% 7.3%

ings for the corporates, thereby making them globally more competitive. We believe that increased job creation , heightened infrastructure impetus and the rise of consumer spending coupled with the opening of the Indian economy in 1991 had a positive impact on Indias GDP growth rates and helped the country to move up from the earlier Hindu Growth Rate of 4% (from FY1952 1991) to 6.3% (FY19922007, Figure 2). The positive business environment also contributed to the rise of globally competitive Indian companies such as Tata Steel, Infosys and Reliance Industries. A decade back, even the most optimistic Indian would not have thought that Tata Steel would become the fifth largest steel maker or Reliance Industries would operate the worlds largest grassroots oil refinery. We believe one of the most important characteristic of the high growth phase of the last two decades is the economys resilience to external shocks and considerable amount of stability. The Indian economy was relatively resilient to the impacts of the 19971998 East Asian currency crises, sanctions such as those after the 1998 nuclear tests and the India-Pakistan conflict during May-June 1999. The Bombay Stock Exchange index (Sensex) has risen more than fourfold over the last five years on the back of buoyant GDP numbers, strong corporate earnings, bullish investor sentiment and soaring liquidity (Figure 3). The opening of the Indian economy and the primary markets in the early 1990s has resulted in the structural growth of the market, both in terms of the breadth of companies and sectors available for investment as well as the size of the companies. This is indicated by the fact that the market capitalization as a percentage of GDP has increased from less than 30% in the mid1990s to more than 90% currently. Bearing fruit The successful journey of the Indian economy over the last two decades can be summed up by the following facts: Six Indian companies listed in the 2007 Global Fortune 500, compared with only one in the year 2000

Figure 3 BSE Sensex performance

Source: Credit Suisse/Government of India

Source: Credit Suisse/IDC

Research Flash

Dubai, 3 October 2007

According to the World Wealth Report 2007, India recorded the second highest increase in HNWI population 20.3%. Total forex reserves stand at USD 230 billion up 800% in the last ten years. Let us now discuss some of the strengths and emerging trends, which will enable India to sustain its growth momentum. Demographic dividend Indias huge population of 1.15 billion, which was once viewed as a curse, today has become a blessing in disguise. India is and will remain for some time one of the youngest countries in the world. This is evident from the fact that in 2006, 63% of Indias population (approximately equal to Europes total population) was between the age of 1560 years and this percentage will even increase to 69% by 2026 (Figure 4, Figure 5). What this means is that a typical Indian family will earn and save more as the dependency ratio also declines. According to some estimates, in 2020, the average Indian will be only 29 years old, compared with 37 in China and USA, 45 in Western Europe and 48 in Japan. The experience of Asia shows that the economic miracles in Japan and the Tiger Economies of Southeast Asia and recently China occurred at a similar stage of demographic transition where the share of working population grew sharply. The presence of a skilled young population in an environment where investment is expanding and the industrial world is ageing could be a major advantage. The current unemployment rate is no cause for alarm, and we believe that if the Indian government puts in place a proper education system and higher employment-creating opportunities for the vast young population, India can accelerate its growth rates further. The country is indeed in the midst of a process where it has a window of opportunity created by its demographic dividend.

Doubling of per capita income in 1314 years With population growth over the past few years slowing down to 1.6% p.a. as compared with 2.2% p.a. between 1951 2001 and economic growth increasing to +8% p.a. as compared with 4.4% p.a. in the same period, it is estimated that the average Indian will double his real income in the next 13 14 years, as compared with the earlier case of 3435 years. This is a remarkable difference and we believe that a sizeable young population with rising per capita income could unleash a powerful wave of consumer demand and open up opportunities for number of sectors such as telecom, automobile, financial products, organized retailing etc. Let us look at some of the sectors and their penetration levels in brief. Telecom. The Indian Wireless sector has been among the fastest growing, driven by falling tariffs (less than USD 2 cents/minute) and cheap handsets (less than USD 40). The net monthly additions of 7 million in June 2007 surpassed those of China. In spite of the accelerating growth, India remains heavily under-penetrated with overall teledensity at 22% and wireless penetration at just under 17%. This compares poorly with the wireless penetration of other countries (Figure 6). The Minister for Communications and IT has targeted 500 million mobile phone users by FY2010, though independent agencies estimate a figure in the range of 350 400 million to be within reach. Taking into account the independent estimates, it implies CAGR in the range of 2532% for the next four years. Financial Services. Even after sixty years of independence, more than 40% of countrys population does not have a bank account. In spite of the impressive growth in the last three years by the Mututal Fund and Insurance industry, their penetration remains very poor. Mutual fund industry AUM (assets under management) stands at 8% of GDP, as compared with Brazils 45% and Koreas 25%. The life insurance premium as a percentage of GDP stands at 2.5%, which compares poorly with the penetration levels of other countries (Figure 7). We expect financial penetration to further improve over the next few years. Figure 5 Demographic ranges by 2026

>65 yrs 8% <15 yrs 23%

Figure 4 Demographic ranges in 2006

>65 yrs 5%

<15 yrs 32%

1564 yrs 63%

1564 yrs 69%

Source: Credit Suisse, UNDP

Source: Credit Suisse, UNDP

Research Flash

Dubai, 3 October 2007

Figure 6 Wireless telecom penetration

% 120 100 80 60 40 20 0 35% 17% 78% 83% 83%

Figure 7 Life insurance premium as a % of GDP

% 10

106%

9 8 7 6 5

46%

8.9% 7.3% 6.0%

48%

4 3 2 1 0

3.6% 2.5%

China Philippines Japan

Malaysia

Korea Singapore World Average

India

United Kingdom

S. Korea

Singapore

Malaysia

India

Source: Credit Suisse, industry sources

Source: Credit Suisse, industry sources

Organized Retailing. The size of the Indian retail industry is estimated at approximately USD 300 billion. However, currently the industry is highly disorganized and is dominated by family-run stores, with the share of organized retailing standing at a mere 3%. We believe that rising income, changing lifestyles, higher standards of living and a preference for westernstyle products will drive the growth of organized retailing, with estimated growth of 2530% p.a. for the next few years. Strong domestic economy As well as opening up opportunities for various sectors, demographic profile and rising per capita income also create a strong domestic demand-driven economy. What does and will differentiate India from the rest of the emerging Asian countries is the fact that the growth is led by both consumption and investment with less reliance on exports (Figure 8). Indias exports as a percentage of GDP stand at 15%, which is the lowest amongst the important Asian countries. We believe this makes India relatively less vulnerable to any US-led slowdown in the world economy. Increased infrastructure spending Nobody can doubt the role which infrastructure development plays in the overall growth of the country. India fares poorly on most infrastructure indicators such as power, road, telecom and airports. Consider the following facts: Per capita power consumption stands at 600 kwh as compared with a world average of 2400 kwh Turnaround time at Indian ports is 3.5 days as compared with 10 hours in Hong Kong Teledensity stands at 22% which is one of the lowest levels in the world National highways along with expressways form only 2% of the total road network as compared with 17% in China Average air travel stands at 0.014 trips per person per year as compared with 2.02 trips per person per year in USA.

Urbanization also drives the need for better infrastructure. As per the UN reports, the urban population of India will increase by 2.3% p.a. between 2005 and 2025 as compared with the average population growth of 1.3% p.a. in the same period. As a result, the proportion of urban population to the total population will increase from 29% in 2005 to 37% in 2025. According to the Approach paper to the 11th Five Year Plan released by the Indian government, for growth rates to remain at +8%, India will have to increase its infrastructure spending from 4.6% of GDP to 8% of GDP. Table 1 gives a synopsis of the capex planned by the government and the opportunities in various sectors. We believe the infrastructure spending of USD 445 billion is significant as the amount is higher than in Russia or the Gulf States over the next three years. Indian Corporates are also expected to embark on an intense capex cycle, having so far shied away as there was under-utilization of capacities. However, with rising demand and consumption over the past three years, most of the corporates today are operating at near full capacity. With substantial free cash flows and easy access to capital, we expect Indian Corporates to enter a strong capex cycle which in our view will last for the next three years. Figure 8 Merchandise exports as a % of GDP

% 250 208% 200 150 100 50 0 36% 28% 103% 62% 23% Hongkong Korea 38% 15% India 62% 167%

Taiwan

Indonesia

Source: Credit Suisse, CEIC

Philippines

Singapore

Malaysia

Thailand

China

Research Flash

Dubai, 3 October 2007

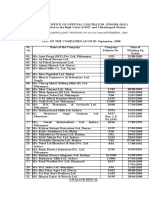

Table 1: Infrastructure capex over a five-year period

Sector (USD bn)

Power Roads Airports Ports Railways Other Telecom Total

Source: IDFC

FY200207

67.5 30.4 1.0 0.8 19.5 50.0 21.5 190.7

FY200812

142.7 81.1 9.0 19.1 65.9 80.0 47.1 444.7

Growth (%)

111 167 787 2229 239 60 119 133

Opportunities

13% shortage in peak demand, high T&D loses, Ultra Mega Power Projects Golden Quadrilateral, Rural Roads, NSEW corridor Privatization of major airports Privatization of major ports Privatization of container traffic SEZs, Urban Metros, Irrigation Increasing teledensity.

Recent gas discoveries India had a current account deficit at 1.1% of GDP in FY200506 and depends heavily on external sources for its energy requirement. This dependency is reflected by the fact that 30% of Indias import bill is made up of oil and related products. However, things could soon change: recent gas discoveries by private sector company Reliance Industries Ltd. (RIL) and state owned Gujarat State Petroleum Corporation (GSPC) have the potential to change the countrys balance of payment outlook. RILs gas discovery in 2002 and GSPCs discovery in 2006 were seen as the biggest discoveries of the respective years. Initial press reports stated that the gas from these fields, which will be available from early FY2009 onwards and will at full capacity by FY2012, should be more than sufficient to meet Indias requirements and possibly also make India a net gas exporter. The obvious benefit of the gas discovery will be the substantial foreign exchange savings by the country and consequent positive impacts on the balance of payments. Apart from the valuable foreign exchange savings, it can also bring cost savings to Indian corporates as gas is always a cheaper source of energy as compared with other fuels. In the longer term, due to the favorable impact on the Indias BOP, we believe it will make the country more resilient to currency fluctuations such as the 1997 98 Asian crisis. Transition from BPO hub to manufacturing hub and implementation of second generation reforms to attract higher FDI The success of the Indian IT industry in the last decade is well known and documented. However, what started off as a trend applicable only to IT and IT-enabled services is rapidly emerging in services such as engineering design, pharma research, clinical trials and industries such as auto components, autos, engineering, and textiles. Going forward, with better infrastructure facilities, implementation of Special Economic Zone policies and an abundant supply of relatively low-cost workers with advanced technical skills, we believe India can also emerge as a global manufacturing hub. We believe this will enable India to create greater employment opportunities for its vast young population and attract higher level of foreign direct investment (FDI). Though the reform process initiated in 1991 enabled India to attract more FDI, it pales when compared with the FDI levels in China, Hong Kong and Singapore. In 2006, India received FDI worth USD 16 billion as compared with Chinas

USD 73 billion and Hong Kongs USD 43 billion. With India fast liberalizing its sectors such as telecom, aviation, media and insurance to foreign participation along with the gradual implementation of its second set of reforms including opening up the pension sector, relaxing the labor laws, introducing a uniform Good and Services Tax regime and reducing government stake in public sector banks, we believe India can attract higher FDI. High savings and investment rates to support growth It will be inappropriate to conclude our bullish view on India without having a look at its savings and investment rates. Since the opening up of the economy in 1991, there has been a significant acceleration in the savings and investments rates which in FY200506 stood at 32% and 34% of GDP respectively (Figure 9). The savings rate has improved from 23% in FY1991 to 32% in FY200506, primarily due to an increase in household savings from 19% to 22% and in corporate savings from 3% to 8%. High corporate savings reflect the healthy and underleveraged balance sheets of the Indian corporates which going forward will enable them to pursue higher M&A activity. High savings when properly channeled result in high investment rates and consequently put an economy into a sustainable growth path. We believe that India is currently undergoing this virtuous phase of high savings, increased investments and therefore high growth rates. Figure 9 Acceleration in savings and investment rate post FY1991

% 40 35 30 25 20 15 10 5 0 FY51 FY57 FY63 FY69 FY75 FY81 FY87 FY93 FY99 FY05

Savings as a % of GDP

Source: Credit Suisse, Government of India

Capital Formation as a % of GDP

Research Flash

Dubai, 3 October 2007

Figure 10 Net FII inflows in USD bn

14 12 10 8 6 4 2 0 2 199697 199798 0.18 199899 200001 200203 200304 200405 199900 200102 200506 1.85 1.48 2.44 2.42 2.07 0.67 12.16 11.00 10.35

Figure 11 BSE Sensex one-year forward PE band chart

25,000

20,000 15,000 10,000 5,000

22x 19x 16x 13x 10x

0 01/04 01/05 01/06 01/90 01/91 01/93 01/94 01/95 01/96 01/97 01/98 01/99 01/00 01/01 01/02 01/92 01/03 01/07

Source: Credit Suisse, Government of India

Source: Credit Suisse, Datastream

Structure of Indian capital markets The history of Indian Stock Markets dates back to 19 century, when the first Bombay Stock Exchange (BSE) was established in 1875. Though the Indian stock markets are more than a century old, they were until recently characterized by a lack of institutionalization, low volumes and limited retail and foreign participation. However, in the last few years, Indian capital markets have undergone substantial changes in terms of integration with global markets, regulation and supervision. The Indian Markets are today more closely correlated with the global markets than they were a few years back. Reforms, particularly the establishment of market regulator SEBI, market determined prices and allocation of resources, screen-based nationwide trading and derivatives trading, have all greatly improved both the regulatory framework and the efficiency of trading and settlement. According to a 2003 Economic Intelligence Unit survey regarding corporate governance, India ranked third after Singapore and Hong Kong. BSE and the National Stock Exchange (NSE) are the two premier stock exchanges. As mentioned before, the opening of the Indian economy and the primary markets in the early 1990s resulted in the structural growth of the market, indicated by the fact that market capitalization as a percentage of GDP has increased from less than 30% in the mid 1990s to more than 90% currently and the combined (BSE+NSE) annual spot market trading volumes have increased by 470% during the same period. Global fund managers and portfolio managers, taking note of the structural changes in the economy and the stock markets, have steadily increased their presence and commitments to the Indian markets (Figure 10). Due to increased foreign participation, the markets today are affected by global as much as local events. Valuations consolidation time BSE Sensex is the benchmark index of the Bombay Stock Exchange and reflective of investor sentiment. It has risen more than fourfold over the last five years and has been in a secular uptrend on the back of buoyant GDP numbers, strong

corporate earnings, bullish investor sentiment and soaring liquidity. As a result of strong consumer demand and increased infrastructure spending, Indian companies reported better earnings, high operating margins and healthy ROEs. Recognizing the growing profitability of Indian companies in the last four years, the Sensex valuations have been rerated from PE band of 1012x forward earnings to the current PE band of 1619x forward earnings. Though the PE expansion has been seen for most of the Asian and emerging markets, the expansion of the Indian stock markets has been more pronounced, making it among the most expensive markets in the region (Figure 11, Figure 12). Though the Indian stock markets are expensive markets compared with the other global emerging and Asian markets, we expect the premium valuations to continue primarily due to the following fundamental and liquidity driven factors: Long-term growth prospects and stability of earnings. Driven by the factors mentioned earlier in the report, we expect the Indian economy to continue on its growth path. With 9% GDP growth and inflation at 56%, we expect Sensex companies to post 15% CAGR in earnings for the period FY2007 09. Figure 12 Comparative PE Valuation for FY2007

25 23.8 20.5 20 15 10 5 0 17.5 17 16.6 16.2 16.1 15.7 15.1 14.5 13.8

12.7

Taiwan

Philippines

Hongkong

Indonesia

Australia

Malaysia

Source: Credit Suisse, Bloomberg, IBES

Singapore

Thailand

China

India

Japan

Korea

Research Flash

Dubai, 3 October 2007

Expected increase in weighting in the MSCI index . India has a relatively low weighting in the MSCI emerging markets and Asia (ex-Japan) indices when compared with countries such as Taiwan and Korea. Though India has seen its weightage steadily increase over the past few years, we believe that given the size of the economy and the structural changes it is undergoing, it deserves a higher weightage. Low exposure of household savings to equities. According to RBI, in 2006 only 4.6% of annual household savings were invested in shares and debentures. However we believe that the better regulatory and trading framework, aided by the changing demographic profile of investors will result in a shift in investment patterns from traditional investment instruments (such as gold and fixed deposits) towards capital market products. This is also vindicated by the AC Nielsen survey which shows that Indians are becoming more and more investment oriented. According to the survey, 53% of Indians would invest in shares of stock or mutual funds after covering their essential living expenses the third highest globally for investment in shares and mutual funds after Hong Kong and China. We believe that due to these fundamental and liquidity driven factors, the Sensex will command premium valuations as compared with other regions. We have considered these factors as well as the value of subsidiaries in the Sensex companies to assign a PE multiple higher than the earnings growth. As discussed earlier, Sensex earnings are expected to grow at a CAGR of 15% for the next two years, and we value the Sensex at 18x FY2009 earnings, which gives us a one-year Sensex target of 17,550. Though our one-year target for the Sensex stands at 17,550, we are currently neutral primarily due to the deteriorating risk/reward ratio (upside of less than 5% from current Sensex levels). It should be noted that our cautious call on the Indian markets is primarily due to higher valuations and a deteriorating risk/reward ratio rather than any concerns on the growth prospects. The risks to our one-year Sensex target are changes in earnings expectations and global risk appetite. Conclusion Though India will have its own share of ups and downs in the form political uncertainty, opposition to second generation reforms, concerns on high fiscal deficits etc, we believe the high savings and investments rate along with the opportunities thrown up by the demographic dividend and accelerated infrastructure spending will enable India to sustain its growth rates in the long term. Doubling of per capita income will ensure a

Table 2: Valuation overview

Stock Bloomberg

steady improvement of penetration levels for various sectors such as telecom, automobiles and financial services. The recent oil and gas discoveries will reduce Indias dependence on external sources and also strengthen its forex position. Though we are bullish on the growth prospects of the Indian economy in the long term and believe in the power of consumer demand that can emerge a few years down the line, we are neutral on the stock markets, primarily due to stretched valuations. To participate in this growth story, we are initiating coverage with large capital goods companies with a diversified exposure. We believe infrastructure spending is a compelling investment theme and expect it to remain in favour for the next few years. The best positioned companies to tap this opportunity include Larsen and Toubro (HOLD), Bharat Heavy Electricals (HOLD), and Crompton Greaves (HOLD). We have initiated coverage on all the three companies with a HOLD recommendation, primarily to reflect the low upside from the current price levels to our one year target price. Individual stock recommendations Larsen and Toubro Ltd. (HOLD) Target price INR 3022 Larsen and Toubro (L&T) is Indias largest engineering company with interests through subsidiaries in IT, financial services and urban infrastructure development and is likely to benefit from the massive infrastructure and corporate capex expected in the country over the next five years. Backed by a strong order-book position (2x FY2007), the company has good earnings visibility. To achieve higher growth rates, the company will focus on exports and has also identified five new areas as future growth engines. We expect a 32% CAGR in consolidated earnings over the period FY200710, driven by 28% CAGR in consolidated sales and a 150 bp improvement in margins. Our HOLT derived one-year price target is INR 3022. Bharat Heavy Electricals Ltd. (HOLD) Target price INR 2097 Bharat Heavy Electricals Ltd. (BHEL) is one of Indias biggest power equipment and engineering companies. The power sector capex is set to increase by more than 2x in the next five years as compared with the previous five. Strong corporate capex and a healthy order-book position of 3x FY2007 sales provide good visibility in earnings growth. The company aims to have USD 10 billion in sales by FY2012 compared with the current USD 4 billion, implying a CAGR of 20% p.a. We expect 29% CAGR in earnings over the period FY200710, primarily driven by 26% CAGR in sales and a 160 bp imP/BV Dividend 2007 Yield 2007

5.9 3.2 7.9 0.90% 2.10% 0.60%

Currency Mcap (in Rating Closing Target P/E P/E EV/EBITDA EV/EBITTA INR mn.) Price as on Price 2008E 2009E 2008E 2009E 01.10.2007

INR INR INR 798469 974341 127070 HOLD HOLD HOLD 2819 1990 346 3022 2097 344 33.2 30.5 35.1 25.3 23.6 25.6 23.1 19.4 19.1 17.6 15.1 15

Larsen and Toubro BHEL Crompton Greaves

LT BHEL CRG

Source: Credit Suisse, Bloomberg, HOLT

Research Flash

Dubai, 3 October 2007

provement in margins. Our HOLT derived one-year price target comes to INR 2097. Crompton Greaves Ltd. (HOLD) Target Price INR 344 Crompton Greaves Ltd. is Indias leading company in the power transmission and distribution (T&D) sector. After the acquisition of Belgium-based Pauwels, the company is now among the worlds top ten transformer manufacturers. Crompton Greaves is a play on the increasing investments in the domestic power T&D sector and the strong corporate capex cycle. Recent acquisitions in the international markets will enable the company to target replacement demand in Europe and USA. Restructuring these acquisitions will see the bottom line of the company growing faster than the topline. We expect 37% CAGR in earnings over the period FY 200710, driven by 21% CAGR in sales and a 250 bp improvement in margins. Our HOLT derived one-year price target comes to INR 344.

Research Flash

Dubai, 3 October 2007

Abbreviations frequently used in reports

Abb.

CAGR CFO CFROI DCF

Description

Compound annual growth rate Cash from operations Cash flow return on investment Discounted cash flow

Abb.

EPS EV FCF FFO IBD

Description

Earnings per share Enterprise value Free cash flow Funds from operations Interest-bearing debt

Abb.

P/B P/E PEG ROE ROIC

Description

Price-to-book value Price-earnings ratio P/E ratio divided by growth in EPS Return on equity Return on invested capital

EBITDA Earnings before interest, taxes, depreciation and amortization

Disclosure appendix

Analyst certification The analysts identified in this report hereby certify that views about the companies and their securities discussed in this report accurately reflect their personal views about all of the subject companies and securities. The analysts also certify that no part of their compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Important disclosures Credit Suisse policy is to publish research reports, as it deems appropriate, based on developments with the subject company, the sector or the market that may have a material impact on the research views or opinions stated herein. Credit Suisse policy is only to publish investment research that is impartial, independent, clear, fair and not misleading.

satisfy the regulatory criteria to be a client. Hong Kong: Other than any interests held by the analyst and/or associates as disclosed in this report, Credit Suisse Hong Kong Branch does not hold any disclosable interests. Qatar: All related financial products or services will only be available to Business Customers or Market Counterparties (as defined by the Qatar Financial Centre Regulatory Authority (QFCRA)), including individuals, who have opted to be classified as a Business Customer, with liquid assets in excess of USD 1 million, and who have sufficient financial knowledge, experience and understanding to participate in such products and/or services. Russia: The research contained in this report does not constitute any sort of advertisement or promotion for specific securities, or related financial instruments. This research report does not represent a valuation in the meaning of the Federal Law On Valuation Activities in the Russian Federation and is produced using Credit Suisse valuation models and methodology. United Kingdom: For fixed income disclosure information for clients of Credit Suisse (UK) Limited and Credit Suisse Securities (Europe) Limited, please call +41 44 333 33 99. For further information, including disclosures with respect to any other issuers, please refer to the Credit Suisse Global Research Disclosure site at: https://entry4.credit-suisse.ch/csfs/research/p/d/de/disclosure_en.html

For more detail, please refer to the information on independence of financial research, which can be found at: https://entry4.creditsuisse.ch/csfs/research/p/d/de/media/independence_en.pdf The analyst(s) responsible for preparing this research report received compensation that is based upon various factors including Credit Suisse total revenues, a portion of which are generated by Credit Suisse Investment Banking business. The Credit Suisse Code of Conduct to which all employees are obliged to adhere, is accessible via the website at: https://www.credit-suisse.com/governance/en/code_of_conduct.html

Guide to analysis

Equity rating allocation as of 02/10/2007

Overall

BUY HOLD SELL RESTRICTED 46.02% 50.71% 1.99% 1.28%

Investment banking interests only

44.80% 52.51% 1.61% 1.08%

Equity rating history as of 02/10/2007

Company Rating Date

since 02/10/2007 since 26/09/2007 since 02/10/2007 since 26/09/2007 since 02/10/2007 since 26/09/2007 BHARAT HEAVY ELECTRICALS LIMITED HOLD (BHEL IN) HOLD CROMPTON GREAVES LIMITED (CRG HOLD IN) HOLD LARSEN & TOUBRO LIMITED (LT IN) HOLD HOLD

Relative performance At the stock level, the selection takes into account the relative attractiveness of individual shares versus the sector, market position, growth prospects, balance-sheet structure and valuation. The sector and country recommendations are overweight, neutral, and underweight and are assigned according to relative performance against the respective regional and global benchmark indices. Absolute performance The stock recommendations are BUY, HOLD and SELL and are dependent on the expected absolute performance of the individual stocks, generally on a 6-12 months horizon based on the following criteria: BUY: HOLD: SELL: RESTRICTED:

Credit Suisse expects to receive or intends to seek investment banking related compensation from the subject issuer (BHARAT HEAVY ELECTRICALS LIMITED, LARSEN & TOUBRO LIMITED) within the next three months. Credit Suisse holds a trading position in the subject issuer (BHARAT HEAVY ELECTRICALS LIMITED, BHARAT HEAVY ELECTRICALS LIMITED, BHARAT HEAVY ELECTRICALS LIMITED, BHARAT HEAVY ELECTRICALS LIMITED, BHARAT HEAVY ELECTRICALS LIMITED, CROMPTON GREAVES LIMITED, CROMPTON GREAVES LIMITED, LARSEN & TOUBRO LIMITED).

Swiss American Securities Inc. disclosures Swiss American Securities Inc. or its affiliates expects to receive or intends to seek investment banking related compensation from the subject issuer (BHARAT HEAVY ELECTRICALS LIMITED, LARSEN & TOUBRO LIMITED) within the next three months. Swiss American Securities Inc. or its affiliates holds a trading position in the subject issuer (BHARAT HEAVY ELECTRICALS LIMITED, BHARAT HEAVY ELECTRICALS LIMITED, BHARAT HEAVY ELECTRICALS LIMITED, BHARAT HEAVY ELECTRICALS LIMITED, BHARAT HEAVY ELECTRICALS LIMITED, CROMPTON GREAVES LIMITED, CROMPTON GREAVES LIMITED, LARSEN & TOUBRO LIMITED). Additional disclosures for the following jurisdictions Dubai: Related financial products or services are only available to wholesale customers with liquid assets of over USD 1 million who have sufficient financial experience and understanding to participate in financial markets in a wholesale jurisdiction and

TERMINATED:

10% or greater increase in absolute share price variation between -10% and +10% in absolute share price 10% or more decrease in absolute share price In certain circumstances, internal and external regulations exclude certain types of communications, including e.g. an investment recommendation during the course of Credit Suisse engagement in an investment banking transaction. Research coverage has been concluded.

Corporate and emerging market bond recommendations The recommendations are based fundamentally on forecasts for total returns versus the respective benchmark on a 36 month horizon and are defined as follows: BUY: HOLD: SELL: RESTRICTED:

Expectation that the bond issue will be a top performer in its segment Expectation that the bond issue will return average performance in its segment Expectation that the bond issue will be among the poor performer in its segment In certain circumstances, internal and external regulations exclude certain types of communications, including e.g. an investment recommendation during the course of Credit Suisse engagement in an investment banking transaction.

Research Flash

Dubai, 3 October 2007

Credit ratings definition Credit Suisse assigns rating opinions to investment-grade and crossover issuers. Ratings are based on our assessment of a companys creditworthiness and are not recommendations to buy or sell a security. The ratings scale (AAA, AA, A, BBB, BB) is dependent on our assessment of an issuers ability to meet its financial commitments in a timely manner. AAA:

AA: A: BBB:

BB:

Best credit quality and lowest expectation of credit risks, including an exceptionally high capacity level with respect to debt servicing. This capacity is unlikely to be adversely affected by foreseeable events. Obligors capacity to meet its financial commitments is very strong Obligors capacity to meet its financial commitments is strong Obligors capacity to meet its financial commitments is adequate, but adverse economic/ operating/financial circumstances are more likely to lead to a weakened capacity to meet its obligations Obligations have speculative characteristics and are subject to substantial credit risk due to adverse economic / operating / financial circumstances resulting in inadequate debt-servicing capacity

For the AA, A, BBB, BB categories, creditworthiness is further detailed with a scale of High, Mid, or Low, with High being the strongest sub-category rating. An Outlook indicates the direction a rating is likely to move over a two-year period. Outlooks may be positive, stable or negative. A positive or negative Rating Outlook does not imply a rating change is inevitable. Similarly, ratings for which outlooks are stable could be upgraded or downgraded before an outlook moves to positive or negative if circumstances warrant such an action.

Credit Suisse HOLT The Credit Suisse HOLT methodology does not assign ratings to a security. It is an analytical tool that involves use of a set of proprietary quantitative algorithms and warranted value calculations, collectively called the Credit Suisse HOLT valuation model, that are consistently applied to all the companies included in its database. Third-party data (including consensus earnings estimates) are systematically translated into a number of default variables and incorporated into the algorithms available in the Credit Suisse HOLT valuation model. The source financial statement, pricing, and earnings data provided by outside data vendors are subject to quality control and may also be adjusted to more closely measure the underlying economics of firm performance. These adjustments provide consistency when analyzing a single company across time, or analyzing multiple companies across industries or national borders. The default scenario that is produced by the Credit Suisse HOLT valuation model establishes the baseline valuation for a security, and a user then may adjust the default variables to produce alternative scenarios, any of which could occur. The Credit Suisse HOLT methodology does not assign a price target to a security. The default scenario that is produced by the Credit Suisse HOLT valuation model establishes a warranted price for a security, and as the third-party data are updated, the warranted price may also change. The default variables may also be adjusted to produce alternative warranted prices, any of which could occur. Additional information about the Credit Suisse HOLT methodology is available on request. For technical research Where recommendation tables are mentioned in the report, Close is the latest closing price quoted on the exchange. MT denotes the rating for the medium-term trend (3 6 months outlook). ST denotes the short-term trend (3 6 weeks outlook). The ratings are + for a positive outlook (price likely to rise), 0 for neutral (no big price changes expected) and - for a negative outlook (price likely to fall). Outperform in the column Rel perf denotes the expected performance of the stocks relative to the benchmark. The Comment column includes the latest advice from the analyst. In the column Recom the date is listed when the stock was recommended for purchase (opening purchase). P&L gives the profit or loss that has accrued since the purchase recommendation was given.

tion. It has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Although the information has been obtained from and is based upon sources that Credit Suisse believes to be reliable, no representation is made that the information is accurate or complete. Credit Suisse does not accept liability for any loss arising from the use of this report. The price and value of investments mentioned and any income that might accrue may fluctuate and may rise or fall. Nothing in this report constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to individual circumstances, or otherwise constitutes a personal recommendation to any specific investor. Any reference to past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any products mentioned in this document. Alternative investments, derivative or structured products are complex instruments, typically involve a high degree of risk and are intended for sale only to investors who are capable of understanding and assuming all the risks involved. Investments in emerging markets are speculative and considerably more volatile than investments in established markets. Risks include but are not necessarily limited to: political risks; economic risks; credit risks; currency risks; and market risks. An investment in the funds described in this document should be made only after careful study of the most recent prospectus and other fund information and basic legal information contained therein. Prospectuses and other fund information may be obtained from the fund management companies and/or from their agents. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Credit Suisse recommends that investors independently assess, with a professional financial advisor, the specific financial risks as well as legal, regulatory, credit, tax and accounting consequences. The issuer of the securities referred to herein or a Credit Suisse company may have acted upon the information and analysis contained in this publication before being made available to clients of Credit Suisse. A Credit Suisse company may, to the extent permitted by law, participate or invest in other financing transactions with the issuer of the securities referred to herein, perform services or solicit business from such issuers, and/or have a position or effect transactions in the securities or options thereof.

Distribution of research reports

For a short introduction to technical analysis, please refer to Technical Analysis Explained at: https://entry4.credit-suisse.ch/csfs/research/p/d/de/techresearch/ media/pdf/trs_tutorial_en.pdf

Global disclaimer / important information

References in this report to Credit Suisse include subsidiaries and affiliates. For more information on our structure, please use the following link: http://www.credit-suisse.com/who_we_are/en/structure.html The information and opinions expressed in this report were produced by Credit Suisse as of the date of writing and are subject to change without notice. The report is published solely for information purposes and does not constitute an offer or an invitation by, or on behalf of, Credit Suisse to buy or sell any securities or related financial instruments or to participate in any particular trading strategy in any jurisdic-

Except as otherwise specified herein, this report is distributed by Credit Suisse, a Swiss bank, authorized and regulated by the Swiss Federal Banking Commission. Bahamas: This report was prepared by Credit Suisse, the Swiss bank, and is distributed on behalf of Credit Suisse (Bahamas) Ltd, a company registered as a broker-dealer by the Securities Commission of the Bahamas. Dubai: This information is distributed by Credit Suisse Dubai branch, duly licensed and regulated by the Dubai Financial Services Authority (DFSA). France: This report is distributed by Credit Suisse (France), authorized by the Comit des Etablissements de Crdit et des Entreprises dInvestissements (CECEI) as an investment service provider. Credit Suisse (France) is supervised and regulated by the Commission Bancaire and the Autorit des Marchs Financiers. Germany: Credit Suisse (Deutschland) AG, authorized and regulated by the Bundesanstalt fuer Finanzdienstleistungsaufsicht (BaFin), disseminates research to its clients that has been prepared by one of its affiliates. Gibraltar: This report is distributed by Credit Suisse (Gibraltar) Limited. Credit Suisse (Gibraltar) Limited is an independent legal entity wholly owned by Credit Suisse and is regulated by the Gibraltar Financial Services Commission. Guernsey: This report is distributed by Credit Suisse (Guernsey) Limited. Credit Suisse (Guernsey) Limited is an independent legal entity wholly owned by Credit Suisse and is regulated by the Guernsey Financial Services Commission. Copies of annual accounts are available on request. Hong Kong: This report is issued in Hong Kong by Credit Suisse Hong Kong branch, an Authorized Institution regulated by the Hong Kong Monetary Authority and a Registered Institution regulated by the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). Luxembourg: This report is distributed by Credit Suisse (Luxembourg) S.A., a Luxembourg bank, authorized and regulated by the Commission de Surveillance du Secteur Financier (CSSF). Qatar: This information has been distributed by Credit Suisse Financial Services (Qatar) L.L.C, which has been authorized and is regulated by the Qatar Financial Centre Regulatory Authority (QFCRA) under QFC No. 00005. Singapore: Distributed by Credit Suisse Singapore branch, regulated by the Monetary Authority of Singapore. Spain: This report is distributed in Spain by Credit Suisse Spain branch, authorized under number 1460 in the Register by the Banco de Espaa. United Kingdom: This report is issued by Credit Suisse (UK) Limited and Credit Suisse Securities (Europe) Limited. Credit Suisse Securities (Europe) Limited and Credit Suisse (UK) Limited, both authorized and regulated by the Financial Services Authority, are associated but independent legal entities within Credit Suisse. The protections made available by the Financial Services Authority for private customers do not apply to investments or services provided by a person outside the UK, nor will the Financial Services Compensation Scheme be available if the issuer of the investment fails to meet its obligations.

UNITED STATES: NEITHER THIS REPORT NOR ANY COPY THEREOF MAY BE SENT, TAKEN INTO OR DISTRIBUTED IN THE UNITED STATES OR TO ANY US PERSON.

Research Flash

10

Dubai, 3 October 2007

Local law or regulation may restrict the distribution of research reports into certain jurisdictions.

This report may not be reproduced either in whole or in part, without the written permission of Credit Suisse. 2007 CREDIT SUISSE

7C007A

Research Flash

11

You might also like

- Masala 2011Document9 pagesMasala 2011gauhar77No ratings yet

- Grant Thornton FICCI MSMEDocument76 pagesGrant Thornton FICCI MSMEIshan GuptaNo ratings yet

- Investment in IndiaDocument39 pagesInvestment in IndiaJohnyNo ratings yet

- Ipo 1Document13 pagesIpo 1Prakash TripurariNo ratings yet

- Research Paper On Economic Growth in IndiaDocument7 pagesResearch Paper On Economic Growth in Indiaiimytdcnd100% (1)

- A Review of The Economic Growth of Start-Up and Older Companies in India From 2011-2021Document9 pagesA Review of The Economic Growth of Start-Up and Older Companies in India From 2011-2021IJRASETPublicationsNo ratings yet

- Managing FIIs Inflows - .RKSDocument8 pagesManaging FIIs Inflows - .RKSAnonymous Y0M10GZVNo ratings yet

- Managerial EconomicsDocument7 pagesManagerial EconomicsTanya Miriam SimonNo ratings yet

- India Positive Economic OutlookDocument17 pagesIndia Positive Economic OutlookZinnov_LLCNo ratings yet

- Industry Analysis: BankingDocument6 pagesIndustry Analysis: BankingVinod PalNo ratings yet

- Indian EconomyDocument12 pagesIndian Economyarchana_anuragiNo ratings yet

- SPEX Issue 22Document10 pagesSPEX Issue 22SMU Political-Economics Exchange (SPEX)No ratings yet

- Cmv27i19 EmergentSectorCosDocument7 pagesCmv27i19 EmergentSectorCossunil0547No ratings yet

- The $5 Trillion-Economy Goal A Challenge ForDocument12 pagesThe $5 Trillion-Economy Goal A Challenge ForDeepak ShekhawatNo ratings yet

- FDI - Driving The Future of IndiaDocument4 pagesFDI - Driving The Future of IndiaHusain AttariNo ratings yet

- Research Paper On GDP of IndiaDocument6 pagesResearch Paper On GDP of Indiauifjzvrif100% (1)

- Economics Is Not About Things and Tangible Material Objects It Is About Men, Their Meanings and Actions. - Ludwig Von MisesDocument27 pagesEconomics Is Not About Things and Tangible Material Objects It Is About Men, Their Meanings and Actions. - Ludwig Von MisesSurya SudhakarNo ratings yet

- Fdi in IndiaDocument15 pagesFdi in IndiaChandra ShekarNo ratings yet

- China Vs India Export Conference September 2011Document10 pagesChina Vs India Export Conference September 2011kkarthikbhatNo ratings yet

- The Real Economy in The Long RunDocument7 pagesThe Real Economy in The Long RuncharlNo ratings yet

- LenovoDocument84 pagesLenovoasifanis100% (1)

- Assignment OF Service Marketing: Submitted byDocument10 pagesAssignment OF Service Marketing: Submitted bymanalibhardwajNo ratings yet

- Foreign Direct Investment in Banking Sector by Shubham ShuklaDocument12 pagesForeign Direct Investment in Banking Sector by Shubham ShuklaShubham ShuklaNo ratings yet

- Performance ApppraidDocument81 pagesPerformance ApppraidManisha LatiyanNo ratings yet

- Growth and DevelopmentDocument12 pagesGrowth and DevelopmentRahul BaggaNo ratings yet

- Indian EconomyDocument38 pagesIndian EconomyGagan PreetNo ratings yet

- Type The Document Title: Stocklayouts NavdeepDocument36 pagesType The Document Title: Stocklayouts Navdeepnavi_one100% (1)

- Summer Internship Report On LenovoDocument74 pagesSummer Internship Report On Lenovoshimpi244197100% (1)

- Role of FDI in IndiaDocument3 pagesRole of FDI in Indiagurwinderdhillon0% (1)

- Journey To A 5 Trillion Dollar EconomyDocument4 pagesJourney To A 5 Trillion Dollar EconomySarvagnya JatadharanNo ratings yet

- Indian Economic Growth 2003-08 Driven by Foreign Capital InflowsDocument3 pagesIndian Economic Growth 2003-08 Driven by Foreign Capital InflowsRohan RanganathanNo ratings yet

- Extension ChromeDocument6 pagesExtension ChromeKostas Georgioy0% (1)

- 19 Dr. v. K. Goswami Eng Vol4 Issue1Document8 pages19 Dr. v. K. Goswami Eng Vol4 Issue1Subbarao VenkataNo ratings yet

- Economics Project: Professor Dharmendra United World School of Law (UWSL), Karnavati University (Faculty-Economics)Document37 pagesEconomics Project: Professor Dharmendra United World School of Law (UWSL), Karnavati University (Faculty-Economics)ABHISHEK SAADNo ratings yet

- Business Perpespective: Debaki Deepak S Deepika Sharma Ganesh C Samarth J V Tanya VermaDocument6 pagesBusiness Perpespective: Debaki Deepak S Deepika Sharma Ganesh C Samarth J V Tanya VermaTanya VermaNo ratings yet

- India5trillioneconomy Visionmissionjetir2003408Document10 pagesIndia5trillioneconomy Visionmissionjetir2003408shubham satamNo ratings yet

- Economics Project: Professor Dharmendra United World School of Law (UWSL), Karnavati University (Faculty-Economics)Document37 pagesEconomics Project: Professor Dharmendra United World School of Law (UWSL), Karnavati University (Faculty-Economics)ytrdfghjjhgfdxcfghNo ratings yet

- IndiaEconomicGrowth SDocument16 pagesIndiaEconomicGrowth SAmol SaxenaNo ratings yet

- Fundamental AnalysisDocument8 pagesFundamental AnalysisJithin ManoharNo ratings yet

- Foreign Direct Investment and Its Impact: Vivekanandha College of Arts and Sciences For Womens ElayampalayamDocument8 pagesForeign Direct Investment and Its Impact: Vivekanandha College of Arts and Sciences For Womens Elayampalayamanon_209785390No ratings yet

- How India Can Unleash Innovation & EntrepreneurshipDocument6 pagesHow India Can Unleash Innovation & Entrepreneurshipsai726No ratings yet

- Keshava FinalDocument82 pagesKeshava FinalRavi KumarNo ratings yet

- Indian Economy - Unit 1Document9 pagesIndian Economy - Unit 1Priyanshu DhasmanaNo ratings yet

- Macro Indicators of Indian EconomyDocument19 pagesMacro Indicators of Indian EconomyTohsif MalekNo ratings yet

- C C Hence, It Would Be A Prudent Idea To Have A Check As To Which Sectors and Industries WouldDocument6 pagesC C Hence, It Would Be A Prudent Idea To Have A Check As To Which Sectors and Industries WouldSweetyShah ShahNo ratings yet

- Manufacturing Management: To, Mr. Subramaniyam From-Deepak Chauhan Roll Number-3180 Class-Ty-DDocument15 pagesManufacturing Management: To, Mr. Subramaniyam From-Deepak Chauhan Roll Number-3180 Class-Ty-DalishajosephNo ratings yet

- India Economic Outlook - Deloitte InsightsDocument15 pagesIndia Economic Outlook - Deloitte InsightslalitNo ratings yet

- Pestle Analysis of IndiaDocument14 pagesPestle Analysis of IndiaJanak SachdevaNo ratings yet

- Sector-Wise Contribution of GDP of India: CIA FackbookDocument8 pagesSector-Wise Contribution of GDP of India: CIA FackbookPrakash VadavadagiNo ratings yet

- Analyze The Impact of Macroeconomics Variables On The Performance of Firms in The EconomyDocument16 pagesAnalyze The Impact of Macroeconomics Variables On The Performance of Firms in The EconomyAshish kumar ThapaNo ratings yet

- Retail Evolution, Trends & Opportunities in IndiaDocument21 pagesRetail Evolution, Trends & Opportunities in IndiabhuppibhuvanNo ratings yet

- European Business Group - India and Retail Landscape 4th Feb 10v1 5Document21 pagesEuropean Business Group - India and Retail Landscape 4th Feb 10v1 59827005212No ratings yet

- DTZ India Real Estate Overview Nov 2006Document9 pagesDTZ India Real Estate Overview Nov 2006Prachi JainNo ratings yet

- Problems Facing Indian EconomyDocument2 pagesProblems Facing Indian Economymeeraraj_11No ratings yet

- Leading Indicators in The Indian EconomyDocument42 pagesLeading Indicators in The Indian EconomyAditya BhandariNo ratings yet

- Infosys Strategic AnalysisDocument40 pagesInfosys Strategic AnalysisRishin RahimNo ratings yet

- Moving up the Value Chain: The Road Ahead for Indian It ExportersFrom EverandMoving up the Value Chain: The Road Ahead for Indian It ExportersNo ratings yet

- Germanwings Traffic Figures For June 2010: Press ReleaseDocument1 pageGermanwings Traffic Figures For June 2010: Press Releaseamitc5No ratings yet

- LH Creditor Info 2010 02 e PDFDocument2 pagesLH Creditor Info 2010 02 e PDFamitc5No ratings yet

- The Smile Factory PDFDocument13 pagesThe Smile Factory PDFamitc5No ratings yet

- Germanwings 2010 08 e PDFDocument1 pageGermanwings 2010 08 e PDFamitc5No ratings yet

- Germanwings Traffic Figures For July 2010: Press ReleaseDocument1 pageGermanwings Traffic Figures For July 2010: Press Releaseamitc5No ratings yet

- LH Investor Info 2010 06 e PDFDocument3 pagesLH Investor Info 2010 06 e PDFamitc5No ratings yet

- SWISS Raises Load Factors For The First Half of 2010: Media ReleaseDocument9 pagesSWISS Raises Load Factors For The First Half of 2010: Media Releaseamitc5No ratings yet

- SWISS July 2010 traffic figures show increased load factorsDocument10 pagesSWISS July 2010 traffic figures show increased load factorsamitc5No ratings yet

- Germanwings Traffic Figures For October 2010: Press ReleaseDocument1 pageGermanwings Traffic Figures For October 2010: Press Releaseamitc5No ratings yet

- Germanwings Traffic Figures For December 2010: Press ReleaseDocument1 pageGermanwings Traffic Figures For December 2010: Press Releaseamitc5No ratings yet

- Swiss Traffic Statistics English Komplett PDFDocument11 pagesSwiss Traffic Statistics English Komplett PDFamitc5No ratings yet

- Germanwings Traffic Figures Down 2.66% in November 2010Document1 pageGermanwings Traffic Figures Down 2.66% in November 2010amitc5No ratings yet

- LH Investor Info 2010 08 e PDFDocument3 pagesLH Investor Info 2010 08 e PDFamitc5No ratings yet

- LH Investor Info 2010 07 e PDFDocument3 pagesLH Investor Info 2010 07 e PDFamitc5No ratings yet

- Germanwings Traffic Figures For September 2010: Press ReleaseDocument1 pageGermanwings Traffic Figures For September 2010: Press Releaseamitc5No ratings yet

- Swiss - Traffic - Statistics - English - Komplett PDFDocument13 pagesSwiss - Traffic - Statistics - English - Komplett PDFamitc5No ratings yet

- SWISS Traffic Figures: January 2011Document4 pagesSWISS Traffic Figures: January 2011amitc5No ratings yet

- SWISS Traffic Figures: February 2011Document5 pagesSWISS Traffic Figures: February 2011amitc5No ratings yet

- SWISS Traffic Figures: October 2010Document13 pagesSWISS Traffic Figures: October 2010amitc5No ratings yet

- LH Investor Info 2010 10 e PDFDocument3 pagesLH Investor Info 2010 10 e PDFamitc5No ratings yet

- LH Investor Info 2011 03 e PDFDocument3 pagesLH Investor Info 2011 03 e PDFamitc5No ratings yet

- LH Investor Info 2010 11 e PDFDocument3 pagesLH Investor Info 2010 11 e PDFamitc5No ratings yet

- Swiss Traffic Statistics English Komplett PDFDocument15 pagesSwiss Traffic Statistics English Komplett PDFamitc5No ratings yet

- LH Investor Info 2010 09 e PDFDocument3 pagesLH Investor Info 2010 09 e PDFamitc5No ratings yet

- Swiss Traffic Statistics English Komplett PDFDocument14 pagesSwiss Traffic Statistics English Komplett PDFamitc5No ratings yet

- LH Creditor Info 2011 02 e PDFDocument2 pagesLH Creditor Info 2011 02 e PDFamitc5No ratings yet

- LH Investor Info 2011 02 e PDFDocument3 pagesLH Investor Info 2011 02 e PDFamitc5No ratings yet

- Swiss Traffic Statistics English Komplett PDFDocument6 pagesSwiss Traffic Statistics English Komplett PDFamitc5No ratings yet

- LH Investor Info 2010 12 e PDFDocument3 pagesLH Investor Info 2010 12 e PDFamitc5No ratings yet

- LH Investor Info 2011 01 e PDFDocument3 pagesLH Investor Info 2011 01 e PDFamitc5No ratings yet

- Elmeasure Solenoid Ates CatalogDocument12 pagesElmeasure Solenoid Ates CatalogSEO BDMNo ratings yet

- Reinvestment Allowance (RA) : SCH 7ADocument39 pagesReinvestment Allowance (RA) : SCH 7AchukanchukanchukanNo ratings yet

- Budget ControlDocument7 pagesBudget ControlArnel CopinaNo ratings yet

- Easa Ad Us-2017-09-04 1Document7 pagesEasa Ad Us-2017-09-04 1Jose Miguel Atehortua ArenasNo ratings yet

- THE PEOPLE OF FARSCAPEDocument29 pagesTHE PEOPLE OF FARSCAPEedemaitreNo ratings yet

- 2016 Mustang WiringDocument9 pages2016 Mustang WiringRuben TeixeiraNo ratings yet

- Positioning for competitive advantageDocument9 pagesPositioning for competitive advantageOnos Bunny BenjaminNo ratings yet

- Victron MultiPlus 48 1200-13-16 Datasheet enDocument1 pageVictron MultiPlus 48 1200-13-16 Datasheet enBAHJARI AMINENo ratings yet

- Problems of Teaching English As A Foreign Language in YemenDocument13 pagesProblems of Teaching English As A Foreign Language in YemenSabriThabetNo ratings yet

- AtmDocument6 pagesAtmAnkit JandialNo ratings yet

- ROPE TENSIONER Product-Catalog-2019Document178 pagesROPE TENSIONER Product-Catalog-2019jeedanNo ratings yet

- Fiera Foods - Production SupervisorDocument1 pageFiera Foods - Production SupervisorRutul PatelNo ratings yet

- New Brunswick CDS - 2020-2021Document31 pagesNew Brunswick CDS - 2020-2021sonukakandhe007No ratings yet

- Ali ExpressDocument3 pagesAli ExpressAnsa AhmedNo ratings yet

- Your Inquiry EPALISPM Euro PalletsDocument3 pagesYour Inquiry EPALISPM Euro PalletsChristopher EvansNo ratings yet

- Suband Coding in MatlabDocument5 pagesSuband Coding in MatlabZoro Roronoa0% (1)

- GIS Arrester PDFDocument0 pagesGIS Arrester PDFMrC03No ratings yet

- Mechanics of Deformable BodiesDocument21 pagesMechanics of Deformable BodiesVarun. hrNo ratings yet

- Health Education and Health PromotionDocument4 pagesHealth Education and Health PromotionRamela Mae SalvatierraNo ratings yet

- Unit 1 Writing. Exercise 1Document316 pagesUnit 1 Writing. Exercise 1Hoài Thương NguyễnNo ratings yet

- Wacker Neuson RTDocument120 pagesWacker Neuson RTJANUSZ2017100% (4)

- Bandung Colonial City Revisited Diversity in Housing NeighborhoodDocument6 pagesBandung Colonial City Revisited Diversity in Housing NeighborhoodJimmy IllustratorNo ratings yet

- Machine Spindle Noses: 6 Bison - Bial S. ADocument2 pagesMachine Spindle Noses: 6 Bison - Bial S. AshanehatfieldNo ratings yet

- Identifying The TopicDocument2 pagesIdentifying The TopicrioNo ratings yet

- Calibration Motion Control System-Part2 PDFDocument6 pagesCalibration Motion Control System-Part2 PDFnurhazwaniNo ratings yet

- ĐỀ SỐ 3Document5 pagesĐỀ SỐ 3Thanhh TrúcNo ratings yet

- Empowerment Technology Reviewer: First SemesterDocument5 pagesEmpowerment Technology Reviewer: First SemesterNinayD.MatubisNo ratings yet

- Planview Innovation Management Maturity Model PDFDocument1 pagePlanview Innovation Management Maturity Model PDFMiguel Alfonso Mercado GarcíaNo ratings yet

- Desert Power India 2050Document231 pagesDesert Power India 2050suraj jhaNo ratings yet

- Statement of Compulsory Winding Up As On 30 SEPTEMBER, 2008Document4 pagesStatement of Compulsory Winding Up As On 30 SEPTEMBER, 2008abchavhan20No ratings yet